Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SCANSOURCE, INC. | a2015-q4exhibit991063015.htm |

| 8-K - 8-K - SCANSOURCE, INC. | a2015-q4form8xk063015.htm |

Q4 AND FY 2015 FINANCIAL RESULTS CONFERENCE CALL August 20, 2015 at 5:00 pm ET Exhibit 99.2

SAFE HARBOR This presentation may contain certain comments, which are “forward-looking” statements that involve plans, strategies, economic performance and trends, projections, expectations, costs or beliefs about future events and other statements that are not descriptions of historical facts, may be forward- looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking information is inherently subject to risks and uncertainties; these statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Any number of factors could cause actual results to differ materially from anticipated results. For more information concerning factors that could cause actual results to differ from anticipated results, see the “Risk Factors” included in the Company’s annual report on Form 10-K for the fiscal year ended June 30, 2014, as well as the quarterly report on Form 10-Q for the quarter ended March 31, 2015, filed with the Securities and Exchange Commission (“SEC”). Although ScanSource believes the expectations in its forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievement. ScanSource disclaims any intentions or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by law. In addition to disclosing results that are determined in accordance with United States Generally Accepted Accounting Principles (“GAAP”), the Company also discloses certain non-GAAP measures, including non-GAAP operating income, non-GAAP operating margin, non-GAAP net income, non-GAAP diluted earnings per share, return on invested capital (“ROIC”) and the percentage change in net sales excluding the impact of foreign currency exchange rates. A reconciliation of the Company's non-GAAP financial information to GAAP financial information is provided in the Appendix and in the Company’s Form 8-K, filed with the SEC, with the quarterly earnings press release for the period indicated. 2

HIGHLIGHTS – Q4 FY15 3 Record net sales of $857 million, up 13% Y/Y, and non-GAAP diluted EPS of $0.66*, up 5% Y/Y; both above expected range Worldwide Barcode & Security sales unchanged Y/Y; up 7% Y/Y excluding FX Record sales for Worldwide Communications & Services, up 37% Y/Y; up 13% Y/Y excluding acquisitions and FX Implementation of SAP ERP system in North America in early July 2015 Over 80% of business worldwide using global platform Returned cash to shareholders through share repurchases Fourth quarter 2015 return on invested capital of 15.2%* * See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures.

ANNOUNCES AGREEMENT TO ACQUIRE KBZ 4 Description • Premier Cisco video conferencing distributor in the United States, formerly Tandberg’s largest distributor • Specialized focus on video, cloud and services • Sales for the TTM ended 6/30/15 ~ over $225 million • Established in 1987; HQ in Doylestown, PA Key Vendor/ Focus • Exclusive focus on Cisco (~90%) and complementary vendors • Cisco Americas Collaboration Distributor of the Year in 2014 • Cisco Americas Cloud Distributor of the Year in 2015 • Specialized public sector team for Federal, state and local Key Talent/ Employees • Currently ~ 75 employees • Operations in US with regional sales teams • Kyle Zorzi, KBZ’s Vice President, to serve as SVP of KBZ, a ScanSource Company Accretion/ Closing • Expected to be accretive to EPS and ROIC in the first year after closing, excluding one-time acquisition costs • Announced 8/18/15; expect to close in the quarter ending 9/30/15

Q4 FY15 Q4 FY14 GAAP Non- GAAP* GAAP Non- GAAP* Y/Y Change (non-GAAP): Net sales $856.7 $856.7 $758.1 $758.1 13% increase; 18% excl. FX Gross profit 91.3 91.3 74.0 74.0 23% increase Gross profit margin % (of net sales) 10.7% 10.7% 9.8% 9.8% 90 bp margin increase SG&A expenses 60.4 60.4 47.8 47.8 26% higher SG&A SAP-related ERP costs 2.3 2.3 -- -- Amortization of intangible assets 2.1 -- 1.1 -- Change, FV contingent consideration 1.4 -- 0.1 -- Acquisition costs/legal recovery 0.1 -- (15.5) -- Operating income 25.0 28.6 40.4 26.2 9% increase Operating income % (of net sales) 2.9% 3.3% 5.3% 3.5% 11 bp margin decrease Net income $16.4 $19.0 $27.1 $18.2 5% increase Diluted EPS $0.57 $0.66 $0.94 $0.63 5% increase HIGHLIGHTS – FOURTH QTR 5 * See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. In millions, except EPS

