Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ascent Solar Technologies, Inc. | september920158-k.htm |

19/09/2015

29/09/2015 In addition to historical information, this presentation contains forward–looking statements that are based on assumptions made by management regarding future circumstances over which the company may have little or no control and involve risks, uncertainties and other factors that may cause actual results to be materially different from any future results expressed or implied by such forward–looking statements. Please note that these forward-looking statements reflect our opinions only as of the date of this publication and we undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events. Please refer to our SEC filings for a more detailed description of the risk factors that may affect our results. These documents are available at our website, www.ascentsolar.com, and at the SEC’s website, www.sec.gov. Safe Harbor Statement

39/09/2015 Founded: Incorporated in 2005; Nasdaq IPO in July 2006 Headquarters/: Thornton, Colorado (~139k sf of fab & office space) Headcounts: ~150 Employees Technology: Thin-Film CIGS on flexible, plastic substrate Manufacturing: Roll-to-roll manufacturing, monolithic integration & intelligent process control Business Segments: SOLAR SOLUTION Aerospace, UAVs, Military, Specialty Applications, Consumer Market & Transportation POWER STORAGE SOLUTION Mobility, Outdoor & Emergency Portable Power Company Snapshot

49/09/2015 Award-Winning Technology R&D Magazine selected Ascent’s Innovative Monolithically-Integrated CIGS Photovoltaic Product on Polyimide Substrate as one of the 100 Most Innovative Technologies for 2010 Time Magazine Selected Ascent as one of the 50 Best Inventions of 2011

59/09/2015 Lightweight ASTI CIGS panels weigh a small fraction of conventional c-Si panels CIGS chemistry – highest thin-film conversion efficiency Best Power-to-Weight Ratio (50 - 250 watt/kg) Flexible Numerous applications compared to rigid based PV Allows for easy Roll-to-Roll fabrication More efficient use of equipment and manufacturing floor space Durable (MIL-STD-810G and IEC 61646 certified) Inherent robust construction with redundant interconnects reducing failure points Plastic substrate does not crack or shatter upon impact Customizable (with Monolithic Integration) Simplified electrical and mechanical construction Customized cell shapes easily integrated into manufacturing process Meaningful Output in Small Area Higher voltages economically achieved in smaller areas ASTI’s PV Voltage is more easily integrated into electronics than Discrete Cells What Makes Ascent’s PV Unique?

69/09/2015 ASTI is Trading at Significant Discount • Current Stock Price** : $0.25 • Current Share Outstanding** : 71,579,659 shares • Current Market Capitalization** : $17.9m • Cash* : $1.5m • Total Debt* : $13.7m • Enterprise Value** : ~$30.1m • Fixed Assets (Building/Equipment)* : $10.9m • $78m worth of usable equipment were written off by prior management in FY2011 due to non-utilization, resulting in current net BV of ~$6.5m. • The market is trading at EV of ~$30.1 and has completely ignored the Intellectual Property value of Ascent, which was developed over the last 20 years with a total R&D & CAPEX cost of >$200m *Figures as of Sept 8, 2015 unaudited financials **Data as of Sept 8, 2015

79/09/2015 $0 $50 $100 $150 $200 $250 $300 R&D and Engineering CAPEX Market Capitalization $ Millions Substantial Investments Not Currently Reflected In Valuation Market Cap does NOT reflect the large prior investments of over $200 million in CAPEX, R&D and Engineering already in place.

89/09/2015

99/09/2015 Dynamics of Current Solar PV Market Source: Solarcellcentral.com $0.60/W

109/09/2015 The Game of Racing to the Bottom of $X per Watt

119/09/2015 Groundbreaking Technology Now in Good Hands Prior management was PV-only oriented and focused primarily on roof- top solar market, which requires significant CAPEX and large scale deployments to achieve breakeven. Current management assumed control of the company in early 2012, and has since developed a unique approach to competing in the solar market by pivoting our strategy. New strategy to reposition as a leading provider of portable solar and power solutions for consumer electronics through our flagship EnerPlexTM brand and high-value PV applications such as Aerospace, Military, Emergency Power & etc. Unlike most solar companies, which are primarily dependent on winning the race to producing the lowest cost per watt, Ascent now targets attractive markets which will help insulate the company from the margin erosion and pricing pressure that pervades the rest of the solar industry. Key Transformation Messages

