Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - Dine Brands Global, Inc. | din-2016x6x30x10qxex101.htm |

| EX-31.2 - EXHIBIT 31.2 SECTION 302 CFO CERTIFICATION - Dine Brands Global, Inc. | din-2015630x10qxex312.htm |

| EX-32.2 - EXHIBIT 32.2 SECTION 906 CFO CERTIFICATION - Dine Brands Global, Inc. | din-2015630x10qxex322.htm |

| EX-31.1 - EXHIBIT 31.1 SECTION 302 CEO CERTIFICATION - Dine Brands Global, Inc. | din-2015630x10qxex311.htm |

| EX-32.1 - EXHIBIT 32.1 SECTION 906 CEO CERTIFICATION - Dine Brands Global, Inc. | din-2015630x10qxex321.htm |

| EX-12.1 - EXHIBIT 12.1 COMPUTATION OF RATIOS - Dine Brands Global, Inc. | din-2015630x10qxex121.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2015

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-15283

DineEquity, Inc.

DineEquity, Inc.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 95-3038279 (I.R.S. Employer Identification No.) | |

450 North Brand Boulevard, Glendale, California (Address of principal executive offices) | 91203-1903 (Zip Code) | |

(818) 240-6055

(Registrant’s telephone number, including area code)

______________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer o | |

Non-accelerated filer o | Smaller reporting company o | |

(Do not check if a smaller reporting company) | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class | Outstanding as of July 24, 2015 | |

Common Stock, $0.01 par value | 18,871,808 | |

DineEquity, Inc. and Subsidiaries

Index

Page | ||

1

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

DineEquity, Inc. and Subsidiaries

Consolidated Balance Sheets

(In thousands, except share and per share amounts)

Assets | June 30, 2015 | December 31, 2014 | ||||||

(Unaudited) | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 104,383 | $ | 104,004 | ||||

Receivables, net | 107,807 | 153,498 | ||||||

Restricted cash | 41,255 | 52,262 | ||||||

Prepaid gift card costs | 41,559 | 51,268 | ||||||

Prepaid income taxes | 1,278 | 11,753 | ||||||

Deferred income taxes | 38,465 | 30,860 | ||||||

Other current assets | 12,835 | 9,239 | ||||||

Total current assets | 347,582 | 412,884 | ||||||

Long-term receivables, net | 170,368 | 180,856 | ||||||

Property and equipment, net | 231,124 | 241,229 | ||||||

Goodwill | 697,470 | 697,470 | ||||||

Other intangible assets, net | 777,425 | 782,336 | ||||||

Deferred rent receivable | 90,917 | 91,117 | ||||||

Other non-current assets, net | 40,972 | 42,216 | ||||||

Total assets | $ | 2,355,858 | $ | 2,448,108 | ||||

Liabilities and Stockholders’ Equity | ||||||||

Current liabilities: | ||||||||

Accounts payable | $ | 39,162 | $ | 41,771 | ||||

Gift card liability | 116,865 | 179,760 | ||||||

Accrued advertising | 13,374 | 10,150 | ||||||

Accrued employee compensation and benefits | 14,932 | 25,722 | ||||||

Dividends payable | 16,546 | 16,635 | ||||||

Accrued interest payable | 3,886 | 14,126 | ||||||

Current maturities of capital lease and financing obligations | 15,291 | 14,852 | ||||||

Other accrued expenses | 15,566 | 10,033 | ||||||

Total current liabilities | 235,622 | 313,049 | ||||||

Long-term debt | 1,300,000 | 1,300,000 | ||||||

Capital lease obligations, less current maturities | 91,505 | 98,119 | ||||||

Financing obligations, less current maturities | 42,461 | 42,524 | ||||||

Deferred income taxes | 309,159 | 319,111 | ||||||

Deferred rent payable | 74,874 | 75,375 | ||||||

Other non-current liabilities | 21,365 | 20,857 | ||||||

Total liabilities | 2,074,986 | 2,169,035 | ||||||

Commitments and contingencies | ||||||||

Stockholders’ equity: | ||||||||

Common stock, $0.01 par value, shares: 40,000,000 authorized; June 30, 2015 - 25,212,715 issued, 18,873,985 outstanding; December 31, 2014 - 25,240,055 issued, 18,953,567 outstanding | 252 | 252 | ||||||

Additional paid-in-capital | 284,055 | 279,946 | ||||||

Retained earnings | 335,750 | 313,644 | ||||||

Accumulated other comprehensive loss | (85 | ) | (73 | ) | ||||

Treasury stock, at cost; shares: June 30, 2015 - 6,338,730; December 31, 2014 - 6,286,488 | (339,100 | ) | (314,696 | ) | ||||

Total stockholders’ equity | 280,872 | 279,073 | ||||||

Total liabilities and stockholders’ equity | $ | 2,355,858 | $ | 2,448,108 | ||||

See the accompanying Notes to Consolidated Financial Statements.

2

DineEquity, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

(In thousands, except per share amounts)

(Unaudited)

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | June 30, | |||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||

Revenues: | ||||||||||||||||

Franchise and restaurant revenues | $ | 137,768 | $ | 126,444 | $ | 279,586 | $ | 258,239 | ||||||||

Rental revenues | 31,132 | 30,709 | 62,534 | 61,462 | ||||||||||||

Financing revenues | 2,649 | 3,368 | 5,243 | 8,021 | ||||||||||||

Total revenues | 171,549 | 160,521 | 347,363 | 327,722 | ||||||||||||

Cost of revenues: | ||||||||||||||||

Franchise and restaurant expenses | 51,423 | 42,155 | 103,449 | 87,833 | ||||||||||||

Rental expenses | 23,319 | 23,653 | 46,809 | 47,519 | ||||||||||||

Financing expenses | — | 240 | 12 | 825 | ||||||||||||

Total cost of revenues | 74,742 | 66,048 | 150,270 | 136,177 | ||||||||||||

Gross profit | 96,807 | 94,473 | 197,093 | 191,545 | ||||||||||||

General and administrative expenses | 34,577 | 34,816 | 68,807 | 69,001 | ||||||||||||

Interest expense | 15,677 | 24,942 | 31,323 | 49,911 | ||||||||||||

Amortization of intangible assets | 2,500 | 3,070 | 5,000 | 6,141 | ||||||||||||

Closure and impairment charges, net | 475 | 637 | 2,302 | 837 | ||||||||||||

Loss on extinguishment of debt | — | 6 | — | 12 | ||||||||||||

Loss (gain) on disposition of assets | 66 | (130 | ) | 57 | 797 | |||||||||||

Income before income tax provision | 43,512 | 31,132 | 89,604 | 64,846 | ||||||||||||

Income tax provision | (16,615 | ) | (11,965 | ) | (34,295 | ) | (24,855 | ) | ||||||||

Net income | 26,897 | 19,167 | 55,309 | 39,991 | ||||||||||||

Other comprehensive income (loss), net of tax: | ||||||||||||||||

Adjustment to unrealized loss on available-for-sale investments | — | 107 | — | 107 | ||||||||||||

Foreign currency translation adjustment | 3 | 7 | (12 | ) | 1 | |||||||||||

Total comprehensive income | $ | 26,900 | $ | 19,281 | $ | 55,297 | $ | 40,099 | ||||||||

Net income available to common stockholders: | ||||||||||||||||

Net income | $ | 26,897 | $ | 19,167 | $ | 55,309 | $ | 39,991 | ||||||||

Less: Net income allocated to unvested participating restricted stock | (359 | ) | (307 | ) | (726 | ) | (649 | ) | ||||||||

Net income available to common stockholders | $ | 26,538 | $ | 18,860 | $ | 54,583 | $ | 39,342 | ||||||||

Net income available to common stockholders per share: | ||||||||||||||||

Basic | $ | 1.41 | $ | 1.00 | $ | 2.90 | $ | 2.09 | ||||||||

Diluted | $ | 1.40 | $ | 1.00 | $ | 2.88 | $ | 2.07 | ||||||||

Weighted average shares outstanding: | ||||||||||||||||

Basic | 18,763 | 18,776 | 18,819 | 18,785 | ||||||||||||

Diluted | 18,895 | 18,955 | 18,959 | 19,003 | ||||||||||||

Dividends declared per common share | $ | 0.875 | $ | 0.75 | $ | 1.75 | $ | 1.50 | ||||||||

Dividends paid per common share | $ | 0.875 | $ | 0.75 | $ | 1.75 | $ | 1.50 | ||||||||

See the accompanying Notes to Consolidated Financial Statements.

