Attached files

| file | filename |

|---|---|

| EX-10.1 - EX-10.1 - Fuel Systems Solutions, Inc. | d75334dex101.htm |

| 8-K - FORM 8-K - Fuel Systems Solutions, Inc. | d75334d8k.htm |

| EX-2.1 - EX-2.1 - Fuel Systems Solutions, Inc. | d75334dex21.htm |

| EX-99.2 - EX-99.2 - Fuel Systems Solutions, Inc. | d75334dex992.htm |

| EX-99.3 - EX-99.3 - Fuel Systems Solutions, Inc. | d75334dex993.htm |

1 CREATING A PREMIER ALT FUEL & ENGINE COMPANY Exhibit 99.1 Combining complementary technologies and development focus to expand global customer and product mix |

2 Cautionary Note Regarding Forward Looking Statements and determinations of our joint venture and development partners, as well as other risk

factors and assumptions that may affect our actual results, performance or

achievements or financial position discussed in

Westport’s most recent Annual Report on Form 40-F for the year ended December 31, 2014, as amended and Fuel System’s Annual Report on

Form 10-K for the year ended December 31, 2014, and other filings made

by the companies with securities regulators. Readers should

not place undue reliance on any such forward-looking

statements, which speak only as of the date they were made. We

disclaim any obligation to publicly update or revise such statements to

reflect any change in our expectations or in events,

conditions or circumstances on which any such statements may

be based, or that may affect the likelihood that actual results will differ from those set forth in these forward looking statements except as required by National

Instrument 51-102. The contents of any website, RSS feed or twitter

account referenced in this presentation are not incorporated

by reference herein. This communication is not intended to and does not constitute an offer to

sell or the solicitation of an offer to subscribe for or buy or

an invitation to purchase or subscribe for any securities or

the solicitation of any vote in any jurisdiction pursuant to

the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable

law. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the United States

Securities Act of 1933, as amended. Subject to certain

exceptions to be approved by the relevant regulators or certain

facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of

the laws of such jurisdiction, or by use of the mails or by any means or

instrumentality (including without limitation, facsimile

transmission, telephone and the internet) of interstate or

foreign commerce, or any facility of a national securities

exchange, of any such jurisdiction. This presentation contains forward-looking statements, including

statements regarding the anticipated timing for and ultimate

completion of the merger, result, timing and financial metrics

associated with Westport's and Fuel Systems' combined operating

business units and consolidated business, revenue and cash usage

expectations, the effect of the proposed reorganization and

restructuring of our business, continued research and

development investment, future of our development programs, timing for

launch, delivery and completion of milestones related to the

products referenced herein, Westport's and Fuel Systems’

expected actions and results relating to the key components of its strategy in 2015 and to the integration of Westport’s and Fuel Systems’ businesses, future sales of

assets and the benefits therefrom, the demand for our products, the future

success of our business and technology strategies, investment

in new product and technology development and otherwise, cash

and capital requirements, intentions of partners and potential

customers, the performance and competitiveness of Westport's and Fuel Systems’ products and expansion of product coverage, future market opportunities, speed

of adoption of natural gas for transportation and terms and timing of future

agreements as well as the combined company’s management's

response to any of the aforementioned factors. These

statements are neither promises nor guarantees, but involve known and unknown risks and uncertainties and are based on both the views of management and

assumptions that may cause our actual results, levels of activity,

performance or achievements and ability to complete the

proposed merger to be materially different from any future

results, levels of activities, performance or achievements expressed in or implied by these forward looking statements. These risks and uncertainties include risks

and assumptions related to our revenue growth, operating results, industry

and products, the general economy, conditions of and access to

the capital and debt markets, governmental policies,

regulation and approvals, technology innovations, fluctuations in foreign exchange rates, operating expenses, the availability and price of natural gas, global

government stimulus packages, the acceptance of and shift to natural gas

vehicles, the relaxation or waiver of fuel emission standards,

the inability of fleets to access capital or government

funding to purchase natural gas vehicles, the development of competing technologies, our ability to adequately develop and deploy our technology, the actions

|

Non-GAAP Financial Measures » This communication may contain certain non-GAAP financial measures, which

management believes are useful to investors and others in evaluating

business combinations. Further detail and reconciliations

between the non-GAAP financial measures and the GAAP

financial measures are available in the most recent press

releases of Westport and Fuel Systems Solutions concerning quarterly

financial results, filed with the SEC on Form

6-K. Additional Information and Where to Find

it »

Westport will file with the SEC a registration statement on Form F-4,

which will include the proxy statement of Fuel Systems that

also constitutes a prospectus (the “proxy

statement/prospectus”). INVESTORS AND SHAREHOLDERS ARE

URGED TO READ THE PROXY STATEMENT/PROSPECTUS, AND OTHER RELEVANT

DOCUMENTS TO BE FILED WITH THE SEC, IN THEIR ENTIRETY CAREFULLY

WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT WESTPORT, FUEL SYSTEMS, THE PROPOSED

