Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SAExploration Holdings, Inc. | v419606_8-k.htm |

| EX-99.2 - EXHIBIT 99.2 - SAExploration Holdings, Inc. | v419606_ex99-2.htm |

Exhibit 99.1

NASDAQ: SAEX OSLO, NORWAY PARETO SECURITIES OIL & OFFSHORE CONFERENCE

This presentation includes certain forward - looking statements, including statements regarding future financial performance, future growth and future acquisitions . These statements are based on SAE’s current expectations or beliefs and are subject to uncertainty and changes in circumstances . Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of SAE’s business . These risks, uncertainties and contingencies include : fluctuations in the levels of exploration and development activity in the oil and gas industry ; intense industry competition ; a limited number of customers ; the need to manage rapid growth ; delays , reductions or cancellations of service contracts ; operational disruptions due to seasonality, weather or other external factors ; crew productivity ; the availability of capital resources ; high levels of indebtedness, substantial international business exposing SAE to currency fluctuations and global factors, including economic, political and military uncertainties ; the need to comply with diverse and complex laws and regulations ; and other factors set forth in SAE’s filings with the Securities and Exchange Commission . The information set forth herein should be read in light of such risks . Except as required by law, SAE is not under any obligation to, and expressly disclaims any obligation to, update or alter its forward - looking statements, whether as a result of new information, future events, changes in assumptions or otherwise . Safe Harbor 2 NASDAQ: SAEX

Corporate Profile 3 NASDAQ: SAEX Summary Ticker Symbol : Stock Price (as of 8 / 27 / 15 ) : 52 - Week Range : 5 0 - Day Avg . Volume (as of 8 / 27 / 15 ) : Total Shares Outstanding (Pro Forma) : Market Capitalization (Pro Forma) : Total Long - Term Debt (Pro Forma) : Executive and Board Ownership : Corporate Headquarters : Nasdaq: SAEX $2.93 $2.23 - $9.15 5,529 17.3 million $50.7 million $140.0 million ~48% Houston, TX Source: Nasdaq stock exchange and company filings Note: Certain market figures are adjusted to reflect the recent $10 million exchange of senior secured notes for ~2.4 million sh ares of common stock

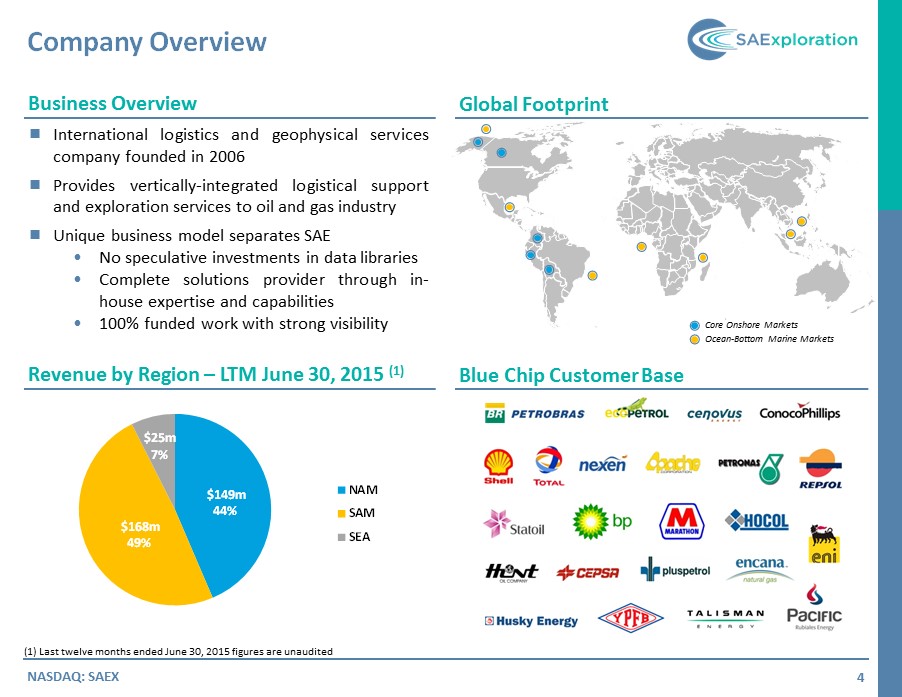

Company Overview 4 Business Overview Global Footprint Blue Chip Customer Base Revenue by Region – LTM June 30, 2015 (1) International logistics and geophysical services company founded in 2006 Provides vertically - integrated logistical support and exploration services to oil and gas industry Unique business model separates SAE • No speculative investments in data libraries • Complete solutions provider through in - house expertise and capabilities • 100 % funded work with strong visibility NASDAQ: SAEX Core Onshore Markets (1) Last twelve months ended June 30, 2015 figures are unaudited Ocean - Bottom Marine Markets $149m 44% $168m 49% $25m 7% NAM SAM SEA

