Attached files

Exhibit 99.3

C ONFIDENTIAL INVE S T OR PRESEN TA TION JU L Y 2 0 15 OT C QX: BONE

IMPOR T ANT C A UTIONS R ega r din g F or w a r d L ookin g S t a t ement s This presentatio n contains certain disclosure s that may b e deeme d forward - looking statements withi n the meaning o f the Private Securities Litigatio n Refor m Act o f 199 5 that ar e subject to significant risks an d uncertainties . Forward - looking statements includ e statements that are predictiv e i n nature , that depen d upo n o r refer to future event s o r conditions, o r that includ e word s such a s "continue," "e f forts," "expects," "anticipates," "intends," "plans," "believes," "estimates," "projects," "forecasts," "strateg y ," "will," "goal," "target," "prospects," "potential," "optimistic," "confident," "likel y ," "probable" o r similar expression s o r the negativ e thereof. Statements o f historica l fact als o may b e deeme d to be forward - looking statements. Y o u ar e cautioned no t to plac e undu e reliance o n forward - looking statements that speak onl y a s o f the dat e o n which they are made. Forward - looking statements reflect management ’ s current estimates, projections, expectations and beliefs, and are subject to risks an d uncertaintie s outsid e o f ou r control that may cause actua l results to di f fer materially from wha t i s indicate d i n those forward - looking statements. W e assum e n o dut y to updat e the forward - looking statements. These statements b y their natur e involv e risks an d uncertainties , an d actua l results may di f fer materially dependin g o n a variety o f important factors, including , amon g others , the occurrenc e o f the risks describe d i n the “Risk Factors” section o f ou r most recent quarterl y report o n Form 10 - Q filed wit h the U.S . Securities an d Exchange Commission . In additio n to those factors, the following factors, amon g other s could cause our actua l results to di f fer materially from forward - looking o r actua l performance : the possibilit y that conditions to closing the propose d X - spine acquisitio n ar e no t satisfied o n a timely basi s o r a t all ; the possibilit y that modifications to the terms o f the transaction may b e required; changes in the anticipated timing for closing the transaction; di f ficulty integrating our business and X - spine ’ s businesses or realizing the projected benefits of the transaction; and diversion of management time on transaction and integration related issues. Annualized, pro forma, projected and estimated number s use d i n this presentatio n ar e use d onl y for illustrativ e purpose s an d ar e no t forecasts an d may no t reflect actua l results. This presentatio n contains certain supplemental measures o f performance , such a s EBITDA, that ar e no t required b y , o r presente d i n accordance with , generall y accepte d accountin g principle s i n the Unite d States (“GAAP”). Such measures should no t b e considered a s replacements o f GAA P . Further informatio n wit h respect to an d reconciliations o f such measures to the neares t GAAP measure can b e found a t the en d o f this presentation. Any market o r industr y dat a contained i n this presentatio n ar e base d o n a variety o f sources, includin g interna l dat a an d estimates , independent industr y publications , governmen t publications , reports b y market research firms o r othe r publishe d independen t sources. Industry publication s and othe r publishe d sources generall y state that the informatio n contained therein ha s bee n obtaine d from third - party sources believe d to b e reliable, bu t there can b e n o assuranc e a s to the accurac y o r completeness o f such information . Our interna l dat a an d estimate s ar e base d upon information obtained from trade and business organizations and other contacts in the markets in which we operate and our management's understandin g o f industr y conditions, an d such informatio n ha s no t bee n verified b y an y independen t sources. Accordingl y , investor s should not plac e undu e reliance o n such dat a an d information. 2 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

C ONVERTIBLE DE B T OFFERING SUMMA R Y ORBIMED INTEN D S T O PURCH A SE $33 MILLION OF THE A GGREG A TE PRINCI P AL AMOUNT $65 MILLION SENIOR UNS E CURED C ONVERTIBLE DE B T OFFERING, 15% O VE R AL L O TMENT OPTION 6% - 8% C OUPON 22.5% - 2 7 .5% C ONVERSION PREMIUM 6 - YEAR TERM, NON - C ALLABLE A C QUISITION OF X - SPINE & GENE R AL C ORPO R A TE PURP O SES 3 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

