Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - YADKIN FINANCIAL Corp | q22015pressrelease1.htm |

| 8-K - 8-K Q2 2015 EARNINGS RELEASE - YADKIN FINANCIAL Corp | form8-kq22015pressrelease.htm |

2015 Q2 Earnings Call July 23, 2015

Forward Looking Statements Information in this presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties that could cause actual results to differ materially, including without limitation, reduced earnings due to larger than expected credit losses in the sectors of our loan portfolio secured by real estate due to economic factors, including declining real estate values, increasing interest rates, increasing unemployment, or changes in payment behavior or other factors; reduced earnings due to larger credit losses because our loans are concentrated by loan type, industry segment, borrower type, or location of the borrower or collateral; the rate of delinquencies and amount of loans charged-off; the adequacy of the level of our allowance for loan losses and the amount of loan loss provisions required in future periods; costs or difficulties related to the integration of the banks we acquired or may acquire may be greater than expected; results of examinations by our regulatory authorities, including the possibility that the regulatory authorities may, among other things, require us to increase our allowance for loan losses or writedown assets; the amount of our loan portfolio collateralized by real estate, and the weakness in the commercial real estate market; our ability to maintain appropriate levels of capital; adverse changes in asset quality and resulting credit risk-related losses and expenses; increased funding costs due to market illiquidity, increased competition for funding, and increased regulatory requirements with regard to funding; significant increases in competitive pressure in the banking and financial services industries; changes in political conditions or the legislative or regulatory environment, including the effect of recent financial reform legislation on the banking industry; general economic conditions, either nationally or regionally and especially in our primary service area, becoming less favorable than expected resulting in, among other things, a deterioration in credit quality; our ability to retain our existing customers, including our deposit relationships; changes occurring in business conditions and inflation; changes in monetary and tax policies; ability of borrowers to repay loans; risks associated with a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers or other third parties, including as a result of cyber attacks, which could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses; changes in accounting principles, policies or guidelines; changes in the assessment of whether a deferred tax valuation allowance is necessary; our reliance on secondary sources such as FHLB advances, sales of securities and loans, federal funds lines of credit from correspondent banks and out-of-market time deposits, to meet our liquidity needs; loss of consumer confidence and economic disruptions resulting from terrorist activities or other military actions; and changes in the securities markets. Additional factors that could cause actual results to differ materially are discussed in the Company’s filings with the Securities and Exchange Commission ("SEC"), including without limitation its Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q, and its Current Reports on Form 8-K. The forward-looking statements in this presentation speak only as of the date of the presentation, and the Company does not assume any obligation to update such forward-looking statements. Combined information contained in this presentation are used for illustrative purposes only. Non‐GAAP Measures Statements included in this presentation include non‐GAAP measures and should be read along with the accompanying tables to the July 23, 2015 presentation and earnings release which provide a reconciliation of non‐GAAP measures to GAAP measures. Management believes that these non‐GAAP measures provide additional useful information that allows readers to evaluate the ongoing performance of the Company. Non‐GAAP measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider the Company's performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company. Non‐GAAP measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the Company's results or financial condition as reported under GAAP. Important Information 2

