Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Prestige Consumer Healthcare Inc. | a8-kpressreleasejune2015.htm |

| EX-99.1 - EXHIBIT 99.1 - Prestige Consumer Healthcare Inc. | exhibit991fy16-q1earningsr.htm |

Review of First Quarter FY 16 Results August 6, 2015 Exhibit 99.2

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 2 This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements about the Company’s product expansion and development plans, investments in brand building and marketing, debt reduction and future financing capacity, consumption growth and market position of the Company’s brands, M&A strategy and market activity, future financial performance, and creation of shareholder value. Words such as “continue,” “target,” “will,” “expect,” “project,” “strategy”, “anticipate,” “likely,” “estimate,” “may,” “should,” “could,” “would,” and similar expressions identify forward-looking statements. Such forward-looking statements represent the Company’s expectations and beliefs and involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied by such forward- looking statements. These factors include, among others, the inability to identify and consummate future acquisitions at attractive valuations, the failure to successfully commercialize new products, consumer trends, the severity of the cold and flu season, the inability of third party manufacturers and suppliers to meet demand, competitive pressures, the effectiveness of the Company’s brand building and marketing investments, fluctuating foreign exchange rates, and other risks set forth in Part I, Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K for the year ended March 31, 2015. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this presentation. Except to the extent required by applicable law, the Company undertakes no obligation to update any forward-looking statement contained in this presentation, whether as a result of new information, future events, or otherwise. Safe Harbor Disclosure

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 3 Agenda for Today’s Discussion I. Performance Highlights II. Financial Overview III. FY 16 Outlook and the Road Ahead

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 4

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 5 Solid Start to the Fiscal Year Q1 consolidated Revenue of $192.1 million, up 31.9% versus PY Q1 – Organic growth of +3.7%(1) on a constant currency basis, and +1.8% on a reported basis versus PY Q1 Total Core OTC consumption growth of 6.5% YoY – 82% of Core OTC portfolio with consumption growth – Consistent and innovative marketing support building long-term brand equity in core OTC brands Adjusted Gross Margin of 58.4%(2) versus 56.3% in the PY Q1, and up from 57.9% in Q4 Adjusted EPS of $0.52(2), up 26.8% versus the PY Q1 Strong Free Cash Flow of $42.7(2) million, up 46.5% versus the PY Q1 – Leverage of ~5.1x(3), down from 5.7x at the time of Insight acquisition On track to continue to deliver strong financial performance in FY2016 – Full year sales growth 1H +20% to +23%, 2H +1.5% to 2.0% – Adjusted E.P.S. $2.05 to $2.10(7) – Free Cash Flow ~$175MM(8) or more