3

DineEquity, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

Six Months Ended | ||||||||

June 30, | ||||||||

2015 | 2014 | |||||||

Cash flows from operating activities: | ||||||||

Net income | $ | 55,309 | $ | 39,991 | ||||

Adjustments to reconcile net income to cash flows provided by operating activities: | ||||||||

Depreciation and amortization | 15,855 | 17,498 | ||||||

Non-cash interest expense | 1,519 | 3,315 | ||||||

Deferred income taxes | (16,768 | ) | (16,047 | ) | ||||

Non-cash stock-based compensation expense | 4,593 | 5,508 | ||||||

Tax benefit from stock-based compensation | 4,688 | 3,578 | ||||||

Excess tax benefit from stock-based compensation | (4,572 | ) | (4,455 | ) | ||||

Closure and impairment charges | 2,302 | 837 | ||||||

Loss on disposition of assets | 57 | 797 | ||||||

Other | (1,534 | ) | (1,704 | ) | ||||

Changes in operating assets and liabilities: | ||||||||

Accounts receivable, net | (11,249 | ) | (4,949 | ) | ||||

Current income tax receivables and payables | 9,717 | 16,004 | ||||||

Gift card receivables and payables | (3,256 | ) | (4,165 | ) | ||||

Prepaid expenses and other current assets | (2,299 | ) | (1,608 | ) | ||||

Accounts payable | 6,024 | 10,103 | ||||||

Accrued employee compensation and benefits | (10,790 | ) | (10,552 | ) | ||||

Other current liabilities | (1,473 | ) | 1,841 | |||||

Cash flows provided by operating activities | 48,123 | 55,992 | ||||||

Cash flows from investing activities: | ||||||||

Additions to property and equipment | (4,612 | ) | (4,086 | ) | ||||

Proceeds from sale of property and equipment | 800 | 681 | ||||||

Principal receipts from notes, equipment contracts and other long-term receivables | 9,517 | 6,066 | ||||||

Other | (110 | ) | 75 | |||||

Cash flows provided by investing activities | 5,595 | 2,736 | ||||||

Cash flows from financing activities: | ||||||||

Repayment of long-term debt | — | (2,400 | ) | |||||

Principal payments on capital lease and financing obligations | (5,975 | ) | (5,570 | ) | ||||

Repurchase of DineEquity common stock | (35,007 | ) | (30,006 | ) | ||||

Dividends paid on common stock | (33,271 | ) | (28,518 | ) | ||||

Tax payments for restricted stock upon vesting | (3,010 | ) | (1,944 | ) | ||||

Proceeds from stock options exercised | 8,374 | 6,658 | ||||||

Excess tax benefit from stock-based compensation | 4,572 | 4,455 | ||||||

Change in restricted cash | 11,007 | (7,064 | ) | |||||

Other | (29 | ) | — | |||||

Cash flows used in financing activities | (53,339 | ) | (64,389 | ) | ||||

Net change in cash and cash equivalents | 379 | (5,661 | ) | |||||

Cash and cash equivalents at beginning of period | 104,004 | 106,011 | ||||||

Cash and cash equivalents at end of period | $ | 104,383 | $ | 100,350 | ||||

Supplemental disclosures: | ||||||||

Interest paid in cash | $ | 46,419 | $ | 53,767 | ||||

Income taxes paid in cash | $ | 36,968 | $ | 22,169 | ||||

See the accompanying Notes to Consolidated Financial Statements.

4

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(Unaudited)

1. General

The accompanying unaudited consolidated financial statements of DineEquity, Inc. (the “Company”) have been prepared in accordance with United States generally accepted accounting principles (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. The operating results for the six months ended June 30, 2015 are not necessarily indicative of the results that may be expected for the twelve months ending December 31, 2015.

The consolidated balance sheet at December 31, 2014 has been derived from the audited consolidated financial statements at that date, but does not include all of the information and footnotes required by U.S. GAAP for complete financial statements.

These consolidated financial statements should be read in conjunction with the consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014.

2. Basis of Presentation

The Company’s fiscal quarters end on the Sunday closest to the last day of each quarter. For convenience, the fiscal quarters of each year are referred to as ending on March 31, June 30, September 30 and December 31. The first quarter of fiscal 2015 began on December 29, 2014 and ended on March 29, 2015; the second quarter of fiscal 2015 ended on June 28, 2015. The first quarter of fiscal 2014 began on December 30, 2013 and ended on March 30, 2014; the second quarter of fiscal 2014 ended on June 29, 2014.

The accompanying consolidated financial statements include the accounts of the Company and its subsidiaries that are consolidated in accordance with U.S. GAAP. All intercompany balances and transactions have been eliminated.

The preparation of financial statements in conformity with U.S. GAAP requires the Company’s management to make assumptions and estimates that affect the reported amounts of assets and liabilities, disclosures of contingent assets and liabilities, if any, at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Significant areas requiring the use of management estimates in the calculation and assessment of reported or disclosed amounts include: (a) impairment of tangible and intangible assets, (b) income taxes, (c) allowance for doubtful accounts and notes receivables, (d) lease accounting estimates, (e) stock-based compensation and (f) contingencies. On an ongoing basis, the Company evaluates its estimates based on historical experience, current conditions and various other assumptions that are believed to be reasonable under the circumstances. The Company adjusts such estimates and assumptions when facts and circumstances dictate. Actual results could differ from those estimates.

3. Accounting Policies

Accounting Standards Adopted in the Current Fiscal Year

In April 2014, the Financial Accounting Standards Board (“FASB”) issued an amendment to the guidance on the reporting of discontinued operations. The amendment changed the criteria for the reporting of discontinued operations such that only disposals resulting in a strategic shift that will have a major effect on an entity's operations and financial results will be reported as discontinued operations. The amendment also removed the requirement that an entity not have any significant continuing involvement in the operations of the component after disposal to qualify for reporting of the disposal as a discontinued operation. The Company adopted the amendment as of January 1, 2015 and adoption did not have an impact on the Company’s consolidated financial statements.

Newly Issued Accounting Standards Not Yet Adopted

In May 2014, the FASB issued new accounting guidance on revenue recognition, which provides for a single five-step model to be applied to all revenue contracts with customers. The new standard also requires additional financial statement disclosures that will enable users to understand the nature, amount, timing and uncertainty of revenue and cash flows relating to customer contracts. Companies have an option to use either a retrospective approach or cumulative effect adjustment approach to implement the standard. In July 2015, the FASB deferred the effective date of the new guidance by one year such that the Company will be required to adopt the guidance beginning with its first fiscal quarter of 2018.

5

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

3. Accounting Policies (Continued)

This amendment supersedes nearly all of the existing general revenue recognition guidance under U.S. GAAP as well as most industry-specific revenue recognition guidance, including guidance with respect to revenue recognition by franchisors. The Company believes the recognition of the majority of its revenues, including franchise royalty revenues, sales of IHOP pancake and waffle dry mix and retail sales at company-operated restaurants will not be affected by the new guidance. Additionally, lease rental revenues are not within the scope of the new guidance. The Company is currently evaluating the impact of the new guidance on its financial statements and related disclosures and which method of adoption will be used.

In April 2015, the FASB issued an amendment that modifies the presentation of debt issuance costs. The amendment requires debt issuance costs be presented in the balance sheet as a direct reduction of the related debt liability rather than as an asset. The amendment is effective commencing with the Company's first fiscal quarter of 2016 and is required to be applied on a retrospective basis. As the amendment does not change the underlying accounting for debt issuance costs, adoption of this standard is not expected to have a material effect on the Company's consolidated financial statements.

The Company reviewed all other newly issued accounting pronouncements and concluded that they either are not applicable to the Company or are not expected to have a material effect on the Company's consolidated financial statements as a result of future adoption.

4. Stockholders' Equity

Dividends

During the six months ended June 30, 2015, the Company paid dividends on common stock of $33.3 million, representing the dividends declared in the fourth quarter of 2014 and first quarter of 2015. On May 19, 2015, the Company's Board of Directors declared a second quarter 2015 cash dividend of $0.875 per share of common stock. This dividend was paid on July 10, 2015 to the Company's stockholders of record at the close of business on June 12, 2015. The Company reported a payable for this dividend of $16.5 million at June 30, 2015.

Stock Repurchase Program

In October 2014, the Company's Board of Directors approved a stock repurchase authorization of up to $100 million of DineEquity common stock. Under this program, the Company may repurchase shares on an opportunistic basis from time to time in open market transactions and in privately negotiated transactions based on business, market, applicable legal requirements and other considerations. The repurchase program does not require the repurchase of a specific number of shares and may be terminated at any time. During the six months ended June 30, 2015, the Company repurchased 344,890 shares of common stock at a cost of $35.0 million. As of June 30, 2015, the Company has repurchased a cumulative total of 365,225 shares of common stock under the current Board authorization at a total cost of $37.0 million. The Company may repurchase up to an additional $63.0 million of common stock under the current Board authorization.

Treasury Stock

Repurchases of DineEquity common stock are included in treasury stock at the cost of shares repurchased plus any transaction costs. Treasury stock may be re-issued when stock options are exercised, when restricted stock awards are granted and when restricted stock units settle in stock upon vesting. The cost of treasury stock re-issued is determined using the first-in, first-out (“FIFO”) method. During the six months ended June 30, 2015, the Company re-issued 292,648 treasury shares at a total FIFO cost of $10.6 million.

