Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - SunVault Energy, Inc. | svlt_ex311.htm |

| EX-32.1 - CERTIFICATION - SunVault Energy, Inc. | svlt_ex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2014

|

¨ |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from ____________ to ____________

Commission file number 333-181040

|

SUNVAULT ENERGY, INC. |

|

(Exact name of registrant as specified in its charter) |

|

Nevada |

27-4198202 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

Suite 200, 10703 - 181 Street NW, Edmonton, Alberta, Canada |

|

T5S 1N3 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: (778) 478-9530

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Name of Each Exchange On Which Registered | |

|

None |

None |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

¨ |

Accelerated filer |

¨ |

|

Non-accelerated filer |

¨ |

Smaller reporting company |

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of Common Stock held by non-affiliates of the Registrant on June 30, 2014 was $4,679,679 based on a $0.16875 average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant's classes of common stock as of the latest practicable date.

106,878,613 common shares as of July 12, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

|

Item 1. |

Business |

|

|

3 |

|

|

|

|

|

|

|

|

|

Item 1A. |

Risk Factors |

|

|

20 |

|

|

|

|

|

|

|

|

|

Item 1B. |

Unresolved Staff Comments |

|

|

24 |

|

|

|

|

|

|

|

|

|

Item 2. |

Properties |

|

|

25 |

|

|

|

|

|

|

|

|

|

Item 3. |

Legal Proceedings |

|

|

25 |

|

|

|

|

|

|

|

|

|

Item 4. |

Mine Safety Disclosures |

|

|

26 |

|

|

|

|

|

|

|

|

|

Item 5. |

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

|

|

27 |

|

|

|

|

|

|

|

|

|

Item 6. |

Selected Financial Data |

|

|

30 |

|

|

|

|

|

|

|

|

|

Item 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

|

30 |

|

|

|

|

|

|

|

|

|

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

|

|

34 |

|

|

|

|

|

|

|

|

|

Item 8. |

Financial Statements and Supplementary Data |

|

|

35 |

|

|

|

|

|

|

|

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

|

36 |

|

|

|

|

|

|

|

|

|

Item 9A. |

Controls and Procedures |

|

|

36 |

|

|

|

|

|

|

|

|

|

Item 9B. |

Other Information |

|

|

37 |

|

|

|

|

|

|

|

|

|

Item 10. |

Directors, Executive Officers and Corporate Governance |

|

|

39 |

|

|

|

|

|

|

|

|

|

Item 11. |

Executive Compensation |

|

|

45 |

|

|

|

|

|

|

|

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

|

47 |

|

|

|

|

|

|

|

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

|

48 |

|

|

|

|

|

|

|

|

|

Item 14. |

Principal Accounting Fees and Services |

|

|

50 |

|

|

|

|

|

|

|

|

|

Item 15. |

Exhibits, Financial Statement Schedules |

|

|

51 |

|

| 2 |

PART I

Item 1. Business

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common shares" refer to the common shares in our capital stock.

As used in this current report and unless otherwise indicated, the terms "we", "us", "our" and "Sunvault" mean Sunvault Energy, Inc. and our wholly-owned subsidiaries, unless otherwise indicated:

|

1. |

1454004 Alberta Ltd., an Alberta, Canada corporation; | |

|

2. |

CleanGen Inc., an Alberta, Canada corporation; | |

|

3. |

CleanGen Power Corp., the wholly-owned subsidiary of 1454004 Alberta Ltd.; | |

|

4. |

CleanGen Aboriginal HR Services Ltd., the wholly-owned subsidiary of CleanGen Inc.; | |

|

5. |

1098541 Alberta Ltd., the wholly-owned subsidiary of CleanGen Inc. and the general partner of CuttingEdge Tire Recycling Limited Partnership; | |

|

6. |

Coole Immersive Inc., the 75.5% owned subsidiary of CleanGen Inc.; and | |

|

7. |

Werkman Transport Inc., an Alberta, Canada corporation. |

General Overview

Our company was incorporated in the State of Nevada on December 8, 2010 under the name China Green Clothing Inc. Our company changed its name on April 29, 2011 to My Natural Baby Boutique Inc., then to Organic Treehouse Ltd. on January 5, 2012. Our company's previous business was in the wholesale and distribution of organic infant and toddler products which was discontinued on May 8, 2013.

On May 8, 2013, a change of control of our company was made when entities acquired 4,000,000 common shares representing 100% of the common shares held by Sophia Movshina, our former officer, director and majority shareholder which represented 78.74% of the then issued and outstanding common shares of our company. As a result of this acquisition, the following purchasers became the majority shareholders of our company:

| · | West Point International Inc., Millennium Trends International Inc.: 15.75%; | |

| · | Millennium Trends International Inc.,: 15.75%; | |

| · | Sunvault Holding Inc.,: 23.62%; and | |

| · | Sunvault Holding Corp.,: 23.62%. |

| 3 |

As part of the purchase, Sophia Movshina, resigned as our sole officer and director effective May 8, 2013 and John Crawford was appointed president, chief executive officer, chief financial officer, and director and Rory Husch was appointed secretary of our company.

On May 24, 2013, we filed a Certificate of Amendment to Articles of Incorporation with the State of Nevada to change the name of our company to Sunvault Energy, Inc. In addition to the name change we increased the authorized common shares of our company from 75,000,000 to 500,000,000 common shares with a par value of $0.001. The Certificate of Amendment to effect the change of name and increase to authorized capital was filed and became effective with the Nevada Secretary of State on May 31, 2013.

On May 31, 2013, we affected a 20 for 1 forward stock split of the issued and outstanding shares of our common stock. As a result of the forward split, our then issued and outstanding common stock increased from 5,080,000 common shares to 101,600,000 common shares with a par value of $0.001. The name change and forward split became effective on approval from FINRA at the opening of trading on June 28, 2013 under the trading symbol to SVLT.

We have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or previous purchase or sale of a significant amount of assets not in the ordinary course of our business. Our management decision, to acquire revenue producing companies to provide a firm foundation that our company's significant technologies could grow from, is one that we stand committed to.

Our Current Business

Our company's mission is to bring cost effective generation and energy storage to the world market through a seamless and simultaneous integration of energy generation and storage. The Company has applied for several patents relating to photovoltaics, transfer protocols and energy storage through the company's technology platforms. The company has completed research and development in the advancement of a energy storage device technology and has made some significant achievements.

We believe this technical approach has the potential to enable one of the lowest overall system cost structures while operating at maximum efficiency. Our company's objective is to then facilitate global energy generation through a distributed utility business model built upon and around our company's All-in-One™, PolyCell™ and our Energy Storage Deviceplus the Vertical Solar Appliance technology platforms.

Once verification of our energy storage device has completed we expect to conduct a licensing approach to ensure this technology is utilized in many markets with many potential partners. We expect this licensing strategy will be used to further develop and build upon our company's business plan and facilitate increased speed-to-market of our products. Our corporate website is www.sunvaultenergy.com.