FULL SERVICE LOGISTICS PROVIDER Majority of revenue is earned through logistics - related activities performed in - house Vertically - integrated model allows customers to work with one company instead of multiple sub - contractors, reducing execution and reputation risk CASH FLOW POTENTIAL GENERATED BY STABLE BACKLOG Focused on high - growth, underdeveloped markets Disciplined investment into new markets while growing presence in existing markets Experience includes onshore and offshore projects in Alaska, Canada, Bolivia, Brazil, Colombia, Peru, Malaysia, Papua New Guinea and New Zealand INTERNATIONAL GEOGRAPHIC DIVERSIFICATION Subject matter experts on operating in the most geographically complex and logistically challenging resource producing regions of the world Vast experience and deep relationships with local communities and governments EXTENSIVE EXPERIENCE IN CHALLENGING ENVIRONMENTS Approximately $ 101 m in backlog and $ 763 m of total bids, adjusted to include the recent $ 47 ocean - bottom marine project award Strong free cash flow generation with high ROI and clear visibility of future performance STRONG RELATIONSHIPS WITH BLUE CHIP CUSTOMERS Strong local relationships at the management and operational level Selected relationships with key customers date back 30 years Majority of clients are well - established IOCs, NOCs, and large independents Key Investment Highlights 5 NASDAQ: SAEX EXPERIENCED MANAGEMENT TEAM WITH SIGNIFICANT OWNERSHIP STAKE Seasoned and dedicated management team with deep industry knowledge having managed multiple companies through various cycles Top three executive officers own more than one - third of the company ; aligning interests with stockholders

Differentiated Business Model 6 What We Do What We Do Not Do NASDAQ: SAEX Work on a 100 % fully funded and contracted basis with dependable blue - chip customers Provide full in - house logistics services through vertical integration leading to more efficient movement into remote areas and greater control of field - level processes Maintain global diversification with a focus on underdeveloped markets in logistically complex and geographically challenging environments Entrench ourselves in core areas to develop competitive barriers through operating efficiencies, specialized knowledge and strategic relationships Evaluate capital expenditures on a case - by - case basis, using available liquidity only when returns are expected to exceed cost of capital invested Develop strong local relationships and maintain QHSE standards through stringent processes and controls Invest in or build multi - client libraries that are dependent on future sales of speculative data acquired through unfunded programs Participate in oil and gas drilling ventures or take ownership in reserves as payment for services Strain resources and waste capital chasing one - off projects in non - core areas that don’t offer long - term, viable potential for growth Enter over - supplied, saturated, low - margin, highly competitive markets Lower QHSE performance and environmental standards to enhance short - term operating results Sacrifice core principles and strategy to boost short - term financial performance

Full Service Logistics Provider 7 NASDAQ: SAEX Program Design Planning & Permitting Camp Services & Infrastructure Survey & Line Cutting Drilling Recording & Processing On average, approximately 80% of SAE’s revenues are earned through logistics - related activities performed in - house Typical Project Characteristics : Program design and planning usually starts up to a year in advance On average, projects tend to last 3 - 6 months in duration, but can also last multiple years Crew size can be up to 3 , 000 skilled laborers hired from local communities Ability to increase and control efficiencies with logistical services, as opposed to commoditized recording and processing activities Less susceptible to outright cancellation due to long - term nature of very expensive development programs, compared to more volatile, commodity - price driven short - term projects typical of the Lower 48