B A CTERIN INTERN A TIONAL INC. C ompa n y O v ervi e w LARGE & GR O WING PORTFOLIO OF PROPRIE T A R Y ORTHO - BIO L OGIC PRODUC T S P ARTICI P ANT IN $3B US R E GENE R A TIVE MEDICINE MARKET PRODUC T S P O SITIONED FOR A V ARIETY OF ORTHOPEDIC APPLI C A TIONS, P ARTICULAR L Y SPINE INVE S TING IN CLINI C AL SUPPORT & PRODUCT DEVE L OPMENT E S T ABLISHED & GR O WING DI S TRIBUTION CHANNEL T O ORTHOPEDIC SURG E ONS & NEUR O SURG E ONS FOUNDED 1 9 98 Q1 2 0 15 REVENUE $ 9 .5M A CTIVE ORTHOPEDIC DI S TRIBU T ORS 115 US DBM MARKET SHARE* 6.8% *BioMed GPS 4 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

REVENUE PERFORMANCE Quar t erl y R e v enu e G r o wt h 6TH C ONSECUTIVE Q U ARTER OF YEAR - O VER - YEAR GR O WTH PREVIOUS YEAR Q U ARTER RECENT Q U ARTER % YEAR - O VER - YEAR GR O WTH $8M $9M $10M 1Q14 v s 1Q15 4Q13 v s 4Q14 3Q13 v s 3Q14 2Q13 v s 2Q14 1Q13 v s. 1Q14 4Q12 v s. 4Q13 3% 3% 8% 7% 10% 7% 5 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

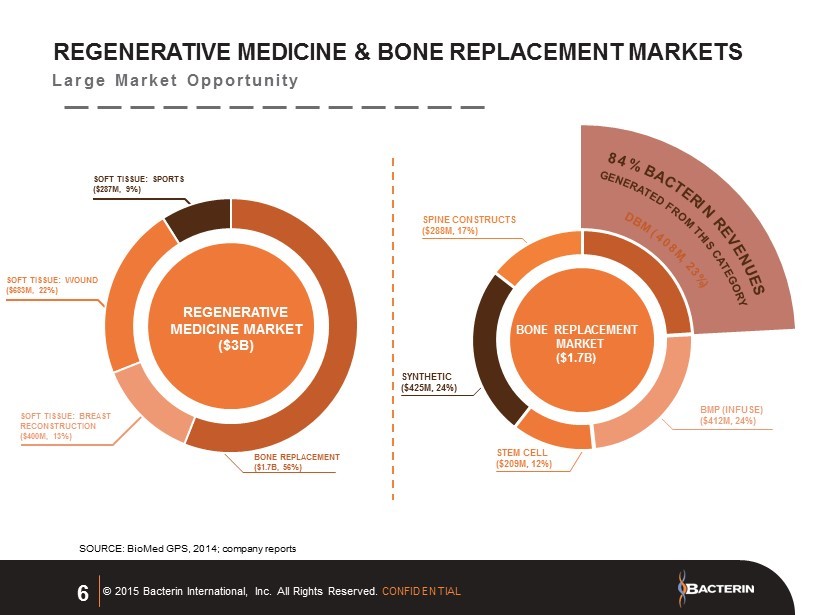

La r g e Mar k e t Opportunit y R E GENE R A TIVE MEDICINE & BONE REPL A CEMENT MARKE T S REGENER A TIVE MEDICINE MARKET ($3B) SOFT TI S SUE: BRE A S T RE C ON S TRUCTION ($400M, 13%) BONE REPL A CEMENT ($1 . 7B, 56%) SOFT TI S SUE: W OUND ($683M, 22%) SOFT TI S SUE: SPOR T S ($2 8 7M, 9%) SOURCE: BioMed GPS, 20 14; c ompa n y r eports BMP (INFUSE) ($ 4 12M, 2 4%) S YNTHETIC ($425M, 2 4%) S TEM CELL ($209M, 12%) SPINE C ON S TRUC T S ($288M, 17%) BONE REPL A CEMENT MARKET ($1 . 7B) 6 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

