Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CHC Group Ltd. | exhibit991earningsreleasef.htm |

| 8-K - 8-K - CHC Group Ltd. | a8kearningsreleasefy16q1.htm |

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 CHC Helicopter Fiscal 2016 First Quarter Ended July 31, 2015 September 9, 2015

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 2 Presenters Karl Fessenden Lee Eckert President, Chief Executive Officer SVP, Chief Financial Officer Norway

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 3 Forward-Looking Statements and non-GAAP Financial Measures Safe Harbor Statement This presentation contains forward-looking statements and information within the meaning of certain securities laws, including the “safe harbor” provision of the United States Private Securities Litigation Reform Act of 1995, the United States Securities Act of 1933, as amended, the United States Securities Exchange Act of 1934, as amended and other applicable securities legislation. All statements, other than statements of historical fact included in this press release regarding the benefits of the transactions, as well as, our strategy, future operations, projections, conclusions, forecasts and other statements are “forward- looking statements”. While these forward-looking statements represent our best current judgment, actual results could differ materially from the conclusions, forecasts or projections contained in the forward-looking statements. Certain material factors or assumptions were applied in drawing a conclusion or making a forecast or projection in the forward-looking information contained herein. Such factors include: volatility in the oil and gas sector generally, and the potential impact of such volatility on offshore exploration and production, particularly on demand for offshore transportation services, competition in the markets we serve, our ability to secure and maintain long-term support contracts, our ability to maintain standards of acceptable safety performance, exchange rate fluctuations, political, economic, and regulatory uncertainty, problems with our non-wholly owned entities, including potential conflicts with the other owners of such entities, exposure to credit risks, our ability to continue funding our working capital requirements, our ability to remain in compliance with the New York Stock Exchange listing standards, risks inherent in the operation of helicopters, unanticipated costs or cost increases associated with our business operations, trade industry exposure, inflation, ability to continue maintaining government issued licenses, necessary aircraft or insurance, loss of key personnel, work stoppages due to labor disputes, and future material acquisitions or dispositions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated. The Company disclaims any intentions or obligations to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Please refer to our annual report on Form 10-K and quarterly reports on Form 10-Q, and our other filings, in particular any discussion of risk factors or forward-looking statements, which are filed with the SEC and available free of charge at the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact any estimates or forward-looking statements made herein. Adjusted EBITDAR excluding special items is referred to in this document as EBITDAR. Note to non-GAAP Financial Measures This presentation contains certain non-GAAP financial measures, which are not measures of financial condition or profitability. Non-GAAP measures should not be considered as an alternative to GAAP financial measures. Non-GAAP measures may not be calculated or comparable to similarly titled measures used by other companies. See Non-GAAP reconciliations in the appendix to this presentation for a reconciliation of these measures to the most directly comparable GAAP financial measures. Adjusted EBITDAR, Adjusted EBITDAR excluding special items, Adjusted EBITDAR margin, Adjusted Net Loss, Liquidity, Free Cash Flow, Adjusted Free Cash Flow, Adjusted Net Debt, Adjusted Leverage Ratio, are not measurements of the company’s financial performance under GAAP and should not be considered as an alternative to net income or any other performance measures derived in accordance with GAAP or as an alternative to net cash provided by operating activities or any other measures of the company’s cash flow or liquidity. We believe these non-GAAP financial measures are useful for investors, analysts and other interested parties as they facilitate company-to-company operating and financial condition performance comparisons by excluding potential differences caused by variations in capital structures, taxation, the age and book depreciation of facilities and equipment, restructuring initiatives, consulting agreements and equity-based, long-term incentive plans.

