Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WCI Communities, Inc. | d88856d8k.htm |

| EX-99.1 - EARNINGS PRESS RELEASE - WCI Communities, Inc. | d88856dex991.htm |

WCI

Communities Second Quarter 2015 Earnings Conference Call

July 29, 2015 Exhibit 99.2 |

Disclosure

Statement This presentation contains forward-looking statements. All

statements that are not statements of historical fact, including

statements about the Company’s beliefs and expectations, are forward-looking

statements within the meaning of the federal securities laws and should

be evaluated as such. Forward-looking statements include information concerning the Company’s future goals, expected growth, market conditions and outlook (including the estimates, forecasts, statements and projections

relating to Florida or national markets prepared by John Burns Real Estate Consulting),

expected liquidity and possible or assumed future results of operations,

including descriptions of its business plan and strategies. These forward-looking statements may be identified by the use of such forward-looking terminology, including the terms “believe,” “estimate,”

“project,” “anticipate,” “expect,”

“seek,” “predict,” “contemplate,” “continue,” “possible,” “intend,” “may,” “might,” “will,” “could,” “would,” “should,”

“forecast,” or “assume” or, in each case, their

negative, or other variations or comparable terminology. For more

information concerning factors that could cause actual results to differ materially from those contained in the forward- looking statements, please refer to “Risk Factors” in Item 1A of Part I of our Annual Report on Form 10-K for the year ended

December 31, 2014 that was filed by the Company with the Securities and

Exchange Commission on February 25, 2015 and elsewhere therein, and

subsequent filings by the Company. The Company bases these forward-looking statements or projections on its current expectations, plans and assumptions that it has made in light of its experience in the industry, as well as its

perceptions of historical trends, current conditions, expected future developments and

other factors it believes are appropriate under the circumstances and at

such time. As you read and consider this presentation, you should understand that these statements are not guarantees of performance or results. The forward-looking statements and projections are subject to and

involve risks, uncertainties and assumptions and you should not place undue reliance on

these forward-looking statements or projections. Although the Company

believes that these forward-looking statements and projections are based on reasonable assumptions at the time they are made, you should be aware that many factors could affect the Company’s actual financial

results or results of operations and could cause actual results to differ

materially from those expressed in the forward-looking statements and

projections. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. If the Company does update one or more forward-looking statements, there should be

no inference that it will make additional updates with respect to those or other

forward-looking statements. In addition to the financial measures

prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation contains the non-GAAP financial measures EBITDA, Adjusted EBITDA, Adjusted gross margin from homes delivered

and net debt to net capitalization.

The reasons for the use of these measures, a reconciliation of these measures to the

most directly comparable GAAP measures and other information relating to

these measures are included in the appendix to this presentation.

2 |

Cash 50.6% LTV > 80% 7.8% LTV 65 - 80% 25.1% LTV 1 - 64% 16.5% Loan to Value Percentage (“LTV”) – 2Q15 Deliveries WCI Communities at a Glance Lifestyle community developer and luxury homebuilder throughout Florida Target move-up, second-home and active adult customers High average selling prices - $476,000 on 2Q15 deliveries High proportion of cash buyers – 51% of 2Q15 deliveries Low cancellation rate – 8.3% during 2Q15 Approximately 13,500 home sites owned or controlled as of June 30, 2015 Conservative balance sheet with $146 million of cash Complementary and value-add Real Estate Services (“RES”) and Amenities businesses 3 Buyer Profile with Low Reliance on Financing |

Compelling

Florida Real Estate Market Florida building permits

(1) Second highest in the U.S. in 2014 Permits still ~70% off peak YTD May 2015 building permits are up 23% vs. prior year Florida is a leading growth state Job growth rate of 3.4%; higher than national average of 2.1% (2) Nine of the top 18 U.S. cities forecast to see the most economic growth are located in Florida (3) 25 Florida locations were named the best places to retire; more than double any other state (4) 2015 resale statistics (5) 1H15 closings up 13.6% over 1H14 43rd

consecutive month median sales

prices increased year-over-year

4 (1) U.S. Census Bureau (2) Florida Department of Economic Opportunity; July 17, 2015 (3) U.S. Conference of Mayors with HIS Global Insight; BloombergBusiness article – June 19, 2015 (4) TopRetirements.com 9 th annual survey of the 100 most popular retirement spots; February 21, 2015 (5) Florida Realtors ® Florida Annual Permit Activity (1) Strong Growth in Florida Resale Closings in 2015 (5) 50,251 59,599 67,579 77,724 24,860 26,637 30,918 33,183 75,111 86,236 98,497 110,907 1Q14 1Q15 2Q14 2Q15 Single-Family Resale Condo/Townhouse Resale |

