Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Post Holdings, Inc. | d21405d8k.htm |

| EX-99.1 - EX-99.1 - Post Holdings, Inc. | d21405dex991.htm |

Investor Presentation August 2015 Exhibit 99.2 Post Holdings, Inc. |

The information contained in this presentation is intended to facilitate discussions with potential investors regarding offerings of securities of Post Holdings, Inc. (“Post,” the “Company,” “we,” “us,” or “our”). This presentation is not being used as an offer to sell or a solicitation of an offer to buy securities of the Company or any of its affiliates in any jurisdiction. The common stock is being offered by the Company pursuant to an effective Form S-3 shelf registration statement (including a base prospectus) previously filed with the Securities and Exchange Commission (SEC) on March 10, 2014 and amended on May 19, 2014. Before you invest, you should read the prospectus in the registration statement, the related prospectus supplement and the other documents that Post has filed with the SEC for more complete information about Post and this offering. You may obtain the preliminary prospectus supplement for the offering, the registration statement and the other documents for free by visiting EDGAR on the SEC’s website located at www.sec.gov. Copies of the preliminary prospectus supplement and accompanying prospectus may also be obtained from the offices of Credit Suisse Securities (USA) LLC, Attention: Credit Suisse Prospectus Department, One Madison Avenue, New York, NY 10010, by telephone: 800-221-1037, or by email at newyork.prospectus@credit-suisse.com; Barclays Capital Inc., Attn: Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717, by telephone: 888-603-5847, or by email: barclaysprospectus@broadridge.com; Nomura Securities International, Inc., Attention: Equity Syndicate, Worldwide Plaza, 309 West 49th Street, 5th floor, New York, NY 10019-7316, or by telephone 212-667-9562; BMO Capital Markets Corp., Attention: Syndicate Department, 3 Times Square, 27th Floor, New York, New York 10036, or by email at bmoprospectus@bmo.com, or by telephone 800-414-3627; Goldman, Sachs & Co., by mail, Attn: Prospectus Department, 200 West Street, New York, NY 10282, by facsimile: 212-902-9316, by email: prospectus-ny@ny.email.gs.com, or by telephone: 866-471-2526; or SunTrust Robinson Humphrey, Inc., by telephone: 404-926-5744, by facsimile: 404-926-5464 or by email: strh.prospectus@suntrust.com. The debt securities are being offered by the Company pursuant to a separate and distinct preliminary offering memorandum, together with any supplement thereto, including a term sheet specifying the pricing and other terms of the debt securities being offered. Such preliminary offering memorandum and any supplement thereto will specifically state that you may rely on the information contained therein (but only as of the date of such preliminary offering memorandum or supplement thereto). You should not rely on the information contained in this presentation. This presentation does not purport to be all inclusive or contain all of the information that a prospective investor would need to make an investment decision regarding the Company’s securities. The preliminary prospectus supplement and accompanying prospectus, and the preliminary offering memorandum and any supplement thereto, referred to earlier may include other information about the Company and the offerings that is not included in or differs from the information in this presentation. This additional or different information will include information that is important to any investment decision regarding the Company’s securities. The information contained in the preliminary prospectus supplement and the accompanying prospectus, and the preliminary offering memorandum and any supplement thereto, for the relevant offering will supersede the information in this presentation in its entirety. Important Notice Regarding the Information Contained in this Presentation |