Our company's current business strategy is as follows:

| 1. |

Purchase revenue generating renewable assets that align with the corporate mission so as to lessen our company's dependency on external funding sources while simultaneously serving as an existing socket in which to plug proprietary Sunvault products into once our products come to fruition and become commercially viable. | |

|

|

2. |

Align with two leading technical universities to develop the vertical solar appliance and All-in-One™ platforms, described below. The company will utilize relationships with these two leading universities to gain independent third party verification of the company developed energy storage device. |

|

|

3. |

Set up manufacturing once the company has completed verification and certification with CSA and ULC plus additional regulatory authorities in Asia and Europe. |

|

|

4. |

Once the technology platforms are production ready, align with a for-profit global energy brand that brings manufacturing, distribution and a complimentary energy product portfolio and generate revenue via a royalty licensing model. |

| 4 |

Our company is no longer a development stage company. The company is bringing cost-effective energy generation and energy storage to the world market.. Our company views the global energy dilemma as a system problem, involving all aspects of the way electricity is produced, consumed and managed. Three platform technologies underpin Sunvault: 1) Energy Storage Device and PolyCell™ batteries for energy storage, 2) All-in-One™, a new energy generation/storage chemistry, and 3) a vertical solar appliance. These platforms and a commercialization strategy have been crafted in an attempt to redefine all aspects contributing to the total cost of electricity.

PolyCell™ is a fundamentally new, proprietary, patent pending method for assembling a multi-celled battery. The PolyCell™ technical mindset is built upon technology currently in production operating at TRL level 9 but slated for mobile applications such as electric vehicles, scooters, etc. These current products, not produced by our company, are intended for small scale storage, <5kWh per unit. Our company anticipates building upon this working knowledge so as to develop advanced processes to manufacture large, 50kWh, 120V batteries having the potential to be the lowest cost stationary batteries on the market at $100/kWh. This cost compares to $300-350/kWh for the nearest alternatives such as lead-acid and molten salt batteries. The cycle life of large scale PolyCell™ storage batteries is anticipated to deliver electricity at grid parity cost upon market entry. Our company currently needs funding to execute our plan to develop additive manufacturing techniques and production scale-up.

All-in-One™ is primarily a photovoltaic (PV), electrochemical cell invented for the purposes of generating and storing energy at the molecular level. It is not a solar panel or a battery. It is a new chemistry that combines the functions of each into one seamless and potentially disruptive, low cost energy solution. One can think of this technology as a solar panel that stores its own energy and provides power when the sun goes down. The concept has been experimentally verified, demonstrated by video via our company's website with a current TRL of 3. This technology anticipates eliminating the cost and complexity of power conversion when charging batteries with PV by building this functionality into the chemistry of the photoactive material. Research suggests power conversion costs account for 1/3 to 1/2 of the system cost.

PolyCell™ and All-In-One™ chemistry enable our company's ultimate vision of a three-dimensional solar appliance. Energy cost and installation complexity are significantly reduced with this appliance by integrating energy generation and storage into one unit which eliminates the boots-on-the-roof and other custom engineering associated with conventional solar installations. The appliance is envisioned to be installed in a matter of hours as opposed to days. Multiple appliances could be theoretically aggregated and controlled remotely by entities tasked with integrating 100% renewable energy production portfolio. A vertical appliance, perhaps similar in size to a water heater, will produce 2-20 times the energy in an equivalent footprint compared to conventional solar. This performance suggestion has been verified experimentally by research developed at the Massachusetts Institute of Technology. Initially, we expect that conventional PV materials will be integrated with PolyCell™ to commercialize this technology. Ultimately, the All-in-One™ chemistry is expected to be the low cost solution for this appliance approach but this will take time to develop, refine and acquire necessary agency approvals. Appliances can be scaled for both residential and industrial use and can be aggregated in such a manner as to enable 100% clean renewable energy independent of whether the sun shines or the wind blows.

Our Business and Patent Pending Technology

Our platform technology is comprised of four patents-pending applications that are anticipated to be combined with future rights to other patented and patent pending technologies. The Company has invented a number of new technology platforms which include a separator, a non toxic electrolyte and a energy storage device which the company believes is at the lithium ion level of performance. Each product has incredible potential and together could produce a higher quality battery than lithium ion. Patents are being prepared on the intellectual property created by the Company. This technology we believe is going to radically change the energy storage market and affect many industries, from the electric car, to smart phones to the actual power grid to every hand held battery powered device.

| 5 |

Intellectual Property

The Company has made significant advances in the last few months in the development of a energy storage device is currently being verified by independent third parties. Patents are in process of being completed for submission to protect the IP.

We have filed four pending patent applications and will require licensing agreements with third parties upon which to further develop their technologies to facilitate and execute our business plan:

| 1. |

SVLT patent application #1 US 61/834,394 - Sunvault -SUNV-1001A Cross referenced - with PHOTOVOLTAIC ARRAY WITH COLORANT - this patent under 1001A is also for Photovoltaic Coating - Filing Patent Receipt received - June 16, 2014. |

This provisional patent application is related to coatings and films which improve the aesthetics of existing solar panels without impeding their efficiency. While the potential technology has use in existing, typical solar installations, the primary purpose for its development is to enable aesthetics and performance targets for the vertical photovoltaic energy generation/storage appliance.

| 2. | SVLT patent application #2 US 61/834,396 - Sunvault -SUNV-1002A - Vertical Solar Appliance - Filing Patent Receipt received - June 16, 2014. |

This provisional patent application is related to a vertical appliance which generates and stores energy from the sun. Its value proposition is the potential to provide electrical energy at grid parity pricing even when the sun is not shining. The reason for the vertical aspect is that it provides more power per area illuminated. Going vertical also eliminates solar panels on the roof of a structure and decreases associated installation time and cost. When the energy storage is integrated and these appliances are grid tied, they enable a distributed aggregation business model. Such a model allows remote access for utility companies to defer capital expenditures by using these appliances for peak shaving and load shifting as opposed to gas-fired peaker turbines or similar carbon-emitting generation.

| 3. | SVLT patent application #3 US 61/834,399 - Sunvault -SUNV-1003A - Technologies for Generating Storing and Discharging Electricity - Filing Patent Receipt received - June 16, 2014, |

This provisional patent application covers the PolyCell™ battery design and installation strategy. The PolyCell™ battery design is enabled by a manufacturing method which will potentially produce cost effective electrical energy storage for renewables. PolyCell™ is also an enabler for the vertical appliance, as it is anticipated to be the lowest-cost method in which to store the majority of the energy in that system.

| 4. | SVLT patent application #4 US 61/831,580 - Cross Referenced - Sunvault -SUNV-1001A - Renewable Energy Technologies - PHOTOVOLTAIC ARRAY WITH COLORANT - Filing Patent Receipt received - June 16, 2014. |

This provisional patent application covers all of the technology in the broad technology roadmap.

