Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROCADE COMMUNICATIONS SYSTEMS INC | brcd-8keprxfy15q3.htm |

| EX-99.1 - PRESS RELEASE - BROCADE COMMUNICATIONS SYSTEMS INC | brcd-8keprxfy15q3xex991.htm |

|

Q3 FY 2015 Earnings

Prepared Comments and Slides

August 20, 2015

Michael Iburg

Investor Relations

Phone: 408-333-0233

miburg@Brocade.com

Kristy Campbell

Media Relations

Phone: 408-333-4221

kcampbel@Brocade.com

NASDAQ: BRCD

Brocade Q3 FY 2015 Earnings 8/20/2015

|

Prepared comments provided by Michael Iburg, Investor Relations

Thank you for your interest in Brocade’s Q3 Fiscal 2015 earnings presentation, which includes prepared remarks, cautionary statements and disclosures, slides, and a press release detailing fiscal third quarter 2015 results. The press release, along with these prepared comments and slides, has been furnished to the SEC on Form 8-K and has been made available on the Brocade Investor Relations website at www.brcd.com. The press release will be issued subsequently via Marketwired.

© 2015 Brocade Communications Systems, Inc. Page 2 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

© 2015 Brocade Communications Systems, Inc. Page 3 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

Today’s prepared comments include remarks by Lloyd Carney, Brocade CEO, regarding the company’s quarterly results, its strategy, and a review of operations, as well as industry trends and market/technology drivers related to its business; and by Dan Fairfax, Brocade CFO, who will provide a financial review.

A management discussion and live question and answer conference call will be webcast at

2:30 p.m. Pacific Time on August 20 at www.brcd.com and will be archived on the Brocade Investor Relations website.

© 2015 Brocade Communications Systems, Inc. Page 4 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

Prepared comments provided by Lloyd Carney, CEO

© 2015 Brocade Communications Systems, Inc. Page 5 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

Q3 was a solid quarter in which we delivered on our top-line outlook and exceeded our gross margin and operating margin expectations. Cash flow was above the high end of our outlook range in what is typically a seasonally lower cash flow quarter due to the timing of variable compensation and bond interest payments.

In terms of our business performance, we had taken a prudent view of the storage networking market when we provided our Q3 outlook in May, incorporating the partner-specific storage dynamics we saw at the time. We were pleased that revenue came in slightly above our expectations, demonstrating the vital role of Fibre Channel as customers connect both traditional disk storage and next-generation flash arrays. In addition, our IP Networking revenue growth rate continues to outpace the market, underscoring our success in leveraging New IP technologies to drive sales across our portfolio.

Our industry continues to be at the forefront of a massive transition to third platform computing technologies driving the need for open and scalable network architectures that make up the New IP. Third platform architecture enables new ways to store and share significant amounts of data, as well as new ways to connect via the cloud and mobile devices. Brocade is well positioned to take advantage of this emerging market transition, and we plan to leverage the strategic investments we have made across our business to drive growth.

© 2015 Brocade Communications Systems, Inc. Page 6 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

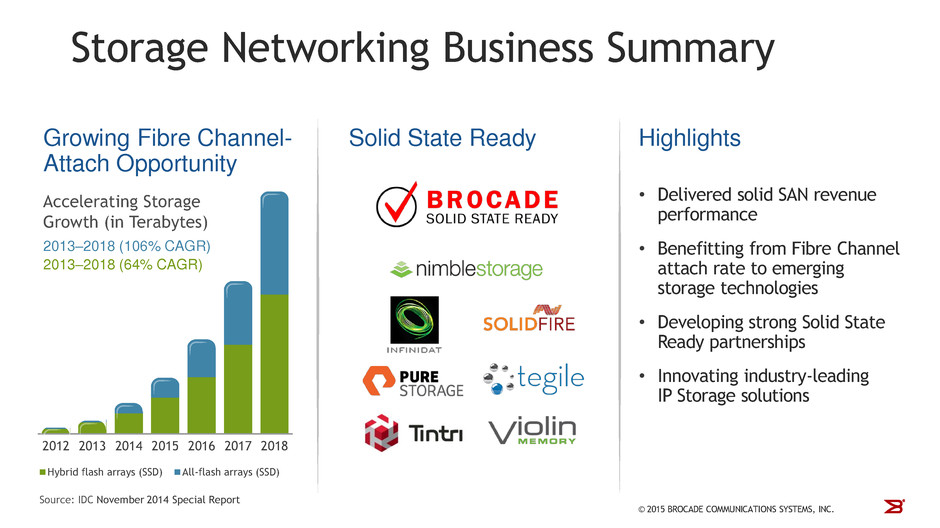

Given some partner reports of generally softer storage sales at the high-end of the market, we entered the quarter with more moderate expectations for Q3 relative to our results in Q2 15. Revenue came in better than our Q3 outlook, in large part driven by the high Fibre Channel attach rate to emerging storage technologies, such as all-flash arrays, that continue to grow rapidly, as well as some improvement with certain OEM partners that had experienced operational issues earlier this year.

