Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Hycroft Mining Corp | d17013d8k.htm |

| EX-10.1 - EX-10.1 - Hycroft Mining Corp | d17013dex101.htm |

| EX-10.2 - EX-10.2 - Hycroft Mining Corp | d17013dex102.htm |

| EX-99.1 - EX-99.1 - Hycroft Mining Corp | d17013dex991.htm |

Exhibit 99.2

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| ) | ||||

| In re: | ) | Chapter 11 | ||

| ) | ||||

| Allied Nevada Gold Corp., et al.,1 | ) | Case No. 15-10503 (MFW) | ||

| ) | ||||

| Debtors. |

) | Jointly Administered | ||

| ) |

AMENDED DISCLOSURE STATEMENT FOR THE

DEBTORS’ AMENDED JOINT CHAPTER 11 PLAN OF REORGANIZATION

| AKIN GUMP STRAUSS HAUER & FELD LLP Ira S. Dizengoff (admitted pro hac vice) Philip C. Dublin (admitted pro hac vice) Alexis Freeman (admitted pro hac vice) Matthew C. Fagen (admitted pro hac vice) One Bryant Park New York, New York 10036-6745 Telephone: (212) 872-1000 Facsimile: (212) 872-1002 |

BLANK ROME LLP Stanley B. Tarr (No. 5535) Michael D. DeBaecke (No. 3186) Victoria A. Guilfoyle (No. 5183) 1201 N. Market Street, Suite 800 Wilmington, Delaware 19801 Telephone: (302) 425-6400 Facsimile: (302) 425-6464 |

Counsel to the Debtors and Debtors in Possession

Dated: July 23, 2015

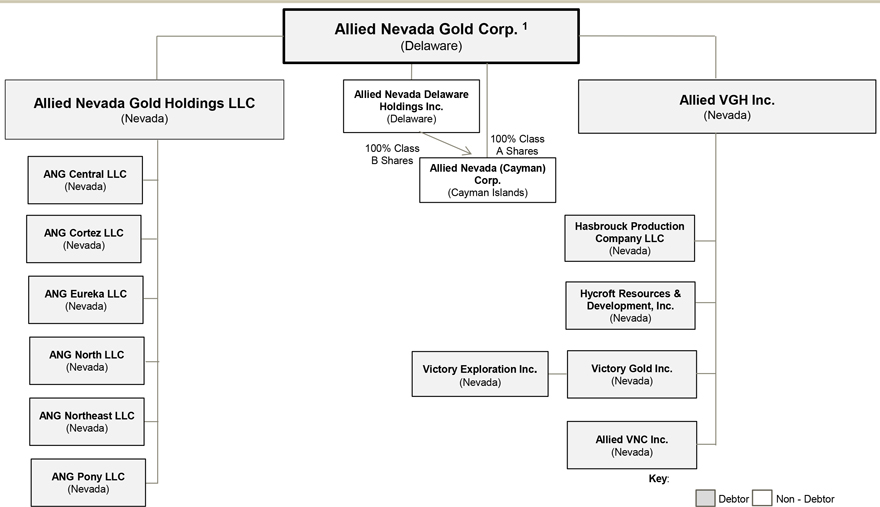

| 1 | The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are: Allied Nevada Gold Corp. (7115); Allied Nevada Gold Holdings LLC (7115); Allied VGH Inc. (3601); Allied VNC Inc. (3291); ANG Central LLC (7115); ANG Cortez LLC (7115); ANG Eureka LLC (7115); ANG North LLC (7115); ANG Northeast LLC (7115); ANG Pony LLC (7115); Hasbrouck Production Company LLC (3601); Hycroft Resources & Development, Inc. (1989); Victory Exploration Inc. (8144); and Victory Gold Inc. (8139). The corporate headquarters for each of the above Debtors are located at, and the mailing address for each of the above Debtors, except Hycroft Resources & Development, Inc., is 9790 Gateway Drive, Suite 200, Reno, NV 89521. The mailing address for Hycroft Resources & Development, Inc. is P.O. Box 3030, Winnemucca, NV 89446. |

IMPORTANT NOTICE

ALLIED NEVADA GOLD CORP. (“ANV”) AND CERTAIN OF ITS DIRECT AND INDIRECT SUBSIDIARIES, AS CHAPTER 11 DEBTORS AND DEBTORS IN POSSESSION (COLLECTIVELY, THE “DEBTORS”), ARE SENDING YOU THIS DOCUMENT AND THE ACCOMPANYING MATERIALS (THE “DISCLOSURE STATEMENT”) BECAUSE YOU MAY BE A HOLDER OF CLAIMS AGAINST THE DEBTORS AND ENTITLED TO VOTE ON THE DEBTORS’ AMENDED JOINT CHAPTER 11 PLAN OF REORGANIZATION, AS THE SAME MAY BE AMENDED FROM TIME TO TIME (THE “PLAN”).2

THIS DISCLOSURE STATEMENT PROVIDES INFORMATION REGARDING THE PLAN. THIS DISCLOSURE STATEMENT AND ITS RELATED DOCUMENTS ARE THE ONLY DOCUMENTS AUTHORIZED BY THE BANKRUPTCY COURT TO BE USED IN CONNECTION WITH THE SOLICITATION OF VOTES TO ACCEPT THE PLAN. NO REPRESENTATIONS HAVE BEEN AUTHORIZED BY THE BANKRUPTCY COURT CONCERNING THE DEBTORS, THEIR BUSINESS OPERATIONS OR THE VALUE OF THEIR ASSETS, EXCEPT AS EXPLICITLY SET FORTH IN THIS DISCLOSURE STATEMENT.

THE DEBTORS URGE YOU TO READ THIS DISCLOSURE STATEMENT CAREFULLY FOR A DISCUSSION OF VOTING INSTRUCTIONS, RECOVERY INFORMATION, CLASSIFICATION AND TREATMENT OF CLAIMS AND INTERESTS, THE HISTORY OF THE DEBTORS AND THE CHAPTER 11 CASES, THE DEBTORS’ BUSINESS, PROPERTIES AND RESULTS OF OPERATIONS, HISTORICAL AND PROJECTED FINANCIAL RESULTS AND A SUMMARY AND ANALYSIS OF THE PLAN. IF YOU ARE ENTITLED TO VOTE ON THE PLAN, YOU ARE ENCOURAGED TO READ THIS DISCLOSURE STATEMENT IN ITS ENTIRETY, INCLUDING WITHOUT LIMITATION, THE PLAN, AND THE SECTION ENTITLED “RISK FACTORS,” BEFORE SUBMITTING YOUR BALLOT TO VOTE ON THE PLAN.

INFORMATION CONTAINED HEREIN IS SUBJECT TO COMPLETION OR AMENDMENT. THE DEBTORS RESERVE THE RIGHT, WITH THE CONSENT OF THE REQUISITE CONSENTING PARTIES, WHICH CONSENT SHALL NOT BE UNREASONABLY WITHHELD, AND IN CONSULTATION WITH THE CREDITORS COMMITTEE (AS FURTHER SET FORTH IN THE PLAN), TO FILE A FURTHER AMENDED PLAN AND RELATED DISCLOSURE STATEMENT FROM TIME TO TIME, SUBJECT TO THE TERMS OF THE PLAN.

THIS DISCLOSURE STATEMENT HAS BEEN PREPARED IN ACCORDANCE WITH BANKRUPTCY CODE SECTION 1125 AND BANKRUPTCY RULE 3016(b). THE PLAN AND THIS DISCLOSURE STATEMENT WERE NOT REQUIRED TO BE PREPARED IN ACCORDANCE WITH FEDERAL OR STATE SECURITIES LAWS OR OTHER APPLICABLE NONBANKRUPTCY LAW. DISSEMINATION OF THIS DISCLOSURE STATEMENT IS CONTROLLED BY BANKRUPTCY RULE 3017. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| 2 | Capitalized terms used but not otherwise defined herein shall have the meaning ascribed to such terms in the Plan. |

i

THIS DISCLOSURE STATEMENT WAS PREPARED TO PROVIDE PARTIES IN INTEREST IN THESE CASES WITH “ADEQUATE INFORMATION” (AS DEFINED IN BANKRUPTCY CODE SECTION 1125) SO THAT THOSE HOLDERS OF CLAIMS WHO ARE ENTITLED TO VOTE ON THE PLAN CAN MAKE AN INFORMED JUDGMENT REGARDING SUCH VOTE.

THIS DISCLOSURE STATEMENT CONTAINS ONLY A SUMMARY OF THE PLAN. THIS DISCLOSURE STATEMENT IS NOT INTENDED TO REPLACE A CAREFUL AND DETAILED REVIEW AND ANALYSIS OF THE PLAN; RATHER, THIS DISCLOSURE STATEMENT IS INTENDED ONLY TO AID AND SUPPLEMENT SUCH REVIEW. THIS DISCLOSURE STATEMENT IS QUALIFIED IN ITS ENTIRETY BY REFERENCE TO THE PLAN, THE PLAN SUPPLEMENT (WHICH WILL BE FILED NO LATER THAN 9 DAYS PRIOR TO THE DEADLINE FOR OBJECTIONS TO THE PLAN), AND THE EXHIBITS ATTACHED THERETO AND THE AGREEMENTS AND DOCUMENTS DESCRIBED THEREIN. IF THERE IS A CONFLICT BETWEEN THE PLAN AND THIS DISCLOSURE STATEMENT, THE PROVISIONS OF THE PLAN WILL GOVERN. YOU ARE ENCOURAGED TO REVIEW THE FULL TEXT OF THE PLAN AND PLAN SUPPLEMENT AND TO READ CAREFULLY THE ENTIRE DISCLOSURE STATEMENT, INCLUDING ALL EXHIBITS, BEFORE DECIDING HOW TO VOTE WITH RESPECT TO THE PLAN.