Certain matters discussed in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on the current expectations of Post and are subject to uncertainty and changes in circumstances. These forward-looking statements include, among others, statements regarding our Adjusted EBITDA guidance for fiscal 2015, the expected synergies and benefits of the recent expected financial contributions of the MOM Brands Company (“MOM Brands”) and the assumptions related to avian influenza. These forward-looking statements may be identified by the use of words such as “expect,” “anticipate,” “believe,” “estimate,” “potential,” “should” or similar words. There are a number of risks and uncertainties that that could cause actual results to differ materially from the forward-looking statements made herein. These risks and uncertainties include our ability to realize the synergies contemplated by the acquisition of MOM Brands, including the expected timing and our ability to recognize the benefits of the closure of the Parsippany, New Jersey office; our ability to promptly and effectively integrate the MOM Brands business; our high leverage and substantial debt, including covenants that restrict the operation of our business; our ability to service outstanding debt or obtain additional financing, including secured and unsecured debt; the recent avian influenza outbreak in the U.S. Midwest; our ability to continue to compete in our product markets and our ability to retain market position; our ability to identify and complete acquisitions, manage growth and integrate acquisitions; changes in our cost structure, management, financing and business operations; significant volatility in the costs of certain raw materials, commodities, packaging or energy used to manufacture our products; our ability to maintain competitive pricing, introduce new products or successfully manage costs; our ability to successfully implement business strategies to reduce costs; impairment in the carrying value of goodwill or other intangibles; the loss or bankruptcy of a significant customer; allegations that our products cause injury or illness, product recalls and product liability claims and other litigation; our ability to anticipate and respond to changes in consumer preferences and trends; changes in economic conditions and consumer demand for our products; disruptions in the U.S. and global capital and credit markets; labor strikes, work stoppages or unionization efforts; legal and regulatory factors, including changes in advertising and labeling laws, food safety and laws and regulations governing animal feeding operations; our ability to comply with increased regulatory scrutiny related to certain of our products and/or international sales; the ultimate impact litigation may have on us, including the lawsuit (to which Michael Foods is a party) alleging violations of federal and state antitrust laws in the egg industry; our reliance on third party manufacturers for certain of our products; disruptions or inefficiencies in supply chain; our ability to recognize the expected benefits of the closing of the Modesto, California and Boise, Idaho manufacturing facilities; fluctuations in foreign currency exchange rates; consolidations among the retail grocery and foodservice industries; change in estimates in critical accounting judgments and changes to or new laws and regulations affecting our business; losses or increased funding and expenses related to qualified pension plans; loss of key employees; our ability to protect our intellectual property; changes in weather conditions, natural disasters, disease outbreaks and other events beyond our control; our ability to successfully operate international operations in compliance with applicable laws and regulations; our ability to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, including with respect to acquired businesses; business disruptions caused by information technology failures and/or technology hacking; and other risks and uncertainties described in the Company’s filings with the Securities and Exchange Commission. These forward-looking statements represent the Company’s judgment as of the date of this presentation. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company disclaims, however, any intent or obligation to update these forward-looking statements. Forward-Looking Statements |

Non-GAAP Financial Measures While the Company reports financial results in accordance with accounting principles generally accepted in the U.S., this presentation includes the non-GAAP measure Adjusted EBITDA for Post on both a historical and forecast basis, neither of which is in accordance with or a substitute for GAAP measures. Adjusted EBITDA is a non-GAAP measure which represents earnings before interest, taxes, depreciation, amortization and other adjustments. Post considers Adjusted EBITDA an important supplemental measure of performance and ability to service debt. Adjusted EBITDA is often used to assess performance because it allows comparison of operating performance on a consistent basis across periods by removing the effects of various items. Adjusted EBITDA has various limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of results as reported under GAAP. For a reconciliation of Adjusted EBITDA to the comparable GAAP measures, see “Post Historical Financials Reconciliation” in the appendix. This presentation also includes supplemental financial measures related to MOM Brands and American Blanching Company (“ABC”) and also Post’s Pro Forma Adjusted EBITDA and related ratios. This data has not been prepared in accordance with the requirements of Regulation S-X or any other securities laws relating to the presentation of pro forma financial information. This data is presented for informational purposes only and does not purport to represent what Post’s actual financial position or results of operations would have been if the acquisitions had been completed as of an earlier date or that may be achieved in the future. For a reconciliation of the Adjusted EBITDA of MOM Brands and ABC to the comparable GAAP measure and of Post’s Pro Forma Adjusted EBITDA to Adjusted EBITDA, see “Post Historical Financials Reconciliation” in the appendix. Certain of the non-GAAP financial measures included herein present prospective financial information. The Company has not provided a quantitative reconciliation of the forecast non-GAAP financial measures included in this presentation to the most comparable financial measure or measures calculated and presented in accordance with GAAP due primarily to the difficulty in forecasting and quantifying the exact amount of the items excluded from Adjusted EBITDA that will be included in the comparable GAAP financial measures such that it is not practicable to produce such reconciliations for this financial information without unreasonable effort. Additional Information |