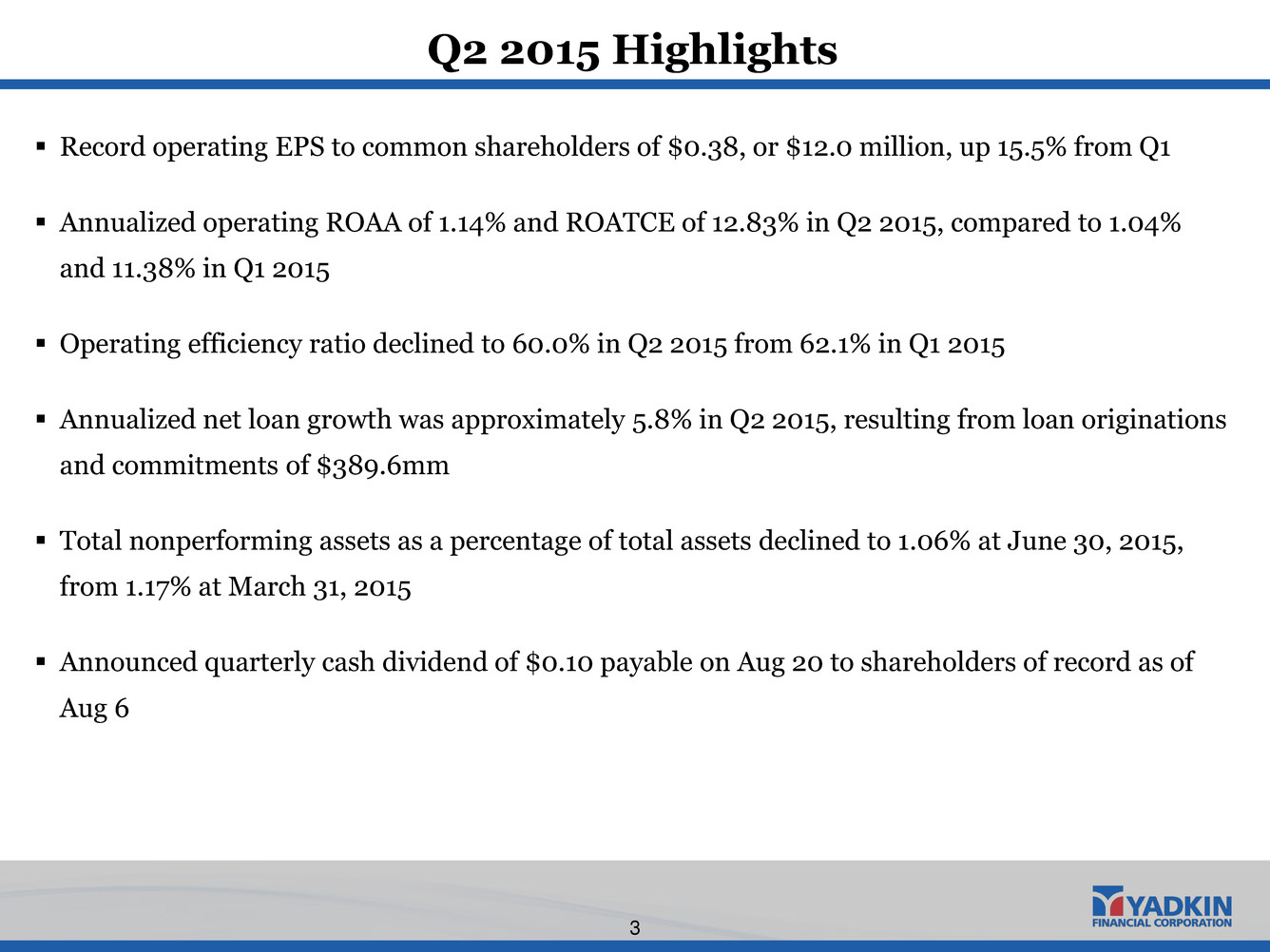

Q2 2015 Highlights 3 Record operating EPS to common shareholders of $0.38, or $12.0 million, up 15.5% from Q1 Annualized operating ROAA of 1.14% and ROATCE of 12.83% in Q2 2015, compared to 1.04% and 11.38% in Q1 2015 Operating efficiency ratio declined to 60.0% in Q2 2015 from 62.1% in Q1 2015 Annualized net loan growth was approximately 5.8% in Q2 2015, resulting from loan originations and commitments of $389.6mm Total nonperforming assets as a percentage of total assets declined to 1.06% at June 30, 2015, from 1.17% at March 31, 2015 Announced quarterly cash dividend of $0.10 payable on Aug 20 to shareholders of record as of Aug 6

