Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-33119

ALLIED NEVADA GOLD CORP.

(Exact name of Registrant as specified in its charter)

| Delaware | 20-5597115 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

9790 Gateway Drive, Suite 200, Reno Nevada 89521

(775) 358-4455

(Address and telephone number of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 Par Value | NYSE Amex LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files): Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| Large Accelerate Filer | x | Accelerated Filer | ¨ | |||

| Non-accelerated Filer | ¨ | Smaller Reporting Company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of voting Common Stock held by non-affiliates as of June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, was $1,590,767,856 based on the last reported sale price of the Common Stock on the NYSE Amex LLC on that date.

Number of shares outstanding of the registrant’s Common Stock as of February 22, 2011: 88,999,553

Documents Incorporated by Reference:

To the extent specifically referenced in Part III, portions of the registrant’s definitive Proxy Statement on Schedule 14A for the 2011 Annual Meeting of Stockholders are hereby incorporated by reference into this report. See Part III.

Table of Contents

Table of Contents

Note Regarding Forward-Looking Statements

In addition to historical information, this Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein or incorporated by reference, that address activities, events or developments that we expect or anticipate will or may occur in the future, are forward-looking statements, including but not limited to such things as:

| • | our future business strategy, plans and goals; |

| • | our estimated capital expenditures; |

| • | our expansion expectations, including with respect to the Hycroft mine and Hasbrouck property; |

| • | our expectations regarding the growth of our business, our estimates of reserves and other mineralized material; |

| • | the economic potential of the sulfide mineralization and milling project at the Hycroft property; |

| • | the preliminary economic assessment at the Hasbrouck property; |

| • | the anticipated results of the exploration drilling programs at our properties; |

| • | future gold and silver prices; |

| • | our production estimates; |

| • | our expectations regarding gold and silver recovery; |

| • | our estimated future sales and cost of sales; |

| • | the availability of outside contractors; |

| • | our anticipated cash flows and cash operating costs; and |

| • | the availability of additional capital. |

These statements can be found under Part I—Item 1. Business, Part I—Item 1A. Risk Factors, Part I—Item 2. Properties, Part I—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and elsewhere throughout this Annual Report on Form 10-K. The words “estimate”, “plan”, “anticipate”, “expect”, “intend”, “believe”, “target”, “budget”, “may”, “schedule” and similar words or expressions identify forward-looking statements. These statements involve known and unknown risks, uncertainties, assumptions and other factors which may cause our actual results, performance or achievements to be materially different from any results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on current expectations. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to:

| • | volatile market prices of gold and silver; |

| • | risks related to the heap leaching process at the Hycroft Mine, including but not limited to gold recovery rates, gold extraction rates, and the grades of ore placed on our leach pads; |

| • | uncertainties concerning estimates of mineral reserves, mineral resources and grading; |

| • | cost of compliance with current and future government regulations, including those related to environmental protection, mining, health and safety, corporate governance and public disclosure; |

| • | uncertainties relating to obtaining or retaining approvals and permits from governmental regulatory authorities; |

| • | our ability to achieve our estimated production rates and stay within our estimated operating costs; |

| • | the commercial success of our exploration and development activities; |

| • | an increase in the cost or timing of new projects; |

| • | our current intention not to use forward sale arrangements; |

| • | the inherently hazardous nature of mining activities, including operational, geotechnical and environmental risks; |

| • | our ability to raise additional capital on favorable terms or at all; |

| • | intense competition within the mining industry; |

| • | uncertainties related to our ability to find and acquire new mineral properties; |

| • | potential operational and financial effects of current and proposed federal and state regulations related to environmental protection and mining, and the exposure to potential liability created by such regulations; |

| • | availability of equipment or supplies; |

i

Table of Contents

| • | our ability to attract and retain personnel; |

| • | our ability to manage our growth; |

| • | potential challenges to title in our mineral properties; |

| • | risks associated with the expansion of our operations, including those associated with any future acquisitions or joint ventures; |

| • | risks that our principal stockholders will be able to exert significant influence over matters submitted to stockholders for approval; |

| • | potential conflicts of interests that may arise though some of our directors’ involvement with other natural resources companies; |

| • | the market price and future sales of our common stock; and |

| • | our decision not to pay dividends. |

For a more detailed discussion of such risks and other important factors that could cause actual results to differ materially from those in such forward-looking statements, please see the risk factors discussed in Part I—Item 1A. Risk Factors of this Form 10-K and in other filings with the SEC. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that our forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in the statements. We assume no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

Cautionary Note Regarding Mineralized Material

Allied Nevada has reported reserve and mineralized material estimates in accordance with SEC Industry Guide 7. In accordance with SEC Industry Guide 7, resources have been reported as “mineralized material”. Canadian investors are cautioned that estimates of mineralized materials may differ from mineral resource estimates prepared in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in Canadian National Instrument 43-101 (NI 43-101). Canadian investors should review the mineral resource estimates prepared in accordance with NI 43-101 contained in the mineral proven and probable ore reserves table.

ii

Table of Contents

| Item 1. | Business |

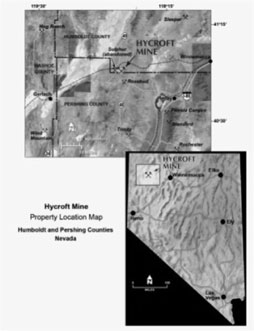

Allied Nevada Gold Corp. is a mining and exploration company which produces gold as a primary product and silver as a by-product. Allied Nevada currently operates its wholly-owned Hycroft Mine, located west of Winnemucca, Nevada. The Hycroft mine hosts a current Proven and Probable mineral reserve of 2.6 million ounces of gold and 49.3 million ounces of silver. The property resides on an aggregate land position of approximately 96 square miles. The mine reopened in 2007, and in 2010, the Company began an accelerated mining plan for its oxide heap leach operation involving the purchase of a larger capacity mining fleet, essentially tripling the 2009 mining rate over a three-year period. The expansion is in progress and will increase expected annual production from 130,000 ounces of gold in 2011 to over 260,000 ounces of gold in 2012. With the accelerated mining rate taken into account, the reserve is sufficient to support a 6 year mine life. The Company has completed a scoping study that includes a milling option for processing sulfide ore and higher grade oxide ores. The Company plans to issue an initial feasibility study in 2011 for this milling option. The Company intends to continue exploration programs with a goal of extending the mine life at Hycroft and identifying potential development opportunities at outside exploration properties.

Allied Nevada’s corporate headquarters is located at 9790 Gateway Drive, Suite 200, Reno, Nevada 89521. In this report, “Allied Nevada”, the “Company”, “our” and “we” refer to Allied Nevada Gold Corp. and its subsidiaries.

Formation of Allied Nevada

Allied Nevada Gold Corp. was incorporated under the laws of Delaware on September 14, 2006 and until May 10, 2007 we were a wholly-owned subsidiary of Vista Gold Corp. (“Vista”), a corporation incorporated under the laws of the Yukon Territory, Canada.

