Attached files

Exhibit 10.7

ORBIT

ENERGY CHARLOTTE, LLC MEMBERSHIP

INTEREST PURCHASE AGREEMENT

among

ORBIT

ENERGY, INC.,

ORBIT ENERGY CHARLOTTE, LLC,

BLUE SPHERE CORPORATION, INC.,

and

CONCORD ENERGY PARTNERS, LLC

dated as of

January 30, 2015

TABLE OF CONTENTS

ORBIT

ENERGY CHARLOTTE, LLC MEMBERSHIP

INTEREST PURCHASE AGREEMENT

This Agreement, dated as of January 30, 2015 is entered into by and between Orbit Energy, Inc., a North Carolina corporation (“Seller”), Concord Energy Partners, LLC, a Delaware limited liability company (“Buyer”), Orbit Energy Charlotte, LLC, a North Carolina limited liability company (“Project LLC”) and Blue Sphere Corporation, a Nevada corporation (“Blue Sphere”).

WITNESSETH:

WHEREAS, Project LLC holds certain development and other rights necessary and appropriate to develop, construct and operate a high solids anaerobic digestion and energy generation facility for the production of biogas and electricity in Charlotte, North Carolina (the “Project”);

WHEREAS, Seller and Blue Sphere are parties to that certain Amended and Restated Orbit Energy Charlotte, LLC Purchase Agreement, (including Exhibit A thereto) made and entered into as of November 19, 2014 (the “Prior Purchase Agreement”), pursuant to which Blue Sphere purchased 100% of the limited liability company interests of Project LLC, along with certain contractual, governmental and permitting rights relating to the Project (collectively, in addition to the 100% limited liability company interests of Project LLC, the “Interests”) from Seller, and became the sole member of Project LLC, a copy of which agreement is attached hereto and incorporated herein as Exhibit A. For the avoidance of doubt, the terms “Interests” as used throughout this Agreement includes without limitation, any and all Rights (as hereinafter defined) acquired by Project LLC (or by Blue Sphere on behalf of Project LLC) during Blue Sphere’s period of ownership;

WHEREAS, under the Prior Purchase Agreement, (i) Blue Sphere acknowledges and agrees that it has an obligation to make certain payments to Seller, including, without limitation, pursuant to Section 2, Section 3 and Section 4 of the Prior Purchase Agreement, including a Seller Participation Fee, a Development Fee, an extension fee, and a Management Fee (all as defined in the Prior Purchase Agreement), and to perform certain other obligations under the Prior Purchase Agreement (collectively, all of Blue Sphere’s obligations to perform under the Prior Purchase Agreement as set forth therein and herein are referred to herein as the “Blue Sphere Obligations”), and (ii) Seller has granted certain technology rights to Blue Sphere and/or Project LLC for use in the Project;

WHEREAS, Blue Sphere, during the period in which it was the sole member of Project LLC, on behalf of Project LLC, procured and coordinated certain contractual and governmental and permitting rights necessary for the development and construction of the Project (collectively, the “Rights”);

WHEREAS, Blue Sphere, Seller and York Renewable Energy Partners LLC, a Delaware limited liability company (“York”), have been engaged in negotiations to effect a transaction whereby Blue Sphere would contribute 100% of the Interests to Buyer and York would make certain capital contributions to Buyer, such that Blue Sphere and York would become the sole members of Buyer, and Buyer would become the sole member of Project LLC (“Previous Transaction”);

| 1 |

WHEREAS, in contemplation of the Previous Transaction and payment by Blue Sphere of the Development Fee to Seller as well as Blue Sphere’s performance of the Blue Sphere Obligations, Seller executed and delivered a release to Buyer, pursuant to which Seller released Buyer, York and Project LLC and their respective assets, including the Project, from any liability for any of the Blue Sphere Obligations under the Prior Purchase Agreement, including without limitation, the Seller Participation Fee, the Development Fee, an extension fee and the Management Fee, and granted to Project LLC a perpetual, royalty-free, nonexclusive license to use certain technology in the Project (the “Release”, a copy of which is attached hereto and incorporated herein as Exhibit B);

WHEREAS, the Previous Transaction has not been consummated;

WHEREAS, pursuant to Section 3.3 of the Prior Purchase Agreement, if payment in full of the Development Fee (as defined in the Prior Purchase Agreement) is not made by Blue Sphere on December 15, 2015, as extended to January 15, 2015, the Interests automatically revert to Seller without further action, and effective on the date hereof, with the consent of Blue Sphere, Seller and Buyer, such reversion is deemed to have occurred and Seller is the sole legal and beneficial the owner of the Interests;

WHEREAS, Blue Sphere, Seller and Buyer desire, in lieu of the Previous Transaction to enter into the following transaction: (i) Seller shall sell and Buyer shall purchase the Interests for the consideration described herein and Buyer shall become the sole member of Project LLC; (ii) Blue Sphere, York and Buyer shall enter into a certain Development and Indemnification Agreement pursuant to which Blue Sphere shall make certain representations and warranties regarding Project LLC, its assets and liabilities and the Project and undertake certain covenants and indemnification obligations to Buyer relating thereto, and contribute to Project LLC certain assets relating to the Project in exchange for consideration stated therein; (iii) York, Buyer and Blue Sphere shall enter into an amended and restated limited liability company agreement pursuant to which York shall make certain capital contributions to Buyer as a member of Buyer holding Series A units representing 75% of the limited liability company interests of Buyer, and Blue Sphere shall become a member of Buyer holding Series B units representing 25% of the limited liability company interests of Buyer; and (iv) Seller shall confirm the Release and the grant to Project LLC of the license described therein in light of the transactions contemplated by the foregoing by its execution of this Agreement;

WHEREAS, subject to the terms and conditions hereof, Seller desires to sell all of the Interests to Buyer, and Buyer wishes to purchase all of the Interests from Seller; and

WHEREAS, Blue Sphere, Seller and Buyer desire to confirm certain of their respective obligations under the Prior Purchase Agreement, including under the Release;

NOW THEREFORE, in consideration of the premises and the mutual covenants and agreements contained in this Agreement and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

| 2 |

Section 1.01

Purchase and Sale.

Subject to the terms and conditions set forth herein, at the Closing (as defined herein), Seller shall sell to Buyer, and Buyer shall purchase from Seller, all of Seller’s right, title and interest in and to the Interests free and clear of any mortgage, pledge, lien, charge, security interest, claim or other encumbrance (“Encumbrance”), and Seller abandons all economic and ownership interest in the Interests in favor of Buyer, for the consideration specified in Section 1.02, and effective with the Closing, Seller shall cease to be a member of Project LLC, consents to the admission of Buyer as the sole member of Project LLC, and Buyer shall be admitted as the sole member of Project LLC.

Section 1.02

Purchase Price.

Buyer shall pay to Seller $917,764 as the purchase price for the Interests (such amount referred to herein as the “Closing Purchase Price”). Buyer shall pay the Closing Purchase Price to Seller at the Closing (as defined herein) in cash, by wire transfer of immediately available funds in accordance with the wire transfer instructions provided by Seller to Buyer.

Section 1.03

Closing.

The closing of the transactions contemplated by this Agreement (the “Closing”) shall take place simultaneously with the execution of this Agreement on the date of this Agreement (the “Closing Date”) at the offices of Sullivan & Worcester LLP, One Post Office Square, Boston, Massachusetts 02109.

Article

II

Representations and Warranties of Seller

Seller represents and warrants to Buyer that the statements contained in this Article II are true and correct as of the date hereof. For purposes of this Article II, “Seller’s knowledge,” “knowledge of Seller” and any similar phrases shall mean the actual knowledge of any director or officer of Seller, after due inquiry.

Section 2.01

Organization and Authority of Seller; Enforceability.

Seller is a corporation duly organized, validly existing and in good standing under the laws of the State of North Carolina. Seller has the corporate power and authority to enter into this Agreement and the documents to be delivered hereunder, to carry out its obligations hereunder and to consummate the transactions contemplated hereby. This Agreement and the documents to be delivered hereunder have been duly executed and delivered by Seller, and (assuming due authorization, execution and delivery by Buyer) this Agreement and the documents to be delivered hereunder constitute legal, valid and binding obligations of Seller, enforceable against Seller in accordance with their respective terms, except as may be limited by any bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or other similar laws affecting the enforcement of creditors’ rights generally or by general principles of equity.

| 3 |

Section 2.02

No Conflicts; Consents.