Market and Industry Data This presentation includes industry and trade association data, forecasts and information that was prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys and other independent sources available to the Company. Some data also are based on Post’s good faith estimates, which are derived from management’s knowledge of the industry and from independent sources. These third-party publications and surveys generally state that the information included therein has been obtained from sources believed to be reliable, but that the publications and surveys can give no assurance as to the accuracy or completeness of such information. Post has not independently verified any of the data from third-party sources nor has it ascertained the underlying economic assumptions on which such data are based. Post’s market share data is based on information from Nielsen Expanded All Outlets Combined (“xAOC”) or ACNielsen. Financial Information for Acquired Businesses The estimate of the pre-acquisition Adjusted EBITDA of ABC and MOM Brands, and the other financial data contained in this presentation for each such business, are based on the financial statements that were prepared by their respective prior management and do not include any contributions from synergies or cost savings that Post expects to achieve in the future. These financial statements have not been audited or reviewed by Post’s independent registered public accounting firm or any other accounting firm. Adjusted EBITDA for the acquired entities may not be entirely comparable to Post’s measure of Adjusted EBITDA. Pro Forma Adjusted EBITDA does not include any pre-acquisition contribution from, or otherwise adjust for, Post’s acquisition of the PowerBar and Musashi branded premium bars, powders and gel products business of Nestlé S.A, which was completed on October 1, 2014. Trademarks and Brands The logos, trademarks, trade names and service marks mentioned in this presentation, including Honey Bunches of Oats®,

Pebbles™, Post Selects®,

Great Grains®,

Post® Shredded Wheat,

Golden Crisp®,

Alpha-Bits®, Spoon Size®

Shredded Wheat,

Post® Raisin Bran,

Grape-Nuts®, Honeycomb®,

Malt-O-Meal®, Farina®,

Dyno-Bites®, Mom’s Best®,

Attune®, Uncle Sam®,

Erewhon®, Golden Temple™,

Peace Cereal®,

Sweet Home Farm®,

Willamette Valley Granola Company™,

Premier Protein®,

Joint Juice®,

Dymatize®, Supreme Protein®,

PowerBar®, Papetti’s®,

All Whites®, Better’n Eggs®,

Easy Eggs®,

Abbotsford Farms®,

Simply Potatoes®

and Crystal Farms®

brands are currently the property of, or are under license by, Post or its subsidiaries. Additional Information (Cont’d) |

Topic Speakers Transaction Overview Barclays & Credit Suisse Post Holdings Update Rob Vitale President & Chief Executive Officer Post Holdings Financial Update Jeff Zadoks Chief Financial Officer Post Holdings Appendix Agenda |

6 1. Transaction overview |

Transaction Overview Post Holdings, Inc. (NYSE: POST) (“Post” or the “Company”) is seeking to issue $600mm in New

8.5-Year Senior Notes, $600mm in New 10-Year Senior Notes, and $275mm New Equity (together, the “Transaction”) Proceeds from the Transaction will be used to refinance a portion of the existing Term Loan B, to pay

related transaction fees and expenses and for general corporate purposes

Post is taking advantage of current market conditions to:

Increase secured debt capacity to provide flexibility for strategic acquisitions and

investment in the business

Extend its maturity profile

Lock in long-term debt with a favorable fixed rate of interest

Post continues to deliver strong financial results, while building on the momentum

created by the acquisitions of Michael Foods and MOM Brands

For the third quarter of fiscal year 2015, the Company reported net sales of $1,212mm

(91% increase

vs. 3Q 2014) and Adjusted EBITDA of $187.5mm (114% increase vs. 3Q 2014) (1) Pro Forma for the Transaction, the Company will have net leverage of 5.3x, based on LTM 3Q 2015

PF Adjusted EBITDA of $754mm, including $50mm in expected synergies from the MOM Brands

acquisition

(2) Transaction is expected to close on August 18, 2015 (1) Please see Appendix for a full reconciliation. (2) Please see Appendix for a full reconciliation. Includes Adjusted EBITDA for all completed acquisitions. Acquisition adjustments for completed acquisitions represent management’s estimate of the Adjusted EBITDA of ABC and MOM Brands. In connection with the acquisition of MOM Brands, the Company expects to recognize $50mm in run-rate synergies by the second full fiscal year following the closing of the acquisition (excluding one-time costs to achieve synergies). |

