Attached files

| file | filename |

|---|---|

| 8-K - FEDERATED NATIONAL HOLDING COMPANY 8-K 9-10-2015 - FedNat Holding Co | form8k.htm |

Exhibit 99.1

1 September 2015 NASDAQ: FNHC

SAFE HARBOR statement / FNHC Snapshot Safe harbor statement under the Private Securities Litigation Reform Act of 1995: Statements that are not historical fact are forward-looking statements that are subject to certain risks and uncertainties that could cause actual events and results to differ materially from those discussed herein. Without limiting the generality of the foregoing, words such as “anticipate,” “believe,” “budget,” “contemplate,” “continue,” “could,” “envision,” “estimate,” “expect,” “guidance,” “indicate,” “intend,” “may,” “might,” “plan,” “possibly,” “potential,” “predict,” “probably,” “pro-forma,” “project,” “seek,” “should,” “target,” or “will” or the negative thereof or other variations thereon and similar words or phrases or comparable terminology are intended to identify forward-looking statements. Forward-looking statements might also include, but are not limited to, one or more of the following:Projections of revenues, income, earnings per share, dividends, capital structure or other financial items or measures;Descriptions of plans or objectives of management for future operations, insurance products/or services; Forecasts of future insurable events, economic performance, liquidity, need for funding and income; andDescriptions of assumptions or estimates underlying or relating to any of the foregoing.The risks and uncertainties include, without limitation, risks and uncertainties related to estimates, assumptions and projections generally; the nature of the Company’s business; the adequacy of its reserves for loss and loss adjustment expense; claims experience; weather conditions (including the severity and frequency of storms, hurricanes, tornadoes and hail) and other catastrophic losses; reinsurance costs and the ability of reinsurers to indemnify the Company; raising additional capital and our potential failure to meet minimum capital and surplus requirements; potential assessments that support property and casualty insurance pools and associations; the effectiveness of internal financial controls; the effectiveness of our underwriting, pricing and related loss limitation methods; changes in loss trends; court decisions and trends in litigation; our potential failure to pay claims accurately; ability to obtain regulatory approval applications for requested rate increases, or to underwrite in additional jurisdictions, and the timing thereof; the impact that the results of the Monarch joint venture may have on our results of operations; inflation and other changes in economic conditions (including changes in interest rates and financial markets); pricing competition and other initiatives by competitors; legislative and regulatory developments; the outcome of litigation pending against the Company, and any settlement thereof; dependence on investment income and the composition of the Company’s investment portfolio; insurance agents; ratings by industry services; the reliability of our information technology systems; reliance on key personnel; acts of war and terrorist activities; and other matters described from time to time by the Company in releases and publications, and in periodic reports and other documents filed with the United States Securities and Exchange Commission. In addition, investors should be aware that generally accepted accounting principles prescribe when a company may reserve for particular risks, including claims and litigation exposures. Accordingly, results for a given reporting period could be significantly affected if and when a reserve is established for a contingency. Reported results may therefore appear to be volatile in certain accounting periods. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We do not undertake any obligation to update publicly or revise any forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. 2 Federated National Holding Company (as of 6/30/2015) NASDAQ: FNHCHeadquarters: Sunrise, FL (Ft. Lauderdale)Core Market: Homeowners’ insurance in FloridaIPO Year: 1998Financial Stability Rating: Cash and Investments: $462.3 MTotal Shareholders’ Equity: $231.4 M (1)Common Shares Outstanding: 13.7 MBook Value Per Common Share: $16.86 (1) (2)Includes non-controlling interestExcluding non-controlling interest, BVPS was $15.54

We are predominantly a homeowners’ insurer in Florida 3 …Our Distinguishing Characteristics Top five writer of voluntary business in Florida (1)Started offering homeowners’ insurance in Florida in 2000Homeowners’ insurance in Florida represents over 90% of our premiumsFlorida is the third largest state and represents approximately $10.5 billion in homeowners’ insurance premium Voluntary Business Focus Strong Reinsurance Program Outstanding Service Voluntary business sold through independent agentsOne of few select Florida homeowners’ insurance companies appointed to write voluntary business through Allstate’s Florida agents Full indemnity reinsurance with 65 reinsurance partners, all of which are rated “A-” or higher by A.M. Best or fully collateralized Many of our partner agents prefer to entrust their clients with us due to our experience within Florida and our high level of service Based on Florida residential homeowners’ insurance new policies written for the three months ended March 31, 2015; Florida Office of Insurance RegulationComprised of 4% of gross written premium in MGA fees and 3.6% of gross earned premium in claims service fees Efficient Operating Model Superior and highly efficient operating model relative to peersOur partner agent’s receive a competitive 11.6% commission on averageMGA and claims services fees are a lean 7.6% (2)Low 19.2% acquisition costs versus the industry average of 25% - 30%