FY15 FY14 GAAP Non-GAAP* GAAP Non-GAAP* Y/Y Change (non-GAAP): Net sales $3,218.6 $3,218.6 $2,913.6 $2,913.6 10% increase; 13% excl. FX Gross profit 327.1 327.1 301.1 301.1 9% increase Gross profit margin % (of net sales) 10.2% 10.2% 10.3% 10.3% 17 bp margin decrease SG&A expenses 208.2 208.2 188.6 188.6 10% higher SG&A SAP-related ERP costs 4.9 4.9 -- -- Amortization of intangible assets 6.6 -- 3.9 -- Change, FV contingent consideration 2.7 -- 2.3 -- Acquisition costs/legal recovery 3.3 -- (15.5) -- Operating income 101.4 114.0 121.8 112.5 1% increase Operating income % (of net sales) 3.2% 3.5% 4.2% 3.9% 32 bp margin decrease Net income $65.4 $75.1 $81.8 $76.1 1% decrease Diluted EPS $2.27 $2.61 $2.86 $2.66 2% decrease HIGHLIGHTS – FULL YEAR 6 * See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. In millions, except EPS

SALES GROWTH SUMMARY 7 FOURTH QTR: Q4 FY15 – Y/Y % CHANGE As Reported Excluding FX Impact Excluding FX and Acquisitions WW Barcode & Security -0.2% 7.0% 7.0% WW Comms. & Services 37.2% 38.3% 13.2% Consolidated 13.0% 18.1% 9.2% FULL YEAR: FY15 – Y/Y % CHANGE As Reported Excluding FX Impact Excluding FX and Acquisitions WW Barcode & Security 2.1% 6.1% 6.1% WW Comms. & Services 25.5% 26.3% 8.8% Consolidated 10.5% 13.3% 7.1%

Q4 FY15 Q4 FY14 Net sales $489.6 $490.5 Gross profit $44.4 $41.7 Gross margin 9.1% 8.5% Operating income $12.2 $12.8 Operating income % 2.5% 2.6% Non-GAAP operating income $13.4 $13.5 Non-GAAP operating income % 2.7% 2.7% WW BARCODE & SECURITY 8 $491 $490 Q4 FY14 Q4 FY15 Net Sales, $ in millions Down 0.2% Excluding FX, Up 7.0% $ in millions Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent consideration. See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures.

FY15 FY14 Net sales $1,912.4 $1,873.2 Gross profit $168.1 $168.2 Gross margin 8.8% 9.0% Operating income $48.6 $51.5 Operating income % 2.5% 2.8% Non-GAAP operating income $52.2 $56.1 Non-GAAP operating income % 2.7% 3.0% WW BARCODE & SECURITY 9 FY14 FY15 Net Sales, $ in millions Up 2.1% Excluding FX, Up 6.1% $ in millions Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent consideration. See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. $1,873 $1,912

Q4 FY15 Q4 FY14 Net sales $367.1 $267.6 Gross profit $46.9 $32.3 Gross margin 12.8% 12.1% Operating income $12.9 $12.2 Operating income % 3.5% 4.5% Non-GAAP operating income $15.2 $12.7 Non-GAAP operating income % 4.1% 4.7% WW COMMUNICATIONS & SERVICES 10 Q4 FY14 Q4 FY15 Net Sales, $ in millions Up 37.2% Excluding FX and Acquisitions, Up 13.2% $ in millions Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent consideration. See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. $367 $268 Acqs.