6

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

5. Income Taxes

The Company's effective tax rate was 38.3% for the six months ended June 30, 2015 and 2014.

The total gross unrecognized tax benefit as of June 30, 2015 and December 31, 2014 was $3.3 million and $3.4 million, respectively, excluding interest, penalties and related tax benefits. The Company estimates the unrecognized tax benefit may decrease over the upcoming 12 months by an amount up to $0.7 million related to settlements with taxing authorities and the lapse of statutes of limitations. For the remaining liability, due to the uncertainties related to these tax matters, the Company is unable to make a reasonably reliable estimate when cash settlement with a taxing authority will occur.

As of June 30, 2015, accrued interest was $4.3 million and accrued penalties were less than $0.1 million, excluding any related income tax benefits. As of December 31, 2014, accrued interest was $3.9 million and accrued penalties were less than $0.1 million, excluding any related income tax benefits. The Company recognizes interest accrued related to unrecognized tax benefits and penalties as a component of its income tax provision recognized in the Consolidated Statements of Comprehensive Income.

The Company files federal income tax returns and the Company or one of its subsidiaries files income tax returns in various state and foreign jurisdictions. With few exceptions, the Company is no longer subject to federal, state or non-United States tax examinations by tax authorities for years before 2008. In the second quarter of 2013, the Internal Revenue Service (“IRS”) issued a Revenue Agent’s Report related to its examination of the Company’s U.S federal income tax return for each of the tax years 2008 to 2010. The Company disagrees with a portion of the proposed assessments and has contested them through the IRS administrative appeals procedures. The appeal process is ongoing. The Company continues to believe that adequate reserves have been provided relating to all matters contained in the tax periods open to examination.

6. Stock-Based Compensation

The following table summarizes the components of stock-based compensation expense included in general and administrative expenses in the Consolidated Statements of Comprehensive Income for the three and six months ended June 30, 2015 and 2014:

Three Months Ended | Six Months Ended | ||||||||||||||

June 30, | June 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(In millions) | |||||||||||||||

Total stock-based compensation expense: | |||||||||||||||

Equity classified awards expense | $ | 2.2 | $ | 2.4 | $ | 4.6 | $ | 5.5 | |||||||

Liability classified awards (credit) expense | (1.1 | ) | 0.6 | (0.8 | ) | 0.5 | |||||||||

Total pre-tax stock-based compensation expense | 1.1 | 3.0 | 3.8 | 6.0 | |||||||||||

Book income tax benefit | (0.4 | ) | (1.1 | ) | (1.4 | ) | (2.3 | ) | |||||||

Total stock-based compensation expense, net of tax | $ | 0.7 | $ | 1.9 | $ | 2.4 | $ | 3.7 | |||||||

As of June 30, 2015, total unrecognized compensation costs of $16.0 million related to restricted stock and restricted stock units and $5.2 million related to stock options are expected to be recognized over a weighted average period of 1.85 years for restricted stock and restricted stock units and 1.67 years for stock options.

Equity Classified Awards - Stock Options

The estimated fair value of the stock options granted during the six months ended June 30, 2015 was calculated using a Black-Scholes option pricing model. The following summarizes the assumptions used in the Black-Scholes model:

Risk-free interest rate | 1.54 | % |

Weighted average historical volatility | 36.8 | % |

Dividend yield | 3.17 | % |

Expected years until exercise | 4.5 | |

Weighted average fair value of options granted | $27.20 | |

7

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

6. Stock-Based Compensation (Continued)

Stock option balances as of June 30, 2015 and related activity for the six months ended June 30, 2015 were as follows:

Shares | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term (in Years) | Aggregate Intrinsic Value (in Millions) | ||||||||

Outstanding at December 31, 2014 | 618,115 | $ | 53.10 | ||||||||

Granted | 133,814 | 111.54 | |||||||||

Exercised | (197,591 | ) | 42.38 | ||||||||

Forfeited | (14,348 | ) | 96.83 | ||||||||

Outstanding at June 30, 2015 | 539,990 | 70.35 | 7.4 | $17.1 | |||||||

Vested at June 30, 2015 and Expected to Vest | 507,678 | 68.37 | 7.2 | $16.9 | |||||||

Exercisable at June 30, 2015 | 324,927 | $ | 51.87 | 6.2 | $15.3 | ||||||

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference between the closing stock price of the Company’s common stock on the last trading day of the second quarter of 2015 and the exercise price, multiplied by the number of in-the-money options) that would have been received by the option holders had all option holders exercised their options on June 30, 2015. The aggregate intrinsic value will change based on the fair market value of the Company’s common stock and the number of in-the-money options.

Equity Classified Awards - Restricted Stock and Restricted Stock Units

Outstanding balances as of June 30, 2015 and activity related to restricted stock and restricted stock units for the six months ended June 30, 2015 were as follows:

Restricted Stock | Weighted Average Grant Date Fair Value | Restricted Stock Units | Weighted Average Grant Date Fair Value | |||||||||||

Outstanding at December 31, 2014 | 233,818 | $ | 70.14 | 41,622 | $ | 66.92 | ||||||||

Granted | 95,057 | 108.02 | 9,985 | 113.72 | ||||||||||

Released | (63,414 | ) | 52.93 | (16,567 | ) | 52.19 | ||||||||

Forfeited | (15,232 | ) | 79.83 | (72 | ) | 113.72 | ||||||||

Outstanding at June 30, 2015 | 250,229 | $ | 88.30 | 34,968 | $ | 86.49 | ||||||||

Liability Classified Awards - Long-Term Incentive Awards

The Company has granted cash long-term incentive awards (“LTIP awards”) to certain employees. Annual LTIP awards vest over a three-year period and are determined using a multiplier from 0% to 200% of the target award based on the total shareholder return of DineEquity, Inc. common stock compared to the total stockholder returns of a peer group of companies. Although LTIP awards are both denominated and paid only in cash, because the multiplier is based on the price of the Company's common stock, the awards are considered stock-based compensation in accordance with U.S. GAAP. For the three months ended June 30, 2015 and 2014, a credit of $1.1 million and an expense of $0.6 million, respectively, were included in total stock-based compensation expense related to the LTIP awards. For the six months ended June 30, 2015 and 2014, a credit of $0.8 million and an expense of $0.5 million, respectively, were included in total stock-based compensation expense related to the LTIP awards. At June 30, 2015 and December 31, 2014, liabilities of $1.1 million and $4.0 million, respectively, related to LTIP awards were included as part of accrued employee compensation and benefits in the Consolidated Balance Sheets.

7. Segments

The Company has two reportable segments: franchise operations (an aggregation of Applebee’s and IHOP franchise operations) and rental operations. The Company also has company-operated restaurant operations and financing operations, but neither of these operations exceeded 10% of consolidated revenues, income before income tax provision or total assets.

As of June 30, 2015, the franchise operations segment consisted of (i) 1,993 restaurants operated by Applebee’s franchisees in the United States, two U.S. territories and 15 countries outside the United States and (ii) 1,645 restaurants operated by IHOP franchisees and area licensees in the United States, two U.S. territories and eight countries outside the United States. Franchise operations revenue consists primarily of franchise royalty revenues, sales of proprietary products to franchisees (primarily

8

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

7. Segments (Continued)

pancake and waffle dry mixes for the IHOP restaurants), IHOP franchise advertising fees and franchise fees. Franchise operations expenses include IHOP advertising expenses, the cost of IHOP proprietary products, IHOP and Applebee's pre-opening training expenses and other franchise-related costs.

Rental operations revenue includes revenue from operating leases and interest income from direct financing leases. Rental operations expenses are costs of operating leases and interest expense from capital leases on franchisee-operated restaurants.

At June 30, 2015, the company restaurant operations segment consisted of 23 Applebee’s company-operated restaurants and 13 IHOP company-operated restaurants, all of which are located in the United States. Company restaurant sales are retail sales at company-operated restaurants. Company restaurant expenses are operating expenses at company-operated restaurants and include food, labor, utilities, rent and other restaurant operating costs.

Financing operations revenue primarily consists of interest income from the financing of franchise fees and equipment leases and sales of equipment associated with refranchised IHOP restaurants. Financing expenses are primarily the cost of restaurant equipment associated with refranchised IHOP restaurants.

