Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CHARTER FINANCIAL CORP | chfn-8k07242015.htm |

| EX-99.2 - EXHIBIT 99.2 - CHARTER FINANCIAL CORP | ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - CHARTER FINANCIAL CORP | ex99-1.htm |

1

Forward-Looking Statement 2 This presentation may contain certain forward-looking statements regarding our prospective performance and strategies within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the Safe Harbor Provision for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of said safe harbor provision. Forward- looking statements can be identified by the use of words such as “estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,” “seek,” “expect” and words of similar meaning. These forward-looking statements include, but are not limited to: statements of our goals, intentions and expectations; statements regarding our business plans, prospects, growth and operating strategies; statements regarding the asset quality of our loan and investment portfolios; and estimates of our risks and future costs and benefits. These forward-looking statements are based on current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: general economic conditions, either nationally or in our market areas, that are worse than expected; competition among depository and other financial institutions; changes in the interest rate environment that reduce our margins or reduce the fair value of financial instruments; adverse changes in the securities markets; changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees and capital requirements; our ability to enter new markets successfully and capitalize on growth opportunities; our ability to successfully integrate acquired entities; our incurring higher than expected loan charge-offs with respect to assets acquired in FDIC-assisted acquisitions; changes in consumer spending, borrowing and savings habits; changes in accounting policies and practices, as may be adopted by the bank regulatory agencies and the Financial Accounting Standards Board; and changes in our organization, compensation and benefit plans. Because of these and other uncertainties, our actual future results may be materially different from the results indicated by these forward-looking statements. Readers are cautioned not to place undue reliance on the forward-looking statements contained herein, which speak only as of the date of this presentation. Except as required by applicable law or regulation, we do not undertake, and specifically disclaim any obligation to update any forward-looking statements that may be made from time to time by or on behalf of the Company. Please see “Risk Factors” beginning on page 19 of the Company’s Prospectus dated February 11, 2013.

Market Profile 3 NASDAQ: CHFN Recent Price1 (07/20/2015): $12.33 Shares Outstanding (06/30/2015): 16.4 Million Market Capitalization2: $202.3 Million Price/Tangible Book Value3: 99.1% Dividend Yield: 1.62% Total Assets (06/30/2015): $1.0 Billion 1- Source: Bloomberg 2- Based on July 20, 2015 closing market price and June 30, 2015 shares outstanding. 3- Based on July 20, 2015 closing market price, June 30, 2015 shares outstanding and June 30, 2015 tangible book value.

Corporate Profile 4 Headquartered in West Point, Georgia Founded in 1954 as First Federal Savings and Loan Association Organic & acquisitive growth Three FDIC-assisted acquisitions (June 2009, March 2010, Sept 2011) Approximately 274 FTE’s servicing over 48,000 checking accounts 15 Branches along I-85 & I-20 in GA/AL and NW Florida June 30, 2015: Total Assets: $1.0 Billion Total Net Loans: $672.8 Million Total Deposits: $734.2 Million Total Capital: $208.9 Million

Overview of Management Team 5 Focus on Growing Atlanta MSA Presence Conservative Credit M&A Experience … 5 Transactions Both Assisted & Unassisted Full Conversion From Mutual Thrift – Established Strong Capital Position Transformed Balance Sheet From Traditional Thrift to Commercial Bank Top Executives NAME POSITION (Banking/CharterBank) EXPERIENCE Robert Lee Johnson Chairman & CEO 33/31 Lee Washam President, CharterBank 31/15 Curtis R. Kollar Senior VP & CFO 28/24

6 Market Conditions Auto Industry is Strong on I-85 Corridor Most of Our Markets have Significant Manufacturing, University or Military Influences Lending Opportunities in Metro Markets Gradual Recovery in Non-Metro Markets Active Regional M&A Market

7 Recent Accomplishments EPS Growth Improving Operating Leverage Flat Expenses and Core NIM Expansion Annualized Loan Growth 14.6% in Three Quarters Continued Growth in Checking Accounts and Bank Card Fees Accretive Impact of Stock Repurchases Good Credit Quality –Non Performing Assets 0.55% of Assets Reduced Shares Outstanding by 28% in the Last 2 Years All Purchased Below Tangible Book Value

