Attached files

| file | filename |

|---|---|

| 8-K - HAWTHORN BANCSHARES, INC. | form8k-08142015_020843.htm |

Exhibit 99.1

Hawthorn Bancshares Reports Second Quarter Financial Results

Jefferson City, Mo. — August 14, 2015 — Hawthorn Bancshares Inc. (NASDAQ: HWBK), today reported consolidated financial results for the Company for the second quarter ended June 30, 2015.

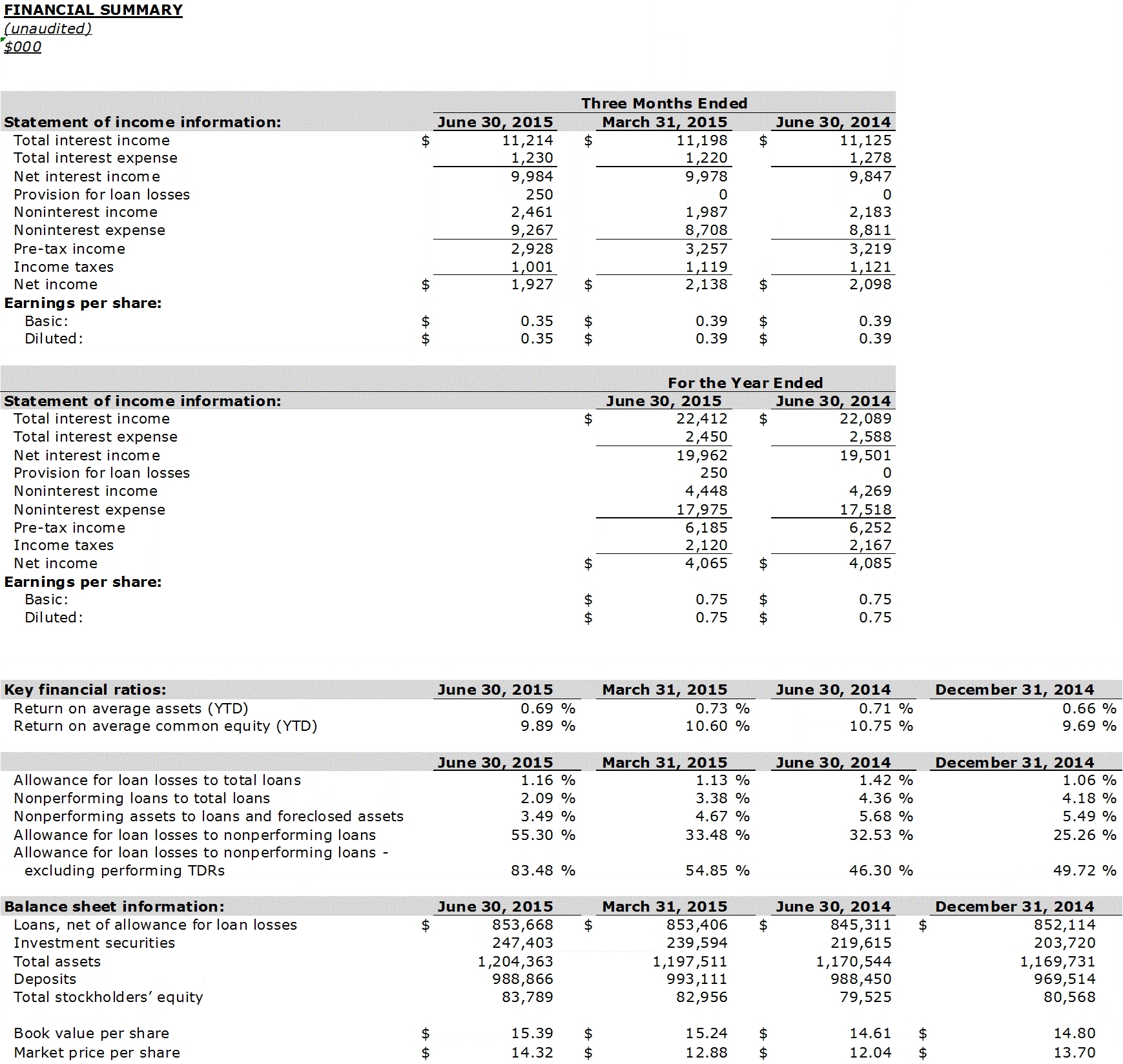

Net income for the second quarter 2015 was $1.9 million, or $0.35 per diluted common share, compared to $2.1 million, or $0.39 per diluted common share, for first quarter 2015, and $2.1 million, or $0.39 per diluted common share, for the second quarter 2014. For the six months ended June 30, 2015, net income was $4.1 million, or $0.75 per diluted common share, compared to $4.1 million, or $0.75 per diluted common share, for the prior year-to-date.

The return on average common equity was 9.21% and the return on average assets was 0.65% for the second quarter ended June 30, 2015 compared to 10.83% and 0.72% for the second quarter ended June 30, 2014, respectively. For the current year, return on average common equity was 9.89% and the return on average assets was 0.69% compared to 10.75% and 0.71% for the prior year-to date, respectively.