Experienced MANAGEMENT TEAM An experienced management team that has a long history with Federated National and has extensive tenure in the homeowners’ insurance market in Florida Michael Braun, Chief Executive Officer & President Appointed Chief Executive Officer in July 2008Elected to Board in 2005Previously served as Chief Operating Officer Joined in 1998 Peter Prygelski, Chief Financial Officer & Treasurer Re-nominated to Board in 2008Appointed Chief Financial Officer in June 2007Served as Independent Director from 2004 through 2007 Joined in 2004 Stephen Young, Vice President of Operations Appointed Vice President of Operations in June 2009 Served as President of Federated Premium FinanceMore than 20 years of industry experienceJoined in August 1995 Gordon Jennings, Vice President of Risk Management Appointed Vice President of Risk Management in May 2008 Serves as President of Federated National UnderwritersMore than 24 years of industry experienceJoined in May 2000 C. Brian Turnau, Director of Claims Management Served as President of Federated National AdjustingWorked for private practice insurance defense litigation law firms for 15 yearsMore than 13 years of industry experienceJoined in June 2000 Christopher Clouse, Director of PL Underwriting Appointed Underwriting Manager in June 2010More than 25 years of industry experienceJoined in March 2008 Melissa Knox, Director of Internal Audit Appointed as Director of Internal Audit in December 2010More than 14 years experience in internal audit and enterprise risk management Tracy Wiggan, Director of Human Resources Appointed as Director of Human Resources in July 2008More than 20 years experience in human resourcesWorked for both private and public organizationsJoined in December 2005 4

Florida property insurance market timeline 5 Hurricane Andrew Emergence of Citizens’ predecessor Creation of the Florida Hurricane Catastrophe Fund Hurricane seasons bring four Florida hurricanes in 2004 and four in 2005 Windstorm mitigation credit overhaul Citizens becomes a competitor to the private market Citizens establishes “glide path” to actuarial sound rates “Cost driver” bill to expedite rate filings, increase surplus requirements and reform sinkhole claims Citizens reduces potential assessment Citizens Clearinghouse established National carriers begin to exit / contract National carriers accelerate exit / contraction Monarch National approved byFL OIR Lloyd’s of London appoints FedNat Underwriters

Florida Market provides continued growth 6 Based on Florida residential homeowners’ insurance new policies written for the three months ended March 31, 2015; Florida Office of Insurance Regulation The Florida Homeowners’ Insurance Market is Poised for Continued Growth and Profitability Rate adequacyReduced reinsurance costs combined with increased capacityCitizens, Florida’s residual market, is less competitive in the homeowners’ insurance marketLack of competition from national and large carriersImproved real estate market is driving demand and has increased premiumsFederated National is One of the Fastest Growing Homeowners’ Insurers in Florida and is Poised to Continue to Grow Profitably Top five writer of voluntary business in Florida (1)All new policies are generated on a voluntary basisOne of few select Florida homeowners’ insurance companies appointed to write voluntary business through Allstate’s Florida agentsOpportunity to increase Federated National’s 3.51% market share and further increase our market presence through Monarch Top Personal Residential Homeowners’ Insurers in FloridaAs of March 31, 2015 (1) Note: Includes personal residential and excludes commercial residential business. The Florida Office of Insurance Regulation’s QUASR next generation database excludes State Farm Florida Insurance Company in its dataset as of March 31, 2015 3/31/2015 Rank 3/31/2014 Rank Institution Total DPW for Policies In-Force Market Share 1 1 Citizens Property Insurance Corporation $1,258,434,370 12.22% 2 2 Universal Property & Casualty Insurance Co. 767,395,723 7.45% 3 8 Heritage Property & Casualty Insurance Co. 494,972,662 4.81% 4 7 Homeowners Choice P&C Inc Co., Inc. 434,303,913 4.22% 5 11 Federated National Insurance Company 361,950,445 3.51% 6 6 United Property & Casualty Insurance Co. 319,363,002 3.10% 7 N/A American Coastal Insurance Company 304,815,327 2.96% 8 10 Florida Peninsula Insurance Company 294,781,370 2.86% 9 13 United Services Automobile Association 289,504,252 2.81% 10 5 St. Johns Insurance Company, Inc 268,222,622 2.60% 11 4 Security First Insurance Company 263,163,849 2.55% 12 14 People's Trust Insurance Company 263,416,910 2.56% 13 3 American Integrity Insurance Co. of FL 243,076,113 2.36% 14 9 Tower Hill Prime Insurance Company 232,310,593 2.26% 15 N/A Federal Insurance Company 179,430,544 1.74% 16 N/A Olympus Insurance Company 169,436,639 1.64% 17 18 Tower Hill Signature Insurance Company 164,269,268 1.59% 18 N/A Tower Hill Preferred Insurance Company 143,324,737 1.39% 19 N/A USAA Casualty Insurance Company 143,026,149 1.39% 20 N/A AIG Property Casualty Company 142,458,040 1.38% Top 20 6,737,656,528 65.40% Grand Total 10,537,355,974 156.39%