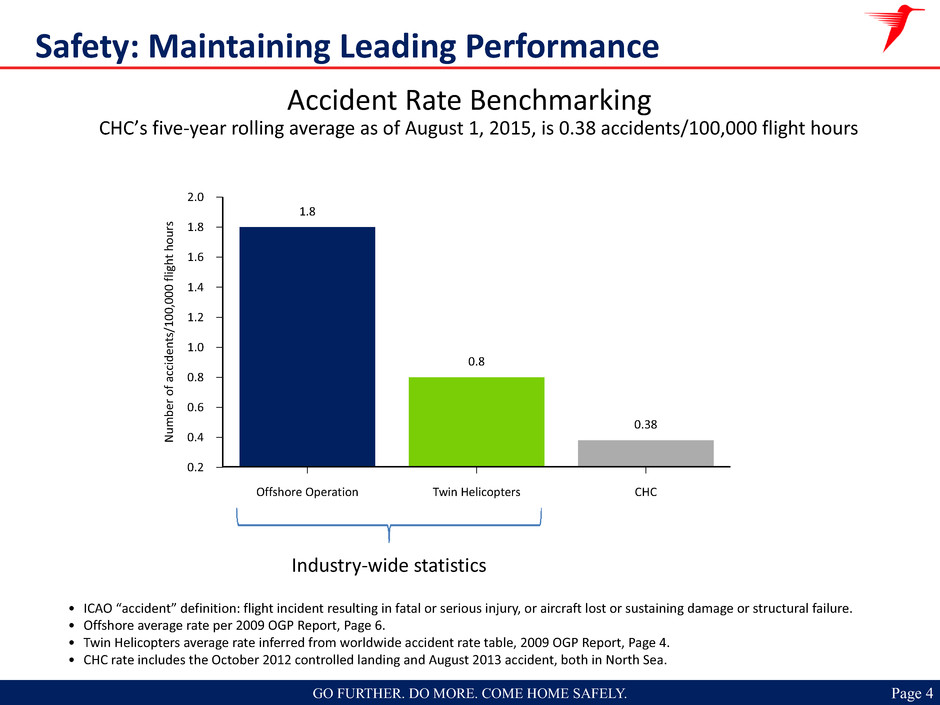

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 4 Accident Rate Benchmarking CHC’s five-year rolling average as of August 1, 2015, is 0.38 accidents/100,000 flight hours Safety: Maintaining Leading Performance • ICAO “accident” definition: flight incident resulting in fatal or serious injury, or aircraft lost or sustaining damage or structural failure. • Offshore average rate per 2009 OGP Report, Page 6. • Twin Helicopters average rate inferred from worldwide accident rate table, 2009 OGP Report, Page 4. • CHC rate includes the October 2012 controlled landing and August 2013 accident, both in North Sea. Industry-wide statistics 2.0 1.8 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 N um be ro fa cc id en ts /1 00 ,0 00 fli gh th ou rs Offshore Operation Twin Helicopters CHC 1.8 0.8 0.38

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 5 Market Downturn Continues to Evolve • The market continues to be volatile as evidenced by the sharp decline in Brent oil prices through the quarter and recently • The market downturn is now widely expected to be more prolonged than initially forecasted Source: Bloomberg. Note: 6/29/15 = date of CHC Q4 2015 and Full Year results release. Brent Oil ($/bbl) $70 $65 $60 $55 $50 $45 $40 $35 $30 1/ 6/ 20 15 1/ 19 /2 01 5 1/ 30 /2 01 5 2/ 12 /2 01 5 2/ 25 /2 01 5 3/ 10 /2 01 5 3/ 23 /2 01 5 4/ 6/ 20 15 4/ 17 /2 01 5 4/ 30 /2 01 5 5/ 13 /2 01 5 5/ 26 /2 01 5 6/ 8/ 20 15 6/ 19 /2 01 5 7/ 2/ 20 15 7/ 15 /2 01 5 7/ 28 /2 01 5 8/ 10 /2 01 5 8/ 21 /2 01 5 9/ 3/ 20 15 -18.3% 6/29/2015: $62.01 9/3/2015: $50.68 Market volatility drives the need to remain flexible and focus on cost control in near term

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 6 Long-term Trends Benefit CHC Discoveries By Water Depth2 1 © OECD/IEA 2015 Oil Market Report, IEA Publishing. License: https://www.iea.org/t&c/termsandconditions 2Source: Infield Systems, Ltd. (June 2015). Growing World Oil Demand Growth in Platform Distance from Shore Increasing Deep Water Discoveries • World demand for crude oil is forecasted to grow • Platforms are increasingly moving further offshore • Offshore logistics require mission-critical helicopter services • Near shore reserves are declining • Discoveries in deep and ultra-deep water are increasing Long-term trends drive demand for helicopter services World Oil Demand Forecast1 Growth in Platform Distance to Shore2

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 7 Key Focus Areas Focus areas aimed at enhancing competitive and financial position Leverage customer and OEM relationships Execute rigorous cost control Enhance capital efficiency through fixed charge reduction and fleet optimization Efforts resulted in EBITDAR increase in fiscal 2016 first quarter versus prior year 321

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 8 Navigating Current Market Environment • Customer and OEM relationships remain critical, discussions ongoing • Operating performance matters • Ability to operate in remote and challenging environments • Global footprint and standard processes • Search and rescue and emergency services capabilities in addition to oil & gas Leverage customer and OEM relationships Execute rigorous cost control • Targeted headcount reduction about two thirds complete • Continue to review opportunities to reduce cost structure • Effective cost management drove first quarter EBITDAR performance improvement year-over-year • Focus on managing EBITDAR margin and cash flow

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 9 Navigating Current Market Environment (cont'd) • Fixed charge reduction: ◦ Reduce interest expense on long term debt ▪ $41 million of bond repurchases in fiscal 2016 to date ▪ Combined with $320 million of repurchases in fiscal 2015 - reduces annualized interest expense ~$34 million ◦ Move to debt at more effective rates ▪ Asset-Based Loan ("ABL") facility ▪ Seeking optimal terms on any new leases • Fleet optimization ◦ 11 aircraft included in restructuring accrual at end of July - intend to return to lessor ◦ Reduced commitments by $169 million, additional flexible purchase orders of $249 million • Continue to assess opportunities to further enhance capital structure Enhance capital efficiency through fixed charge reduction and fleet optimization