As the leader in storage networking, we continue to closely monitor the demand environment for our products across all storage platforms and expect to maintain a prudent near-term outlook. However, we believe that the Fibre Channel market remains durable. A recent Gartner report finds that continued adoption of faster Fibre Channel speeds are indicators that the storage market continues to value Fibre Channel resiliency and fault tolerance features.

As we look to growth opportunities in storage and SAN, we continue to expand our partner base by building closer ties with next-generation flash storage array and server vendors. We believe these new relationships, along with our traditional OEM partner relationships, will help provide a long and stable revenue stream from our Fibre Channel switching business.

In addition, while still relatively nascent, one of the most exciting trends we see in storage networking is the rising interest in IP storage. Historically, IP storage was typically confined to low-priority workloads such as file sharing and home directories. But today, it is being used as an incremental storage environment to support new business-critical workloads, including server virtualization and big data analytics.

Brocade, as the storage networking expert, is once again helping to define storage best-practices by enabling customers to deploy IP storage networks that deliver predictable performance, ease of management, enhanced visibility, and security. In fact, we now offer the industry’s first purpose-built storage connectivity portfolio for data center and disaster recovery applications, and we are successfully leveraging our longstanding partnerships to drive market penetration.

© 2015 Brocade Communications Systems, Inc. Page 7 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

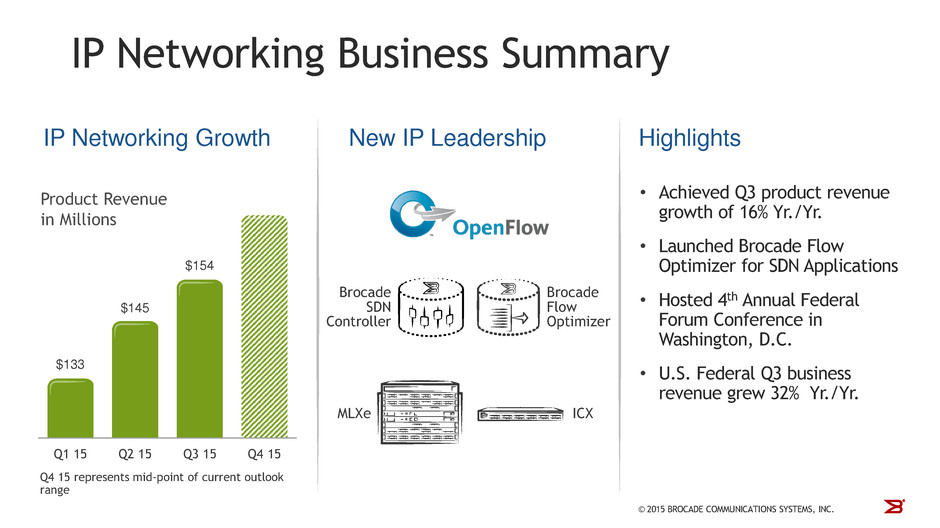

We achieved another strong quarter of double-digit revenue growth year-over-year in IP Networking with continued strength across service provider and federal markets. Our federal revenue grew 32% Yr./Yr. and has grown year-over-year by double digits for each of the last five quarters. From a product standpoint, router and Ethernet switch sales were up 35% and 6%, respectively, year-over-year.

Our IP sales performance through Q3 and our Q4 outlook demonstrate that we are growing the business above our two-year revenue target model of 8% to 12% growth provided at our 2014 Investor Day. Across all of our customer segments, our portfolio of solutions is optimized for the ongoing transition to the New IP with technologies for cloud, social, mobile, and big data requirements. We also continue to expand our software-centric New IP capabilities through technology innovation.

For example, during Q3 we announced the Brocade Flow Optimizer, a new software-defined networking (SDN) application that can be effectively paired with Brocade MLXe routers to provide proactive insight into network traffic, mitigate network attacks, and eliminate network congestion. This announcement demonstrates our strategy to leverage standards-based protocols and open APIs to provide new use cases for existing product families.