Federated National’s approach to the Florida market 7 Utilize innovative point of sale software providing agent ‘ease of use’Deliver instantaneous quoting and binding capabilitiesProvides agents with access to numerous key data points essential to assessing risk factors Reduced geographic concentration in the Tri-County / South Florida area and expanded in other counties in FloridaEnhanced underwriting results and reduced our risk exposure via greater diversificationExpansion into other coastal states AgentExperience Geographic Diversification Underwriting Standards Focus on higher value propertiesEmphasis on newer properties which typically have more advanced wind / hurricane mitigation features and lower All Other Peril (non-catastrophe) losses, all of which mitigate expected lossesLargely avoided claims associated with sinkhole losses by carefully underwriting certain geographic areas in Florida

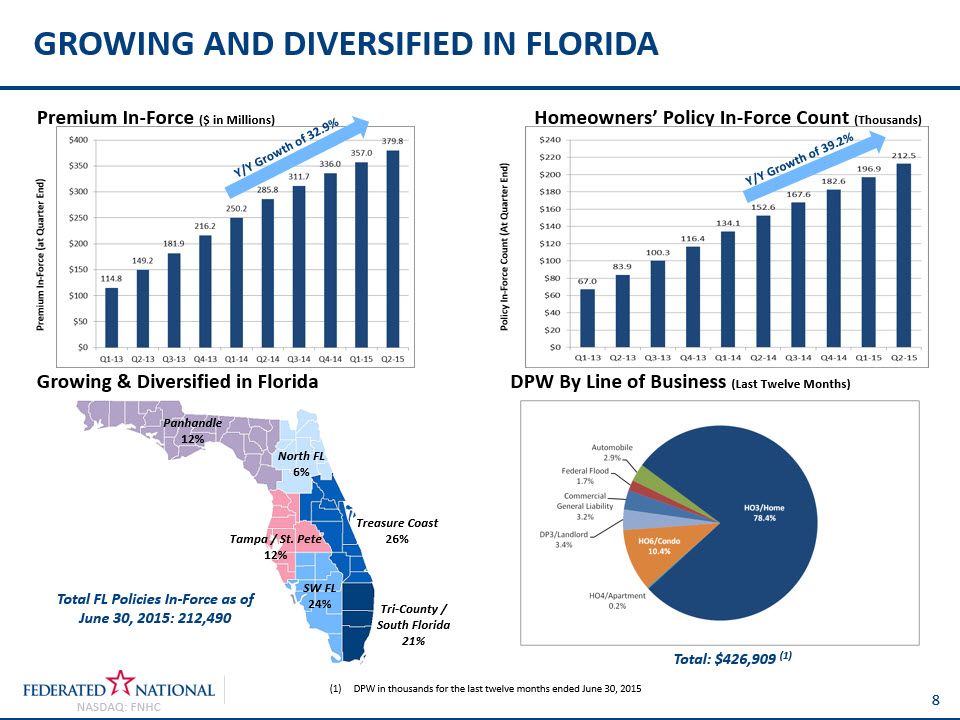

DPW in thousands for the last twelve months ended June 30, 2015 Growing and diversified In Florida 8 Premium In-Force ($ in Millions) Growing & Diversified in Florida Panhandle12% North FL6% SW FL24% Treasure Coast26% Tri-County / South Florida21% DPW By Line of Business (Last Twelve Months) Homeowners’ Policy In-Force Count (Thousands) Total: $426,909 (1) Total FL Policies In-Force as of June 30, 2015: 212,490 Tampa / St. Pete12% Premium In-Force (at Quarter End) Policy In-Force Count (At Quarter End) Y/Y Growth of 32.9% Y/Y Growth of 39.2%