The execution, delivery and performance by Seller of this Agreement and the documents to be delivered hereunder, and the consummation of the transactions contemplated hereby, do not and will not: (i) violate or conflict with the articles of incorporation, by-laws or other organizational documents of Seller; (ii) violate or conflict with any judgment, order, decree, statute, law, ordinance, rule or regulation applicable to Seller; (iii) conflict with, or result in (with or without notice or lapse of time or both) any violation of, or default under, or give rise to a right of termination, acceleration or modification of any obligation or loss of any benefit under any contract or other instrument to which Seller is a party; (iv) result in any violation, conflict with or constitute a default under Project LLC’s Articles of Organization; or (v) result in the creation or imposition of any Encumbrance on the Interests.

Section 2.03

Legal Proceedings.

There is no claim, action, suit, proceeding or governmental investigation (“Action”) of any nature pending or, to Seller’s knowledge, threatened against or by Seller (i) relating to or affecting the Interests; or (ii) that challenges or seeks to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement. No event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such Action.

Section 2.04

Ownership of Interests; Limited Liability Company Agreement.

(a)

Seller organized and was the sole member of Project LLC from March 16, 2010, the date of its formation as a limited liability company under the laws of the State of North Carolina, through November 19, 2014, the effective date of the Prior Purchase Agreement.

(b)

From the date of formation of Project LLC through November 19, 2014 there was no limited liability company agreement for Project LLC.

(c)

Pursuant to the Prior Purchase Agreement, Seller transferred and abandoned 100% of the limited liability company interests of Project LLC, including all the economic and ownership rights in Project LLC owned by Seller to Blue Sphere, and consented to the admission of Blue Sphere as the sole member of Project LLC, and Blue Sphere was admitted as the sole member, of Project LLC, effective November 19, 2014.

(d)

Effective on the date hereof, pursuant to Section 3.3 of the Prior Purchase Agreement, ownership of the Interests reverted to Seller, and Seller became and is the sole legal, beneficial, record and equitable owner of the Interests, free and clear of all Encumbrances whatsoever and is the sole member of Project LLC.

(e)

The Interests were issued in compliance with applicable laws. The Interests were not issued in violation of the organizational documents of Project LLC or any other agreement, arrangement or commitment to which Seller or Project LLC was a party during the periods when the Interests were owned by Seller and, to the knowledge of Seller, are not subject to and were not issued or otherwise transferred in violation of any preemptive or similar rights of any person or entity.

| 4 |

(f)

To the knowledge of Seller, the Interests are not subject to any restriction with respect to their transferability (other than restrictions on transfer under applicable federal and state securities laws); there are no outstanding or authorized options, warrants, subscriptions, calls, puts, conversion or other rights, contracts, agreements, commitments or understandings of any kind respecting the Interests or obligating Seller to sell, purchase or return any of the Interests and there are no other securities convertible into, exchangeable for or evidencing the right to subscribe for any of the Interests.

Section 2.05

Brokers.

Except for Seller’s agreement with Excelsior Capital, which shall be the sole obligation of Seller, no broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Seller.

Section 2.06

Non-foreign Status.

Seller is not a foreign person as such term is used in Treasury Regulation Section 1.1445-2.

Article

III

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer represents and warrants to Seller that the statements contained in this Article III are true and correct as of the date hereof. For purposes of this Article III, “Buyer’s knowledge,” “knowledge of Buyer” and any similar phrases shall mean the actual knowledge of any director or officer of Buyer, after due inquiry.

Section 3.01

Organization and Authority of Buyer; Enforceability.

Buyer is a limited liability company duly organized, validly existing and in good standing under the laws of the State of Delaware. Buyer has full limited liability company power and authority to enter into this Agreement and the documents to be delivered hereunder, to carry out its obligations hereunder and to consummate the transactions contemplated hereby. The execution, delivery and performance by Buyer of this Agreement and the documents to be delivered hereunder and the consummation of the transactions contemplated hereby have been duly authorized by all requisite limited liability company action on the part of Buyer. This Agreement and the documents to be delivered hereunder have been duly executed and delivered by Buyer, and (assuming due authorization, execution and delivery by Seller) this Agreement and the documents to be delivered hereunder constitute legal, valid and binding obligations of Buyer enforceable against Buyer in accordance with their respective terms, except as may be limited by any bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or other similar laws affecting the enforcement of creditors’ rights generally or by general principles of equity.

| 5 |

Section 3.02

No Conflicts; Consents.

The execution, delivery and performance by Buyer of this Agreement and the documents to be delivered hereunder, and the consummation of the transactions contemplated hereby, do not and will not: (i) violate or conflict with the certificate of formation or limited liability company agreement of Buyer; or (ii) violate or conflict with any judgment, order, decree, statute, law, ordinance, rule or regulation applicable to Buyer. No consent, approval, waiver or authorization is required to be obtained by Buyer from any person or entity (including any governmental authority) in connection with the execution, delivery and performance by Buyer of this Agreement and the consummation of the transactions contemplated hereby.

Section 3.03

Investment Purpose.

Buyer is acquiring the Interests solely for its own account for investment purposes and not with a view to, or for offer or sale in connection with, any distribution thereof. Buyer acknowledges that the Interests are not registered under the Securities Act of 1933, as amended, or any state securities laws, and that the Interests may not be transferred or sold except pursuant to the registration provisions of the Securities Act of 1933, as amended, or pursuant to an applicable exemption therefrom and subject to state securities laws and regulations, as applicable.

Section 3.04

Brokers.

No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission from Seller in connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Buyer.

Section 3.05

Legal Proceedings.

There is no Action pending or, to Buyer’s knowledge, threatened against or by Buyer or any affiliate of Buyer that challenges or seeks to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement. No event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such Action.

Section 4.01

Confidentiality.

From and after the Closing, Seller shall, and shall cause its affiliates to, hold, and shall use its reasonable best efforts to cause its or their respective representatives to hold, in confidence any and all information, whether written or oral, concerning Project LLC or Buyer, except to the extent that Seller can show that such information (i) is generally available to and known by the public through no fault of Seller, any of its affiliates or their respective representatives; or (ii) is lawfully acquired by Seller, any of its affiliates or their respective representatives from and after the Closing from sources which are not prohibited from disclosing such information by a legal, contractual or fiduciary obligation. If Seller or any of its affiliates or their respective representatives are compelled to disclose any information by judicial or administrative process or by other requirements of law, Seller shall promptly notify Buyer in writing and shall disclose only that portion of such information which Seller is advised by its counsel in writing is legally required to be disclosed, provided that Seller shall use reasonable best efforts to obtain an appropriate protective order or other reasonable assurance that confidential treatment will be accorded such information.

| 6 |

Section 4.02

Public Announcements.

Unless otherwise required by applicable law (based upon the reasonable advice of counsel), no party to this Agreement shall make any public announcements in respect of this Agreement or the transactions contemplated hereby or otherwise communicate with any news media without the prior written consent of the other parties (which consent shall not be unreasonably withheld or delayed), and the parties shall cooperate as to the timing and contents of any such announcement.

Section 4.03

Transfer Taxes.

Seller shall pay, and shall reimburse Buyer for, any sales, use or transfer taxes, documentary charges, recording fees or similar taxes, charges, fees or expenses, if any, that become due and payable as a result of the transactions contemplated by this Agreement.

Section 4.04

Seller Release; Continuing Obligations of Blue Sphere.