Also in the third quarter, Brocade hosted the fourth annual Federal Forum conference in Washington, D.C., where technologies for the New IP were central to the discussion of enabling improved cost efficiency and the deployment of new services. The event has continued to grow in size and influence over the years, with approximately 1,000 attendees this year across a wide variety of federal agencies. Brocade showcased 11 innovative technology solutions and had executive engagement with hundreds of both current and potential customers. Data center networks and network modernization continue to be major themes as federal agencies actively explore the tremendous benefits of leveraging open, multi-vendor network solutions.

© 2015 Brocade Communications Systems, Inc. Page 8 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

We continued to gain traction and validation of our software technology leadership through both customer adoption and industry recognition in Q3.

As evidence of our recognized leadership, we were pleased to announce a partnership with CERN Openlab, a public-private partnership between CERN and leading ICT companies, to assist in their development of a long-term SDN strategy for the New IP. This open SDN solution will be based on OpenFlow and will utilize the Brocade SDN Controller and Brocade Flow Optimizer, as well as OpenFlow-enabled Brocade MLXe routers and ICX switches.

In addition, Masergy, a global leader in secure networking and cloud services, announced a new set of NFV-based services featuring the Brocade vRouter. Masergy’s new managed service offerings target U.S. enterprises, enabling full-featured network services through a simple software download.

In the area of virtual application delivery controllers (“vADC”), we are effectively leveraging the assets from our Q2 purchase of Riverbed’s SteelAppTM product line to expand our presence and customer base. The ADC market is going through an aggressive disruption where proprietary hardware is being replaced with virtual software running on industry-standard servers. Approximately 15% of the $1.8 billion market has already converted to virtual software, and this dynamic is growing by 33% annually. We are excited about our market position and are executing quickly to take advantage of this opportunity.

Highlighting our success in delivering some of the industry’s most innovative solutions, Brocade was named a winner in the Light Reading 2015 Leading Lights awards program in two distinct categories. Our unique Brocade SDN Controller won the award for Most Innovative SDN Product Strategy and the Brocade Virtual Evolved Packet Core (vEPC) solution won for Best New Product for Mobile. In addition, we were pleased that our customer, Telekom Austria Group, was awarded Most Innovative NFV Deployment Strategy for Network/Data Center Operators for its Brocade-powered solution.

© 2015 Brocade Communications Systems, Inc. Page 9 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

In closing, we are committed to continued market and technology leadership in storage networking and are successfully expanding our capabilities as the market evolves. With 20 years of industry best-practice expertise, we are enabling new technologies and adding new partners to meet the evolving requirements of next-generation storage networks. While we are maintaining an appropriately cautious view of the market near term, we are encouraged with signs that market conditions are stabilizing, and we believe that our storage networking business will continue to provide healthy revenue and profits over the long term.

In IP Networking, our focused innovation and strong capital structure have allowed us to invest in strategic technologies, both through internal R&D and targeted M&A, providing a solid foundation for our continued leadership in the era of the New IP. We are progressing with the integration of our recent software acquisitions and are excited to be building one of the most relevant and advanced software portfolios in the industry. This success is underscored by both customer adoption of our solutions and continued industry recognition.

At our Investor Day event on September 30 in San Jose, we will provide further details about our overall corporate strategy, take you through our market opportunities, and provide an updated financial model. I encourage you to attend in person or participate virtually, and look forward to speaking with you soon.

© 2015 Brocade Communications Systems, Inc. Page 10 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

Prepared comments provided by Dan Fairfax, CFO

© 2015 Brocade Communications Systems, Inc. Page 11 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

