Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PINNACLE FOODS INC. | a8k0909barclaysconference.htm |

Barclays Global Consumer Staples Conference September 9, 2015

2 This presentation contains “forward-looking statements” within the meaning of U.S. federal securities laws. Forward-looking statements are not historical facts, and are based upon management’s current expectations, beliefs, projections and targets, many of which, by their nature, are inherently uncertain. Such expectations, beliefs, projections and targets are expressed in good faith. However, there can be no assurance that management’s expectations, beliefs, projections and targets will be achieved and actual results may differ materially from what is expressed in or indicated by the forward- looking statements. Forward-looking statements are subject to significant business, economic, regulatory and competitive risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the forward-looking statements, including risks detailed in Pinnacle Foods Inc.’s (“Pinnacle Foods,” “Pinnacle” or the “Company”) filings with the U.S. Securities and Exchange Commission (the “SEC”). Nothing in this presentation should be regarded as a representation by any person that these forward-looking statements will be achieved. Forward-looking statements speak only as of the date the statements are made. The Company assumes no obligation to update forward-looking statements to reflect actual results, subsequent events or circumstances or other changes affecting forward-looking information except to the extent required by applicable securities laws. This presentation includes certain financial measures, including Adjusted Gross Profit and Unleveraged Free Cash Flow, which differ from results using U.S. Generally Accepted Accounting Principles (GAAP). Non-GAAP financial measures typically exclude certain charges, which are not expected to occur routinely in future periods. The Company uses non-GAAP financial measures internally to focus management on performance excluding these special charges to gauge our business operating performance. Management believes this information is helpful to investors in understanding trends in the business. The most directly comparable GAAP financial measures and reconciliations to non-GAAP financial measures are set forth in the slides in this presentation and included in the Company’s filings with the SEC. Forward-Looking Statements & Non-GAAP Financial Measures

3 Agenda Overview Executing Our Strategy Financial Update Outlook

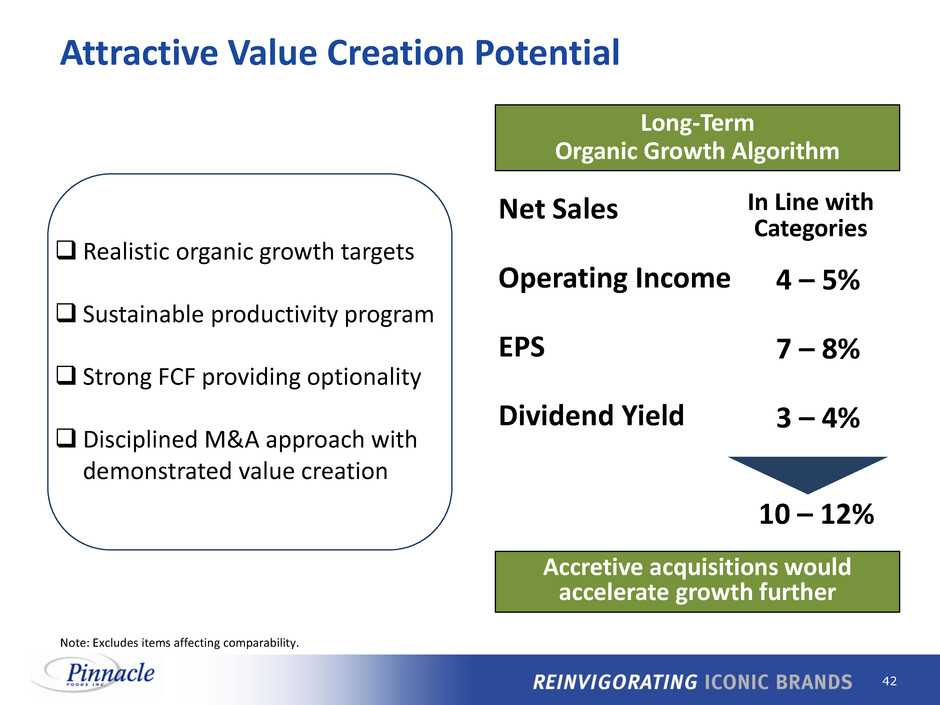

4 Pinnacle Value Creation Model Net Sales Operating Income EPS Dividend Yield In Line with Categories 10 – 12% 4 – 5% 7 – 8% 3 – 4% LT Organic Growth Algorithm Accretive Acquisitions Accelerate Growth Note: Excludes items affecting comparability.