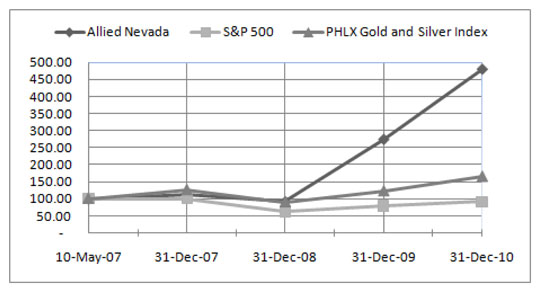

We commenced operations on May 10, 2007, following Vista’s transfer to us of its Nevada-based mining properties and related assets, along with cash, and the transfer to us by Carl Pescio and Janet Pescio (the “Pescios”) of their interests in certain Nevada mining properties and related assets. In this document, we sometimes use the term “Vista Nevada Assets” to refer to, Vista’s Nevada-based mining properties and related assets that were transferred to us pursuant to the Arrangement Agreement that we entered into with Vista and the Pescios on September 22, 2006, as amended. Before the Arrangement Agreement transactions were completed, we had no properties or property interests, were not yet conducting business operations and had no shareholders other than Vista. The shares of Allied Nevada common stock began trading on May 10, 2007, on the NYSE Amex, and the Toronto Stock Exchange (“TSX”).

In July 2007, Allied Nevada completed a private placement for gross proceeds of CDN$17,000,000. We issued 3,696,000 units consisting of one common share and common share purchase warrant. The proceeds of the private placement were for the exploration and development of the Hycroft Mine and for general corporate purposes.

In September 2007, the Board of Directors approved the re-opening of the Hycroft Mine (“Hycroft Development Program”). The Hycroft Development Program involved re-opening the Hycroft Mine and heap leach facilities which had been placed on a care and maintenance program due to low gold prices since 1998.

In April 2008, we completed a financing and issued 14,375,000 common shares for gross proceeds of CDN$75,468,750. Proceeds from the financing were to fund the reactivation of the Hycroft Mine and to continue oxide and sulfide exploration activities at Hycroft.

In August 2009, we completed a cross-border financing and issued 11,150,000 common shares for gross proceeds of CDN$100,350,000. Proceeds from the financing were to fund an expanded oxide and sulfide exploration program at Hycroft and general corporate purposes.

In June, 2010, we completed a cross-border financing and issued 13,500,000 common shares for aggregate proceeds of CDN$283,500,000. Proceeds from the financing were to satisfy initial capital needs for the accelerated oxide expansion, to fund exploration programs and to complete an initial milling feasibility study related to the development of the sulfide resource.

Segment Information

Our operating segments are the Hycroft Mine, Exploration Properties, and other. The Hycroft Mine operating segment contains the exploration and operational activities at our wholly-owned Hycroft Mine located in Nevada. The Exploration Properties segment contains the exploration and development activities on the Company’s Advanced Exploration Properties and Other Exploration Properties. The other operating segment primarily contains the corporate overhead functions of the Company. Please see Note 19 to our Consolidated Financial Statements for information related to our business segments.

General Description of the Business of Allied Nevada

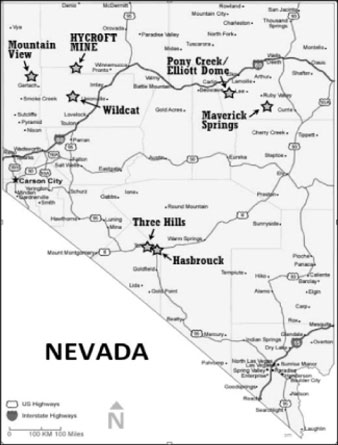

Allied Nevada owns the Hycroft Mine, Hasbrouck, Mountain View, Three Hills and Wildcat projects, the Maverick Springs project (a 45% joint venture with Silver Standard Resources Inc. (“Silver Standard”)), the Pony Creek/Elliot Dome project, and the

1

Table of Contents

exploration rights to approximately 100 Other Exploration Properties. For more information related to each of these properties, see “Part I—Item 2. Properties”. All of these properties are located in the state of Nevada.

Allied Nevada operates the wholly-owned Hycroft Mine, which is located 54 miles west of Winnemucca, Nevada. The Hycroft Mine is an open pit, run-of-mine and crushed ore heap leach gold mine that also produces silver as a byproduct of the gold recovery process. We intend to mine all currently identified ore reserves by open pit methods with a typical drill, blast, load, and haul cycle from six pits; the Brimstone, Bay, Central, Cut-5, Camel and Boneyard pits. Currently, the majority of the ore-grade material placed on the leach pad is run-of-mine with a small percentage being crushed. Ore is selectively crushed based on ore type and grade. The pregnant solution is processed using a Merrill-Crowe zinc-precipitation process (“Merrill-Crowe process”) and a Carbon-in-Column leach solution recovery process (“CIC process”).

In addition to operating the Hycroft Mine, Allied Nevada is engaged in the evaluation, acquisition, exploration and advancement of gold exploration and development projects in the State of Nevada. We expect to continue our focus on gold project acquisition and development in the future.

Principal Products

Allied Nevada sold 102,483 ounces of gold and 238,242 ounces of silver during 2010. We generally sell our gold at the prevailing market price during the month in which the gold is delivered to the customer. We recognize revenue from a sale when the price is determinable, the gold has been delivered, the title has been transferred to the customer and collection of the sales price is reasonably assured.

Most of our revenue arises from the sale of refined gold in the international market. The end product at our gold operations, however, is generally doré bars. Doré is an alloy consisting of gold, silver and other metals. Doré is sent to refiners to produce bullion that meets the required market standard of 99.95% pure gold. Under the terms of our refining agreements, the doré bars are refined for a fee, and our share of the refined gold and the separately-recovered silver are credited to our account or delivered to our buyers.

During 2010, our gold revenues were more than 26 times our silver revenues. As such, we consider gold to be a principal product and silver to be a byproduct of the gold recovery process.

Gold Uses. Gold has two main categories of use: fabrication and investment. Fabricated gold has a variety of end uses, including jewelry, electronics, dentistry, industrial and decorative uses, medals, medallions and official coins. Gold investors buy gold bullion, official coins and jewelry.