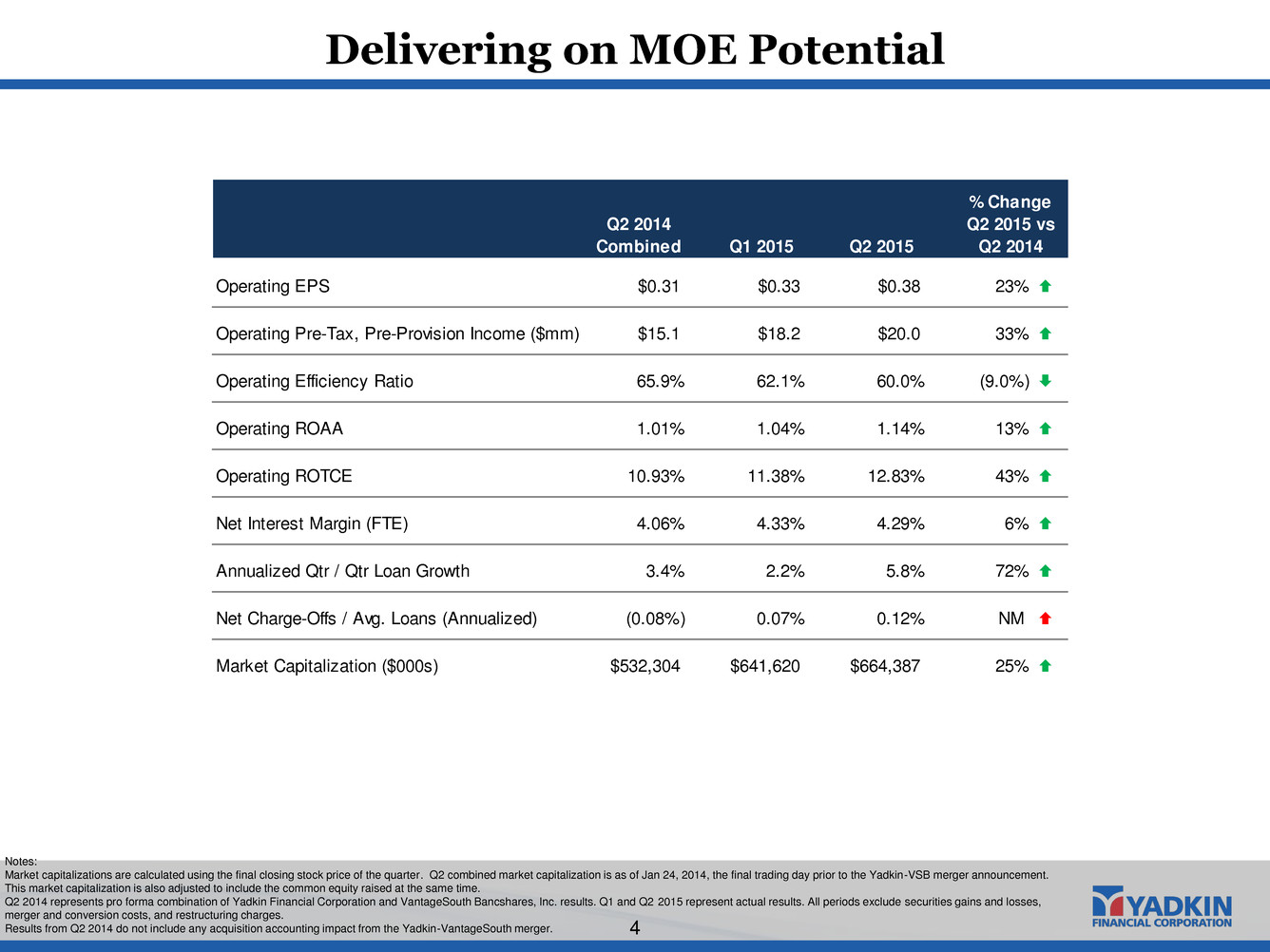

Delivering on MOE Potential 4 Notes: Market capitalizations are calculated using the final closing stock price of the quarter. Q2 combined market capitalization is as of Jan 24, 2014, the final trading day prior to the Yadkin-VSB merger announcement. This market capitalization is also adjusted to include the common equity raised at the same time. Q2 2014 represents pro forma combination of Yadkin Financial Corporation and VantageSouth Bancshares, Inc. results. Q1 and Q2 2015 represent actual results. All periods exclude securities gains and losses, merger and conversion costs, and restructuring charges. Results from Q2 2014 do not include any acquisition accounting impact from the Yadkin-VantageSouth merger. Q2 2014 Combined Q1 2015 Q2 2015 % Change Q2 2015 vs Q2 2014 Operating EPS $0.31 $0.33 $0.38 23% Operating Pre-Tax, Pre-Provision Income ($mm) $15.1 $18.2 $20.0 33% Operating Efficiency Ratio 65.9% 62.1% 60.0% (9.0%) Operating ROAA 1.01% 1.04% 1.14% 13% Operating ROTCE 10.93% 11.38% 12.83% 43% Net Interest Margin (FTE) 4.06% 4.33% 4.29% 6% Annualized Qtr / Qtr Loan Growth 3.4% 2.2% 5.8% 72% Net Charge-Offs / Avg. Loans (Annualized) (0.08%) 0.07% 0.12% NM Market Capitalization ($000s) $532,304 $641,620 $664,387 25%