Capital Management Strategies 8 TCE of 20.31% at June 30, 2015 Uses of Capital Disciplined Approach to Growth Organic Balance Sheet Growth Metro Markets Lender Lift Outs Whole Bank Acquisitions Branch Purchases Stock Repurchases and Dividends

Growth Strategies 9 Focus on Whole Bank Targets Providing High EPS Accretion Reasonable Tangible Book Value Earn-Back Metro Institution With Loan Growth Potential Interstate or Franchise Add-On for Income Accretion and Funding Lender Lift-out in Key Markets

11.20 11.40 11.60 11.80 12.00 12.20 12.40 12.60 15 16 17 18 19 20 21 22 23 24 $ DollarsM ill ion s Shares Outstanding Tangible Book Value per Share Stock Repurchases 10 Reduced Outstanding Shares by 28%

Financial Information

Fiscal YTD 2015 (9 Months) Results and Developments 12 Total Loans, Net Tangible Common Equity/Total Assets Net Income $5.0 million Fully Diluted EPS** $0.30 Loan Loss Reserves $8.5 million (Non-covered) ALL / Non-covered NPLs – 196.86% ALL as a % of Total Non-covered Loans - 1.33% Continued advances in core profitability Nonperforming Assets / Assets 0.55%* Superior asset quality 20.31% $673 million 5 consecutive quarters of total loan growth * For non-covered assets. **Diluted net income per share for the nine months ended June 30, 2015 was computed by dividing net income by weighted average shares outstanding plus potential common shares resulting from dilutive stock options and unvested restricted shares, determined using the treasury stock method. ROAA 0.67% Improved Basic EPS over Fiscal YTD 2014 (9 Months) by 39.1% June Qtr. Basic EPS $0.12 June Qtr. ROA 0.76% Well capitalized & protective of book value per share Actively repurchasing common shares Basic EPS $0.32

Balance Sheet Highlights 13 Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30. [1] Includes FDIC Acquisition of Neighborhood Community Bank. [2] Includes FDIC Acquisition of McIntosh Commercial Bank. [3] Includes FDIC Acquisition of First National Bank of Florida. [4] Core deposits consist of transaction accounts, money market accounts, and savings accounts. [5] Incremental capital raise of approximately $30 million (net). [6] Second step conversion and reorganization resulted in $142.9 million in gross offering proceeds. (Dollars in $000's) 2009 [1] 2010 [2] 2011 [3] 2012 2013 2014 Q3 2015 Total Assets $936,880 $1,186,082 $1,171,710 $1,032,220 $1,089,406 $1,010,361 $1,004,936 Loans, net 552,550 599,370 655,028 593,904 579,854 606,367 672,830 Non Covered 462,786 451,231 419,979 427,676 470,863 536,732 627,006 Covered 89,764 148,138 235,050 166,228 108,991 69,635 45,824 Securities 206,061 133,183 158,737 189,379 215,118 188,743 189,791 Total Liabilities $838,623 $1,052,746 $1,032,294 $889,699 $815,628 $785,406 $796,017 Retail Deposits 463,566 739,691 883,389 779,397 745,900 717,192 703,471 Core [4] 216,902 313,170 447,176 456,292 475,426 486,248 505,721 Time 246,664 426,521 436,213 323,105 270,475 230,944 228,517 Total Borrowings 227,000 212,000 110,000 81,000 60,000 55,000 50,000 Total Equity $98,257 $135,788 [5] $139,416 $142,521 $273,778 [6] $224,955 $208,919

Funding Mix 14 32.1% At June 30, 2015 Average cost of deposits for the three months ended June 30, 2015: 0.43% Deposits by Type • Core Deposits – Transaction, Savings & Money Market Accounts Funding by Type ($ Million) $0 $200 $400 $600 $800 $1,000 $1,200 Core Deposits Retail CD's Wholesale Funding 55% 21% 24% 46% 25% 29% 64% 17% 19% 48% 27% 25% 26% 30% 44% 30% 41% 29% 43% 13% 44% $710 $703 $1,021 $825 $1,035 $881 11% 37% 52% $811 8% 59% 33% $702$688 $687 19% 17% 64% $784 10% 25% 64% $722 7% 30% 63%Time Deposits (Excluding Wholesale Deposits) 27% Savings & Money Market 24% Transaction Accounts 45% Wholesale Time Deposits 4%