Commenting on earnings performance, Chairman David T. Turner said, “Hawthorn continues to report solid earnings performance with quarterly earnings per diluted common share decreasing slightly from the first quarter 2015 and the prior year quarter. However, on a year-to date basis, earnings have matched the prior year at $0.75 per diluted common share. Average loans increased $4.5 million during the current quarter and average loan balances for the current year were $13.9 million, or 1.6%, ahead of last year. The net interest margin contracted modestly to 3.63% for the current quarter versus 3.71% for the prior quarter and 3.72% for the prior year quarter while it is only 4 basis points below the prior year-to-date level at 3.67%. Net interest income for the current quarter was equal to the linked quarter and the prior year quarter but for the current year it was $0.5 million, or 2.4%, higher than the prior year. We continue to maintain both our net interest margins and net interest income levels during the extended low interest rate environment. A loan loss provision of $0.3 million was recorded in the current quarter, while no provision was made for the prior linked quarter or prior year quarter. The increase in the provision for loan losses resulted primarily from an increase in the specific reserves required for impaired loans mostly related to one loan relationship. Non-interest income of $2.5 million for the current quarter was $0.5 million ahead of the prior quarter and $0.3 million above the prior year quarter primarily due to increased residential real estate mortgage income. Non-interest expense of $9.3 million was $0.6 million, or 6.4%, above the linked prior quarter, primarily due to higher real estate foreclosure expenses, and $0.5 million, or 5.2%, higher than the prior year quarter.”

Net Interest Income

Net interest income was $10.0 million for both the second and first quarters of 2015 and $9.8 million for the second quarter 2014. Average loans increased $13.9 million, or 1.6%, from the prior year, which contributed to the continued strong net interest margin for the current year of 3.67%.

1

Non-Interest Income and Expense

Non-interest income for the second quarter ended June 30, 2015 was $2.5 million compared to $2.2 million for the second quarter ended June 30, 2014. The $0.3 million increase from the prior year was primarily due to a $0.3 million increase in combined real estate servicing fees and mortgage loan sales income resulting primarily from an increase in refinancing activity during the current year.

Non-interest expense was $9.3 million for the second quarter ended June 30, 2015 compared to $8.8 million for the second quarter 2014. The $0.5 million increase, or 5.2%, resulted primarily from a $0.2 million increase, or 4.3%, in salaries and employee benefits coupled with a $0.1 million increase in legal, examination and professional fees.

Allowance for Loan Losses

The Company’s level of non-performing loans improved significantly during the current year to 2.09% of total loans at June 30, 2015, compared to 3.38% at March 31, 2015 and 4.18% at December 31, 2014. During the second quarter ended June 30, 2015, the Company recognized net charge-offs of $25,000 compared to net charge-offs of $695,000 for the second quarter ended June 30, 2014. For the six months ended June 30, 2015, net recoveries of $637,000 were recorded compared to net charge-offs of $1.6 million for the prior year. A $250,000 provision for loan losses was recorded during the second quarter ended June 30, 2015 while no loan loss provision was recorded in the linked prior quarter or the prior year quarter. The current quarter loan loss provision resulted primarily from additional specific reserves required for impaired loans mostly related to one loan relationship. The allowance for loan losses at June 30, 2015 was $10.0 million, or 1.16% of outstanding loans, 55.30% of non-performing loans and 83.48% of nonperforming loans when excluding accruing TDR’s. At December 31, 2014, the allowance for loan losses was $9.1 million, or 1.06% of outstanding loans, 25.26% of non-performing loans and 49.72% of nonperforming loans when excluding accruing TDR’s. The allowance for loan losses represents management’s best estimate of probable losses contained in the loan portfolio and is commensurate with risks in the loan portfolio as of June 30, 2015.

Financial Condition

Comparing June 30, 2015 balances with December 31, 2014, total assets increased $34.6 million to $1.2 billion. The largest driver in asset growth was investment securities increasing $40.5 million, or 20.3% Total deposits increased $19.4 million to $988.9 million and federal funds purchased and securities sold under agreements to repurchase increased $7.9 million to $25.8 million at June 30, 2015. During the same period, stockholders’ equity increased 4.0% to $83.8 million, or 7.0% of total assets. The total risk based capital ratio of 14.97% and the leverage ratio of 9.36% at June 30, 2015, respectively, far exceed minimum regulatory requirements of 8.00% and 4.00%, respectively.

[Tables follow]

2

About Hawthorn Bancshares

Hawthorn Bancshares, Inc., a financial-bank holding company headquartered in Jefferson City, Missouri, is the parent company of Hawthorn Bank of Jefferson City with locations in the Missouri communities of Lee's Summit, Liberty, Springfield, Branson, Independence, Columbia, Clinton, Windsor, Collins, Osceola, Warsaw, Belton, Drexel, Harrisonville, California and St. Robert.

Contact:

Bruce Phelps

Chief Financial Officer

TEL: 573.761.6100 FAX: 573.761.6272

www.HawthornBancshares.com

Statements made in this press release that suggest Hawthorn Bancshares' or management's intentions, hopes, beliefs, expectations, or predictions of the future include "forward-looking statements" within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended. It is important to note that actual results could differ materially from those projected in such forward-looking statements. Additional information concerning factors that could cause actual results to differ materially from those projected in such forward-looking statements is contained from time to time in the company's quarterly and annual reports filed with the Securities and Exchange Commission.

3