Net income available to common shareholders totaled $10.6mm or $0.33 per share during Q2 2015, compared to $9.6mm or $0.30 per share during Q1 2015 Net operating earnings available to common shareholders totaled $12.0mm, or $0.38 per share, in Q2 2015, compared to $0.33 per share in Q1 2015 Annualized operating ROAA of 1.14% in Q2 2015, compared to 1.04% in Q1 2015 Annualized operating ROATCE 12.83% in Q2 2015, compared to 11.38% in Q1 2015 Operating efficiency improved to 60.0% in Q2 2015, compared to 62.1% in Q1 2015 During May, the Company redeemed $28.4mm of preferred stock(1) • Redemption of the preferred stock is expected to improve annual pre-tax earnings by $2.6mm and increase fully-diluted net income per common share by $0.08 annually (1) Proffered stock was initially issued in connection with the TARP Capital Purchase Program. (2) Excludes securities gains and losses, branch sale gain, merger and conversion costs, and restructuring charges. Earnings Profile 5 For the Quarter Ended, ($ in thousands) 2015Q1 2015Q2 Net interest income 39,176$ 39,327$ Provision for loan losses 961 994 Net interest income after provision for loan losses 38,215 38,333 Operating non-interest income 8,838 10,716 Operating non-interest expense 29,831 30,047 Operating income before taxes & M&A costs 17,222$ 19,002$ Gain (loss) on sales of available for sale securities 1 84 Merger and conversion costs 220 (25) Restructuring charges 907 2,294 Income before income taxes 16,096 16,817 Income tax expense 5,846 6,076 Net income 10,250 10,741 Pr ferred stock dividends 639 183 Net income to common shareholders 9,611 10,558 Pre-tax, pre-provision operating earnings (Non-GAAP)(2) 18,183 19,996

Net Interest Income 6 Combined Net Interest Margin (1)(%) Impact of acquisition accounting on GAAP net interest margin is declining A favorable change in earning asset and funding mix partially offset continued loan pricing pressure Core net interest margin increased by 2 bps Focus remains on disciplined loan pricing and low-cost, core deposits Average Yields and Rates For the Quarter Ended, 2015Q1 2015Q2 Loans 5.52% 5.47% Securities 2.43% 2.35% Other earning assets 0.34% 0.37% Total earning assets 4.84% 4.83% Interest bearing deposits (0.46%) (0.48%) Borrowed funds (1.64%) (1.61%) Total interest bearing liabilities (0.63%) (0.65%) Net interest margin (FTE) 4.33% 4.29% Cost of funds 0.52% 0.53% (1) Q2 2014 represents a pro forma combination of Yadkin Financial Corporation and VantageSouth Bancshares, Inc. results. Q3 2014 through Q2 2015 represent actual results.

Diverse Drivers of Non-Interest Income Growth 7 $2,388 $1,885 $2,133 $1,390 $1,911 $1,299 $1,520 $1,002 $1,322 $1,633 $2,121 $2,072 $2,917 $2,873 $3,677 $2,730 $3,265 $3,506 $3,253 $3,495 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Other Mortgage SBA Service charges & fees on deposits accounts Combined Operating Non-Interest Income Composition1, 2 ($000) $8,538 $8,742 Operating non-interest income totaled $10.7mm in the Q2 2015, compared to $8.8mm in Q1 2015 Q2 2015 over Q1 2015 growth of 21.2% across all fee income categories Record SBA production of $34.9 mm in Q2 as pipeline strengthened and gain on sale continued to hold Mortgage revenue increased to $1.6mm, benefiting from a 15% production increase over Q1 2015 and a $0.2mm recovery of previous MSR impairment Other non-interest income growing due to impact of wealth management, merchant, and purchased accounts receivable (1) Q2 2014 represents pro forma combination of Yadkin Financial Corporation and VantageSouth Bancshares results. Q3 2014 to Q2 2015 represent actual results. Excludes securities gains and losses and branch sale gain. (2) Certain items have been reclassified between service charges and other non-interest income following the merger. Combined pro forma prior period balances have not been restated. $9,558 $8,838 $10,716