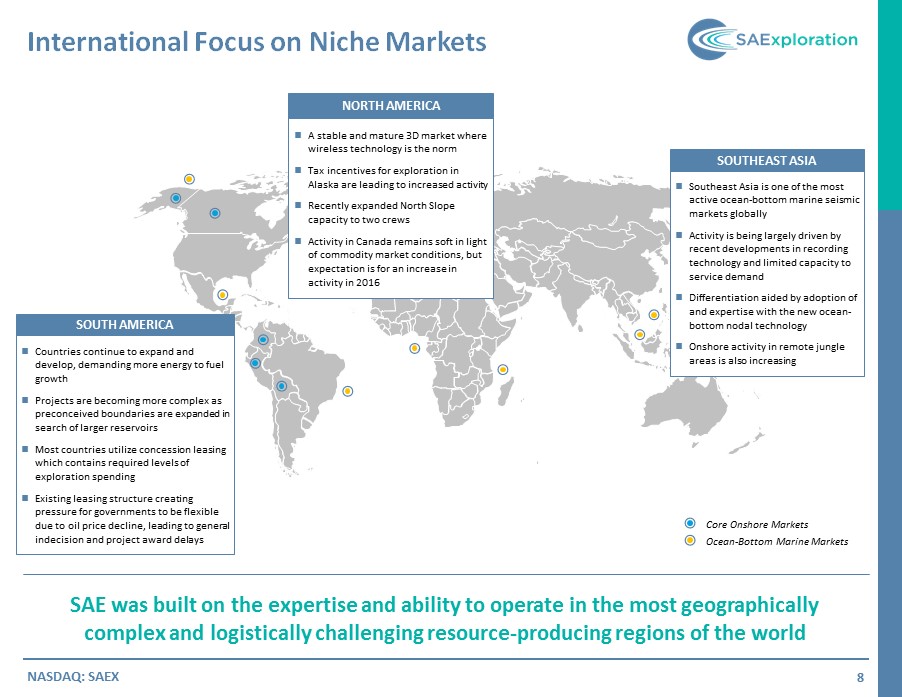

International Focus on Niche Markets 8 NASDAQ: SAEX SAE was built on the expertise and ability to operate in the most geographically complex and logistically challenging resource - producing regions of the world Countries continue to expand and develop, demanding more energy to fuel growth Projects are becoming more complex as preconceived boundaries are expanded in search of larger reservoirs Most countries utilize concession leasing which contains required levels of exploration spending Existing leasing structure creating pressure for governments to be flexible due to oil price decline, leading to general indecision and project award delays SOUTH AMERICA A stable and mature 3D market where wireless technology is the norm Tax incentives for exploration in Alaska are leading to increased activity Recently expanded North Slope capacity to two crews Activity in Canada remains soft in light of commodity market conditions, but expectation is for an increase in activity in 2016 NORTH AMERICA Ocean - Bottom Marine Markets Core Onshore Markets Southeast Asia is one of the most active ocean - bottom marine seismic markets globally Activity is being largely driven by recent developments in recording technology and limited capacity to service demand Differentiation aided by adoption of and expertise with the new ocean - bottom nodal technology Onshore activity in remote jungle areas is also increasing SOUTHEAST ASIA

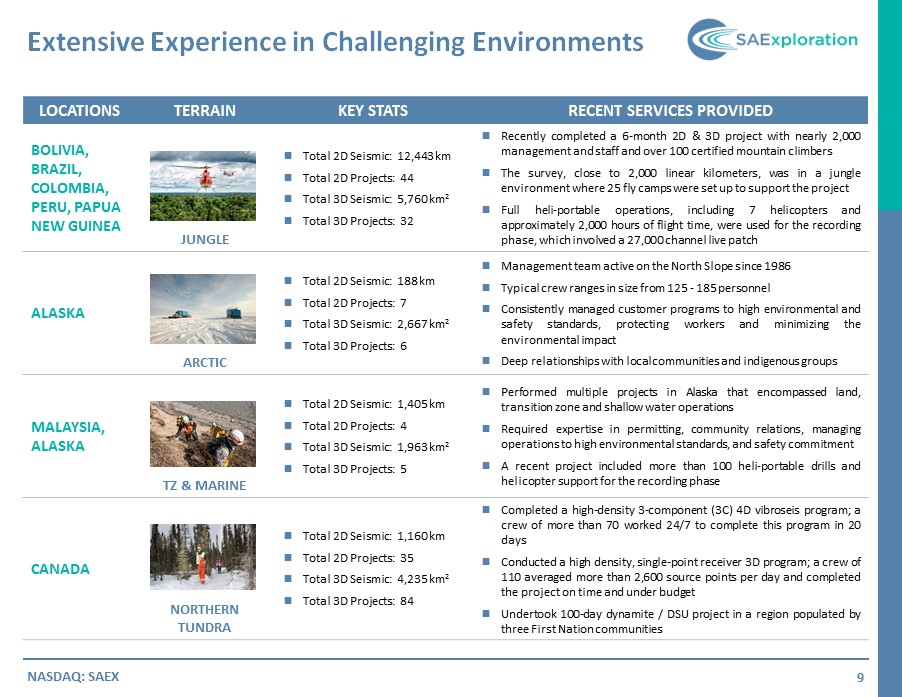

LOCATIONS TERRAIN KEY STATS RECENT SERVICES PROVIDED BOLIVIA, BRAZIL, COLOMBIA, PERU, PAPUA NEW GUINEA JUNGLE Total 2 D Seismic : 12 , 443 km Total 2 D Projects : 44 Total 3 D Seismic : 5 , 760 km 2 Total 3 D Projects : 32 Recently completed a 6 - month 2 D & 3 D project with nearly 2 , 000 management and staff and over 100 certified mountain climbers The survey, close to 2 , 000 linear kilometers, was in a jungle environment where 25 fly camps were set up to support the project Full heli - portable operations, including 7 helicopters and approximately 2 , 000 hours of flight time, were used for the recording phase, which involved a 27 , 000 channel live patch ALASKA ARCTIC Total 2 D Seismic : 188 km Total 2 D Projects : 7 Total 3 D Seismic : 2 , 667 km 2 Total 3 D Projects : 6 Management team active on the North Slope since 1986 Typical crew ranges in size from 125 - 185 personnel Consistently managed customer programs to high environmental and safety standards, protecting workers and minimizing the environmental impact Deep relationships with local communities and indigenous groups MALAYSIA, ALASKA TZ & MARINE Total 2 D Seismic : 1 , 405 km Total 2 D Projects : 4 Total 3 D Seismic : 1 , 963 km 2 Total 3 D Projects : 5 Performed multiple projects in Alaska that encompassed land, transition zone and shallow water operations Required expertise in permitting, community relations, managing operations to high environmental standards, and safety commitment A recent project included more than 100 heli - portable drills and helicopter support for the recording phase CANADA NORTHERN TUNDRA Total 2 D Seismic : 1 , 160 km Total 2 D Projects : 35 Total 3 D Seismic : 4 , 235 km 2 Total 3 D Projects : 84 Completed a high - density 3 - component ( 3 C) 4 D vibroseis program ; a crew of more than 70 worked 24 / 7 to complete this program in 20 days Conducted a high density, single - point receiver 3 D program ; a crew of 110 averaged more than 2 , 600 source points per day and completed the project on time and under budget Undertook 100 - day dynamite / DSU project in a region populated by three First Nation communities Extensive Experience in Challenging Environments 9 NASDAQ: SAEX