50 122 143 243 2Q12 2Q13 2Q14 2Q15 128 147 195 300 2Q12 2Q13 2Q14 2Q15 Homebuilding – 2Q15 Highlights Revenues from homes delivered up 89.8% to $115.6 million Deliveries up 69.9% to 243 homes Average selling price per delivered home of $476,000, up 11.7% New orders up 53.8% to 300 homes Contract value of new orders of $128.6 million, up 37.4% Sales mix weighted more toward primary and active adult segment in 2Q15 Neighborhood count up 60.7% Backlog units up 44.8% to 627 homes Backlog contract value of $294.1 million, up 27.9% Adjusted gross margin from homes delivered of 29.1% All cash buyers accounted for 51% of 2Q15 deliveries 5 Second Quarter – New Orders Trend Second Quarter – Deliveries Trend Note: All comparisons are to 2Q14 32.8% CAGR 69.4% CAGR |

$1,495

$2,116 2Q14 2Q15 +40.0% $26,499 $29,107 2Q14 2Q15 +9.8% 2,746 2,857 2Q14 2Q15 +4.0% $307 $320 2Q14 2Q15 +4.2% Real Estate Services – 2Q15 Highlights 6 RES Revenues Brokerage Transactions Brokerage ASP Brokerage closed home sales transactions up 4.0% Brokerage average selling price up 4.2% to $320,000 Title revenues increased 36.8% Total revenues up 9.8% Total gross margin up 40.0% to $2.1 million RES Gross Margin Note: All comparisons are to 2Q14 ($ in thousands) ($ in thousands) ($ in thousands) |

$14.4

$15.9 $30.7 10.5% 9.5% 12.4% 1H13 1H14 1H15 $84 $109 $183 $40 $45 $52 $12 $13 $14 $137 $167 $248 1H13 1H14 1H15 HB RES AM Executing on the WCI Growth Strategy Year to Date June 2015 Comparisons to Prior Year Periods Increasing revenues driven by Homebuilding and Real Estate Services Continued Homebuilding gross margin strength Improved SG&A leverage by 330 basis points 93% growth in Adjusted EBITDA 7 (1) Represents adjusted gross margin from homes delivered (2) Measured as a percentage of Homebuilding revenues (3) Measured as a percentage of total revenues Revenues ($ in millions) Adjusted EBITDA (3) SG&A % (2) Adjusted GM % (1) ($ in millions) 33.5% 30.1% 29.4% 1H13 1H14 1H15 19.8% 17.7% 14.9% 2.4% 1.5% 1.1% 22.2% 19.3% 16.0% 1H13 1H14 1H15 Stock-based compensation expense Note: Totals may not foot due to rounding |