5 Birds Eye Frozen Specialty Duncan Hines Grocery Other 2014 Net Sales: $2.6 billion* Diversified Portfolio With Critical Scale in Frozen • Includes Gardein 2014 run-rate sales of $57 million. Birds Eye Frozen and Duncan Hines Grocery combined represent NA Retail. Canada Snacks Food Service Private Label Other

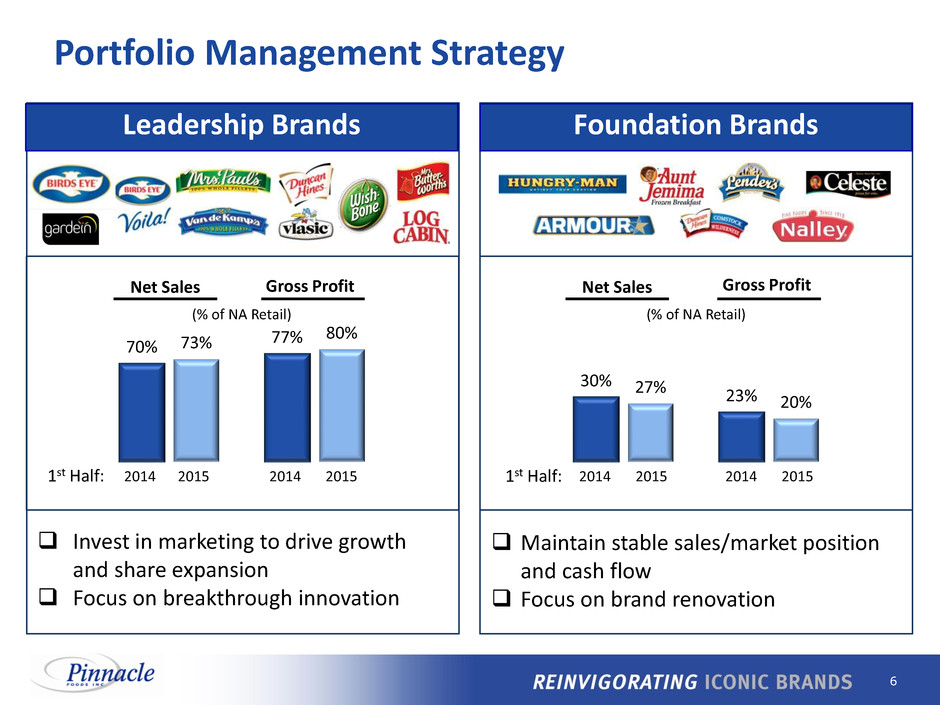

6 70% 77% 73% 80% Net Sales 2014 2015 2014 2015 30% 23% 27% 20% 2014 2015 2014 2015 Invest in marketing to drive growth and share expansion Focus on breakthrough innovation Gross Profit Net Sales Gross Profit Maintain stable sales/market position and cash flow Focus on brand renovation Leadership Brands Foundation Brands (% of NA Retail) (% of NA Retail) 1st Half: 1st Half: Portfolio Management Strategy

7 Net Sales Operating Income EPS Dividend Yield In Line with Categories 10 – 12% 4 – 5% 7 – 8% 3 – 4% LT Organic Growth Algorithm 10% 39% 3% Outpaced Categories 42% 2013 Actual Accretive Acquisitions Accelerate Growth Beyond Algorithm Note: Excludes items affecting comparability. See reconciliation to GAAP financial measures in Appendix. 17% 14% 2014 Actual Outpaced Categories 3% 13% Attractive Value Creation Results

8 Agenda Overview Executing Our Strategy Financial Update Outlook

9 3. Generate exceptional cash flow to provide value creation optionality 1. Drive Leadership Brands through innovation and marketing 2. Deliver industry-leading efficiency Productivity SG&A overheads Executing Our Strategy

10 Leadership Brands Category Pinnacle Market Position Growing/ Holding Share Frozen Vegetables #1 Frozen Complete Bagged Meals #1 Frozen Prepared Seafood #2 Frozen/Refrig. Meat Substitutes #4 Shelf-Stable Pickles #1 Table Syrups #1 Cake/Brownie Mixes and Frostings #2 Shelf-Stable Salad Dressings #3 Source: IRI US Multi-Outlet data, YTD ending 8/2/15; based on IRI’s Pinnacle custom definitions; market position ranks are among branded players. Growth driven by strong performance of Leadership Brands 2012 2013 2014 2015 YTD $ Market Share +0.1 pts. +0.3 pts. +0.2 pts. +0.5 pts. (Change vs. PY) Pinnacle Foods Composite Market Share

11 Innovation Q2 Introductions Flavor Full Protein Blends Q3 Introductions Disney-themed sides Voila! premium offerings Marketing New campaign supporting base business and new platforms Television Digital Social Birds Eye - $1 Billion Health & Wellness Brand Driving growth through innovation and marketing

12 Birds Eye Flavor Full Pairing of popular vegetables with on-trend flavors creates a perfect combination of taste and nutrition

13 Birds Eye Protein Blends Delivering plant-based protein benefit through the power of nutrient-rich vegetables, beans and whole grains

14 Both platforms off to a strong start Highly incremental to the category and Birds Eye Attracting new users and skewing younger Strong velocities, trending at or above the category average Dedicated marketing campaigns Flavor Full & Protein Blends Performance to Date Digital Television Social