O st eoSelect Putty (17%) O s t eoSponge (65%) Other (7%) 3Demin (2%) SportsMed (9%) KEY PRODUCT LINES G r o win g P ort f oli o o f P r oprietar y R egene r a ti v e Medicin e P r oduct s • 1 s t allog r aft t o mar k et as a c omp r e s sible DBM sca f old • Pa t en t ed p r o c e s sing t echnology • 100%, human demine r ali z ed bone m atrix • Ideal sca f old f or bone r egene r a tion DB M PUTT Y • P r o v en t o c ontain g r o wth f ac t ors f or r egene r a tion • Enginee r ed t o with s tand g r aft mig r a tion • Indic a t ed f or use in spine B O A T S & S TRIP S • Launched N o v ember 2 014 • Demine r ali z ed c ortical fibers • Ability t o p r o c e s s in v arious shapes and si z es • Designed f or r e - c on s tructi v e / c ompl e x spine p r o c edu r es • Mo s t c ommonly used f or A CL r epair • G r o wing mar k et as li f e s tyles be c ome mo r e acti v e, sports mo r e agg r e s si v e 65% 2% 17% 9% FIR S T Q U ARTER 20 15 REVENUE MIX 7 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL SOURCE: C ompa n y r eports

A global d e v eloper and manu f actu r er of implants, su r gical in s truments, biologics and biom a t erials f or su r gery of the spine

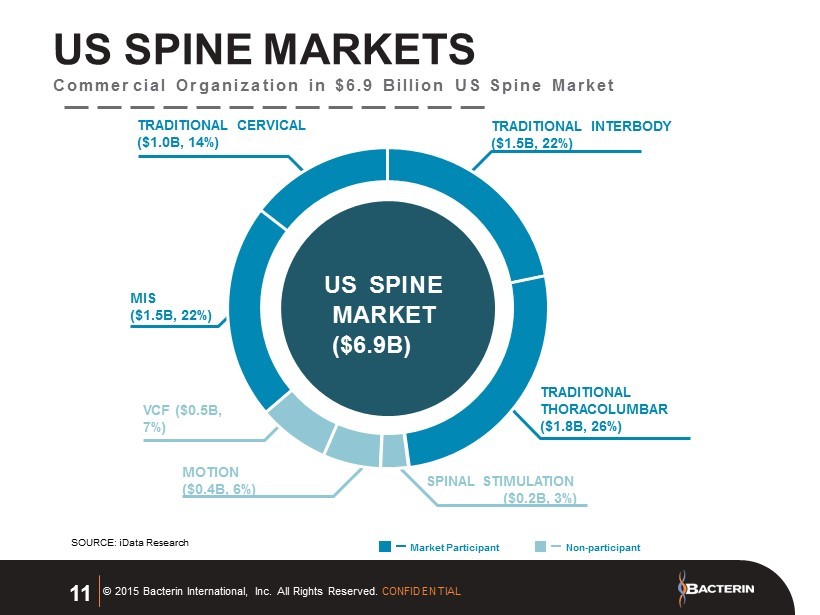

X - SPINE S Y S TEMS, INC. C ompa n y O v ervi e w LARGE & GR O WING PORTFOLIO OF PROPRIE T A R Y SPINE HAR D W ARE PRODUC T S INVE S TING IN CLINI C AL SUPPORT & PRODUCT DEVE L OPMENT E S T ABLISHED C OMMERCIAL ORGANIZ A TION IN A $6.9B US SPINE HAR D W ARE INDU S T R Y DRIVING GR O WTH IN DI S TRIBUTION CHANNEL T O ORTHOPEDIC SURG E ONS & NEUR O SURG E ONS FOUNDED 2004 Q1 2 0 15 REVENUE $12.2M Q1 2 0 15 EBIT D A $1.6M A CTIVE ORTHOPEDIC DI S TRIBU T ORS 150 9 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