In regard to the All-in-One™ technology, our company has intentions to enter into a technology license agreement with the University of British Columbia pertaining to a unique organic chlorophyll-based simultaneous energy generation and storage technology. After significant investment in time and research, our company now believes that we have superseded this organic bio-based solar technology with an alternative technology which we now refer to as "All-In-One". The licensing rights, previously negotiated and consummated with Millennium, were transferred back to Millennium due to company concerns regarding performance and lifetime constraints. We may not be exercising the licensing rights to the technology from the University of British Columbia, instead focusing our efforts on this new and improved "All-In-One" technology. Nevertheless, our company's proprietary All-in-One™ technology meets many of the current performance requirements to power remote sensors and other low-drain devices. The University of Florida was signed to move the All-in-One™ technology forward for the synergistic and supporting licensing rights to this technology. All patents were filed on June 16, 2014.

| 6 |

We own our domain name and website www.sunvaultenergy.com.

Pending Trademark Applications:

Sunvault corporate name (US Application 85857326) - Application date June 8, 2013. We are no longer pursuing a trademark of our corporate name at this time. We may review this decision at a later date.

Future Business Operating Segments

Our Company has developed privately held independent incubation companies to begin to enter into areas of cash flow that can be added to Sunvault's group of companies by acquisition as we mature these companies forward. The companies are as follows:

1. Edison Power Company - with domains - Edison Power Corp .com, Edison Power Corp.ca, Edisonpower.ca - Edison Power Company is being launched to sell power into deregulated power markets in North America.

2. Aboriginal Power Corp - with domains - Aboriginal Power Corp.com, Aboriginal Power Corp.ca and apcorp.ca. Aboriginal Power will sell power and natural gas and other services into the aboriginal marketplace.

3. Edison Battery - As the Company develops its energy storage device - Edison Battery is an excellent brand for the product.

We expect to use the electricity markets in Alberta Canada as our market entry for a number of our products in 2015. Our company plans to pursue the electrical and other community infrastructure markets in Alberta with our various technology platforms. Our company is focusing on opportunities that present themselves from a supply of power and other infrastructure services in markets that are in need of these services, a number of our directors and managers have extensive experience in this regard.

Current renewables integration is fraught with issues stemming from the fact that the sun doesn't always shine and the wind doesn't always blow thereby forcing electrical utilities to invest in auxiliary power generation equipment so as to make up the difference during periods lacking in sun and wind availability.

Our company has strategically added Former-Governor William Richardson, former Secretary of Energy, to our board of directors so as to try to strengthen management relationships and business competency in unregulated global markets where the business case for energy arbitrage (buy low, sell high) is immediately attractive.

| 7 |

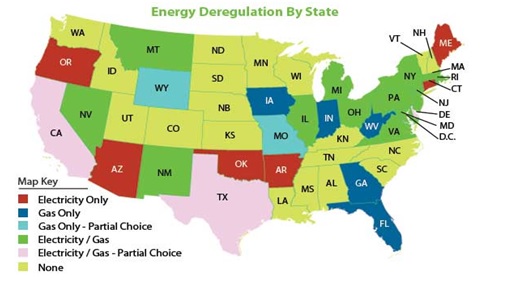

We anticipate all Alberta arbitrage projects in the future will incorporate our company's energy storage device and patent-pending PolyCell™ and All-in-One™ technologies in addition to best-in-class components that are accessible in the market today. We are currently working to determine the proper timing, amounts and type of financing we will require to complete our energy storage device move this to manufacturing and build out our other technologies while continuimng to build our cash flowing operations. The Alberta market is a natural entry point due to geographic proximity, although markets in Germany and Asia are beginning to emerge in to the global spotlight due to the recent establishment of significant government financial support programs. There are also many deregulated states in the US.The following map illustrates this:

Acquisition of Intellectual Property

On May 8, 2013, pursuant to a securities purchase agreement, Millennium and its affiliated corporate entities acquired 80,000,000 shares (4,000,000 pre-split shares) of our company's common stock and became a majority shareholder. Following consummation of the transaction, Millennium and its affiliated entities held 78.74% of the voting securities of our company. The transaction resulted in a change in control of our company from the former shareholder to Millennium and its related entities. On May 8, 2013, our company also received a 50% interest in certain intellectual property ("Joint IP") that was transferred to our company from Millennium for total consideration of $1. This transfer was accounted for as a transfer of intellectual property between entities under common control and there was no historical cost basis in this intellectual property for Millennium, therefore no gain or loss was recognized.

| 8 |

On June 8, 2013, there was an agreement for the transfer of intellectual property rights ("Premier IP") between Millennium and Premier Global Holdings Corp., a related party to our company and Millennium, whereby Millennium agreed to transfer 3,150,000 shares of our company's common stock which it obtained as part of the change in control in our company to Premier's debenture holders, to satisfy Premier's liability to all its debenture holders, in return for the transfer of Premier IP to Millennium.

On August 6, 2013, our company assigned our rights, interests and our share in this Joint IP back to Millennium for a 100% interest in the intellectual property our company now owns, mentioned above. We have let our rights to certain intellectual property acquired in this transfer to expire.

Under the terms of the assignment, our company agreed to assign the exclusive rights and title of our 50% interest in the Joint IP to Millennium for $1. Millennium agreed to assign exclusive rights and title in the Premier IP to our company for $1. In consideration for this assignment, Millennium surrendered 36,850,000 of our company's common shares for cancellation. Our company was required to issue to Millennium 20,000,000 warrants to purchase common shares of our company at an exercise price of $2.00 per share and expiring ten years from the date of issuance.

The 20,000,000 warrants that were to be issued as part as the intellectual property transfer were subsequently cancelled by our company.

Effective December 9, 2013, we entered into a standard exclusive licensing agreement with sublicensing terms with the University of South Florida Research Foundation, Inc. pursuant to which our company has been granted a royalty-bearing worldwide exclusive license to certain patented inventions, as more particularly described in the License Agreement, as follows:

| · |

Patent(s)/patent application(s) identified in the agreement, namely, US Provisional Patent Application for Electrochemical Based Solar Cells with Energy Storage Capacity. | |

|

|

· |

Any and all United States and foreign patent applications claiming priority to any of the patent(s) and patent application(s). |

|

|

· |

Any and all patents issuing from the patent applications, including, but not limited to, letters patents, patents of addition, reissues, examinations, extensions, restorations and supplementary protection certificates. |

|

|

· |

Our company may also sublicense the licensed patents to third parties upon approval from South Florida Research, subject to the terms and conditions of the license agreement. The agreement was signed by both parties as of January 23, 2014. |

|

|

· |

Our company has agreed that the first commercial sale of products to the retail customer shall occur on or before March 31, 2019 or South Florida Research shall have the right to terminate the license agreement. Our company is also required to meet certain milestones as set out in the agreement and will notify South Florida Research when each milestone is met. |

As payment under the license agreement, our company has agreed to pay South Florida Research a license issue fee of $3,000 and as further consideration our company has issued 300,000 shares as part of the signed agreement but still has a license issue fee of $3,000 to pay to South Florida Research. Our company will also pay royalties as earned to South Florida Research calculated based on 4% of net sales for licensed product and processes, as more particularly described in the license agreement.

Our company will be obligated to provide annual minimum royalty payments to be paid in advance on a quarterly basis for each year in which the license agreement is in effect. Such payments to be advanced on a quarterly basis starting on December 31, 2018, and then each following quarters of March 31, June 30 and September 30.