Each of Seller and Blue Sphere and their respective (as applicable) past and present parent companies, subsidiaries, affiliates, divisions, predecessors, successors, assignees, agents, partners, members, representatives, officers, directors, managers, employees, consultants, licensees, sublicensees, shareholders, insurers, assigns, and their attorneys, and all persons acting by, through, under or in concert with them or any of them, other than Project LLC (all collectively referred to as the “Releasors”), (i) do hereby release and forever discharge Project LLC, Buyer, Entropy Investment Management, LLC, York and each of their (as applicable) past and present parent companies, subsidiaries, affiliates, divisions, predecessors, successors, assignees, agents, partners, members, representatives, officers, directors, managers, employees, consultants, licensees, sublicensees, shareholders, insurers, assigns, past and present, and their attorneys, and all persons acting by, through, under or in concert with them or any of them, other than any of the Releasees which are also Releasors (all collectively referred to as the “Releasees”), of and from any and all claims, causes of action, suits, debts, liens, contracts, judgments, agreements, promises, infringements, liabilities, claims, demands, damages, losses, costs, or expenses of any nature whatsoever, known or unknown, fixed or contingent, which the Releasors or any of them now has or may hereafter have against the Releasees, or any of them, including any of the respective assets of the Releasees, including without limitation the Project and the Interests, relating to or by reason of the Prior Purchase Agreement and the failure of Blue Sphere to perform any obligations under the Prior Purchase Agreement, or the failure of Project LLC or the Project to perform any of its obligations or obligations imputed to it under the Prior Purchase Agreement, including to pay the Development Fee, the Seller Participation Fee, the extension fee, the Management Fee (each as defined in the Prior Purchase Agreement), the obligation to enter into an operation agreement with Seller, or the failure to disclose or deliver financial information about the Project or Project LLC, and (ii) do hereby waive any rights to impose liens, remedies or liabilities on or against any of the Releasees or their assets due to or arising out of Blue Sphere’s failure to perform its obligations under the Prior Purchase Agreement from the beginning of time to the date of this Agreement. Blue Sphere hereby specifically acknowledges and agrees to its continuing responsibility to pay and perform the Blue Sphere Obligations under the Prior Purchase Agreement, which include, without limitation, the payment of the Management Fee by Blue Sphere and the payment of the Seller Participation Fee by Blue Sphere, as such terms are defined and described in the Prior Purchase Agreement. The foregoing release shall not apply to the other obligations of the parties hereto set forth in this Agreement. The Blue Sphere Obligations shall be the sole responsibility and liability of Blue Sphere, and any failure by Blue Sphere to pay or perform all of the Blue Sphere Obligations hereunder shall have no effect on the right, title and interest in and to the Interests or the Rights acquired by Buyer hereunder.

| 7 |

Section 4.05

Technology License and Technology Incorporation.

Without limiting the scope of the release set forth in Section 4.04 above, Seller hereby grants Project LLC an unconditional, perpetual, assignable, royalty-free nonexclusive license to use the Technology (as defined in the Prior Purchase Agreement) for HSAD Units (as defined in the Prior Purchase Agreement), and Project LLC (or its successor) and Buyer agrees to incorporate the Technology and HSAD Units as part of the Project, (as defined in the Prior Purchase Agreement) subject to the following terms and conditions:

(a)

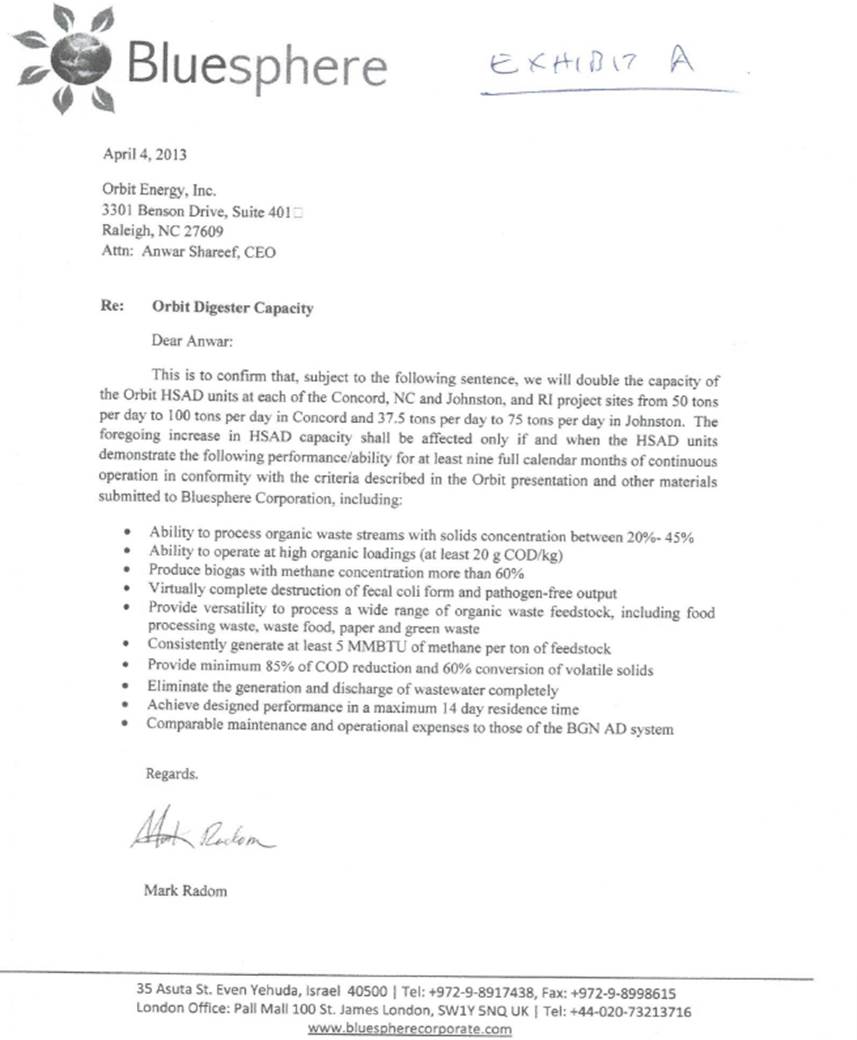

At such time as the Technology has been fully demonstrated to meet all technical and operational parameters for use in the Project and all applicable thresholds, requirements and criteria set forth in the Prior Purchase Agreement (including as set forth in Exhibit A to the Prior Purchase Agreement and any other relevant exhibits and annexes), and subject to subsection (c) hereof, Project LLC shall incorporate the Technology and the requisite HSAD Units into the Project, up to a total maximum capacity of 100 tons per day.

(b)

Blue Sphere acknowledges and agrees that it shall be responsible for all costs of evaluating and incorporating the Technology and the HSAD Units, both direct and indirect, including all payments to Seller and all increased costs, expenses and any damages incurred in connection with the design, installation, integration, operation and maintenance of the Technology incorporated into the Project, which, for the purposes of clarity, shall include the payment of the Management Fee (as defined in the Prior Purchase Agreement) to Seller.

(c)

Each of the following shall be conditions precedent to the requirement that Project LLC incorporate the Technology and the HSAD Units into the Project and to the continued operation of the Technology and HSAD Units as part of the Project: (1) Seller shall provide Project LLC a Performance Guarantee, in form and substance satisfactory to Project LLC, meeting the requirements for such Performance Guarantee under the terms set forth in Section 2.4 of the Prior Purchase Agreement; (2) the incorporation of the Technology shall have been determined by Project LLC to (i) be capable of feasible integration within the overall engineering design, construction and delivery agreement with Auspark LLC and any other project contractors (collectively, the “EPC Agreements”) and will not adversely impact the Project’s performance or void any warranties under the EPC Agreements; and (ii) not reasonably be expected to result in any material adverse impact on the Project or in Project LLC incurring any liabilities to any third party. Upon such time as the HSAD Units are incorporated into the Project, Blue Sphere, Project LLC and Buyer shall cooperate in good faith with Seller to enter into an operation agreement the terms of which shall govern the technical terms on which the HSAD Units will be incorporated into the Project, which shall include, inter alia, agreement as to feedstock for the HSAD Units, auxiliary resources to be devoted to the HSAD Units, and such other terms as the parties may agree to in good faith in order to permit Seller to perform its obligations hereunder.

| 8 |

(d)

For the avoidance of doubt, in no event shall any of the Releasees have any financial obligation to Seller in connection with the Technology, and the nonexclusive license granted by Seller hereunder shall be freely assignable to any third party in connection with a sale or transfer of any interest in the Project or Project LLC, including any future debt or equity financing.

(e)

Seller hereby represents and warrants to Project LLC that Seller owns or holds a valid license to any and all intellectual property relating to the Technology and has full authority to grant the license granted hereunder and that Project LLC’s use of the Technology and the license and/or any subsequent transfer thereof will not infringe on the rights of any third parties or give rise to any claims on the part of any third parties.