Non-Interest Expense 8 Combined Non-Interest Expense Composition1, 2 ($000) Efficiency ratio declined to 60.0% for the second quarter • Reduced costs and invested savings in people to continue strong revenue growth • Remaining expense initiatives include four branch closing in Q3 and two branch sales in Q4 • Remain confident in reaching the previously announced efficiency goal of sub 60% before the end of 2015 Total Non-Interest Expense $31,817 $48,187 $33,592 $30,958 $32,316 One-time charges ($2,710) ($17,450) ($1,622) ($1,127) ($2,485) Operating Non-Interest Expense $29,107 $30,737 $31,970 $29,831 $30,047 $2,884 $4,687 $4,569 $4,376 $4,006 $644 $1,075 $1,105 $1,096 $1,030 $1,547 $2,408 $2,497 $2,600 $2,636 $5,991 $11,009 $10,034 $9,452 $9,014 $0 $4,000 $8,000 $12,000 $16,000 $20,000 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Other Data Processing Occupancy & Equipment Salaries & Benefits $2,884 $4,687 $4,569 $4,376 $4,006 $644 $1,075 $1,105 $1,096 $1,030 $1,547 $2,408 $2,497 $2,600 $2,636 $5,991 $11,009 $10,034 $9,452 $9,014 $0 $4,000 $8,000 $12,000 $16,000 $20,000 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Other Data Processing Occupancy & Equipment Salaries & Benefits $2,884 $4,687 $4,569 $4,376 $4,006 $644 $1,075 $1,105 $1,096 $1,030 $1,547 $2,408 $2,497 $2,600 $2,636 $5,991 $11,009 $10,034 $9,452 $9,014 $0 $4,000 $8,000 $12,000 $16,000 $20,000 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Other Data Processing Occupancy & Equipment Salaries & Benefits $29,107 $30,737 $31,970 (1) Q2 2014 represents pro forma combination of Yadkin Financial Corporation and VantageSouth Bancshares, Inc. results. Q3 2014 to Q2 2015 represent actual results. Excludes merger and conversion costs and restructuring charges. (2) Certain items have been reclassified, particularly between occupancy & equipment and other, following the merger. Combined pro forma prior period balances have not been restated. $2,884 $4,687 $4,569 $4,376 $4,006 $644 $1,075 $1,105 $1,096 $1,030 $1,547 $2,408 $2,497 $2,600 $2,636 $5,991 $11,009 $10,034 $9,452 $9,014 $0 $4,000 $8,000 $12,000 $16,000 $20,000 Q1 2013 Q2 2 13 Q3 2 13 Q4 2013 Q1 2014 Other Data Processing Occupancy & Equipment Salaries & Benefits n Core Deposit Intangible Amortization $29,831 $30,047