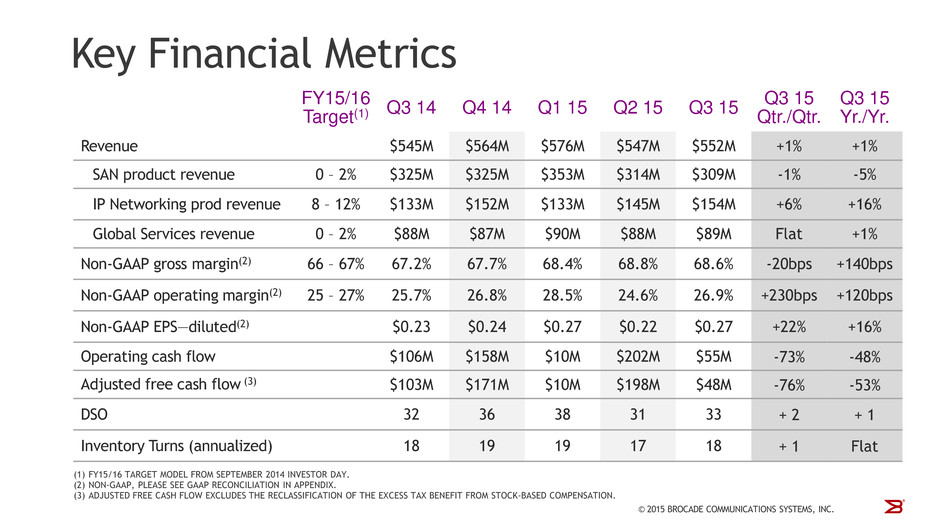

Q3 15 revenue of $552M was up 1% Yr./Yr., driven by increased IP Networking product revenue, while SAN product revenue was down 5% Yr./Yr. as both switch and server sales declined Yr./Yr. IP Networking was up 16% Yr./Yr. primarily due to stronger router and Ethernet switch revenue and higher sales to both service provider and U.S. federal customers.

Fiscal Q3 15 followed normal quarterly seasonal patterns, with a modest sequential decline in SAN revenue offset by an increase in IP Networking revenue. Fiscal Q3 is typically our weakest SAN quarter during the year as it is a seasonally soft storage quarter for many of our OEM partners. IP Networking is typically up modestly in fiscal Q3 driven by improved public sector sales.

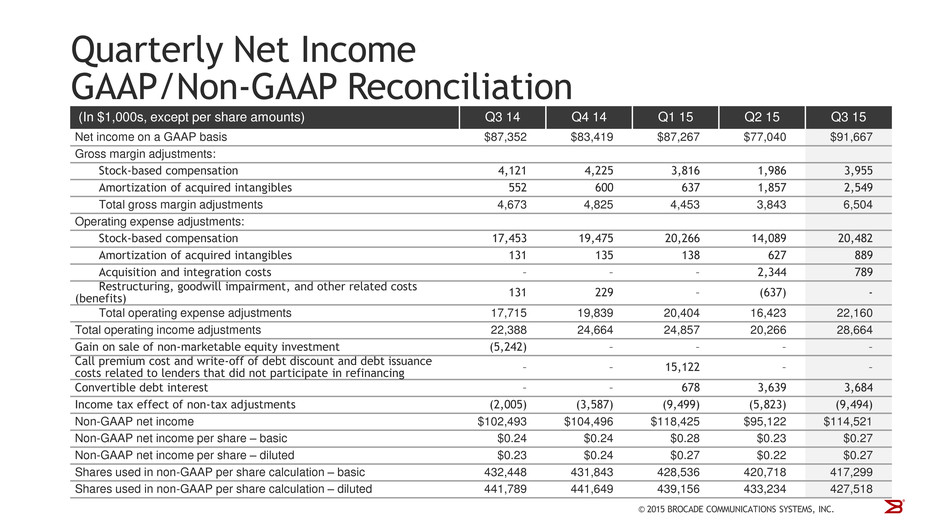

Non-GAAP gross margin was 68.6% in Q3 15, up 140 basis points Yr./Yr. due primarily to lower manufacturing overhead costs, and favorable product mix within SAN and IP Networking, partially offset by the overall revenue shift towards IP Networking. Non-GAAP operating margin was 26.9% in Q3 15, up 120 basis points from Q3 14 primarily due to higher gross margin.

Q3 15 non-GAAP diluted EPS was $0.27, up from $0.23 in Q3 14, due to higher operating margin, lower number of shares outstanding, and various tax benefits, including a domestic manufacturing deduction and releases of previously reserved tax provisions recognized in Q3 15. The various tax benefits increased both GAAP and non-GAAP EPS approximately $0.02 in the quarter.

Both operating cash flow of $55M and adjusted free cash flow of $48M were above our Q3 outlook range of $25M to $45M and $20M to $40M, respectively, due to improved profitability.

Inventory turns were flat year-over-year, but increased slightly sequentially.

The Q3 15 effective non-GAAP tax rate was 20.1%, down 180 basis points Yr./Yr. and lower than our Q3 outlook range of 25.0% to 27.0%. The lower rate was due to the tax benefits previously mentioned.

© 2015 Brocade Communications Systems, Inc. Page 12 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

Revenue from our SAN business, including hardware products and SAN-based support and services, in Q3 15 was $362M, down 5% from Q3 14. The year-over-year decline was primarily due to softer demand for server blade and fixed-configuration Fibre Channel switches and related support.