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 10 Consolidated Results • First quarter revenue declined 18% from prior year quarter, down 9% excluding currency impact ◦ Driven by Helicopter Services which was down 9% excluding the impact of currency ◦ Heli-One was up 8% excluding the impact of currency 400 300 200 100 0 $ (M ill io ns ) FY15 Q1 FY16 Q1 $461 $376 120 100 80 60 40 20 0 $ (M ill io ns ) 50 45 40 35 30 25 20 EB IT DA R M ar gi n (% )(2 ) FY15 Q1 FY16 Q1 $112 $114 26.6% 32.8% 1Adjusted EBITDAR excluding special items is referred to as EBITDAR in this document. See Appendix for reconciliation to GAAP measures. 2Adjusted EBITDAR margin is referred to as EBITDAR margin. It is calculated as adjusted EBITDAR excluding special items divided by Operating Revenue. Operating revenue is total revenue less reimbursable revenue which is costs reimbursed from customers. • Quarterly EBITDAR1 and EBITDAR margin2 increase demonstrates strong execution of cost control program • Further $19 million restructuring charge taken in Q1 • Excluding foreign exchange, Q1 operating expenses at the Adjusted EBITDAR level reduced ~$50 million year-over- year, a ~14% reduction Revenue Reported: (18)% YoY | FX Adjusted: (9)% YoY EBITDAR Reported: 2% YoY | FX Adjusted: up modestly YoY

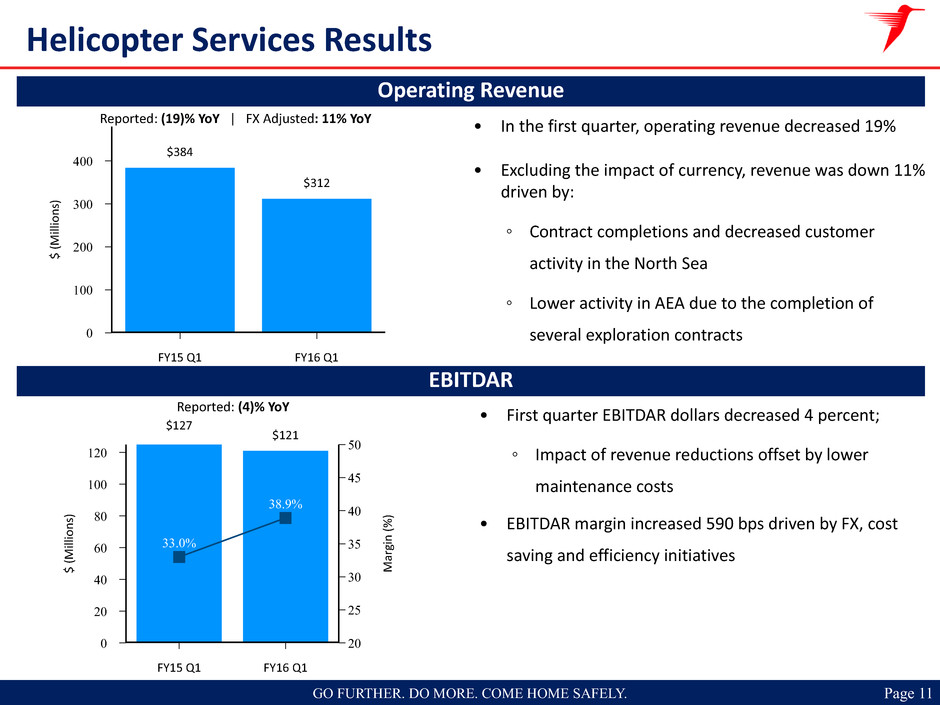

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 11 Helicopter Services Results 400 300 200 100 0 $ (M ill io ns ) FY15 Q1 FY16 Q1 $384 $312 120 100 80 60 40 20 0 $ (M ill io ns ) 50 45 40 35 30 25 20 M ar gi n (% ) FY15 Q1 FY16 Q1 $127 $121 33.0% 38.9% • In the first quarter, operating revenue decreased 19% • Excluding the impact of currency, revenue was down 11% driven by: ◦ Contract completions and decreased customer activity in the North Sea ◦ Lower activity in AEA due to the completion of several exploration contracts • First quarter EBITDAR dollars decreased 4 percent; ◦ Impact of revenue reductions offset by lower maintenance costs • EBITDAR margin increased 590 bps driven by FX, cost saving and efficiency initiatives Operating Revenue Reported: (19)% YoY | FX Adjusted: 11% YoY EBITDAR Reported: (4)% YoY