Information on segments and a reconciliation to income before income tax provision for the three and six months ended June 30, 2015 and 2014 were as follows:

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | June 30, | |||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||

(In millions) | ||||||||||||||||

Revenues from external customers: | ||||||||||||||||

Franchise operations | $ | 120.3 | $ | 110.7 | $ | 244.8 | $ | 226.3 | ||||||||

Rental operations | 31.1 | 30.7 | 62.5 | 61.4 | ||||||||||||

Company restaurants | 17.4 | 15.7 | 34.8 | 32.0 | ||||||||||||

Financing operations | 2.7 | 3.4 | 5.3 | 8.0 | ||||||||||||

Total | $ | 171.5 | $ | 160.5 | $ | 347.4 | $ | 327.7 | ||||||||

Interest expense: | ||||||||||||||||

Rental operations | $ | 3.4 | $ | 3.7 | $ | 6.9 | $ | 7.6 | ||||||||

Company restaurants | 0.1 | 0.1 | 0.2 | 0.2 | ||||||||||||

Corporate | 15.7 | 24.9 | 31.3 | 49.9 | ||||||||||||

Total | $ | 19.2 | $ | 28.7 | $ | 38.4 | $ | 57.7 | ||||||||

Depreciation and amortization: | ||||||||||||||||

Franchise operations | $ | 2.6 | $ | 2.6 | $ | 5.2 | $ | 5.2 | ||||||||

Rental operations | 3.2 | 3.3 | 6.4 | 6.7 | ||||||||||||

Company restaurants | 0.2 | 0.5 | 0.4 | 1.0 | ||||||||||||

Corporate | 2.1 | 2.3 | 3.9 | 4.6 | ||||||||||||

Total | $ | 8.1 | $ | 8.7 | $ | 15.9 | $ | 17.5 | ||||||||

Income before income tax provision: | ||||||||||||||||

Franchise operations | $ | 86.2 | $ | 84.2 | $ | 175.2 | $ | 170.3 | ||||||||

Rental operations | 7.8 | 7.1 | 15.7 | 13.9 | ||||||||||||

Company restaurants | 0.1 | 0.1 | 0.9 | 0.2 | ||||||||||||

Financing operations | 2.7 | 3.1 | 5.3 | 7.2 | ||||||||||||

Corporate | (53.3 | ) | (63.4 | ) | (107.5 | ) | (126.8 | ) | ||||||||

Total | $ | 43.5 | $ | 31.1 | $ | 89.6 | $ | 64.8 | ||||||||

9

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

8. Net Income per Share

The computation of the Company's basic and diluted net income per share for the three and six months ended June 30, 2015 and 2014 was as follows:

Three Months Ended | Six Months Ended | ||||||||||||||

June 30, | June 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(In thousands, except per share data) | |||||||||||||||

Numerator for basic and dilutive income per common share: | |||||||||||||||

Net income | $ | 26,897 | $ | 19,167 | $ | 55,309 | $ | 39,991 | |||||||

Less: Net income allocated to unvested participating restricted stock | (359 | ) | (307 | ) | (726 | ) | (649 | ) | |||||||

Net income available to common stockholders - basic | 26,538 | 18,860 | 54,583 | 39,342 | |||||||||||

Effect of unvested participating restricted stock in two-class calculation | 1 | 1 | 2 | 2 | |||||||||||

Net income available to common stockholders - diluted | $ | 26,539 | $ | 18,861 | $ | 54,585 | $ | 39,344 | |||||||

Denominator: | |||||||||||||||

Weighted average outstanding shares of common stock - basic | 18,763 | 18,776 | 18,819 | 18,785 | |||||||||||

Dilutive effect of stock options | 132 | 179 | 140 | 218 | |||||||||||

Weighted average outstanding shares of common stock - diluted | 18,895 | 18,955 | 18,959 | 19,003 | |||||||||||

Net income per common share: | |||||||||||||||

Basic | $ | 1.41 | $ | 1.00 | $ | 2.90 | $ | 2.09 | |||||||

Diluted | $ | 1.40 | $ | 1.00 | $ | 2.88 | $ | 2.07 | |||||||

9. Fair Value Measurements

The Company does not have a material amount of financial assets or liabilities that are required under U.S. GAAP to be measured on a recurring basis at fair value. The Company is not a party to any derivative financial instruments. The Company does not have a material amount of non-financial assets or non-financial liabilities that are required under U.S. GAAP to be measured at fair value on a recurring basis. The Company has not elected to use the fair value measurement option, as permitted under U.S. GAAP, for any assets or liabilities for which fair value measurement is not presently required.

The Company believes the fair values of cash equivalents, accounts receivable and accounts payable approximate their carrying amounts due to their short duration.

The fair values of the Company's Series 2014-1 Class A Notes at June 30, 2015 and December 31, 2014 were as follows:

June 30, 2015 | December 31, 2014 | |||||||||||||||

Carrying Amount | Fair Value | Carrying Amount | Fair Value | |||||||||||||

(In millions) | ||||||||||||||||

Long-term debt | $ | 1,300.0 | $ | 1,317.1 | $ | 1,300.0 | $ | 1,302.0 | ||||||||

The fair values were determined based on Level 2 inputs, including information gathered from brokers who trade in the Company’s notes and information on notes that are similar to that of the Company.

10

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

10. Commitments and Contingencies

Litigation, Claims and Disputes

The Company is subject to various lawsuits, administrative proceedings, audits and claims arising in the ordinary course of business. Some of these lawsuits purport to be class actions and/or seek substantial damages. The Company is required under U.S. GAAP to record an accrual for litigation loss contingencies that are both probable and reasonably estimable. Legal fees and expenses associated with the defense of all of the Company's litigation are expensed as such fees and expenses are incurred. Management regularly assesses the Company's insurance coverage, analyzes litigation information with the Company's attorneys and evaluates the Company's loss experience in connection with pending legal proceedings. While the Company does not presently believe that any of the legal proceedings to which it is currently a party will ultimately have a material adverse impact on the Company, there can be no assurance that the Company will prevail in all the proceedings the Company is party to, or that the Company will not incur material losses from them.

Lease Guarantees

In connection with the sale of Applebee’s restaurants or previous brands to franchisees and other parties, the Company has, in certain cases, guaranteed or has potential continuing liability for lease payments totaling $368.1 million as of June 30, 2015. This amount represents the maximum potential liability for future payments under these leases. These leases have been assigned to the buyers and expire at the end of the respective lease terms, which range from 2015 through 2048. In the event of default, the indemnity and default clauses in the sale or assignment agreements govern the Company's ability to pursue and recover damages incurred. No lease payment guarantee liabilities have been recorded as of June 30, 2015.

11. Subsequent Event

On July 23, 2015, the Company completed the previously announced refranchising and sale of related restaurant assets of 23 Applebee’s company-operated restaurants located in a two-state market area geographically centered around Kansas City, Missouri. The Company received proceeds of approximately $9 million and expects to recognize a gain of approximately $2 million on the transaction.

11

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Cautionary Statement Regarding Forward-Looking Statements

Statements contained in this report may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors, which may cause actual results to be materially different from those expressed or implied in such statements. You can identify these forward-looking statements by words such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan” and other similar expressions. You should consider our forward-looking statements in light of the risks discussed under the heading “Risk Factors” in our most recent Annual Report on Form 10-K, as well as our consolidated financial statements, related notes, and the other financial information appearing elsewhere in this report and our other filings with the United States Securities and Exchange Commission. The forward-looking statements contained in this report are made as of the date hereof and the Company assumes no obligation to update or supplement any forward-looking statements.

You should read the following Management's Discussion and Analysis of Financial Condition and Results of Operations in conjunction with the consolidated financial statements and the related notes that appear elsewhere in this report.

Overview

The following discussion and analysis provides information we believe is relevant to an assessment and understanding of our consolidated results of operations and financial condition. The discussion should be read in conjunction with the consolidated financial statements and the notes thereto included in Item 1 of Part I of this Quarterly Report and the audited consolidated financial statements and notes thereto and Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014. Except where the context indicates otherwise, the words “we,” “us,” “our” and the “Company” refer to DineEquity, Inc., together with its subsidiaries that are consolidated in accordance with United States generally accepted accounting principles (“U.S. GAAP”).

Through various subsidiaries, we own, franchise and operate two restaurant concepts: Applebee's Neighborhood Grill & Bar® (“Applebee's®”), in the bar and grill segment within the casual dining category of the restaurant industry, and International House of Pancakes® (“IHOP®”), in the family dining category of the restaurant industry. References herein to Applebee's and IHOP restaurants are to these two restaurant concepts, whether operated by franchisees, area licensees or by us. With over 3,600 restaurants combined, 99% of which are franchised, we believe we are one of the largest full-service restaurant companies in the world. The June 15, 2015 issue of Nation's Restaurant News recently reported that IHOP and Applebee's were the largest restaurants in their respective categories in terms of United States system-wide sales during 2014. This marks the eighth consecutive year our two brands have achieved the number one ranking.