Gold Supply. The supply of gold consists of a combination of current production from mining and the draw-down of existing stocks of gold held by governments, financial institutions, industrial organizations and private individuals. Based on public information total world gold supply increased only 2% for 2010. For the years 2007 through 2009, global mine production has, on average, accounted for approximately 60% of the annual supply of gold. Increased mine supply and recycling along with reduced producer de-hedging accounted for a sizable increase year over year. These gains were partially offset by net official sector sales, which decreased to 49 tons in 2009 compared with the average annual sales over the last five years ending 2008 of 489 tons. According to the World Gold Council, gold demand in 2010 reached a 10 year high, up 9% year-over-year, and marginally above the previous peak of 2008 despite a 40% increase in the annual average price level between 2008 and 2010. Annual demand for gold jewelry rose 17%, investment demand, comprising bar and coin demand, ETFs and similar products, remained stable in 2010, down just 2% from 2009 and demand for gold used in technology was 12.4% higher than in 2009. India was the strongest growth market in 2010 with total annual consumer demand registering growth of 66% relative to 2009, which was largely driven by the jewelry sector. China was the strongest market for investment demand growth with demand for small bars and coins increasing 70% compared with 2009.

Gold Prices. The price of gold is volatile and is affected by many factors beyond our control, such as the sale or purchase of gold by central banks and financial institutions, inflation or deflation, fluctuation in the value of the US dollar and foreign currencies, global and regional demand and the political and economic conditions of major gold producing countries throughout the world. The following table presents the annual high, low and average afternoon fixing prices for gold over the past ten years, expressed in US dollars per ounce, on the London Bullion Market.

| Gold Price (USD) per Ounce on the London Bullion Market |

||||||||||||

| Year |

High | Low | Average | |||||||||

| 2001 |

293 | 256 | 271 | |||||||||

| 2002 |

349 | 278 | 310 | |||||||||

| 2003 |

416 | 320 | 363 | |||||||||

| 2004 |

454 | 375 | 410 | |||||||||

| 2005 |

536 | 411 | 444 | |||||||||

| 2006 |

725 | 525 | 604 | |||||||||

| 2007 |

841 | 608 | 695 | |||||||||

| 2008 |

1,011 | 713 | 872 | |||||||||

| 2009 |

1,213 | 810 | 972 | |||||||||

| 2010 |

1,421 | 1,058 | 1,225 | |||||||||

Source: London Metal Exchange

2

Table of Contents

On February 22, 2011, the afternoon fixing price for gold on the London Bullion Market was $1,401 per ounce.

Business Strategy

Our business plan was developed with the overriding goal of maximizing shareholder value through the operation of the Hycroft Mine, the exploration and development of our mineral properties, and through strategic partnerships. To achieve this goal, our business plan focuses on three strategic areas:

| • | Hycroft Mine |

| • | Mine Operations |

| • | Hycroft Expansion Projects |

| • | Hycroft Exploration Drilling Program |

| • | Advanced Exploration Properties |

| • | Mergers and Acquisitions |

Hycroft Mine

Mine Operations

The Hycroft Mine is located 54 miles west of Winnemucca, Nevada along the border of Humboldt and Pershing Counties, and covers approximately 61,389 acres of mineral rights. The mine can be accessed by various routes year-round. However, primary access is by an all-weather, maintained gravel road from the town of Winnemucca.

Our operating objective at the Hycroft Mine is to mine the deposit in a profitable, safe, and environmentally friendly manner. To attain this goal, we have focused on recruiting and retaining experienced executives, managers, and employees. Our team has extensive experience in managing and operating mines utilizing the specific mining and processing methods used by the Company. We believe this team has identified the appropriate technologies and developed the appropriate production management, health and safety programs and environmental management, monitoring, and protection programs.

2010 Operations

In 2010, Hycroft successfully completed its second full year of operations, achieving its stated operating goals. The mine moved 26.5 million tons of material, including 9.9 million tons of ore placed on the leach pad at average grades of 0.020 opt gold and 0.246 opt silver, placing 194,100 contained ounces of gold (109,900 ounces of recoverable gold) and 2,436,600 contained ounces of silver (243,700 ounces of recoverable silver).

The mine completed a 3.5 million square foot expansion of its Brimstone leach pad in 2010, increased the flow rate through the Merrill-Crowe plant from 2,500 to 3,500 gallons per minute (“gpm”) and began work on the construction of a new truck shop capable of handling larger capacity mining equipment. The improvements were all in connection with the ramping up of the accelerated oxide mine plan, announced in early 2010.

Hycroft Expansion Projects

Accelerated Oxide Heap Leach Plan

The Company began implementing an accelerated oxide mine plan in mid-2010 with a goal of tripling the mining rate utilizing a larger capacity mining fleet. By the end of 2010, one hydraulic shovel and three of the 320-ton trucks were in operation.

The accelerated oxide mine plan that we began implementing in 2010, is being phased in over the next two years, with gold production being expected to increase from approximately 100,000 ounces in 2010 to over 260,000 ounces of gold in 2012 and an expectation that it will peak at over 300,000 ounces in each of 2013 and 2014.

Mill Project Scoping Study

The Company completed a milling scoping study in April 2010, designed to extract the large sulfide resource and additional oxide resources associated with the sulfides. This study was subsequently updated in September of 2010 (“2010 scoping study”). The 2010 scoping study envisions an 174,000 ore ton per day (“tpd”) milling and heap leach operation. This updated scoping study concludes that average annual production of approximately 610,000 ounces of gold and 27 million ounces of silver could be produced from the combined 100,000 tpd milling operation and 74,000 tpd heap leach operation. The estimated capital cost was expected to be $1.1 billion for the milling and flotation process facility, additional leach pads, mining equipment and other ancillary infrastructure. The milling facility would be comprised of one or two lines, with each consisting of a primary crusher, semi-autogenous grinding mill, two ball mills and a flotation circuit and could be implemented in stages in order to manage capital expenditures over the first few years of the project.

3

Table of Contents

The Company expects to complete an update to the 2010 scoping study in March 2011. Based on the favorable result of the milling scoping study and the subsequent updates, the Company is preparing an initial feasibility study, currently expected to be released in the third quarter of 2011. For detailed information regarding the scoping study see “Part I—Item 2. Properties—Operating Properties—Hycroft Mine—Mill Project Scoping Study”.

Hycroft Exploration Drilling Program

In 2010, Allied Nevada successfully completed its drill campaign with primary goals of improving the confidence level of other mineralized material and providing data for engineering and metallurgical studies in support of the initial milling feasibility study that the Company expects to issue in the third quarter of 2011. In the first quarter of 2011, drilling is expected to utilize a fleet of seven to ten drill rigs. For the remainder of the year, we expect to reduce the drill fleet to two or three rigs which will be directed toward step-out drilling and testing geophysical anomalies around the Hycroft property with a goal of expanding the resource base.

In 2010, the Company continued to define sulfide gold and silver mineralization as part of the Hycroft exploration drilling program. The drilling was also used to collect samples for ongoing metallurgical work and pit slope analyses in preparation of an initial feasibility study for a milling scenario. Results of this exploration campaign are expected to be released in the first quarter of 2011 as part of the Company’s annual reserve reporting.