15 Marketing Vegetables to Kids Birds Eye pioneered marketing vegetables to kids and continues to expand its reach

16 Birds Eye Disney-themed Sides Great-tasting, nutritious offering featuring key Disney characters

17 Regular Size Family Size 15.7% 17.2% 21.1% 23.7% 28.0% 33.9% 39.8% 2009 2010 2011 2012 2013 2014 2015 YTD $ Market Share Source: IRI US Multi-Outlet data; based on IRI’s Pinnacle custom definitions. More than doubled share and grew consumption 88% since acquisition 2015 YTD consumption +16% Adding capacity in Q4 2015 Birds Eye Voila! Vegetable-rich complete meals at a great value

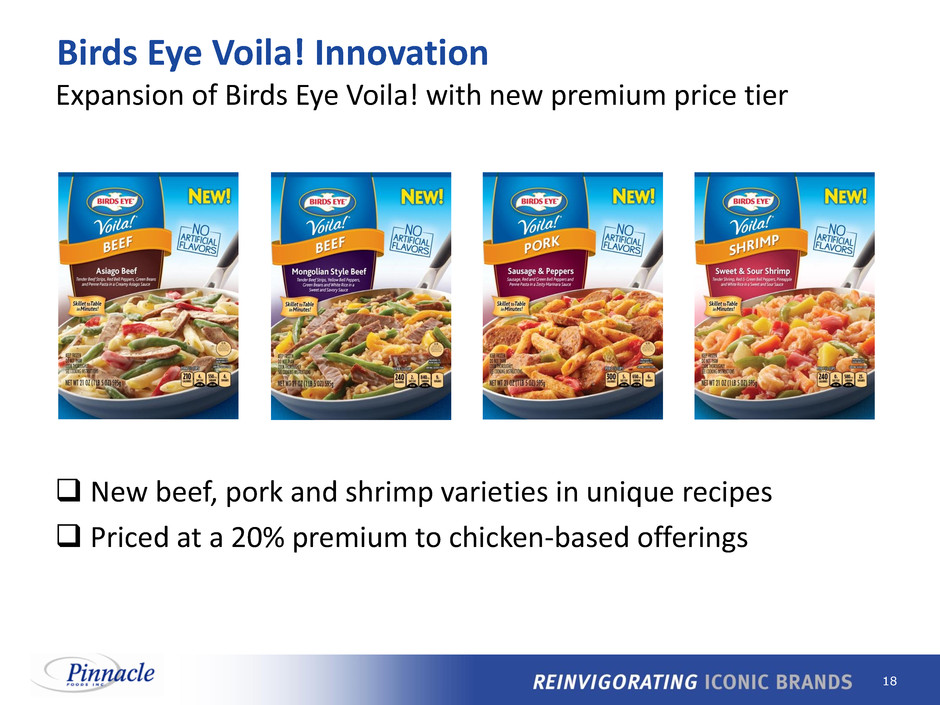

18 New beef, pork and shrimp varieties in unique recipes Priced at a 20% premium to chicken-based offerings Birds Eye Voila! Innovation Expansion of Birds Eye Voila! with new premium price tier

19 Birds Eye Advertising New campaign supporting new platforms and base business, including dedicated advertising for Voila! for the first time

20 Baking Category

21 High consumer interest Structural barriers Short-term pricing pressure Category Dynamics Tap into excitement Innovate to address barriers Trade consumers up to higher-value offerings Pinnacle Strategy Baking Category

22 Tapping into the Excitement of Baking Duncan Hines driving superior engagement through popular website and social media Duncan Hines Website (1) Adweek Magazine blog Social Times 6/9/2015, based on Facebook data 1/1/15 through 4/30/15. ‘Interactions’ are ‘likes’+’comments’+’shares’. (2) Facebook data 1/1/15 through 6/30/15. 9M+ Visits Annually 2.6x Competitors Duncan Hines #1 CPG brand for total interactions (1) 2.9m 1.1m + Facebook Interactions(2) Over 500k very engaged Baker’s Club members

23 Price Tier/ Benefit Decadent Classic Signature Tiered pricing and benefits strategy driving profitable market share growth… Trading Consumers Up to Higher-Value Offerings Source: IRI US Multi-Outlet data, YTD ending 8/2/15; based on IRI’s Pinnacle custom definitions. Price and share changes versus year ago. Premium/ Extreme Indulgence Entry Level/ Everyday Baking Mid-Tier/ Special Recipes $ Share ∆ 2014 +0.7 pts. 2015 YTD -0.1 pts. 2014 +0.4 pts. 2015 YTD +0.4 pts. 2014 +0.6 pts. 2015 YTD +0.0 pts. …with significant net price growth versus category in 2014 and 2015 YTD

