Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - United Financial Bancorp, Inc. | ex992presentationtogroup.htm |

| 8-K/A - 8-K/A - United Financial Bancorp, Inc. | a8-kasubmissionxkbwconfere.htm |

Second Quarter 2015 EarningsNASDAQ Global Select Market: UBNK Create Your Balance

2NASDAQ: UBNK This Presentation contains forward-looking statements that are within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are based upon the current beliefs and expectations of our management and are subject to significant risks and uncertainties. These risks and uncertainties could cause our results to differ materially from those set forth in such forward-looking statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. Words such as “believes,” “anticipates,” “expects,” “intends,” “plans,” “estimates,” “targeted” and similar expressions, and future or conditional verbs, such as “will,” “would,” “should,” “could” or “may” are intended to identify forward-looking statements but are not the only means to identify these statements. Forward-looking statements involve risks and uncertainties. Actual conditions, events or results may differ materially from those contemplated by a forward-looking statement. Factors that could cause this difference — many of which are beyond our control — include without limitation the following: Any forward-looking statements made by or on behalf of us in this Presentation speak only as of the date of this Presentation. We do not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the date the forward- looking statement was made. The reader should; however, consult any further disclosures of a forward-looking nature we may make in future filings. With regard to presentations compared to peer institutions, the peer companies include: BHLB, BPFH, BRKL, CNBKA, CUBI, EGBN, FCF, FFIC, INDB, LBAI, SASR, SNBC, STBA, STL, TBBK, TMP, WASH. TBBK has been removed from current and future periods due to delinquent SEC filings. TBBK remains in historic peer comparisons. Data for peers is sourced from SNL Financial LLC. NON-GAAP FINANCIAL MEASURES This presentation references non-GAAP financial measures incorporating tangible equity and related measures, and operating earnings excluding non-recurring costs. These measures are commonly used by investors in evaluating financial condition. GAAP earnings are lower than core earnings primarily due to non-recurring conversion, balance sheet restructuring and cost cutting initiative related expenses. The efficiency ratio represents the ratio of non-interest expenses to the sum of net interest income before provision for loan losses and non-interest income, exclusive of net gain (loss) on limited partnership investments. The pre-provision net revenue to average assets ratio represents the ratio of net interest income, on a fully tax-equivalent basis, fees and other non-interest income, net of non-credit-related expenses as a percent of total average assets. The pre-provision net revenue to average equity ratio represents the ratio of net interest income, on a fully tax-equivalent basis, fees and other non-interest income, net of non-credit-related expenses as a percent of total average equity. Reconciliations are in earnings releases at www.unitedfinancialinc.com. Forward Looking Statements

3NASDAQ: UBNK Corporate Contacts William H. W. Crawford, IV Chief Executive Officer Eric R. Newell, CFA Executive Vice President, Chief Financial Officer Investor Information: Marliese L. Shaw Executive Vice President, Corporate Secretary/Investor Relations Officer 860-291-3622 or mshaw@bankatunited.com