Loans Outstanding at June 30, 2015 15 1-4 Family 26% Comm RE - Owner Occupied 12% Comm RE - Non Owner Occupied - Other 35% Comm RE - Hotels 5% Comm RE - Multifamily 6% Commercial & Industrial 5% Consumer & Other 1% Real Estate Construction 10% Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30. At 2009 2010 2011 2012 2013 2014 6/30/15 Non-Covered NPAs / Total Non-Covered Assets (%) 2.16% 2.33% 1.99% 0.69% 0.49% 0.65% 0.55% on- overed COs / Average Non-Covered Loans (%) 0.71 0.90 0.48 0.86 0.32 0.08 --- ALLL Non-Covered Loans / Non-Covered NPLs (x) 0.70x 0.84x 0.80x 2.38x 2.80x 2.00x 1.97x Non-Covered Allowance / Total Non-Covered oans (%) 1.97% 2.12% 2.19% 1.87% 1.70% 1.55% 1.33%

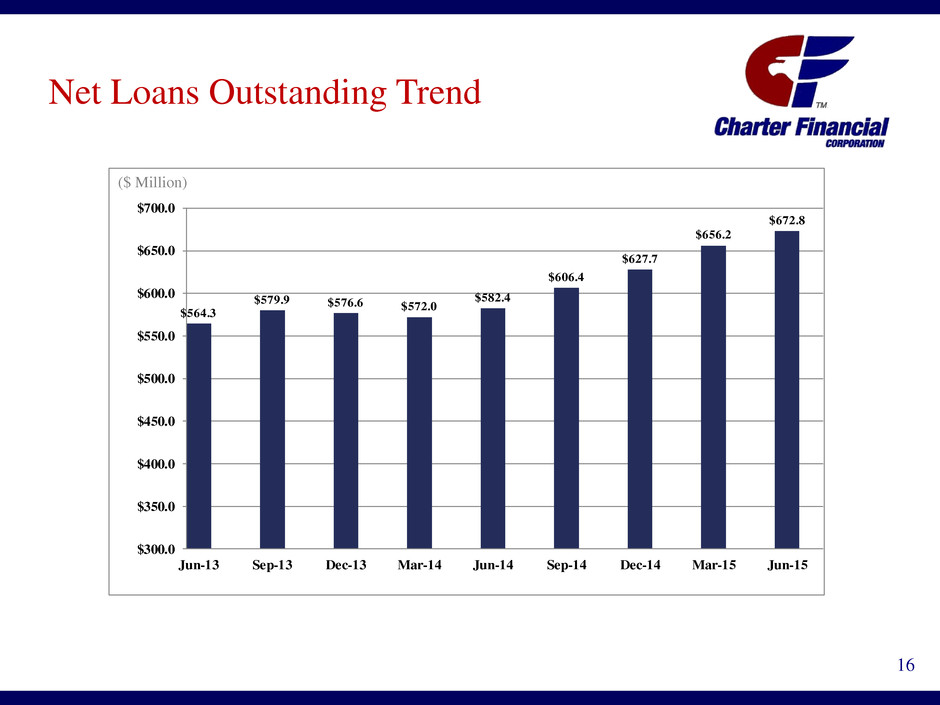

$564.3 $579.9 $576.6 $572.0 $582.4 $606.4 $627.7 $656.2 $672.8 $300.0 $350.0 $400.0 $450.0 $500.0 $550.0 $600.0 $650.0 $700.0 Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Net Loans Outstanding Trend ($ Million) 16

