Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PLEXUS CORP | a8-kcoverpageq3f15.htm |

| EX-99.1 - EXHIBIT 99.1 - PLEXUS CORP | q3f15pressrelease-final.htm |

FISCAL THIRD QUARTER 2015 FINANCIAL RESULTS July 23, 2015

SAFE HARBOR & FAIR DISCLOSURE STATEMENT 2 Any statements made during our call today and information included in the supporting material that is not historical in nature, such as statements in the future tense and statements that include "believe," "expect," "intend," "plan," "anticipate," and similar terms and concepts, are forward-looking statements. Forward-looking statements are not guarantees since there are inherent difficulties in predicting future results, and actual results could differ materially from those expressed or implied in the forward-looking statements. For a list of factors that could cause actual results to differ materially from those discussed, please refer to the Company’s periodic SEC filings, particularly the risk factors in our Form 10-K filing for the fiscal year ended September 27, 2014, and the Safe Harbor and Fair Disclosure statement in yesterday’s press release. Plexus provides non-GAAP supplemental information, such as ROIC, Economic Return, and free cash flow, because such measures are used for internal management goals and decision making, and because they provide additional insight into financial performance. In addition, management uses these and other non-GAAP measures, such as adjusted net income and adjusted operating margin, to provide a better understanding of core performance for purposes of period-to-period comparisons. For a full reconciliation of non-GAAP supplemental information please refer to yesterday’s press release and our periodic SEC filings.

FISCAL THIRD QUARTER 2015 RESULTS 3 Q3F15 Guidance April 22, 2015 Q3F15 Jul 4, 2015 Q2F15 Apr 4, 2015 Q3F15 vs. Q2F15 Revenue ($ millions) $670 to $700 $670 $651 + 3% Diluted EPS $0.71 to $0.79 $0.69 $0.69 Flat ROIC 14.1% 14.5% - 40 bps Q3F15 consistent with announcement of preliminary results on July 13th Relative to April 22nd guidance • Revenue at bottom of the range • EPS $0.02 below bottom of the range

FISCAL THIRD QUARTER NOTES Revenue of $670 million establishes a new record • Up 3% Q/Q; up 8% Y/Y Market Sectors vs. Expectations • Networking/Communications— Late quarter weakness that continues into Q4 • Healthcare/Life Sciences—modest weakness • Industrial/Commercial—modest strength • DSA—modest weakness coupled with missed product shipments Focus on Customers • Net Promotor Scores rising • Six outstanding performance awards, including GE Healthcare 2014 Supplier of the Year! • AS9100 Quality Management System Certification for Plexus Engineering Solutions in Europe Global Leadership • Oliver Mihm named President of Plexus EMEA; relocates to Europe • Ronnie Darroch to focus on Global Manufacturing strategy and execution; relocates to U.S. • Mike Running assumes leadership over our global Engineering Solutions business unit 4

FISCAL FOURTH QUARTER 5 Q4F15 Guidance Revenue $650 to $680 million Diluted EPS $0.64 to $0.72 • Includes $0.10 stock-based compensation expense • Excludes any unanticipated special items All sectors weakened in Q4 versus our view in April • Networking/Communication had the largest reduction • Expect growth in other sectors to be offset by reductions in N/C Assuming revenue at midpoint of guidance • Down approximately 1% Q/Q and about flat Y/Y • Fiscal 2015 up about 11% versus prior year; just shy of our enduring goal of 12% • Fiscal 2015 all sectors achieve Y/Y growth

PERFORMANCE BY SECTOR 6 Q3F15 Jul 4, 2015 Q2F15 Apr 4, 2015 Q3F15 vs. Q2F15 Q4F15 Expectations (percentage points) Networking/ Communications $222 33% $210 32% + 6% Down high teens Healthcare/ Life Sciences $180 27% $191 29% - 6% Up low single Industrial/ Commercial $176 26% $160 25% + 10% Up low double Defense/ Security/ Aerospace $92 14% $90 14% + 2% Up low double Total Revenue $670 100% $651 100% + 3% Revenue in millions

MANUFACTURING WINS BY REGION 7 • $147M in annualized manufacturing revenue when fully ramped (34 programs) • Balanced wins across the regions • Strong wins momentum in EMEA $61M $56M $30M Q3F15 AMER APAC EMEA

MANUFACTURING WINS BY SECTOR • Strength in Healthcare/Life Sciences • Funnel healthy at $2.0B $38M $66M $39M $4M Q3F15 N/C HC/LS I/C D/S/A 8

MANUFACTURING WINS MOMENTUM 9 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 % o f TFQ S al e s N ew W in s $ M TFQ Wins TFQ Wins% of TFQ Sales Qtrly Wins Quarterly Target approximately $160.0M TFQ $716M Target 25% Trailing Four Quarter Wins Above Target