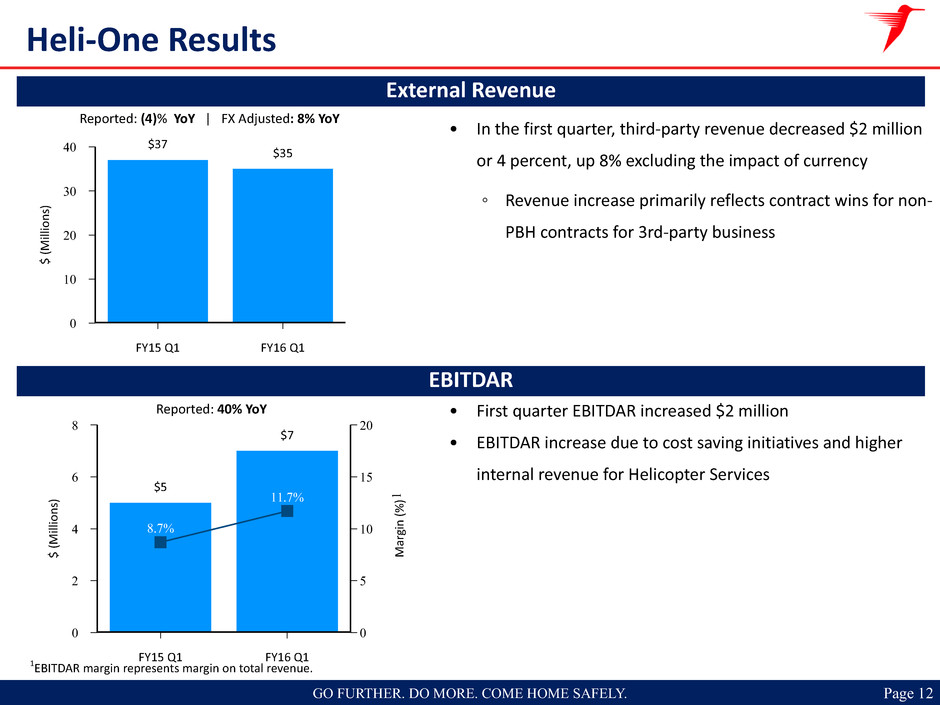

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 12 Heli-One Results • In the first quarter, third-party revenue decreased $2 million or 4 percent, up 8% excluding the impact of currency ◦ Revenue increase primarily reflects contract wins for non- PBH contracts for 3rd-party business • First quarter EBITDAR increased $2 million • EBITDAR increase due to cost saving initiatives and higher internal revenue for Helicopter Services 40 30 20 10 0 $ (M ill io ns ) FY15 Q1 FY16 Q1 $37 $35 8 6 4 2 0 $ (M ill io ns ) 20 15 10 5 0 M ar gi n (% ) FY15 Q1 FY16 Q1 $5 $7 8.7% 11.7% 1EBITDAR margin represents margin on total revenue. 1 External Revenue Reported: (4)% YoY | FX Adjusted: 8% YoY EBITDAR Reported: 40% YoY

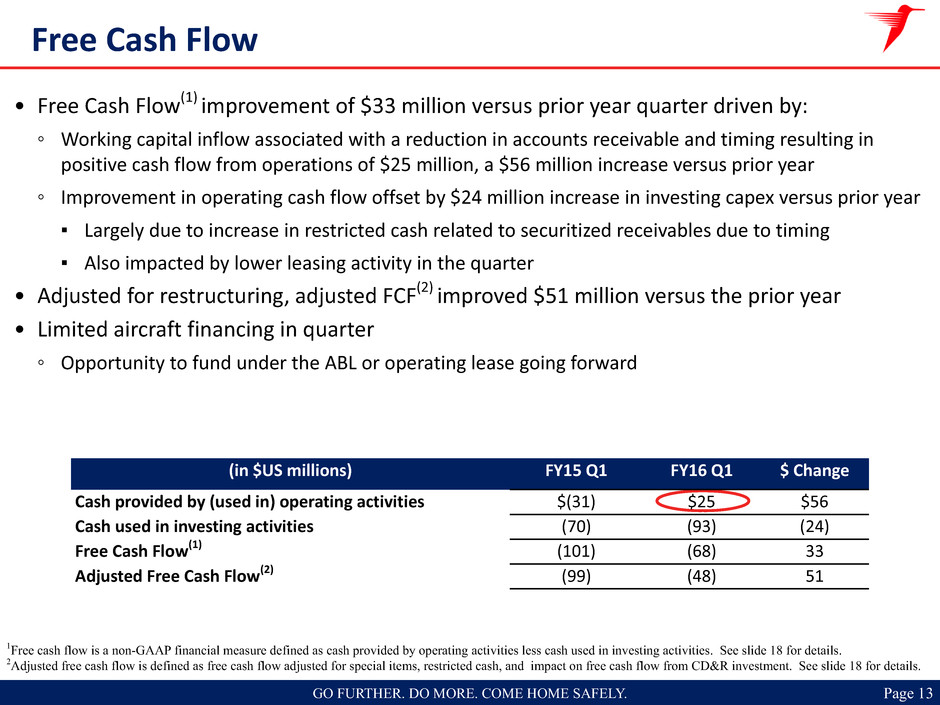

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 13 Free Cash Flow 1Free cash flow is a non-GAAP financial measure defined as cash provided by operating activities less cash used in investing activities. See slide 18 for details. 2Adjusted free cash flow is defined as free cash flow adjusted for special items, restricted cash, and impact on free cash flow from CD&R investment. See slide 18 for details. • Free Cash Flow(1) improvement of $33 million versus prior year quarter driven by: ◦ Working capital inflow associated with a reduction in accounts receivable and timing resulting in positive cash flow from operations of $25 million, a $56 million increase versus prior year ◦ Improvement in operating cash flow offset by $24 million increase in investing capex versus prior year ▪ Largely due to increase in restricted cash related to securitized receivables due to timing ▪ Also impacted by lower leasing activity in the quarter • Adjusted for restructuring, adjusted FCF(2) improved $51 million versus the prior year • Limited aircraft financing in quarter ◦ Opportunity to fund under the ABL or operating lease going forward (in $US millions) FY15 Q1 FY16 Q1 $ Change Cash provided by (used in) operating activities $(31) $25 $56 Cash used in investing activities (70) (93) (24) Free Cash Flow(1) (101) (68) 33 Adjusted Free Cash Flow(2) (99) (48) 51