THE VOTING DEADLINE TO ACCEPT OR REJECT THE PLAN IS 4:00 P.M. (PREVAILING EASTERN TIME) ON SEPTEMBER 24, 2015, UNLESS EXTENDED BY THE DEBTORS (THE “VOTING DEADLINE”). TO BE COUNTED, BALLOTS INDICATING ACCEPTANCE OR REJECTION OF THE PLAN MUST BE ACTUALLY RECEIVED BY PRIME CLERK LLC, THE DEBTORS’ NOTICE, CLAIMS, AND BALLOTING AGENT (THE “BALLOTING AGENT”) NO LATER THAN THE VOTING DEADLINE.

THE EFFECTIVENESS OF THE PLAN IS SUBJECT TO MATERIAL CONDITIONS PRECEDENT. THERE IS NO ASSURANCE THAT THESE CONDITIONS WILL BE SATISFIED OR WAIVED.

IF THE PLAN IS CONFIRMED BY THE BANKRUPTCY COURT AND THE EFFECTIVE DATE OCCURS, ALL HOLDERS OF CLAIMS AGAINST, AND HOLDERS OF INTERESTS IN, THE DEBTORS (INCLUDING, WITHOUT LIMITATION, THOSE HOLDERS OF CLAIMS AND INTERESTS WHO DO NOT SUBMIT BALLOTS TO ACCEPT OR REJECT THE PLAN OR WHO ARE NOT ENTITLED TO VOTE ON THE PLAN) WILL BE BOUND BY THE TERMS OF THE PLAN AND THE TRANSACTIONS CONTEMPLATED THEREBY.

THIS DISCLOSURE STATEMENT HAS NOT BEEN FILED WITH OR REVIEWED BY THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR WITH ANY OTHER SECURITIES REGULATORY AUTHORITY OF ANY STATE UNDER ANY STATE SECURITIES OR “BLUE SKY” LAWS. ADDITIONALLY, THE SECURITIES TO BE ISSUED ON OR AFTER THE EFFECTIVE DATE WILL NOT HAVE BEEN THE SUBJECT OF, OR REGISTERED PURSUANT TO, A REGISTRATION STATEMENT FILED WITH THE

ii

SEC. THE PLAN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC, ANY OTHER SECURITIES REGULATORY AUTHORITY, OR ANY STATE SECURITIES COMMISSION, AND NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. THIS DISCLOSURE STATEMENT DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY STATE OR OTHER JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS NOT AUTHORIZED.

THE DEBTORS BELIEVE THAT THE SOLICITATION OF VOTES ON THE PLAN MADE BY THIS DISCLOSURE STATEMENT, AND THE OFFER OF CERTAIN NEW SECURITIES THAT MAY BE DEEMED TO BE MADE PURSUANT TO THE SOLICITATION, ARE EXEMPT FROM REGISTRATION UNDER THE SECURITIES ACT AND RELATED STATE STATUTES BY REASON OF THE EXEMPTION PROVIDED BY BANKRUPTCY CODE SECTION 1145(a)(1), AND EXPECT THAT THE OFFER, ISSUANCE AND DISTRIBUTION OF THE SECURITIES UNDER THE PLAN WILL BE EXEMPT FROM REGISTRATION UNDER THE SECURITIES ACT AND RELATED STATE STATUTES BY REASON OF THE APPLICABILITY OF BANKRUPTCY CODE SECTION 1145(a)(1), IN EACH CASE TO THE EXTENT SET FORTH HEREIN.

EXCEPT AS OTHERWISE SET FORTH HEREIN, THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE BY THE DEBTORS AS OF THE DATE HEREOF, AND THE DELIVERY OF THIS DISCLOSURE STATEMENT WILL NOT, UNDER ANY CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THE INFORMATION CONTAINED HEREIN IS CORRECT AT ANY TIME SUBSEQUENT TO THE DATE HEREOF OR CREATE ANY DUTY TO UPDATE SUCH INFORMATION.

NO PERSON HAS BEEN AUTHORIZED BY THE DEBTORS IN CONNECTION WITH THE PLAN OR THE SOLICITATION THEREOF TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION OTHER THAN AS CONTAINED IN THIS DISCLOSURE STATEMENT, THE PLAN AND THE EXHIBITS, NOTICES AND SCHEDULES ATTACHED TO OR INCORPORATED BY REFERENCE OR REFERRED TO IN THIS DISCLOSURE STATEMENT AND/OR THE PLAN, AND, IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATION MAY NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE DEBTORS.

IT IS THE DEBTORS’ POSITION THAT THIS DISCLOSURE STATEMENT MAY NOT BE RELIED ON FOR ANY PURPOSE OTHER THAN TO DETERMINE WHETHER TO VOTE TO ACCEPT OR REJECT THE PLAN, AND NOTHING STATED HEREIN SHALL CONSTITUTE AN ADMISSION OF ANY FACT OR LIABILITY BY ANY PERSON, OR BE ADMISSIBLE IN ANY PROCEEDING INVOLVING THE DEBTORS OR ANY OTHER PERSON, OR BE DEEMED CONCLUSIVE EVIDENCE OF THE TAX OR OTHER LEGAL EFFECTS OF THE PLAN ON THE DEBTORS OR HOLDERS OF CLAIMS OR INTERESTS.

EXCEPT WHERE SPECIFICALLY NOTED, THE FINANCIAL INFORMATION CONTAINED HEREIN HAS NOT BEEN AUDITED BY A CERTIFIED PUBLIC ACCOUNTANT AND HAS NOT BEEN PREPARED IN ACCORDANCE WITH GENERALLY ACCEPTED ACCOUNTING PRINCIPLES.

iii

HOLDERS OF CLAIMS OR INTERESTS SHOULD NOT CONSTRUE THE CONTENTS OF THIS DISCLOSURE STATEMENT AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL OR TAX ADVICE. EACH HOLDER SHOULD CONSULT WITH ITS OWN LEGAL, BUSINESS, FINANCIAL AND TAX ADVISOR(S) WITH RESPECT TO ANY SUCH MATTERS CONCERNING THIS DISCLOSURE STATEMENT, THE SOLICITATION OF VOTES TO ACCEPT THE PLAN, THE PLAN, THE PLAN DOCUMENTS AND THE TRANSACTIONS CONTEMPLATED HEREBY AND THEREBY.

FORWARD-LOOKING STATEMENTS:

THIS DISCLOSURE STATEMENT CONTAINS FORWARD-LOOKING STATEMENTS BASED PRIMARILY ON THE CURRENT EXPECTATIONS OF THE DEBTORS AND PROJECTIONS ABOUT FUTURE EVENTS AND FINANCIAL TRENDS AFFECTING THE FINANCIAL CONDITION OF THE DEBTORS’ AND THE REORGANIZED DEBTORS’ BUSINESSES. IN PARTICULAR, STATEMENTS USING WORDS SUCH AS “BELIEVE,” “MAY,” “ESTIMATE,” “CONTINUE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS IDENTIFY THESE FORWARD-LOOKING STATEMENTS. THESE FORWARD-LOOKING STATEMENTS ARE SUBJECT TO A NUMBER OF RISKS, UNCERTAINTIES AND ASSUMPTIONS, INCLUDING THOSE DESCRIBED BELOW UNDER SECTION VIII. IN LIGHT OF THESE RISKS AND UNCERTAINTIES, THE FORWARD-LOOKING EVENTS AND CIRCUMSTANCES DISCUSSED IN THE DISCLOSURE STATEMENT MAY NOT OCCUR, AND ACTUAL RESULTS COULD DIFFER MATERIALLY FROM THOSE ANTICIPATED IN THE FORWARD-LOOKING STATEMENTS. CONSEQUENTLY, THE PROJECTED FINANCIAL INFORMATION AND OTHER FORWARD-LOOKING STATEMENTS CONTAINED HEREIN SHOULD NOT BE REGARDED AS REPRESENTATIONS BY ANY OF THE DEBTORS, THE REORGANIZED DEBTORS, THEIR ADVISORS OR ANY OTHER PERSON THAT THE PROJECTED FINANCIAL CONDITIONS OR RESULTS OF OPERATIONS CAN OR WILL BE ACHIEVED. EXCEPT AS OTHERWISE REQUIRED BY LAW, NEITHER THE DEBTORS NOR THE REORGANIZED DEBTORS UNDERTAKE ANY OBLIGATION TO UPDATE OR REVISE PUBLICLY ANY FORWARD-LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE FOLLOWING APPROVAL OF THIS DISCLOSURE STATEMENT BY THE BANKRUPTCY COURT.