Summary Results of Operations

Three Months Ended | Favorable (Unfavorable) Variance | Six Months Ended | Favorable (Unfavorable) Variance | |||||||||||||||||||||

June 30, | June 30, | |||||||||||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||||||||||

(In millions, except per share information) | ||||||||||||||||||||||||

Revenue | $ | 171.5 | $ | 160.5 | $ | 11.0 | $ | 347.4 | $ | 327.7 | $ | 19.7 | ||||||||||||

Gross profit | $ | 96.8 | $ | 94.5 | $ | 2.3 | $ | 197.1 | $ | 191.6 | $ | 5.5 | ||||||||||||

General and administrative expenses | 34.6 | 34.8 | 0.2 | 68.8 | 69.0 | 0.2 | ||||||||||||||||||

Interest expense | 15.7 | 24.9 | 9.2 | 31.3 | 49.9 | 18.6 | ||||||||||||||||||

Other expenses, net (1) | 3.0 | 3.6 | 0.6 | 7.4 | 7.8 | 0.4 | ||||||||||||||||||

Income tax provision | 16.6 | 12.0 | (4.6 | ) | 34.3 | 24.9 | (9.4 | ) | ||||||||||||||||

Net income | $ | 26.9 | $ | 19.2 | $ | 7.7 | $ | 55.3 | $ | 40.0 | $ | 15.3 | ||||||||||||

Net income per diluted share | $ | 1.40 | $ | 1.00 | $ | 0.40 | $ | 2.88 | $ | 2.07 | $ | 0.81 | ||||||||||||

___________________________________

(1) Amortization of intangible assets, closure and impairment charges, loss on extinguishment of debt and gain or loss on disposition of assets.

Net income for the three and six months ended June 30, 2015 increased 40.3% and 38.3%, respectively, compared with the same periods of the prior year. In each case, the improvement was due to (i) significantly lower interest expense resulting from the refinancing of our long-term debt in the fourth quarter of 2014 at a fixed interest rate approximately 3% lower than prior to the refinancing and (ii) revenue and gross profit growth, primarily stemming from an increase in IHOP and Applebee's domestic same-restaurant sales and IHOP restaurant development over the past twelve months.

12

Key Performance Indicators

In evaluating the performance of each restaurant concept, we consider the key performance indicators to be net franchise restaurant development and the percentage change in domestic system-wide same-restaurant sales. Since we are a 99% franchised company, expanding the number of Applebee's and IHOP franchise restaurants is an important driver of revenue growth because we currently do not plan to open any new company-operated restaurants. Further, while refranchising or renewals may result in new rental and financing agreements, we currently do not plan to significantly expand our rental and financing operations, legacies from the IHOP business model we operated under prior to 2003. Growth in both the number of franchise restaurants and sales at those restaurants will drive franchise revenues in the form of higher royalty revenues, additional franchise fees and, in the case of IHOP restaurants, sales of proprietary pancake and waffle dry mix.

An overview of these key performance indicators for the three and six months ended June 30, 2015 is as follows:

Three Months Ended | Six Months Ended | ||||||

June 30, 2015 | June 30, 2015 | ||||||

Applebee's | IHOP | Applebee's | IHOP | ||||

Percentage increase in domestic system-wide same-restaurant sales | 1.0% | 6.2% | 2.0% | 5.5% | |||

Net franchise restaurant (reduction) development (1) | 2 | 8 | (1) | 8 | |||

___________________________________

(1) Franchise and area license openings, net of closings

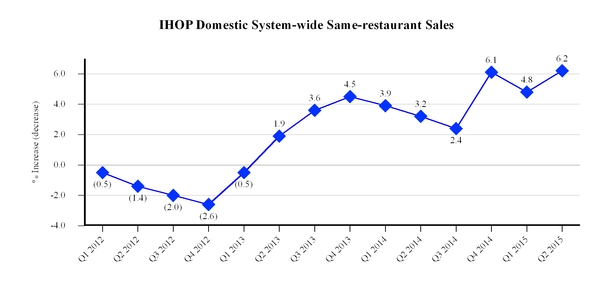

The 6.2% increase in IHOP domestic system-wide same-restaurant sales for the three months ended June 30, 2015 was the ninth consecutive quarter of positive same-restaurant sales for IHOP and was the largest quarterly increase since the first quarter of 2004. Coupled with an increase of 4.8% in the first quarter of 2015, IHOP domestic system-wide same-restaurant sales increased 5.5% for the six months ended June 30, 2015. The increases for both the three and six months ended June 30, 2015 resulted from a higher average customer check and an increase in customer traffic. According to industry data, IHOP has outperformed the overall restaurant industry as well as the family dining segment in domestic system-wide same-restaurant sales in the first half of 2015. Based on data from Black Box Intelligence, a restaurant sales reporting firm (“Black Box”), during the six months ended June 30, 2015, both the family dining segment and the overall restaurant industry experienced an increase in average customer check that was partially offset by a decrease in customer traffic.

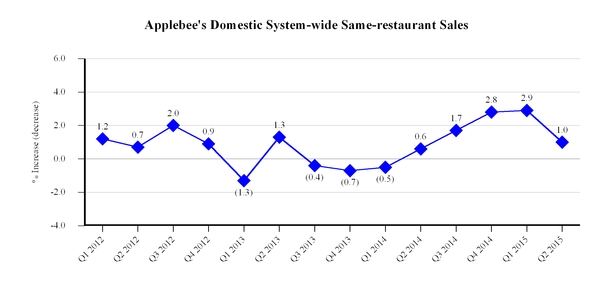

The 1.0% increase in Applebee's domestic system-wide same-restaurant sales for the three months ended June 30, 2015 was the fifth consecutive quarter of positive same-restaurant sales for Applebee's. This represents a decline from the 2.9% increase in the first quarter of 2015, and as a result, for the six months ended June 30, 2015, Applebee's domestic system-wide same-restaurant sales increased 2.0%. The increases for both the three and six months ended June 30, 2015 were due to a higher average customer check partially offset by a decline in customer traffic. Based on data from Black Box, Applebee's domestic system-wide same-restaurant sales performance during the six months ended June 30, 2015 was slightly lower than that of the casual dining segment, which experienced a larger increase in average customer check that was partially offset by a similar decrease in customer traffic.

During the six months ended June 30, 2015, Applebee's franchisees opened 14 new restaurants and closed 15 restaurants, resulting in a net decrease of one Applebee's franchise restaurant for the first half of 2015. IHOP franchisees opened 18 new restaurants and closed 10 restaurants, resulting in net IHOP franchise restaurant development of eight restaurants during 2015 to date. Typically, the majority of gross and net franchise restaurant development for each brand takes place in the second half of any given year.

Franchise restaurant closures take place each year for a variety of reasons. The number of Applebee's and IHOP restaurants that were closed during the first six months of 2015 is slightly less than the number that were closed during the first six months of 2014, but that is not considered to be indicative of any trend.

In 2015, we expect IHOP franchisees to open between 50 to 60 new restaurants and Applebee's franchisees to open between 30 to 40 new restaurants. The majority of openings for each brand is expected to be in domestic markets. The actual number of openings in 2015 may differ from both our expectations and development commitments. Historically, the actual number of restaurants developed in a particular year has been less than the total number committed to be developed due to various factors, including economic conditions and franchisee noncompliance with restaurant opening commitments in development agreements. The timing of new restaurant openings also may be affected by various factors including weather-related and other construction delays, difficulties in obtaining timely regulatory approvals and the impact of currency fluctuations on our international franchisees.

13

Additional detail on each of these key performance indicators is presented under the captions “Restaurant Development Activity” and “Restaurant Data” that follow.

In evaluating the performance of the consolidated enterprise, we consider the key performance indicators to be cash flows from operating activities and free cash flow (cash from operations, plus net receipts from notes and equipment contract receivables, less capital expenditures).

Our cash flows from operating activities and free cash flow for the six months ended June 30, 2015 and 2014 were as follows:

Six Months Ended | |||||||||||

June 30, | Increase | ||||||||||

2015 | 2014 | (Decrease) | |||||||||

(In millions) | |||||||||||

Cash flows from operating activities | $ | 48.1 | $ | 56.0 | $ | (7.9 | ) | ||||

Free cash flow | $ | 49.7 | $ | 54.6 | $ | (4.9 | ) | ||||

The decrease in cash flows from operating activities and free cash flow was primarily due to the impact on working capital of the timing of income tax and interest payments, partially offset by an increase in net income. Additional detail is presented under the caption “Liquidity and Capital Resources.”

Restaurant Development Activity

Three Months Ended | Six Months Ended | ||||||||||

June 30, | June 30, | ||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||

(Unaudited) | |||||||||||

Applebee's Restaurant Development Activity | |||||||||||

Summary - beginning of period: | |||||||||||

Franchise | 1,991 | 1,988 | 1,994 | 1,988 | |||||||

Company restaurants | 23 | 23 | 23 | 23 | |||||||

Total Applebee's restaurants, beginning of period | 2,014 | 2,011 | 2,017 | 2,011 | |||||||

Franchise restaurants opened: | |||||||||||

Domestic | 6 | 5 | 10 | 13 | |||||||

International | 2 | 1 | 4 | 1 | |||||||

Total franchise restaurants opened | 8 | 6 | 14 | 14 | |||||||

Franchise restaurants closed: | |||||||||||

Domestic | (4 | ) | (5 | ) | (8 | ) | (10 | ) | |||

International | (2 | ) | (3 | ) | (7 | ) | (6 | ) | |||

Total franchise restaurants closed | (6 | ) | (8 | ) | (15 | ) | (16 | ) | |||

Net franchise restaurant development (reduction) | 2 | (2 | ) | (1 | ) | (2 | ) | ||||

Summary - end of period: | |||||||||||

Franchise | 1,993 | 1,986 | 1,993 | 1,986 | |||||||

Company restaurants (1) | 23 | 23 | 23 | 23 | |||||||

Total Applebee's restaurants, end of period | 2,016 | 2,009 | 2,016 | 2,009 | |||||||

__________________________________

(1) On July 23, 2015, we completed the previously announced refranchising and sale of related restaurant assets of the Applebee’s company-operated restaurants.