Our company purchased 729 KW of solar panels but has not paid or issued shares on these panels as of yet. Money owing on these panels will be issued to the seller in the form of shares for purchase.

| 9 |

Products

The product markets we are focusing on initially are:

| 1) | The Electric Car market - with our energy storage device surpassing lithium in performance during testing, we expect that this market will continue to be a major emphasis for the company. | |

| 2) | The smart phone market - is a very large churning market with a real opportunity for our Energy Storage Device - faster charging, longer lasting energy storage in smart phones will be widely accepted by a demanding consumer. | |

| 3) | Grid Stabilization - the ability to store energy off peak and return to the grid during peak hours is a revenue stream we are pursuing. |

Market, Customers and Distribution Methods

On the Energy Storage Device our market opportunities will be in the following market areas initially:

| 1) | Grid Stabilization - the ability to store energy off the grid during non peak hours and return during peak hours is a business model we are pursuing. | |

| 2) | The Electric Car - powering the electric car with a faster charging more reliable energy storage device. | |

| 3) | Smart Phone - Energy Storage Devices - using fast charging longer lasting energy storage. | |

| 4) | Solar - to Energy Storage - off grid |

Our market opportunities will be in the following areas and are a combination of solar opportunities represented through our patents working in conjunction with our Energy Storage Device. :

| · |

Military - Cost-effective, energy security, fixed or rapid deployment. | |

|

|

· |

Industrial - Increased revenue dollars per acre on new and existing solar parks with lowest-cost above or below ground energy storage. |

|

|

· |

Commercial - The vertical appliance integration maximizes solar exposure and return on investment on cluttered rooftops. |

|

|

· |

Residential - Dramatically enhancing the aesthetic appeal of conventional solar thereby generating greater home owner association acceptance. Enabling the ability to automatically buy electricity at night when it is cheap and use it during the day when it is expensive. Replace gas-fired backup generators with entire house or dedicated circuit protection. |

|

|

· |

Electronic Device (laptop, smartphone, LED lighting, etc.) - Seamless outdoor lifestyle integration, next generation aesthetics. Power for use in backyard sheds. |

Our primary operating structure anticipates both demand fulfillment and demand generation.

| · |

Demand Fulfillment - Inbound logistics include call-off to suppliers, materials handling, warehousing and inventory control. Operations include conversion, assembly, packaging and maintenance. Outbound logistics include warehousing, order processing, picking, shipment and delivery. | |

|

|

· |

Demand Generation - Marketing and sales includes channels to market, product, pricing, advertising and promotion, distribution, customer value, cost to consumer, convenience, communication and sales force effectiveness. Service includes installation, repair and training. |

We also provide the following support activities:

| · | Procurement includes purchasing raw material, supplies, fixed assets. | |

| · | Technological development includes process design, product design and research and development. | |

| · | Human Resources includes recruiting, hiring, training, developing and compensating all personnel. | |

| · | Infrastructure includes general management, finance, accounting and IT. |

| 10 |

Our target segments are as follows:

Renewable developers and owners with an estimated target market of $100,000,000,000:

| · | Ramp control | |

| · | Curtailment mitigation | |

| · | Firming/shaping | |

| · | Interconnection compliance | |

| · | Grid services |

Transmission and distribution providers with an estimated target market of $2,000,000,000,000:

| · | Transmission and distribution deferral | |

| · | Voltage support | |

| · | Power quality | |

| · | Grid reliability enhancement |

Ancillary service providers with an estimated target market of $9,000,000,000:

| · | Frequency regulation | |

| · | Voltage regulation | |

| · | Response services |

End users with an estimated target market of $500,000,000,000:

| · | Arbitrage | |

| · | Power reliability | |

| · | Power quality | |

| · | LED lighting integration |

Homeland Security & Defense with an estimated target market of $25,000,000,000:

| · | Off-grid | |

| · | Mission critical support | |

| · | Diesel gen set optimization |

Bottom of the Pyramid with an estimated target market of $60,000,000,000:

| · | Off-grid villages | |

| · | Gen Set Optimization | |

| · | Micro-Franchise charging |

| 11 |

Our paths to market include, but are not limited to:

| · | Global Electric Utilities - Existing boots-on-the-ground install network; flagship branded or private-label solution provider. | |

| · | Department of Defense and Homeland Security - Off-grid/mission critical. | |

| · | Renewable Developers - New and existing installations, utility customers, home/ business owners. | |

| · | Humanitarian Aid - Existing distribution network to access the 1.6 billion people living without electricity. |

To date, we have worked towards technology optimization in the areas of energy density, conversion efficiency and storage time; pilot demonstration development relating to aesthetic solar inks and underground energy storage; developing a multi-generation technology/product roadmap that include macro and micro lifestyle integration options; business development relating to our recent public listing, manufacturing and product distribution options; legal support including IP portfolio expansion, freedom-to-operate navigation.

Competition

The alternative energy industry is highly competitive. Numerous entities in the United States., Canada and around the world compete with our efforts to provide energy.

Many of our competitors have substantially greater capital resources and more experience that we do. These companies have greater financial, technical, research, marketing, sales, distribution, service and other resources than us. Moreover, they may offer broader product lines, services and have greater name recognition than we do, and may offer discounts as a competitive tactic.

In addition, rapidly changing technology, evolving industry standards and changing customer needs require that we enhance our products, develop new products and services that meet our customers' changing needs and market our products and services to respond to emerging industry standards in a timely and cost effective manner. There can be no assurance that we will be successful in developing new products and services, enhancing existing products and services or whether such new or enhanced products and services will gain market acceptance.

Acquisitions

Our company has set a course to acquire companies with strong balance sheets to set our company on a firm foundation for future growth while we develop our technology forward.

Some of these acquisitions contemplated could have an associated market risk. There is no assurance that the company plans to acquire specifically the types of revenue producing companies desired will be achieved. The company believes that this course of action will make our company more appealing for future investment.

Compliance with Government Regulation

There are no government regulations, which apply specifically to our appliance and to which we have to comply. Sunvault subsidiaries - Cutting Edge Tire Recycling deals withAlberta Environment, Alberta Labour Standards, Workman Compensation Board, Occupational Health & Safety Act, Fire Marshall Standards, County of Ponoka bylaws, Alberta Recycling Management Authority, AB Transport, Aboriginal Affairs & Northern Development Canada, and Parkland County bylaws.