Any expansion of the Hycroft Mine necessary to exploit any additional reserves that may be established through our Hycroft exploration drilling program that are not located within our current mine plan will require us to obtain all permits, approvals and consents of regulatory agencies responsible for the use and development of mines in Nevada.

For further discussions concerning these programs, see “Part I—Item 2. Properties—Operating Properties—Hycroft Mine—Hycroft Mine Exploration”.

Advanced Exploration Properties

Our Advanced Exploration Properties portfolio consists of six advanced properties, being Hasbrouck, Mountain View, Maverick Springs (a 45% joint venture interest with Silver Standard), Three Hills, Wildcat, and Pony Creek/ Elliot Dome.

The Company commenced drilling activities on Hasbrouck in 2010 with the goal of developing the property. The Company intends to publish an updated resource estimate and preliminary economic assessment in 2011 for Hasbrouck. Exploration drilling will continue through the first half of 2011 with a goal of delineating and expanding the mineralization. The resource model and economic analyses will then be updated during the second half of the year.

The Company is developing exploration programs at other Advanced Exploration Properties for 2011 with the goal of confirming or establishing mineralization at these properties.

For further discussions concerning our exploration properties, please see information concerning each property under “Part I—Item 2. Properties”.

Other Exploration Properties

The Company has approximately 100 Other Exploration Properties in the state of Nevada. The Company intends to pursue strategic options for these exploration properties that could include development through exploration programs, joint ventures, royalty agreements, or the sale or release of the property.

Mergers and Acquisitions

We routinely review merger and acquisition opportunities. Our primary focus will be on those opportunities involving precious metal production or near-term production with a secondary focus on other resource-based opportunities. Potential acquisition targets would include private and public companies or individual properties. Although our preference would be for acquisition candidates located in the United States, Allied Nevada will consider opportunities located in other countries where the geopolitical risk is acceptably low.

Financial Information Included in This Document

This Annual Report on Form 10-K includes financial and other information for the years ended December 31, 2006-2010. Prior to May 10, 2007, we were still a wholly-owned subsidiary of Vista. Consistent with our past filings, the financial statements, related discussion and analysis and other financial information in this document were prepared as it relates to the subsidiaries of Vista that held Nevada-based mining properties and related assets that were transferred to Allied Nevada as part of the Arrangement Agreement. In our filings prior to the completion of the Arrangement Agreement, we referred to these subsidiaries as “Vista Gold Corp.—Nevada exploration properties” or “Vista Nevada”. Our financial statements do not include any historical financial information on the property interests acquired by Allied Nevada from the Pescios. Accordingly, the financial statements for periods prior to the completion of the Arrangement Agreement as presented in this Annual Report on Form 10-K are those of Vista Nevada, as so termed, and are not indicative of results of operations of Allied Nevada as it is now constituted.

For further information concerning financial information included in this document, please see “Part II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Notes to Consolidated Financial Statements—Note 1.

4

Table of Contents

Employees

Allied Nevada currently has 231 employees, of which 207 are employed at the Hycroft Mine. To the extent necessary, Allied Nevada uses consultants with specific skills to assist with various aspects of its project evaluation drill program management, expansion and feasibility studies, due diligence, acquisition initiatives, corporate governance and property management.

Competition

Allied Nevada competes with other mining companies in connection with the acquisition of gold properties. There is competition for the limited number of gold acquisition opportunities, some of which is with companies having substantially greater financial resources than Allied Nevada. As a result, Allied Nevada may have difficulty acquiring attractive gold projects at reasonable prices.

Allied Nevada also competes with other mining companies for skilled employees and from time-to-time certain production inputs have been in short supply. Shortages of production supplies rarely lead to serious issues for the operation, but would require us to either substitute with lower quality supplies or to ship these supplies from longer distances. These substitutions and changes would therefore result in minor production inefficiencies or additional costs. We have not experienced any material shortages in production inputs of this nature.

Management of Allied Nevada believes that no single company has sufficient market power to affect the price or supply of gold in the world market.

Allied Nevada does not have any major customers for its gold production that would adversely affect the Company should such customers fail.

Please see “Part I—Item 1A. Risk Factors—Risks Relating to Our Company—We face intense competition in the mining industry”, for additional discussion related to our current and potential competition.

Available Information

Allied Nevada maintains an internet web site at www.alliednevada.com. Allied Nevada makes available, free of charge, through the Investor Information section of the web site, its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K filed or furnished pursuant to Section 13(a) of 15(c) of the Exchange Act, and all amendments to those reports, as soon as reasonably practical after such material is electronically filed with the Securities and Exchange Commission. Allied Nevada’s Corporate Governance Guidelines, the charters of key committees of its Board of Directors and its Code of Business Ethics and Conduct are also available on the web site.

Government Regulation of Mining-Related Activities

Property Interests and Mining Claims

Our exploration activities are conducted in the state of Nevada. Mineral interests may be owned in Nevada by (a) the United States, (b) the state itself, or (c) private parties. Where prospective mineral properties are owned by private parties, or by the state, some type of property acquisition agreement is necessary in order for Allied Nevada to explore or develop such property. Generally, these agreements take the form of long-term mineral leases under which we acquire the right to explore and develop the property in exchange for periodic cash payments during the exploration and development phase and a royalty, usually expressed as a percentage of gross production or net profits derived from the leased properties if and when mines on the properties are brought into production. Other forms of acquisition agreements are exploration agreements coupled with options to purchase and joint venture agreements. Where prospective mineral properties are held by the United States, mineral rights may be acquired through the location of unpatented mineral claims upon unappropriated federal land. If the statutory requirements for the location of a mining claim are met, the locator obtains a valid possessory right, subject to the paramount title of the United States, to develop and produce minerals from the claim conditioned upon applicable environmental reviews and permitting programs. Federal unpatented mining claims must be maintained through filing notices of intent to maintain the claims with the county and the completion of annual assessment work or, since 1993, payment of federal maintenance fees. The right can be transferred as prescribed under law and, provided that the locator is able to prove the discovery of valuable, locatable minerals on the claims and to meet all other applicable federal and state requirements and procedures pertaining to the location and maintenance of federal unpatented mining claims, the claim locator would have the right to prosecute a patent application to secure fee title to the claim from the federal government. The right to pursue a patent, however, has been subject to a moratorium since October 1993, through federal legislation restricting the U.S. Bureau of Land Management (BLM) from accepting any new mineral patent applications. Additionally, proposed federal legislation has been introduced to amend the federal mining law pursuant to which, if adopted, would, among other changes, remove the right to obtain a patent and replace the claim location process with a leasing program.