24 Ideal for serving 2 to 4 people Kit includes mix, frosting and 6-inch disposable pan New premium baking kits positioned for smaller households Innovating to Address Structural Barriers

25 Significant Consumer Excitement for Perfect Size goobereena August 14 2015, 3:52 PM finally a cake mix for a single to 2 person household!!! “Thank you for having a great new product called Perfect Size. There are only 2 of us and this is the right amount of cake to bake for us…” “…I bought it as it is the perfect size product for people who live alone and love cake. No more having to eat something for a week…” “It's just me and my husband and every time I make a cake we end up throwing half of it away. These are, well, perfect!! What's not to love!” Ioma August 1 2015, 7:19 PM Moist, flavorful, and just the right size. No waste. judy gambill August 7 2015, 2:48 PM Thank you Duncan Hines!!! Finally someone thinks about 2 people families like mine now that we are retired... “Thank you, thank you, thank you. I was making the other cakes and throwing them away after 2 days. Too much cake. Thank you so much!”

26 A Disciplined Approach to M&A North America focus Existing or adjacent categories Market leadership or line of sight to leadership Synergy-rich transactions Speed of integration

27 Category remains highly competitive, with share below expectations Profitability on track with acquisition model In-house manufacturing start-up complete Robust new product pipeline ready for launch in early 2016 Wish-Bone Update

28 Rapidly growing innovator of plant-based proteins Broad portfolio of 25+ retail SKUs Popular flavors and formats Gardein Update Unique health & wellness platform

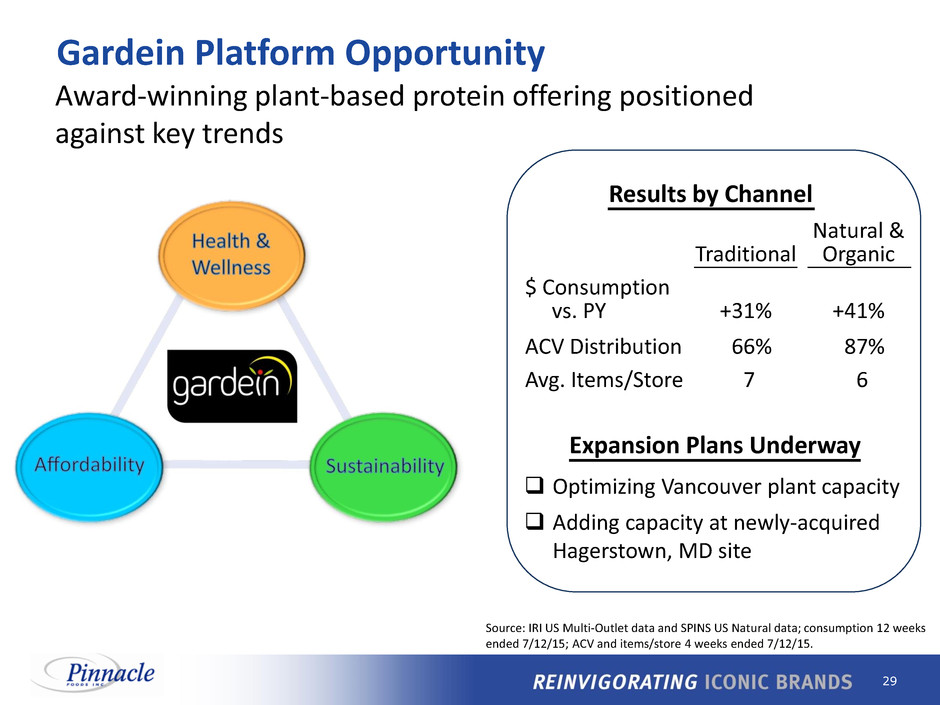

29 Results by Channel Optimizing Vancouver plant capacity Adding capacity at newly-acquired Hagerstown, MD site Expansion Plans Underway Award-winning plant-based protein offering positioned against key trends Gardein Platform Opportunity Traditional Natural & Organic $ Consumption vs. PY +31% +41% ACV Distribution +66% +87% Avg. Items/Store +07% +06% Source: IRI US Multi-Outlet data and SPINS US Natural data; consumption 12 weeks ended 7/12/15; ACV and items/store 4 weeks ended 7/12/15.