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 14 1Liquidity is a non-GAAP financial measure which was comprised at FY16 Q1 of cash and cash equivalents of $102 million, unused capacity in the revolver of $288 million, net of letters of credit of $32 million, undrawn overdraft facilities of $23 million and the undrawn capacity under the ABL facility of $145 million. 2Reflects firm aircraft purchase commitments at Q1'16 based on current agreements. For prior periods, commitments exclude amounts previously disclosed in relation to purchase commitments for heavy helicopters from Airbus Helicopters ($80.7 million at April 30, 2015) and parts commitments ($37.7 million at April 30, 2015). • Liquidity(1) of $559 million at the end of the first quarter • Earliest significant debt maturity in FY19 on revolver, notes (secured and unsecured) or ABL • Aircraft purchase commitments at historic low ◦ Option to lease finance the aircraft purchase commitments ◦ Reduced firm aircraft purchase commitments by $169 million in Q1'16 ◦ Additional flexible purchase orders of $249 million at Q1'16 - allow market recovery to be monitored before securing dates and aircraft types Liquidity 1,000 800 600 400 200 0 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 Q1'16 775 651 472 464 580 500 559 2 Liquidity $ millions Aircraft Purchase Commitments $ millions 1,000 800 600 400 200 0 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 Q1'16 878 688 615 529 458 428 259 Liquidity of $559 million; commitments reduced by $169 million

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 15 1Adjusted Net Debt is a non-GAAP financial measure calculated as net debt plus NPV of lease commitments at quarter end presented discounted at 9%. See Appendix for adjusted net debt reconciliation. 2Adjusted Leverage Ratio is a non-GAAP financial measure calculated as Adjusted Net Debt divided by trailing twelve months Adjusted EBITDAR excluding special items. • Adjusted leverage ratio remains at 5.0x; flat on fiscal 2015 year end, down from Q1'15 • Total bond repurchases FY16 year to date of $41 million • ABL facility remains undrawn at quarter end Adjusted net debt has stabilized and leverage reduced versus previous quarters Leverage Net debt Adjusted net debt Adjusted leverage ratio Debt and Leverage 3,000 2,500 2,000 1,500 1,000 500 $ m ill io n 5.8 5.6 5.4 5.2 5.0 4.8 4.6 Le ve ra ge (x ) Q1'15 Q2'15 Q3'15 Q4'15 Q1'16 $1,374 $1,383 $1,093 $1,143 5.4x 5.0x 5.0x $1,033 4.8x $2,648 5.6x $2,631 $2,306 $2,306 $2,314 1 2

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 16 Key Takeaways ü Financial focus remains on cash flow and debt management ü Actively executing in three key areas - customer & OEM relationships, rigorous cost control and capital efficiency ü Long-term fundamentals are positive

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 17 APPENDIX

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 18 Adjusted Free Cash Flow • Total free cash flow of $(68) million, a $33 million reduction in use from last year • Cash provided by operating activities, $56 million higher than last year resulting in inflow rather than use in prior year ◦ Working capital and lower interest costs • Cash used in investing activities, $24 million higher use than last year ◦ Higher net expansionary capex due to increase in ownership of aircraft ◦ Partially offset by a decrease in maintenance capex • Adjusted free cash flow of $(48) million after excluding restructuring and other special items ◦ Variance larger than on total free cash flow due to the restructuring charge incurred in fiscal 2016 first quarter 1Special items include corporate transaction costs, which includes costs related to senior executive turnover and other transactions. Adjusted Free Cash flow Year to date ($ in millions) FY15 Q1 FY16 Q1 $ Change Cash flow from operating activities before changes in working capital $(16) $(18) $(2) Changes in operating assets and liabilities (15) 44 59 Cash provided by (used in) operating activities (31) 25 56 Net Expansionary capex (49) (62) (13) Maintenance capex (26) (18) 9 Disposals 4 3 (1) Restricted Cash and Other 2 (17) (18) Cash used in investing activities (70) (93) (24) Total Free Cash Flow (101) (68) 33 Special items(1) and restructuring 2 20 18 Total Adjusted Free Cash Flow $(99) $(48) $51