TRANSACTIONS AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents filed

with the SEC by the parties through the website maintained by the SEC at

www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC by

the parties by contacting Westport Investor Relations at +1

604-718-2046 or invest@westport.com (for documents

filed with the SEC by Westport) or Fuel Systems Investor

Relations advisors, LHA, at 1-415-433-3777 or fuel@lhai.com (for documents filed with the SEC by Fuel Systems). Participants in the Solicitation » Westport, Fuel Systems and their respective directors and executive officers may be

deemed to be participants in the solicitation of proxies from the

shareholders of Fuel Systems in respect of the proposed

transactions contemplated by the proxy

statement/prospectus.

Information regarding the persons who are, under the rules

of the SEC, participants in the solicitation of the shareholders of Fuel

Systems in connection with the proposed transactions,

including a description of their direct or indirect

interests, by security holdings or otherwise, will be set forth in the proxy statement/prospectus when it is filed with the SEC. Information regarding Westport’s directors and executive officers is contained in Westport’s Annual Report on Form

40-F for the year ended December 31, 2014, as amended, and its

Management Information Circular, dated March 11, 2015, which

is filed with, in the case of the Annual Report on Form

40-F, and furnished to, in the case of the Management

Information Circular, the SEC and can be obtained free of charge from the

sources indicated above. Information regarding Fuel

System’s directors and executive officers is contained

in Fuel System’s Annual Report on Form 10-K for the year ended December 31, 2014 and its Proxy Statement on Schedule 14A, dated April 14, 2015,

each of which are filed with the SEC and can be obtained free of charge

from the sources indicated above.

3 Important Additional Information |

4 Participants Mr. David Demers, Chief Executive Officer Ms. Nancy Gougarty, President and Chief Operating Officer Mr. Ashoka Achuthan, Chief Financial Officer Mr. Mariano Costamagna, Chief Executive Officer Mr. Andrea Alghisi, Interim Chief Operating Officer Mr. Pietro Bersani, Chief Financial Officer |

Strategic rationale

» Creates a premier alternative fuel vehicle and engine company with operations in more than 70 countries » Complementary technologies and expertise create an expanded product and technology portfolio » Combined company to possess scale and positioning to compete effectively, grow, and deliver strong shareholder returns as markets improve » Unanimously approved by both boards of directors 5 Transaction Overview Structure Stock for stock transaction resulting in market value of $351 million*

Consideration

• FSYS shareholders will receive 2.129 WPRT shares for each share of FSYS common stock

they own at closing

• 10.0% premium to implied current exchange ratio and 23.9% premium on implied

exchange ratio over the last 30 days VWAP as of August 31, 2015 Pro forma ownership following closing • Existing Westport shareholders will hold ~64% of combined company • Existing Fuel Systems shareholders will hold ~36% of combined company

Synergies and

accretion

• Estimated annual pre-tax savings and merger synergies of $30 million fully-realized by 2018 • Expected to be accretive to Westport earnings in 2016 Governance • Combined company will be headquartered in Vancouver, Canada • Selected by Fuel Systems, Mariano Costamagna, and with two directors to be confirmed, will be nominated for addition to the combined company’s Board of Directors Management • Mr. David Demers and Westport executive team will lead the combined company.

• Mr. Mariano Costamagna will serve in a senior advisory position of the company's new business unit with additional titles in the organization to be determined at a later date

Timing and closing

conditions

• So far, shareholders owning 34% of FSYS and 15% of WPRT outstanding shares have agreed to vote their shares in favor of the merger • Subject to both companies’ shareholder approvals, regulatory approvals and customary closing conditions • Expected to close in Q4 2015 * Based on closing prices as of August 31, 2015 |

For Westport » Two companies, both rich in technology innovation and with proven track records of manufacturing, production and sales, will provide greater breadth of alternative fuel systems solutions as products and development engineering to OEM partners globally. » Combined company’s product offerings will span a more comprehensive array of natural gas solutions from passenger cars to heavy-duty trucks to locomotives and marine applications to stationary power. » We expect that the increased scale of products and consolidation of facilities will produce both cost- efficiencies and enhanced products, ultimately creating value for all our customers and our shareholders. » Combination of a strong intellectual property position, prolific development and commercialization efforts will help expand the product pipeline for the industry, preparing us to compete more effectively as our end markets turn around. » This transaction marks a milestone in our strategic plans, whereby Westport will realize increased sales and significant cost efficiency opportunities while continuing to focus on the development, validation and launch of its proprietary HPDI 2.0 and enhanced spark ignition technology. 6 A Compelling Merger |