30 2015 New Products

31 Agenda Overview Executing Our Strategy Financial Update Outlook

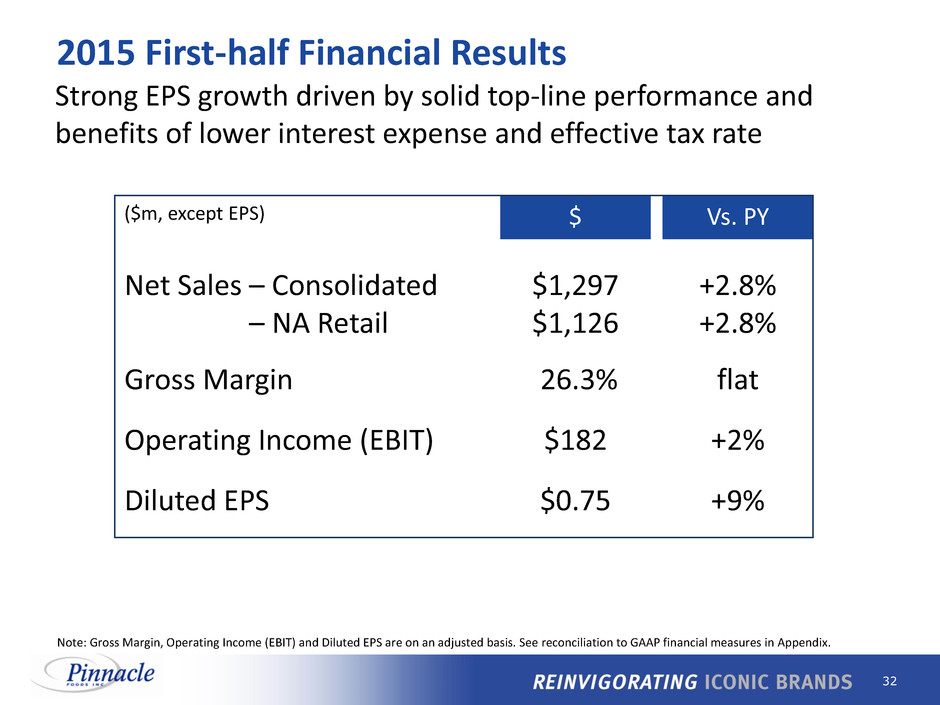

32 ($m, except EPS) $ Vs. PY Net Sales – Consolidated Net Sales – NA Retail $1,297 $1,126 +2.8% +2.8% Gross Margin 26.3% flat Operating Income (EBIT) $182 +2% Diluted EPS $0.75 +9% Note: Gross Margin, Operating Income (EBIT) and Diluted EPS are on an adjusted basis. See reconciliation to GAAP financial measures in Appendix. 2015 First-half Financial Results Strong EPS growth driven by solid top-line performance and benefits of lower interest expense and effective tax rate

33 4.0% 4.1% 3.7% 3-4% 7.4% 2.3% 2.7% 3-3.5% 2012 2013 2014 2015E Productivity Inflation % of COGS Productivity exceeded inflation in the past two years, enabling offset to weak industry growth 2015 2nd half gross margin expected to accelerate, benefitting from favorable productivity/inflation relationship Business model calls for productivity to offset inflation over time Productivity and Inflation

34 Conversion Logistics Proteins Grains & Oils Packaging Vegetables & Fruit All Other Sugar & Cocoa 2015 Cost of Goods Sold: $1.9 billion More Inflationary Logistics Proteins Conversion Deflationary Grains & Oils Sugar & Cocoa 2015 Outlook Diversity of cost basket serves as a natural hedge 2015 Input Cost Breakdown

35 2014 37.9% One-time items benefitting 2014 +0.8% 2014 Ongoing 38.7% Domestic Production Activities Deduction (DPAD) Foreign Tax Credit (FTC) Other 2015 Guidance 36.5% - 37.0% ETR Utilization of NOL benefit enables ETR reduction in 2015 2015 Effective Tax Rate (ETR) Note: ETR is on an adjusted basis. See reconciliation to GAAP financial measures in Appendix.