(f)

Seller agrees to indemnify and hold harmless Project LLC from any claims, damages, losses, liabilities and/or costs (including for the avoidance of doubt, reasonable counsel fees) (i) relating to or arising out of Project LLC’s use of the HSAD Units, the Technology or the license granted hereunder or (ii) against or in respect of Project LLC arising out of Seller’s conduct that occurred on or prior to November 19, 2014. To the extent Seller lacks the funds to fulfill its indemnity obligations hereunder, Seller pledges its rights, title and interest in, to and under the Technology to Project LLC for Project LLC’s full and unfettered use until such time as Project LLC has been made whole and recouped any losses, costs or other out-of-pocket amounts.

Section 4.06

Further Assurances.

Following the Closing, each of the parties hereto shall, and shall cause their respective affiliates to, execute and deliver such additional documents, instruments, conveyances and assurances and take such further actions as may be reasonably required to carry out the provisions hereof and give effect to the transactions contemplated by this Agreement.

Article

V

CLOSING DELIVERIES AND CONDITIONS

Section 5.01

Seller’s Deliveries.

At the Closing, to the extent applicable, Seller shall deliver to Buyer the following:

(a)

The written resignation or resignations of Seller’s representatives, if any, serving as managers, officers or any other position with or on behalf of Project LLC, such resignations to be effective as of the date hereof.

(b)

A certificate of the Secretary or Assistant Secretary (or equivalent officer) of Seller certifying as to (i) the resolutions of the board of directors of Seller, duly adopted and in effect, which authorize the execution, delivery and performance of this Agreement and the transactions contemplated hereby, and (ii) the names and signatures of the officers of Seller authorized to sign this Agreement and the documents to be delivered hereunder.

(c)

A certificate pursuant to Treasury Regulations Section 1.1445-2(b) that Seller is not a foreign person within the meaning of Section 1445 of the Internal Revenue Code of 1986, as amended.

| 9 |

Section 5.02

Buyer’s Deliveries.

At the Closing, Buyer shall deliver the Closing Purchase Price to Seller.

Section 5.03

Other Closing Conditions.

Each of Blue Sphere, York and Buyer shall have executed and delivered to the other (i) the amended and restated limited liability company agreement of Buyer together with all exhibits thereto in form satisfactory to Buyer dated the date hereof (“Concord LLC Agreement”), and (ii) the Development and Indemnification Agreement (“Development Agreement”) together with all exhibits and schedules thereto and closing deliverables thereunder, in form satisfactory to Buyer and the transactions contemplated under such agreements and documents shall have been consummated.

Section 6.01

Expenses.

Except as otherwise specifically provided herein, all costs and expenses incurred in connection with this Agreement and the transactions contemplated hereby shall be paid by the party incurring such costs and expenses.

Section 6.02

Notices.

All notices, requests, consents, claims, demands, waivers and other communications hereunder shall be in writing and shall be deemed to have been given (i) when delivered by hand (with written confirmation of receipt); (ii) when received by the addressee if sent by a nationally recognized overnight courier (receipt requested); (iii) on the date sent by facsimile or e-mail of a PDF document (with confirmation of transmission) if sent during normal business hours of the recipient, and on the next Business Day if sent after normal business hours of the recipient or (iv) on the third day after the date mailed, by certified or registered mail, return receipt requested, postage prepaid. Such communications must be sent to the respective parties at the following addresses (or at such other address for a party as shall be specified in a notice given in accordance with this Section 6.02):

| If to Seller: |

Orbit Energy, Inc. 900 Ridgefield Dr., Suite 145 Raleigh, NC 27609 Telephone: 919-882-3980 Fax: 919-954-0379 Email: Attention: Chief Executive Officer |

| If to Buyer or Project LLC: |

c/o York Capital Management 767 Fifth Avenue, 17th Floor New York, New York 10153 Telephone 212-710-6567 Fax 646-514-9321 Attention: Investment Counsel Email: mmauro@yorkcapital.com |

| 10 |

| If to Blue Sphere: |

Blue Sphere Corporation 301 McCullough Drive, 4th Floor Charlotte, NC 28262 Attn: Shlomi Palas |

| with copies to: |

Orit Marom-Albeck, Adv. 4 Berkowitz St. Level 8 (Museum Tower) Tel-Aviv, Israel, 6423806 Telephone: +972-3-7778333 Fax: +972-3-7778444 e-mail: oritma@shibolet.com |

Section 6.03

Headings.

The headings in this Agreement are for reference only and shall not affect the interpretation of this Agreement.

Section 6.04

Severability.

If any term or provision of this Agreement is invalid, illegal or unenforceable in any jurisdiction, such invalidity, illegality or unenforceability shall not affect any other term or provision of this Agreement or invalidate or render unenforceable such term or provision in any other jurisdiction.

Section 6.05

Entire Agreement.

This Agreement, together with the Concord LLC Agreement and the Development Agreement and the exhibits and schedules thereto constitute the sole and entire agreement of the parties to this Agreement with respect to the subject matter contained herein (the “Documents”), and supersede all prior and contemporaneous understandings and agreements, both written and oral, with respect to such subject matter.

Section 6.06

Successors and Assigns.

This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and permitted assigns. No party may assign its rights or obligations hereunder without the prior written consent of the other parties, which consent shall not be unreasonably withheld or delayed. No assignment shall relieve the assigning party of any of its obligations hereunder.

| 11 |

Section 6.07

Third Party Beneficiaries.

This Agreement is for the sole benefit of the parties hereto and their respective successors and permitted assigns and nothing herein, express or implied, is intended to or shall confer upon any other Person or entity any legal or equitable right, benefit or remedy of any nature whatsoever under or by reason of this Agreement, except that York shall be a third party beneficiary of this Agreement.

Section 6.08

Amendment and Modification.

This Agreement may only be amended, modified or supplemented only by an agreement in writing signed by each party hereto, provided however, if Sections 4.04 or 4.05 are not amended, a writing signed by Blue Sphere shall not be required to effect such amendment, modification or supplement.

Section 6.09

Waiver.

No waiver by any party of any of the provisions hereof shall be effective unless explicitly set forth in writing and signed by the party so waiving. No waiver by any party shall operate or be construed as a waiver in respect of any failure, breach or default not expressly identified by such written waiver, whether of a similar or different character, and whether occurring before or after that waiver. No failure to exercise, or delay in exercising, any right, remedy, power or privilege arising from this Agreement shall operate or be construed as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege.

Section 6.10

Governing Law.

This Agreement shall be governed by and construed in accordance with the internal laws of the State of North Carolina without giving effect to any choice or conflict of law provision or rule (whether of the State of North Carolina or any other jurisdiction).

| 12 |

Section 6.11

Arbitration.

Any controversy or claim by or between the parties related in any way to this Agreement shall be settled by binding arbitration administered by the American Arbitration Association (the “AAA”) in accordance with its Commercial Arbitration Rules; provided that nothing herein shall require arbitration of any claim or charge which, by law, cannot be the subject of a compulsory arbitration agreement. Any arbitration proceeding brought under this Agreement shall be conducted in Charlotte, North Carolina by a single arbitrator appointed by agreement of the parties within thirty (30) days of receipt by respondent of the demand for arbitration, or in default thereof by the AAA. Each of Buyer, Project LLC, Seller and Blue Sphere, agree to be bound by this arbitration clause provided that they have either (i) signed this contract or a contract that incorporates this contract by reference or (ii) signed any other agreement to be bound by this arbitration clause. Each such party agrees that it may be joined as an additional party to an arbitration involving other parties under any such agreement. The arbitrator(s) in the first-filed of such proceeding shall be the arbitrator(s) for the consolidated proceeding. The arbitrator, in rendering an award in any arbitration conducted pursuant to this provision, shall issue a reasoned award stating the findings of fact and conclusions of law on which it is based, and the arbitrator shall be required to follow the law of the state designated by the parties herein. Any judgment or enforcement of any award, including an award providing for interim or permanent injunctive relief, rendered by the arbitrator may be entered, enforced or appealed from in any court having jurisdiction thereof. Any arbitration proceedings, decision or award rendered hereunder, and the validity, effect and interpretation of this arbitration provision, shall be governed by the Federal Arbitration Act, 9 U.S.C.§ 1 et seq. In any arbitration proceedings under this Agreement, each party shall pay all of its, his or her own legal fees, including counsel fees, but AAA filing fees and arbitrator compensation shall be paid pursuant to the AAA Commercial Arbitration Rules, unless otherwise provided by law for a prevailing party. The parties agree that, notwithstanding the foregoing, prior to the appointment of the arbitrator, nothing herein shall prevent any party from seeking preliminary or temporary injunctive relief against any other party in the federal or state courts of North Carolina. For the avoidance of doubt, any actions for permanent relief or monetary damages shall be settled by arbitration.