129/09/2015

139/09/2015 Paradigm Shift in Strategy and Business Model Capitalizing on our Unmatched Technology Focusing on Consumer Products & high-value PV Applications • Where customers are more interested in functionality and durability rather than low cost per watt of electricity • Consumer products and high-value PV markets that do not compete with less-expensive fossil fuel generated power • Deviate from a commodity-based pricing to a value pricing model, effectively shifting from $X per watt to $Y per unit and/or solution • Portfolio can be expanded to include high-margin non PV ancillary products Strategy and Business Model • Hybrid of B2B/B2C strategy to develop EnerPlexTM consumer products • Aggressive “Go-to-market” strategy • Developed global sales and distribution model • Reduced CAPEX requirement • Ability to achieve profitability without massive ramping up of PV production Transformation Completed

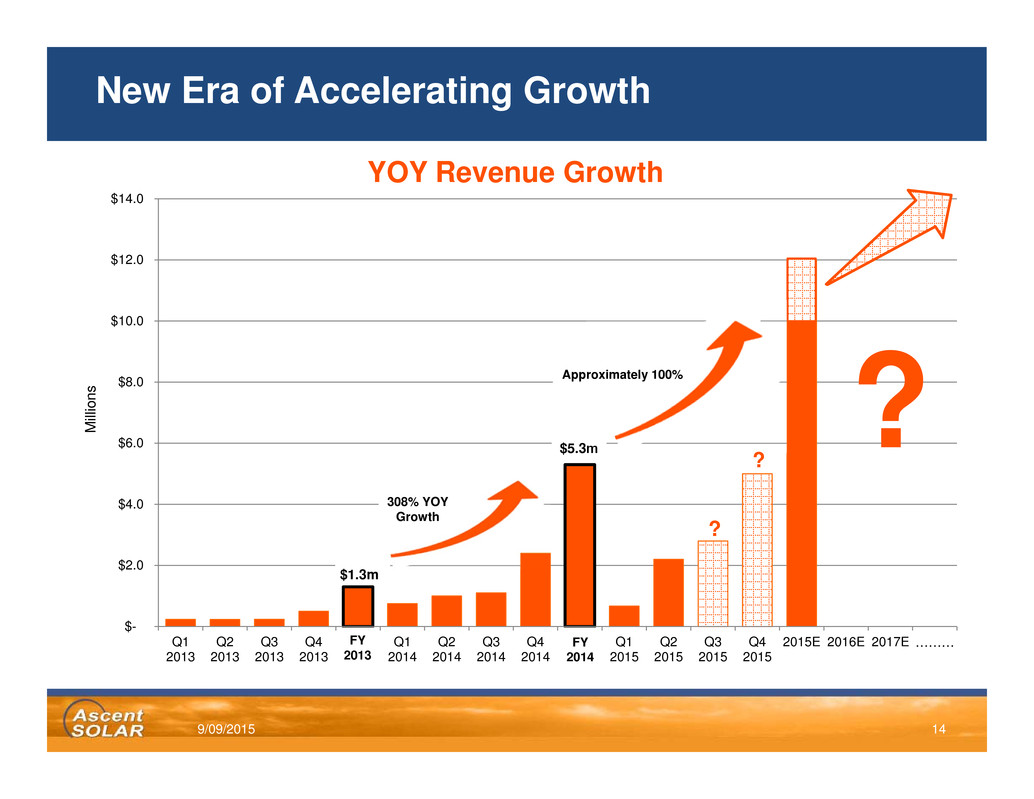

149/09/2015 New Era of Accelerating Growth YOY Revenue Growth $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 Q1 2013 Q2 2013 Q3 2013 Q4 2013 FY 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 2015E 2016E 2017E ……… M i l l i o n s $5.3m 308% YOY Growth $1.3m ?Approximately 100% ? ?