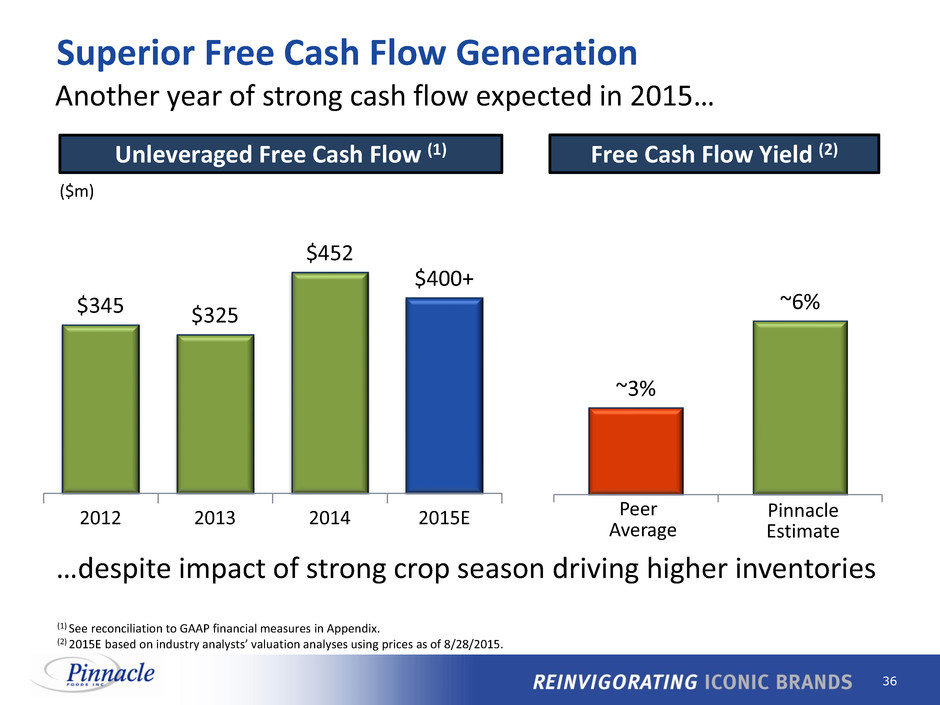

36 $345 $325 $452 $400+ $0 $100 $200 $300 $400 $500 $600 $700 2012 2013 2014 2015E Unleveraged Free Cash Flow (1) ~3% ~6% Peer Average Pinnacle Estimate Free Cash Flow Yield (2) ($m) (1) See reconciliation to GAAP financial measures in Appendix. (2) 2015E based on industry analysts’ valuation analyses using prices as of 8/28/2015. Superior Free Cash Flow Generation Another year of strong cash flow expected in 2015… …despite impact of strong crop season driving higher inventories

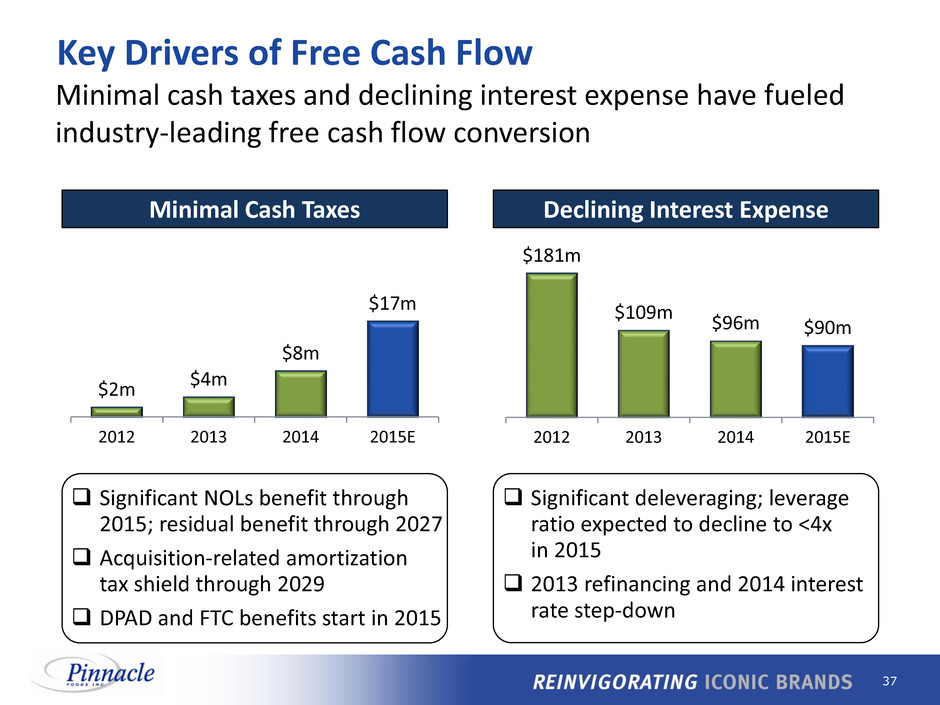

37 Key Drivers of Free Cash Flow $2m $4m $8m $17m 2012 2013 2014 2015E $181m $109m $96m $90m 2012 2013 2014 2015E Minimal cash taxes and declining interest expense have fueled industry-leading free cash flow conversion Minimal Cash Taxes Significant NOLs benefit through 2015; residual benefit through 2027 Acquisition-related amortization tax shield through 2029 DPAD and FTC benefits start in 2015 Declining Interest Expense Significant deleveraging; leverage ratio expected to decline to <4x in 2015 2013 refinancing and 2014 interest rate step-down

38 2012 2013 2014 2015E Capital Expenditures Capital Expenditures Prudent investment against both acquisitions and the base business further supports strong cash flow $78m $84m $103m $110m- $120m Base Acquisition-related Base Acquisition-related