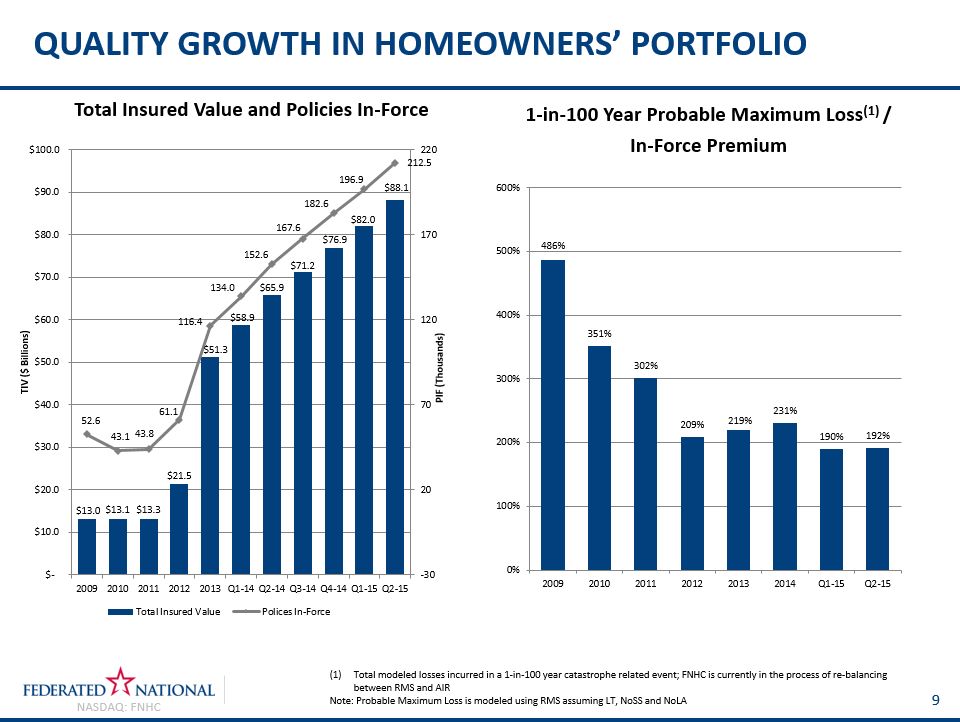

Quality Growth in Homeowners’ Portfolio 9 1-in-100 Year Probable Maximum Loss(1) / In-Force Premium Total modeled losses incurred in a 1-in-100 year catastrophe related event; FNHC is currently in the process of re-balancing between RMS and AIRNote: Probable Maximum Loss is modeled using RMS assuming LT, NoSS and NoLA Total Insured Value and Policies In-Force

Superior underwriting results 10 Loss & LAE Ratio (Net Basis)(2) Net Premiums Earned ($ in Millions)(1) Net premiums earned have been reduced by $73.5 million due to the accounting for our quota-share program from inception of July 1, 2014 through June 30, 2015. The reduction in net premiums earned was offset by an estimated $14.4 million reduction in our reinsurance costs, a reduction in losses and loss adjustment expenses of $25.7 million, a reduction in amortization of deferred policy acquisition costs of $26.4 million, and the recognition of $7.0 million in accrued income resulting from the quota-share agreement.Loss and LAE will vary each quarter but we anticipate it to average near 50.0%Source: Company Filings and SNL FinancialNote: NPE and Losses & LAE based on GAAP

Robust claims capabilities and tenured staff 11 21 field adjusters covering the entire state of Florida and 42 onsite (desk) adjusters; 15 claims managers and supervisors; in-house litigation manager supported by eight litigation adjusters; all of whom are fully licensed in all of the states we write businessAverage experience is over 10 yearsLong tenure with Federated National; many of our homeowners’ adjusting staff served the Company during the storms of 2004 and 2005Training and knowledge is promoted and enhanced through on and off-site education 24/7 new claims reporting capacity with immediate emergency response available when warrantedLong standing relationships with water remediation companies, emergency services providers and loss causation analysts that provide rapid mitigation of damages and exceptional customer service In-House Claims Adjuster Efficient Claims Response Strategic Alliance with Catastrophe Adjuster Owns 1/3 of Southeast Catastrophe Consulting Company, an independent catastrophe claims adjusterDedicated catastrophe adjusters available to Federated National as neededAll data and systems functionality is backed-up through a remote cloud-based computing system