Quality, Health, Safety & Environment (“QHSE”) 10 NASDAQ: SAEX Historical Lost - Time Injury Frequencies (LTIF) & Total Recordable Injury Rate (TRIR) SAE maintains an industry - leading quality, health, safety and environmental program Internal QHSE requirements are more stringent than industry standards, despite operating in some of the harshest environments in the world Superior QHSE performance record is a key competitive advantage and has assisted in establishing and maintaining customer relationships with some of the largest oil and gas producers in the world

STRONG RELATIONSHIPS WITH A DIVERSIFIED BLUE CHIP CUSTOMER BASE (1) IOCs NOCs INDEPENDENTS Blue Chip Customer Base 11 (1) Based on historical and ongoing customers Members of the management team have long - standing relationships extending over 30 years with many of the largest IOCs, NOCs and independents Most historical revenue generated through repeat customer sales and new sales to customers referred by existing and past customers NASDAQ: SAEX

Diversified Level of Contracted Cash Flow 12 NASDAQ: SAEX Adjusted Historical Backlog (1)(2) Current Backlog and Bids Outstanding (2) Backlog Realization Expectations (2 ) Backlog $101 million Bids O/S $763 million (1) Historical backlog retroactively adjusted to reflect resulting growth apart from $114 million of paused revenue in Alaska du ring Q2’13 and Q3’13 that was removed in Q4’13 (2) Backlog and Bids Outstanding are as of June 30, 2015, adjusted to include the $47 million ocean - bottom marine project award announced on July 27, 2015 Note: Backlog is unaudited financial information and only consists of committed work secured through a signed contract or le tte r of intent Current Backlog by Customer Type (2 ) 30% 65% 5% Onshore Ocean-Bottom Marine Logistics $150.4 $291.9 $322.3 $265.5 $203.1 $176.7 $122.1 $101.0 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 48% 52% Onshore Ocean-Bottom Marine 53% 43% 4% Onshore Ocean-Bottom Marine Logistics $67m $34m IOC Independent 66% 34% 2H 2015 2016