Status

Quo Refinancing

Pro Forma 6/30/15 Adjustment 6/30/15 Cash $274 $254 $528 Revolving Credit Facility - - - Term Loan B 1,574 (1,200) 374 Capital Leases 3 - 3 Total Secured Debt $1,578 ($1,200) $378 6.75% Senior Notes 875 - 875 7.375% Senior Notes 1,375 - 1,375 6.00% Senior Notes 630 - 630 Amortizing Note Component of TEU 29 - 29 2012 Series Bond - Wakefield IRB 4 - 4 New Senior Notes (8.5-Yr) - 600 600 New Senior Notes (10-Yr) - 600 600 Total Debt $4,490 $0 $4,490 3.75% Convertible Preferred 242 - 242 2.50% Convertible Preferred 320 - 320 Tangible Equity Units (TEU) 259 - 259 Equity Capitalization 3,186 275 3,461 Total Capitalization $8,497 $275 $8,772 Credit & Coverage Statistics PF Adjusted EBITDA $704 - $704 Plus: MOM Brands Synergies 50 - 50 PF Adjusted EBITDA w/ Synergies $754 - $754 Secured Debt / Adjusted EBITDA 2.1x 0.5x Net Debt / Adjusted EBITDA 5.6x 5.3x Sources & Uses and Pro Forma Capitalization Table Sources & Uses Pro Forma Capitalization Note: The Pro Forma data presented in this table has not been prepared in accordance with the requirements of Regulation S-X and has not been derived from any Pro Forma financial statements. Such data consists of the sum of the operating results for Post and the unaudited estimated results for the applicable consummated acquisitions, without further Pro Forma adjustment, except as otherwise noted. (1) Equity capitalization based on share price as of August 7, 2015 and common shares outstanding of 54.9mm. (2) Includes Adjusted EBITDA for all completed acquisitions. Acquisition adjustments for completed acquisitions represent management’s estimate of the Adjusted EBITDA of ABC and MOM Brands. (3) In connection with the acquisition of MOM Brands, the Company expects to recognize $50mm in run-rate synergies by the second full fiscal year following the closing of the acquisition (excluding one-time costs to achieve synergies). (2) ($ in mm) ($ in mm) (3) Transaction Highlights Reduces net leverage Enhances financial flexibility Increases secured debt capacity Extends maturity profile Sources New Senior Notes (8.5-Yr) $600 New Senior Notes (10-Yr) 600 New Equity 275 Total Sources $1,475 Uses Paydown Existing Term Loan B $1,200 Cash to Balance Sheet 254 Fees & Transaction Expenses 21 Total Uses $1,475 (1) |

9 2. Post Holdings update |

Introduction to Post Holdings

Post Holdings is a consumer packaged goods (“CPG”) holding company, currently

operating in four reportable segments:

- Post Consumer Brands – legacy Post Foods and legacy MOM Brands ready-to-eat (“RTE”)

cereal businesses - Michael Foods Group – egg, potato, cheese and pasta businesses - Active Nutrition – protein bar, shake and powder products of PowerBar, Premier Protein

and Dymatize

brands - Private Brands – peanut butter, other nut butters, nut and dried fruit snacks and private label and branded granola and cereal Post has a deep and experienced leadership team Executive Chairman Bill Stiritz, a long-time CPG CEO with a stellar track record for

focusing on and delivering returns to shareholders

Rob Vitale, former CFO of Post, succeeded Stiritz as CEO of Post in November

2014 1 2 3 4 |

Post

Holdings Evolution February 2012:

Post completes tax-free

spin-off from Ralcorp

Holdings and begins trading on the NYSE as a stand-alone company February 2012 December 2012: Post acquires assets of Attune Foods, a maker of natural and organic cereals September 2013: Post acquires active nutrition and supplements businesses of Premier Nutrition Corporation February 2014: Post completes the acquisitions of Golden Boy Foods Ltd., a manufacturer of private label peanut and other nut butters, nut and dried fruit snacks, and Dymatize Enterprises, LLC, a manufacturer of nutritional supplements May 2013: Post completes acquisition of certain assets from Hearthside Food Solutions, LLC, maker of natural and organic cereals and granola Post has expanded in both its core category and established new platforms January 2014: Post completes the acquisition of Dakota Growers Pasta Company, a private label pasta manufacturer October 2014: Post acquires the PowerBar and Musashi brands and related worldwide assets, manufacturers and marketers of premium bars, powders and gels June 2014: Post completes the acquisition of Michael Foods November 2014: Post acquires American Blanching Company, a peanut butter manufacturer May 2015: Post completes the acquisition of MOM Brands Company |

(1) Fiscal year ended September 30, 2013. (2) Last twelve months ended June 30, 2015; Pro Forma to include all closed acquisitions as of June 30, 2015 including both pre- and post-acquisition periods. Post’s Transformation to a Growing, Diversified Enterprise 2015 Diversified consumer products enterprise Multi-category participant Categories with dynamic growth prospects June 30, 2015 LTM net sales of $5.1bn (2) Net Sales Breakdown (2) 2013 Slight diversification Participant in three categories Initial entry in growing categories Net sales of $1.0bn (1) Net Sales Breakdown Protein bars, powders and shakes, 1% |

Strong,

defensible free cash flow Business model focused on strong cash

generation Leading market positions in each of our primary

categories Diversified broadly with respect to:

Channels of distribution

Secular themes in food

Efficient capital allocation and balance sheet management

Provides attractive risk-adjusted, leveraged returns

Demonstrated success in M&A

Positioned to expand existing platforms or pursue additional platforms

Decentralized business model optimizes portfolio optionality

Talented management team across the organization

Maximizes managerial bandwidth

Enables creative structuring

Investment Highlights |

Key

Cash Flow Characteristics 1

2 3 4 Recurring revenue stream supported by strong or growing market positions or attractive category trends Attractive Adjusted EBITDA margins Limited capex needs Modest working capital requirements M&A tax efficiency where possible (1) Please see the Appendix for a full reconciliation. (2) Adjustment gives effect to the acquisition of ABC, which was consummated effective November 1, 2014, as if such acquisition had occurred on July

1, 2014, by including management’s estimate of the Adjusted EBITDA of

ABC for the period from July 1, 2014 through October 31, 2014.

(3) Adjustment gives effect to the acquisition of MOM Brands, which was consummated effective May 4, 2015, as if such acquisition had occurred on July 1, 2014, by including management’s estimate of the Adjusted EBITDA of MOM Brands for the period from June 29, 2014 through May 3, 2015.

(4) In connection with the acquisition of MOM Brands, the Company expects to recognize $50mm in run-rate synergies by the second full fiscal year

following the closing of the acquisition (excluding one-time costs to

achieve). (5)

Pro Forma for expected interest on debt issued in the Transaction.

(6) Based on current Post shares outstanding of 54.9mm plus $275mm of common equity expected to be issued in conjunction with the Transaction. Assumes new common equity issued to the public is based on a share price as of August 7, 2015, for illustrative purposes.

Illustrative Free Cash Flow (“FCF”) Calculation

5 Bank cash balance as of 7/31/2015: ~$385mm Post LTM 6/30/2015 Adjusted EBITDA $602 Acquired American Blanching Adjusted EBITDA 6 Acquired MOM Brands Adjusted EBITDA 96 Run-rate MOM Brands Synergies 50 PF LTM 6/30/2015 Adjusted EBITDA $754 Less: Cash Interest (302) Less: Maintenance Capital Expenditures (100) Less: Cash Taxes (90) FCF to All Shareholders $262 Less: Dividends on Convertible Preferred Securities (17) FCF to Common Shareholders $245 FCF to Common Shareholders per Share $4.11 ($ in mm) (1) (3) (2) (4) (5) (6) Business Model Focused on Strong Cash Generation |

Leading

Market Positions in Each of Our Primary Categories (1)

Per ACNielsen xAOC, 52 weeks ended July 25, 2015. U.S. data only.

(2) Volume share per ACNielsen, 52 weeks ended June 20, 2015 and management estimates. U.S. data only.

(3) Management estimates. Michael Foods Group (2) Private Brands Group (3) #1 egg whites; 46% market share #2 egg products; 28% market share #1 in Midwest markets #3 U.S. cheese brand #1 refrigerated potatoes; ~65% market share #1 value-added eggs; ~60% market share #1 processed egg products; ~49% market share Foodservice Retail #1 refrigerated potatoes; 37% market share Largest producer of private label peanut and nut butter Post Consumer Brands (1) Strong #3 RTE cereal; 18.1% dollar market share 20.8% volume market share 16 of top 50 cereal brands Consolidator in fragmented active nutrition category Active Nutrition Leading private label granola producer Leading private label dry pasta producer |

Highly

Diversified Cash Flows: Channels of Distribution Foodservice

QSR Specialty Online Dollar Food / Drug / Mass Club Natural and Organic |

Highly

Diversified Cash Flows: Secular Themes in Foods Private Label

Brands Away From Home

Portable Health and Wellness Portfolio Insulated From Dietary, Lifestyle and Economic Shifts Private Label Granola |

(1) Values represent Total Shareholder Return from February 6, 2012 to August 7, 2015.