Subsidiaries

Our subsidiaries consist of Werkman Transport Inc. (wholly-owned) and 1454004 Alberta Ltd. (wholly-owned), including 1454004 Alberta Ltd.'s wholly-owned subsidiaries, CleanGen Power Corp., and CleanGen Inc., including CleanGen Inc.'s wholly-owned subsidiaries, CleanGen Aboriginal HR Services Ltd and 1098541 Alberta Ltd. (which is the general partner for CuttingEdge Tire Recycling Limited Partnership), and its 75.5% owned subsidiary Coole Immersive Inc. The Company plans to close CleanGen Power Corp and CleanGen Inc. this upcoming calendar year. The companies are now considered redundant. The company does plan to reopen landfill operations in a different location - but will utilize incubation company Aboriginal Power Corp for this purpose.

| 12 |

CleanGen Inc. is a 100% solely owed group of companies acquired by our company and encompasses CleanGen Inc., CleanGen Power Corp, Cutting Edge Tire Recycling LP. Coole Immersive, and CleanGen Aboriginal HR Services. The group of companies were acquired to 100% ownership through three separate acquisitions.

| 1. | The acquisition of 1454004 Alberta Ltd which owned 100% of CleanGen Power Corp and 50% of CleanGen Inc. group of companies. In this transaction we issued 19,500,000 shares of our common stock at market on February 14, 2014. | |

| 2. | The issuance and conversion of preferred shares to common shares to acquire an additional 6% of CleanGen Inc. moving our company into a control position of 56%. This was completed by the vend in of $900,000 worth of solar panels of which $525,000 was converted to preferred shares by subscription agreement and then to common shares. This left $375,000 still owing to our company for these panels. | |

| 3. | Our company then acquired the remaining 44% of CleanGen for $2,000,000 and an issue of 8,000,000 shares at a deemed value of $0.25 per share. A treasury order was issued on June 10, 2014 to complete the transaction and shares were held until the final agreement was signed on July 15, 2014. |

On April 1, 2014, we acquired 100% of Eco-West Transport through the issuance of 3,333,334 shares of our common stock at $0.15 per share. This agreement was rescinded by agreement by all parties on October 27, 2014 after receiving a collection of conditions surfaced that within the context of the agreement did not match the original agreement. All parties rescinded and the Eco-West company purchase was reversed.

On April 11, 2014, we acquired the assets of 1305140 Alberta Ltd., doing business as "Werkman Transport". The purchase price was CAN$3,000,000. This asset purchase was completed through the issuance of our common shares. On April 11, 2014, we issued 5,000,000 common shares of our company with a deemed value of CAN$0.20 for aggregate consideration of CAN$1,000,000. Pursuant to the agreement, our company created a new, wholly-owned subsidiary, named Werkman Transport Inc., under which the purchased assets and assumed liabilities of 1301540 Alberta were transferred upon receipt by 1301540 Alberta of the 5,000,000 shares of common stock of our company.

Subsequently on September 29, 2014, we issued a second tranche of 4,000,000 common shares of our company with a deemed value of CAN$0.30 cents as payment of CAN$1,200,000 towards the purchase price and leaving a balance owing by our company of CAN$800,000 worth of common shares of our common stock.

On July 15, 2014, we entered into an agreement to acquire the remaining 44% (valued at CAN$2,000,000) of CleanGen and the associated companies of CleanGen Power Corp, CleanGen Inc., Cutting Edge Tire Recycling LP, Coole Immersive and CleanGen Aboriginal HR Services through the acquisition of the CleanGen shares by agreement with the Elizabeth Metis Settlement, and the Kanata Metis Cultural Enterprises Ltd. Our company's board of directors approved the transaction by board meeting held on July 24, 2014. Our company issued shares of 8,000,000 shares of our common stock with a deemed value of $0.25 per share. Our company now owns 100% of the above aforementioned companies.

Bankruptcy or Similar Proceedings

We have not been subject to any bankruptcy, receivership or similar proceeding.

Employees

We have developed operations through Cutting Edge Tire Recycling and our head office is in Edmonton Alberta.( Suite 200 - 10703 - 181 Street NW Edmonton, Alberta, T5S 1N3 The Company is no longer a development stage company. Gary Monaghan, our chief executive officer and director currently devotes 40 hours per week to company matters. Effective January 15, 2014, a management contract was signed for Gary Monaghan, our chief executive officer, and a consulting contract was signed for Franzi Tschurtschenthaler, as chief technical officer. On Dec 2, 2014 - Mr. Tschurtschenthaler withdrew his contract due to conflicts with his workload at the University of British Columbia Unpaid fees to Mr. Monaghan have been accrued. The company has approximately 40 employees between Sunvault Corporate and Operations of Cutting Edge Tire and our Edmonton head office.

| 13 |

Emerging Growth Company Status

We are an "emerging growth company," as defined in the JOBS Act, and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We have not made a decision whether to take advantage of any or all of these exemptions. If we do take advantage of any of these exemptions, we do not know if some investors will find our common stock less attractive as a result. The result may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an "emerging growth company" can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an "emerging growth company" can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act.

We could remain an "emerging growth company" for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

In addition, Section 103 of the JOBS Act provides that an emerging growth company is not required to comply with the requirements of Sarbanes-Oxley Section 404(b). This exemption is available to us as well as a smaller reporting company.

As above, on January 7, 2014, our company entered into a recapitalization agreement with its largest shareholder group Millennium Trends International Inc. and West Point International Inc., who negotiated the transaction with our former chief executive officer and director, John Crawford, while he was still in office. This transaction gave the direction to return 35 million common shares of our company to treasury. The shares returned under the agreement were owned by Millennium Trends International Inc. and West Point International Inc. both of which are Bahamian Companies.

Effective February 19, 2014, we entered into a share purchase agreement, with Mr. Klyne and 1454004 Alberta Ltd., an Alberta, Canada Corporation. Mr. Klyne is the sole shareholder of 1454004 Alberta. Pursuant to the agreement, 100% of the issued and outstanding common shares of 1454004 Alberta were acquired from Mr. Klyne for 19,500,000 common shares of our common stock. The share purchase agreement was approved by a meeting of the board of directors on March 1, 2014. As a result, 1454004 Alberta Ltd. became our wholly-owned subsidiary. 1454004 Alberta holds 100% of the issued and outstanding shares of CleanGen Power Corp. and 50% of the issued and outstanding shares of CleanGen Inc., an Alberta, Canada Corporation that operates CuttingEdge Tire Recycling LP.

Effective March 1, 2014, we entered into a collaborative agreement with Massachusetts Institute of Technology, wherein they agreed to conduct a research program on behalf of our company for our Sunvault 3D PV (Photovoltaics) appliance. Our company had payment terms within the agreement of $42,500 at signing and $42,500 effective May 1, 2014. On April 29, 2014, we received a termination letter from the Massachusetts Institute of Technology, due to Professor Jeffrey Grossman having conflicting commitments. Our company moved on to an agreement with the University of British Columbia working with our chief operating officer, Franzi Tschurtschenthaler and Professor John Madden. On Dec 2, 2014 Mr. Tschurtschenthaler withdrew his contract due to conflicts with his workload at the University of British Columbia.

| 14 |

On February 20, 2014, Premier Global through a bill of sale agreement agreed to transfer 433KW of solar panels to our company.

Effective March 5, 2014, we transferred 900 KW panels (valued CAN$900,000 at $1,000 per KW) to CleanGen in exchange for two items; (1) our purchase of 21,000 preferred shares of CleanGen for CAN$525,000. The shortfall from the 729 solar panels now owned by our company was made up from 171 of the 433KW of panels received from Premier Global. The remaining 262KW of panels are part of a collateral agreement between our former chief executive officer and director, John Crawford, and an investment he made into our company through Westpoint International. Mr. Crawford has ownership of 262KW; and (2) CleanGen Inc. owes our company $375,000. After these transactions, our company does not have any panels remaining. Our company was issued 21,000 preferred shares from CleanGen on March 20, 2014. At this date our company moved into a position of control of CleanGen with 51% of the voting shares.