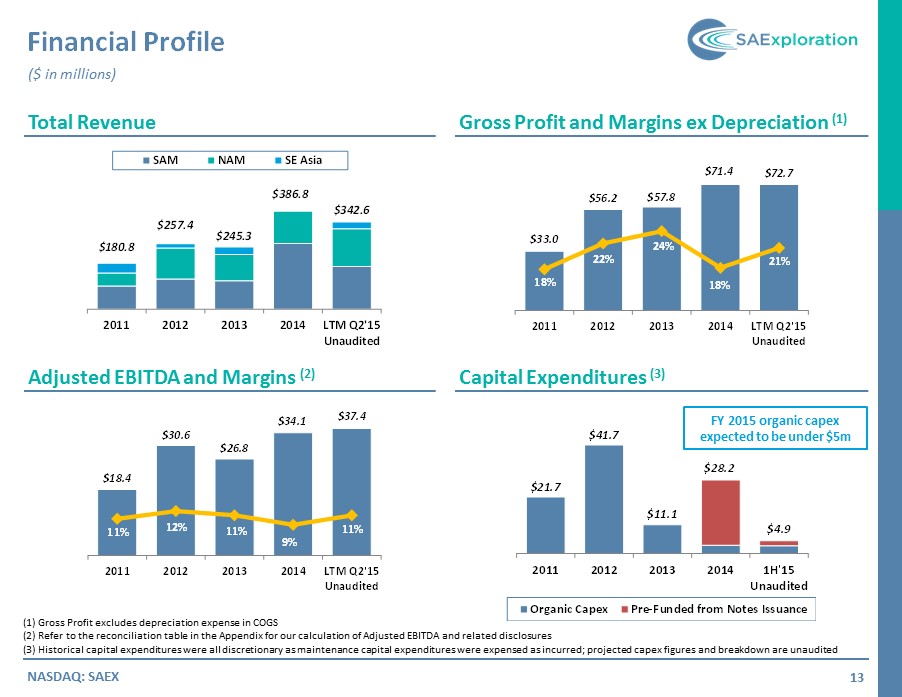

Financial Profile 13 NASDAQ: SAEX Total Revenue Gross Profit and Margins ex Depreciation (1) Capital Expenditures (3) (1) Gross Profit excludes depreciation expense in COGS (2) Refer to the reconciliation table in the Appendix for our calculation of Adjusted EBITDA and related disclosures (3) Historical capital expenditures were all discretionary as maintenance capital expenditures were expensed as incurred; pro jec ted capex figures and breakdown are unaudited Adjusted EBITDA and Margins (2) ($ in millions) FY 2015 organic capex expected to be under $5m $33.0 $56.2 $57.8 $71.4 $72.7 18% 22% 24% 18% 21% 13% 15% 18% 20% 23% 25% 28% 30% $0 $10 $20 $30 $40 $50 $60 $70 2011 2012 2013 2014 LTM Q2'15 Unaudited $18.4 $30.6 $26.8 $34.1 $37.4 11% 12% 11% 9% 11% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 26% 27% 28% 29% 30% $0 $5 $10 $15 $20 $25 $30 $35 2011 2012 2013 2014 LTM Q2'15 Unaudited $21.7 $41.7 $11.1 $28.2 $4.9 2011 2012 2013 2014 1H'15 Unaudited Organic Capex Pre-Funded from Notes Issuance $180.8 $257.4 $245.3 $386.8 $342.6 2011 2012 2013 2014 LTM Q2'15 Unaudited SAM NAM SE Asia

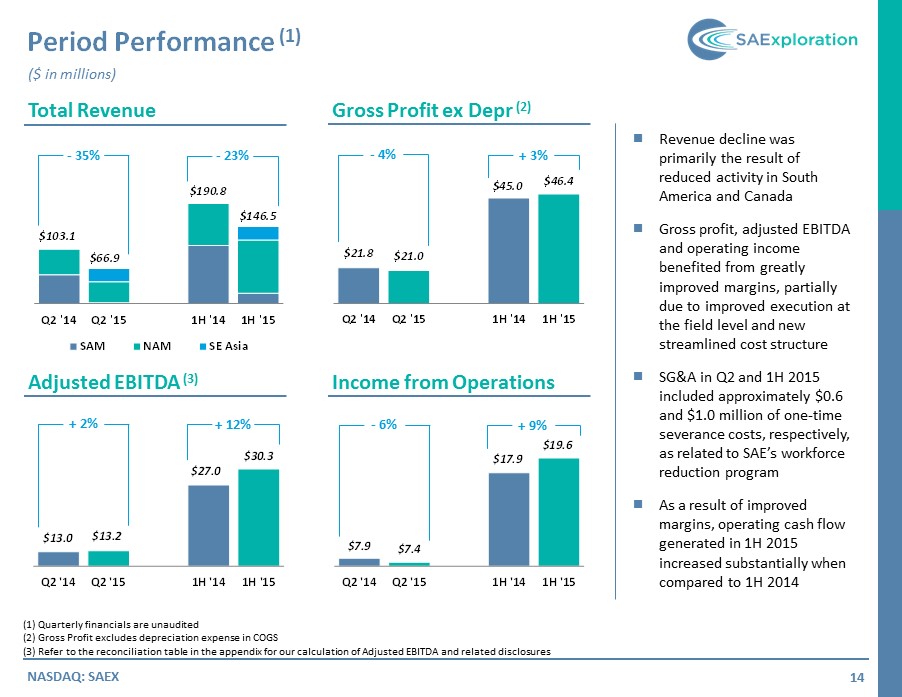

$103.1 $66.9 $190.8 $146.5 Q2 '14 Q2 '15 1H '14 1H '15 SAM NAM SE Asia Period Performance (1) 14 NASDAQ: SAEX Total Revenue Gross Profit ex Depr (2) Income from Operations Adjusted EBITDA (3) (1) Quarterly financials are unaudited (2) Gross Profit excludes depreciation expense in COGS (3) Refer to the reconciliation table in the appendix for our calculation of Adjusted EBITDA and related disclosures Revenue decline was primarily the result of reduced activity in South America and Canada Gross profit, adjusted EBITDA and operating income benefited from greatly improved margins, partially due to improved execution at the field level and new streamlined cost structure SG&A in Q2 and 1H 2015 included approximately $0.6 and $1.0 million of one - time severance costs, respectively, as related to SAE’s workforce reduction program As a result of improved margins, operating cash flow generated in 1H 2015 increased substantially when compared to 1H 2014 ($ in millions) - 35% - 23% $21.8 $21.0 $45.0 $46.4 Q2 '14 Q2 '15 1H '14 1H '15 $13.0 $13.2 $27.0 $30.3 Q2 '14 Q2 '15 1H '14 1H '15 $7.9 $7.4 $17.9 $19.6 Q2 '14 Q2 '15 1H '14 1H '15 - 4 % + 3% + 2 % + 12% - 6% + 9%