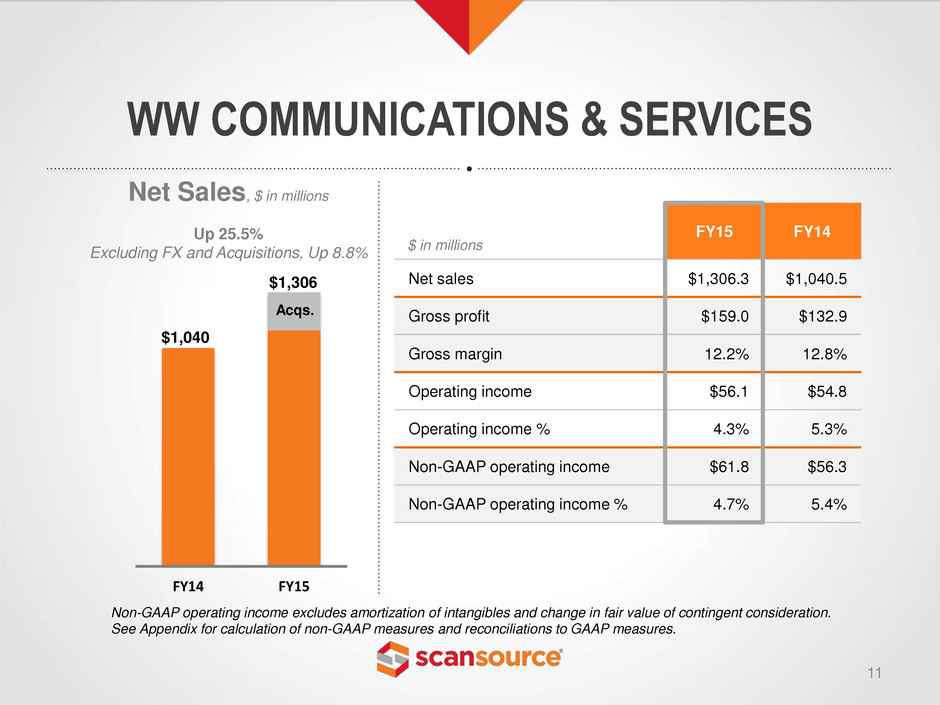

FY15 FY14 Net sales $1,306.3 $1,040.5 Gross profit $159.0 $132.9 Gross margin 12.2% 12.8% Operating income $56.1 $54.8 Operating income % 4.3% 5.3% Non-GAAP operating income $61.8 $56.3 Non-GAAP operating income % 4.7% 5.4% WW COMMUNICATIONS & SERVICES 11 FY14 FY15 Net Sales, $ in millions Up 25.5% Excluding FX and Acquisitions, Up 8.8% $ in millions Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent consideration. See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. $1,306 $1,040 Acqs.

Q4 FY15 Q3 FY15 Q4 FY14 Return on invested capital (“ROIC”)* 15.2% 12.1% 14.0% Cash and cash equivalents (Q/E) $121.6 $93.6 $194.9 Operating cash flow, trailing 12-months $75.5 $39.1 $47.7 Days sales outstanding in receivables 55 57 55 Inventory (Q/E) $553.1 $485.6 $504.8 Inventory turns 5.9 5.4 5.6 Paid for inventory days 6.1 12.3 10.9 Shares repurchased – # of shares 409,860 69,965 -- Shares repurchased – dollars $16.1 $2.7 -- Q4 FY15 KEY MEASURES $ in millions 12 * Excludes non-GAAP adjustments and change in fair value of contingent consideration. See Appendix for calculation of ROIC, a non-GAAP measure.

Q1 FY16 OUTLOOK* 13 * Outlook as of August 20, 2015. Non-GAAP diluted EPS excludes amortization of intangible assets, change in fair value of contingent consideration, and acquisition costs. Reflects the following FX rates: $1.10 to EUR 1.00 for the Euro, $0.295 to R$1.00 for the Brazilian real (R$3.39 to $1), and $1.56 to GBP 1.00 for the British pound. For the quarter ending September 30, 2015, excluding amortization of intangible assets, change in fair value of contingent consideration, and acquisition costs: Net Sales Non-GAAP Diluted Earnings Per Share Range from $820 million to $880 million Range from $0.50 to $0.58 per share

Q4 FY15 SALES MIX 14 By Technology By Geography 57% Barcode & Security 43% Communications & Services 73% North America* 27% International Barcode & Security = Worldwide Barcode and Security Communications & Services = Worldwide Communications and Services As a % of Q4 FY15 net sales of $856.7 million * Includes the United States and Canada.