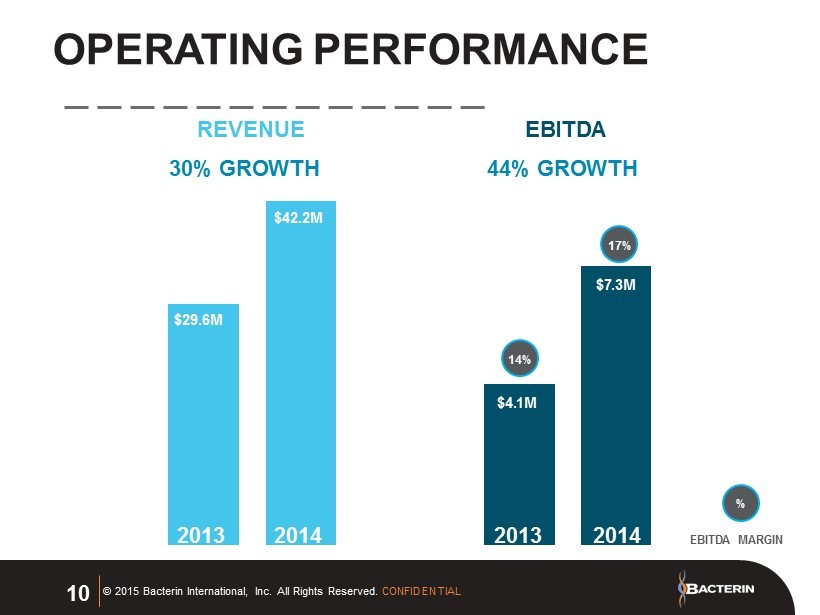

OPE R A TING PERFORMANCE % REVENUE 30% GR O WTH $42.2M EBIT D A 44% GR O WTH 17% $ 7 .3M $4 . 1M 2 0 13 2 0 14 14% $2 9 .6M 10 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL 2 0 14 2 0 13 EBIT D A MARGIN $42.2M

US SPINE MARKE T S C omme r cia l O r ganiz a tio n i n $6. 9 Billio n U S Spin e Mar k e t Mar k et P articipant Non - participant V CF ($ 0 .5B, 7%) M O TION ($ 0 .4B, 6%) SPINAL S TIMUL A TION ($ 0 .2B, 3%) TRADITIONAL THOR A C O L UMBAR ($1.8B, 26%) TRADITIONAL INTERBO D Y ($1.5B, 22%) MIS ($1.5B, 22%) TRADITIONAL CE R VICAL ($1 . 0B, 14%) US SPINE MARKET ( $ 6 . 9 B) 11 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL SOURCE: iData Resea r ch

KEY PRODUCT LINES G r o win g P ort f oli o o f P r oprietar y R egene r a ti v e Medicin e P r oduct s A minimally i nv asi v e, modular in t erspinous fusion s y s t em with angled spi k es th at all o w s f or adequ a t e L5 - S1 engagement and other v aria tions in p atient an a t o m y . Frictional titanium plasma - c o a t ed PEEK implants. P r o vide additional bio - mechanical per f orman c e and end - pl a t e visualization. Simplicity of design pai r ed with c omp r ehensi v e in s trument a tion c r e a t es a gold - s tanda r d pedicle sc re w s y s t em. A v ailable in s tanda r d or r eduction sc re ws. S tandalone z e r o p r ofile c ervical & lumbar in t eg r a t ed fusion sy s t em with titanium t eeth and locking sc re w s. A di s tincti v e sac r oiliac joint fusion sy s t em designed t o p r omo t e fusion using titanium plasma - c o a t ed anchor implants f ene s t r a t ed f or bone g r aft int r oduction along with cannul a t ed titanium locking implants. SILEX (7%) IRIX (26%) CALIX (13%) O THER (23%) A XLE (21%) FORTEX (10%) FIR S T Q U ARTER 2 0 15 REVENUE MIX 12 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL SOURCE: C ompa n y r eports

A c ombin a tion of biologic implants & su r gical in s truments f or di s tribution in t o the r egene r a ti v e medicine & spine mar k ets

NEW C ORPO R A TE S TRUCTURE T r ans f orm a ti v e C ombin a tio n o f T w o C omplementar y C ompanie s Bac t erin In t ern a tional Holdings, Inc. Bac t erin In t ern a tional, Inc. Biologics Subsidiary o f X tant Medical X - Spine S y s t ems, Inc. Ha r d w a r e Subsidiary o f X tant Medical 14 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

S T R A T E GIC R A TIONALE B r oader C a talog Of P r oducts F or Spine Su r geons • Biologics plus ha r d w a r e is a p ow erful c ombin a tion • A v e r age re v enue per p r o c edu r e e xpec t ed t o inc r ease • Scale of p r oduct o f erings ma k es the c ombined c ompa n y mo r e a tt r acti v e t o cu s t omers & di s tribu t ors •C r e a t es an inn o v a tion engine with e xpertise in ha r d w a r e and biologics th a t can n o w c r o s s - pollin a t e Expansion o f Sales Di s tribution Net w ork • X - Spine & Bac t erin sha r e some hospital cu s t omers with minimal t o no ov erlap in p r oducts • 250 plus c ombined di s tribu t or partners • 50 plus c ombined n a tional a cc ounts & r egional hospital g r oup c ont r acts Enhan c ed R e v enue G r o wth & Imp r o v ed Ma r gins • A c c r eti v e t o re v enues, g r o s s ma r gins, & EBIT D A a t close • G r o s s ma r gins a r e anticip a t ed t o e xpand th r ough e c onomies of scale and bet t er absorption SOURCE: C ompa n y r eports 15 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