Mining claims are subject to the same risk of defective title that is common to all real property interests. Additionally, mining claims are self-initiated and self-maintained and therefore, possess some unique vulnerabilities not associated with other types of property interests. It is impossible to ascertain the validity of unpatented mining claims solely from an examination of the public real estate records and, therefore, it can be difficult or impossible to confirm that all of the requisite steps have been followed for location and maintenance of a claim. If the validity of a patented mining claim is challenged by the BLM or the U.S. Forest Service on the grounds that mineralization has not been demonstrated, the claimant has the burden of proving the present economic feasibility of mining minerals located thereon. Such a challenge might be raised when a patent application is submitted, when the government seeks to include the land in an area to be dedicated to another use, or when a party files a permit application or plan of operation to develop the mining claims.

5

Table of Contents

Reclamation

We are required to mitigate long-term environmental impacts by stabilizing, contouring, resloping and revegetating various portions of a site after mining and mineral processing operations are completed. These reclamation efforts will be conducted in accordance with detailed plans, which must be reviewed and approved by the appropriate regulatory agencies.

Allied Nevada’s principal reclamation liability is at the Hycroft Mine. At December 31, 2010, we have posted reclamation bonds totaling $16.6 million. These reclamation bonds are supported by an insurance-backed financial assurance program and a surety bond. Please see Note 7-Restricted Cash to our consolidated financial statements for more information.

In January, 2010, the reclamation surety for the Hycroft mine was increased to a total of $16.6 million. This increase covers the reclamation liability associated with the increased exploration activities, Brimstone and Central pit expansions, and a consolidation and expansion of the numerous waste rock facilities into larger, well-defined areas.

Government Regulation

Mining operations and exploration activities are subject to various federal, state and local laws and regulations in the United States, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We have obtained or have pending applications for those licenses, permits or other authorizations currently required to conduct our exploration and other programs. We believe that Allied Nevada is in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed thereunder in Nevada and the United States and in any other jurisdiction in which we will operate. We are not aware of any current orders or directions relating to Allied Nevada with respect to the foregoing laws and regulations.

Environmental Regulation

Our gold projects are subject to various federal and state laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. It is our policy to conduct business in a way that safeguards public health and the environment. We believe that Allied Nevada’s operations are and will be conducted in material compliance with applicable laws and regulations.

Changes to current state or federal laws and regulations in Nevada, where we operate currently, or in jurisdictions where we may operate in the future, could require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could impact the economics of our projects.

During 2008, 2009, and 2010, there were no material environmental incidents or non-compliance with any applicable environmental regulations on the properties now held by Allied Nevada. Allied Nevada did not incur material capital expenditures for environmental control facilities during 2008, 2009, or 2010 and does not expect to incur any such expenditures in 2011.

Mine Safety and Health Administration Regulations

Allied Nevada considers health, safety and environmental stewardship to be a core value for the Company and received a “Sentinels of Safety” award for 2008 in 2009. Allied Nevada has a mandatory mine safety and health program including employee training, risk management, workplace inspection, emergency response, accident investigation and program auditing. The Company considers this program to be essential at all levels to ensure that employees and the Company conduct themselves in an environment of exemplary health, safety and environmental governance.

Our operations and exploration properties are subject to regulation by the Federal Mine Safety and Health Administration (“MSHA”) under the Federal Mine Safety and Health Act of 1977 (the “Mine Act”). MSHA inspects our mines on a regular basis and issues various citations and orders when it believes a violation has occurred under the Mine Act. Following passage of The Mine Improvement and New Emergency Response Act of 2006, MSHA significantly increased the numbers of citations and orders charged against mining operations. The dollar penalties assessed for citations issued has also generally increased in recent years.

In accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Act”) made law in July 2010, which requires certain disclosures by companies required to file periodic reports under the Securities Exchange Act of 1934, as amended, the Company has provided disclosure as required by the Act in Part I—Item 4B. A list of the citations/orders and proposed assessments for Hycroft for the year ended December 31, 2010 were taken from the MSHA data retrieval system, which can be found at http://www.msha.gov/drs/drshome.htm.

| Item 1A. | Risk Factors |

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information contained in this Form 10-K before deciding to invest or to continue holding your investment in our common stock. The risks described below are not the only ones facing us or otherwise associated with an investment in our common stock. Additional risks not presently known to us or which we currently consider immaterial may also adversely affect our business. We have attempted to identify the major factors that could cause differences between actual and planned or expected results, and we have

6

Table of Contents

included these material risk factors. If any of the following risks actually happen, our business, financial condition and operating results could be materially adversely affected. In this case, the trading price of our common stock could decline, and you could lose part or all of your investment. See “Note Regarding Forward-Looking Statements” above.

The market prices of gold and silver are volatile. Low gold and silver prices could result in decreased revenues, decreased net income or losses and decreased cash flows, and may negatively affect our business.

Gold and silver are commodities. Their prices fluctuate and are affected by many factors beyond our control, including interest rates, expectations regarding inflation, speculation, currency values, central bank activities, governmental decisions regarding the disposal of precious metals stockpiles, global and regional demand and production, political and economic conditions and other factors. The prices of gold and silver on the London Bullion Market on December 31, 2010 were $1,410.25 per ounce for gold and $30.65 per ounce for silver. The prices of gold and silver may decline in the future. Any decline in our realized gold or silver price adversely impacts our revenues, net income and cash flows, particularly in light of our strategy of not engaging in hedging transactions with respect to gold. In addition, sustained lower gold or silver prices can:

| • | reduce revenues further through production declines due to cessation of the mining of deposits, or portions of deposits, that have become uneconomic at the then-prevailing gold or silver price; |

| • | reduce or eliminate the profit that we currently expect from ore stockpiles and ore on leach pads; |

| • | halt or delay the development of new projects; |

| • | cause us to recognize an impairment to the carrying values of mineral properties; |

| • | reduce funds available for exploration with the result that depleted reserves may not be replaced; and |

| • | reduce existing reserves by removing ores from reserves that can no longer be economically processed at prevailing prices. |

The estimation of the ultimate recovery of gold and silver contained within the Hycroft heap leach pad inventory (and that of any future heap leach mines, although based on standard industry sampling and estimating methods) is subjective. Actual recoveries can be expected to vary from estimations.

The Hycroft Mine utilizes the heap leach process to extract gold and silver from ore. The heap leach process is a process of extracting gold and silver by placing ore on an impermeable pad and applying a diluted cyanide solution that dissolves a portion of the contained gold and silver, which are then recovered in metallurgical processes. We use several integrated steps in the process of extracting gold and silver to estimate the metal content of ore placed on the leach pad. Although we refine our estimates as appropriate at each step in the process, the final amounts are not determined until a third-party smelter converts the doré and determines final ounces of gold and silver available for sale. We then review this end result and reconcile it to the estimates we developed and used throughout the production process. Based on this review, we adjust our estimation procedures when appropriate. Due to the complexity of the estimation process and the number of steps involved, among other things, actual recoveries can vary from estimates, and the amount of the variation could be significant and could have a material adverse impact on our financial condition and results of operations.