For Fuel Systems Solutions

» After conducting a lengthy strategic evaluation process, Fuel Systems’ Strategic Oversight Committee determined that this opportunity creates significant returns for the shareholders of Fuel Systems. » Bringing together these two premier companies in alternative fuel technology combines our technology expertise and long-standing relationships with global OEMs, our strong shared focus on improving profitability, and aligns our corporate cultures, creating an ideal fit. » We are creating a strong platform for growth in all of our addressable markets from which to best serve our customers. » The combined businesses and brands mean increased scale and relevance both internationally and in the U.S. » We are confident that we have found the right partner, and look forward to working together as we integrate the two companies. 7 A Compelling Merger |

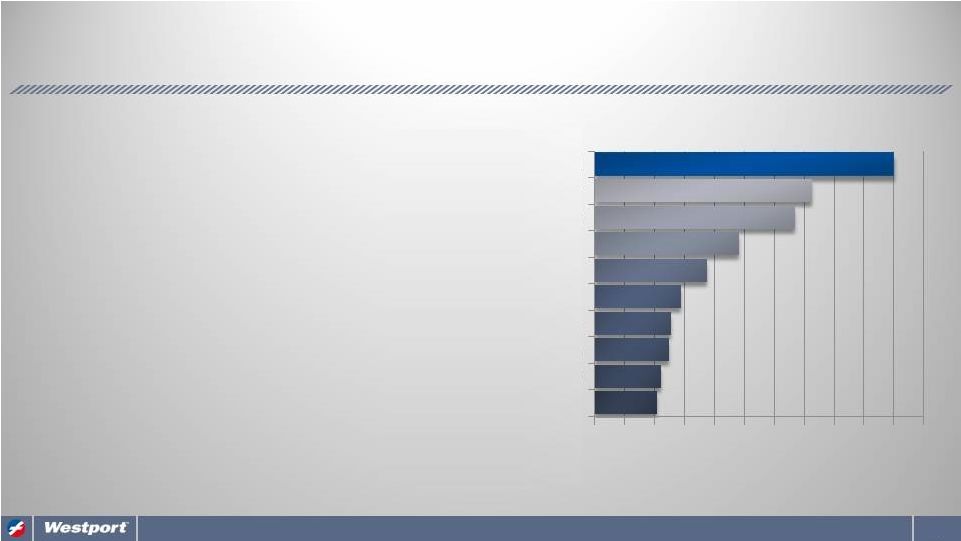

8 Industry Overview 1 1. Selected Competitors 2. Represents energy segment

revenues 3. Represents total revenues 4. Represents 2013 revenues 5. PF for Power Integration

acquisition Note: Foreign figures translated into USD at the exchange rate as of FYE

Industrial

HD / MD

automotive

LD automotive CNG compression Fuel storage APPLICATION SEGMENTS 469.7 388.0 339.1 282.2 255.6 220.2 130.6 85.9 47.5 41.2 34.1 30.9 27.3 22.2 12.6 917.2 Clean Diesel Quantum Tech. Landi Renzo Enovation Controls 4 Hexagon Westport Nikki Co. Agility Tartarini Auto Spa Tech. Ventrex 4 Zenith FS Clean Air Power Woodward 2 Romano 4 Rotarex 3,4 Fuel Systems FSYS + WPRT PSI 5 10.5 7.5 |

STRATEGIC HIGHLIGHTS 9 |

» The combined company will have a broad global reach, and will be able to serve the world’s largest and fastest growing markets through a fortified geographic footprint, greater product diversity, and a leading distribution network spanning 70 countries. 10 Increased Scale and Opportunity to Better Serve Customers 2 2 3 |

» The merger combines 17 brands in the automotive and industrial space.

11 Company & Product Brands FUEL SYSTEMS SOLUTIONS WESTPORT |

» The customer bases and communities will be served with an outstanding asset base and state-of-the-art

facilities strategically located across 5 continents.

* not all customers listed 12 Complementary Customer Bases FUEL SYSTEMS SOLUTIONS * WESTPORT * |

» Both companies have a long history of technology innovation and engineering capabilities, which have garnered the interest and demand from global vehicle and engine OEMs. » The combined company will have filed over 500 patents in CNG/LNG/LPG parts and systems worldwide. This combination of a strong intellectual property position, and prolific development and commercialization efforts will help expand the product pipeline for the industry. 13 Premier Technology Position * As of January 15, 2015 and based on the patent search results of publicly available data within the International Patent Classification

F02, meeting the search term criteria: one of

("engine" or "combustion" or "injector" or "injection valve") and ("natural gas" or "methane" or "gaseous fuel") and in the claims, not ("fuel cell" or "turbine"). This chart includes issued or granted patents from: Argentina,

Australia, Austria, Belgium, Brazil, Bulgaria, Canada, China,

Czech Republic, Denmark, Eurasian Patent Organization Grants, European Patent Office Grants, Finland, France, Georgia, Germany, Greece, Hong Kong, Hungary, India, Ireland, Italy, Japan, Latvia, Lithuania, Malaysia, Mexico, Moldova, Monaco, Morocco, Netherlands,