Balance Sheet 9 Annualized net loan growth was approximately 5.8% in Q2 2015 • Driven by loan originations and commitments of $389.6mm • Loan growth is net of $22.5 mm in SBA loan sales • $170mm (12.2%) originated loan growth from Q1 to Q2: • Non-interest demand deposits increased by 25.8% annualized • Non-interest demand deposits are 21.5% of total deposits TCE / TA increased to 9.16% at June 30, 2015, compared to 9.06% at March 31, 2015 TBV per share up 8.9% annualized to $12.01 Redeemed $28.4mm of preferred stock in May Balance Sheet As of the Quarter Ended, (Dollars in thousands) 2015Q1 2015Q2 Assets: Cash and due from banks 55,426$ 65,620$ Federal funds & interest-earning deposits 53,076 57,341 Investment securities 697,834 688,417 Loans held for sale 32,322 38,622 Loans 2,913,859 2,955,771 Allowance for loan losses (8,284) (8,358) Premises and equipment, net 78,683 77,513 Foreclosed assets 12,427 13,547 Other assets 433,735 438,579 Total assets 4,269,078$ 4,327,052$ Liabilities: Deposits: Non-interest demand 655,333$ 697,653$ Interest-bearing demand 472,524 475,597 Money market and savings 1,010,348 991,982 Time deposits 1,070,970 1,077,862 Total deposits 3,209,175 3,243,094 Short-term borrowings 325,500 355,500 Long-term debt 137,199 147,265 Accrued interest & other liabilities 29,385 33,077 Total liabilities 3,701,259$ 3,778,936$ Shareholders' equity: Preferred stock 28,405$ -$ Common stock & other equity 539,414 548,116 Total shareholders' equity 567,819 548,116 Total liabilities and shareholders' equity 4,269,078$ 4,327,052$ Tangible book value per common share 11.75$ 12.01$ ($ in thousands) Q1 2015 Q2 2015 Originat d Loans 1,395,723 1,565,597 Acquired Loans 1,518,136 1,390,174 Total Loans 2,913,859 2,955,771 Qtr / Qtr Change in Balance Originated Loans 10.2% 12.2% Acquired Loans -7.0% -8.4% Total Loans 0.5% 1.4%

28.1% 21.2% 17.0% 21.9% 20.3% 21.2% 10.0% 20.0% 30.0% 40.0% Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 VantageSouth Yadkin Strong Asset Quality 10 Effective Reserve of 1.88% or $55.5mm Classified Asset Ratio (2) – Bank Level (1) Non-purchased impaired loan balances include $32 million of SBA guaranteed loan balances. (2) Classified Asset Ratio = Classified Assets / (Tier 1 Capital + Loan Loss Reserves) Net charge-offs - 12bps Remaining mark declined by $3.9mm in Q2 2015 Loan Loss Reserves Breakdown ($ in thousands) Non- Purchased Impaired Purchased Impaired (SOP 03-3) Total ALLL balance at 3/31/15 6,907$ 1,377$ 8,284$ Net charge-offs (920) 0 (920) Provision for loan losses 1,013 (19) 994 ALLL balance at 6/30/15 7,000$ 1,358$ 8,358$ Remaining credit mark 22,447 12,726 35,173 Remaining interest rate mark 3,579 8,408 11,987 Total effective reserve 33,026$ 22,492$ 55,518$ Loan balances (1) 2,786,340$ 169,431$ 2,955,771$ ALLL percentage 0.25% 0.80% 0.28% Remaining credit mark percentage 0.81% 7.51% 1.19% Remaining interest rate mark percentage 0.13% 4.96% 0.41% Effective reserve percentage 1.19% 13.28% 1.88 Classified assets declined in Q2, but the preferred stock redemption reduced capital, thus slightly increasing the classified asset ratio