4NASDAQ: UBNK Table of Contents

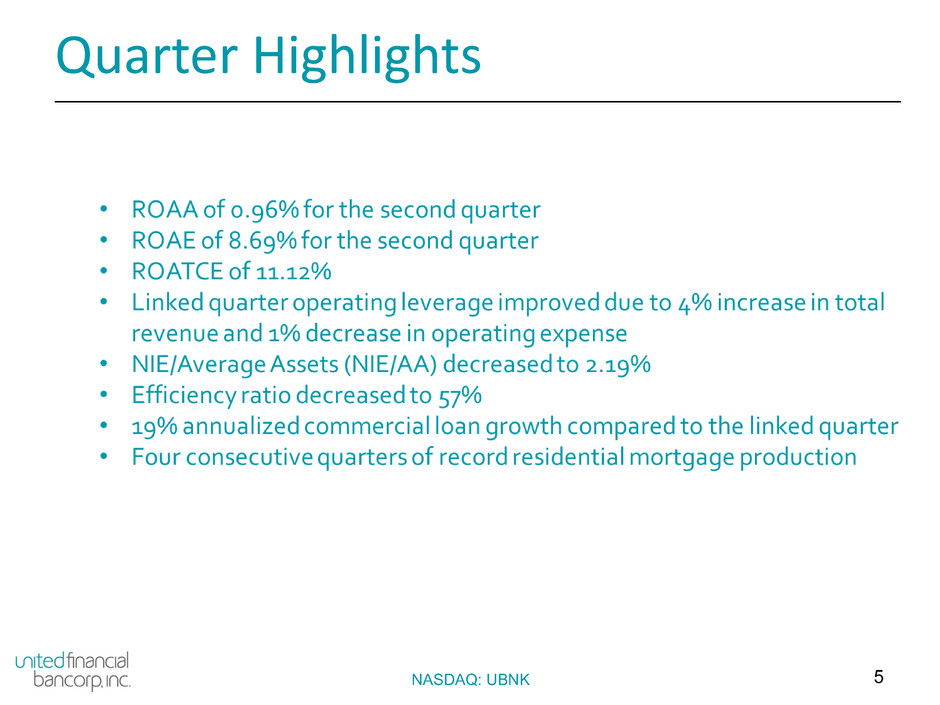

5NASDAQ: UBNK Quarter Highlights

6NASDAQ: UBNK Merger * Metrics announced November 2013 were achieved by second half 2015 on an annualized basis ** June 30, 2015 actual metrics annualized, when appropriate *** Last peer data available from quarter ending March 31, 2015 **** NIE/AA is Pro-Forma after cost saves