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 19 Summary Results - Consolidated Note: all comparisons are year over year unless otherwise noted. CHC Consolidated Quarter ($ in millions except margin, share count, and EPS) FY15 Q1 FY16 Q1 % Revenue $461 $376 (18)% Operating Revenue(1) 421 347 (18) EBITDAR(2) 112 114 2 EBITDAR Margin(3) 26.6% 32.8% 620bps Net Loss(4) (37) (34) 8% Share Count 80,530,687 81,375,804 1% Net loss per ordinary share(5) $(0.46) $(0.58) (26) 1Operating revenue is total revenue less reimbursable revenue which is costs reimbursed from customers. 2Adjusted EBITDAR excluding special items is referred to as EBITDAR in this document. See Appendix for reconciliation to GAAP measures. 3Adjusted EBITDAR margin is referred to as EBITDAR margin. It is calculated as adjusted EBITDAR excluding special items divided by Operating Revenue. 4Adjusted Net Loss is referred to as Net Loss in this document. See Appendix for reconciliation to GAAP measures. 5Adjusted net loss per share is calculated by dividing adjusted net loss available to common stockholders by the weighted average share count. See Appendix for reconciliation to comparable GAAP measures.

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 20 Summary Results - Helicopter Services and Heli-One 1Adjusted EBITDAR margin is referred to as EBITDAR margin. It is calculated as adjusted EBITDAR divided by Operating Revenue. Helicopter Services Quarter ($ in millions except margin) FY15 Q1 FY16 Q1 % Operating Revenue $384 $312 (19)% Reimbursable revenue 40 29 (27) Total External Revenue 424 341 (20) EBITDAR 127 121 (4) EBITDAR Margin(1) 33.0% 38.9% 590bps Heli-One Quarter ($ in millions except margin) FY15 Q1 FY16 Q1 % External Revenue $37 $35 (4)% Inter-Segment revenue 24 27 14 Total Revenue 61 63 3 EBITDAR 5 7 40 EBITDAR Margin 8.7% 11.7% 300bps

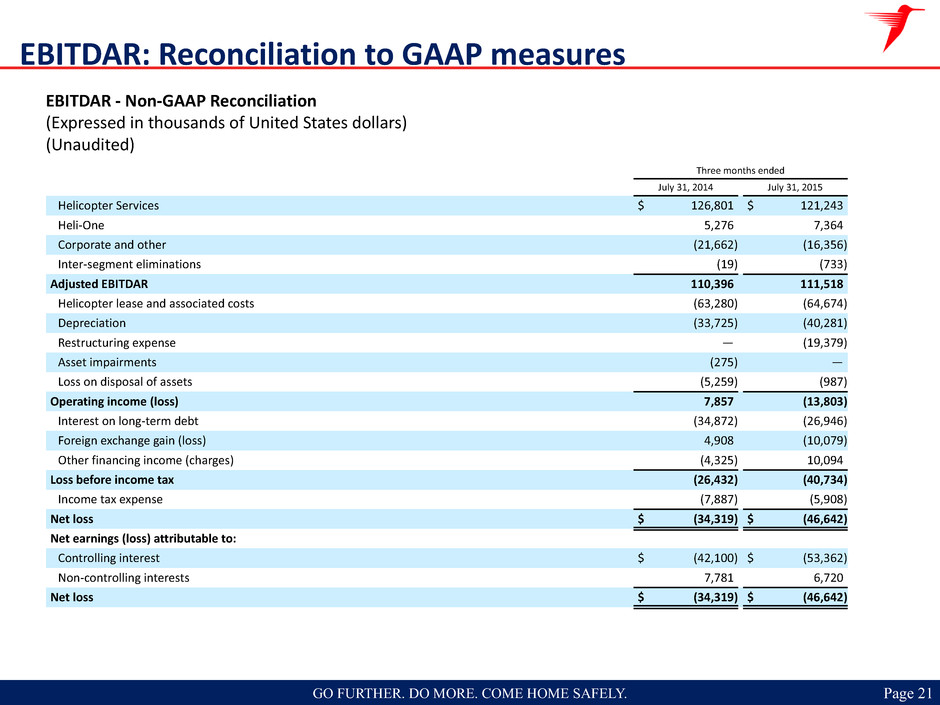

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 21 EBITDAR - Non-GAAP Reconciliation (Expressed in thousands of United States dollars) (Unaudited) EBITDAR: Reconciliation to GAAP measures Three months ended July 31, 2014 July 31, 2015 Helicopter Services $ 126,801 $ 121,243 Heli-One 5,276 7,364 Corporate and other (21,662) (16,356) Inter-segment eliminations (19) (733) Adjusted EBITDAR 110,396 111,518 Helicopter lease and associated costs (63,280) (64,674) Depreciation (33,725) (40,281) Restructuring expense — (19,379) Asset impairments (275) — Loss on disposal of assets (5,259) (987) Operating income (loss) 7,857 (13,803) Interest on long-term debt (34,872) (26,946) Foreign exchange gain (loss) 4,908 (10,079) Other financing income (charges) (4,325) 10,094 Loss before income tax (26,432) (40,734) Income tax expense (7,887) (5,908) Net loss $ (34,319) $ (46,642) Net earnings (loss) attributable to: Controlling interest $ (42,100) $ (53,362) Non-controlling interests 7,781 6,720 Net loss $ (34,319) $ (46,642)