Section 6.12

Specific Performance.

The parties agree that irreparable damage would occur if any provision of this Agreement were not performed in accordance with the terms hereof and that the parties shall be entitled to specific performance of the terms hereof, in addition to any other remedy to which they are entitled at law or in equity. Each party hereto (i) agrees that it shall not oppose the granting of such specific performance or relief and (ii) hereby irrevocably waives any requirements for the security or posting of any bond in connection with such relief.

Section 6.13

Counterparts.

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile, e-mail or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

[SIGNATURE PAGE FOLLOWS]

| 13 |

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date first written above by their respective officers thereunto duly authorized.

| Orbit Energy, Inc. | |

| By: | |

| Name: | |

| Title: | |

| Orbit Energy Charlotte, LLC | |

| By: | |

| Name: | |

| Title: |

| [LLC Member Interest Purchase Agreement – Signature Page] |

| Concord Energy Partners, LLC | |

|

By: York Renewable Energy

Partners LLC, | |

| By: | |

| Name: Richard P. Swanson | |

| Title: General Counsel |

| [LLC Member Interest Purchase Agreement – Signature Page] |

| Blue Sphere Corporation | |

| By: | |

| Name: Shlomi Palas | |

| Title: CEO |

| [LLC Member Interest Purchase Agreement – Signature Page] |

Exhibit A – Prior Purchase Agreement

AMENDED AND RESTATED ORBIT ENERGY CHARLOTTE, LLC PURCHASE AGREEMENT

This amended and restated Orbit Energy Charlotte, LLC Purchase Agreement (this “Agreement”) is made and entered into as of November 19, 2014 (the “Effective Date”) by and between Bluesphere Corporation, a Nevada corporation (“Purchaser”), and Orbit Energy, Inc., a North Carolina corporation (“Seller”).

RECITALS

A.

Seller has established Orbit Energy Charlotte, LLC (the “LLC”) to implement an anaerobic digestion and energy generation project in Concord, North Carolina or at an alternate site in North Carolina (the “Project”).

B.

In accordance with the terms of this Agreement, Seller desires to sell and transfer 100% of its right, title and interest in, to and under the LLC to Purchaser and Purchaser desires to purchase and accept 100% of the right, title and interest in, to and under the LLC for the purpose of implementing the Project.

Now. therefore, the parties hereby agree as follows.

1.

RECITALS. The foregoing recitals are incorporated by reference as if fully set forth herein.

2.

SALE AND PURCHASE OF THE LLC.

2.1

Terms of Sale and Purchase. Subject to the terms and conditions of this Agreement, Seller hereby sells, assigns, conveys and transfers to Purchaser, and Purchaser hereby purchases, accepts and receives from Seller, 100% of its right, title and interest (for the avoidance of doubt, both economic and ownership) in, to and under the LLC in exchange for Purchaser’s payment to Seller of (i) a development fee of $900,000 as well as reimbursement of an amount equal to an additional $17,764 in immediately available funds pursuant to wiring instructions to be provided separately (the “Development Fee”) to be paid in accordance with Section 3.1 below and (ii) an amount equal to thirty percent (30%) of the Project” s distributable cash flow after the Purchaser and the party(ies) making an equity investment in the Project fully recoup their respective investment in the Project (such investment(s) to be calculated solely as amounts expended in and for the construction of the Project) and the Project achieves a thirty (30%) percent internal rate of return (the “IRR”), which, for the avoidance of doubt, will take into account and be computed on the basis of any and all benefits from tax credits, depreciation and other incentives of any nature (such payment to the Seller, the “Seller Participation Payment”). The Seller Participation Payment shall be paid by Purchaser to Seller on a quarterly basis commencing the first quarter in which the Project achieves the IRR. Within 45 days of the end of the fiscal year of each of the LLC, Seller will be provided the audited financials of the LLC, including the cash distributions to the members of each of the foregoing. Purchaser hereby guarantees the Seller Participation Payment.

2.2

Seller, as the sole member of the LLC, hereby (i) admits Purchaser as a member of the LLC and (ii) abandons 100% of its ownership and economic interest in the LLC with such abandonment to take effect immediately and without any further action after Purchaser becomes an ownership member of the LLC. In this connection, Seller will take any and all actions necessary or helpful to record and/or reflect ownership of the LLC in Purchaser’s name with all applicable governmental authorities and non-governmental third-parties as soon as practicable and, going forward, as and when requested by Purchaser.

2.3

[intentionally omitted].

2.4

HSAD License. Purchaser shall incorporate high solid anaerobic digester units designed by Seller (the “HSAD Units”) in the planning, implementation, design, and operation of the Project. Seller shall provide Purchaser with (i) the detailed design and engineering of such HSAD Units as is required for all applicable permitting and fabrication purposes and (ii) a performance guarantee in respect of the HSAD Units from a third party which shall guarantee to Purchaser that the rate of gas production from the HSAD Units shall be equal to or greater than that from other digesters used in the Project for a period of three years from the date on which the HSAD Units are used for power production in the Project, and, if there is a shortfall in production relative to that of other digesters in the Project. Seller or the third party providing the performance guarantee shall pay an amount equal to the difference to Purchaser. Purchaser will use its reasonable efforts to procure acceptance by the party(ies) financing the inclusion of the HSAD Units in the Project of a performance guarantee directly from Seller permitting Purchaser to withhold in escrow payments otherwise due to Seller in escrow in amount up to $100,000, against which Purchaser, at its option, could offset amounts owed to it due to breaches of the performance guarantee (the “Orbit PG”). Any outstanding escrow amount held by Purchaser would be released to Seller upon the earlier to occur of: (i) thirty-six (36) consecutive months without a breach of the performance guarantee or (ii) the termination of the Operation Agreement. If Purchaser is unable to procure acceptance of the Orbit PG, Seller shall be required to obtain a market-standard performance guarantee in form and substance reasonably acceptable to Purchaser. Seller agrees to cover the cost of such market-standard performance guarantee up to an amount equal to what a market-standard performance guarantee for a bankable high solid anaerobic digester technology costs. Purchaser will cover any cost to be incurred in excess thereof. The HSAD Units shall be used by the LLC and the Project in and for the production of power, and shall be an integral part of the Project. That certain letter agreement between Seller and Purchaser dated as of April 4, 2013 is attached hereto as Exhibit A and its terms are hereby incorporated by reference. Neither Purchaser nor any third party shall be permitted to operate or access the HSAD Units except pursuant to the terms of an operation agreement (the “Operation Agreement”) to be negotiated in good faith between Seller and Purchaser prior to March 1, 2015, which shall provide, inter alia, for the respective obligations of the Purchaser to maintain and operate the HSAD Units (including the ancillary equipment supporting the HSAD Units) and for Seller to manage the HSAD Units. Seller shall fully cooperate in good faith to provide Purchaser such budgets. specifications, site plans and other information that Purchaser may reasonably request from time to time in order to accomplish the foregoing; provided that, Purchaser shall be solely responsible for the cost of the implementation, construction and operation of the Units. Seller hereby grants Purchaser an unconditional and irrevocable, non-exclusive license to use Seller’s high solids anaerobic digestion (HSAD) technology consisting of a proprietary process that uses an anaerobic digester design developed by the U.S. Department of Energy and subsequently modified by Seller in combination with the proprietary bacteria to be supplied by Seller (the “Technology”) at the Project site for so long as the Project is in operation (the “License”). Purchaser may freely sell or transfer the License in the event of a sale or transfer of its rights in the Project to another party.