Strong Catastrophe reinsurance 2015 – 2016 Excess of Loss Catastrophe Reinsurance HighlightsApproximately $1.8 billion of aggregate coverage with maximum single event coverage of approximately $1.2 billion65 reinsurance partners, all of which are rated “A-” or higher by A.M. Best or fully collateralized Quota share of 40% of $200 million aggregate coverage on two events with maximum single event coverage of 40% of $100 millionA minimum retention of $12.9 million and not to exceed $15.4 million pre-tax retention on first event with losses above $100 million. First event coverage extends to $1.2 billion All private market layers have prepaid automatic restatements premium protection (“RPP”) and a cascading, drop down, feature with exception of the first layer where we have retained 10% RPP 12 Federated National has full indemnity reinsurance with highly rated reinsurers, many of which it has maintained a business relationship with for numerous years

Catastrophe REINSURANCE PROGRAM 13 July 1, 2015 – June 30, 2016 Excess of Loss Catastrophe Reinsurance Program Note: Uses historical models with loss amplification for RMS v 13.1 $1.23B166 YrRMSLong TermWith LossAmplification First Event Second Event $615.5M50 YrRMSLong TermWith LossAmplification $950M100 YrRMSLong TermWith LossAmplification Company Retention $12.9M RPP $2.5M Layer 2$165mn xs $21.5mn Layer 3$77.5M xs $21.5M Layer 160% of $78.5M xs $21.5M Quota Share30% of $100Mxs $0 QS 10% of $100Mxs $0 Layer 4$192M xs $21.5M Inuring FHCF Layer75% of$775M xs $265M Inuring FHCF ReplacementLayer15% of$775M xs$265M Non Florida Layer 1 – 100% of $16.5M xs $5M Company Retention $12.9M Layer 160% of $78.5M xs $21.5M Non Florida Layer 1 – 100% of $16.5M xs $5M Quota Share30% of $100Mxs $0 Layer 2$165M xs $21.5M Inuring FHCF RPLMT Layer – 15% Inuring FHCF Layer 75% of$90M xs $265M Layer 3$77.5M xs $21.5M Inuring FHCF RPLMT Layer – 15% QS 10% of $100Mxs $0 Layer 4$192M xs $21.5M

Monarch is a new Growth opportunity 14 Our agents ask, “How can we write more business with FedNat?” …Monarch is our answer. Monarch is designed to capture additional quality business that FNHC is not able to secure with FedNat’s productsFedNat only historically binds approximately 12% of the quotes submitted by its agentsThe opportunity lies in the ability to provide more coverage options to agentsFNHC’s business is scalable and can achieve more economies of scale with increased volumeStatutory regulations require a separate capital base unless the policies are mutually exclusiveFNHC is partnering with Monarch as a separate insurance company with a separate capital base and different premium rates and policy forms than FedNat to capture standard market businessMonarch received approval in April 2015 from the Florida Office of Insurance Regulation to write homeowner business in the State of Florida 88% Policies Not Bound 12% Policies Bound Monarch Opportunity

Monarch Management and Structure Benefits to Federated NationalNew market opportunityManagement and operational controlMGA, claims and policy feesParticipation in underwriting resultsMonarch ManagementMichael H. Braun – CEO & PresidentPeter J. Prygelski – CFO & TreasurerMonarch Board of ManagersFederated National (3 seats)Crosswinds (3 seats)Independent third party (1 seat) selected by FNHC and CrosswindsCrosswinds OverviewPublicly traded Canadian merchant bank and alternative investment managerTSX: BKPTransRe OverviewInternational reinsurance organization headquartered in New York with operations worldwideSubsidiary of Alleghany Corporation (NYSE: Y) * Crosswinds Holdings Inc. f/k/a C.A. Bancorp Inc.Non-voting equity owner 15 Federated National Holding Company$14 million Crosswinds Holdings Inc. (“Crosswinds”)*$14 million TransRe (1)$5 million Monarch Federated National Underwriters, Inc. $5M of Senior Debt MGA & Claims Fees MGA & Claims Services 100% Owned 42.4% Owned 42.4% Owned 15.2% Owned