7NASDAQ: UBNK Regression Imputed 6/30/2015 Actual

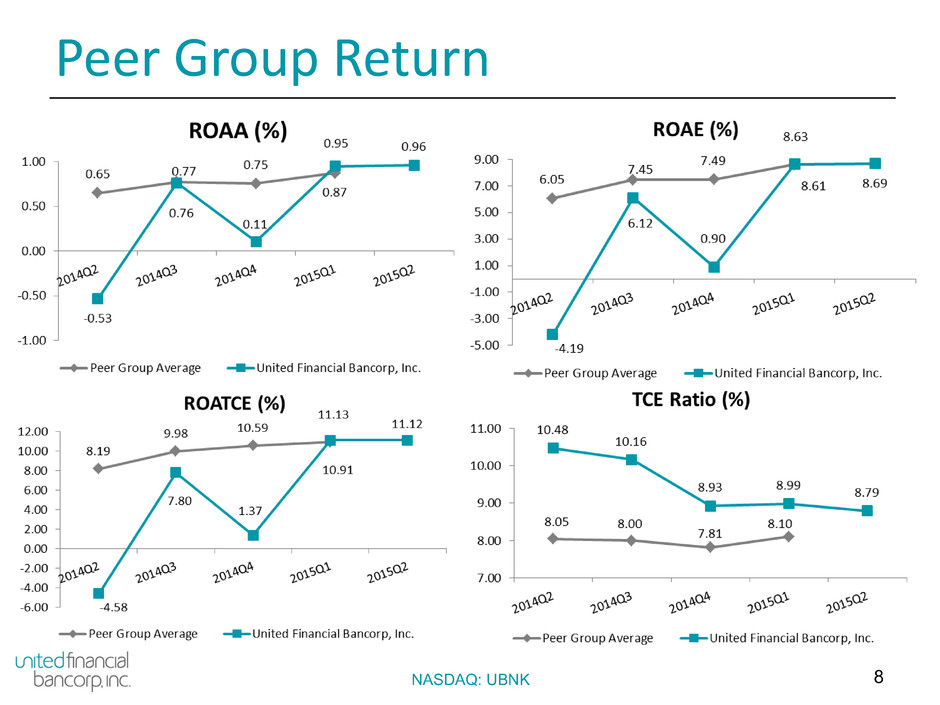

8NASDAQ: UBNK Peer Group Return

9NASDAQ: UBNK Peer Group Earnings

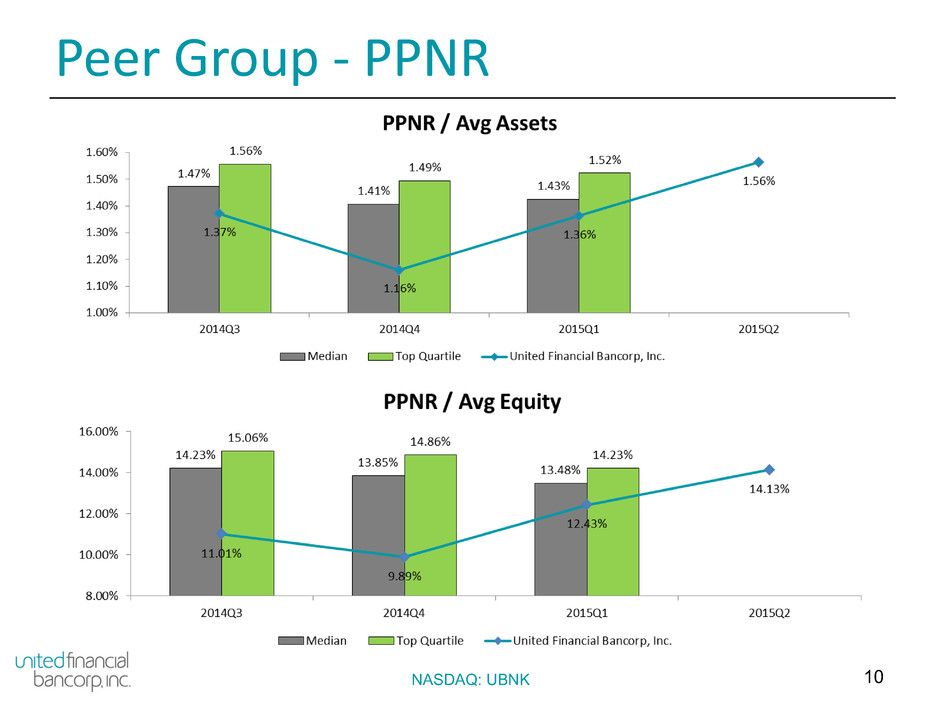

10NASDAQ: UBNK Peer Group - PPNR

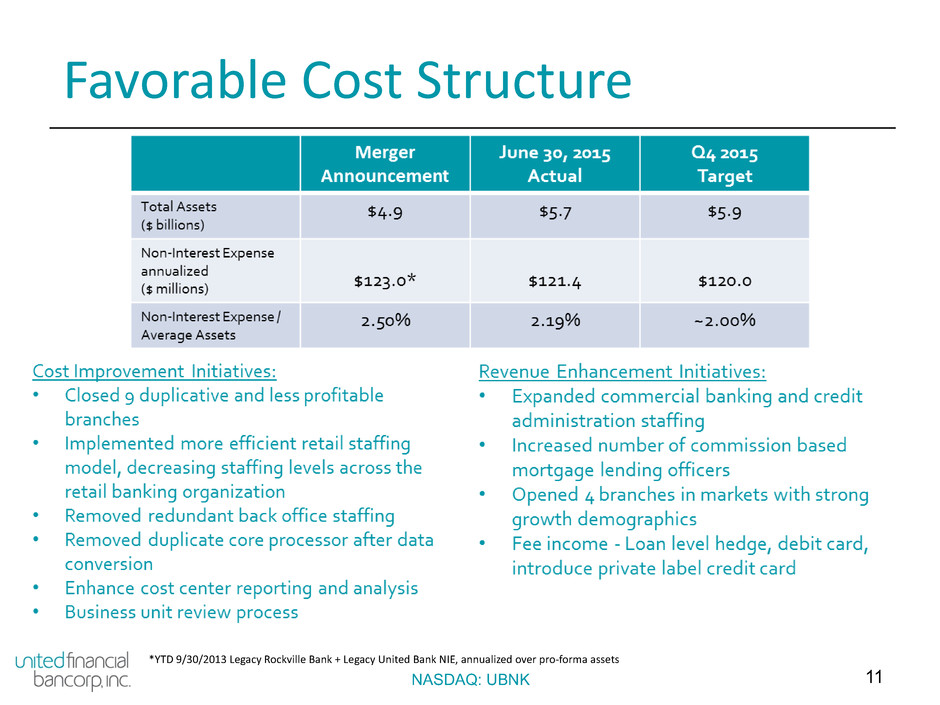

11NASDAQ: UBNK Favorable Cost Structure *YTD 9/30/2013 Legacy Rockville Bank + Legacy United Bank NIE, annualized over pro-forma assets