159/09/2015 Relative Segment Attractiveness CUSTOMER TAM G M % H I G H L O W LOW HIGH Emergency Power Transportation Mobility Power Aerospace BIPV/BAPV Outdoor Power Military

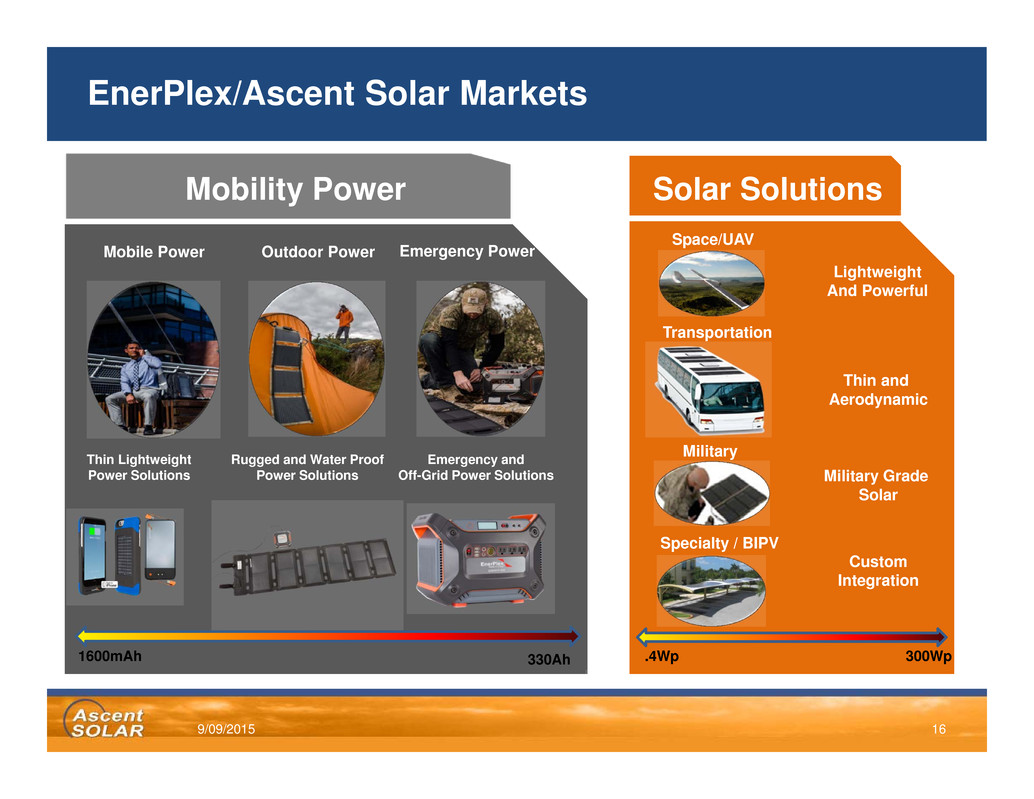

169/09/2015 Thin Lightweight Power Solutions EnerPlex/Ascent Solar Markets Mobile Power Outdoor Power Emergency Power Mobility Power Solar Solutions Military Transportation Space/UAV Specialty / BIPV Thin and Aerodynamic Lightweight And Powerful Military Grade Solar Custom Integration Rugged and Water Proof Power Solutions Emergency and Off-Grid Power Solutions 1600mAh 330Ah .4Wp 300Wp

179/09/2015 Go To Market Strategy Current Focus will Drive Higher Margins and Protected Market Share, while Longer Term Goals Focus on Increasing Wider Demand for Ascent’s Products Current Focus Long Term Expansion Focused on entering and establishing new markets where Ascent’s unique lightweight & flexible PV will provide higher margins and barriers to entry The Company’s lightweight, flexible and durable products are ideal for these markets and are leading the integration of solar products into the consumer electronics, drones and defense markets As the smaller high premium markets mature, Ascent will broaden its target markets to include higher volume opportunities such as transportation, off-grid and building integrated By that time, these markets will be more fully developed and Ascent’s products will offer a unique advantage due to their light weight, durable and flexible nature combined with high efficiency technology MARGIN LOW VOLUME HIGH HIGH VOLUME LOW MARGIN Transportation MilitaryConsumer BIPV/BAPV Off-GridDrones Space Array Horizon II Horizon III

189/09/2015 Ascent’s Addressable Market EnerPlex Surfr™ – 320 million units market potential Transportation 1,200 MW EnerPlex™ Consumer Products - $33bn market by 2015 (Pike Research 2011) Defense/Aerospace & Off-Grids 2,550 MW Customized BIPV 11,500 MW Sources: BIPV estimates according to GBI Research: Thin-Film Photovoltaic (PV) Cells Market Analysis to 2020. Ascent Solar internal estimates. Ascent’s Total Addressable Market 15,250 MW