Each of these factors also applies to any future development of properties not yet in production. In the case of mines that we may develop in the future, we will not have the benefit of actual experience in our estimates with respect to those mines, and there is a greater likelihood that actual results will vary from the estimates.

Reserve and resource calculations are estimates only, and are subject to uncertainty due to factors including metal prices, inherent variability of the ore and recoverability of metal in the mining process.

The calculation of mineral reserves, mineral resources and grading are merely estimates and depend upon geological interpretation and statistical inferences or assumptions drawn from drilling and sampling analysis, which may prove to be unpredictable. There is a degree of uncertainty attributable to the calculation of reserves, resources and corresponding grades. Until reserves and resources are actually mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of reserves and resources and ore may vary depending on metal prices. Any material change in the quantity of reserves, resources, mineralization, grade or stripping ratio may affect the economic viability of our properties. In addition, there can be no assurance that gold recoveries or other metal recoveries in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Compliance with current and future government regulations may cause us to incur significant costs.

Our operations are subject to extensive federal and state legislation governing matters such as mine safety, occupational health, labor standards, prospecting, exploration, production, exports, toxic substances, explosives, management of natural resources, price controls, land use, water use, air emissions, waste disposal, environmental review and taxes. Compliance with this and other legislation could require us to make significant capital outlays. The enactment of new legislation or more stringent enforcement of

7

Table of Contents

current legislation may increase costs, which could have a negative effect on our financial position. We cannot make assurances that we will be able to adapt to these regulatory developments on a timely or cost-effective basis. Violations of these laws, regulations and other regulatory requirements could lead to substantial fines, penalties or other sanctions, including possible shut-downs of the Hycroft Mine or future operations, as applicable.

Our operations are subject to numerous governmental permits that are difficult to obtain and we may not be able to obtain or renew all of the permits we require, or such permits may not be timely obtained or renewed.

In the ordinary course of business we are required to obtain and renew governmental permits for our operations, including in connection with our mining and exploration plans at the Hycroft Mine and our exploration plan at Hasbrouck. Obtaining or renewing the necessary governmental permits is a complex and time-consuming process involving costly undertakings by us. The duration and success of our efforts to obtain and renew permits are contingent upon many variables not within our control, including the interpretation of applicable requirements implemented by the permitting authority and intervention by third parties in any required environmental review. We may not be able to obtain or renew permits that are necessary to our operations on a timely basis or at all, and the cost to obtain or renew permits may exceed our estimates. Failure to comply with the terms of our permits may result in injunctions, fines, suspension or revocation of permits and other penalties. There can be no assurance that we have been or will at all times be in full compliance with all of the terms of our permits or that we have all required permits. The costs and delays associated with compliance with these permits and with the permitting process could stop us from proceeding with the operation or development of a property or increase the costs of development or production and may materially adversely affect our business, results of operations or financial condition.

We may not achieve our production estimates and our operating costs may be higher than our estimates.

We prepare estimates of future production and operating costs for our operations. We develop our estimates based on, among other things, mining experience, reserve and resource estimates, assumptions regarding ground conditions and physical characteristics of ores (such as hardness and presence or absence of certain metallurgical characteristics) and estimated rates and costs of mining and processing. All of our estimates are subject to numerous uncertainties, many of which are beyond our control. Our actual production may be lower than our production estimates and our actual operating costs may be higher than our operating cost estimates.

We cannot be certain that our future exploration and development activities will be commercially successful.

Substantial expenditures are required to further explore our Hycroft and Hasbrouck properties, to establish reserves and resources through drilling and analysis, to develop metallurgical processes to extract metal from the ore and, in the case of new properties or the expansion of our existing projects, to develop the mining and processing facilities and infrastructure at any site chosen for mining. We cannot provide assurance that any reserves or resources discovered will be in sufficient quantities to justify commercial operations or that the funds required for development can be obtained on a timely basis. A number of factors, including costs, actual mineralization, consistency and reliability of ore grades and commodity prices, affect successful project development. The reactivation and efficient operation of processing facilities, the existence of competent operational management and prudent financial administration, as well as the availability and reliability of appropriately skilled and experienced consultants also can affect successful project development. There can be no assurance that our exploration and development programs, including the advancement of the Hycroft oxide operation, the feasibility study for the Hycroft milling project and the preliminary economic assessment of Hasbrouck, will result in economically viable mining operations or yield new mineral reserves and resources.

Cost estimates and timing of new projects are uncertain.

The capital expenditures and time required to develop and explore our properties, including the Hycroft and Hasbrouck properties, are considerable and changes in costs, construction schedules or both, can affect project economics. There are a number of factors that can affect costs and construction schedules, including, among others:

| • | availability of labor, power, transportation and infrastructure; |

| • | changes in input commodity prices and labor costs; |

| • | fluctuations in currency exchange rates; |

| • | availability and terms of financing; |

| • | changes in anticipated tonnage, grade and metallurgical characteristics of the ore to be mined and processed; |

| • | recovery rates of gold and other metals from the ore; |

| • | difficulty of estimating construction costs over a period of years; |

| • | delays in completing any environmental review or in obtaining environmental or other government permits; |

| • | weather and severe climate impacts; and |

| • | potential delays related to social and community issues. |

8

Table of Contents

The scoping study initially announced by us in April 2010 and subsequently updated in September 2010 relates to the economic potential of the sulfide mineralization at the Hycroft property and is not part of, and should be distinguished from, the current oxide heap leach mining operation. The scoping study is based solely on the other mineralized material (or measured and indicated sulfide resources as defined by NI 43-101) defined on the property. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Investors should be cautioned that the scoping study is very preliminary in nature and, accordingly, is subject to a high degree of uncertainty. A preliminary and/or a definitive feasibility study will be required to further evaluate project economics.

We do not currently intend to use forward sale arrangements to protect against low commodity prices and, as a result, our operating results are exposed to the impact of any significant drop in commodity prices.

We do not currently intend to enter into forward sales arrangements to reduce the risk of exposure to volatility in commodity prices. Accordingly, our future operations are exposed to the impact of any significant decrease in commodity prices. If such prices decrease significantly, we will realize reduced revenues. While it is not our current intention to enter into forward sales arrangements, we are not restricted from entering into forward sales arrangements at a future date.

The hazards and uncertainties associated with mining pose operational and environmental risks that may not be covered by insurance and may increase our costs.

Mining and processing operations involve many hazards and uncertainties, including, among others: environmental contamination; metallurgical and other processing problems; unusual and unexpected rock formations or water conditions; seismic activity; ground or slope failures or underground cave-ins; industrial accidents; fires; flooding and periodic interruptions due to inclement or hazardous weather conditions or other acts of nature; organized labor disputes or work slow-downs; mechanical equipment failure and facility performance problems; and the availability of critical materials, equipment and skilled labor. These risks could result in damage to, or destruction of, our properties or production facilities, personal injury or death, environmental damage, delays in mining or processing, increased production costs, asset write downs, monetary losses and legal liability.