3.

DEVELOPMENT FEE PAYMENT EXTENSION AND RETURN OF THE LLC TO SELLER.

3.1

Development Fee Payment. Subject to Section 3.2 below, Purchaser shall pay the Development Fee to Seller in immediately available funds in accordance with separately provided instructions by no later than December 15, 2014 (the “Payment Date”).

3.2

Extension. Notwithstanding anything else to the contrary herein, Purchaser shall have the option to extend the Payment Date until January 15, 2015 upon the payment of $75,000 to Seller in immediately available funds on December 15, 2014 wired to the account of Seller pursuant to separately provided instructions.

3.3

Return of LLC to Seller. If payment in full of the Development Fee is not made by Purchaser on the Payment Date as set forth above, all right, title and interest in the LLC (including all permits, deposits, interconnection studies and agreements held by or related to the LLC) shall automatically revert to Seller without any further action by either party and without cost or transfer of liability to Seller. In the event of such a reversion: (i) Purchaser shall cooperate in good faith with Seller to provide such documentation and to take such actions as Seller may reasonably request to evidence and effect such reversion to Seller, including, but not limited to, abandoning its economic and ownership interest in the LLC; and (ii) Purchaser shall indemnify and hold harmless Seller from any claims, damages, losses, liabilities and/or costs (including, for the avoidance of doubt, reasonable counsel fees) against or in respect of the LLC due to or arising out of Purchaser’s conduct that occurred during the period of time that Purchaser was a member of the LLC.

4.

PROJECT MANAGEMENT.

4.1

Seller hereby agrees to manage the implementation and operation of the HSAD Units subject to any agreements entered into or to be entered into in respect of the Project by Purchaser and the supervision and control of Purchaser. With respect to the HSAD Units, Seller shall cooperate with Purchaser and provide relevant information pertaining to the LLC’s obligations regarding (i) reporting to all applicable authorities, (ii) permit compliance and renewal, (iii) presence at the site and operation, service and maintenance of the anaerobic digester plant, in each case, as required or helpful, (iv) ongoing identification of feedstock sources, compost off-takers and other third-parties for use in the Project and (v) such other actions as may be required or desirable in the reasonable discretion of either Seller or Purchaser. Seller shall provide such management services as a reasonably prudent operator and the LLC shall pay Seller an annual fee of U.S. $187,500 therefor, which shall be payable in monthly installments of 1/12 thereof (the “Management Fee”). The first such payment shall be payable on the sooner of: (i) the first day of the month occurring after the Project is operational; or (ii) November 19, 2015, and, subject to Sections 4.2 and 4.3, shall thereafter be paid on the first day of each month for so long as the Project is operational.

4.2

Seller hereby agrees to forego receipt of the full Management Fee in the second and third year from the date hereof if the transfer of Orbit Energy Rhode Island, LLC from Seller to Purchaser pursuant to that Amended and Restated Orbit Energy Rhode Island Purchase Agreement of even date herewith (“OERI Amended and Restated Purchase Agreement”) does not take place due solely to (i) Seller’s failure to obtain consent to change of control in respect of the power purchase agreement dated May 26, 2011, as amended, from the Narragansett Electric Company d/b/a National Grid; provided that, National Grid’s rejection of Seller’s proposed transferee and/or Purchaser’s EPC contractor shall not be considered a failure of Seller to obtain consent or (ii) failure by the owner of the site to be used by OERI in its project to provide information required to provide a lease guarantee from the Purchaser. For the purposes of clarity, if the foregoing transfer or execution does not take place due to reasons other than the Seller’s failure to obtain such consent (unless such failure is due to National Grid rejecting Seller’s proposed transferee or Purchaser’s EPC contractor or failure by the OERI site owner to provide information required to provide a lease guarantee as set forth above, then the Management Fee shall be payable in full.

4.3

Notwithstanding anything else to the contrary herein, Seller hereby agrees that in the event that if the HSAD Units are not used in the Project due to Seller’s fault or fail to perform and the terms of the performance guaranty are not complied with by Seller or any third party guarantor, Purchaser’s obligation to pay the Management Fee shall be limited to four years from the date of first payment of the Management Fee (if the HSAD Units are not used at all) or four years after the date on which the HSAD Units no longer perform in accordance with their specifications and the terms of the performance guaranty are not complied with by Seller.

5.

REPRESENTATIONS AND WARRANTIES OF SELLER. Seller represents and warrants to Purchaser as follows.

5.1

No Broker-Dealer. Except for the involvement of Excelsior Capital, Seller has not effected this transfer of the LLC by or through any intermediaries.

5.2

Title to the LLC. Seller has valid marketable title to the LLC, free and clear of any pledge, lien, security interest, encumbrance, claim or equitable interest (“Encumbrances”). Upon the sale and transfer of the LLC, and payment therefor, in accordance with the provisions of this Agreement, Purchaser will acquire valid marketable title to the LLC, free and clear of any pledge, lien. security interest, encumbrance, claim or equitable interest.

5.3

Consents. All consents, approvals, authorizations and orders required for the execution and delivery of this Agreement and the transfer of the LLC under this Agreement have been obtained and are in full force and effect.

5.4

Authority. Seller has full legal right, power and authority to enter into and perform its obligations under this Agreement and to transfer the LLC under this Agreement, and Seller is not obligated to transfer the LLC to any other person or entity. Seller has been duly organized and is validly existing in good standing under the laws of the jurisdiction of its organization as the type of entity that it purports to be and all corporate or other entity actions necessary to authorize the transactions contemplated by this Agreement have been duly taken. The person(s) executing and delivering this Agreement on behalf of Seller are duly authorized to do so.

5.5

Intellectual Property. Seller owns or holds a valid license to any and all intellectual property relating to the Technology and has full authority to grant the License. Purchaser’s use of the Technology and License and/or any subsequent transfer thereof will not infringe on the rights of any third parties or give rise to any claims on the part of any third-parties.

6.

COMPLIANCE WITH LAWS AND REGULATIONS. The sale and transfer of the LLC and the implementation and management of the Project will be subject to and conditioned upon compliance by Purchaser with all applicable state and federal laws and regulations at the time of such sale, transfer, implementation and/or management.

7.

GENERAL PROVISIONS.

7.1

Successors and Assigns; Assignment. Except as otherwise provided in this Agreement, this Agreement, and the rights and obligations of the parties hereunder, will be binding upon and inure to the benefit of their respective successors, assigns. heirs, executors, administrators and legal representatives. Each party hereto may assign its rights in, to and under this Agreement with the consent of the other party with such consent not to be unreasonably withheld or delayed.

7.2

Governing Law. This Agreement will be governed by and construed in accordance with the laws of the State of North Carolina without giving effect to its body of laws pertaining to conflict of laws.

7.3

Notices. Any and all notices required or permitted to be given to a party pursuant to the provisions of this Agreement will be in writing and will be effective and deemed to provide such party sufficient notice under this Agreement on the earliest of the following: (a) at the time of personal delivery, if delivery is in person; (b) one (1) business day after deposit with an express overnight courier for United States deliveries, or two (2) business days after such deposit for deliveries outside of the United States; or (c) three (3) business days after deposit in the United States mail by certified mail (return receipt requested) for United States deliveries. All notices for delivery outside the United States will be sent by express courier. All notices not delivered personally will be sent with postage and/or other charges prepaid and properly addressed to the party to be notified at the address set forth below the signature lines of this Agreement or at such other address as such other party may designate by one of the indicated means of notice herein to the other party hereto. A “business day” shall be a day, other than Saturday or Sunday, when the banks in the city of New York are open for business.

7.4

Further Assurances. The parties agree to execute such further documents and instruments and to take such further actions as may be reasonably necessary to carry out the purposes and intent of this Agreement.

7.5

Titles and Headings. The titles, captions and headings of this Agreement are included for ease of reference only and will be disregarded in interpreting or construing this Agreement. Unless otherwise specifically stated, all references herein to “sections” and “exhibits” will mean “sections” and “exhibits” to this Agreement.

7.6

Entire Agreement. This Agreement and the documents referred to herein constitute the entire agreement and understanding of the parties with respect to the subject matter of this Agreement and supersede all prior understandings and agreements, whether oral or written, between or among the parties hereto with respect to the specific subject matter hereof.