Provides Attractive Risk-Adjusted, Leveraged Returns

Strong cash flow enables long-term leverage target of 5x Adjusted

EBITDA Willing to “flex” to capitalize on an opportunity to

execute strategic and/or transformational M&A

Demonstrated ability to use multiple securities to maintain reasonable

leverage Open to structured solutions that “open doors” and

create value Maintain attractive return potential with debt / equity

balance Since spin-off, Post has achieved a Total Shareholder Return of

118% vs. 71% for the S&P 500 (1) |

Portfolio performance exceeding acquisition case

Demonstrated Success in M&A

Key Highlights Asset Performance vs. Acquisition Case Growth in health and wellness sector and success in new product introduction Rapid growth in revenue and cash flow since ownership Restored customer base and profitability Consolidation of private label peanut butter, continued growth in tree nut butter and health & wellness Successfully navigated avian influenza incident Meeting profit targets Redesigned product and packaging Closed Boise facility Integration well underway Profit targets being met Ongoing operational challenges / weak international pricing |

Positioned to Expand Existing Platforms or

Pursue Additional Platforms

Post Holdings Post Consumer Brands Private Brands Active Nutrition Michael Foods Optimal Optionality Holding company structure Distinct M&A focus • Execution • Integration |

Decentralized Business Model

Decentralized corporate structure enhances operational flexibility

Business unit leaders drive performance with ability to react to market opportunities

more rapidly

Entrepreneurial ownership mentality and compensation structure

Greater accountability

Centralized functions are limited to governance and control

Maintain ability to make capital allocation decisions across the

portfolio Access to more efficient financing than as standalone operating

companies Business Model Highly Management Dependent

|

Talented

Management Team Across the Organization Name & Title

Previous Experience Bill Stiritz Executive Chairman Has previously served as CEO of Post Holdings and as CEO of Ralston Purina for over 20 years, and

executed more than 14 spin and divestiture transactions to create shareholder value Rob Vitale President and CEO Has previously served as CFO of Post Holdings and as President and CEO of AHM Financial Group, LLC,

and Chairman and majority shareholder of The Bargain Shop, Inc. Jeff Zadoks SVP and CFO Has previously served as SVP and Chief Accounting Officer of Post Holdings, Corporate Controller of Post

Holdings and as Senior Vice President and Chief Accounting Officer at RehabCare Group,

Inc. Diedre Gray

Senior VP, General Counsel

and Administration, Secretary

Has previously served as Senior Vice President – Legal and Corporate Secretary at Post Holdings and as Associate General Counsel and Assistant Secretary at MEMC Electronic Materials, Inc. (now SunEdison,

Inc.) Jim Dwyer EVP, Post Holdings; President and CEO, Michael Foods Has previously served as CEO of Michael Foods and as EVP and Chief Business Development officer for

Ahold USA responsible for Private Brands, E-Commerce, Marketing and Pharmacy operations

Rich Koulouris EVP, Post Holdings; President and CEO, Post Foods Group Has previously served as President of Ralcorp Food Group at Ralcorp Holdings, Inc.; has previously served as President of several business units during his various assignments Chris Neugent President, Post Consumer Brands Has previously served as Chairman and CEO of MOM Brands Company Bill Gatto President, Active Nutrition Group Has over 30 years of General Management, Sales and Marketing experience in Consumer Products;

previous assignments included roles with ConAgra/Ralcorp Holdings, Beech-Nut Baby

Food and Ralston Purina Company

Post Holdings |

23 3. Financial update |

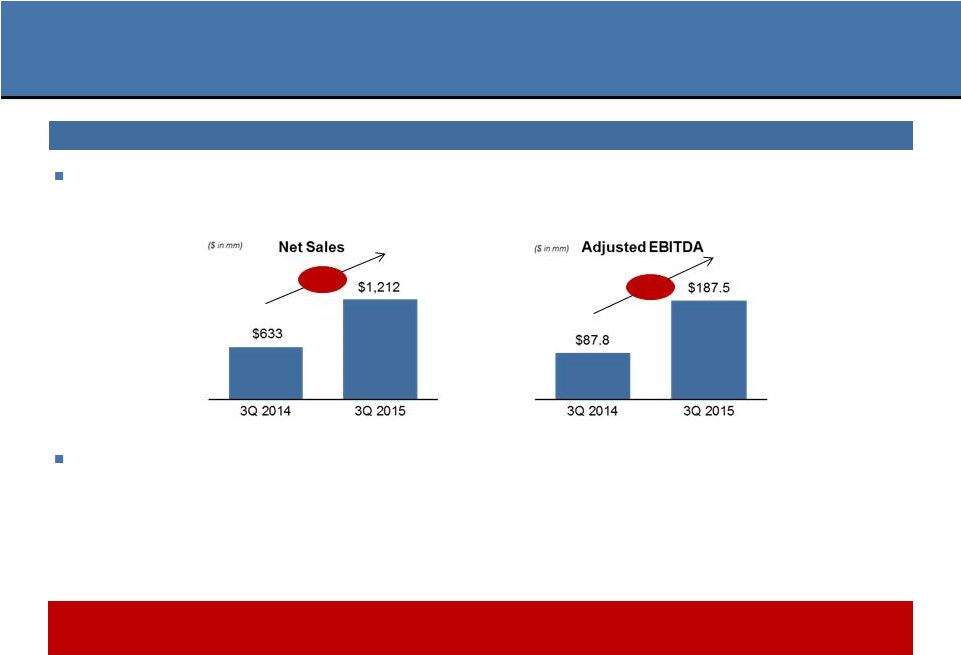

On

August 6, 2015, Post reported results for the fiscal quarter ended June 30, 2015 Increase driven by businesses acquired after June 30, 2014 and the lapping of partial period results in Q3

