Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Spectra Energy Partners, LP | d83229d8k.htm |

| EX-99.1 - EX-99.1 - Spectra Energy Partners, LP | d83229dex991.htm |

| Exhibit 99.2 |

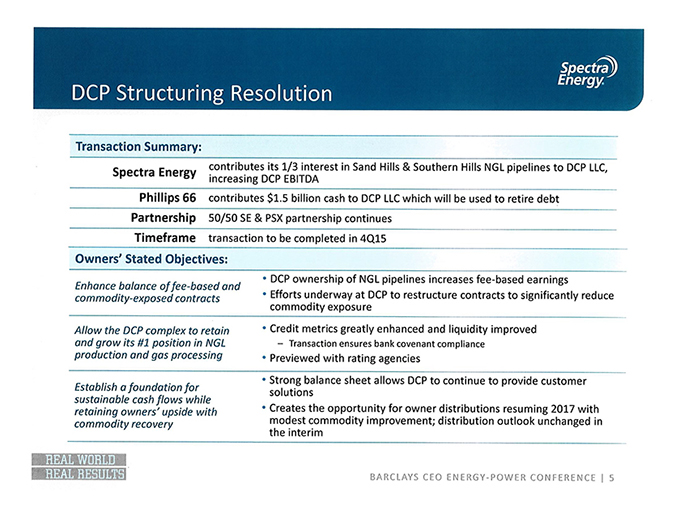

DCP Structuring Resolution Transaction Summary: Spectra energy contributes its 1/3 interest in Sand Hills & Southern Hills NGL pipelines to DCP LLC; increasing DCP EB|TDA Phillips 66 contributes $1.5 billion cash to DCP LLC which will be used to retire debt Partnership 50/50 SE & PSX partnership continues Timeframe transaction to be completed in 4Q15 Owners’ Stated Objectives: Enhance balance of fee-based and commodity-exposed contracts DCP ownership of NGL pipelines increases fee-based earnings Efforts underway at DCP to restructure contracts to significantly reduce commodity exposure Allow the DCP complex to retain and grow its #1 position in NGL production and gas processing Credit metrics greatly enhanced and liquidity improved - Transaction ensures bank covenant compliance Previewed with rating agencies Establish a foundation for sustainable cash flows while retaining owner’’ upside with commodity recovery Strong balance sheet allows DCP to continue to provide customer solutions Creates the opportunity for owner distributions resuming 2017 with modest commodity improvement; distribution outlook unchanged in the interim BARCLAYS CEO ENERGY-POWER CONFERENCE| 5

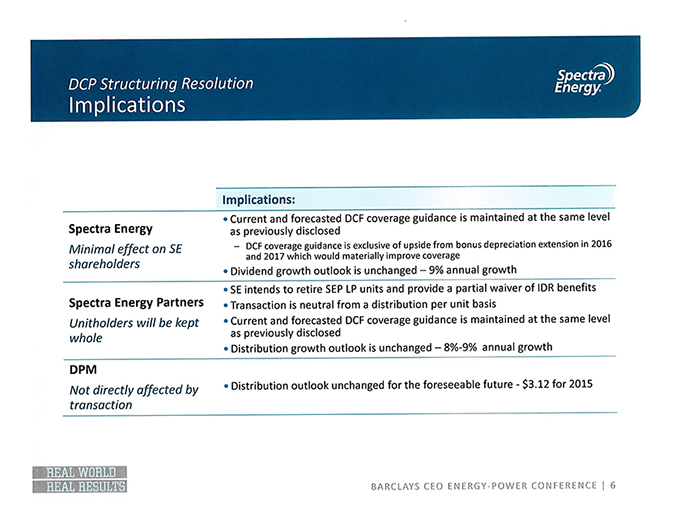

DCP Structuring Resolution Implications Implications: Spectra Energy • DCF coverage guidance is maintained at the same level as previously disclosed for 2016 and 2017 Minimal effect on SE shareholders - DCF coverage guidance is exclusive of upside from bonus depreciation extension in 2016 and 2017 which would materially improve coverage • Dividend growth outlook is unchanged - 9% annual growth Spectra Energy Partners SE to retire proportionate SEP LP units with partial waiver of IDR benefits Transaction is neutral from a distribution per unit basis Unitholders will be kept whole DCF coverage guidance is maintained at the same level as previously disclosed for 2016 and 2017 Distribution growth outlook is unchanged - 8%-9% annual growth DPM Not directly affected by • Distribution outlook unchanged for the foreseeable future - $3.12 for 2015 transaction REAL WORLD REAL RESULT BARCLAYS CEO ENERGY-POWER CONFERENCE | 6