7.7

Severability. If any provision of this Agreement is determined by any court or arbitrator of competent jurisdiction to be invalid, illegal or unenforceable in any respect, such provision will be enforced to the maximum extent possible given the intent of the parties hereto. If such clause or provision cannot be so enforced, such provision shall be stricken from this Agreement and the remainder of this Agreement shall be enforced as if such invalid, illegal or unenforceable clause or provision had (to the extent not enforceable) never been contained in this Agreement. Notwithstanding the forgoing. if the value of this Agreement based upon the substantial benefit of the bargain for any party is materially impaired, which determination as made by the presiding court or arbitrator of competent jurisdiction shall be binding, then both parties agree to substitute such provision(s) through good faith negotiations.

7.8

Amendment and Waivers. This Agreement may be amended only by a written agreement executed by each of the parties hereto. No amendment of or waiver of, or modification of any obligation under this Agreement will be enforceable unless set forth in a writing signed by the party against which enforcement is sought. Any amendment effected in accordance with this section will be binding upon all parties hereto and each of their respective successors and assigns. No delay or failure to require performance of any provision of this Agreement shall constitute a waiver of that provision as to that or any other instance. No waiver granted under this Agreement as to any one provision herein shall constitute a subsequent waiver of such provision or of any other provision herein, nor shall it constitute the waiver of any performance other than the actual performance specifically waived.

7.9

Confidentiality. Each of Seller and Purchaser agrees that it will keep confidential and will not disclose or use for any purpose any information about the terms or existence of this Agreement and the transactions contemplated hereby and any confidential information obtained from the Company in connection herewith, unless any such information (a) is known or becomes known to the public in general (other than as a result of a breach of this Agreement by the disclosing party), or (b) is or has been made known or disclosed to the disclosing party by a third party without a breach of any confidentiality obligations by such third party; provided, however, that either Seller or Purchaser may disclose such information (i) to its attorneys, accountants, consultants, financiers and other professionals to the extent necessary to obtain their services in connection with the transfer and ownership of the LLC or the implementation of the Project; (ii) to any affiliate in the ordinary course of business, provided that such affiliate agrees to maintain the confidentiality of such information in accordance herewith; or (iii) as may be required by law, including without limitation Purchaser’s disclosure obligations under applicable U.S. securities laws, provided that the disclosing party promptly notifies the other parties hereto in advance of such disclosure and agrees to cooperate to take reasonable steps to minimize the extent of any such required disclosure. Any public statements regarding the LLC or the Project shall be mutually agreed to in writing in advance by the parties hereto, and shall in no event occur sooner than three (3) days after the payment in full of the Development Fee. All public statements shall identify the Seller and Purchaser as joint developers of the Project. Notwithstanding anything else to the foregoing herein, the Purchaser’s 8-K reporting this agreement, which shall be released three days after the payment of the development fee, shall contain a copy hereof as an exhibit to such 8-K.

7.10

Counterparts; Facsimile Signatures. This Agreement may be executed in any number of counterparts, each of which when so executed and delivered will be deemed an original, and all of which together shall constitute one and the same agreement. This Agreement may be executed and delivered by facsimile or other means of electronic delivery and upon such delivery the signature will be deemed to have the same effect as if the original signature had been delivered to the other party.

7.11

Expenses. Each party hereto shall pay its own expenses in connection with this Agreement.

7.12

Specific Performance. Unless this Agreement has been terminated, each party to this Agreement acknowledges and agrees that any breach by it of this Agreement shall cause any (or either) of the other parties irreparable harm which may not be adequately compensable by money damages. Accordingly, except in the case of termination, in the event of a breach or threatened breach by a party of any provision of this Agreement, each party shall be entitled to seek the remedies of specific performance, injunction or other preliminary or equitable relief, without having to prove irreparable harm or actual damages. The foregoing right shall be in addition to such other rights or remedies as may be available to any party for such breach or threatened breach, including but not limited to the recovery of money damages.

7.13

Indemnification/Pledge. Seller hereby agrees to indemnify and hold harmless Purchaser from any claims, damages, losses, liabilities and/or costs (including, for the avoidance of doubt, reasonable counsel fees) (i) relating to or arising out of Purchaser’s use of the HSAD Units, Technology or License or (ii) against or in respect of the LLC due to or arising out of Seller’s conduct that occurred on or prior to the date hereof. To the extent that Seller lacks the funds to fulfill its indemnity obligations hereunder, Seller hereby pledges its rights, title and interest in, to and under the Technology to Purchaser for Purchaser’s full and unfettered use until such time as Purchaser has been made whole and recouped any losses, costs or other out-of-pocket amounts.

7.14

Costs of Enforcement. If any party to this Agreement seeks to enforce its rights under this Agreement by legal proceedings against any other party to this Agreement, the non-prevailing party or parties named in such legal proceedings shall pay all costs and expenses incurred by the prevailing party or parties, including, without limitation, all reasonable attorneys’ fees.

IN WITNESS WHEREOF, Seller and Purchaser have each executed this Agreement as of the Effective Date.

|

SELLER: _____________________________

By: _____________________________

Address: _____________________________ _____________________________ |

PURCHASER: _____________________________

By: _____________________________

Address: _____________________________ _____________________________ |

Exhibit B – Release

RELEASE

THIS RELEASE (the “Release”) is made and entered into as of the 22nd day of January, 2015 by and among Orbit Energy, Inc., a North Carolina corporation (“Seller”), Blue Sphere Corporation, a Nevada corporation (“Blue Sphere”), and Orbit Energy Charlotte, LLC, a North Carolina limited liability company (“Orbit”) with reference to the following facts:

A.

WHEREAS, Seller and Blue Sphere are parties to a certain Amended and Restated Orbit Energy Charlotte, LLC Purchase Agreement, (including Exhibit A thereto) made and entered into as of November 19, 2014 (the “Purchase Agreement”), pursuant to which Blue Sphere purchased 100% of the limited liability interests of Orbit (the “Interests”) from Seller, a copy of which agreement is attached hereto as Exhibit A.

B.

WHEREAS, pursuant to the Purchase Agreement, (i) Blue Sphere and/or Orbit has, or may have, an obligation to (1) make certain payments to Seller, including without limitation, pursuant to Section 2, Section 3 and Section 4 of the Purchase Agreement, including a Seller Participation Fee, a Development Fee, an extension fee, and a Management Fee (all as defined in the Purchase Agreement), and (2) perform certain other obligations under the Purchase Agreement to or in connection with Seller, and (ii) Seller has granted certain rights to Blue Sphere and/or Orbit relating to the Project;

C.

WHEREAS, Blue Sphere, Concord Energy Partners LLC, a Delaware limited liability company (“Holdco”) and York Renewable Energy Partners LLC (“York”) intend to consummate a transaction whereby Blue Sphere will contribute 100% of the Interests to Holdco and York will make certain capital contributions to Holdco, such that Blue Sphere and York will become the sole members of Holdco, and Holdco will become the sole member of Orbit (the “Transaction”) pursuant to the terms of a certain Contribution Agreement by and among Holdco, York and Blue Sphere, a certain Contribution Agreement by and between Holdco and Blue Sphere and a certain Amended and Restated Limited Liability Agreement of Holdco (the “Transaction Documents”);

D.

WHEREAS, a condition of the Transaction is that Blue Sphere have good title to the Interests, free and clear of all encumbrances of any kind or nature, and that Orbit have no liability or obligation to Seller under the Purchase Agreement nor that any of Orbit’s assets nor any assets relating to the Project (as defined below) be subject to any liability or obligation under the Purchase Agreement, other than as expressly stated herein;

E.

WHEREAS, a further condition of the Transaction is that all of the development rights, permits, technology rights and contractual rights necessary for the construction and operation of a high solids anaerobic digestion and energy generation facility for the production of biogas and electricity in Charlotte, North Carolina (the “Project”) be owned by Orbit and not by Blue Sphere or any affiliate of Blue Sphere;

| - 1 - |

F.