14

Three Months Ended | Six Months Ended | ||||||||||

June 30, | June 30, | ||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||

(Unaudited) | |||||||||||

IHOP Restaurant Development Activity | |||||||||||

Summary - beginning of period: | |||||||||||

Franchise | 1,470 | 1,449 | 1,472 | 1,439 | |||||||

Area license | 167 | 168 | 167 | 168 | |||||||

Company | 13 | 10 | 11 | 13 | |||||||

Total IHOP restaurants, beginning of period | 1,650 | 1,627 | 1,650 | 1,620 | |||||||

Franchise/area license restaurants opened: | |||||||||||

Domestic franchise | 7 | 7 | 13 | 16 | |||||||

Domestic area license | 1 | 1 | 2 | 2 | |||||||

International franchise | 3 | 5 | 3 | 9 | |||||||

Total franchise/area license restaurants opened | 11 | 13 | 18 | 27 | |||||||

Franchise/area license restaurants closed: | |||||||||||

Domestic franchise | (1 | ) | (6 | ) | (7 | ) | (11 | ) | |||

Domestic area license | (2 | ) | (2 | ) | (3 | ) | (2 | ) | |||

International franchise | — | — | — | (1 | ) | ||||||

International area license | — | — | — | (1 | ) | ||||||

Total franchise/area license restaurants closed | (3 | ) | (8 | ) | (10 | ) | (15 | ) | |||

Net franchise/area license restaurant development | 8 | 5 | 8 | 12 | |||||||

Refranchised from Company restaurants | — | 1 | 1 | 4 | |||||||

Franchise restaurants reacquired by the Company | — | (1 | ) | (3 | ) | (1 | ) | ||||

Net franchise/area license restaurant additions | 8 | 5 | 6 | 15 | |||||||

Summary - end of period: | |||||||||||

Franchise | 1,479 | 1,455 | 1,479 | 1,455 | |||||||

Area license | 166 | 167 | 166 | 167 | |||||||

Company | 13 | 10 | 13 | 10 | |||||||

Total IHOP restaurants, end of period | 1,658 | 1,632 | 1,658 | 1,632 | |||||||

15

Restaurant Data

The following table sets forth the number of “Effective Restaurants” in the Applebee’s and IHOP systems and information regarding the percentage change in sales at those restaurants compared to the same periods in the prior year. Sales at restaurants that are owned by franchisees and area licensees are not attributable to the Company. However, we believe that presentation of this information is useful in analyzing our revenues because franchisees and area licensees pay us royalties and advertising fees that are generally based on a percentage of their sales, and, where applicable, rental payments under leases that partially may be based on a percentage of their sales. Management also uses this information to make decisions about future plans for the development of additional restaurants as well as evaluation of current operations.

Three Months Ended | Six Months Ended | ||||||||||||||||

— | June 30, | June 30, | |||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||||

(Unaudited) | |||||||||||||||||

Applebee's Restaurant Data | |||||||||||||||||

Effective Restaurants(a) | |||||||||||||||||

Franchise | 1,990 | 1,985 | 1,991 | 1,985 | |||||||||||||

Company | 23 | 23 | 23 | 23 | |||||||||||||

Total | 2,013 | 2,008 | 2,014 | 2,008 | |||||||||||||

System-wide(b) | |||||||||||||||||

Sales percentage change(c) | 2.0 | % | 0.6 | % | 2.9 | % | (0.1 | )% | |||||||||

Domestic same-restaurant sales percentage change(d) | 1.0 | % | 0.6 | % | 2.0 | % | 0.0 | % | |||||||||

Franchise(b) | |||||||||||||||||

Sales percentage change(c) | 2.0 | % | 0.6 | % | 2.9 | % | (0.1 | )% | |||||||||

Domestic same-restaurant sales percentage change(d) | 1.0 | % | 0.6 | % | 2.0 | % | 0.1 | % | |||||||||

Average weekly domestic unit sales (in thousands) | $ | 48.9 | $ | 48.2 | $ | 50.0 | $ | 48.8 | |||||||||

IHOP Restaurant Data | |||||||||||||||||

Effective Restaurants(a) | |||||||||||||||||

Franchise | 1,471 | 1,448 | 1,471 | 1,444 | |||||||||||||

Area license | 167 | 167 | 167 | 167 | |||||||||||||

Company | 13 | 10 | 13 | 11 | |||||||||||||

Total | 1,651 | 1,625 | 1,651 | 1,622 | |||||||||||||

System-wide(b) | |||||||||||||||||

Sales percentage change(c) | 7.1 | % | 6.0 | % | 6.6 | % | 6.2 | % | |||||||||

Domestic same-restaurant sales percentage change(d) | 6.2 | % | 3.2 | % | 5.5 | % | 3.6 | % | |||||||||

Franchise(b) | |||||||||||||||||

Sales percentage change(c) | 6.8 | % | 6.1 | % | 6.4 | % | 6.3 | % | |||||||||

Domestic same-restaurant sales percentage change(d) | 6.2 | % | 3.2 | % | 5.5 | % | 3.6 | % | |||||||||

Average weekly domestic unit sales (in thousands) | $ | 37.4 | $ | 35.6 | $ | 37.6 | $ | 36.4 | |||||||||

Area License(b) | |||||||||||||||||

Sales percentage change(c) | 7.7 | % | 5.8 | % | 7.4 | % | 6.9 | % | |||||||||

16

(a) “Effective Restaurants” are the weighted average number of restaurants open in a given fiscal period, adjusted to account for restaurants open for only a portion of the period. Information is presented for all Effective Restaurants in the Applebee’s and IHOP systems, which includes restaurants owned by franchisees and area licensees as well as those owned by the Company.

(b) “System-wide sales” are retail sales at Applebee’s restaurants operated by franchisees and IHOP restaurants operated by franchisees and area licensees, as reported to the Company, in addition to retail sales at company-operated restaurants. Sales at restaurants that are owned by franchisees and area licensees are not attributable to the Company. Unaudited reported sales for Applebee's domestic franchise restaurants, IHOP franchise restaurants and IHOP area license restaurants were as follows:

Three Months Ended | Six Months Ended | ||||||||||||||

June 30, | June 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Reported sales (unaudited) | (In millions) | ||||||||||||||

Applebee's domestic franchise restaurant sales | $ | 1,174.6 | $ | 1,150.7 | $ | 2,400.6 | $ | 2,333.8 | |||||||

IHOP franchise restaurant sales | $ | 715.1 | $ | 669.5 | $ | 1,436.4 | $ | 1,349.8 | |||||||

IHOP area license restaurant sales | $ | 69.8 | $ | 64.8 | $ | 144.8 | $ | 134.9 | |||||||

(c) “Sales percentage change” reflects, for each category of restaurants, the percentage change in sales in any given fiscal period compared to the prior fiscal period for all restaurants in that category.

(d) “Domestic same-restaurant sales percentage change” reflects the percentage change in sales in any given fiscal period, compared to the same weeks in the prior fiscal period, for domestic restaurants that have been operated throughout both fiscal periods that are being compared and have been open for at least 18 months. Because of new unit openings and restaurant closures, the domestic restaurants open throughout both fiscal periods being compared may be different from period to period. Domestic same-restaurant sales percentage change does not include data on IHOP area license restaurants.

17

Significant Known Events, Trends or Uncertainties Impacting or Expected to Impact Comparisons of Reported or Future Results

Same-restaurant Sales Trends

Applebee’s domestic system-wide same-restaurant sales increased 1.0% for the three months ended June 30, 2015 from the same period in 2014. This marks the fifth consecutive quarter of positive same-restaurant sales. The increase resulted from a higher average customer check partially offset by a decline in customer traffic. Same-restaurant sales for the second quarter of 2015 are not necessarily indicative of results expected for the full year.

IHOP’s domestic system-wide same-restaurant sales increased 6.2% for the three months ended June 30, 2015 from the same period in 2014. The increase resulted from a higher average customer check and an increase in customer traffic, which increased for the fourth consecutive quarter. The increased annual contribution percentage of restaurant gross sales to the IHOP National Advertising Fund by a large majority of IHOP franchisees continues to have a positive impact on sales and traffic. Same-restaurant sales for the second quarter of 2015 are not necessarily indicative of results expected for the full year.