12NASDAQ: UBNK Mortgage Banking

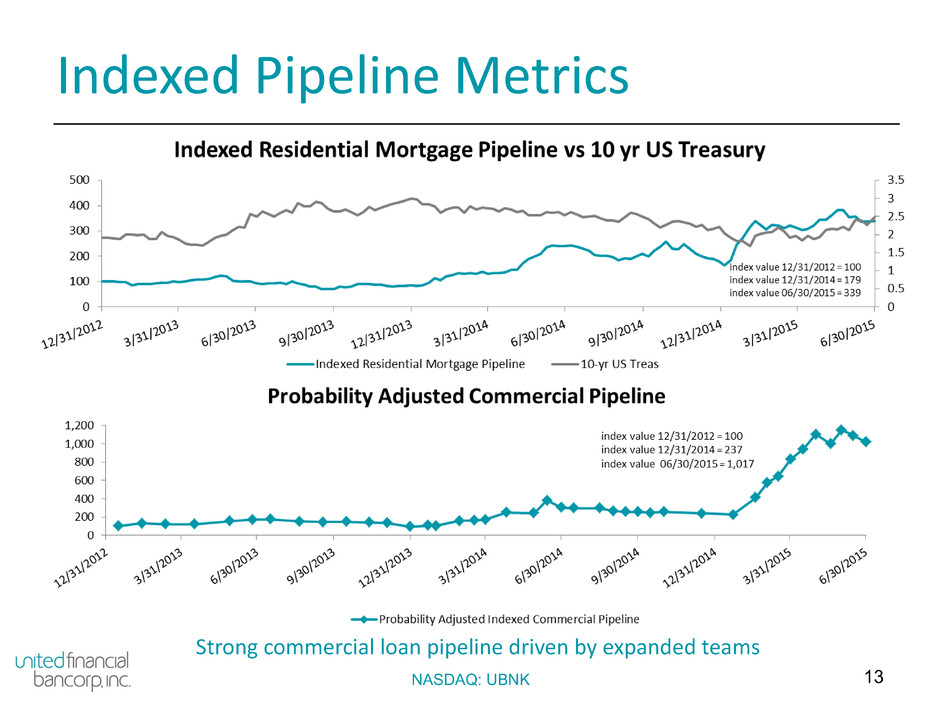

13NASDAQ: UBNK Indexed Pipeline Metrics Strong commercial loan pipeline driven by expanded teams