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 22 EBITDAR and Net Loss: Non-GAAP Reconciliation EBITDAR excluding special items - Non-GAAP Reconciliation (Expressed in thousands of United States dollars) (Unaudited) Adjusted net loss - Non-GAAP Reconciliation (Expressed in thousands of United States dollars) (Unaudited) 1Corporate transaction costs include costs related to senior executive turnover and other transactions. 2Restructuring expense relates to severance and other costs incurred as part of a review of our operations and organizational structure. 3Net loss/(gain) on debt extinguishment relates to the redemption and purchase on the open market of our senior secured and senior unsecured notes. 4Adjusted net loss available to common stockholders includes redeemable convertible preferred share dividends but excludes the adjustment of $16.4 million to our redeemable non- controlling interest to redemption amount which was recognized in additional paid-in capital in the three months ended July 31, 2015. Three months ended July 31, 2014 July 31, 2015 Adjusted EBITDAR $ 110,396 $ 111,518 Corporate transaction costs1 1,701 2,309 Adjusted EBITDAR excluding special items $ 112,097 $ 113,827 Three months ended July 31, 2014 July 31, 2015 Net loss attributable to controlling interest $ (42,100) $ (53,362) Corporate transaction costs1 1,701 2,309 Restructuring expense2 — 19,379 Asset impairments 275 — Loss on disposal of assets 5,259 987 Foreign exchange loss (gain) (4,908) 10,079 Net loss (gain) on debt extinguishment3 7,444 (14,687) Unrealized loss (gain) on derivatives (4,343) 1,608 Adjusted net loss $ (36,672) $ (33,687) Redeemable convertible preferred share dividends — (13,324) Adjusted net loss available to common stockholders4 $ (36,672) $ (47,011)

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 23 (Expressed in thousands of United States dollars) (Unaudited) Adjusted Net Loss: Non-GAAP Reconciliation Three months ended July 31, 2014 July 31, 2015 Adjusted EBITDAR excluding special items $ 112,097 $ 113,827 Helicopter lease and associated costs (63,280) (64,674) Depreciation (33,725) (40,281) Net loss (gain) on debt extinguishment 7,444 (14,687) Unrealized loss (gain) on derivatives (4,343) 1,608 Interest on long-term debt (34,872) (26,946) Other financing income (charges) (4,325) 10,094 Income tax expense (7,887) (5,908) Earnings attributable to non-controlling interests (7,781) (6,720) Adjusted net loss $ (36,672) $ (33,687)

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 24 Adjusted Net Debt Reconciliation 1NPV of lease commitments as of April 30, 2015 and July 31, 2015 discounted at 9%. (Expressed in millions of United States dollars) (Unaudited) April 30, 2015 July 31, 2015 Long-term debt obligations $ 1,215.7 $ 1,227.4 Current portion of long-term debt obligations 3.6 10.1 Discount on senior secured notes 9.1 8.8 Premium on senior secured notes (1.2) (1.2) Less: Cash and cash equivalents (134.3) (102.1) Net Debt $ 1,092.9 $ 1,143.0 NPV of lease commitments1 1,212.9 1,171.3 Adjusted net debt $ 2,305.8 $ 2,314.3

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 25 Additional Fleet Detail – July 31, 2015 1Approximate range based on maintaining a 30-minute fuel reserve. 2Fleet value is based on 2015 Ascend and Helivalue$ mid-life appraised value based on fleet count as of July 31, 2015. Helicopter Model Count Cruise Speed (kts) Appr. Range (nm) full pax 1 Passengers Max Weight (lbs) Sikorsky S92A 46 145 400 19 26,500 Airbus H225 40 145 400 19 24,250 Airbus AS332L, L1, L2 35 130-140 250-350 17-19 18,000 -20,500 Heavy total 121 Agusta AW139 42 145 280 12-15 15,000 Sikorsky S76C++ 23 145 220 12 11,700 Sikorsky S76C+ 20 145 175 12 11,700 Sikorsky S76A++ 8 135 130 12 10,800 Bell 412 7 125 135 13 11,900 Airbus AS365 Series/H155 7 120-145 80-120 11-13 4,920-9,500 Airbus H135/145 3 NA (EMS only) Medium total 110 Total 231 H e a v y M e d i u m New technology aircraft represents ~85% of total CHC Fleet Value 231 Heavy/Medium twin engine helicopters with ~$3.1 Billion Fleet Value2 • Fleet average age ~10 years - down from ~17 years in 2007 • Fleet comprised entirely of heavy and medium aircraft

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 26 Helicopter Services - Regional Revenue break-down Third Party Revenue Quarter ($ in millions) FY15 Q1 FY16 Q1 % Eastern North Sea $102 $80 (22)% Western North Sea 118 88 (25)% Americas 73 70 (3)% Asia Pacific 80 71 (11)% Africa-Euro Asia 48 30 (38)% Other 2 1 (62)% Helicopter Services $424 $341 (20)%

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 27 EPS after issuance of Convertible Preferred Shares: Basic Diluted Net loss Net loss attributable to controlling interest – preferred dividends1 Weighted average share count of common shares outstanding Not calculated Net income Net income to common shareholders2 – Preferred dividends Weighted average share count of common shares outstanding Net income Weighted average share count of common shares outstanding + Preferred shares which are assumed to be converted to common • When in a net loss position: report GAAP and adjusted EPS based on basic share count only • When in a net income position: report GAAP and adjusted EPS on a basic and diluted basis EPS Calculations for Convertible Preferred Shares Generally Accepted Accounting Principles: Convertible Preferred Shares 1Both cash dividends and dividends paid in kind are not included in net income. They are only included in the EPS calculation and can be found in Statements of Shareholders Equity. Cash dividends will impact financing cash flow while dividends paid in kind will have no impact on the cash flow statements. 2Net income attributable to controlling interest will be allocated between common and preferred shareholders as preferred shareholders participate equally in dividends.