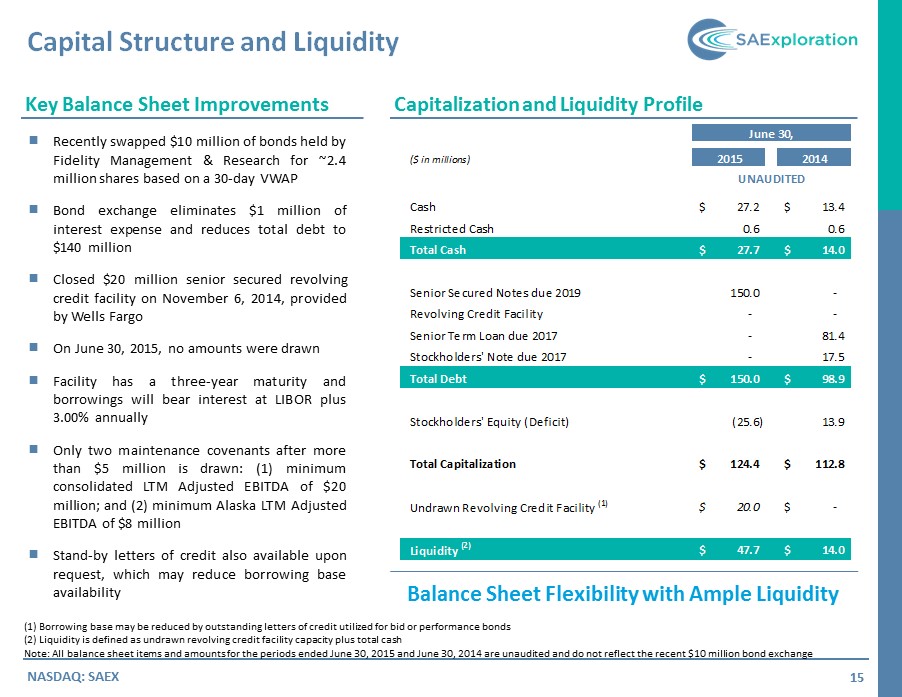

Capital Structure and Liquidity 15 NASDAQ: SAEX Capitalization and Liquidity Profile Key Balance Sheet Improvements Recently swapped $ 10 million of bonds held by Fidelity Management & Research for ~ 2 . 4 million shares based on a 30 - day VWAP Bond exchange eliminates $ 1 million of interest expense and reduces total debt to $ 140 million Closed $ 20 million senior secured revolving credit facility on November 6 , 2014 , provided by Wells Fargo On June 30 , 2015 , no amounts were drawn Facility has a three - year maturity and borrowings will bear interest at LIBOR plus 3 . 00 % annually Only two maintenance covenants after more than $ 5 million is drawn : ( 1 ) minimum consolidated LTM Adjusted EBITDA of $ 20 million ; and ( 2 ) minimum Alaska LTM Adjusted EBITDA of $ 8 million Stand - by letters of credit also available upon request, which may reduce borrowing base availability (1) Borrowing base may be reduced by outstanding letters of credit utilized for bid or performance bonds (2) Liquidity is defined as undrawn revolving credit facility capacity plus total cash Note: All balance sheet items and amounts for the periods ended June 30, 2015 and June 30, 2014 are unaudited and do not refl ect the recent $10 million bond exchange Balance Sheet Flexibility with Ample Liquidity June 30, ($ in millions) 2015 2014 UNAUDITED Cash 27.2$ 13.4$ Restricted Cash 0.6 0.6 Total Cash 27.7$ 14.0$ Senior Secured Notes due 2019 150.0 - Revolving Credit Facility - - Senior Term Loan due 2017 - 81.4 Stockholders' Note due 2017 - 17.5 Total Debt 150.0$ 98.9$ Stockholders' Equity (Deficit) (25.6) 13.9 Total Capitalization 124.4$ 112.8$ Undrawn Revolving Credit Facility (1) 20.0$ -$ Liquidity (2) 47.7$ 14.0$

Strategic Direction 16 NASDAQ: SAEX Catalysts Near - term, ongoing contribution expected from Alaska, which should provide onshore and offshore activity year - round with seasonal ramp - ups during the winter windows on the North Slope, as evidenced by recent results • High level of activity in Alaska correlated with exploration tax incentives in place through mid - 2017 Offshore activity in niche, complex shallow and deep - water markets expected to be a key driver with increasing demand for ocean - bottom nodal (“OBN”) technology in water depths up to 3 , 000 meters • Alaska, Southeast Asia, Brazil , Africa and Mexico include underdeveloped markets in need of OBN solutions Logistics services unrelated to exploration activity needed within certain niche markets, namely South America and Alaska • Opportunity to utilize existing low - cost non - seismic gear to assist in various functions related to pipeline maintenance and installation, drilling site preparation and remediation, civil construction and infrastructure, etc . Overall drivers shifting away from legacy South American markets to increased contribution from Alaskan and OBN marine markets, with the expectation of meaningful cash flow potential from eventual logistics activity Primary Objectives Improve margins by focusing on core markets with defensible positions while implementing sustainable cost structures to maximize profitability and generate free cash flow De - lever financial profile through growth in earnings and the strategic and opportunistic deployment of capital resources without compromising overall liquidity Evaluate accretive opportunities to accelerate the formation of a comprehensive logistics service offering platform capable of servicing existing niche seismic markets as well as alternative end - markets