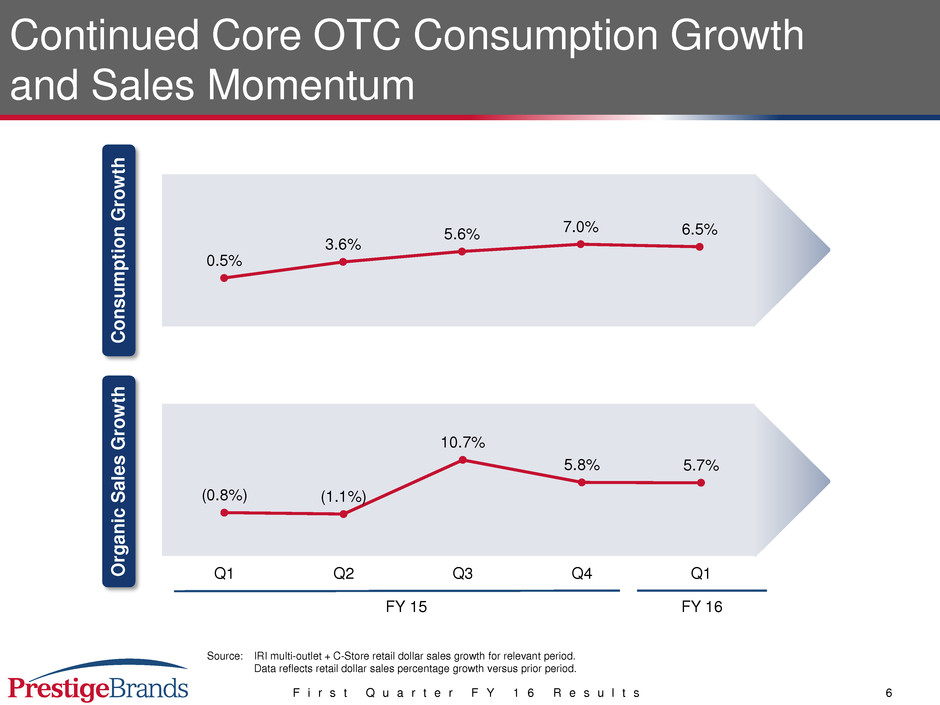

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 6 Continued Core OTC Consumption Growth and Sales Momentum Source: IRI multi-outlet + C-Store retail dollar sales growth for relevant period. Data reflects retail dollar sales percentage growth versus prior period. O rg a n ic Sa les G ro w th C o n s u m p ti o n G ro w th (0.8%) (1.1%) 10.7% 5.8% 5.7% Q1 Q2 Q3 Q4 Q1 0.5% 3.6% 5.6% 7.0% 6.5% FY 15 FY 16

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 7 Q1 FY 16 Core OTC Growth Broad Based Led by Largest Brands % of Core OTC Portfolio with Consumption Growth in Q1 FY 16 82% 6.0% 13.3% 15.6% 16.2% 14.9% Q1 Q2 Q3 Q4 Q1 Growth of Largest Brands Accelerating 1.6% 2.5% 5.1% 4.6% 9.1% Q1 Q2 Q3 Q4 Q1 Y/Y Retail Sales % Growth Core OTC, includes Insight Pharmaceuticals. Source: IRI multi-outlet + C-Store, L-52 period ending June 14, 2015. % of Core OTC Retail Sales Represented by Growing Brands Recently Acquired 0.4% 3.6% 4.5% 5.3% 7.9% Q1 Q2 Q3 Q4 Q1 FY 15 FY 16

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 8 New Goody’s Marketing Campaign Launched June 1st Featuring Dale Earnhardt, JR. Promotes New Products Race Sponsorship TV & Radio Social Media Introduced in July: 2 New Goody’s Line-Extending Innovations in Taste for Headache Sufferers & in Dosage Form for Pain Relief

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 9 Clear Eyes Now #1 in Redness Relief Innovative Line Extensions Pocket Pal line creates distribution & revenue opportunities Full Range of SKUs Commands Shelf Presence Targeted Marketing Campaign Social Media & Digital Banner Ads TV, Radio & Print Advertising Vanessa Williams will continue this year as celebrity spokesperson across all media, reaching target market consumers with her message of trust for Clear Eyes

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 10 Monistat: Building Brand Momentum Developing HCP Relationship Awareness Beyond HCP New TV & digital advertising campaigns target Hispanic markets and women 18-24 “Prescription strength cure without the prescription” Too Much Information “TMI” Women’s Health PR Program Reinforcing strategy, messaging and communication with Health Care Professionals Hispanic Pilot Program Delivers the Monistat Message: Retail Events Drug Chain Shelf Brochures Doctor’s Office Waiting Rooms Targeted Digital Channels

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 11 Core OTC International Other OTC Household Contribution to Portfolio: # of Brands: Investment: Targeted Mix Over Time(4)(5): Q1 FY 16 % Organic Growth: (Constant Currency)(1) Invest for Growth Manage for Cash Flow Generation ~25% of Total Brands ~75% of Total Brands 63% 15% Investment in Core OTC and International Driving Organic Growth +6.5% (2.4%) +3.7%(1) Organic Growth High Maintain ~78% ~85% Current Target ~22% ~15% Current Target 11% 11%

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 12

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 13 Key Financial Results for First Quarter Performance Excellent overall financial performance in the quarter − Achieved organic growth of 3.7%(1) excluding the impact of foreign currency − Revenue of $192.1 million, an increase of 31.9% − Adjusted EPS of $0.52(2), up 26.8% − Free Cash Flow growth of 46.5% to $42.7 million(2) $145.7 $51.0 $29.2 $192.1 $69.6 $42.7 Total Revenue Adjusted EBITDA Adjusted EPS Free Cash Flow Q1 FY 16 Q1 FY 15 31.9% 36.4% 26.8% 46.5% $0.41 $0.52 (2) (2) (2) Dollar values in millions, except per share data.