3.5% 4.0% 4.5% 5.0% 5.5% 450 500 550 600 650 700 Q1F13 Q2F13 Q3F13 Q4F13 Q1F14 Q2F14 Q3F14 Q4F14 Q1F15 Q2F15 Q3F15 Q4F15* R e ve n u e $ M Revenue Operating Margin KEY OPERATING METRICS Operating Margin Target Range: 4.7 to 5.0% *represents midpoint of guidance 10 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 450 500 550 600 650 700 Q1F13 Q2F13 Q3F13 Q4F13 Q1F14 Q2F14 Q3F14 Q4F14 Q1F15 Q2F15 Q3F15 Q4F15* Economic Return Performance Economic Return

OPERATING MARGIN Q4F15 Q2F15 – Q3F15 11 F16 Projections Results

FISCAL THIRD QUARTER INCOME STATEMENT 12 Dollars in millions, except earnings per share Q3F15 Comments Revenue $670 Record revenue and at the low end of the guidance range, 8% growth vs Q3F14 Gross margin 8.8% Below guidance range of 9.0-9.3% and below Q2F15 of 9.2% Selling & administrative expenses $30.5 Low end of guidance range and, as a percent of revenue, the lowest in several years Operating margin 4.3% Below guidance range due to lower gross margin Diluted earnings per share $0.69 Sequentially flat

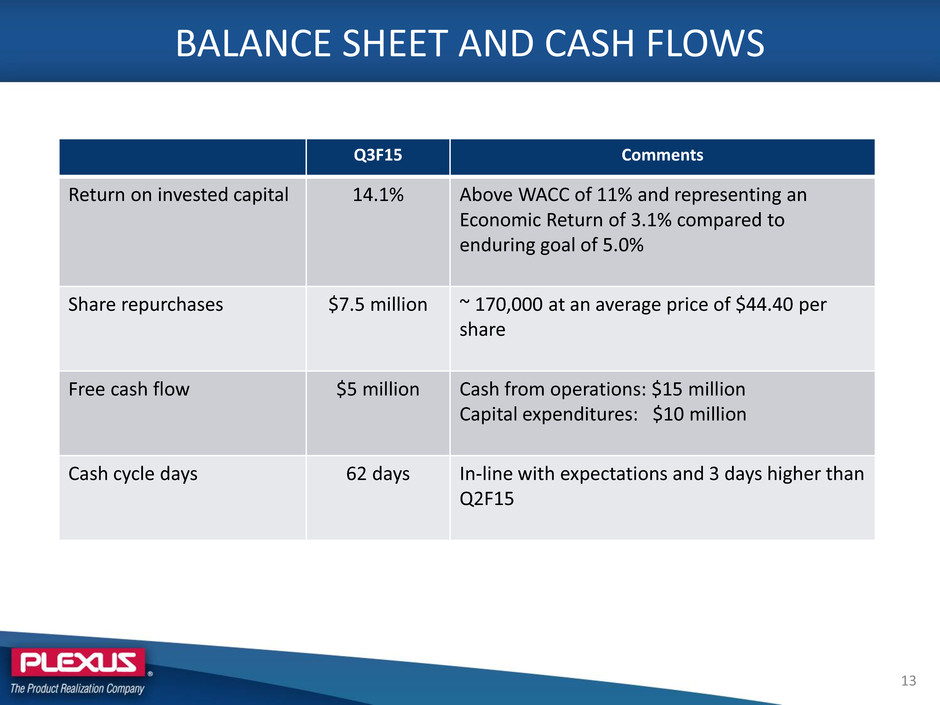

BALANCE SHEET AND CASH FLOWS 13 Q3F15 Comments Return on invested capital 14.1% Above WACC of 11% and representing an Economic Return of 3.1% compared to enduring goal of 5.0% Share repurchases $7.5 million ~ 170,000 at an average price of $44.40 per share Free cash flow $5 million Cash from operations: $15 million Capital expenditures: $10 million Cash cycle days 62 days In-line with expectations and 3 days higher than Q2F15

Q1F13 Q2F13 Q3F13 Q4F13 Q1F14 Q2F14 Q3F14 Q4F14 Q1F15 Q2F15 Q3F15 *Q4F15 Inventory Days 92 87 78 72 83 84 84 80 82 86 88 A/R Days 50 55 54 49 51 49 48 44 52 48 48 A/P Days 61 61 54 56 64 63 67 60 53 63 62 Customer Deposit Days 7 17 19 12 8 8 8 8 9 12 12 Net Cash Cycle Days 74 64 59 53 62 62 57 56 72 59 62 65 WORKING CAPITAL TRENDS 14 *represents midpoint guidance

FISCAL FOURTH QUARTER 2015 GUIDANCE 15 Guidance Revenue $650 to $680 million Diluted earnings per share $0.64 to $0.72 Gross margin 8.7% to 9.0% SG&A $30 to $31 million Operating margin 4.2% to 4.5% Depreciation $12.3 million Q4 tax rate F15 tax rate 10 to 12% 10 to 12% Cash cycle days 63 to 67 days F15 capital expenditures ~ $40 million

Q&A ANALYSTS PLEASE CONFORM TO: ONE QUESTION ONE FOLLOW-UP THANKS