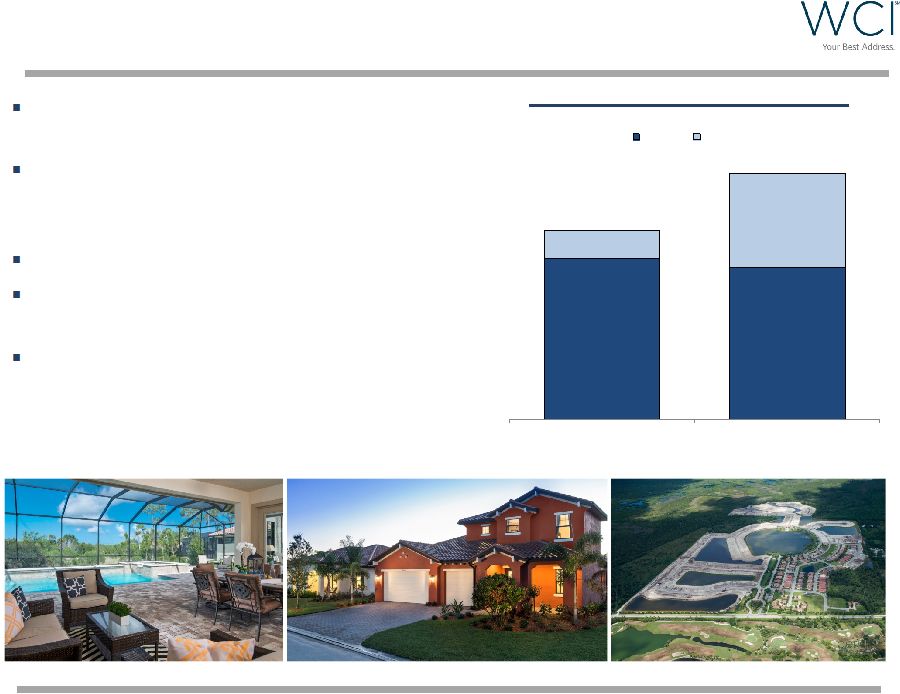

Land

Portfolio Positioned for Growth High quality land positions in

land- constrained markets

Land portfolio totals approximately 13,500

owned or controlled home sites; up 30%

from 2Q14 62% owned / 38% optioned Experienced team with extensive land entitlement and development experience Actively pursuing additional land acquisition opportunities throughout Florida 8 Owned or Controlled Home Sites 8,814 8,307 1,520 5,158 10,334 13,465 2Q14 2Q15 Owned Optioned |

Selected

Operating Results 9

$ in thousands, except per share amounts

2015 2014 Variance % 2015 2014 Variance % Homebuilding revenues 115,565 $ 60,918 $ 89.8% 182,612 $ 108,913 $ 67.7% Real estate services revenues 29,107 26,499 9.8% 51,873 44,962 15.3% Amenities revenues 6,038 5,542 9.1% 13,927 12,864 7.8% Total revenues 150,710 92,959 62.0% 248,412 166,739 49.0% Total gross margin 32,216 18,007 78.9% 52,344 31,841 64.4% Income tax expense 6,187 2,974 108.0% 7,103 4,634 53.3% Net income attributable to common shareholders 9,820 $

4,338 $

126.4% 15,472 $ 5,818 $

165.9% Earnings per share - diluted 0.37 $

0.17 $

117.6% 0.59 $

0.22 $

168.2% SG&A expenses as a percent of Homebuilding revenues 14.0% 17.5% -350 bps 16.0% 19.3% -330 bps Adjusted gross margin percentage 29.1% 30.1% -100 bps 29.4% 30.1% -70 bps Adjusted EBITDA 20,714 $ 10,235 $ 102.4% 30,746 $ 15,893 $ 93.5% Adjusted EBITDA percentage 13.7% 11.0% +270 bps 12.4% 9.5% +290 bps Homes delivered 243 143 69.9% 381 260 46.5% Average selling price per home delivered 476 $

426 $

11.7% 479 $

419 $

14.3% New orders 300 195 53.8% 616 400 54.0% Average selling price per new order 429 $

480 $

-10.6% 437 $

487 $

-10.3% Backlog units 627 433 44.8% Average selling price in backlog 469 $

531 $

-11.7% Three Months Ended June 30, Six Months Ended June 30, |

Conservative Balance Sheet

Balance sheet positioned to

execute the growth strategy

Undrawn $75 million revolving

credit facility Invested $42 million year-to- date on land and land development Completed two secondary offerings; no primary shares or proceeds to the company April 2015 – 3.7 million shares July 2015 – 3.7 million shares 10 (1) Available liquidity includes the $75 million of borrowing capacity under a four-year revolving credit

facility and $8.3 million of borrowing capacity under a revolving credit facility with

Stonegate Bank (2)

Debt to capital is computed by dividing the carrying value of our total debt, as

reported on our consolidated balance sheets, by total

capital (3)

Net debt represents total debt, excluding premium, less cash and cash equivalents; net

capitalization represents net debt plus total equity

$ in thousands Cash and cash equivalents 146,015 $

174,756 $

Real estate inventories

510,985 449,249

Total

debt 251,106

251,179 Total equity

452,154 434,443

Total

capital 703,260

685,622 Available liquidity

(1) 229,351 257,756

Debt to capital

(2) 35.7% 36.6% Net debt to net capitalization (3) 18.7% 14.8% (Cash + inventories) / total debt 2.62 2.48

June 30, 2015 December 31, 2014 |

Key

Takeaways Florida real estate market remains strong

Fully integrated Florida luxury homebuilder and

community developer Executing the strategy Focus on move-up, second-home and active adult customer segments Differentiate via extensive amenity offerings Operational discipline Positioned for continued growth Growing new orders and deliveries Increasing active selling neighborhood count Growing revenues and Adjusted EBITDA Complementary Real Estate Services and Amenities businesses Actively pursuing land acquisition opportunities Conservative balance sheet with liquidity and flexibility for growth Experienced and talented team 11 |