APPENDIX: NON-GAAP FINANCIAL INFORMATION 15 ($ in thousands) Quarter Ended June 30, 2015 Operating Income Pre-tax income Net income Diluted EPS GAAP measure $ 24,977 $ 24,911 $ 16,447 $ 0.57 Adjustment: Amortization of intangible assets 2,091 2,091 1,450 0.05 Change in fair value of contingent consideration 1,406 1,406 955 0.03 Acquisition costs (a) 138 138 138 0.01 Non-GAAP measure $ 28,612 $ 28,546 $ 18,990 $ 0.66 Quarter Ended June 30, 2014 Operating Income Pre-tax income Net income Diluted EPS GAAP measure $ 40,439 $ 40,880 $ 27,105 $ 0.94 Adjustment: Amortization of intangible assets 1,117 1,117 740 0.03 Change in fair value of contingent consideration 93 93 61 - Legal recovery, net of attorney fees (15,490) (15,490) (9,756) (0.34) Non-GAAP measure $ 26,159 $ 26,600 $ 18,150 $ 0.63 (a) Acquisition costs are nondeductible for tax purposes.

APPENDIX: NON-GAAP FINANCIAL INFORMATION 16 ($ in thousands) Year Ended June 30, 2015 Operating Income Pre-tax income Net income Diluted EPS GAAP measure $ 101,441 $ 99,906 $ 65,419 $ 2.27 Adjustment: Amortization of intangible assets 6,641 6,641 4,599 0.16 Change in fair value of contingent consideration 2,667 2,667 1,842 0.06 Acquisition costs (a) 3,254 3,254 3,254 0.12 Non-GAAP measure $ 114,003 $ 112,468 $ 75,114 $ 2.61 Year Ended June 30, 2014 Operating Income Pre-tax income Net income Diluted EPS GAAP measure $ 121,786 $ 123,107 $ 81,789 $ 2.86 Adjustment: Amortization of intangible assets 3,880 3,880 2,550 0.09 Change in fair value of contingent consideration 2,311 2,311 1,525 0.05 Legal recovery, net of attorney fees (15,490) (15,490) (9,756) (0.34) Non-GAAP measure $ 112,487 $ 113,808 $ 76,108 $ 2.66 (a) Acquisition costs are nondeductible for tax purposes.

APPENDIX: NON-GAAP FINANCIAL INFORMATION 17 ($ in thousands) Quarter Ended June 30, 2015 WW Barcode & Security WW Comms. & Services Corporate Consolidated Net sales $ 489,559 $ 367,126 $ - $ 856,685 GAAP operating income $ 12,168 $ 12,947 $ (138) $ 24,977 Adjustments: Amortization of intangible assets 431 1,660 - 2,091 Change in fair value of contingent consideration 806 600 - 1,406 Acquisition costs - - 138 138 Non-GAAP operating income $ 13,405 $ 15,207 $ - $ 28,612 GAAP operating income % (of net sales) 2.5% 3.5% n/m 2.9% Non-GAAP operating income % (of net sales) 2.7% 4.1% n/m 3.3% Quarter Ended June 30, 2014 WW Barcode & Security WW Comms. & Services Corporate Consolidated Net sales $ 490,505 $ 267,608 $ - $ 758,113 GAAP operating income $ 12,789 $ 12,160 $ 15,490 $ 40,439 Adjustments: Amortization of intangible assets 591 526 - 1,117 Change in fair value of contingent consideration 93 - - 93 Legal recovery, net of attorney fees - - (15,490) (15,490) Non-GAAP operating income $ 13,473 $ 12,686 $ - $ 26,159 GAAP operating income % (of net sales) 2.6% 4.5% n/m 5.3% Non-GAAP operating income % (of net sales) 2.7% 4.7% n/m 3.5% n/m = not meaningful