Investor Contact Ryan Abney Vice President, Capital Markets and Investor Relations (281) 258 - 4409 rabney@saexploration.com Contacts 17 NASDAQ: SAEX SAE Canada 3333 8th Street SE, 3rd Floor Calgary, AB T2G 3A4 O : (403) 776 - 1950 SAE Alaska 8240 Sandlewood Pl, Suite 102 Anchorage, AK 99507 O : (907) 522 - 4499 SAE Houston 1160 Dairy Ashford, Suite 160 Houston, TX 77079 O : (281) 258 - 4400 SAE Peru Francisco Masias 544, Of 301 San Isidro, Lima 27 O : (511) 221 - 5209 SAE Colombia Calle 93 No 14 - 20, Of 709 Bogota , Colombia O : (571) 593 - 6800 SAE Bolivia Av. Iberica , Calle 3 Oeste No 11 Barrio Las Palmas, Bolivia O : (591) 3 358 - 7575 SAE Brazil Av. Almirante Barroso No 02, 6th Fl Rio de Janeiro, Centro 20031 - 001 O : (55) 21 3553 - 5104 SAE Malaysia Suite 22.01A, Level 22 Menara Citibank 165, Jalan Ampang 50450 Kuala Lumpur O: (603) 2 181 - 4324 SAE New Zealand Unit 2/54 Hurlstone Dr. New Plymouth 4312, New Zealand O: (64) 06 755 - 4485

Appendix

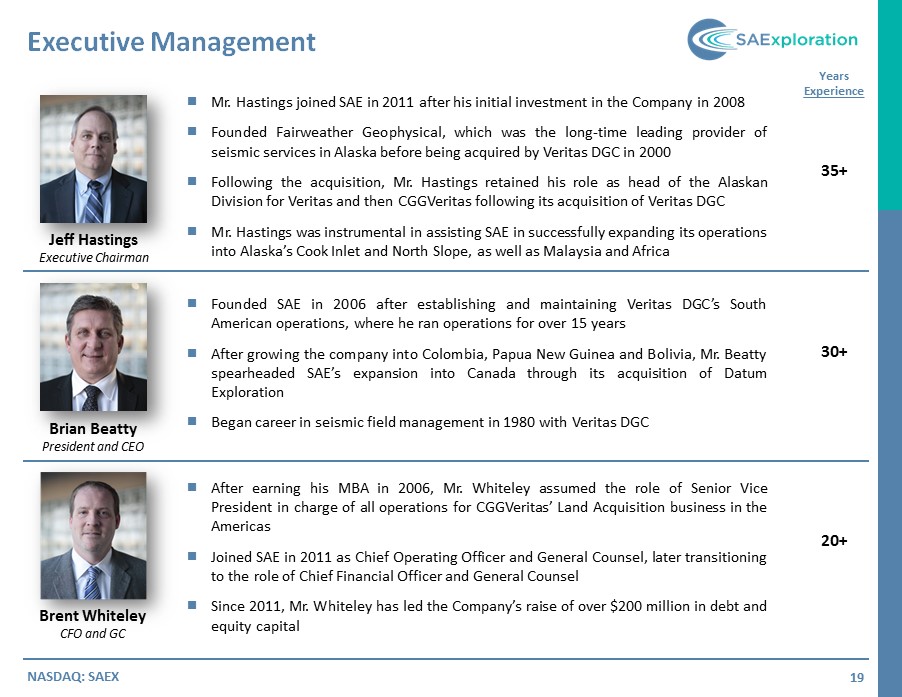

Executive Management 19 NASDAQ: SAEX Jeff Hastings Executive Chairman Brian Beatty President and CEO Brent Whiteley CFO and GC Years Experience 35+ 30+ 20+ After earning his MBA in 2006 , Mr . Whiteley assumed the role of Senior Vice President in charge of all operations for CGGVeritas ’ Land Acquisition business in the Americas Joined SAE in 2011 as Chief Operating Officer and General Counsel, later transitioning to the role of Chief Financial Officer and General Counsel Since 2011 , Mr . Whiteley has led the Company’s raise of over $ 200 million in debt and equity capital Founded SAE in 2006 after establishing and maintaining Veritas DGC’s South American operations, where he ran operations for over 15 years After growing the company into Colombia, Papua New Guinea and Bolivia, Mr . Beatty spearheaded SAE’s expansion into Canada through its acquisition of Datum Exploration Began career in seismic field management in 1980 with Veritas DGC Mr . Hastings joined SAE in 2011 after his initial investment in the Company in 2008 Founded Fairweather Geophysical, which was the long - time leading provider of seismic services in Alaska before being acquired by Veritas DGC in 2000 Following the acquisition, Mr . Hastings retained his role as head of the Alaskan Division for Veritas and then CGGVeritas following its acquisition of Veritas DGC Mr . Hastings was instrumental in assisting SAE in successfully expanding its operations into Alaska’s Cook Inlet and North Slope, as well as Malaysia and Africa