C OMBINED REVENUE PERFORMANCE P r eliminar y P r o F orm a B A CTERIN X - SPINE C OMBINED $20M $40M $60M $80M L TM - 03/ 31 / 15 2014 2013 2012 16 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL 18% 3 - YEAR CAGR

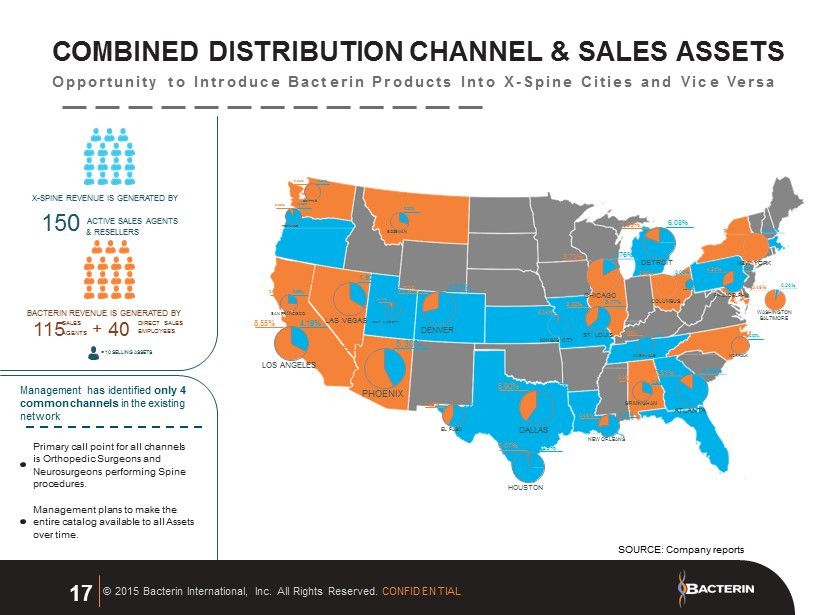

C OMBINED DI S TRIBUTION CHANNEL & S ALES AS SE T S Opportunit y t o Int r odu c e Bac t eri n P r oduct s In t o X - Spin e Citie s an d Vi c e V ers a = 10 SELLING AS SE T S Management has identified only 4 c ommon channels in the e xi s ting net w ork Primary call point f or all channels is Orthopedic Su r geons and Neu r osu r geons per f orming Spine p r o c edu r es. Management plans t o ma k e the enti r e c a talog a v ailable t o all A s sets ov er tim e . X - SPINE REVENUE IS GENER A TED B Y 150 A CTIVE S ALES A GEN T S & RESELLERS B A CTERIN REVENUE IS GENER A TED B Y DIRECT S ALES EMP L O YEES S ALES A GEN T S + 115 40 1 0 . 3 7% 6.90% D ALL A S 4 . 19% L A S VEG A S S A L T LAKE CITY 8.55% L O S ANGELES 7 .29% 0. 0 7% HOU S T ON 3.32% 6 . 12% 0 . 13% K AN SA S CITY 5.30% 7 .20% PHOENIX 0. 00% 0. 00% 2.21% 5.99% C O L UMBUS 0. 00% 7 .68% NEW Y ORK 9 .56% 2.84% 0 .51% 0 .99% A TLAN T A 4.54% 3.46% PHILADELPHIA 1.9 2% 3 .7 9% 0.7 6% 3 .7 3% CHIC A GO 5 . 77% 0 . 2 4% W A SHIN G T ON BA L TIMORE 4.22% 1 .7 2% 1.6 3% DENVER 2.55% 0. 00% B O ZEMAN 1.32% 0 .48% NEW ORLEANS 2. 3 9% BIRMINGHAM 2.33% 0 .80% S AN FRANCIS C O 0 . 12% DETROIT 2 . 08% 0. 00% N ASHVILLE 0. 00% 1 . 19 % NOR F OLK CINCINN A TI 2. 5 3% 1.86% EL P A SO S T . L OUIS SE A TTLE 0 .80% 0 .22% 0. 09% 6 . 08% 1. 4 9% PO R TLAND 0. 09% SOURCE: C ompa n y r eports 17 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