Norway, OAPI grants, Philippines, Poland, Portugal, Romania,

Russian Federation, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan, Tajikistan, Turkey, UK, Ukraine, USA, USSR, Yugoslavia, and pending published patent applications from: Canada,

China, the European Patent Office, USA, and the World

Intellectual Property Office. Continental

Mazda Bosch Porsche Honda GE Ford Toyota Caterpillar FSYS + Westport Top 10 Companies with Natural Gas Engine Related Patents* 105 111 125 127 145 187 242 334 363 500+ |

» Upon closing, the combined company: Will continue trading on both the TSX and Nasdaq as WPT and WPRT respectively; under the name Westport Fuel Systems Inc., headquartered in Vancouver, Canada New business unit called Fuel Systems Automotive and Industrial Group, with its automotive division headquartered in Cherasco, Italy and its industrial division headquartered in Santa Ana, CA » Mr. David Demers and the rest of the Westport executive team will lead the combined company. » Mr. Mariano Costamagna, who is retiring as CEO of Fuel Systems, will serve in a senior advisory position of the company's new business unit with additional titles in the organization to be determined at a later date. » Top talent across the combined organization will be evaluated and retained based on the organization’s new structure. » Three individuals selected by Fuel Systems—Mariano Costamagna, and two directors to be confirmed—will be nominated for addition to the combined company’s Westport’s Board of Directors. 14 Management, Board Composition & Headquarters |

TRANSACTION DETAILS 15 |

16 Transaction Process 1. Westport will create a new entity called Westport Merge Co. 2. Fuel Systems Solutions, Inc. will merge with Whitehorse Merger Sub Inc.

The new entity will be called Fuel Systems Solutions

3. Fuel Systems Solutions shareholders will receive 2.129 Westport Innovations shares as consideration for each share of Fuel Systems common stock they own at closing. Whitehorse Merger Sub Inc. Fuel Systems Solutions, Inc. Whitehorse Merger Sub Inc. |

» Shareholders owning approximately 34% of Fuel Systems and approximately 15% of WPRT outstanding shares so far, have each agreed to vote their shares in favor of the merger. » The transaction is subject to regulatory approvals such as: Expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act and certain other anti-trust approvals SEC Review » The transaction is also subject to the approval of Fuel Systems’ and Westport shareholders. Information circular and proxy statements/ prospectus in advance of special meetings Shareholder meetings at respective locations Shareholders can vote in person or by signing and returning their form of proxy Requirement for the merger to be approved by simple majority (50% plus one) of votes cast present in person or by proxy » The transaction is expected to close in the fourth quarter of 2015. 17 Transaction Process Details |

FINANCIAL HIGHLIGHTS 18 |

» The transaction is expected to be accretive to Westport’s earnings per share and adjusted EBITDA in 2016, excluding one-time costs, with approximately $30 million per year of expected annual pre-tax savings and merger synergies fully realized by calendar year 2018 ~$15 million in annualized benefits expected to be generated by Fuel Systems’ restructuring program in 2016 and beyond Westport’s initiatives to reach positive adjusted EBITDA positive by mid 2016 Combination of reductions in corporate management costs, manufacturing costs, and operating expenses So far, shareholders owning 34% of FSYS and 15% of WPRT outstanding shares have agreed to vote their shares in favor of the merger » The combined company savings and merger synergies are expected to generate positive effects on Westport’s adjusted EBITDA results and target for breakeven by mid 2016 » Combined annual revenues ranging from $380 to $405 million projected for 2015 » On a pro forma basis, the combined company had approximately $117 million in cash and short term investments as of June 30, 2015 19 Positive Financial Impacts |

» Compelling merger creates premier alternative fuel vehicle and engine company Combines complementary technologies, development focus, customers and product mix Scales globally, building foundation for future growth as markets improve » Stock-for-stock consideration 10.0% premium to yesterday’s closing price implied exchange ratio and 23.9% premium on implied exchange ratio over past 30 days VWAP as at August 31, 2015 » $30 million in annual pre-tax savings and merger synergies Fuel Systems restructuring program Westport initiatives to meet adjusted EBITDA target for mid 2016 Reductions in corporate management costs, manufacturing costs, and operating expenses Accretive to combined company earnings and adjusted EBITDA in 2016 » Unanimously approved by both boards of directors » Expected to close in Q4 2015 subject to shareholder and regulatory approvals 20 Summary and Key Highlights |

9/1/2015 Visit www.westport.com/merger

Visit phx.corporate-

ir.net/phoenix.zhtml?c=109507&p=irol-

ProjectEngine

21 FOR MORE INFORMATION ABOUT THIS MERGER: |