Based on data from Black Box, during the six months ended June 30, 2015, customer traffic declined for the overall restaurant industry as well as for both the casual dining and family dining segments of the restaurant industry. During the second quarter of 2015, we experienced an increase in IHOP customer traffic and a decline in Applebee's customer traffic. In the short term, a decline in customer traffic may be offset by an increase in average customer check resulting from an increase in menu prices, a favorable change in product sales mix, or a combination thereof. A sustained decline in same-restaurant customer traffic that cannot be offset by an increase in average customer check could have an adverse effect on our business, results of operations and financial condition.

18

We strive to identify and create opportunities for growth in customer traffic and frequency, average check and same-restaurant sales. We focus on building our brands with a long-term view through a strategic combination of menu, media, remodel and development initiatives to continually innovate and evolve both brands. To drive each brand forward, we seek to innovate and remain actively focused on driving sustainable sales and traffic.

53rd Week in Fiscal 2015

We have a 52/53 week fiscal year that ends on the Sunday nearest to December 31 of each year. In a 52-week fiscal year, each fiscal quarter contains 13 weeks, comprised of two, four-week fiscal months followed by a five-week fiscal month. In a 53-week fiscal year, the last month of the fourth fiscal quarter contains six weeks. Our fiscal 2015, which began on December 29, 2014, will end on January 3, 2016 and will contain 53 weeks.

CONSOLIDATED RESULTS OF OPERATIONS

Comparison of the Three and Six Months Ended June 30, 2015 and 2014

REVENUE | Three Months Ended | Favorable (Unfavorable) Variance | Six Months Ended | Favorable (Unfavorable) Variance | ||||||||||||||||||||

June 30, | June 30, | |||||||||||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||||||||||

(In millions) | ||||||||||||||||||||||||

Franchise operations | $ | 120.3 | $ | 110.7 | $ | 9.6 | $ | 244.8 | $ | 226.3 | $ | 18.5 | ||||||||||||

Rental operations | 31.1 | 30.7 | 0.4 | 62.5 | 61.4 | 1.1 | ||||||||||||||||||

Company restaurant operations | 17.4 | 15.7 | 1.7 | 34.8 | 32.0 | 2.8 | ||||||||||||||||||

Financing operations | 2.7 | 3.4 | (0.7 | ) | 5.3 | 8.0 | (2.7 | ) | ||||||||||||||||

Total revenue | $ | 171.5 | $ | 160.5 | $ | 11.0 | $ | 347.4 | $ | 327.7 | $ | 19.7 | ||||||||||||

Change vs. prior period | 6.9 | % | 6.0 | % | ||||||||||||||||||||

The improvement in total revenue for the three months ended June 30, 2015 compared with the same period of the prior year was primarily due to (i) higher IHOP advertising revenues resulting from an agreement with a large majority of franchisees to increase the advertising contribution as a percentage of gross sales, (ii) higher franchise and rental revenues that resulted from a 6.2% increase in IHOP domestic same-restaurant sales, (iii) a 1.0% increase in Applebee's domestic same-restaurant sales and (iv) IHOP restaurant development over the past twelve months. These favorable items were partially offset by the expected progressive decline in interest revenue from rental and financing operations.

The improvement in total revenue for the six months ended June 30, 2015 compared with the same period of the prior year was primarily due to (i) higher IHOP advertising revenues resulting from an agreement with a large majority of franchisees to increase the advertising contribution as a percentage of gross sales, (ii) higher franchise and rental revenues that resulted from a 5.5% increase in IHOP domestic same-restaurant sales, (iii) a 2.0% increase in Applebee's domestic same-restaurant sales and (iv) IHOP restaurant development over the past twelve months. These favorable items were partially offset by a decline in financing revenues of $1.4 million associated with the early termination of two leases in the first quarter of 2014 that did not recur in 2015, as well as the expected progressive decline in interest revenue from rental and financing operations.

GROSS PROFIT (LOSS) | Three Months Ended | Favorable (Unfavorable) Variance | Six Months Ended | Favorable (Unfavorable) Variance | ||||||||||||||||||||

June 30, | June 30, | |||||||||||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||||||||||

(In millions) | ||||||||||||||||||||||||

Franchise operations | $ | 86.2 | $ | 84.2 | $ | 2.0 | $ | 175.2 | $ | 170.3 | $ | 4.9 | ||||||||||||

Rental operations | 7.8 | 7.1 | 0.7 | 15.7 | 13.9 | 1.8 | ||||||||||||||||||

Company restaurant operations | 0.1 | 0.1 | 0.0 | 0.9 | 0.2 | 0.7 | ||||||||||||||||||

Financing operations | 2.7 | 3.1 | (0.4 | ) | 5.3 | 7.2 | (1.9 | ) | ||||||||||||||||

Total gross profit | $ | 96.8 | $ | 94.5 | $ | 2.3 | $ | 197.1 | $ | 191.6 | $ | 5.5 | ||||||||||||

Change vs. prior period | 2.4 | % | 2.9 | % | ||||||||||||||||||||

19

The improvement in total gross profit for the three months ended June 30, 2015 compared with the same period of the prior year was primarily due to higher franchise and rental revenues that resulted from the increase in IHOP domestic same-restaurant sales, IHOP restaurant development over the past twelve months and the increase in Applebee's domestic same-restaurant sales, partially offset by the expected progressive decline in interest revenue from rental and financing operations. The improvement in total gross profit for the six months ended June 30, 2015 compared with the same period of the prior year was due to these same factors, offset in part by the decline in financing revenues of $1.4 million associated with the early termination of two leases as discussed under “Revenue” above.

FRANCHISE OPERATIONS | Three Months Ended | Favorable (Unfavorable) Variance | Six Months Ended | Favorable (Unfavorable) Variance | ||||||||||||||||||||

June 30, | June 30, | |||||||||||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||||||||||

(In millions, except number of restaurants) | ||||||||||||||||||||||||

Effective Franchise Restaurants:(1) | ||||||||||||||||||||||||

Applebee’s | 1,990 | 1,985 | 5 | 1,991 | 1,985 | 6 | ||||||||||||||||||

IHOP | 1,638 | 1,615 | 23 | 1,638 | 1,611 | 27 | ||||||||||||||||||

Franchise Revenues: | ||||||||||||||||||||||||

Applebee’s | $ | 49.9 | $ | 50.0 | $ | (0.1 | ) | $ | 102.3 | $ | 100.8 | $ | 1.5 | |||||||||||

IHOP | 44.1 | 40.0 | 4.1 | 89.5 | 83.6 | 5.9 | ||||||||||||||||||

IHOP advertising | 26.3 | 20.7 | 5.6 | 53.0 | 41.9 | 11.1 | ||||||||||||||||||

Total franchise revenues | 120.3 | 110.7 | 9.6 | 244.8 | 226.3 | 18.5 | ||||||||||||||||||

Franchise Expenses: | ||||||||||||||||||||||||

Applebee’s | 1.7 | 1.2 | (0.5 | ) | 3.3 | 2.7 | (0.6 | ) | ||||||||||||||||

IHOP | 6.1 | 4.6 | (1.5 | ) | 13.3 | 11.4 | (1.9 | ) | ||||||||||||||||

IHOP advertising | 26.3 | 20.7 | (5.6 | ) | 53.0 | 41.9 | (11.1 | ) | ||||||||||||||||

Total franchise expenses | 34.1 | 26.5 | (7.6 | ) | 69.6 | 56.0 | (13.6 | ) | ||||||||||||||||

Franchise Segment Profit: | ||||||||||||||||||||||||

Applebee’s | 48.2 | 48.8 | (0.6 | ) | 99.0 | 98.1 | 0.9 | |||||||||||||||||

IHOP | 38.0 | 35.4 | 2.6 | 76.2 | 72.2 | 4.0 | ||||||||||||||||||

Total franchise segment profit | $ | 86.2 | $ | 84.2 | $ | 2.0 | $ | 175.2 | $ | 170.3 | $ | 4.9 | ||||||||||||

Gross profit as % of revenue (2) | 71.7 | % | 76.0 | % | 71.6 | % | 75.3 | % | ||||||||||||||||

_____________________________________________________

(1) Effective Franchise Restaurants are the weighted average number of franchise and area license restaurants open in a given fiscal period, adjusted to account for restaurants open for only a portion of the period.

(2) Percentages calculated on actual amounts, not rounded amounts presented above.

Applebee’s franchise revenue for the three months ended June 30, 2015 decreased slightly from the same period of the prior year, as lower franchise extension and transfer fees were partially offset by a 1.0% increase in domestic same-restaurant sales. Applebee’s franchise revenue for the six months ended June 30, 2015 increased 1.5% from the same period of the prior year, primarily due to a 2.0% increase in domestic same-restaurant sales and a 0.3% increase in the number of Effective Franchise Restaurants open during the period, partially offset by lower franchise extension and transfer fees.