We cannot be certain that our insurance will cover all of the risks associated with mining and processing or that we will be able to maintain insurance to cover these risks at economically feasible premiums. We could also become subject to liability for hazards against which we cannot insure or against which we may elect not to insure because of high premium costs or commercial impracticality. Such events could result in a prolonged interruption in operations that would have a negative effect on our ability to generate revenues, profits and cash flow. Losses from such events may increase costs and decrease profitability.

We may be unable to raise additional capital on favorable terms.

The exploration and development of our properties, including the advancement of the Hycroft oxide operation, the feasibility study for the Hycroft milling project and the preliminary economic assessment of Hasbrouck, will require significant capital investment. Failure to obtain sufficient financing may result in the delay or indefinite postponement of exploration activity, development or production on any of our properties. There can be no assurance that additional financing will be available at all or on terms we consider acceptable.

We face intense competition in the mining industry.

The mining industry is intensely competitive. As a result of this competition, some of which is with large established mining companies with substantial capabilities and with greater financial and technical resources than ours, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. This, in turn, may adversely affect our financial condition and our results of operations. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully attract and retain qualified employees, our exploration and development programs may be slowed down or suspended.

Our exploration and development operations are subject to extensive environmental regulations, which could result in the incurrence of additional costs and operational delays.

All phases of our operations are subject to extensive environmental regulation. These environmental regulations require we obtain various operating approvals and licenses and also impose standards and controls relating to exploration, development and production activities. The regulatory environment in which we operate is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. New environmental laws and regulations or changes in existing environmental laws and regulations could have a negative effect on exploration activities, operations, production levels and methods of production. There is no assurance that future changes in environmental laws and regulations will not adversely affect our projects.

9

Table of Contents

Our properties in Nevada occupy private and public lands and are subject to environmental regulation, under applicable Federal and state laws and regulations. Production at our Hycroft Mine involves the use of sodium cyanide, which is a toxic material. Should sodium cyanide leak or otherwise be discharged from the containment system, we may become subject to liability for cleanup work that may not be insured.

U.S. Federal Laws

The Comprehensive Environmental, Response, Compensation, and Liability Act (CERCLA), and comparable state statutes, impose strict, joint and several liability on current and former owners and operators of sites and on persons who disposed of or arranged for the disposal of hazardous substances found at such sites. It is not uncommon for the government to file claims requiring cleanup actions, demands for reimbursement for government-incurred cleanup costs, or natural resource damages, or for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances released into the environment. The Federal Resource Conservation and Recovery Act (RCRA), and comparable state statutes, govern the disposal of solid waste and hazardous waste and authorize the imposition of substantial fines and penalties for noncompliance, as well as requirements for corrective actions. CERCLA, RCRA and comparable state statutes can impose liability for clean-up of sites and disposal of substances found on exploration, mining and processing sites long after activities on such sites have been completed.

The Clean Air Act, as amended, restricts the emission of air pollutants from many sources, including mining and processing activities. Our mining operations may produce air emissions, including fugitive dust and other air pollutants from stationary equipment, storage facilities and the use of mobile sources such as trucks and heavy construction equipment, which are subject to review, monitoring and/or control requirements under the Clean Air Act and state air quality laws. New facilities may be required to obtain permits before work can begin, and existing facilities may be required to incur capital costs in order to remain in compliance. In addition, permitting rules may impose limitations on our production levels or result in additional capital expenditures in order to comply with the rules.

The National Environmental Policy Act (NEPA) requires federal agencies to integrate environmental considerations into their decision-making processes by evaluating the environmental impacts of their proposed actions, including issuance of permits to mining facilities such as Hycroft Mine, and assessing alternatives to those actions. If a proposed action could significantly affect the environment, the agency must prepare a detailed statement known as an Environmental Impact Statement (EIS). The U.S. Environmental Protection Agency, other federal agencies, and any interested third parties will review and comment on the scoping of the EIS and the adequacy of and findings set forth in the draft and final EIS. This process can cause delays in issuance of required permits or result in changes to a project to mitigate its potential environmental impacts, which can in turn impact the economic feasibility of a proposed project.

The Clean Water Act (CWA), and comparable state statutes, impose restrictions and controls on the discharge of pollutants into waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the Environmental Protection Agency (EPA) or an analogous state agency. The CWA regulates storm water mining facilities and requires a storm water discharge permit for certain activities. Such a permit requires the regulated facility to monitor and sample storm water run-off from its operations. The CWA and regulations implemented thereunder also prohibit discharges of dredged and fill material in wetlands and other waters of the United States unless authorized by an appropriately issued permit. The CWA and comparable state statutes provide for civil, criminal and administrative penalties for unauthorized discharges of pollutants and impose liability on parties responsible for those discharges for the costs of cleaning up any environmental damage caused by the release and for natural resource damages resulting from the release.

The Safe Drinking Water Act (SDWA) and the Underground Injection Control (UIC) program promulgated thereunder, regulate the drilling and operation of subsurface injection wells. EPA directly administers the UIC program in some states and in others the responsibility for the program has been delegated to the state. The program requires that a permit be obtained before drilling a disposal or injection well. Violation of these regulations and/or contamination of groundwater by mining related activities may result in fines, penalties, and remediation costs, among other sanctions and liabilities under the SWDA and state laws. In addition, third party claims may be filed by landowners and other parties claiming damages for alternative water supplies, property damages, and bodily injury.

Nevada Laws

At the state level, mining operations in Nevada are also regulated by the Nevada Department of Conservation and Natural Resources, Division of Environmental Protection. Nevada state law requires the Hycroft Mine to hold Nevada Water Pollution Control Permits, which dictate operating controls and closure and post-closure requirements directed at protecting surface and ground water. In addition, we are required to hold Nevada Reclamation Permits. These permits mandate concurrent and post-mining reclamation of mines and require the posting of reclamation bonds sufficient to guarantee the cost of mine reclamation. We have set up a provision for our reclamation bond at the Hycroft Mine but this provision may not be adequate. If we are required to carry out unanticipated reclamation work, our financial position could be adversely affected.

10

Table of Contents

Other Nevada regulations govern operating and design standards for the construction and operation of any source of air contamination and landfill operations. Any changes to these laws and regulations could have an adverse impact on our financial performance and results of operations by, for example, requiring changes to operating constraints, technical criteria, fees or surety requirements.

Legislation has been proposed that would significantly affect the mining industry.