THE DEBTORS SUPPORT CONFIRMATION OF THE PLAN, AND URGE ALL HOLDERS OF CLAIMS WHOSE VOTES ARE BEING SOLICITED TO ACCEPT THE PLAN.

iv

TABLE OF CONTENTS

| Page | ||||||||

| I. |

EXECUTIVE SUMMARY |

1 | ||||||

| II. |

QUESTIONS AND ANSWERS REGARDING THIS DISCLOSURE STATEMENT AND THE PLAN |

2 | ||||||

| A. |

What is chapter 11? |

2 | ||||||

| B. |

Why are the Debtors sending me this Disclosure Statement? |

2 | ||||||

| C. |

Am I entitled to vote on the Plan? |

3 | ||||||

| D. |

What will I receive from the Debtors if the Plan is consummated? |

4 | ||||||

| E. |

What will Holders of Class 1 Secured ABL Claims receive under the Plan? |

4 | ||||||

| F. |

What will Holders of Class 2 Secured Swap Claims receive under the Plan? |

4 | ||||||

| G. |

What will Holders of Class 4 Unsecured Claims receive under the Plan? |

4 | ||||||

| H. |

What will Holders of Class 8 Existing Equity Interests receive under the Plan? |

5 | ||||||

| I. |

How do I vote on the Plan and what is the Voting Deadline? |

5 | ||||||

| J. |

What will I receive from the Debtors if I hold an Administrative Expense Claim, a Professional Fee Claim, a Priority Claim or a DIP Facility Claim? |

5 | ||||||

| K. |

What happens to my recovery if the Plan is not confirmed or the confirmed Plan does not go effective? |

5 | ||||||

| L. |

If the Plan provides that I get a distribution, do I get it upon Confirmation or when the Plan goes effective, and what is meant by “Confirmation,” “Effective Date” and “Consummation?” |

5 | ||||||

| M. |

What are the Debtors’ Intercompany Claims and Intercompany Interests? |

5 | ||||||

| N. |

Are there risks to owning the New Common Stock upon emergence from chapter 11? |

6 | ||||||

| O. |

Will there be releases granted to parties in interest as part of the Plan? |

6 | ||||||

| P. |

Why is the Bankruptcy Court holding a Confirmation Hearing and when is the Confirmation Hearing set to occur? |

6 | ||||||

| Q. |

What is the purpose of the Confirmation Hearing? |

6 | ||||||

| R. |

What is the effect of the Plan on the Debtors’ ongoing business? |

7 | ||||||

| S. |

Who do I contact if I have additional questions with respect to this Disclosure Statement or the Plan? |

7 | ||||||

| T. |

Do the Debtors recommend voting in favor of the Plan? |

7 | ||||||

| III. |

THE DEBTORS’ BACKGROUND |

7 | ||||||

| A. |

Debtors’ Corporate Structure |

8 | ||||||

| B. |

Overview of the Debtors’ Mineral Reserves and Development Projects |

8 | ||||||

| C. |

Regulatory Matters |

9 | ||||||

| D. |

Summary of the Debtors’ Prepetition Capital Structure and Liabilities under Derivative Instruments |

9 | ||||||

| IV. |

EVENTS LEADING TO THE COMMENCEMENT OF THE CHAPTER 11 CASES AND ENTRY INTO THE ORIGINAL RESTRUCTURING SUPPORT AGREEMENT |

12 | ||||||

| A. |

Events Leading to the Commencement of the Chapter 11 Cases |

12 | ||||||

| B. |

Prepetition Restructuring Initiatives and the Original Restructuring Support Agreement |

13 | ||||||

| V. |

EVENTS DURING THE CHAPTER 11 CASES |

13 | ||||||

| A. |

The First and Second Day Pleadings and Other Case Matters |

13 | ||||||

| B. |

Debtor in Possession Financing |

15 | ||||||

| C. |

Mining Suspension Plan and Proposed Compensation Plans |

15 | ||||||

| D. |

Events Leading up to the Debtors’ Entry into the Amended and Restated Restructuring Support Agreement |

17 | ||||||

i

| VI. |

SUMMARY OF THE PLAN |

18 | ||||||

| A. |

General Basis for the Plan |

18 | ||||||

| B. | Treatment of Unclassified Claims |

18 | ||||||

| C. | Classification and Treatment of Claims and Interests |

19 | ||||||

| D. | Means for Implementation of the Plan |

21 | ||||||

| E. | Discharge, Release, Injunction and Related Provisions |

28 | ||||||

| VII. |

PROJECTED FINANCIAL INFORMATION |

30 | ||||||

| VIII. |

RISK FACTORS |

30 | ||||||

| A. | Risks Related to Bankruptcy |

31 | ||||||

| B. | Risks Related to the Debtors’ or the Reorganized Debtors’ Business |

33 | ||||||

| C. | Risks Related to Environmental Issues |

39 | ||||||

| D. | Risks Related to the Debtors’ Indebtedness and Plan Securities |

40 | ||||||

| E. | Risks Associated with Financial Information and Projections |

42 | ||||||

| IX. |

SOLICITATION AND VOTING PROCEDURES |

43 | ||||||

| X. |

CONFIRMATION OF THE PLAN |

43 | ||||||

| A. | Requirements for Confirmation of the Plan |

43 | ||||||

| B. | Best Interests of Creditors/Liquidation Analysis |

43 | ||||||

| C. | Feasibility |

44 | ||||||

| D. | Acceptance by Impaired Classes |

44 | ||||||

| E. | Confirmation without Acceptance by All Impaired Classes |

44 | ||||||

| F. | Valuation of the Debtors |

45 | ||||||

| XI. |

APPLICABILITY OF FEDERAL AND OTHER SECURITIES LAWS |

45 | ||||||

| A. | Plan Securities |

45 | ||||||

| B. | Issuance and Resale of Plan Securities Under the Plan |

45 | ||||||

| C. | Listing of New Common Stock |

47 | ||||||

| A. | U.S. Federal Income Tax Consequences to the Debtors Under the Plan |

48 | ||||||

| B. | U.S. Federal Income Tax Consequences to U.S. Holders Under the Plan |

52 | ||||||

| C. | Information Reporting and Backup Withholding |

59 | ||||||

| D. | U.S. Federal Income Tax Considerations for Non-U.S. Holders |

59 | ||||||

| XIII. |

CONCLUSION AND RECOMMENDATION |

63 | ||||||

ii

EXHIBITS

| Exhibit A | Plan of Reorganization | |

| Exhibit B | Amended and Restated Restructuring Support Agreement | |

| Exhibit C | Financial Projections | |

| Exhibit D | Liquidation Analysis | |

| Exhibit E | Valuation Analysis | |

| Exhibit F | Debtors’ Corporate Structure | |

| THE DEBTORS HEREBY ADOPT AND INCORPORATE EACH EXHIBIT ATTACHED TO THIS DISCLOSURE STATEMENT BY REFERENCE AS THOUGH FULLY SET FORTH HEREIN |

iii

| I. | EXECUTIVE SUMMARY |

The Debtors submit this Disclosure Statement pursuant to Bankruptcy Code section 1125 to certain Holders of Claims against the Debtors in connection with the solicitation of acceptances with respect to the Plan. A copy of the Plan is attached hereto as Exhibit A and incorporated herein by reference. This Disclosure Statement describes certain aspects of the Plan, including the treatment of Claims and Interests, and also describes certain aspects of the Debtors’ operations, financial projections, and other related matters.

As of March 10, 2015, the Debtors had principal outstanding funded indebtedness of (a) approximately $74.95 million under the Credit Agreement, (b) approximately $58.3 million under the Term and Security Deposit Loan Agreement, (c) $5,189,706 on account of the Jacobs Promissory Note, (d) approximately $97.6 million of capital lease obligations, and (e) CDN $400.0 million in respect of the Notes. In addition, as a result of the applicable counterparties’ exercise of early termination rights with respect to the Debtors’ Cross Currency Swaps and Diesel Swaps, the Debtors had outstanding funded indebtedness of (a) approximately $86.3 million with respect to close-out amounts under the Secured Swaps (as defined below), (b) approximately $371,666.67 with respect to the close-out amounts under a Cross Currency Swap (the “NBC Cross Currency Swap”) with National Bank of Canada (“NBC”) after realization of collateral and (c) approximately $518,937.00 with respect to the close-out amounts under a Cross Currency Swap (the “SocGen Cross Currency Swap”) with Société Générale (Canada Branch) (“SocGen”) after realization of collateral.

The Debtors are pleased to report that after extensive, good-faith and arm’s-length negotiations with the Plan Support Parties, the Plan embodies a settlement among the Debtors and the majority of their key stakeholders on a consensual restructuring transaction (the “Restructuring Transaction”) that will de-lever the Debtors’ balance sheet and enable the Debtors to implement a financial and operational restructuring. To evidence their support of the Debtors’ restructuring plan, Holders of 76.24% of the aggregate outstanding principal amount of the Notes Claims, 100% of the Holders of Secured ABL Claims and 100% of the Holders of Secured Swap Claims, executed the Amended and Restated Restructuring Support Agreement, dated July 23, 2015, attached hereto as Exhibit B, which provides for the implementation of the Restructuring Transaction through the Plan.

After giving effect to the following transactions contemplated by the Amended and Restated Restructuring Support Agreement and the Plan, the Debtors will emerge from chapter 11 appropriately capitalized with access to favorable financing to support their emergence and go-forward business needs:

| • | each Holder of an Allowed Secured ABL Claim shall receive, on the Effective Date: its Pro Rata (after giving effect to the Secured ABL $10MM Cash Payment) share of (i)(A) the Secured ABL/Swap Cash Payments not made prior to the Effective Date and (B) the Secured ABL/Swap Claims Excess Cash Flow Payment, and (ii) New First Lien Term Loans in an aggregate principal amount equal to (A) the amount of Allowed Claims pursuant to Article 2.7(b) of the Plan minus (B) the amount paid in cash in respect of the Secured ABL Claims pursuant to clause (i) of Article 2.7(c) of the Plan. In addition, for the avoidance of doubt, any unpaid amounts owed to the holders of Secured ABL Claims pursuant to Section 11 of the DIP Facility Order (including accrued interest to and including the Effective Date pursuant to clause (a) thereof) shall be due and payable in cash on the Effective Date; |

| • | each Holder of an Allowed Secured Swap Claim shall receive, on the Effective Date: its Pro Rata share of (i)(A) the Secured ABL/Swap Cash Payments not made prior to the Effective Date and (B) the Secured ABL/Swap Claims Excess Cash Flow Payment, and (ii) New First Lien Term Loans in an aggregate principal amount equal to (A) the amount of Allowed Claims pursuant to Article 2.8(b) of the Plan minus (B) the amount paid in cash in respect of the Secured Swap Claims pursuant to clause (i) of Article 2.8(c) of the Plan. In addition, for the avoidance of doubt, any unpaid amounts owed to the holders of Secured Swap Claims pursuant to Section 11 of the DIP Facility Order (including accrued interest to and including the Effective Date pursuant to clause (a) thereof ) shall be due and payable in cash on the Effective Date; |

| • | each Holder of an Allowed DIP Facility Claim shall receive, on the Effective Date: its Pro Rata share of the DIP Facility Consideration; provided, however, that only the DIP Backstop Lenders shall receive their Pro Rata share (calculated based on the amount of Allowed DIP Facility Claims held by each of the DIP Backstop Lenders relative to each other) of the 3.0% Backstop Put Option Payment (for the avoidance of doubt, the DIP Facility Consideration shall be paid in its entirety from the proceeds of the Exit Facility); |

| • | each Holder of an Allowed Unsecured Claim shall receive, on the Effective Date, its Pro Rata share of 100% of the New Common Stock, subject to dilution on account of the conversion of the New Second Lien Convertible Notes; |

| • | all Allowed Subordinated Securities Claims shall be extinguished and Holders of Allowed Subordinated Securities Claims shall not receive any property or consideration under the Plan; |

| • | all Allowed Intercompany Claims between the Debtors shall be adjusted, continued, contributed to capital or discharged to the extent determined by the Debtors, with the consent of the Requisite Consenting Parties, which consent shall not be unreasonably withheld, or the Reorganized Debtors; and |

| • | all Existing Equity Interests shall be deemed canceled, released and extinguished as of the Effective Date and Holders of Existing Equity Interests shall receive no recovery on account of their Existing Equity Interests. |