WHEREAS, other than as expressly stated herein, Orbit wishes (i) to be released from any and all and all obligations to Seller with respect to the Purchase Agreement, including without limitation, the payment of such Development Fee, extension fee, Seller Participation Fee and Management Fee, the disclosure or delivery of financial or other information relating to Orbit or the Project to Seller, and the obligation of Orbit or the Project to use any technology of Seller; (ii) that all of the assets relating to the Project be released from all obligations under the Purchase Agreement by Seller and Blue Sphere, and (iii) that all liens, remedies or liabilities of Seller, whenever arising, arising out of such obligations or the failure of Blue Sphere or Orbit to perform any of such obligations be released by Seller and Blue Sphere with respect to Orbit, and each of Seller and Blue Sphere agrees to such releases;

THEREFORE, for valuable consideration, the receipt and adequacy of which are hereby acknowledged, and intending to be legally bound hereby, the parties hereto mutually agree as follows:

1.

Seller Release. Effective upon the consummation of the Transaction, each of Seller and Blue Sphere and their respective (as applicable) past and present parent companies, subsidiaries, affiliates, divisions, predecessors, successors, assignees, agents, partners, members, representatives, officers, directors, managers, employees, consultants, licensees, sublicensees, shareholders, insurers, assigns, and their attorneys, and all persons acting by, through, under or in concert with them or any of them, other than Orbit (all collectively referred to as the “Releasors”), (i) do hereby release and forever discharge Orbit, Holdco, Entropy Investment Management, LLC, York and each of their (as applicable) past and present parent companies, subsidiaries, affiliates, divisions, predecessors, successors, assignees, agents, partners, members, representatives, officers, directors, managers, employees, consultants, licensees, sublicensees, shareholders, insurers, assigns, past and present, and their attorneys, and all persons acting by, through, under or in concert with them or any of them, other than any of the Releasees which are also Releasors (all collectively referred to as the “Releasees”), of and from any and all claims, causes of action, suits, debts, liens, contracts, judgments, agreements, promises, infringements, liabilities, claims, demands, damages, losses, costs, or expenses of any nature whatsoever, known or unknown, fixed or contingent, which the Releasors or any of them now has or may hereafter have against the Releasees, or any of them, including any of the respective assets of the Releasees, including without limitation the Project and the Interests, relating to or by reason of the Purchase Agreement and the failure of Blue Sphere to perform any obligations under the Purchase Agreement, or the failure of Orbit or the Project to perform any of its obligations or obligations imputed to it under the Purchase Agreement, including to pay the Development Fee, the Seller Participation Fee, the extension fee, the Management Fee (each as defined in the Purchase Agreement), the obligation to enter into an operations agreement with Seller, or the failure to disclose or deliver financial information about the Project or Orbit, and (ii) do hereby waive any rights to impose liens, remedies or liabilities on or against any of the Releasees or their assets due to or arising out of Blue Sphere’s failure to perform its obligations under the Purchase Agreement, including without limitation, any reversion of the Interests to Seller pursuant to Section 3.3 of the Purchase Agreement, from the beginning of time to the date of this Agreement. The foregoing shall not apply to the obligations of the parties hereto set forth in this Release.

2.

Orbit Technology License and Incorporation. Without limiting the scope of the release set forth in Section 1 above, Seller hereby grants Orbit an unconditional, perpetual, assignable, royalty-free nonexclusive license to the Technology (as defined in the Purchase Agreement) for HSAD Units (as defined in the Purchase Agreement), and Orbit (or its successor) agrees to incorporate the Technology and HSAD Units as part of the Project, (as defined in the Purchase Agreement) subject to the following terms and conditions:

| - 2 - |

a)

At such time as the Technology has been fully demonstrated to meet all technical and operational parameters for use in the Project and all applicable thresholds, requirements and criteria set forth in the Purchase Agreement (including as set forth in Exhibit A to the Purchase Agreement and any other relevant exhibits and annexes), and subject to subsection (c) hereof, Orbit shall incorporate the Technology and the requisite HSAD Units into the Project, up to a total maximum capacity of 100 tons per day.

b)

Blue Sphere acknowledges and agrees that it shall be responsible for all costs of evaluating and incorporating the Technology and the HSAD Units, both direct and indirect, including all payments to Seller and all increased costs, expenses and any damages incurred in connection with the design, installation, integration, operation and maintenance of the Technology incorporated into the Project, including as more fully set forth in the Transaction Documents, which, for the purposes of clarity, shall include the payment of the Management Fee (as defined in the Purchase Agreement) to Seller.

c)

Each of the following shall be conditions precedent to the requirement that Orbit incorporate the Technology and the HSAD Units into the Project and to the continued operation of the Technology and HSAD Units as part of the Project: (1) Seller shall provide Orbit a Performance Guarantee, in form and substance satisfactory to Orbit, meeting the requirements for such Performance Guarantee under the terms set forth in Section 2.4 of the Purchase Agreement; (2) the incorporation of the Technology shall have been determined by Orbit to (i) be capable of feasible integration within the overall engineering design, construction and delivery agreement with Auspark LLC and any other project contractors (collectively, the “EPC Agreements”) and will not adversely impact the Project’s performance or void any warranties under the EPC Agreements; and (ii) not reasonably be expected to result in any material adverse impact on the Project or in Orbit incurring any liabilities to any third party.

d)

For the avoidance of doubt, in no event shall any of the Releasees have any financial obligation to Seller in connection with the Technology, and the nonexclusive license granted by Seller hereunder shall be freely assignable to any third party in connection with a sale or transfer of any interest in the Project or Orbit, including any future debt or equity financing.

e)

Seller hereby represents and warrants to Orbit that Seller owns or holds a valid license to any and all intellectual property relating to the Technology and has full authority to grant the license granted hereunder and that Orbit’s use of the Technology and the license and/or any subsequent transfer thereof will not infringe on the rights of any third parties or give rise to any claims on the part of any third parties.

f)

Seller agrees to indemnify and hold harmless Orbit from any claims, damages, losses, liabilities and/or costs (including for the avoidance of doubt, reasonable counsel fees) (i) relating to or arising out of Orbit’s use of the HSAD Units, the Technology or the license granted hereunder or (ii) against or in respect of Orbit arising out of Seller’s conduct that occurred on or prior to November 19, 2014. To the extent Seller lacks the funds to fulfill its indemnity obligations hereunder, Seller pledges its rights, title and interest in, to and under the Technology to Orbit for Orbit’s full and unfettered use until such time as Orbit has been made whole and recouped any losses, costs or other out-of-pocket amounts.

| - 3 - |

3.

Indemnification by Blue Sphere. Blue Sphere shall indemnify, defend and hold harmless the Releasees against all actions, costs, damages, disbursements, expenses, liabilities, losses, deficiencies, obligations, penalties or settlements of any kind or nature, including but not limited to, interest or other carrying costs, penalties, reasonable legal, accounting and other professional fees and expenses incurred in the investigation, collection, prosecution and defense of claims and amounts paid in settlement (“Losses”), that may be imposed on or otherwise incurred or suffered by any of the Releasees as a result of the Purchase Agreement, or as a result of incorporation of the Technology or the HSAD Units into the Project under Section 2 above, except if such Losses are directly resulting from a breach by such Releasee of any of its obligation under the Transaction Documents.

4.

Third Party Beneficiaries. Each of Holdco, York and Entropy Investment Management, LLC shall be third party beneficiaries under this Release.

5.

Governing Law. This Release shall be governed by, and construed and enforced in accordance with, the laws of the State of New York, without reference to conflict of laws principles.

6.

Counterparts. This Release may be executed in several counterparts and all such executed counterparts shall constitute one agreement, which shall be binding on the parties notwithstanding that all parties are not signatories to the same counterpart or counterparts.

7.

Further Assurances. The parties hereby agree to execute, acknowledge and deliver such other statements, certificates, affidavits, instruments, and other documents as may be reasonably requested by the other party in order to confirm, perfect, evidence or otherwise effectuate the assignment and assumption effected hereby.

IN WITNESS WHEREOF, the parties have executed this Release for delivery as of the date first written above.

|

ORBIT ENERGY, INC.:

By:________________________________ Print Name: Anwar Shareef Title: CEO |

ORBIT ENERGY CHARLOTTE, LLC:

By:________________________________ Print Name: Shlomi Palas Title: CEO |

| - 4 - |