Applebee's franchise expenses for the three and six months ended June 30, 2015 increased primarily due to adjustments to insurance reserves.

The 10.2% increase in IHOP franchise revenue (other than advertising) for the three months ended June 30, 2015 was primarily due to higher royalty revenues resulting from a 6.2% increase in domestic same-restaurant sales, a $1.6 million increase in sales volumes of pancake and waffle dry mix and a 1.4% increase in Effective Franchise Restaurants. The 7.1% increase in IHOP franchise revenue (other than advertising) for the six months ended June 30, 2015 was primarily due to higher royalty revenues resulting from a 5.5% increase in domestic same-restaurant sales a $1.8 million increase in sales volumes of pancake and waffle dry mix and a 1.7% increase in Effective Franchise Restaurants.

The increases in IHOP franchise expenses (other than advertising) for the three and six months ended June 30, 2015 compared with the same periods of the prior year were due to higher purchase volumes of pancake and waffle dry mix, as well as an increase in bad debt expense. The majority of the increase in bad debt expense was due to the favorable recovery of fully reserved receivables in 2014 that did not recur in 2015.

20

IHOP’s total franchise expenses are substantially higher than Applebee’s, primarily due to advertising expenses. Advertising contributions designated for IHOP’s national advertising fund and local marketing and advertising cooperatives are recognized as revenue and expense of franchise operations. However, because we have less contractual control over Applebee’s advertising expenditures, that activity is considered to be an agency relationship and therefore is not recognized as franchise revenue and expense. The increases in IHOP advertising revenue and expense for the three and six months ended June 30, 2015 were due to higher contributions to marketing funds by IHOP franchisees. Franchisee contributions to marketing funds were impacted by an agreement with a large majority of franchisees to increase the advertising contribution as a percentage of gross sales effective June 30, 2014, as well as by the increases in domestic franchise same-restaurant sales and the new franchise restaurants that favorably impacted IHOP franchise revenue (other than advertising) as discussed above.

RENTAL OPERATIONS | Three Months Ended | Favorable (Unfavorable) Variance | Six Months Ended | Favorable (Unfavorable) Variance | ||||||||||||||||||||

June 30, | June 30, | |||||||||||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||||||||||

(In millions) | ||||||||||||||||||||||||

Rental revenues | $ | 31.1 | $ | 30.7 | $ | 0.4 | $ | 62.5 | $ | 61.4 | $ | 1.1 | ||||||||||||

Rental expenses | 23.3 | 23.6 | 0.3 | 46.8 | 47.5 | 0.7 | ||||||||||||||||||

Rental operations segment profit | $ | 7.8 | $ | 7.1 | $ | 0.7 | $ | 15.7 | $ | 13.9 | $ | 1.8 | ||||||||||||

Gross profit as % of revenue (1) | 25.1 | % | 23.0 | % | 25.1 | % | 22.7 | % | ||||||||||||||||

_____________________________________________________

(1) Percentages calculated on actual amounts, not rounded amounts presented above.

Rental operations relate primarily to IHOP franchise restaurants. Rental income includes revenue from operating leases and interest income from direct financing leases. Rental expenses are costs of prime operating leases and interest expense on prime capital leases on certain franchise restaurants.

Rental segment revenue for the three and six months ended June 30, 2015 increased compared to the same periods of the prior year primarily due to the favorable impact of the increase in IHOP same-restaurant sales on operating leases with sales-contingent rental provisions, partially offset by expected progressive declines of $0.2 million and $0.5 million, respectively, in interest income as direct financing leases are repaid. Rental segment expenses decreased for the three and six months ended June 30, 2015 compared to the same period of the prior year due to the expected progressive decline in interest expense as capital lease obligations are repaid.

FINANCING OPERATIONS | Three Months Ended | Favorable (Unfavorable) Variance | Six Months Ended | Favorable (Unfavorable) Variance | ||||||||||||||||||||

June 30, | June 30, | |||||||||||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||||||||||

(In millions) | ||||||||||||||||||||||||

Financing revenues | $ | 2.7 | $ | 3.4 | $ | (0.7 | ) | $ | 5.3 | $ | 8.0 | $ | (2.7 | ) | ||||||||||

Financing expenses | — | 0.3 | 0.3 | 0.0 | 0.8 | 0.8 | ||||||||||||||||||

Financing operations segment profit | $ | 2.7 | $ | 3.1 | $ | (0.4 | ) | $ | 5.3 | $ | 7.2 | $ | (1.9 | ) | ||||||||||

Gross profit as % of revenue (1) | 100.0 | % | 92.9 | % | 99.8 | % | 89.7 | % | ||||||||||||||||

_____________________________________________________

(1) Percentages calculated on actual amounts, not rounded amounts presented above.

All financing operations relate to IHOP franchise restaurants. Financing revenues primarily consist of interest income from the financing of equipment leases and franchise fees, as well as sales of equipment associated with refranchised IHOP restaurants. Financing expenses are primarily the cost of restaurant equipment associated with refranchised IHOP restaurants.

The decrease in financing revenue for the three months ended June 30, 2015 was due to a decrease in sales of equipment associated with refranchised IHOP restaurants and the expected progressive decline in interest revenue as note balances are repaid. The decrease in financing revenue for the six months ended June 30, 2015 was primarily due to fees of $1.4 million associated with the negotiated early termination of two leases in the first quarter of 2014 that did not recur in 2015, a decrease in sales of equipment associated with refranchised IHOP restaurants and the expected progressive decline in interest revenue as note balances are repaid. The decrease in financing expenses for the three and six months ended June 30, 2015 was due to a decrease in the cost of sales of restaurant equipment associated with refranchised IHOP restaurants.

21

COMPANY RESTAURANT OPERATIONS

As of June 30, 2015, company restaurant operations comprised 23 Applebee’s company-operated restaurants in the Kansas City market, 10 IHOP company-operated restaurants in the Cincinnati market and three IHOP restaurants reacquired from franchisees we are operating on a temporary basis until they are refranchised. For the three months ended June 30, 2015, revenue from company restaurant operations increased $1.7 million and segment profit was flat compared to the same period of the prior year. For the six months ended June 30, 2015, revenue and segment profit from company restaurant operations increased $2.8 million and $0.7 million, respectively, compared to the same period of the prior year. The higher revenue in each period was due to an increase in same-restaurant sales and an increase in the number of temporarily operated IHOP restaurants. The improvement in segment profit for the six months ended June 30, 2015 was primarily due to the increase in same-restaurant sales.

On July 23, 2015, we completed the previously announced refranchising and sale of related restaurant assets of the 23 Applebee’s company-operated restaurants. We received proceeds of approximately $9 million and expect to recognize a gain of approximately $2 million on the transaction.

OTHER EXPENSE AND INCOME ITEMS

Three Months Ended | Favorable (Unfavorable) Variance | Six Months Ended | Favorable (Unfavorable) Variance | |||||||||||||||||||||

June 30, | June 30, | |||||||||||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||||||||||

(In millions) | ||||||||||||||||||||||||

General and administrative expenses | $ | 34.6 | $ | 34.8 | $ | 0.2 | $ | 68.8 | $ | 69.0 | $ | 0.2 | ||||||||||||

Interest expense | 15.7 | 24.9 | 9.2 | 31.3 | 49.9 | 18.6 | ||||||||||||||||||

Amortization of intangible assets | 2.5 | 3.1 | 0.6 | 5.0 | 6.1 | 1.1 | ||||||||||||||||||

Closure and impairment charges | 0.5 | 0.6 | 0.1 | 2.3 | 0.8 | (1.5 | ) | |||||||||||||||||

Loss (gain) on disposition of assets | 0.1 | (0.1 | ) | (0.2 | ) | 0.1 | 0.8 | 0.7 | ||||||||||||||||

Income tax provision | 16.6 | 12.0 | (4.6 | ) | 34.3 | 24.9 | (9.4 | ) | ||||||||||||||||

Interest Expense

Interest expense for the three and six months ended June 30, 2015 decreased by $9.2 million and $18.6 million, respectively, compared to the same periods of the prior year. In the fourth quarter of 2014 we refinanced $1.225 billion of long-term debt that bore interest at a weighted average rate of approximately 7.3% with $1.3 billion of new long-term debt bearing interest at a fixed rate of 4.277%. Additionally, deferred financing costs associated with the new long-term debt were smaller than those associated with the old long-term debt, resulting in lower non-cash interest expense for the amortization of the deferred financing costs. These items were partially offset by a small increase in the principal amount of long-term debt outstanding.

Amortization of Intangible Assets

Amortization of intangible assets for the three and six months ended June 30, 2015 decreased compared to the same respective periods of the prior year because certain intangible assets that arose from the November 2007 acquisition of Applebee's became fully amortized in November 2014.

Closure and Impairment Charges