Our SAN product revenue was $309M in the quarter, down 5% Yr./Yr. as server blade and switch sales were down 20% and 9% Yr./Yr., respectively, partially offset by higher director sales, which were up 5% Yr./Yr.

SAN-based Global Services revenue was $52.1M, down 5% Yr./Yr., consistent with the hardware revenue decline.

From a total revenue perspective, including SAN and IP Networking, our channels to market have shifted over time due to the growth of the IP Networking revenue and also reflect the seasonal change in segment mix. Total OEM revenue in Q3 15 was 62% of total revenue, down from 67% in Q3 14, while Channel/Direct sales have increased to 38% from 33% of total revenue.

© 2015 Brocade Communications Systems, Inc. Page 13 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

Revenue from our total IP Networking business, including hardware and IP-based support and services, was $190M, up 15% Yr./Yr. The year-over-year revenue improvement was across all geographies with the Americas (excluding federal) up 9%, U.S. federal up 32%, EMEA up 17%, APAC up 26%, and Japan up 6%.

From a product perspective, Q3 15 IP Networking product revenue was $154M, up 16% Yr./Yr. We experienced strong year-over-year growth in both routers (up 35%) and Ethernet switches (up 6%).

IP-based Global Services revenue was $36.5M, up 10% Yr./Yr. primarily due to increased maintenance revenue associated with higher IP Networking product sales and recently acquired virtual application delivery controller software.

Although it is difficult to identify all end users and their specific network deployments due to our two-tier distribution channel, we are providing estimates of the split of our IP Networking business. Our data center deployments represented approximately 52% of IP Networking revenue in Q3 15, compared to 55% in Q3 14 and 62% in Q2 15.* The year-over-year decline was primarily due to a higher mix of carrier and enterprise campus deployments. Data center IP Networking revenue grew 11% Yr./Yr.

* The estimated percentage of revenue coming from data center IP Networking customers may fluctuate quarter to quarter due to the timing of large data center customer transactions and minor changes to classification from improved visibility of actual customer deployments, as well as the seasonality of the public sector, including federal. Other use cases, such as enterprise campus and carrier networks (MAN/WAN) represent the balance of the business.

© 2015 Brocade Communications Systems, Inc. Page 14 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

Looking forward to Q4 15, we considered a number of factors, including the following, in setting our outlook:

• | For Q4 15, we expect SAN revenue to be up 1% to 5% Qtr./Qtr. We typically see stronger buying patterns from our OEM partners in our fiscal Q4. |

• | We expect our Q4 15 IP Networking revenue to be up 6.5% to 11% Qtr./Qtr., principally driven by our IP growth initiatives. |

• | We expect our Global Services revenue to be flat to up 1% Qtr./Qtr. |

• | We expect Q4 15 non-GAAP gross margin to be between 67.5% to 68.5%, and non-GAAP operating margin to be between 24.0% to 26.0%, primarily reflecting the expected mix of SAN and IP revenues. |

• | At the end of Q3 15, OEM inventory increased slightly Qtr./Qtr. on a dollar basis but was essentially flat at a little more than one and one-half weeks of supply based on SAN business revenue. We expect inventory to be between one to two weeks in Q4 15. |

© 2015 Brocade Communications Systems, Inc. Page 15 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

Prepared comments provided by Michael Iburg, Investor Relations

That concludes Brocade’s prepared comments. At 2:30 p.m. Pacific Time on August 20, Brocade will host a webcast conference call at www.brcd.com.

Thank you for your interest in Brocade.

© 2015 Brocade Communications Systems, Inc. Page 16 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

© 2015 Brocade Communications Systems, Inc. Page 17 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

© 2015 Brocade Communications Systems, Inc. Page 18 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

Additional Financial Information:

Q3 14 | Q2 15 | Q3 15 | ||||

GAAP product gross margin | 68.2 | % | 70.0 | % | 68.9 | % |

Non-GAAP product gross margin | 68.8 | % | 70.6 | % | 69.8 | % |

GAAP services gross margin | 56.4 | % | 58.4 | % | 59.7 | % |

Non-GAAP services gross margin | 58.8 | % | 59.6 | % | 62.3 | % |

© 2015 Brocade Communications Systems, Inc. Page 19 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

© 2015 Brocade Communications Systems, Inc. Page 20 of 21

Brocade Q3 FY 2015 Earnings 8/20/2015

|

© 2015 Brocade Communications Systems, Inc. Page 21 of 21