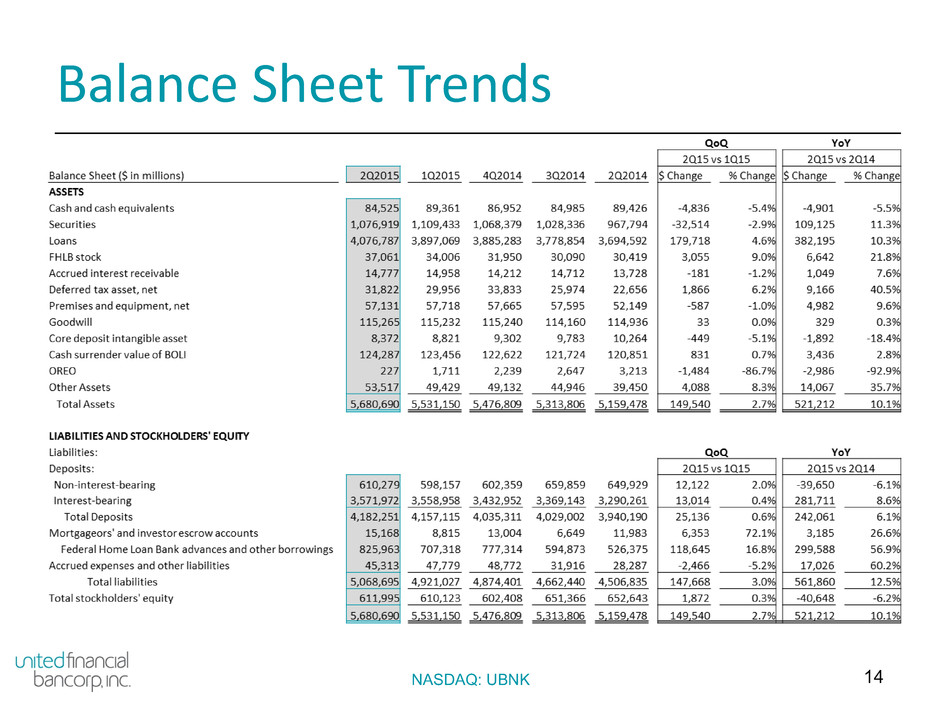

14NASDAQ: UBNK Balance Sheet Trends

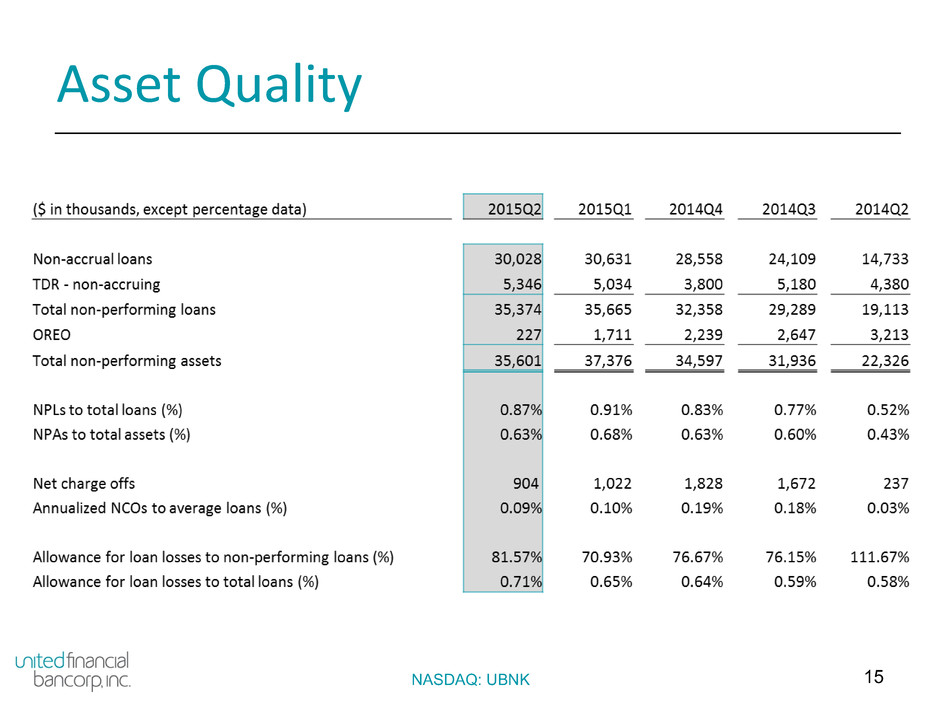

15NASDAQ: UBNK Asset Quality

16NASDAQ: UBNK Peer Asset Quality

17NASDAQ: UBNK 2015 Performance Focus

18NASDAQ: UBNK APPENDIX

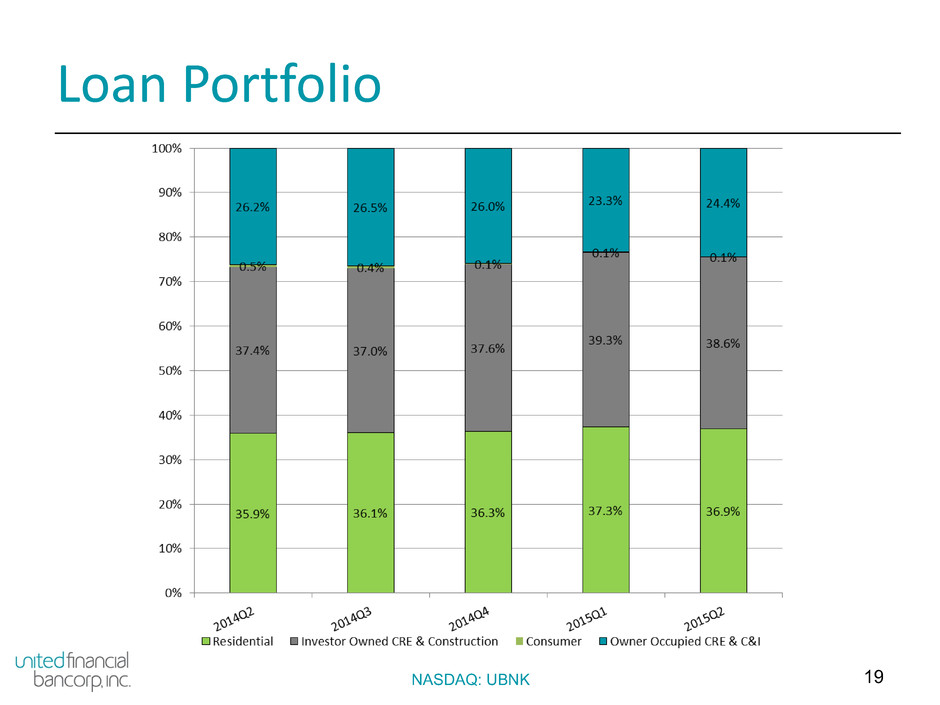