As provided by Article IV of the Plan, the Debtors may also undertake certain other restructuring transactions to implement the Plan.

THE DEBTORS BELIEVE THAT THE COMPROMISE CONTEMPLATED UNDER THE PLAN IS FAIR AND EQUITABLE, MAXIMIZES THE VALUE OF THE ESTATES AND PROVIDES THE BEST RECOVERY TO HOLDERS OF CLAIMS. AT THIS TIME, THE DEBTORS BELIEVE THIS IS THE BEST AVAILABLE ALTERNATIVE FOR COMPLETING THE CHAPTER 11 CASES. FOR THESE REASONS AND OTHERS DESCRIBED HEREIN, THE DEBTORS STRONGLY RECOMMEND THAT CREDITORS ENTITLED TO VOTE ON THE PLAN VOTE TO ACCEPT THE PLAN.

| II. | QUESTIONS AND ANSWERS REGARDING THIS DISCLOSURE STATEMENT AND THE PLAN |

| A. | What is chapter 11? |

Chapter 11 is the principal business reorganization chapter of the Bankruptcy Code. In addition to permitting debtor rehabilitation, chapter 11 promotes equality of treatment for similarly situated creditors and similarly situated equity interest holders, subject to the priority of distributions prescribed by the Bankruptcy Code.

The commencement of a chapter 11 case creates an estate that comprises all of the legal and equitable interests of the debtor as of the bankruptcy commencement date. The Bankruptcy Code provides that the debtor may continue to operate its business and remain in possession of its property as a “debtor in possession.”

Consummating a plan is the principal objective of a chapter 11 case. The Bankruptcy Court’s confirmation of a plan binds the debtor, any person acquiring property under the plan, any creditor or equity interest holder of a debtor, and any other person or entity as may be ordered by the Bankruptcy Court, in accordance with the applicable provisions of the Bankruptcy Code. Subject to certain limited exceptions, the order issued by the Bankruptcy Court confirming a plan provides for the treatment of the debtor’s debt in accordance with the terms of the confirmed plan.

| B. | Why are the Debtors sending me this Disclosure Statement? |

The Debtors will be seeking Bankruptcy Court approval of the Plan. In connection with soliciting acceptances of the Plan, Bankruptcy Code section 1125 requires the Debtors to prepare a disclosure statement containing adequate information of a kind, and in sufficient detail, to enable a hypothetical reasonable investor to make an informed judgment regarding acceptance of the Plan. This Disclosure Statement has been prepared in accordance with these requirements.

2

| C. | Am I entitled to vote on the Plan? |

Your ability to vote on, and your distribution under, the Plan, if any, depends on what type of Claim or Interest you hold. Each category of Holders of Claims or Interests, as set forth in Article II of the Plan pursuant to Bankruptcy Code section 1122(a), is referred to as a “Class.” Each Class’ respective voting status is set forth below.

The tables below designate the Classes of Claims against, and Interests in, each of the Debtors and specify which of those Classes are Impaired or Unimpaired by the Plan. FOR A COMPLETE DESCRIPTION OF THE DEBTORS’ CLASSIFICATION AND TREATMENT OF CLAIMS AND INTERESTS, REFERENCE SHOULD BE MADE TO ARTICLE II OF THE PLAN.

| Class |

Designation |

Impairment |

Entitled to Vote | |||

| Class 1 | Secured ABL Claims | Impaired | Yes | |||

| Class 2 | Secured Swap Claims | Impaired | Yes | |||

| Class 3 | Other Secured Claims | Unimpaired | No (deemed to accept) | |||

| Class 4 | Unsecured Claims | Impaired | Yes | |||

| Class 5 | Intercompany Claims | Unimpaired | No (deemed to accept) | |||

| Class 6 | Subordinated Securities Claims | Impaired | No (deemed to reject) | |||

| Class 7 | Intercompany Interests | Unimpaired | No (deemed to accept) | |||

| Class 8 | Existing Equity Interests | Impaired | No (deemed to reject) | |||

3

| D. | What will I receive from the Debtors if the Plan is consummated? |

The following table summarizes the anticipated recoveries for Holders of Allowed Claims and Holders of Allowed Interests under the Plan. THE EXPECTED RECOVERIES SET FORTH BELOW ARE FOR ILLUSTRATIVE PURPOSES ONLY AND ARE SUBJECT TO MATERIAL CHANGE.3

| Class |

Designation |

Plan |

Estimated Recovery | |||

| Class 1 |

Secured ABL Claims |

Impaired | 100% | |||

| Class 2 |

Secured Swap Claims |

Impaired | 100% | |||

| Class 3 |

Other Secured Claims |

Unimpaired | 100% | |||

| Class 4 |

Unsecured Claims |

Impaired | [To Come] | |||

| Class 5 |

Intercompany Claims |

Unimpaired | 100% | |||

| Class 6 |

Subordinated Securities Claims |

Impaired | 0% | |||

| Class 7 |

Intercompany Interests |

Unimpaired | 100% | |||

| Class 8 |

Existing Equity Interests |

Impaired | 0% | |||

| E. | What will Holders of Class 1 Secured ABL Claims receive under the Plan? |

In full and complete satisfaction, discharge and release of each Class 1 Claim, each Holder of an Allowed Secured ABL Claim shall receive, on the Effective Date: its Pro Rata (after giving effect to the Secured ABL $10MM Cash Payment) share of (i)(A) the Secured ABL/Swap Cash Payments not made prior to the Effective Date and (B) the Secured ABL/Swap Claims Excess Cash Flow Payment, and (ii) New First Lien Term Loans in an aggregate principal amount equal to (A) the amount of Allowed Claims pursuant to Article 2.7(b) of the Plan minus (B) the amount paid in cash in respect of the Secured ABL Claims pursuant to clause (i) of Article 2.7(c) of the Plan. In addition, for the avoidance of doubt, any unpaid amounts owed to the holders of Secured ABL Claims pursuant to Section 11 of the DIP Facility Order (including accrued interest to and including the Effective Date pursuant to clause (a) thereof) shall be due and payable in cash on the Effective Date.

| F. | What will Holders of Class 2 Secured Swap Claims receive under the Plan? |

In full and complete satisfaction, discharge and release of each Allowed Class 2 Claim, each Holder of an Allowed Secured Swap Claim shall receive, on the Effective Date: its Pro Rata share of (i)(A) the Secured ABL/Swap Cash Payments not made prior to the Effective Date and (B) the Secured ABL/Swap Claims Excess Cash Flow Payment, and (ii) New First Lien Term Loans in an aggregate principal amount equal to (A) the amount of Allowed Claims pursuant to Article 2.8(b) of the Plan minus (B) the amount paid in cash in respect of the Secured Swap Claims pursuant to clause (i) of Article 2.8(c) of the Plan. In addition, for the avoidance of doubt, any unpaid amounts owed to the holders of Secured Swap Claims pursuant to Section 11 of the DIP Facility Order (including accrued interest to and including the Effective Date pursuant to clause (a) thereof ) shall be due and payable in cash on the Effective Date.

| G. | What will Holders of Class 4 Unsecured Claims receive under the Plan? |

In full and complete satisfaction, discharge and release of each Allowed Class 4 Claim, each Holder of an Allowed Class 4 Claim shall receive, on the Effective Date, its Pro Rata share of 100% of the New Common Stock, subject to dilution on account of the conversion of the New Second Lien Convertible Notes.

| 3 | The recoveries set forth herein may change based upon changes in the amount of Claims that are “Allowed” as well as other factors related to the Debtors’ business operations and general economic conditions. “Allowed” means, with reference to any Claim or Interest, or any portion thereof, in any Class or category specified, against or of a Debtor, (a) a Claim or Interest that has been listed by such Debtor in the Schedules, as such Schedules may be amended by the Debtors from time to time in accordance with Bankruptcy Rule 1009, as liquidated in amount and not disputed or contingent and for which no contrary Proof of Claim has been filed; (b) a Claim for which a Proof of Claim has been timely filed in a liquidated amount and not contingent and as to which no objection to allowance, to alter priority, or request for estimation has been timely interposed and not withdrawn within the applicable period of limitation fixed by the Plan or applicable law; (c) a Claim or Interest as to which any objection has been settled, waived, withdrawn or denied by a Final Order to the extent such Final Order provides for the allowance of all or a portion of such Claim or Interest; or (d) a Claim or Interest that is expressly allowed (i) pursuant to a Final Order, (ii) pursuant to an agreement between the Holder of such Claim or Interest and the Debtors (with the consent of the Requisite Consenting Parties) or the Reorganized Debtors, as applicable or (iii) pursuant to the terms of the Plan. Unless otherwise specified in the Plan or in an order of the Bankruptcy Court allowing such Claim or Interest, “Allowed” in reference to a Claim shall not include (a) any interest on the amount of such Claim accruing from and after the Petition Date; (b) any punitive or exemplary damages; or (c) any fine, penalty or forfeiture. Any Claim listed in the Schedules as disputed, contingent, or unliquidated, and for which no Proof of Claim has been timely filed, is not considered Allowed and shall be expunged without further action and without any further notice to or action, order, or approval of the Bankruptcy Court. |

