Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Goodman Networks Inc | d80136d8k.htm |

Investor Day Presentation July 14, 2015 Exhibit 99.1 |

©2015 Goodman Networks. Proprietary and Confidential

Safe Harbor Statement

2 This presentation contains “forward-looking” statements that involve risks, uncertainties and assumptions. If

the risks or uncertainties ever materialize or the assumptions prove incorrect,

our results may differ materially from those expressed or implied

by such forward-looking statements. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, any projections of financial

information; any statements about historical results that may suggest trends

for our business and results of operations; any statements of the

plans, strategies and objectives of management for future operations; any statements of expectation or belief regarding future events, market position, margins, profitability, capital

expenditures, liquidity, capital resources, potential markets or market size;

and any statements of assumptions underlying any of the

foregoing. These statements are based on estimates and information available to us at the time of this presentation and are not guarantees of future performance.

These forward-looking statements are based on certain assumptions and are

subject to risks and uncertainties, including those described in

the “Risk Factors” section in our Form 10-K and most recent Form 10-Q which are publicly filed with the Securities and Exchange Commission. You should read these filings, including the Risk

Factors set forth therein and the documents that we have filed as exhibits

thereto, completely and with the understanding that if any such

risks or uncertainties materialize or if any of the relevant assumptions prove incorrect, our actual results could differ materially from the results expressed or implied by these forward-

looking statements. Except as required by law we assume no obligation to

update these forward-looking statements publicly, or to

update the reasons why actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. |

©2015 Goodman Networks. Proprietary and Confidential

Executive Team 3 Ron Hill, President, CEO & Executive Chairman of Board • 30 years experience; with Goodman since 2008 • Previously fulfilled leadership roles in engineering, program management and marketing at AT&T, Lucent and Alcatel-Lucent • MBA from Northwestern University, Bachelor’s Degrees in Biology and Psychology Ernie Carey, COO • Over 40 years experience • Joined Goodman in 2014 from AT&T, where he retired as SVP Construction & Engineering • MBA from the University of Dallas, BBA from Texas A&M Corpus Christi Scott Willis, EVP Sales & Marketing • Nearly 30 years experience • Previously held executive sales and marketing positions at Ericsson, Nokia, Bell South and Sprint • MBA from Wake Forest University, Degree in Business and Finance from University of Oklahoma Geoff Miller, Interim CFO • 30 years of financial leadership experience • Previously served as a partner with Price Waterhouse and as CFO in various industries • Degree in accounting from the University of Maryland, Masters from the University of Baltimore. Cari Shyiak, President, Professional Services • Over 25 years of international telecom management experience • Previously worked with Alcatel-Lucent as Vice President of Services for Central and Southeastern Europe • Held a number of global leadership positions at Alcatel-Lucent and Lucent Technologies • EMBA from the Institute for Management Development in Switzerland Shakeeb Mir, SVP, Chief of Staff and Assistant General Counsel • Prior experience as M&A and capital markets attorney • BBA in Finance from Southern Methodist University and JD from Baylor University |