199/09/2015

209/09/2015 EnerPlex As Near Term Growth Driver

219/09/2015 EnerPlex Line of Products Surfr SeriesJumpr Series Commandr Series Generatr Series Kickr Series Packr Series

229/09/2015 MicroCenter – 25 Stores Fry’s – 34 Superstores TCC Verizon Premium Retailers – 356 Stores Mike’s Camera – 13 Stores Cabelas – 17 Stores Sports Authority – 104 Stores Retail Footprint in US…..and Growing Rapidly

239/09/2015 e-commerce EnerPlex Retail / e-Tail Globally

249/09/2015 Q1 Retail Outlets 393 Q2 Retail Outlets 689 Q3 Retail Outlets 816 0 100 200 300 400 500 600 700 800 900 Anaconda Fry's TCC Verizon Retailers Micro Center Mike's Camera Maplin Sports Authority Cabela's Mobile Workshop Nigeria Totals Q1 Q2 Q3 YTD Growth 207% Retail Footprint Growth (2015)

259/09/2015

269/09/2015 Partnership with Vanguard Space Technologies ASTI lightweight PV modules were selected by Vanguard Space Technologies, Inc. (Vanguard) in 2H 2014 to create an ultra-thin, high power-to-weight ratio, large space solar array Vanguard had passed a key test milestone with its Thin Integrated Solar (THINS) PV technology , performed by the NASA Jet Propulsion Laboratory plasma facility, which is intended to power next-generation spacecraft* *Next-generation spacecraft will use electric propulsion powered by lightweight, high-power solar arrays like THINS. (http://vst-inc.com/solar- photovoltaic-technology-passes-crucial-test/

279/09/2015 ASTI Monolithically Integrated CIGS at AM0 vs AM1.5 ASTI Terrestrial PV is Ideally Suited for Space Environment (AM0) Monolithically integrated cells are small area and ideal for higher currents in space without additional trimming Larger size module (146mm x 304mm) dramatically reduces part count over any other PV technology, hence significantly reducing potential failure points Flexibility and inherent interconnect redundancy ideal for challenging space environment Comparison of AM0 vs AM1.5 20-23% increase in maximum power 21% increase in current at maximum power Voltage at maximum power is approximately unchanged • ±5% of AM1.5 value (nominally 18.5V for 146mm x 304mm module) Note that results typical of all modules of various sizes up to 146mm x 304mm modules

289/09/2015 One and only commercially produced CIGS PV on flexible polyimide substrate with monolithic integration > 230 watts/kg includes UAV mission-ready packaging Super light-weight at approximately 400g per square meter Larger module (unit) size reduces integration costs and increases system reliability Thin film structure on flexible substrate eliminates catastrophic failure common to single crystal PV Easily customizable through monolithic integration for target voltage and current to various power management systems on UAVs and on various different wing designs Super Light Module for Aerospace Application

299/09/2015 Silent Falcon™ UAS with ASTI PV Silent Falcon is a Small Solar Electric UAV 80 watts of ASTI thin film solar photovoltaic (PV), Lithium-polymer batteries and advanced efficient propulsion system Lightweight, Flexibility, and Durability is a “MUST” to integrate PV on the Wings of Silent Falcon Proprietary ISR sensor gimbals with daylight and low light video optics GPS, electric autopilot and servo-control Up to double the flight endurance (12 hours) with ASTI solar at altitude of 200’ to 20,000’ www.silentfalconuas.com

309/09/2015

319/09/2015 Provide power to generators, battery packs, satellite phones and any other power driven devices used by the military Easily foldable & transportable Easily deployable with one-man operation Fully integrated power management system Durable under any conditions Specifications Folded: 80 x 410 x 220mm Fully Deployed: 75 x 1990 x 725mm Weight: 8.2Ibs (3.7kg) Power Storage: 86.5 watt hours (Li-on with Battery Management System Protection) Output (Circuit Breaker Protected) Vmax: 18.5V Amax: 3.2A Pmax: 60W 2 x 5VDC, 2.1A USB (Regulated) Either 19, 24 or 28V DC (Regulated) Military Specs Portable Solar Blanket - MilPak™ E

329/09/2015