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 14 Jun '15 Jun '14 % Chg Total Revenue 192.1$ 145.7$ 31.9% Adj. Gross Margin 112.2 82.0 36.9% % Margin 58.4% 56.3% A&P 26.4 19.1 38.4% % Total Revenue 13.8% 13.1% Adj. G&A 16.2 11.9 36.5% % Total Revenue 8.4% 8.1% Adjusted EBITDA 69.6$ 51.0$ 36.4% % Margin 36.2% 35.0% Adjusted Net Income 27.4$ 21.5$ 27.4% Adjusted Earnings Per Share 0.52$ 0.41$ 26.8% FY 16 First Quarter Consolidated Financial Summary Q1 Revenue growth of +31.9%, or +34.3%(1) on a constant currency basis Q1 Adjusted Gross Margin of 58.4%(2), consistent with full year outlook of 58.0% Q1 A&P 13.8% of Total Revenue, an increase of 70bps versus PY Q1 Q1 Adjusted EBITDA Margin of 36.2%(2) Q1 Adjusted EPS of $0.52, up 26.8%(2) 3 Months Ended Dollar values in millions, except per share data. Refer to footnote 2 for all adjusted items.

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 15 Q1 FY 16 Q1 FY 15 Net Income - As Reported 26.2$ 16.7$ Depreciation & Amortization 5.7 3.0 Other Non-Cash Operating Items 17.1 10.0 Working Capital (5.5) (0.0) Operating Cash Flow 43.5$ 29.7$ Additions to Property and Equipment (0.8) (0.5) Free Cash Flow 42.7$ 29.2$ Debt Profile & Financial Compliance: Net Debt at 6/30/15 of $1,527 million comprised of: – Cash on hand of $22 million – $899 million of term loan and revolver – $650 million of bonds Leverage ratio(3) of ~5.1x Recent term loan refinancing continues to support rapid deleveraging Exceptional Free Cash Flow Trends Cash Flow Comments (6) (2) Dollar values in millions.

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 16

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 17 Staying the Strategic Course to Continue Shareholder Value Creation − Strong momentum heading into Q2 − Consumption trends leading to market share gains − Retail environment continues to present headwinds − Revenue outlook +20% to +23% for 1H FY 16, Fx impact may be larger than anticipated − Continued focus on investment in brand building for FY 16 − Invest and innovate in Core OTC brands and international platform − Continue to build new product pipeline for the long term − Remain aggressive and disciplined − Rapidly de-levering and building meaningful M&A capacity − Continue to monitor major company divestiture announcements − Revenue growth of +10% to +12% (including $10MM negative Fx impact) 1H +20% to +23%, 2H +1.5% to +2.0% − Adjusted EPS +10% to +13% ($2.05 to $2.10)(7) − Free cash flow of $175MM(8) or more − Continued A&P investment in portfolio, Insight brands in particular Brand Building Confident in Full FY 16 Outlook M&A Strategy Strong Consumption Trends

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 18 Q&A

F i r s t Q u a r t e r F Y 1 6 R e s u l t s 19 Appendix (1) Revenue Growth on a constant currency basis is a Non-GAAP financial measure and is reconciled to its most closely related GAAP financial measure in our earnings release in the “About Non-GAAP Financial Measures” section. (2) Adjusted Gross Margin, Adjusted G&A, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted EPS and Free Cash Flow are Non-GAAP financial measures and are reconciled to their most closely related GAAP financial measures in our earnings release in the “About Non-GAAP Financial Measures” section. (3) Leverage ratio reflects net debt / covenant defined EBITDA. (4) Pro forma Net Sales for FY 15 as if Insight and Hydralyte were acquired on April 1, 2014. (5) Based on Company's organic long-term plan. Source: Company data. (6) Operating cash flow is equal to GAAP net cash provided by operating activities. (7) Adjusted EPS for FY 16 is a projected Non-GAAP financial measure, is reconciled to projected GAAP EPS in our earnings release in the “About Non-GAAP Financial Measures” section and is calculated based on projected GAAP EPS of $2.00 to $2.05 plus $0.05 of cost associated with term loan refinancing and CEO retirement totaling $2.05 to $2.10. (8) Free Cash Flow for FY 16 is a projected Non-GAAP financial measure, is reconciled to projected GAAP Net Cash Provided by Operating Activities in our earnings release in the “About Non-GAAP Financial Measures” section and is calculated based on projected Net Cash Provided by Operating Activities of $181 million less projected capital expenditures of $6 million.