©2015 Goodman Networks. Proprietary and Confidential

Agenda 4 • Goodman Vision 2015 and

Beyond

Ron Hill, President, CEO & Executive Chairman

• Customer Diversification & Return to Growth

Scott Willis, EVP, Sales & Marketing

• Operational Excellence & Margin Expansion

Ernie Carey, COO

• Future of Professional

Services

Cari Shyiak, President of Professional Services

• Liquidity & Capital

Structure

Geoff Miller, Interim CFO

|

Ron Hill President, CEO & Executive Chairman |

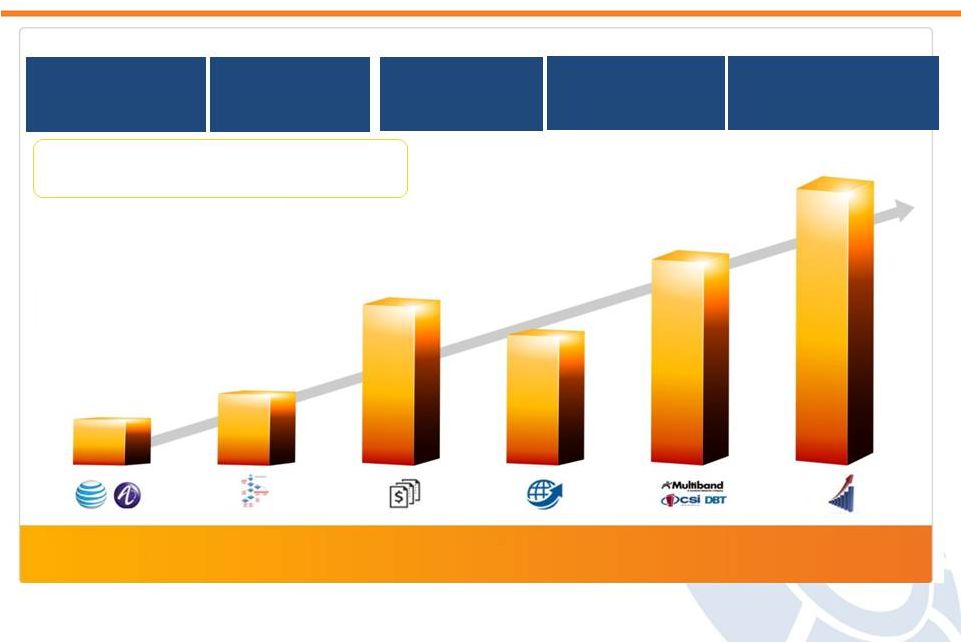

History of Growth

6 $1.4B Estimated 18-Month Contract Backlog* 3,800 Employees Including 350 Engineers and 2,400 Field Technicians* 60+ Offices Offices and Warehouses headquartered in Plano, Texas* 1.6 MILLION Over 56,000 Wireless Projects and 1.6 million CPE Jobs Annually* CERTIFIED TL 9000 V/ISO – 9001 Quality Company & NMSDC Hispanic MBW supplier and Corporate Plus Member 32.8% CAGR over the last 6-years (2009 to 2014) 2014 Macro/Micro Convergence 2009 AT&T Turf and Jupiter Programs 2010 Business Optimization 2011 $225M Capital Raise 2012 Customer Diversification 2013 Industry Diversification $1.19B $932M $609M $729M $389M $291M *As of March 31, 2015 |

Operating Segments Infrastructure Services Professional Services Field Services Site Acquisition Construction Line & Antenna Architectural & Civil Engineering 3G/4G Upgrades Capacity/Carrier Adds New Site Builds FTTCS Program Management RF Design Detail Engineering CO EF&I IP Networking Backhaul Design Integration Engineering RF Optimization DAS WiFi Small Cell Consulting & Systems Integration NOC Monitoring Staff Augmentation Technician-based Workforce Installation Maintenance Dispatch Fleet Mgmt Logistics Field Training Customer Care Tech Support Next Gen Services NextGen OSS/BSS Applications Network Virtualization Cloud Services Data Storage Hosting Services Automation & Certification Today Today Today Future Operating Segments |

8 End-to-End Solutions – Key Differentiator Goodman Networks’ end-to-end services are critical to our customers’ ability to generate

revenue and manage their customers’ experience

|

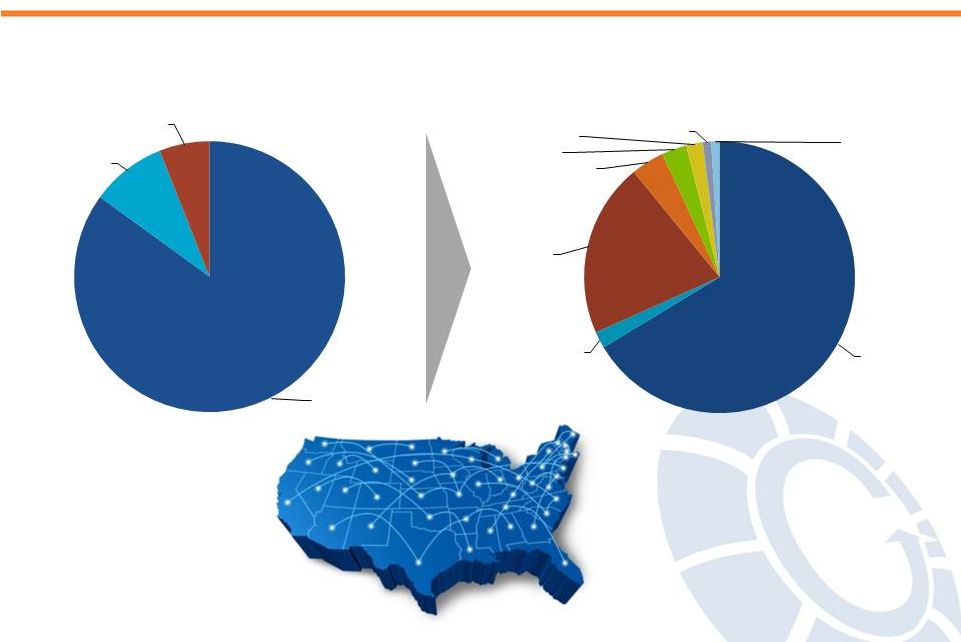

Revenue Growth Through Customer Diversification & Market Share

Gains 9

2009 Accounts Diversification

$291 Million Revenue

2014 Accounts Diversification

$1.19 Billion Revenue

AT&T 85% ALU 9% Other 6% AT&T 67% AT&T Other 2% DTV 21% Sprint 4% ALu 3% DAS 2% Strategic 1% Verizon Wireless 1% |