$30M B A CTERIN OPPORTUNITY $56M X - SPINE OPPORTUNITY 3000 X - Spine P r o c edu r es $2,500 Bac t erin A SP BONE G R AF T S USED IN ALL PROCEDURES 2000 Bac t erin Spine P r o c edu r es $ 7 , 000 X - Spine A SP HAR D W ARE USED IN ALL PROCEDURES P O TENTIAL CR O S S - SELLING OPPORTUNITIES Annuali z e d Q 1 2 0 1 5 $86M CR O S S - SELLING OPPORTUNITY *SOURCE: C OM P ANY REPO R T S • A CT U AL RESU L T S M A Y DIFFER FROM PRESEN TA TION $ 7 .5M Q U A RTER L Y RUN R A TE $14M Q U A RTER L Y RUN R A TE 18 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

FINANCIAL O VE R VIEW 19 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

KEY FINANCIAL DRIVERS C ompa n y O v ervi e w S TRONG REVENUE GR O WTH IN B A SE BUSINE S S, A UGMENTED B Y X - SPINE ENHANCED OPE R A TING LEVE R A GE •G r o s s ma r gin e xpansion • L e v e r aging c orpo r a t e e xpenses A C CELE R A TES P A TH T O PROFI T ABILITY GENE R A TING P OSITIVE C A SH F LO W 20 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

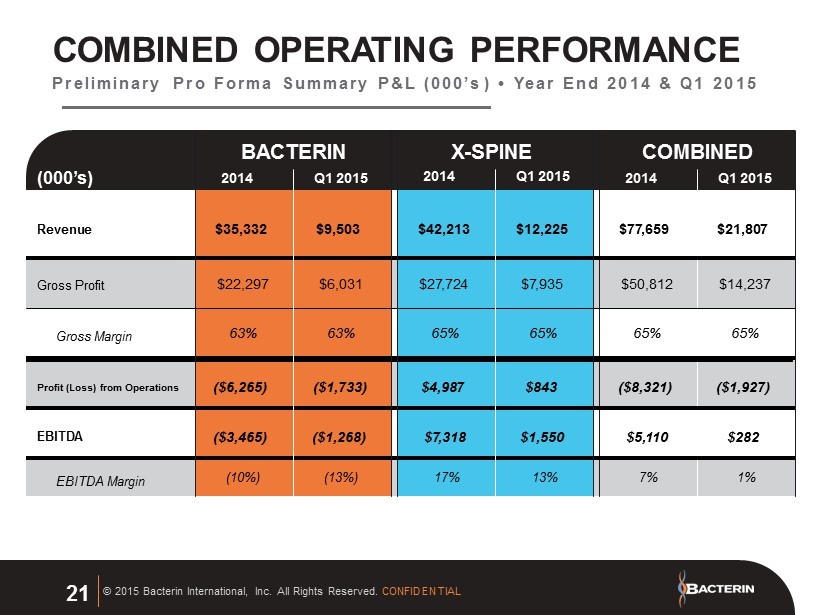

C OMBINED OPE R A TING PERFORMANCE P r eliminar y P r o F orm a Summar y P& L (000’ s ) • Y ea r En d 2 0 1 4 & Q 1 2 0 1 5 (000 ’ s ) R e v enue G r o s s P r ofit G r o s s Ma r gin P r ofit ( L o s s ) f r om Ope r a tions EBIT D A EBIT D A Ma r gin $ 7 7 ,6 5 9 $21,8 0 7 $5 0 ,812 $14,2 3 7 65% 65% ($8,321) ($1, 9 2 7) $5 , 110 $282 7% 1% C OMBINED 2 0 14 Q1 2 0 15 $42,213 $12,225 $ 2 7 ,7 2 4 $ 7 , 9 3 5 65% 65% $4,9 8 7 $843 $ 7 ,318 $1,550 17% 13% 2 0 14 Q1 2 0 15 X - SPINE $ 3 5,332 $ 9 ,5 0 3 $22,2 9 7 $6 , 0 31 6 3% 6 3% ($6,265) ($1 ,7 33) ($3,465) ($1,268) (10%) (13%) B A CTERIN 2 0 14 Q1 2 0 15 21 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