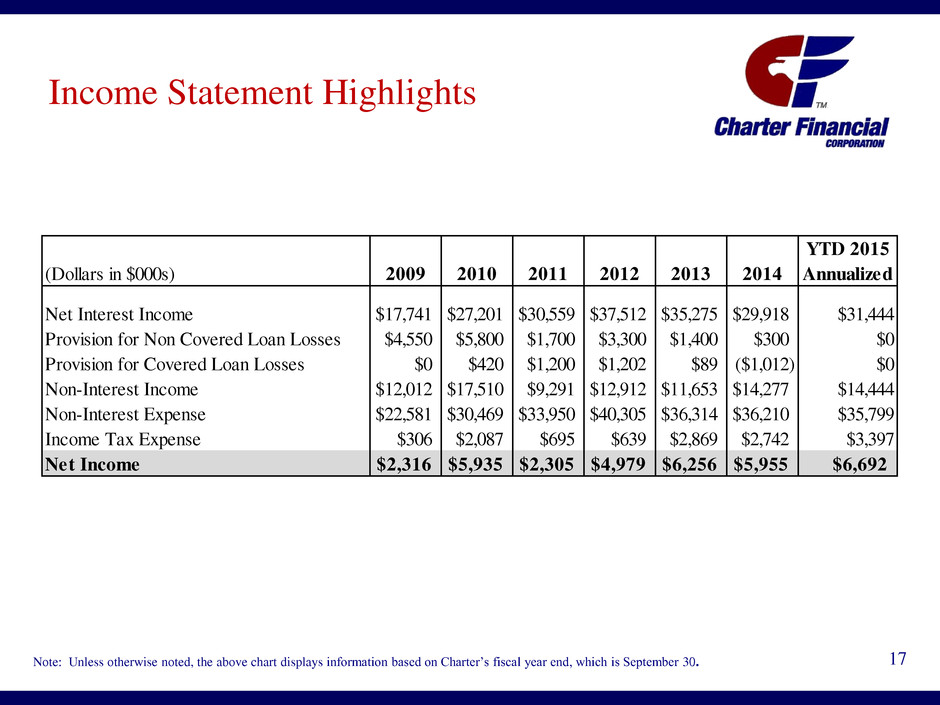

Income Statement Highlights 17 Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30. YTD 2015 (Dollars in $000s) 2009 2010 2011 2012 2013 2014 Annualized Net Interest Income $17,741 $27,201 $30,559 $37,512 $35,275 $29,918 $31,444 Provision for Non Covered Loan Losses $4,550 $5,800 $1,700 $3,300 $1,400 $300 $0 Provision for Covered Loan Losses $0 $420 $1,200 $1,202 $89 ($1,012) $0 Non-Interest Income $12,012 $17,510 $9,291 $12,912 $11,653 $14,277 $14,444 Non-Interest Expense $22,581 $30,469 $33,950 $40,305 $36,314 $36,210 $35,799 Income Tax Expense $306 $2,087 $695 $639 $2,869 $2,742 $3,397 Net Income $2,316 $5,935 $2,305 $4,979 $6,256 $5,955 $6,692