Appendix |

Reconciliation of Non-GAAP Financial Measures

In addition to the results reported in accordance with U.S. generally accepted

accounting principles (“GAAP”), we have provided information in

this presentation relating to adjusted gross margin from homes delivered, EBITDA, Adjusted EBITDA (both terms defined below) and net debt to net capitalization. Our GAAP-based measures can be found in our unaudited consolidated financial statements in Item 1 of the Quarterly Report

on Form 10-Q for the quarter ended June 30, 2015 that we plan to file with the

Securities and Exchange Commission on or before July 31, 2015. Adjusted

Gross Margin from Homes Delivered We calculate adjusted gross margin from

homes delivered by subtracting the gross margin from land and home sites, if any, from Homebuilding gross margin to arrive at gross margin from homes delivered. Adjusted gross margin from homes delivered is calculated by adding asset impairments, if any, and capitalized interest in cost of sales to gross margin from homes delivered. Management uses adjusted gross margin

from homes delivered to evaluate operating performance in our

Homebuilding segment and make strategic decisions regarding sales price,

construction and development pace, product mix and other operating decisions. We

believe that adjusted gross margin from homes delivered is (i) meaningful

because it isolates the impact that our indebtedness and asset impairments have on gross margin and (ii) relevant and useful to shareholders, investors and other interested parties for evaluating our comparative operating performance from period to period and among

companies

within the homebuilding industry as it is reflective of overall profitability during any given reporting period. This measure is considered a non-GAAP financial measure and should be considered in addition to, rather than as a substitute for, the comparable GAAP financial measures

when evaluating our operating performance. Although other companies in the homebuilding industry report similar information, they may calculate this measure differently than we do and, therefore, it may not be comparable. We urge shareholders, investors and other

interested parties to understand the methods used by other companies in

the homebuilding industry to calculate gross margins and any adjustments to such amounts before comparing our measures to those of such other companies. The table below reconciles adjusted gross margin from homes delivered to the most directly comparable GAAP financial measure, Homebuilding gross margin, for the periods presented herein. 13 2015 2014 2015 2014 Homebuilding gross margin 30,889 $

17,049

$

49,388

$

30,496

$

Less: gross margin from

land and home sites -

- -

- Gross margin

from homes delivered 30,889

17,049

49,388

30,496

Add:

capitalized interest in cost of sales

2,740

1,282

4,364

2,267

Adjusted gross margin from homes delivered

33,629

$

18,331

$

53,752

$

32,763

$

Gross margin from homes

delivered as a percentage of

revenues from homes delivered

26.7%

28.0%

27.0%

28.0%

Adjusted gross margin from homes delivered as

a percentage of revenues from

homes delivered 29.1%

30.1%

29.4%

30.1%

Three Months Ended June 30,

($ in thousands)

Six Months Ended June 30,

|

Reconciliation of Non-GAAP Financial Measures

(continued) EBITDA and Adjusted

EBITDA Adjusted

EBITDA measures performance by adjusting net income (loss) attributable to common shareholders of WCI Communities, Inc. to exclude, if any, interest expense, capitalized interest in cost of sales, income taxes, depreciation (‘‘EBITDA’’), preferred stock dividends, income (loss) from discontinued operations, other income, stock-based compensation expense, asset impairments and expenses related to early repayment of debt. We believe that the presentation of Adjusted EBITDA provides useful information to shareholders, investors and other interested parties regarding our results of operations because it assists those parties and us when analyzing and benchmarking the performance and value of our business. We also believe that Adjusted EBITDA is useful as a measure of comparative operating performance from period to period and among companies in the homebuilding industry as it is reflective of changes in pricing decisions, cost controls and other factors that affect operating performance, and it removes the effects of our capital structure (such as preferred stock dividends and interest expense), asset base (primarily depreciation), items outside of our control (primarily income taxes) and the volatility related to the timing and extent of non-operating activities (such as discontinued operations and asset impairments). Accordingly, we believe that this measure is useful for comparing general operating performance from period to period. Other companies may define Adjusted EBITDA differently and, as a result, our measure of Adjusted EBITDA may not be directly comparable to Adjusted EBITDA of other companies. Although we use Adjusted EBITDA as a financial measure to assess the performance of our business, the use of Adjusted EBITDA is limited because it does not include certain material costs, such as interest and income taxes, necessary to operate our business. EBITDA and Adjusted EBITDA should be considered in addition to, and not as substitutes for, net income (loss) in accordance with GAAP as a measure of performance. Our presentation of EBITDA and Adjusted EBITDA should not be construed as an indication that our future results will be unaffected by unusual or nonrecurring items. Our EBITDA-based measures have limitations as analytical tools and, therefore, shareholders, investors and other interested parties should not consider them in isolation or as substitutes for analyses of our results as reported under GAAP. Some such limitations are: they do not reflect the impact of earnings or charges resulting from matters that we consider not to be indicative of our ongoing