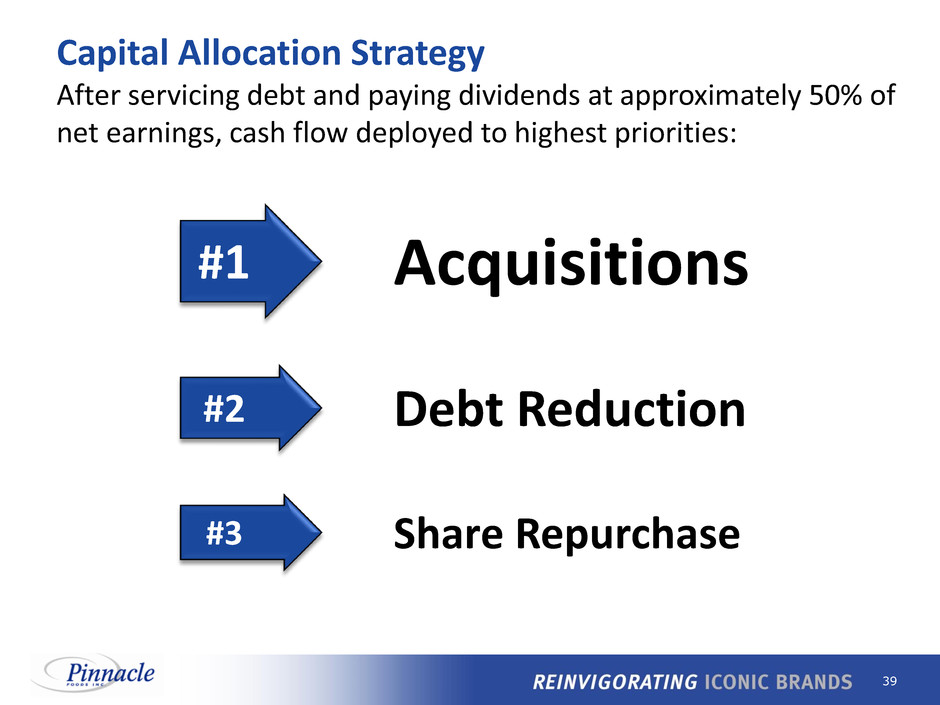

39 After servicing debt and paying dividends at approximately 50% of net earnings, cash flow deployed to highest priorities: Capital Allocation Strategy Acquisitions #1 Debt Reduction #2 Share Repurchase #3

40 Agenda Overview Executing Our Strategy Financial Update Outlook

41 Net Sales Growth exceeds categories Inflation 3.0% to 3.5% of COGS Nm Productivity 3% to 4% of COGS Nm ETR 36.5% to 37.0% Diluted EPS $1.89 to $1.91 +9% to +10% CAPEX $110m to $120m Note: Diluted EPS and ETR adjusted for items affecting comparability. Outlook H1 weighted H2 weighted H2 weighted 2015 Full Year Outlook

42 Attractive Value Creation Potential Long-Term Organic Growth Algorithm Net Sales Operating Income EPS Dividend Yield Note: Excludes items affecting comparability. In Line with Categories 10 – 12% 4 – 5% 7 – 8% 3 – 4% Accretive acquisitions would accelerate growth further Realistic organic growth targets Sustainable productivity program Strong FCF providing optionality Disciplined M&A approach with demonstrated value creation

43 Appendix

44 Reconciliation to GAAP Financial Measures (1) Primarily includes: Hillshire agreement termination fee (net of costs), restructuring charges including integration costs, employee severance and non-recurring merger costs. (2) Primarily includes: Equity-based compensation expense resulting from liquidity event, fair value write-up of acquired inventories and mark-to-market gains/losses. (3) Primarily includes: Restructuring charges from plant consolidations, integration costs, non-recurring merger costs and employee severance. (4) Primarily includes: Bond redemption costs and management fee paid to sponsor. (5) Pro forma data reflects Adjusted Statement of Operations amounts assuming IPO and 2013 Refinancing occurred on the first day of Fiscal 2013. Year (52 Weeks) Ended December 29, 2013 Diluted In millions, except per share Gross Diluted Earnings Net Sales Profit EBIT EBT Net Earnings Shares Per Share Reported $2,591 $681 $512 $416 $248 116.9 $2.13 Acquisition, merger and other restructuring charges (1) 12 (130) (130) (79) Other non-cash items (2) 18 41 41 34 Adjusted 2,591 711 423 327 203 116.9 $1.74 Diluted In millions, except per share Gross Diluted Earnings Net Sales Profit EBIT EBT Net Earnings Shares Per Share Reported $2,464 $654 $293 $161 $89 108.6 $0.82 Acquisition, merger and other restructuring charges (3) 4 22 22 14 Other non-cash items (2) 6 6 6 3 Other adjustments (4) 53 76 55 Adjusted 2,464 664 374 265 161 108.6 $1.49 IPO and Refinancing (5) 26 16 8.0 Pr Forma $2,464 $664 $374 $291 $177 116.6 $1.52 Stock-based Compensation 1 8 8 6 0.05 Pro Forma Excluding Stock-based Compensation $665 $382 $299 $183 116.6 $1.57 Year (52 Weeks) Ended December 28, 2014