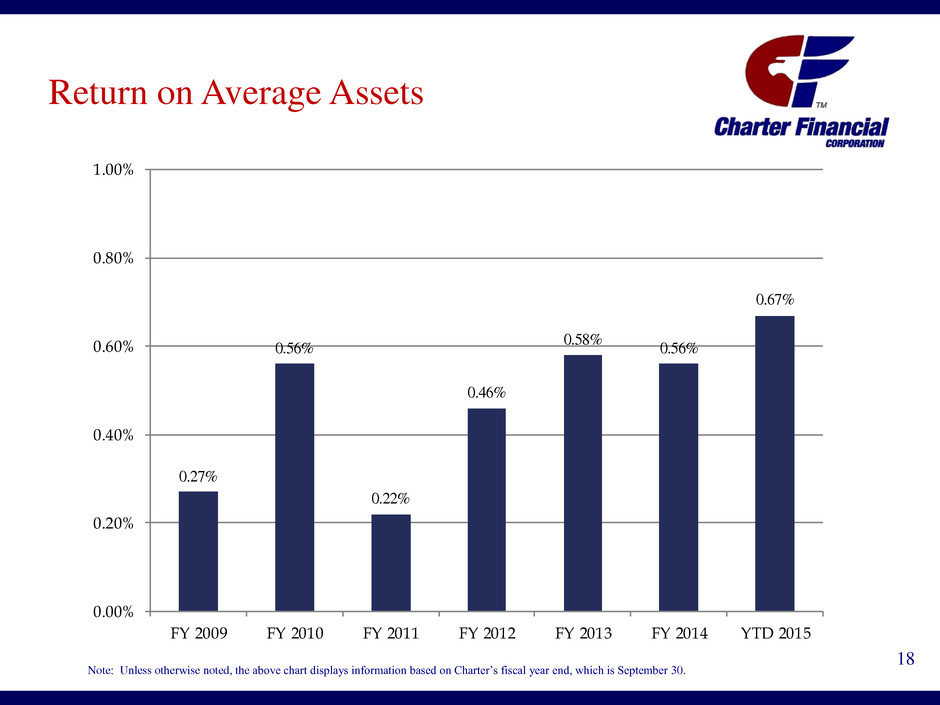

Return on Average Assets 18 Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30. 0.27% 0.56% 0.22% 0.46% 0.58% 0.56% 0.67% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 YTD 2015

5.24% 5.64% 5.38% 5.35% 4.61% 3.83% 4.07% 4.10% 4.16% 3.22% 2.55% 1.85% 1.23% 0.95% 0.81% 0.80% 0.74% 0.72% 2.35% 3.19% 3.59% 4.17% 3.82% 3.22% 3.47% 3.54% 3.62% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 Q1 2015 Q2 2015 Q3 2015 Yield on Interest Earning Assets Cost of Interest Bearing Liabilities Net Interest Margin Net Interest Margin Trends 19 Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30. 2.90% 2.95% 3.14% 3.31% 3.21% 2.00% 2.20% 2.40% 2.60% 2.80% 3.00% 3.20% 3.40% Q3 2014 Q4 2014 Q1 2015 Q2 2 15 Q3 2015 Net Interest Margin Excluding the effects of Purchase Accounting

Operating Leverage 20 ($ Million) *Adjusted Net Operating Revenue = Net Interest Income + Non-Interest Income – Net Purchase Accounting Loan Accretion **Efficiency Ratio = Non-Interest Expense / (Net Interest Income + Non-Interest Income – Net Purchase Accounting Loan Accretion) $28.1 $37.0 $31.6 $41.4 $38.0 $41.1 $43.2 80% 82% 107% 97% 96% 88% 83% 76% 79% 85% 80% 77% 82% 78% 60% 70% 80% 90% 100% 110% 120% $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 YTD 2015 Annualized Adjusted Net Operating Revenue* Bargain Purchase Gain Adjusted Efficiency Ratio** Efficiency Ratio

Operating Leverage 21 ($ Million) $20 $25 $30 $35 $40 $45 $50 $55 FY 2011 FY 2012 FY 2013 FY 2014 YTD 2015 Annualized Net Operating Revenue Adjusted Net Operating Revenue* Expenses *Adjusted Net Operating Revenue excludes Net Purchase Accounting Loan Accretion