T R AN S A CTION SUMMA R Y A C QUISITION Bac t erin is a c quiring X - spine S y s t ems, Inc., a global d e v eloper and manu f actu r er of implants and su r gical in s truments f or su r gery of the spin e . FINANCIAL IM P A CT Immedi a t ely a c c r eti v e t o EBIT D A, when e x cluding one - tim e , t r ansaction r el a t ed I t ems. PURCH A SE PRICE •$60M cash t o sellers •$13M debt p a y of •4.25M sha r es of r e s tric t ed c ommon s t ock subject t o 12 month loc k up FINANCING •$65M Senior Unsecu r ed C o n v ertible Debt •$18M Inc r emental Senior Secu r ed Debt F acility •I s suan c e of Bac t erin C ommon E quity 22 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

DE B T O VE R VIEW P r o F orm a De b t Summar y SENIOR UNSECURED C ONVERTIBLE DE B T $65M $42M SENIOR SECURED DE B T FROM ORBIMED •15% C oupon •5 y ear t erm; 3 y ear no - call • R olling ov er e xi s ting $ 2 4M debt f r om Orbimed in addition t o the n e w $18M • 7 .5% e xit f ee 23 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

SOURCES & USES OF FUN D S N O TE: T otal senior secu r ed debt a t closing will be $42 million, which includes the r oll ov er of the cur r ent out s tanding $ 2 4MM t erm loan due Orbimed. GR O S S PROCEE D S FROM SENIOR SECURED TERM L O AN GR O S S PROCEE D S FROM SENIOR UNSECURED C ONVE RTIBLE N O TE TO T AL GR O S S PROCEE D S C A SH PO R TION OF PURCH A SE PRICE T O SELLERS RE P A YMENT OF X - SPINE OU TS T ANDING DE B T E S TIM A TED TRAN S A CTION FEES AND EXPENSES GENERAL W ORKING CAPI T AL PURP O SES TO T AL USE OF PROCEE D S $18M $60M $65M $13M $5M $5M $83M $83M SOURCE OF FUN D S USE OF FUN D S AMOUNT AMOUNT 24 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

SUMMA R Y Significant c r o s s - selling opportunities; di v ersifies p r oduct port f olio; e xpands cu s t omer base; inc r eases r e v enue per p r o c edu r e Imp r o v ed t op - line per f orman c e A cc ele r a t es p a th t o p r o fitability A c c r eti v e c ombin a tion and EBIT D A e xpansion R&D capabilities in b o th biologics & orthopedic ha r d w a r e 25 © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. C ONFIDENTIAL

THANK Y OU OT C QX: BONE 600 Cruiser ln Belg r ad e , M T , U S A 5 9 7 14 1.406.388 . 0480 in f o@bac t erin . c om I n v e s t or R el a tions C OCKRELL GROUP 1. 8 7 7 .8 8 9 . 1 9 7 2 i n v e s t or r el a tions@the c ock r ellg r ou p . c om

B A CTERIN R E C ONCILI A TION OF EBIT D A F o r th e perio d endin g De c embe r 31 s t , 2 0 1 4 & Ma r c h 31 s t , 2 0 1 5 r especti v el y Appendix A © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. ( 000 ’ s ) L o s s F r om Ope r a tions Be f o r e Impairment 2 0 14 Q1 2 0 15 ( $5, 3 5 2) ( $1 ,7 33) Non - Cash C ompens a tion $ 9 3 5 $ 230 Dep r eci a tion & Amortiz a tion $ 9 52 $ 2 3 5 EBIT D A ( $3,465) ( $1,268)

X - SPINE R E C ONCILI A TION OF EBIT D A F o r th e perio d endin g De c embe r 31 s t , 2 0 1 3 & 2 0 14 , Ma r c h 31 s t 2 0 1 5 r especti v el y Appendix B © 2 0 15 Bac t erin In t ern a tional, Inc. All Rights R eser v ed. ( 000 ’ s ) Ope r a ting in c ome 2 0 13 2 0 14 Q1 2 0 15 $ 2,2 0 7 $ 4,9 8 7 $ 843 Dep r eci a tion & Amortiz a tion $ 1, 89 5 $ 2,331 $ 7 07 EBIT D A $ 4 , 1 0 2 $ 7 ,318 $ 1,550