4

| H. | What will Holders of Class 8 Existing Equity Interests receive under the Plan? |

Holders of Existing Equity Interests shall receive no recovery on account of their Existing Equity Interests.

| I. | How do I vote on the Plan and what is the Voting Deadline? |

Detailed instructions regarding how to vote on the Plan are contained on the applicable Ballots distributed to Holders of Claims that are entitled to vote on the Plan. For your vote to be counted, your Ballot must be completed, signed and submitted so that it is actually received by the Balloting Agent by 4:00 p.m. (prevailing Eastern Time) on September 24, 2015.

| J. | What will I receive from the Debtors if I hold an Administrative Expense Claim, a Professional Fee Claim, a Priority Claim or a DIP Facility Claim? |

In accordance with Bankruptcy Code section 1123(a)(1), Administrative Expense Claims, Professional Fee Claims, Priority Claims and DIP Facility Claims have not been classified and, thus, are excluded from the Classes of Claims and Interests set forth in Article II of the Plan. These Claims will be satisfied as set forth in Articles 2.1, 2.2, 2.3 and 2.4 of the Plan, respectively.

| K. | What happens to my recovery if the Plan is not confirmed or the confirmed Plan does not go effective? |

In the event that the Plan is not confirmed, there is no assurance that the Debtors will be able to reorganize their business. It is possible that any alternative may provide Holders of Claims with less than they would have received pursuant to the Plan. For a more detailed description of the consequences of an extended chapter 11 case, or of a liquidation scenario, see “Confirmation of the Plan—Best Interests of Creditors/Liquidation Analysis,” which begins on page 43, and the Liquidation Analysis attached as Exhibit D to this Disclosure Statement.

| L. | If the Plan provides that I get a distribution, do I get it upon Confirmation or when the Plan goes effective, and what is meant by “Confirmation,” “Effective Date” and “Consummation?” |

“Confirmation” of the Plan refers to the approval of the Plan by the Bankruptcy Court. Confirmation of the Plan does not guarantee that you will receive the distribution indicated under the Plan. After Confirmation of the Plan by the Bankruptcy Court, there are conditions that need to be satisfied or waived so that the Plan can go effective. See “Confirmation of the Plan,” which begins on page 43 of this Disclosure Statement, for a discussion of the conditions to confirmation and consummation of the Plan.

All distributions under the Plan with respect to Allowed Claims shall be made by the Reorganized Debtors or a Distribution Agent selected by the Debtors. The Reorganized Debtors or the Distribution Agent will make distributions on account of Allowed Claims as of the Effective Date or as soon as reasonably practicable after the Effective Date. The Reorganized Debtors or the Distribution Agent will make distributions to a Holder of such Allowed Claim within a reasonable period of time after such Claim becomes Allowed; provided, however, that unless otherwise agreed by the Indenture Trustee and the Reorganized Debtors, distributions under the Plan to Holders of Notes Claims shall be made by the Reorganized Debtors to the Indenture Trustee, which, in turn, shall make the distributions to such Holders. Subject to the Debtors’ receipt of invoices in customary form in connection therewith and without the requirement to file a fee application with the Bankruptcy Court, the Reorganized Debtors shall promptly reimburse the Indenture Trustee for the reasonable fees and expenses incurred by the Indenture Trustee on and after the Effective Date in connection with the performance of its duties and the exercise of its rights and those of the Holders of Notes Claims under the Plan and Confirmation Order.

| M. | What are the Debtors’ Intercompany Claims and Intercompany Interests? |

In the ordinary course of business and as a result of their corporate structure, certain of the Debtor entities hold equity of other Debtor entities and maintain business relationships with each other, resulting in Intercompany Claims and Intercompany Interests. The Intercompany Claims reflect costs and revenues, which are allocated among the appropriate Debtor entities, resulting in Intercompany Claims.

5

Specifically, ANV holds an Intercompany Claim against Hycroft Resources & Development, Inc., in the amount of $933 million for the use of proceeds from the various equity raises, the Notes offering and the drawing on the Credit Agreement by ANV. Additionally, ANV has an Intercompany Claim against the exploration entities in the amount of $85 million for payment of the annual claims fees made for the benefit of each of the various exploration properties that such entities held until they were sold on June 29, 2015.

The Plan’s treatment of Intercompany Claims and Intercompany Interests represents a common component of a chapter 11 plan involving multiple debtors in which the value of the going-concern enterprise may be replicated upon emergence for the benefit of creditor constituents receiving distributions under a plan. The Plan provides that the Reorganized Debtors shall reinstate Intercompany Interests so as to preserve the Reorganized Debtors’ corporate structure as such structure existed on the Petition Date. The Plan further provides that Intercompany Claims will be adjusted, continued or discharged to the extent determined appropriate by the Debtors, subject to the consent of the Requisite Consenting Parties, which consent shall not be unreasonably withheld, or, after the Effective Date, by the Reorganized Debtors in their sole discretion.

| N. | Are there risks to owning the New Common Stock upon emergence from chapter 11? |

Yes. See “Risk Factors,” which begins on page 30.

| O. | Will there be releases granted to parties in interest as part of the Plan? |

Yes. See Article IX of the Plan, which is incorporated herein by reference.

| P. | Why is the Bankruptcy Court holding a Confirmation Hearing and when is the Confirmation Hearing set to occur? |

Bankruptcy Code section 1128(a) requires the Bankruptcy Court to hold a hearing on Confirmation of the Plan and recognizes that any party in interest may object to Confirmation of the Plan.

In connection with the approval of solicitation of votes to accept the Plan, the Debtors will request that the Bankruptcy Court schedule a Confirmation Hearing and will provide notice of such hearing to all necessary parties. The Confirmation Hearing may be adjourned or continued from time to time without further notice except for an announcement of the adjourned date made at the Confirmation Hearing or any adjournment thereof.

Objections to Confirmation of the Plan must be filed and served on the Debtors and certain other parties prior to the Confirmation Hearing in accordance with the notice of the Confirmation Hearing.

The Debtors will publish the notice of the Confirmation Hearing, which will contain, among other things, the deadline for objections to the Plan and the date and time of the Confirmation Hearing, in the Reno Gazette Journal, Elko Daily Free Press, Humboldt Sun and the national edition of The Wall Street Journal.

| Q. | What is the purpose of the Confirmation Hearing? |

The confirmation of a plan of reorganization by a bankruptcy court binds the debtor, any issuer of securities under the plan of reorganization, any person acquiring property under the plan of reorganization, any creditor or equity interest holder of a debtor and any other person or entity as may be ordered by a bankruptcy court in accordance with the applicable provisions of the Bankruptcy Code. Subject to certain limited exceptions, an order issued by a bankruptcy court confirming a plan of reorganization discharges a debtor from any debt that arose before the confirmation of the plan of reorganization upon the occurrence of the effective date and provides for the treatment of such debt in accordance with the terms of the confirmed plan of reorganization.

6

| R. | What is the effect of the Plan on the Debtors’ ongoing business? |

The Debtors are reorganizing under chapter 11 of the Bankruptcy Code. As a result, subject to the occurrence of the Effective Date, Confirmation means that the Debtors will not be liquidated or forced to go out of business. Following Confirmation, the Plan will be consummated on the Effective Date, which is a date that is a Business Day on or after the Confirmation Date on which (i) no stay of the Confirmation Order is in effect and (ii) the conditions to the effectiveness of the Plan specified in Article 8.1 of the Plan have been satisfied, or if capable of being waived, waived.

On or after the Effective Date, and unless otherwise provided in the Plan or the Confirmation Order, the Reorganized Debtors may operate their business and, except as otherwise provided by the Plan, may use, acquire or dispose of property and compromise or settle any Claims, Interests or Causes of Action without supervision or approval by the Bankruptcy Court and free of any restrictions of the Bankruptcy Code or Bankruptcy Rules.

| S. | Who do I contact if I have additional questions with respect to this Disclosure Statement or the Plan? |

If you have any questions regarding this Disclosure Statement or the Plan, you may contact the Debtors’ co-counsel at the addresses and phone numbers listed on the cover page of this Disclosure Statement. Copies of the Plan and this Disclosure Statement may be obtained by contacting the Balloting Agent, located at 830 Third Avenue, 9th Floor, New York, NY 10022, by calling (855) 936-2883 or by emailing angballots@PrimeClerk.com.

| T. | Do the Debtors recommend voting in favor of the Plan? |

Yes. The Debtors believe the Plan provides for a larger distribution to the Holders of Claims than would otherwise result from any other available alternative. The Debtors believe the Plan, which contemplates a significant deleveraging of their balance sheet, is in the best interests of all Holders of Claims and Interests.

| III. | THE DEBTORS’ BACKGROUND |

Debtor Allied Nevada Gold Corp. (“ANV”), a Delaware corporation, together with its Debtor and non-Debtor subsidiaries, is a U.S.-based gold and silver producer engaged in mining,4 developing and, from time to time, exploring properties in the State of Nevada. ANV’s stock has been trading on the NYSE MKT, LLC (the “NYSE”) and the Toronto Stock Exchange (the “TSX”) since May 2007 under the symbol “ANV”.5