APPENDIX: NON-GAAP FINANCIAL INFORMATION 18 ($ in thousands) Year Ended June 30, 2015 WW Barcode & Security WW Comms. & Services Corporate Consolidated Net sales $ 1,912,352 $ 1,306,274 $ - $ 3,218,626 GAAP operating income $ 48,612 $ 56,083 $ (3,254) $ 101,441 Adjustments: Amortization of intangible assets 1,994 4,647 - 6,641 Change in fair value of contingent consideration 1,636 1,031 - 2,667 Acquisition costs - - 3,254 3,254 Non-GAAP operating income $ 52,242 $ 61,761 $ - $ 114,003 GAAP operating income % (of net sales) 2.5% 4.3% n/m 3.2% Non-GAAP operating income % (of net sales) 2.7% 4.7% n/m 3.5% Year Ended June 30, 2014 WW Barcode & Security WW Comms. & Services Corporate Consolidated Net sales $ 1,873,177 $ 1,040,457 $ - $ 2,913,634 GAAP operating income $ 51,523 $ 54,773 $ 15,490 $ 121,786 Adjustments: Amortization of intangible assets 2,306 1,574 - 3,880 Change in fair value of contingent consideration 2,311 - - 2,311 Legal recovery, net of attorney fees - - (15,490) (15,490) Non-GAAP operating income $ 56,140 $ 56,347 $ - $ 112,487 GAAP operating income % (of net sales) 2.8% 5.3% n/m 4.2% Non-GAAP operating income % (of net sales) 3.0% 5.4% n/m 3.9% n/m = not meaningful

APPENDIX: NON-GAAP FINANCIAL INFORMATION 19 ($ in thousands) Q4 FY15 Q3 FY15 Q4 FY14 Return on invested capital (ROIC), annualized (a) 15.2% 12.1% 14.0% Reconciliation of Net Income to EBITDA Net income - GAAP $ 16,447 $ 12,943 $ 27,105 Plus: Income taxes 8,464 6,878 13,775 Plus: Interest expense 509 891 33 Plus: Depreciation and amortization 3,947 3,710 1,985 EBITDA 29,367 24,422 42,898 Change in fair value of contingent consideration 1,406 285 93 Acquisition costs 138 292 - Legal recovery, net of attorney fees - - (15,490) Adjusted EBITDA (numerator for ROIC)(non-GAAP) $ 30,911 $ 24,999 $ 27,501 Invested Capital Calculation Equity - beginning of the quarter $ 799,051 $ 818,748 $ 772,786 Equity - end of quarter 808,985 799,051 802,643 Add: Change in fair value of contingent consideration, net of tax 955 200 61 Add: Acquisition costs, net of tax 138 292 - Less: Legal recovery, net of attorney fees, net of tax - - (9,756) Average equity 804,565 809,146 782,867 Average funded debt (b) 10,377 32,046 5,429 Invested capital (denominator for ROIC)(non-GAAP) $ 814,942 $ 841,192 $ 788,296 Notes: (a) Calculated as net income plus interest expense, income taxes, depreciation and amortization (EBITDA), annualized divided by invested capital for the period. Adjusted EBITDA reflects other adjustments for non-GAAP measures. (b) Average daily amounts outstanding on short-term and long-term interest-bearing debt.

APPENDIX: NON-GAAP FINANCIAL INFORMATION 20 ($ in thousands) WW Barcode & Security WW Comms. & Services Consolidated Q4 FY15 net sales, as reported $ 489,559 $ 367,126 $ 856,685 Foreign exchange impact 35,446 2,902 38,348 Q4 FY15 net sales, excluding FX impact 525,005 370,028 895,033 Less: Acquisitions - (67,197) (67,197) Q4 FY15 net sales, excluding FX and acquisitions $ 525,005 $ 302,831 $ 827,836 Q4 FY14 net sales, as reported $ 490,505 $ 267,608 $ 758,113 Y/Y % Change: As reported -0.2% 37.2% 13.0% Excluding FX impact 7.0% 38.3% 18.1% Excluding FX and acquisitions 7.0% 13.2% 9.2%

APPENDIX: NON-GAAP FINANCIAL INFORMATION 21 ($ in thousands) WW Barcode & Security WW Comms. & Services Consolidated FY15 net sales, as reported $ 1,912,352 $ 1,306,274 $ 3,218,626 Foreign exchange impact 74,712 7,401 82,113 FY15 net sales, excluding FX impact 1,987,064 1,313,675 3,300,739 Less: Acquisitions - (181,138) (181,138) FY15 net sales, excluding FX and acquisitions $ 1,987,064 $ 1,132,537 $ 3,119,601 FY14 net sales, as reported $ 1,873,177 $ 1,040,457 $ 2,913,634 Y/Y % Change: As reported 2.1% 25.5% 10.5% Excluding FX impact 6.1% 26.3% 13.3% Excluding FX and acquisitions 6.1% 8.8% 7.1%