2014 from Michael Foods, acquired on June 2, 2014

Q3 2015 Update +91% +114% (1) Update on Fiscal Q3 2015 (1) Please see Appendix for a full reconciliation. Adjusted EBITDA has grown organically in each of Post’s businesses, except Dymatize |

Initial outbreak of avian influenza occurred in April 2015

Our response was to control costs and work closely with the entire supply chain – including farms, production and customers – in an effort to remedy the supply situation in a fair and reasonable manner Cost management included a plant furlough and shift reductions Suspended production of several product lines to focus remaining egg supply on high velocity

items Several rounds of price increases in cooperation with our customers Through these actions the impact of avian influenza on the third quarter of fiscal year 2015 financial

results was essentially mitigated

Flock repopulation will be phased in between now and the end of calendar year 2016

Have begun to revise certain practices around biosecurity and flock management practices Overview of Avian Influenza Impact on Post Holdings |

Reported

FY Ended September 30, ($ in mm)

2012A 2013A 2014A LTM Q3 2015 Net sales $959 $1,034 $2,411 $4,382 % growth 7.8% 133.2% NA Gross profit 429 425 621 1,070 % margin 44.7% 41.1% 25.8% 24.4% Adjusted EBITDA 215 217 345 602 % margin 22.4% 21.0% 14.3% 13.7% Capex 31 33 116 111 % of sales 3.2% 3.2% 4.8% 2.5% Adjusted EBITDA - Capex 184 184 229 491 % of sales 19.2% 17.8% 9.5% 11.2% Significant top line growth driven by acquisitions and entry into growth categories

Expanded into additional channels including foodservice and online

Business model focused on increasing cash flow generation

Post Holdings Historical Financial Summary

(1) Please see Appendix for a full reconciliation. (1) |

Post

Holdings Adjusted EBITDA Bridge Pro Forma Adjusted EBITDA

(1) LTM Q3 2015 (2) LTM Q3 2015 LTM Q3 2015 (1) Please see Appendix for a full reconciliation. (2) In connection with the acquisition of MOM Brands, the Company expects to recognize $50mm in run-rate synergies by the second full fiscal year

following the closing of the acquisition (excluding one-time costs to

achieve synergies). ($ in mm)

$50 $96 |

28 Appendix |

($ in

mm) Fiscal Year

Ended Sep 30 Fiscal Year Ended Sep 30 Fiscal Year Ended Sep 30 Fiscal Q3 LTM Ended Jun 30 2012 2013 2014 2015 Operating profit (loss) $ 139.1 $ 107.8 $ (207.7) $ (68.7) Depreciation and amortization 63.2 76.8 155.8 258.6 EBITDA $ 202.3 $ 184.6 $ (51.9) $ 189.9 Stock compensation 4.5 10.5 14.5 23.7 Impact of mark-to-market accounting for economic hedges 0.3 0.9 9.8 (1.8) Separation costs 12.5 8.9 2.6 2.6 Retention and severance costs 0.9 - - - Intercompany servicing fees (0.8) - - - Public company costs (5.1) - - - Transaction costs - 2.7 27.7 13.5 Inventory revaluation adjustment on acquired businesses - 1.4 26.1 21.3 Intangible asset impairment - 2.9 295.6 295.6 Restructuring and plant closure costs - 4.8 5.6 17.1 Integration costs - - 5.3 10.4 Loss on assets held for sale - - 5.4 32.8 Foreign currency (gain) loss on intercompany loans - - 0.8 4.4 Gain on change in fair value of acquisition earn-out - - (4.7) (3.3) Gain from insurance proceeds - - (3.4) (4.4) Losses on hedge of purchase price of acquisitions - - 13.1 - Legal settlement - - (2.0) - Purchase price adjustment - - - (0.2) Adjusted EBITDA $ 214.6 $ 216.7 $ 344.5 $ 601.6 Post Historical Financials Reconciliation |