ANV was spun off from Vista Gold Corp. (“Vista”) in 2006 and began operations in May 2007. In connection with that certain Arrangement and Merger Agreement between ANV, Vista and Carl and Janet Pescio (the “Pescios”), ANV acquired Vista’s Nevada-based mining properties and related assets, including the Hycroft Mine6 and a portfolio of

| 4 | As described in more detail in Section V.C. below, the Debtors have recently suspended their mining operations. |

| 5 | On March 10, 2015, ANV received notice from the NYSE that the NYSE had suspended its common stock from trading immediately and determined to commence proceedings to delist its common stock pursuant to Section 1003(c)(iii) of the NYSE Company Guide. The NYSE’s determination was based on the filings in the Chapter 11 Cases, which contemplate that the Debtors’ existing common stock will be extinguished pursuant to the Plan. The last day that ANV’s common stock traded on the NYSE was March 9, 2015. ANV’s common stock was delisted by the NYSE on May 12, 2015. In addition, on March 10, 2015, the TSX suspended ANV’s common stock from trading immediately while the TSX reviewed ANV’s continued eligibility for listing under the TSX’s Expedited Review Process. On March 17, 2015, the TSX determined to delist ANV’s common stock at the close of business on April 16, 2015. The last day that ANV’s common stock traded on the TSX was March 9, 2015. On March 10, 2015, ANV’s common stock began being traded in the over-the-counter market under the symbol “ANVGQ”. |

| 6 | Vista acquired the deed to the Hycroft Mine from Henry C. Crofoot and Daniel M. Crofoot (the “Crofoots”), who retained certain patented and unpatented mining claims that are leased to the Debtors in exchange for a 4% net profit royalty payment. This mining lease also requires an annual advance payment of $120,000 every year mining occurs on the leased claims. All advance annual payments are credited against the future payments due under the 4% net profit royalty. The total payments due under the mining lease are capped at $7.6 million, of which the Debtors have paid approximately $2.1 million through December 31, 2014. The Debtors currently estimate the remaining payments due under the mining lease will approximate $0.1 million in 2015 and $0.2 million in each year 2016 to 2021. Patented mining claims are rights covering private land that is owned by the Crofoots. Unpatented mining claims are rights covering public land on which the Crofoots own restricted rights to extract and develop certain mineral deposits, including gold and silver. |

7

gold and silver exploration properties located throughout Nevada, all of which exploration properties have since been sold or released back to the BLM (as defined below). In addition, ANV acquired the mineral property interests previously held by the Pescios, including royalty and/or other interests in a number of the properties, all of which have since been sold or released back to the BLM.

| A. | Debtors’ Corporate Structure |

A diagram presenting the corporate structure of ANV and each of its direct and indirect subsidiaries, including each Debtor and each non-Debtor entity, is attached hereto as Exhibit F. As demonstrated on Exhibit F, ANV, directly or indirectly, holds 100% of the equity interests in each of the following (i) Debtors: Allied Nevada Gold Holdings LLC, Allied VGH Inc., Allied VNC Inc., ANG Central LLC, ANG Cortez LLC, ANG Eureka LLC, ANG North LLC, ANG Northeast LLC, ANG Pony LLC, Hycroft Resources & Development, Inc. (“HRDI”), Victory Exploration Inc., Victory Gold Inc. and Hasbrouck Production Company LLC and (ii) non-Debtors: Allied Nevada Delaware Holdings Inc. and Allied Nevada (Cayman) Corp.

The Debtors primarily operate through ANV and its wholly-owned subsidiary HRDI. ANV is the corporate center of the Debtors and is, among other things, responsible for all of the Debtors’ general corporate functions. HRDI owns the Hycroft Mine, which is currently, and historically has been, the Debtors’ sole operating and/or producing mine.7 The remaining Debtors held, as of the Petition Date, interests in various exploration properties that have since been sold or released back to the BLM or are legacy entities with no material assets or operations.

| B. | Overview of the Debtors’ Mineral Reserves and Development Projects |

| 1. | Hycroft Mine and Mill Expansion |

The Hycroft Mine is an open-pit heap leach mine8 located 54 miles west of Winnemucca, Nevada. As of December 31, 2014, there were estimated proven and probable mineral reserves at the Hycroft Mine of 10.6 million ounces of gold and 465.3 million ounces of silver, which are contained in oxide (heap leach) and sulfide (mill) ores. Additionally, the Hycroft Mine remains open to the south with the potential for further expansion which could provide additional heap leach mineralized material. In 2014, the Hycroft Mine produced approximately 216,900 ounces of gold and 1.8 million ounces of silver from its heap leach operations.9

In September 2011, the Debtors announced and began a plan for a mill expansion project (the “Hycroft Mill”), which would allow the Debtors to process sulfide (mill) ores and extend the operating life of the Hycroft Mine. However, due to declining metal prices and the resultant lower than expected cash flows generated by the Debtors’ oxide mining operations, in the second quarter of 2013, the Debtors deferred the construction of the Hycroft Mill and other expansion plans. The Debtors are implementing a sulfide demonstration plant to test their ability to process their sulfide reserves on a larger scale than previous sulfide pilot plants, the data from which the Debtors expect any potential financing source or potential purchaser of the Debtors’ assets to want to review prior to making a decision with respect to providing the financing necessary to implement the sulfide mining operations or to considering purchasing the Debtors’ assets. The demonstration plant is expected to begin running in September 2015 and a final report with respect to the demonstration plant should be available by the end of October 2015.

| 2. | Principal Products and Revenues |

The Debtors’ principal products consist of unrefined gold bars (doré) and in-process inventories (metal-laden carbon), both of which are sent to third party refineries before being sold, generally at prevailing spot prices, to precious metals traders or financial institutions. Doré bars and metal-laden carbon are sent to refineries to produce bullion that meets the required market standards of 99.95% pure gold and 99.90% pure silver. Under the terms of the Debtors’ refining

| 7 | As described in more detail in Section V.C. below, the Debtors have recently suspended their mining operations. |

| 8 | Open-pit mining is a process whereby ore is reached by digging or blasting from the ground level. Heap leaching is a process by which gold or silver is extracted from ore by “heaping” the ore on impermeable leach pads and continually applying a weak cyanide solution that dissolves the gold and silver from the ore. The gold- or silver-laden solution is then collected for gold or silver recovery. |

| 9 | As described in more detail in Section V.C. below, the Debtors have recently suspended their mining operations. |

8

agreements, doré bars and metal-laden carbon are refined for a fee, and the Debtors’ share of the refined gold and the separately- recovered silver are credited to the Debtors’ account or delivered to its buyers. Although the Debtors reported operating revenues of approximately $310.4 million for the 2014 fiscal year, the Debtors incurred a gross loss of approximately $518.9 million.

| C. | Regulatory Matters |

Mining operations and exploration activities are subject to various federal, state and local laws and regulations in the U.S., which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. The Debtors have obtained or have pending applications for those licenses, permits or other authorizations currently required to conduct mining, exploration and other programs. The Debtors believe that they are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed thereunder in Nevada and the U.S. Although the Debtors are not aware of any current claims, orders or directions relating to their business with respect to the foregoing laws and regulations, changes to, or more stringent application or interpretation of, such laws and regulations in Nevada, or in jurisdictions where the Debtors may operate in the future, could require additional capital expenditures and increased operating and/or reclamation costs, which could adversely impact the profitability levels of the Debtors’ projects.

In addition, the Debtors are subject to regulation by the Federal Mine Safety and Health Administration (“MSHA”) under the Federal Mine Safety and Health Act of 1977 (the “Mine Act”). MSHA inspects the Debtors’ mines on a regular basis and issues various citations and orders when it believes a violation has occurred under the Mine Act. The number of citations and orders charged against mining operations, and the dollar penalties assessed for such citations, have generally increased in recent years.

Finally, the Debtors’ production, mining and exploration activities, to the extent undertaken, are subject to various federal and state laws and regulations governing the protection of the environment. The Debtors’ asset retirement obligation (“ARO”), consisting of estimated future mine reclamation and closure costs, may increase or decrease significantly in the future as a result of changes in regulations, mine plans, estimates, or other factors. The Debtors’ ARO relates to the Hycroft Mine and was recognized as a liability at fair value in the period incurred. An ARO, which is initially estimated based on discounted cash flow estimates, is accreted to full value over time through charges to accretion expense. Resultant ARO cost assets are depreciated on a units of production method over the related long-lived asset’s useful life. The Debtors’ ARO is adjusted annually, or more frequently at interim periods if necessary, to reflect changes in the estimated present value resulting from revisions to the timing or amount of reclamation and closure costs.

| D. | Summary of the Debtors’ Prepetition Capital Structure and Liabilities under Derivative Instruments |

| 1. | Prepetition Funded Indebtedness |

Credit Agreement

ANV is the borrower under the Credit Agreement, among ANV, the lender parties thereto, the Administrative Agent, and Wells Fargo and the Administrative Agent as co-collateral agents. The obligations under the Credit Agreement are collateralized by substantially all of the Debtors’ assets and are guaranteed by all of the other Debtors. Borrowings under the Credit Agreement bear interest per annum at either LIBOR plus 4.5% or at an Alternate Base Rate Canada (as defined in the Credit Agreement) plus 3.5%. As of the Petition Date, the total principal amount of borrowings outstanding under the Credit Agreement was approximately $56.5 million, the total face amount of the letters of credit issued under the Credit Agreement was approximately $18.5 million (corresponding to the letters of credit posted in connection with the NBC Cross Currency Swap and SocGen Cross Currency Swap discussed in Section III.D.2 below) and approximately $0.5 million of accrued interest was outstanding.