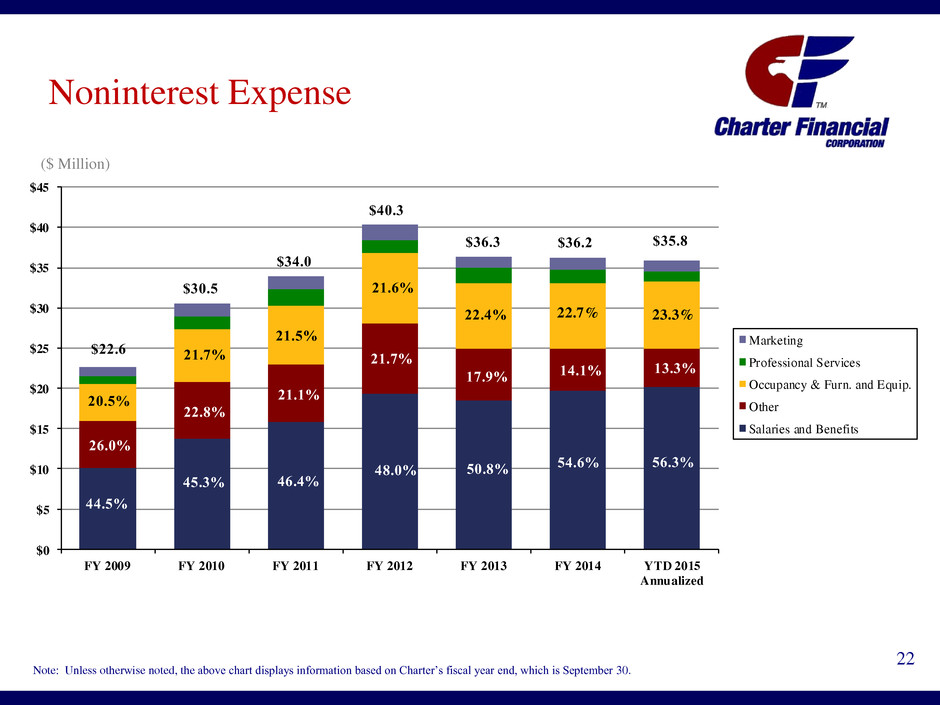

Noninterest Expense 22 Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30. ($ Million) $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 YTD 2015 Annualized Marketing Professional Services Occupancy & Furn. and Equip. Other Salaries and Benefits $35.8 $30.5 21.7% 22.8% $22.6 $34.0 $40.3 $36.3 22.4% 17.9% 50.8%48.0% 21.7% 21.6% 46.4% 21.1% 21.5% 45.3% 44.5% 26.0% 20.5% 54.6% 14.1% 22.7% $36.2 56.3% 13.3% 23.3%

Investment Merits Positioned to be opportunistic…. Favorable credit quality, robust capital position & profitable Trading at 99.1% of tangible book value Implemented consecutive stock repurchase plans Disciplined acquisition approach/Actively seeking opportunities Existing infrastructure can support a larger balance sheet Track record of returns to shareholders with annualized total return since: 2013 stock conversion of 12% 2010 stock offering of 15% 23

Robert L. Johnson Chairman and Chief Executive Officer bjohnson@charterbank.net (706) 645-3249 Lee W. Washam President lwasham@charterbank.net (706) 645-3630 Curtis R. Kollar Senior Vice President and Chief Financial Officer ckollar@charterbank.net (706) 645-3237 24 Investor Contacts 1233 O. G. Skinner Drive West Point, Georgia 31833 1-800-763-4444 www.charterbk.com

Appendix

Board & Executive Team 26 Name Position(s) Held With Charter Financial Corporation Age (1) Director Since (2) Current Term Expires Directors Continuing in Office Jane W. Darden Director 64 1988 2015 Thomas M. Lane Director 60 1996 2015 Edward D. Smith Director 40 2011 2016 Curti M. Johnson General Counsel and Senior Vice President, Director 55 2007 2016 Robert L. Johnson Chief Executive Officer, President and Director 61 1986 2017 David Z. Cauble, III Director 62 1996 2017 David L. Strobel Director 63 2003 2017 Executive Officers Who Are Not Directors Curtis R. Kollar Senior Vice President and Chief Financial Officer 62 Lee Washam President of CharterBank 53 (1) As of December 31, 2014. (2) Includes service as a director of CharterBank prior to its mutual-to-stock conversion.

__________________________________ (1) Assumes an instantaneous uniform change in interest rates at all maturities. (2) NPV is the difference between the present value of an institution’s assets and liabilities. (3) Present value of assets represents the discounted present value of incoming cash flows on interest- earning assets. (4) NPV Ratio represents NPV divided by the present value of assets. Net Portfolio Value 27 At June 30, 2015 Change in Interest Rates (bp) (1) Estimated NPV (2) Estimated Increase (Decrease) in NPV Percentage Change in NPV NPV Ratio as a Percent of Present Value of Assets ( 3 ) ( 4 ) Increase (Decrease) in NPV Ratio as a Percent of Present Value of Assets ( 3 ) ( 4 ) (dollars in thousands) 300 $208,412 $1,286 0.6% 20.8% 0.2% 200 $208,487 $1,361 0.7% 20.8% 0.2% 100 $208,122 $997 0.5% 20.7% 0.1% — $207,126 — — 20.6% — (100) $199,612 ($7,514) (3.6%) 19.9% (0.7%)

End of Presentation