On March 14, 2014, our company, through our subsidiary, purchased land to increase the size of the site of CuttingEdge Tire Recycling to 30 acres from 12 acres. Subsequent to the purchase, we constructed a building with dimensions of 68'L x 40'Wx20"H to house the new mulching plant for our company.

On April 1, 2014, we acquired 100% of Eco-West Transport through the issue of 3,333,334 shares at $0.15 per share. This was approved by a meeting of the board on March 29, 2014. This agreement was rescinded by agreement by all parties on October 27, 2014 after receiving a collection of information and conditions surfaced that within the context of the agreement did not match the original agreement. All parties rescinded and the purchase of Eco-West Transport was reversed. There may be a move in the future to acquire some assets that exists at Eco-West Transport for specified secured debt. We have the intention to acquire specific assets once secured liabilities are clearly defined.

On April 11, 2014, we acquired the assets of 1305140 Alberta Ltd., doing business as "Werkman Transport". The purchase price was CAN$3,000,000. This asset purchase was completed through the issuance of our common shares. On April 11, 2014, we issued 5,000,000 common shares of our company with a deemed value of CAN$0.20 per share for aggregate consideration of CAN$1,000,000. 1301540 Alberta is a transportation company operating under the name of Werkman Transport Inc. Together with the latest environmental technology and equipment, Werkman Transport provides customers the best on site delivery services throughout Western Canada with a fleet of 53' walking trailers.

On October 10, 2014, we issued a second tranche of 4,000,000 common shares of our company with a deemed value of CAN$0.30 as payment of CAN$1,200,000 towards the purchase price and leaving a balance owing by our company of CAN$800,000 worth of common shares of our common stock.

On April 24, 2014, we entered into a Services and Commission Agreement with Aboriginal Financial Services Corporation ("AFSC") pursuant to which AFSC will provide our company with knowledge regarding various Aboriginal peoples, groups, organizations and First Nations, Metis and Inuit communities ("Aboriginal Stakeholders") and their business practices to assist our company in identifying utility resource development and associated services to assist our company with contractual arrangements for the development of resource opportunities on Aboriginal lands.

| 15 |

Under the terms of the agreement our company agreed to pay AFSC a one-time CAN$3,000 retainer upon execution of the agreement and reimburse AFSC on a monthly basis for pre-approved out-of-pocket expenses. Our company has also agreed to issue the following shares based on various target contracts, as more particularly described in the agreement:

| 1. | 500,000 shares of our common stock at the then prevailing market rate for any and all target contracts having a total capital investment value of up to CAN$4,999,999 issuable as of the date of signing of target contracts with Aboriginal Stakeholders. | |

| 2. | An additional 500,000 shares of our common stock at the then prevailing market rate will be deemed earned and issuable as of the date of completion of the target contracts. | |

| 3. | A further 500,000 shares of our common stock at the prevailing market rate for any and all target contracts having a cumulative total capital investment of CAN$5,000,000 or more upon completion of the target contracts. Such shares will be deemed earned and issuable upon the target contracts being completed. |

Our company also agreed to pay AFSC a commission for any and all third party financing introduced to our company by AFSC as follows:

| 1. | 10% of the first CAN$1 million, plus; | |

| 2. | 8% of the second CAN$1 million, plus; | |

| 3. | 6% of the third CAN$1 million, plus; | |

| 4. | 4% of the fourth CAN$1 million, plus | |

| 5. | 2% of everything above CAN$4 million. |

The agreement may be terminated by either party with 90 days written notice.

On September 14, 2014, we signed an addendum to the agreement for additional consideration for AFSC's performance of services rendered in identifying and introducing other business opportunities to our company. As consideration under this addendum we issued 500,000 restricted shares of our common stock to AFSC at a deemed price of $0.30 per share.

On April 24, 2014, we announced that our company had reached an agreement with BCI Renewables to acquire 100% of an assignment and amendatory agreement and gain a 100% interest in an affiliate of BCI Renewables, a special purpose vehicle that owns the Gregos Peloponnisoy Solar Park. The purchase price relating to the 100% equity stake in the special purpose vehicle was approximately 4,293,000 Euros ($5,921,787) less assumed project financing debt and subject to other adjustments.

Our company had previously signed an agreement for an 80% interest in two solar parks, but through a diligence process has determined to move to a 100% interest in one solar park rather than an 80% interest in two solar parks.

The transaction was subject to a successful filing of an S-1 Registration Statement with the regulators so the necessary shares to be issued to the sellers are registered and fulfillment of the acquisition date requirements within the agreement could be achieved. The shares registered under the S-1 were to be done at $0.60 per share. As of the date of this Annual Report the filing an S-1 has not been able to be successfully filed so the acquisition has not proceeded forward at this time. Our company required audits, which have been complicated, to be completed. This has halted our company's ability to fully fulfill the condition to close the agreement and complete through the filing of the S-1 with the regulatory authority. There has been little contact with the vendor and our company's inability to conclude this transaction could lead to a potential disagreement with the parties that could result in some form of legal resolve. At this point our company has not received any form of notice and it is our plan that once our company can resume proper reporting status, the agreement can be revisited. There is a general possibility that the vendor may have moved on to an alternative purchase with a different party.

| 16 |

On July 15, 2014, we entered into an agreement to acquire the remaining 44% (valued at CAN$2,000,000) of CleanGen and the associated companies of CleanGen Power Corp, CleanGen Inc., Cutting Edge Tire Recycling LP, Coole Immersive and CleanGen Aboriginal HR Services through the acquisition of the CleanGen shares by agreement with the Elizabeth Metis Settlement, and the Kanata Metis Cultural Enterprises Ltd. Our company's board of directors approved the transaction by board meeting held on July 24, 2014. Our company issued 8,000,000 shares of our common stock with a deemed value of $0.25 per share. Our company now owns 100% of the above aforementioned companies.

On July 25, 2014, we entered into equipment purchase agreements with Fergus Edward Ismond and Steven Mark Hoof, wherein we agreed to purchase trailer units, of which Mr. Ismond and Mr. Hoof are 50% owners. As consideration for the purchase of the trailer units, we agreed to issue to Mr. Ismond and Mr. Hoof $125,000 each by way of the issuance of shares of an aggregate of 1,400,000 shares our common stock at a deemed price of $0.25 per share.

On July 29, 2014, we entered into an equipment purchase agreement with Mr. Ismond wherein we agreed to purchase an oil service truck. As consideration for the purchase of the oil service truck, we have agreed to issue to Mr. Ismond $100,000, by way of the issuance of shares of our common stock at a deemed price of $0.25 per share.

Pursuant to the equipment purchase agreements, we issued an aggregate of 1,400,000 shares of our common stock.