In addition, as discussed below, as a result of the applicable counterparties’ exercise of early termination rights with respect to the Debtors’ Cross Currency Swaps and Diesel Swaps, the Debtors had outstanding funded indebtedness of (a) $86,306,619.00 with respect to close-out amounts under the Secured Swaps, (b) $371,666.67 with respect to the close-out amounts under the NBC Cross Currency Swap, after realization of collateral and (c) $518,937.00 with respect to the close-out amounts under the SocGen Cross Currency Swap, after realization of collateral.

9

Term and Security Deposit Loan Agreement

On March 27, 2013, HRDI entered into a term and security deposit loan agreement (as amended, amended and restated, supplemented or otherwise modified from time to time, the “Term and Security Deposit Loan Agreement”), with Caterpillar Financial Services Corporation (“Caterpillar”) as lender in connection with the purchase of three electric rope shovels. Pursuant to the Term and Security Deposit Loan Agreement, up to $60.0 million (75% of the total equipment cost) was made available to HRDI for scheduled progress payments pursuant to purchase agreements for the electric rope shovels, and up to $90.0 million was made available to HRDI in term loan financing to fund the purchase of the electric rope shovels once commissioned at the Hycroft Mine.

Under the Term and Security Deposit Loan Agreement, as electric rope shovels were commissioned, amounts previously advanced to HRDI for security deposits, together with the remaining purchase price of each electric rope shovel, were converted to term loan obligations. Caterpillar has a first lien security interest on the electric rope shovels under the Term and Security Deposit Loan Agreement and HRDI’s obligations thereunder are guaranteed by ANV. As of the Petition Date, $40.3 million remained outstanding on the two executed term loan obligations, which are due by 2020 and bear interest at a fixed rate of approximately 5.7%, and $18.0 million, plus $1.6 million of accrued interest, remained outstanding as advances for security deposits under the Term and Security Deposit Loan Agreement, which bear interest at an applicable rate plus three-month LIBOR, which approximated 4.8% as of the Petition Date.

Jacobs Promissory Note

On October 15, 2014, HRDI issued a $7,189,706.00 promissory note (the “Jacobs Promissory Note”) to Jacobs Field Services North America Inc. pursuant to a Release and Settlement Agreement between HRDI and Jacobs settling the action captioned Jacobs Field Services North America, Inc. v. Hycroft Resources & Development, Inc., United States District Court for the District of Nevada Case No. 3:14-cv-00289. The Jacobs Promissory Note is secured, through a deed of trust, by a security interest in certain of HRDI’s real property, namely the Merrill Crowe Facility – Hycroft Mine, located in Humboldt County, Nevada, which security interest is second in priority and subordinate to the security interests securing the obligations under the Credit Agreement, and HRDI’s obligations thereunder are guaranteed by ANV. As of the Petition Date, the aggregate outstanding principal amount of the Jacobs Promissory Note was $5,189,706.

Notes

ANV has issued CDN $400.0 million of Notes pursuant to that certain indenture, dated as of May 25, 2012, by and between ANV and Computershare Trust Company of Canada, as Indenture Trustee. The Notes are denominated in Canadian dollars, pay interest semi-annually at a rate of 8.75% per annum and mature in June 2019. The obligations under the Notes are guaranteed by all of the Debtors except for Hasbrouck Production Company LLC. As of the Petition Date, the aggregate outstanding principal amount of the Notes was CDN $400.0 million.

| 2. | Liabilities Under Derivative Instruments |

Swaps with Scotiabank

In connection with the issuance of the Notes, ANV entered into a cross currency swap with Scotiabank, a portion of which was subsequently novated to NBC and SocGen (collectively, the “Cross Currency Swaps”), based upon a notional amount of US $400.4 million, which fixed the interest rate under the Notes to an effective rate of 8.375%. In addition, as of December 31, 2014, the Debtors had five outstanding diesel swaps (the “Diesel Swaps” and, together with the Cross Currency Swap with Scotiabank, the “Secured Swaps”) with Scotiabank covering the year 2015 for 7.2 million gallons of diesel at an average price of approximately $2.62 per gallon, which represented approximately 60% of the Debtors’ forecasted 2015 diesel consumption. The obligations remaining under the Secured Swaps are secured by a lien on the same assets that secure the Debtors’ obligations under the Credit Agreement on a pari passu basis. On the Petition Date, ANV received a notice of early termination from Scotiabank, which notice had the effect of terminating each such swap with Scotiabank causing the close-out amount under each such swap to immediately become due and payable. As of March 11, 2015, which is the designated early termination date thereunder, the close-out amount under the Secured Swaps was $86,306,619.00.

10

Swaps with NBC and SocGen

As described above, a portion of the Cross Currency Swaps was novated to NBC and SocGen. ANV was required to collateralize any mark-to-market liability position of the NBC Cross Currency Swap and SocGen Cross Currency Swap in the form of either letters of credit or Cash. On the Petition Date, ANV received notices of early termination from NBC and SocGen, which notices had the effect of immediately terminating each such swap and causing the close-out amount under each such swap to become due and payable.

As of March 10, 2015, which is the designated early termination date with respect to the NBC Cross Currency Swap, the close-out amount owed by ANV relating to such swap was approximately $12.6 million. NBC exercised its right against letters of credit and cash collateral granted in its favor. After realization of NBC’s collateral, the remaining unsecured deficiency Claims of NBC aggregated to $371,666.67.

As of March 11, 2015, which is the designated early termination date with respect to the SocGen Cross Currency Swap, the close-out amount owed by ANV relating to such swap was approximately $10.37 million. SocGen exercised its right against letters of credit and cash collateral. After realization of SocGen’s collateral, the remaining unsecured deficiency Claims of SocGen are in the amount of $518,937.00.

| 3. | Capital Lease Obligations. |

The Debtors’ capital lease obligations (the “Capital Lease Obligations”), which are for the purchase of mining equipment, bear interest at rates between 4% and 7% and carry 60 month terms. As of the Petition Date, the Debtors owed $97.6 million in Capital Lease Obligations.

| 4. | Trade Debt |

As a gold and silver producer, the Debtors purchased mining equipment, processing commodities and other inputs from numerous vendors. As of the Petition Date, the Debtors estimate that they owed approximately $33.1 million in prepetition trade debt claims, which includes amounts owed to, among others, critical vendor claimants, shippers, warehousemen, miscellaneous lien claimants and claimants who may assert claims arising under Bankruptcy Code section 503(b)(9).

| 5. | Equity Ownership |

As of the Petition Date, 126,193,336 shares of common stock of the Debtors were outstanding.10 As discussed above, the Debtors’ common stock was traded on the NYSE and the TSX. The Debtors’ market capitalization was approximately $107.9 million as of the Petition Date, though the Debtors do not believe that the market capitalization was indicative of the Debtors’ value and the Debtors were insolvent as of the Petition Date.

| 6. | Prior and Pending Litigation Proceedings |

In the ordinary course of business, the Debtors are, from time to time, the subject of complaints or litigation in the ordinary course of the Debtors’ business. Below is a brief summary of the Debtors’ pending litigation proceedings.

The Debtors and certain of their Officers are subject to a class action securities litigation brought by certain shareholders (the “Securities Litigation”). The plaintiffs in the Securities Litigation seek unspecified damages as a result of purported violations of federal securities laws, which violations allegedly arose out of misrepresentations and omissions concerning the Debtors’ gold and silver mining operations at the Hycroft Mine. The Securities Litigation is ongoing. In addition, two shareholders filed a statement of claim in the Ontario Superior Court in Canada (the “Canadian Litigation”) asserting substantially the same allegations as the U.S. class action complaints and seeking $80 million in damages for

| 10 | The Debtors also have 10 million shares of authorized but not issued preferred stock. |

11

violations of Canadian securities laws. The Canadian Litigation is ongoing. In addition, the Debtors and certain of their Officers are subject to a derivative action (the “Derivative Action”) seeking unspecified damages and asserting breaches of fiduciary duties by the defendants. The allegations in the Derivative Action are substantially similar to the allegations contained in the Securities Litigation.

The costs of the Securities Litigation, Canadian Litigation and Derivative Action are covered by the Debtors’ insurance policies, which have a total cap of $40 million with respect to indemnified claims and $50 million with respect to non-indemnified claims, with a $1.5 million retention.

| IV. | EVENTS LEADING TO THE COMMENCEMENT OF THE CHAPTER 11 CASES AND ENTRY INTO THE ORIGINAL RESTRUCTURING SUPPORT AGREEMENT |

| A. | Events Leading to the Commencement of the Chapter 11 Cases |

A number of factors contributed to the Debtors’ decision to pursue a restructuring through the chapter 11 process. Over the two years prior to the Petition Date, despite a nearly doubling of gold and silver ounces sold, revenue increased only modestly, mainly due to declining gold and silver prices. Gold and silver sales represent 100% of the Debtors’ revenues and, accordingly, the market prices of gold and silver significantly impact the Debtors’ financial position, operating results, and cash flows. The market price of gold peaked at $1,895 per ounce in August 2011. As of March 9, 2015, gold closed at $1,168.50 per ounce, down approximately 38% from the 2011 peak and down 16% from the last twelve-month high of $1,385 per ounce. Similarly, the market price per silver ounce decreased approximately 46.8% over the two years prior to the Petition Date, from $29.95 per ounce as of December 31, 2012 to $15.92 per ounce as of March 9, 2015.