operations; they are not adjusted for all non-cash income or expense items that are reflected in our consolidated statements of cash flows;

they do not reflect the interest that is necessary to service our debt;

and other companies in our industry may calculate these measures

differently than we do, thereby limiting their usefulness as comparative

measures. Because of these limitations, our EBITDA-based measures are not intended to be alternatives to net income (loss), indicators of our operating

performance, alternatives to any other measure of performance in

conformity with GAAP or alternatives to cash flow provided by (used in)

operating activities as measures of liquidity. Shareholders, investors and other

interested parties should therefore not place undue reliance on our

EBITDA-based measures or ratios calculated using those measures.

14 |

Reconciliation of Non-GAAP Financial Measures

(continued) EBITDA and Adjusted EBITDA

(continued) The table below reconciles EBITDA and Adjusted EBITDA to the

most directly comparable GAAP financial measure, net income (loss)

attributable to common shareholders of WCI Communities, Inc., for the periods presented

herein. 15

(1) Represents capitalized interest expensed in cost of sales on home deliveries and land and home site sales.

(2) Represents the expense recorded in the Company’s unaudited consolidated statements of operations related to its stock-based

compensation plans.

2015

2014

2015

2014

Net income attributable to common

shareholders of WCI Communities,

Inc. 9,820

$

4,338

$

15,472

$

5,818

$

Interest

expense 198

187 458

685 Capitalized interest in cost of sales

(1) 2,740

1,282

4,364

2,267

Income tax expense

6,187

2,974

7,103

4,634

Depreciation

758

644 1,467

1,232

EBITDA

19,703

9,425

28,864

14,636

Other

income, net (99)

(63) (195)

(428) Stock-based compensation expense

(2) 1,110

873

2,077 1,685

Adjusted EBITDA

20,714

$

10,235

$

30,746

$

15,893

$

Adjusted EBITDA

margin 13.7%

11.0%

12.4%

9.5%

Three Months Ended June 30,

($ in thousands)

Six Months Ended June 30,

|

Reconciliation of Non-GAAP Financial Measures

(continued) Net Debt to Net

Capitalization We believe that net debt to net capitalization provides

useful information to shareholders, investors and other interested parties regarding our financial position and cash and debt management. It is also a relevant financial measure for understanding the leverage employed in our

operations and as an indicator of our ability to obtain future

financing. By deducting cash and cash equivalents from our

outstanding debt, we provide a measure of our debt that considers our cash position. We believe that this approach provides useful information because the ratio of debt to capital does not consider our cash and cash equivalents and

we believe that a debt ratio net of cash, such as net debt to net capitalization, provides supplemental information by which our financial position may be considered. Shareholders, investors and other interested parties may also find this information to be helpful when comparing our

leverage to the leverage of our competitors that present similar

information. The

table below presents the computations of our net debt to net capitalization and reconciles such amounts to the most directly comparable GAAP financial measure, debt to capital. 16 (1) Debt to capital is computed by dividing the carrying value of our Senior Notes due 2021, as reported on our consolidated balance sheets, by total capital as calculated above. The Senior Notes due 2021 were our only outstanding debt as of June 30, 2015 and December 31, 2014. (2) Net debt to net capitalization is computed by dividing net debt by net capitalization. June 30, December 31, 2015 2014 Senior Notes due 2021 251,106 $

251,179

$

Total equity 452,154 434,443 Total capital 703,260 $

685,622

$

Debt to capital (1) 35.7% 36.6% Senior Notes due 2021 251,106 $

251,179

$

Less: unamortized premium 1,106 1,179 Principal amount of Senior Notes due 2021 250,000 250,000 Less: cash and cash equivalents 146,015 174,756 Net debt 103,985 75,244 Total equity 452,154 434,443 Net capitalization 556,139 $

509,687

$

Net debt to net capitalization (2) 18.7% 14.8% ($ in thousands) |