On August 1, 2014, we entered into business development relationship with Aboriginal Power Corporation to act in the area of business development for our company specifically when it comes to Aboriginal relationships and business opportunities. It has been agreed that Aboriginal Power Corporation will act as an incubation company for opportunities that can be developed into a state of readiness for Sunvault to accept into our company. We have the exclusive right to acquire Aboriginal Power Corporation and will proceed with a planned acquisition of Aboriginal Power Corporation through a normal definitive agreement and subject to approval by our company's board of directors. Our company signed a binding letter of intent on August 5, 2014 to establish a price agreeable between both parties before final definitive agreement.

Our company has set up a preferred share arrangement whereby finder's fees can be issued at a rate up to 15%. If financing is consummated, then the finder shall be entitled to a cash fee of 15% of the funds received pursuant to the financing. This fee will be paid through the issue of securities to a formula based on 15% of the cash value to be determined or 15% of the securities issued to realize the cash value. Securities to be issued will be preferred shares with a 5-1 voting privilege in lieu of the previously approved share issuances for commissions on asset and share purchases. These shares would be convertible to common shares at any time, however, once converted, would have normal common share voting privileges. This arrangement was approved by our board of directors at meetings held on March 29, 2014 and July 24, 2014.

On August 7, 2014, we announced that Aboriginal Power Corporation created a limited partnership with Northern Lights Energy and Power Ltd., named Northern Lights Aboriginal Power Corp LP.

Under the agreement, Aboriginal Power Corporation will own 51% of the limited partnership, while Northern Lights Energy and Power Ltd. will own 49% of the limited partnership.

The newly formed Northern Lights Aboriginal Power Corp LP mandate is to provide electricity and choices to Aboriginal Groups (First Nations) including businesses within their various territories across the country. This service will reduce power pricing and increase the value proposition for Aboriginal Groups (First Nations) and their business partners. Northern Lights Aboriginal Power Corp LP has expansion plans that will see it move beyond Aboriginal (First Nation's) lands to other areas such as municipal and county as well as commercial and industrial users in urban centers.

Our company is dedicated to working with First Nations. This market segment will create additional long term Partnerships for Northern Lights Aboriginal Power Corp LP and can be expanded to include modern infrastructure and services at cost effect rates for First Nations.

On October 6, 2014, our company sold nine mobile office trailers to three purchasers for an aggregate amount of CAN$270,000 or CAN$30,000 per trailer.

In December 2014, Albert Klyne flew to Kelowna to meet with Sunvault management to request to purchase the landfill site for $2,000,000. The suggested deal would have to take place over time, When questions of fiduciary duty as a director came up in reference to selling, because "he could no longer control the landlord" the conversation ended,

| 17 |

On January 1, 2015 - Lorne Mark Roseborough resigned as director of CleanGen Power Corp, On January 15, 2015, Margaret Ward resigned as Director of CleanGen Power Corp. On January 30, 2015, Albert Klyne attempted to resign as Director - but as last remaining director his resignation is invalid. Then on February 1, 2015, a suspicious fire was lit on a leased piece of equipment we were using to turn a large woodpile into approximately $300,000 worth of sawdust. We reported the incident to the RCMP. There was an accelerant used to start the fire. This is the third documented fire on the property, each time resulting in a change of managed operations. Two days later we received a threatening call to not try to process that wood pile or face similar consequences. Then approximately a week later we were asked to leave the leased area by the landlord Margaret Ward because of the fire. It is our understanding that the same cast of characters. Klyne, Ward and others are again operating as a landfill under a new name. There are a number of outstanding issues that are facing Mr. Klyne regarding the conduct we in our opinion believe he undertook. There is a suit being prepared against him and Ward for their conduct. All former management of CleanGen have been removed.The company will look to start new landfill operations in Northern Alberta.

On January 20, 2015, we entered into a Limited Partnership Agreement with Halalt Transportation General Partner Ltd., a British Columbia, Canada corporation (the "General Partner Company") and Chief James Robert Thomas, in trust for the Halalt First Nation of Chemainus, British Columbia Canada ("Halalt LP"). Under the Limited Partnership Agreement, the parties formed a limited partnership under the name of "Halalt Transportation Limited Partnership" for the purpose of providing transportation services and such other businesses as approved in accordance with the Limited Partnership Agreement, in British Columbia. The primary objective of the business is to gain income and profit based on the objectives of encouraging and promoting the participation of members of the Halalt First Nation by providing preferential employment and contracting opportunities; conducting business to reflect respect and concern for the environment and Halalt laws and culture; and to ensure the business is implemented in accordance with long-term and annual business plans, budgets and reporting approved by the board and which must contemplate a reasonable net profit to the Limited Partnership.

Interests of the partners in the Limited Partnership consist of the following classes of Units:

| (a) | GP Units - issued to the General Partner Company; and | |

| (b) | LP Units - issued to the Limited Partners. |

The Limited Partnership may issue a maximum of 100 GP Units and 900 LP Units.

The GP Units must be issued to the General Partner Company as follows:

| - | General Partner Company 1 GP Unit as $1.00 per GP Unit; |

and the LP Units must be issued to the Limited Partners as follows:

| - | Halalt LP 51 LP Units at $1.00 per LP Unit; and | |

| - | Sunvault LP 49 LP Units at $1.00 per LP Unit, |

and the General Partner Company may determine the consideration for which each LP Unit must be issued.

The LP Units carry the right to one vote for each Unit and the GP Units do not carry a right to vote, as more particularly described in the Limited Partnership Agreement.

| 18 |

The net income of the Limited Partnership in each fiscal year must be allocated as follows:

| (a) | 0.01% of the net income among the GP Units as a group pro rata among the issued GP Units; and | |

| (b) | 99.99% of the net income among the LP Units as a group, pro rata, among the issued LP Units. This 99.99% will be allocated based on the ratio of 51:49 for Halalt LP:Sunvault LP, respectively. |

Any net revenue available will be paid annually to each Limited Partner in proportion to its pro rata share of the capital of the Limited Partnership, as more particularly described in the Limited Partnership Agreement.

On January 20, 2015, we entered into a Shareholder Agreement with Halalt (Transport) GP Holdings Ltd., a British Columbia, Canada corporation ("Halalt") and the General Partner Company. Under the Shareholder Agreement, our company and Halalt will vote their shares so that the board of the General Partner is comprised of five directors, which directors will include two nominees of each of our company and Halalt and those four nominees will appoint a fifth director who will conduct the business of the General Partner Company. Our company will hold 49 Class A common voting shares and Halalt will hold 51 Class A common voting shares of the General Partner Company. These shares may not be sold, transferred or disposed of unless agreed to in writing by all of the shareholders of the General Partner Company, pursuant to the terms of the Shareholder Agreement.

In March 2015, a newly formed joint venture company, SuperVault Energy Inc., was created of which our company will be 50% owner. SuperVault has signed a license and development agreement to use certain UCLA developed patented technology for use in the area of electricity storage such as battery alternatives. Our company's solar technology chipset allows for the generation, transfer and storage of energy within the same unit. The UCLA created patented process is useable in the manufacturing of a Super - Super Capacitor that is a bolt on technology for our company's technology, as well as anywhere batteries of any type are used. The combination of these two technologies gives the ability to create, transfer and store large amounts of energy within the same unit.