Financial Overview 16

2015 SECOND QUARTER FINANCIAL HIGHLIGHTS 17 Core GrowthGross premiums written increased $24.6 million, or 23.0%, to $132.0 million for the three months ended June 30, 2015, compared with $107.4 million for the three months ended June 30, 2014.Gross premiums earned increased $28.3 million, or 38.2%, to $102.6 million for the three months ended June 30, 2015, compared with $74.3 million for the three months ended June 30, 2014.Florida homeowners’ policies increased by 39.2% to approximately 212.5K policies as of June 30, 2015 compared with 152.6K policies as of June 30, 2014.Underwriting ResultsLoss ratio for the three months ended June 30, 2015 was 47.0% compared with 47.7% for the same period in 2014.Shareholder ReturnsNet income attributable to FNHC common stockholders increased $0.1 million, or 1.6%, to $11.7 million for the three months ended June 30, 2015, compared with $11.6 million for the three months ended June 30, 2014.Book value per share increased by 44.1% to $16.86(1)(2) as of June 30, 2015 compared with $11.70 as of June 30, 2014. Includes non-controlling interestExcluding non-controlling interest, BVPS was $15.54Note: Based on GAAP financial information

Shareholder value creation 18 New reinsurance program initiated on July 1, 2014. This quarterly cost will remain constant over the next three quarters while we continue to grow our book of business.Q3-2014 LTM ROAE declined primarily due to the Company’s follow-on offering initiated on August 1, 2014. Excluding non-controlling interest, BVPS and LTM ROAE was $14.88 and 22.82%, respectively.Excluding non-controlling interest, BVPS and LTM ROAE was $15.54 and 20.42%, respectively.Source: Company Filings and SNL FinancialNote: Based on GAAP financial information Reported BVPS & LTM ROAE Diluted Earnings Per Share (2) (1) (3) (4)

Designed to preserve capital, maximize after-tax investment income, maintain liquidity and minimize riskUtilize outside investment managers for the fixed income and equities portfoliosFEDERATED NATIONAL As of June 30, 2015, 100% of the Company’s fixed income portfolio was rated investment gradeAverage duration: 3.75 yearsComposite rating: A (S&P)Average yield: 1.798%Historical total returns on cash and investments as of June 30, 20151 Year: 2.30%2 Years: 4.78%MONARCH NATIONAL As of June 30, 2015, 99.95% of the Company’s fixed income portfolio was rated investment gradeAverage duration: 2.503 yearsComposite rating: A- (S&P)Average yield: 1.611%Historical total returns on cash and investments as of June 30, 20151 month: (7.05%)1 Quarter: (3.95%) INVESTMENT Portfolio 19

Investment Portfolio Holdings 20 Federated National Investments and Cash As of June 30, 2015$426.0 Million MonarchInvestments and Cash As of June 30, 2015$36.3 Million

Strong Balance sheet 21 Shareholders’ equity of $231.4 million (1)(2) Statutory surplus of $136.7 million (1)Strong reinsurance program to protect the balance sheet ($ in Thousands) June 30, 2015 June 30, 2014 Cash and Investments $462,340 $349,576 Total Assets $601,062 $409,752 Unearned Premiums $232,811 $178,409 Total Liabilities $369,626 $279,370 Total Shareholders’ Equity $231,436 (2) $130,382 As of June 30, 2015Includes non-controlling interest

Top five writer of voluntary business in Florida (1)Excellent market conditions for Florida homeowners’ insurersMonarch provides opportunities for additional future growth Exceptional Opportunity with a proven team 22 Exceptional Market Opportunity Experienced Management Team Proven Business Model Strong Financial Performance Highly experienced management team with a long history at Federated National and extensive insurance industry experienceThe majority of the management team was with the company during the 2004 and 2005 stormsStrong relationships with agents, reinsurers and regulators Controlled rapid premium growthConsistent loss, expense and combined ratioStrong EPS, BVPS and ROAE Underwrite voluntary businessOne of few select Florida homeowners’ insurance companies appointed to write voluntary business through Allstate’s Florida agentsFull indemnity reinsurance with 65 reinsurance partners, all of which are rated “A-” or higher by A.M. Best or fully collateralized Based on Florida residential homeowners’ insurance new policies written for the three months ended March 31, 2015; Florida Office of Insurance Regulation

CONTACT US Company ContactsMichael Braun, Chief Executive Officer & PresidentEmail: mbraun@FedNat.com Phone: 954-308-1322Peter Prygelski, Chief Financial Officer & TreasurerEmail: pprygelski@FedNat.comPhone: 954-308-1252 23 Federated National Holding Company14050 N.W. 14th StreetSuite 180Sunrise, FL 33323Tel. (954) 581-9993 / (800) 293-2532www.FedNat.com