($ in

mm) Fiscal Q3

Ended Jun 30 Fiscal Q3 Ended Jun 30 2014 2015 Operating profit (loss) $ 8.0 $ 81.3 Depreciation and amortization 42.7 70.4 EBITDA $ 50.7 $ 151.7 Stock compensation 3.6 3.5 Transaction costs 12.4 5.4 Integration costs 2.9 4.4 Restructuring and plant closure costs 0.3 10.7 Impact of mark-to-market accounting for economic hedges 2.0 (9.7) Inventory revaluation adjustment on acquired businesses 17.7 17.0 Spin-off costs/post spin-off non-recurring costs 0.3 0.1 Gain on change in fair value of acquisition earn-out (2.1) - Loss on assets held for sale - 4.9 Foreign currency (gain) loss on intercompany loans - (0.5) Adjusted EBITDA $ 87.8 $ 187.5 Post Historical Financials Reconciliation (Cont’d) |

($ in

mm) Fiscal Q3 LTM

Ended Jun 30 2015 Reported Adjusted EBITDA $ 601.6 American Blanching Company Adjusted EBITDA 6.3 Mom Brands Adjusted EBITDA 95.8 Pro Forma MOM Brands Synergies 50.0 Pro Forma Adjusted EBITDA $ 753.7 Post Historical Financials Reconciliation (Cont’d) Note: Post prepares Pro Forma Adjusted EBITDA by further adjusting Adjusted EBITDA to give effect to recent acquisitions, as if those acquisitions had occurred on July 1, 2014 by adding management’s estimate of the Adjusted EBITDA for each such business. The Adjusted EBITDA presented in this document for the acquisitions (ABC and MOM Brands) are based on the financial statements for those businesses that were prepared by their respective pre-acquisition management and, except as expressly stated otherwise, do not include any contributions from synergies or cost savings that management expects to achieve in the future. These financial statements have not been audited or reviewed by independent auditors or any other accounting firm. Adjusted EBITDA for these acquired entities may not be entirely comparable to Post’s measure of EBITDA or Adjusted EBITDA. Pro Forma Adjusted EBITDA has not been prepared in accordance with the requirements of Regulation S-X or any other securities laws relating to the presentation of pro forma financial information. Pro Forma Adjusted EBITDA is presented for information purposes only and does not purport to represent what Post’s actual financial position or results of operations would have been if the acquisitions had been completed as of an earlier date or that may be achieved in the future. Pro Forma Adjusted EBITDA does not include any pre-acquisition contribution from, or otherwise adjust for, Post’s acquisition of the PowerBar and Musashi branded premium bars, powders and gel products business of Nestlé S.A, which was completed on October 1, 2014. Acquisition adjustments for completed acquisitions represent management’s estimate of the Adjusted EBITDA of MOM Brands and ABC for the period from July 1, 2014 to the closing dates of the acquisitions, as described in more detail in the following table on the next page. |

($ in

mm) American

Blanching Company (1) MOM Brands (2) July 1, 2014 through October 31, 2014 June 29, 2014 through May 3, 2015 Earnings (Loss) Before Tax $ 4.6 $ (7.2) Depreciation and amortization 1.0 47.6 Interest expense, net 0.2 7.0 Sponsor management and fees 0.1 - Transaction expenses 0.4 34.4 Restructuring expenses - 13.3 Board/shareholder expenses - 0.7 Adjusted EBITDA $ 6.3 $ 95.8 Note: The amounts in the table are derived from the financial statements for those businesses that were prepared by their respective

pre-acquisition management and from due diligence procedures performed

by Post. These amounts represent management’s estimates as of the date of this document only. These financial statements have not been audited or reviewed by independent auditors or any other accounting firm. Please refer to the note to “Post Historical Financials Reconciliation” for additional information regarding Adjusted EBITDA of the businesses identified above. (1) Adjustment gives effect to the acquisition of ABC, which was consummated effective November 1, 2014, as if such acquisition had occurred on July

1, 2014, by including management’s estimate of the Adjusted EBITDA of

ABC for the period from July 1, 2014 through October 31, 2014.

(2) Adjustment gives effect to the acquisition of MOM Brands, which was consummated effective May 4, 2015, as if such acquisition had occurred on July 1, 2014, by including management’s estimate of the Adjusted EBITDA of MOM Brands for the period from June 29, 2014 through May 3, 2015.

Adjusted EBITDA Acquisition Adjustments (Partial Year)

Twelve Months Ended June 30, 2015 |

33 Post Holdings, Inc. |