Members of the U.S. Congress have repeatedly introduced bills which would supplant or alter the provisions of the Mining Law of 1872. If enacted, such legislation could change the cost of holding unpatented mining claims and could significantly impact our ability to develop mineralized material on unpatented mining claims. Such bills have proposed, among other things, to either eliminate or greatly limit the right to a mineral patent and to impose a federal royalty on production from unpatented mining claims. Although we cannot predict what legislated royalties might be, the enactment of these proposed bills could adversely affect the potential for development of unpatented mining claims and the economics of existing operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect our financial performance.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on our business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on us, our venture partners and our suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Given the emotion, political significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies in our industry could harm our reputation. The potential physical impacts of climate change on our operations are highly uncertain, and would be particular to the geographic circumstances in areas in which we operate. These may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels and changing temperatures. These impacts may adversely impact the cost, production and financial performance of our operations.

A shortage of equipment and supplies could adversely affect our ability to operate our business.

We are dependent on various supplies and equipment to carry out our mining exploration and development operations. The shortage of such supplies, equipment and parts could have a material adverse effect on our ability to carry out our operations and therefore limit or increase the cost of production.

If we lose key personnel or are unable to attract and retain additional personnel, we may be unable to establish and develop our business.

Our development in the future will be highly dependent on the efforts of key management employees, namely, Robert Buchan, our Executive Chairman, Scott Caldwell, our President and Chief Executive Officer, Hal Kirby, our Executive Vice President and Chief Financial Officer, and other key employees that we may hire in the future. Although we have entered into employment agreements with key employees, we do not have and currently have no plans to obtain key man insurance with respect to any of our key employees. As well, we will need to recruit and retain other qualified managerial and technical employees to build and maintain our operations. If we are unable to successfully recruit and retain such persons, our development and growth could be significantly curtailed.

Our lack of operating experience may cause us difficulty in managing our growth.

We commenced operations on May 10, 2007 as an independent entity and are establishing operating procedures for evaluating, acquiring and developing properties, and negotiating, establishing and maintaining strategic relationships. Our ability to manage our growth, if any, will require us to improve and expand our management and our operational and financial systems and controls. If the experience of current management is unable to manage growth effectively, our business and financial condition would be materially harmed. In addition, if rapid growth occurs, it may strain our operational, managerial and financial resources.

There are uncertainties as to title matters in the mining industry. Any defects in such title could cause us to lose our rights in mineral properties and jeopardize our business operations.

Our mineral properties consist of private mineral rights, leases covering state and private lands, leases of patented mining claims and unpatented mining claims. Many of our mining properties in the United States are unpatented mining claims located on lands

11

Table of Contents

administered by the U.S. Bureau of Land Management (BLM), Nevada State Office to which we have only possessory title. Because title to unpatented mining claims is subject to inherent uncertainties, it is difficult to determine conclusively ownership of such claims. These uncertainties relate to such things as sufficiency of mineral discovery, proper location and posting and marking of boundaries, and possible conflicts with other claims not determinable from descriptions of record. Since a substantial portion of all mineral exploration, development and mining in the United States now occurs on unpatented mining claims, this uncertainty is inherent in the mining industry.

The present status of our unpatented mining claims located on public lands allows us the right to mine and remove valuable minerals, such as precious and base metals, from the claims conditioned upon applicable environmental reviews and permitting programs. We also are allowed to use the surface of the land solely for purposes related to mining and processing the mineral-bearing ores. However, legal ownership of the land remains with the United States. We remain at risk that the mining claims may be forfeited either to the United States or to rival private claimants due to failure to comply with statutory requirements. Prior to 1993, a mining claim locator who was able to prove the discovery of valuable, locatable minerals on a mining claim, and to meet all other applicable federal and state requirements and procedures pertaining to the location and maintenance of federal unpatented mining claims, had the right to prosecute a patent application to secure fee title to the mining claim from the Federal government. The right to pursue a patent, however, has been subject to a moratorium since October 1993, through federal legislation restricting the BLM from accepting any new mineral patent applications. If we do not obtain fee title to our unpatented mining claims, there can be no assurance that we will be able to obtain compensation in connection with the forfeiture of such claims.

There may be challenges to title to the mineral properties in which we hold a material interest. If there are title defects with respect to any properties, we might be required to compensate other persons or perhaps reduce our interest in the affected property. Also, in any such case, the investigation and resolution of title issues would divert our management’s time from ongoing exploration and development programs.

Some of our directors may have conflicts of interest as a result of their involvement with other natural resource companies.

Some of our directors are directors or officers of other natural resource or mining-related companies, or may be involved in related pursuits that could present conflicts of interest with their roles at Allied Nevada. In the event that any such conflict of interest arises, a director who has such a conflict is required to disclose the conflict at a meeting of the directors of the Company and to abstain from voting for or against approval of any matter in which such director may have a conflict. In appropriate cases, we will establish a special committee of independent directors to review a matter in which directors, or management, may have a conflict.

Future sales of our common stock in the public or private markets could adversely affect the trading price of our common stock and our ability to raise funds in new stock offerings.

Future sales of substantial amounts of our common stock or equity-related securities in the public or private markets, or the perception that such sales could occur, could adversely affect prevailing trading prices of our common stock and could impair our ability to raise capital through future offerings of equity or equity-related securities. As of February 22, 2011, 88,999,553 shares of our common stock were outstanding. We cannot predict the effect, if any, that future sales of our common stock, or the perception that such sales could occur, will have on the trading price of our common stock.

We do not intend to pay dividends for the foreseeable future.

We have never declared or paid any dividends on our common stock. We intend to retain all of our earnings for the foreseeable future to finance the operation and expansion of our business, and we do not anticipate paying any cash dividends in the future. As a result, you may only receive a return on your investment in our common stock if the market price of our common stock increases. Our board of directors retains the discretion to change this policy.

Anti-takeover provisions in our organizational documents and under Delaware law could make a third party acquisition of the Company difficult.

Our certificate of incorporation and bylaws contain provisions that may discourage unsolicited takeover proposals that stockholders may consider to be in their best interests. These provisions include the ability of our board of directors to designate the terms of and issue new series of preferred stock and the ability of our board of directors to amend the bylaws without stockholder approval. In addition, as a Delaware corporation, we are subject to Section 203 of the Delaware General Corporation Law, which generally prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years following the date that the stockholder became an interested stockholder, unless certain specific requirements are met as set forth in Section 203. Collectively, these provisions could make a third party acquisition of the Company difficult or could discourage transactions that otherwise could involve payment of a premium over prevailing market prices for our securities.

12

Table of Contents

Our gold and silver production may decline, reducing our revenues and negatively impacting our business.

Our future gold and silver production may decline as a result of an exhaustion of reserves and possible closure of mines. It is our business strategy to conduct gold and silver exploratory activities at the Hycroft and Hasbrouck properties and to consider the acquisition of gold and silver mining properties and businesses or reserves that possess minable ore reserves and are expected to become operational in the near future. We can provide no assurance that our gold and silver production in the future will not decline. Accordingly, our revenues from the sale of gold and silver may decline, negatively affecting our results of operations.

Our ability to find and acquire new mineral properties is uncertain. Accordingly, our prospects are uncertain for the future growth of our business.