19NASDAQ: UBNK Loan Portfolio

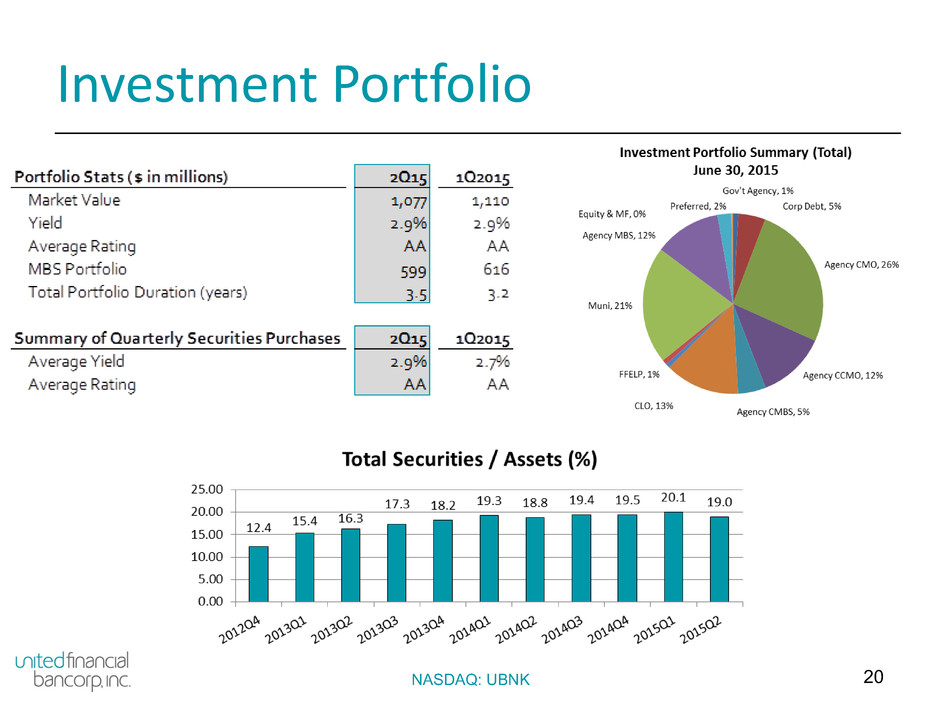

20NASDAQ: UBNK Investment Portfolio

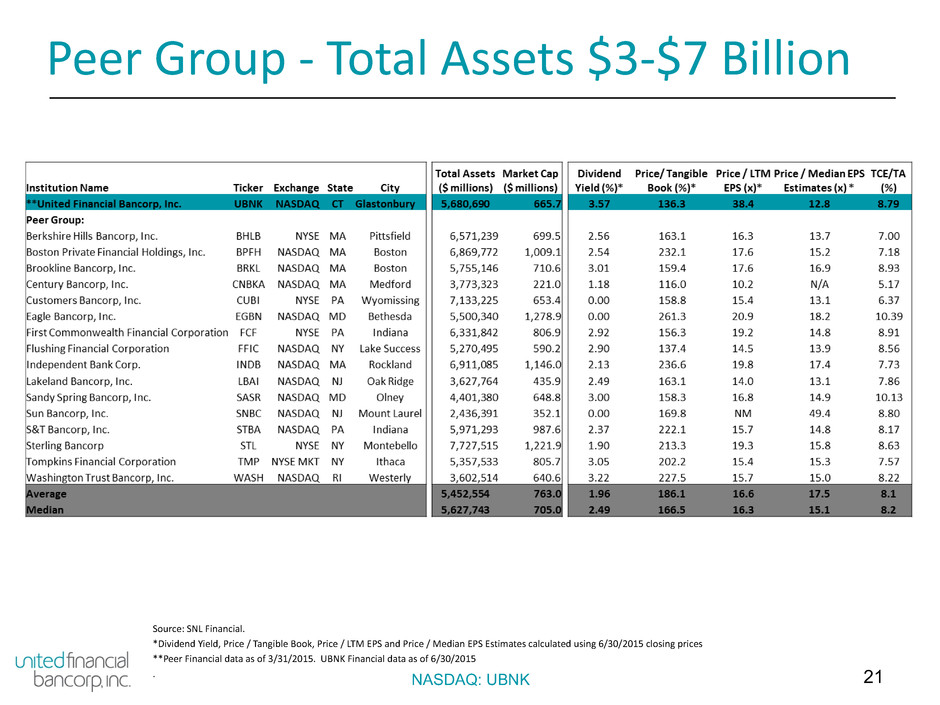

21NASDAQ: UBNK Peer Group - Total Assets $3-$7 Billion Source: SNL Financial. *Dividend Yield, Price / Tangible Book, Price / LTM EPS and Price / Median EPS Estimates calculated using 6/30/2015 closing prices **Peer Financial data as of 3/31/2015. UBNK Financial data as of 6/30/2015 .

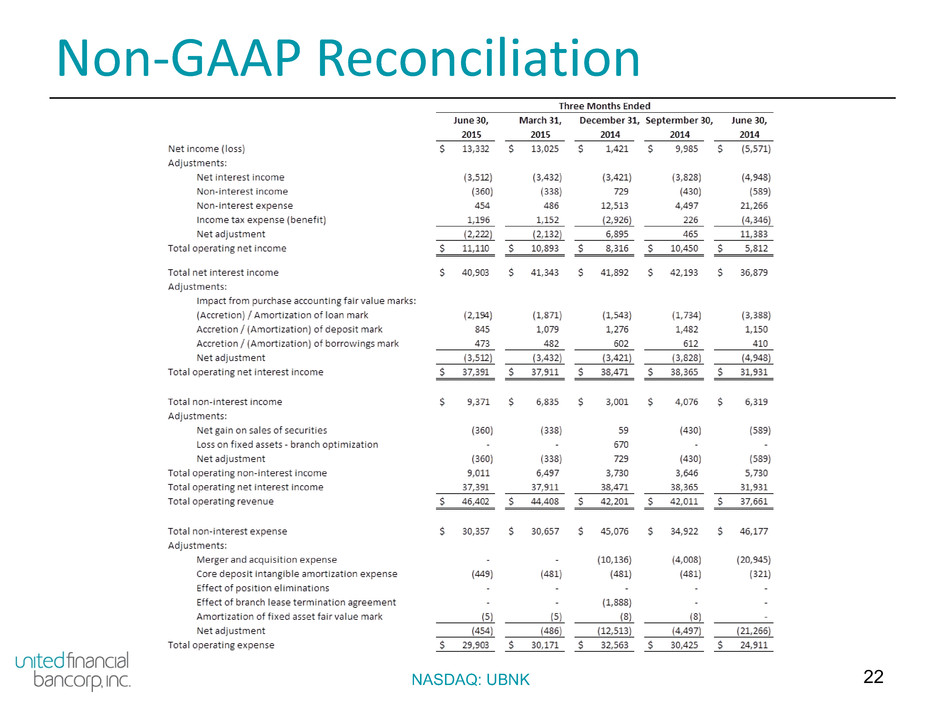

22NASDAQ: UBNK Non-GAAP Reconciliation

23NASDAQ: UBNK Non-GAAP Reconciliation