Despite the Debtors’ prepetition efforts to increase revenue, decrease costs, sell non-core assets, reduce or delay capital expenditures and raise capital to address the Debtors’ liquidity constraints, the Debtors’ liquidity continued to deteriorate. In an effort to meet their liquidity needs, during 2014 the Debtors increased their borrowing capacity under the Credit Agreement by $35.0 million, sold a mineral property for $20.0 million and completed a public offering of common stock and warrants for $21.8 million. Despite these efforts, the Debtors’ cash and cash equivalents decreased from $81.5 million at December 31, 2013 to $7.6 million at December 31, 2014. The continuing loss of liquidity was largely due to (a) the drop in gold and silver prices in the years leading up to the Petition Date, (b) an overleveraged capital structure, the servicing of which requires significant capital resources, (c) the significant contractual capital requirements and delay of the Hycroft Mill expansion project and (d) exposure under the Cross Currency Swaps. Each of these factors is discussed in greater detail below.

| 1. | Decreased Gold and Silver Prices |

As discussed above, the market prices for gold and silver declined substantially from previous highs, which had a direct negative impact on earnings and cash flows derived from the Debtors’ operations. The Debtors’ average operating margin per gold ounce sold decreased approximately 66% to $295 in 2014 from $854 in 2012, thereby straining the Debtors’ ability to fund their operations, service their debt and fund capital requirements.

| 2. | Overleveraged Capital Structure |

The Debtors’ prepetition capital structure placed a significant burden on free cash flow and contributed to the depletion of existing cash balances. As discussed above, prior to the Petition Date, the Debtors had, among other things, substantial (a) Capital Lease Obligations related to the purchase of expensive equipment for their planned use in the Hycroft Mill expansion project, which bear interest at rates between 4% and 7%, (b) semi-annual interest payment obligations under the Notes and (c) an almost fully-drawn $75.0 million revolving loan under the Credit Agreement.

| 3. | Exposure under the Cross Currency Swaps |

As discussed above, the Debtors had significant exposure under the Cross Currency Swaps and were required to collateralize any mark-to-market liability position under the Cross Currency Swaps with NBC and SocGen with either letters of credit or cash. Pursuant to the Cross Currency Swaps with NBC and SocGen, the Debtors had posted approximately $18.5 million in letters of credit, which were issued under the Credit Agreement, and approximately $3.6 million in cash, contributing to the Debtors’ prepetition liquidity position.

12

| 4. | Capital Requirements and Delay of the Hycroft Mill Expansion Project |

From 2012 to 2014, the Debtors incurred approximately $668.9 million of capital expenditures for plant and equipment in connection with the expansion efforts of the Hycroft Mine, the majority of which related to the Hycroft Mill, including mills and mill-related components, a crushing system, and engineering and infrastructure costs. During that same time period, the Debtors repaid an additional $113.2 million in principal of financed capital expenditures for the Hycroft Mine’s expanded mobile mine equipment fleet. The Debtors’ cash and cash equivalents, sources of liquidity and capital resources were depleted as the Debtors sought to satisfy the Hycroft Mine’s capital requirements.

During 2013 and 2014, the Debtors were unable to raise the remaining capital required to complete the construction of the Hycroft Mill, which, as of November 2014, was estimated at $1.39 billion. Specifically, in May 2014, the Debtors undertook a strategic process to finance the expansion of the Hycroft Mine. Over 60 parties were approached to provide financing, acquire a stake in the Debtors or acquire the Debtors. Not a single buyer expressed interest in a sale or financing at a price that would enable the Debtors to finance the construction of the Hycroft Mill. The Debtors’ inability to fund the construction of the Hycroft Mill prevented the Debtors from increasing annual mine production to approximately 450,000 ounces of gold and 23.0 million ounces of silver per year – quantities which would increase revenues and total cash flows from operations using current metal prices.11 Although the Debtors invested significant capital in the expansion of the Hycroft Mine, in particular for the Hycroft mills and motors, they will not be able to realize any significant operational benefits until the Hycroft Mill is constructed, commissioned and operational. However, due to the lack of liquidity and over-levered balance sheet, the Debtors were unable to raise the $1.39 billion necessary to commence and implement the Hycroft Mill expansion project

| B. | Prepetition Restructuring Initiatives and the Original Restructuring Support Agreement |

Faced with the foregoing issues, the Debtors proactively sought to right-size their capital structure and to position themselves for ongoing success in the current industry and economic environment. To this end, beginning in December 2014, the Debtors engaged legal advisors and, in January 2015, financial advisors to explore various restructuring alternatives. The Debtors and their advisors commenced negotiations with certain of their lenders under the Credit Agreement as well as the Consenting Noteholders, and their respective advisors, regarding terms of a potential restructuring that would de-lever the Debtors’ balance sheet and enable the Debtors to implement a financial and operational restructuring. After extensive, good faith and arm’s-length negotiations, the Debtors ultimately reached an agreement with the Initial Consenting Noteholders (as defined in the Original Restructuring Support Agreement) and the Initial Secured Lenders, which was formalized by the Original Restructuring Support Agreement. As discussed in Section V.D. below, on July 23, 2015, the Original Restructuring Support Agreement was amended and restated pursuant to the terms thereof by the Amended and Restated Restructuring Support Agreement.

| V. | EVENTS DURING THE CHAPTER 11 CASES |

| A. | The First and Second Day Pleadings and Other Case Matters |

| 1. | The First and Second Day Pleadings |

To facilitate the administration of the Chapter 11 Cases and minimize disruption to the Debtors’ operations, the Debtors filed certain “first day” and “second day” motions and applications with the Bankruptcy Court on the Petition Date and thereafter seeking certain relief. The relief sought in the “first day” and “second day” pleadings facilitated the Debtors’ seamless transition into chapter 11 and aided in the preservation of the Debtors’ going-concern value. Specifically, the Debtors, among other things, sought authority to: (i) obtain secured postpetition financing (as discussed below); (ii) pay certain employee, insurance and tax obligations; (iii) pay claims of certain critical vendors, shippers, warehousemen,

| 11 | As of March 9, 2015, gold closed at $1,168.50 per ounce and silver closed at $15.92 per ounce. |

13

miscellaneous lien claimants and claimants who may assert claims arising under Bankruptcy Code section 503(b)(9); (iv) provide adequate assurance of payment to certain utility providers; and (v) maintain their cash management system. In addition, the Debtors sought to (a) establish procedures for the sale of certain de minimis assets; (b) retain various professionals of the Debtors; and (c) establish procedures for the retention of ordinary course professionals and compensation of various other professionals.

| 2. | The Sale of the Debtors’ Exploration Properties |

On March 31, 2015, the Debtors filed the Debtors’ Motion for Orders (I)(A) Authorizing Selling Debtors’ Entry into the Stalking Horse Purchase Agreement for the Sale of the Selling Debtors’ Exploration Properties and Related Assets, (B) Approving Bidding Procedures and Bid Protections, (C) Scheduling a Hearing to Consider Approval of the Sale of Assets, (D) Approving Form and Manner of Notice of Sale, and (E) Granting Related Relief; and (II)(A) Authorizing and Approving the Sale of the Selling Debtors’ Assets Free and Clear of Liens, Claims, Interests and Encumbrances, (B) Authorizing the Assumption and Assignment of Certain Executory Contracts and Unexpired Leases, and (C) Granting Related Relief [Docket No. 133] (the “Sale Motion”) seeking authority to enter into a stalking horse purchase agreement with Clover Nevada LLC for the sale of certain of the Debtors’ exploration properties and related assets and seeking approval of bidding procedures in connection therewith. On April 24, 2015, the Bankruptcy Court entered an order approving the bidding procedures with respect to the Sale Motion. On June 18, 2015, the Bankruptcy Court entered an order approving the sale of the exploration properties to Clover Nevada LLC. On June 29, 2015, the Debtors and Clover Nevada LLC closed on the sale of the exploration properties.

| 3. | Non-Insider KEIP |

On May 11, 2015, the Debtors filed the Debtors’ Motion for Entry of an Order (A) Authorizing and Approving the Debtors’ Key Employee Incentive Program and (B) Granting Related Relief [Docket No. 362] seeking to implement a key employee incentive program (the “Non-Insider KEIP”) for 95 non-insider employees (the “Non-Insider KEIP Participants”) for Q2 and Q3 2015 based on the attainment of certain operational and/or strategic goals. On May 29, 2015, the Court entered an order authorizing and approving the Debtors’ implementation of the Non-Insider KEIP. The Non-Insider KEIP Participants earned $194,000 in the aggregate for Q2 2015 on account of the Non-Insider KEIP. The Debtors expect to pay the awards earned under the Non-Insider KEIP for Q2 2015 but discontinued the Non-Insider KEIP for Q3 2015.

| 4. | Claims |

On April 28, 2015, each of the Debtors filed a schedule of assets and liabilities, schedule of executory contracts and unexpired leases, and statement of financial affairs pursuant to Bankruptcy Code section 521, the Official Bankruptcy Forms and the Bankruptcy Rules (collectively, the “Schedules”). On May 15, 2015, the Bankruptcy Court entered an order (the “Bar Date Order”) establishing June 24, 2015 at 4:00 p.m. (prevailing Eastern Time) as the deadline for each entity to file Proofs of Claim based on prepetition Claims. Additionally, the Bar Date Order established separate deadlines for the filing of Claims arising from the Debtors’ rejection of executory contracts and unexpired leases, claims filed by governmental units (as defined in Bankruptcy Code section 101(27)) and Claims that the Debtors have amended in the Debtors’ Schedules. As of June 29, 2015, approximately 998 Proofs of Claim had been filed against the Debtors, asserting approximately $8,363,717,193.84 in aggregate Claims.

| 5. | The Appointment of the Creditors Committee |

On March 19, 2015, the US Trustee appointed a statutory committee of unsecured creditors in the Chapter 11 Cases (the “Creditors Committee”) pursuant to Bankruptcy Code section 1102. The Creditors Committee consists of three members: (i) Computershare Trust Company of Canada, as Indenture Trustee to the Notes (the “Indenture Trustee”); (ii) FLSmidth US Inc.; and (iii) International Lining Technology. The Creditors Committee engaged Arent Fox LLP and Polsinelli PC as its counsel and Zolfo Cooper, LLC as its financial advisor.

| 6. | The Appointment of the Equity Committee |