Contact: Terry Earley (919) 659-9015 terry.earley@yadkinbank.com

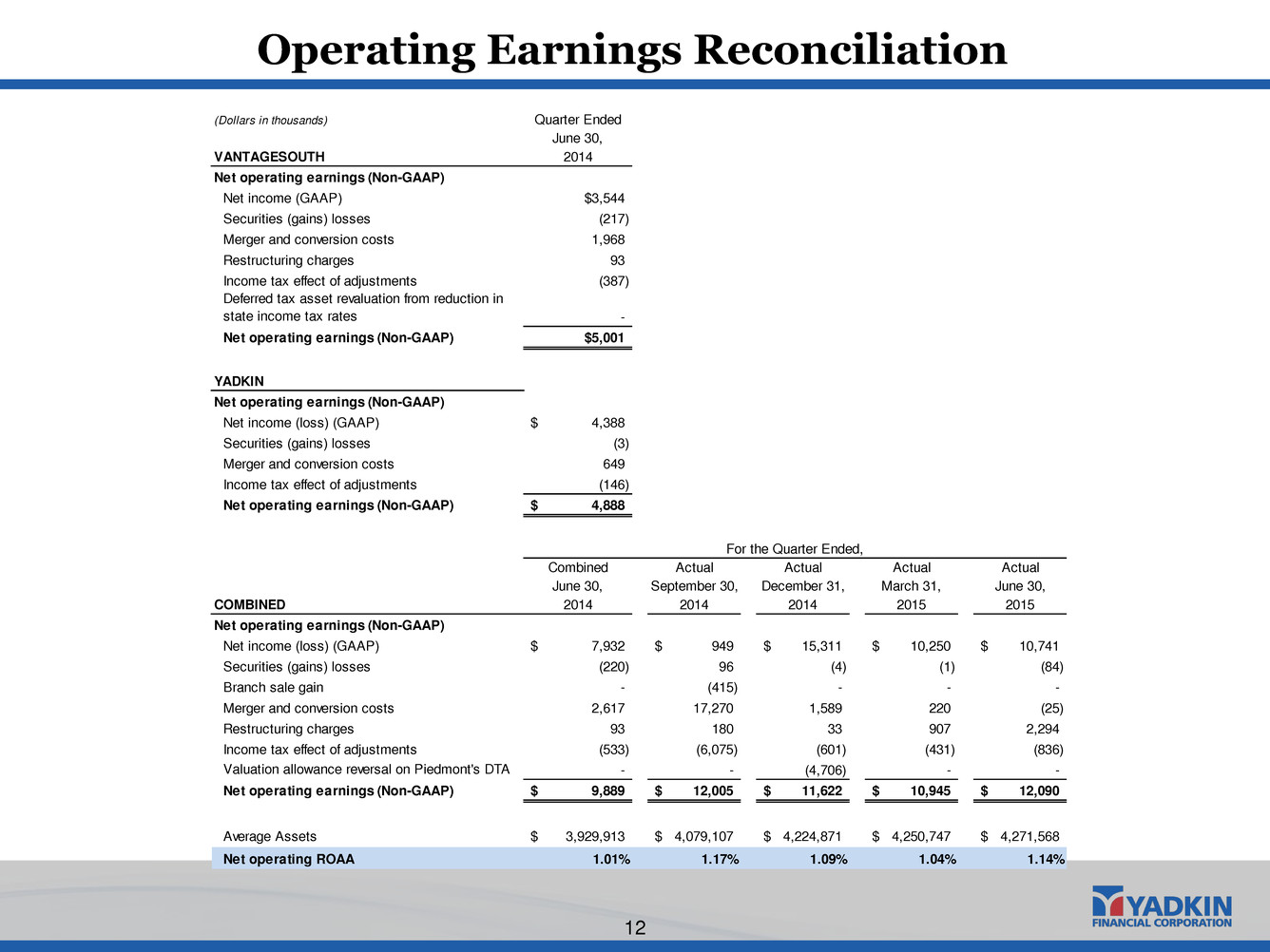

Operating Earnings Reconciliation 12 (Dollars in thousands) Quarter Ended June 30, VANTAGESOUTH 2014 Net operating earnings (Non-GAAP) Net income (GAAP) $3,544 Securities (gains) losses (217) Merger and conversion costs 1,968 Restructuring charges 93 Income tax effect of adjustments (387) Deferred tax asset revaluation from reduction in state income tax rates - Net operating earnings (Non-GAAP) $5,001 YADKIN Net operating earnings (Non-GAAP) Net income (loss) (GAAP) 4,388$ Securities (gains) losses (3) Merger and conversion costs 649 Income tax effect of adjustments (146) Net operating earnings (Non-GAAP) 4,888$ For the Quarter Ended, Combined Actual Actual Actual Actual June 30, September 30, December 31, March 31, June 30, COMBINED 2014 2014 2014 2015 2015 Net operating earnings (Non-GAAP) Net income (loss) (GAAP) 7,932$ 949$ 15,311$ 10,250$ 10,741$ Securities (gains) losses (220) 96 (4) (1) (84) Branch sale gain - (415) - - - Merger and conversion costs 2,617 17,270 1,589 220 (25) Restructuring charges 93 180 33 907 2,294 Income tax effect of adjustments (533) (6,075) (601) (431) (836) Valuation allowance reversal on Piedmont's DTA - - (4,706) - - Net operating earnings (Non-GAAP) 9,889$ 12,005$ 11,622$ 10,945$ 12,090$ Average Assets 3,929,913$ 4,079,107$ 4,224,871$ 4,250,747$ 4,271,568$ Net operating ROAA 1.01% 1.17% 1.09% 1.04% 1.14%