45 (1) Primarily includes: Accelerated depreciation from plant consolidations, restructuring charges including integration costs and employee severance. (2) Primarily includes: Bond redemption costs. (3) Pro forma data reflects Adjusted Statement of Operations amounts assuming IPO occurred on the first day of Fiscal 2012. Diluted In millions, except per share Diluted Earnings Net Sales EBIT Net Earnings Shares Per Share Reported $2,479 $284 $53 86.5 $0.61 Acquisition, merger and other restructuring charges (1) 45 28 Other adjustments (2) 21 23 Adjusted 2,479 350 104 86.5 $1.20 IPO (3) 30 30.9 Public company costs (3) (3) (2) Pro Forma $2,479 $347 $132 117.4 $1.13 Year (53 Weeks) Ended December 30, 2012 Reconciliation to GAAP Financial Measures

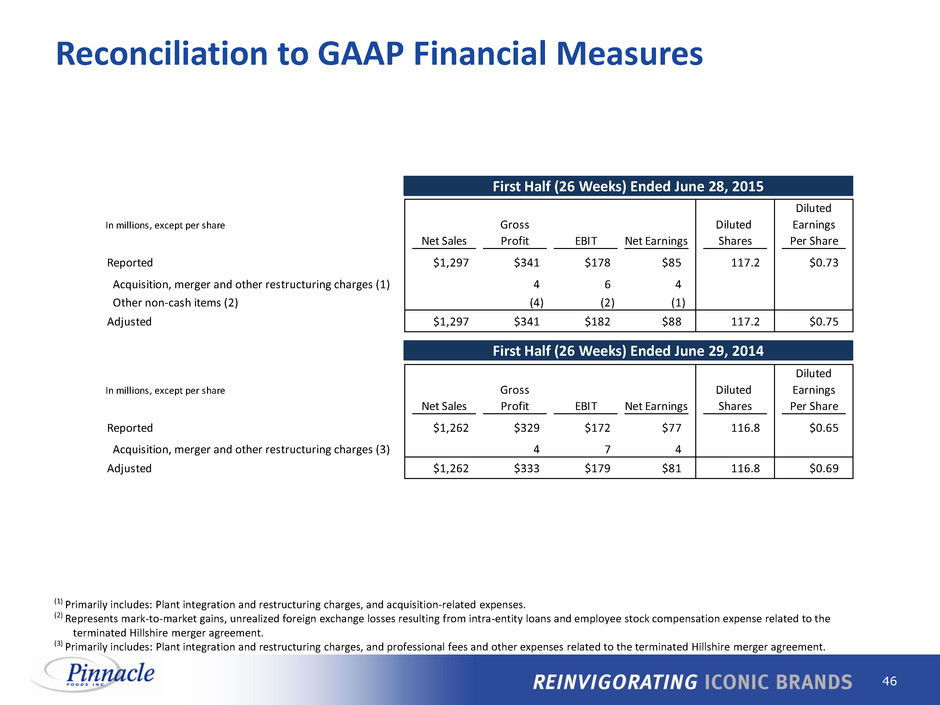

46 (1) Primarily includes: Plant integration and restructuring charges, and acquisition-related expenses. (2) Represents mark-to-market gains, unrealized foreign exchange losses resulting from intra-entity loans and employee stock compensation expense related to the terminated Hillshire merger agreement. (3) Primarily includes: Plant integration and restructuring charges, and professional fees and other expenses related to the terminated Hillshire merger agreement. Diluted In millions, except per share Gross Diluted Earnings Net Sales Profit EBIT Net Earnings Shares Per Share Reported $1,297 $341 $178 $85 117.2 $0.73 Acquisition, merger and other restructuring charges (1) 4 6 4 Other non-cash items (2) (4) (2) (1) Adjusted $1,297 $341 $182 $88 117.2 $0.75 Diluted In millions, except per share Gross Diluted Earnings Net Sales Profit EBIT Net Earnings Shares Per Share Reported $1,262 $329 $172 $77 116.8 $0.65 Acquisition, merger and other restructuring charges (3) 4 7 4 Adjusted $1,262 $333 $179 $81 116.8 $0.69 First Half (26 Weeks) Ended June 29, 2014 First Half (26 Weeks) Ended June 28, 2015 Reconciliation to GAAP Financial Measures

47 (1) Primarily includes: Restructuring charges from plant consolidations, integration costs, non-recurring merger costs and employee severance. 2012 2013 2014 Reported Cash Flows from Operating Activities $203 $262 $551 Capital expenditures (78) (84) (103) Hillshire termination fee (net of costs and cash taxes) (150) Acquisition, merger and other restructuring charges (1) 48 39 64 Free Cash Flow $173 $217 $362 Cash interest expense 172 108 90 Unleveraged Free Cash Flow $345 $325 $452 Reconciliation of Unleveraged Free Cash Flow to Reported Cash Flows from Operating Activities - $m Reconciliation to GAAP Financial Measures