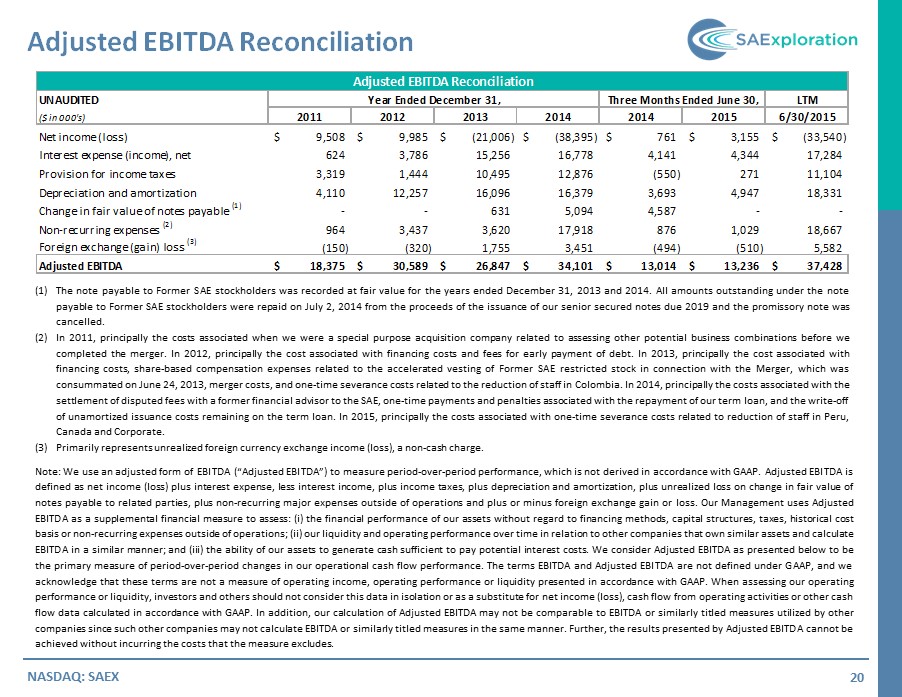

(1) The note payable to Former SAE stockholders was recorded at fair value for the years ended December 31 , 2013 and 2014 . All amounts outstanding under the note payable to Former SAE stockholders were repaid on July 2 , 2014 from the proceeds of the issuance of our senior secured notes due 2019 and the promissory note was cancelled . (2) In 2011 , principally the costs associated when we were a special purpose acquisition company related to assessing other potential business combinations before we completed the merger . In 2012 , principally the cost associated with financing costs and fees for early payment of debt . In 2013 , principally the cost associated with financing costs, share - based compensation expenses related to the accelerated vesting of Former SAE restricted stock in connection with the Merger, which was consummated on June 24 , 2013 , merger costs, and one - time severance costs related to the reduction of staff in Colombia . In 2014 , principally the costs associated with the settlement of disputed fees with a former financial advisor to the SAE, one - time payments and penalties associated with the repayment of our term loan, and the write - off of unamortized issuance costs remaining on the term loan . In 2015 , principally the costs associated with one - time severance costs related to reduction of staff in Peru, Canada and Corporate . (3) Primarily represents unrealized foreign currency exchange income (loss), a non - cash charge . Note : We use an adjusted form of EBITDA (“Adjusted EBITDA”) to measure period - over - period performance, which is not derived in accordance with GAAP . Adjusted EBITDA is defined as net income (loss) plus interest expense, less interest income, plus income taxes, plus depreciation and amortization, plus unrealized loss on change in fair value of notes payable to related parties, plus non - recurring major expenses outside of operations and plus or minus foreign exchange gain or loss . Our Management uses Adjusted EBITDA as a supplemental financial measure to assess : (i) the financial performance of our assets without regard to financing methods, capital structures, taxes, historical cost basis or non - recurring expenses outside of operations ; (ii) our liquidity and operating performance over time in relation to other companies that own similar assets and calculate EBITDA in a similar manner ; and (iii) the ability of our assets to generate cash sufficient to pay potential interest costs . We consider Adjusted EBITDA as presented below to be the primary measure of period - over - period changes in our operational cash flow performance . The terms EBITDA and Adjusted EBITDA are not defined under GAAP, and we acknowledge that these terms are not a measure of operating income, operating performance or liquidity presented in accordance with GAAP . When assessing our operating performance or liquidity, investors and others should not consider this data in isolation or as a substitute for net income (loss), cash flow from operating activities or other cash flow data calculated in accordance with GAAP . In addition, our calculation of Adjusted EBITDA may not be comparable to EBITDA or similarly titled measures utilized by other companies since such other companies may not calculate EBITDA or similarly titled measures in the same manner . Further, the results presented by Adjusted EBITDA cannot be achieved without incurring the costs that the measure excludes . Adjusted EBITDA Reconciliation 20 NASDAQ: SAEX Adjusted EBITDA Reconciliation UNAUDITED Year Ended December 31, Three Months Ended June 30, LTM ($ in 000's) 2011 2012 2013 2014 2014 2015 6/30/2015 Net income (loss) 9,508$ 9,985$ (21,006)$ (38,395)$ 761$ 3,155$ (33,540)$ Interest expense (income), net 624 3,786 15,256 16,778 4,141 4,344 17,284 Provision for income taxes 3,319 1,444 10,495 12,876 (550) 271 11,104 Depreciation and amortization 4,110 12,257 16,096 16,379 3,693 4,947 18,331 Change in fair value of notes payable (1) - - 631 5,094 4,587 - - Non-recurring expenses (2) 964 3,437 3,620 17,918 876 1,029 18,667 Foreign exchange (gain) loss (3) (150) (320) 1,755 3,451 (494) (510) 5,582 Adjusted EBITDA 18,375$ 30,589$ 26,847$ 34,101$ 13,014$ 13,236$ 37,428$