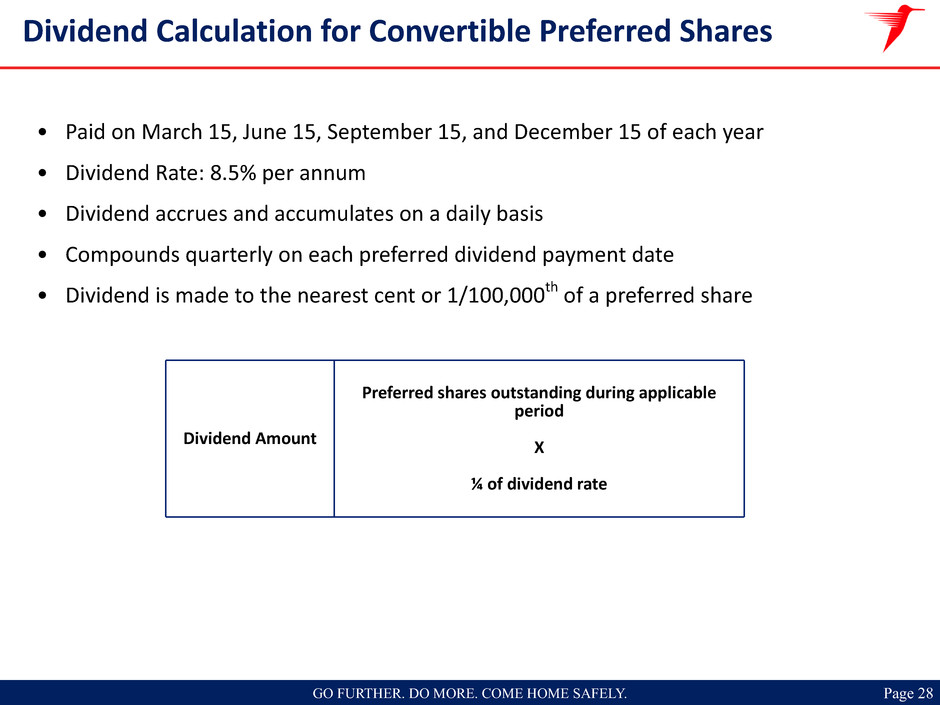

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 28 • Paid on March 15, June 15, September 15, and December 15 of each year • Dividend Rate: 8.5% per annum • Dividend accrues and accumulates on a daily basis • Compounds quarterly on each preferred dividend payment date • Dividend is made to the nearest cent or 1/100,000th of a preferred share Dividend Calculation for Convertible Preferred Shares Dividend Amount Preferred shares outstanding during applicable period X ¼ of dividend rate

GO FURTHER. DO MORE. COME HOME SAFELY. R: 0 G: 32 B: 96 R: 255 G: 0 B: 0 R: 0 G: 112 B: 192 R: 192 G: 0 B: 0 R: 89 G: 89 B: 89 R: 16 G: 37 B: 63 R: 196 G: 189 B: 151 R: 146 G: 208 B: 80 R: 79 G: 129 B: 189 Page 29 Glossary of Terms Adjusted EBITDAR = earnings before interest, taxes, depreciation, amortization, helicopter lease and associated costs, asset impairments, gain (loss) on disposal of assets, restructuring expense, foreign exchange gain (loss) and other financing income (charges). Adjusted EBITDAR excluding special items = Adjusted EBITDAR excluding special items excludes corporate transaction costs and other transactions. Adjusted EBITDAR margin = Adjusted EBITDAR excluding special items/operating revenue. Adjusted free cash flow = free cash flow adjusted for special items, restricted cash, and impact on free cash flow from CD&R investment. Adjusted leverage ratio= Adjusted net debt divided by trailing twelve months Adjusted EBITDAR excluding special items. Adjusted net income (loss) = net loss which excludes corporate transaction costs, asset dispositions, restructuring expense, asset impairments, the revaluation of our derivatives and foreign exchange gain (loss), net gain (loss) on debt extinguishment, and net income or loss attributable to non-controlling interests. Adjusted net loss per share = adjusted net loss available to common shareholders/weighted average share count. Free cash flow = cash provided by operating activities less cash used in investing activities. Liquidity = cash and cash equivalents and unused capacity in the revolver net of letters of credit plus undrawn overdraft facilities and our ABL facility. Operating revenue = Total revenue less reimbursable revenue which is generated through cost reimbursement by customers.