With the ability to cost effectively size these units to any power size, this revolutionizes the world of energy management, generation and storage as we now see it.

This new energy storage device has a number of potential purposes, from the use by large utility operators for grid stabilization applications, right down to powering devices such as battery packs for Electric Cars and powering smart phones, which can then be fully charged to capacity within seconds to minutes. On May 27, 2015 , Sunvault terminated the agreement by letter to SuperVault and Nanotech. The agreement between the parties was to see a development plan and budget submitted within 60 days of the original executed agreement This never materialized between the parties, Sunvault technical personnel discovered our own process and announced on May 6, 2015 that it had created its own 10,000 Farad super capacitor using its own process.

REPORTS TO SECURITY HOLDERS

We are required to file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission and our filings are available to the public over the internet at the Securities and Exchange Commission's website at http://www.sec.gov. The public may read and copy any materials filed by us with the Securities and Exchange Commission at the Securities and Exchange Commission's Public Reference Room at 100 F Street N.E. Washington D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-732-0330. The SEC also maintains an Internet site that contains reports, proxy and formation statements, and other information regarding issuers that file electronically with the SEC, at http://www.sec.gov.

| 19 |

Item 1A. Risk Factors

Risk Associated with our Current Financial Resources and Capital Resources that are Available to Us

We may not have sufficient cash to meet our planned and current financial obligations and our cash requirements for the next 12 months and we are not certain that we will be able to secure the financing we need to meet those requirements. We do not have any current financing arrangements in place and if we do not obtain the necessary financing we need to satisfy our current financial requirements to execute our business plan, we may have to abandon our current business strategy sometime in 2015.

We intend to meet our ongoing cash requirements of approximately in the range of $3 million to $5 million for the next 12 months by raising the shortfall through a combination of equity financing from investors if we are able to identify other investors willing to purchase our securities or loan funds to us. We also will self-fund our company's growth to a minor degree through some of the acquisitions we have completed and will complete this upcoming year. We may not be able to secure financing from other investors who can provide additional financing to us. If financing is available, it may involve issuing securities which could be dilutive to holders of our capital stock. If we do not raise additional capital from conventional sources, such as our existing or new investors or commercial banks, it is likely that our growth will be restricted and we may be forced to scale back or curtail implementing our business plan and our business may fail.

Risks Associated with our Technology

Our technology has not been tested on the scale necessary for large customers to adopt and the willingness of renewable energy operators and other customers to use our technology and our products are uncertain.

Our renewable energy development and research activities entail risks. New designs must be fabricated, tested and licensed before they can be offered for sale in commercial markets. Our technology is still in the research and development stage and while certain testing on our technologies has been completed, further testing and experiments will be required in test facilities to bring our products to a commercial stage. Furthermore, the technology has yet to be demonstrated in existing commercial applications. Until we are able to successfully demonstrate operation of our technology in actual commercial applications, we will not be certain about the ability of the products we design, to perform as expected. In addition, there is also a risk that suitable testing facilities may not be available to us on a timely basis, which could cause development program schedule delays.

If our product designs do not perform as anticipated in commercial use, we will not realize revenues from licensing or other use of our product designs.

We serve the renewable energy market and other industries, some which are regulated. Our designs differ, and if more costly, acceptance of our designs may be hampered.

Our designs differ significantly in some aspects from other products used today. These differences will likely result in a more prolonged and extensive review by our future customers around the world that could cause development program schedule delays. Customers may be hesitant to be the first to use our designs, which has little or no history of successful commercial use. Furthermore, our research and development program schedule relies on the transferability and applicability of the operating experiences of the prior tests of our products. There is a risk that if this operating experience is found to be non-transferable, more extensive experiments will be required which could cause program schedule delays and require more research and development funding.

| 20 |

Applicable intellectual property laws may be inadequate to protect our intellectual property, which could have a material adverse effect on our business.

While we are continuing to diversify our research and development activities with associated intellectual property, our rights in our intellectual property, therefore, derive, or are affected by, intellectual property laws. If the application of these laws to our intellectual property rights proves inadequate, then we may not be able to fully avail ourselves of our intellectual property and our business model may fail or be significantly impeded.

If we are unable to obtain or maintain intellectual property rights relating to our technology, the commercial value of our technology may be adversely affected, which could in turn adversely affect our business, financial condition and results of operations.

Our success and ability to compete depends in part upon our ability to obtain protection in the United States and other countries for our designs by establishing and maintaining intellectual property rights relating to or incorporated into our products. We own a variety of patent pending applications in the United States. We have not obtained patent protection yet. We do not know how successful we would be should we choose to assert our patents against suspected infringers. Our pending and future patent applications may not be issued or approved as patents or, if issued, may not issue in a form that will be advantageous to us. Even if issued, patents may be challenged, narrowed, invalidated or circumvented, which could limit our ability to stop competitors from marketing similar products or limit the length of term of patent protection we may have for our products. Changes in either patent laws or in interpretations of patent laws in the United States and other countries may diminish the value of our intellectual property or narrow the scope of our patent protection, which could in turn adversely affect our business, financial condition and results of operations.

If we infringe or are alleged to infringe on intellectual property rights of third parties, our business, financial condition and results of operations could be adversely affected.

The industry in which we compete is characterized by rapidly changing technology, a large number of patents, and frequent claims and related litigation regarding patent and other intellectual property rights. There can be no assurance that our patents and other proprietary rights will not be challenged or alleged to infringe on others, invalidated, or circumvented; that others will not assert intellectual property rights to technologies that are relevant to us; or that our rights will give us a competitive advantage. In addition, the laws of some foreign countries may not protect our proprietary rights to the same extent as the laws of the United States.

General Business Risks and Risks Relating to our Business

We have a limited operating history and face many of the risks and difficulties frequently encountered by a development stage company.

There can be no assurance that our management will be successful in completing our business plan of selling our products or technology or implementing the corporate infrastructure to support operations at the levels called for by our business plan. We may not be able to generate sufficient revenues to meet our expenses or to achieve or maintain profitability in the future.

Although we do not consider ourselves a development sage company our development efforts have been focused primarily on the development of our relationship with the Alberta, Canada energy market and other markets for energy storage using our energy storage device , remote sensors and cell phones. Our business model is to develop or acquire existing renewable operating assets to enable a market for our products. We have limited operating history for investors to evaluate the potential of our business development. Planned principal operations have commenced, but there has been no revenue from our products to date. Our technology platforms have not reached a point where we can mass produce product based on the technology, and we will not be in a position to commercialize such products until we complete the design development, manufacturing process development and pre-market testing activities. There can be no assurance that our development and testing activities will be successful or that our proposed products will achieve market acceptance or be sold in sufficient quantities and at prices necessary to make them commercially viable.

| 21 |

Our acquisition companies of CleanGen Inc. also have competitive, regulatory and other risks associated to them that could hinder the ability to earn revenues as projected as part of our foundational revenue strategy.

Because our auditors have issued a going concern opinion, there is substantial uncertainty we will continue operations in which case you could lose your investment.