©2015 Goodman Networks. Proprietary and Confidential

Growth Opportunity Through Bolt-On Acquisitions

10 • In addition to organic growth from each of its operating segments, the Company

has a proven track record of growth via M&A

• Successfully integrated employees and operations of these enterprises to gain

optimal synergies:

o 2009 – ALU Outsourcing of Engineering (> 500 Engineers) o 2013 – Acquisition of CSG (300 employees) o 2013 – Acquisition of Multiband (2,500 Service Techs) • Future acquisitions anticipated to consist of market entry as well as tuck-in

acquisitions within key markets

o Target high growth complementary markets o Continue to diversify customer base o Add NextGen service offerings • Successfully implemented accretive processes and system improvements company-wide; will help enable further growth • Continual assessment of current business portfolio to focus on most profitable

growth business |

©2015 Goodman Networks. Proprietary and Confidential

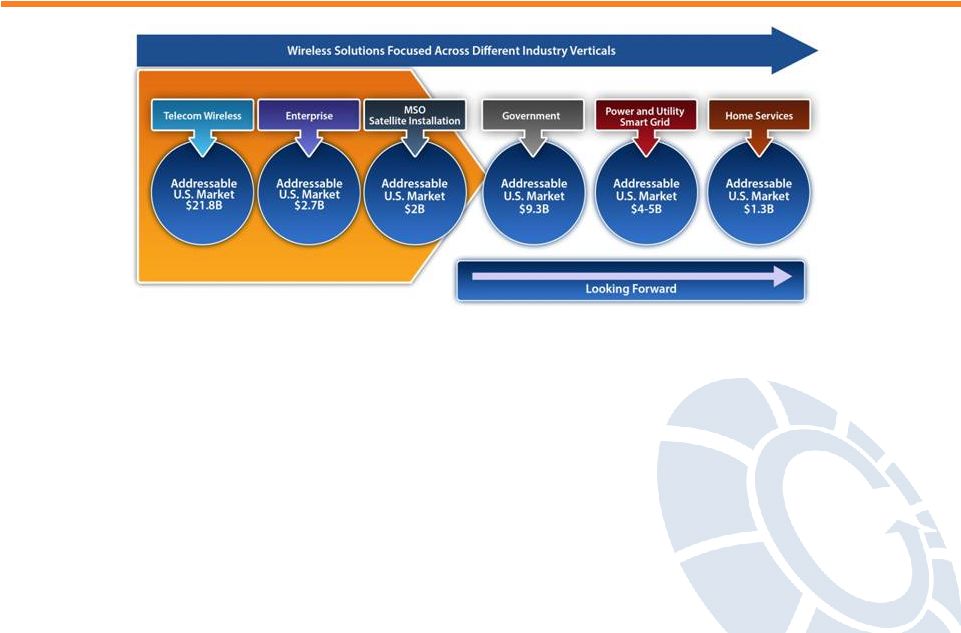

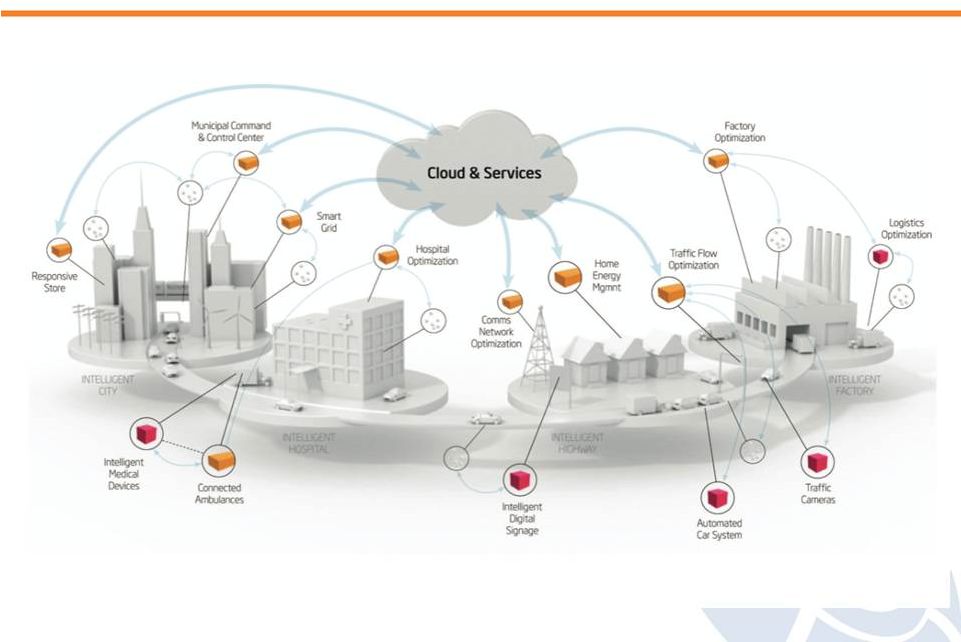

Target Market Growth Opportunities

11 • Further grow and diversify our Carrier/OEM segment with additional business from carriers

• Expand our Enterprise wireless business through organic sales growth of our DAS and Small Cell group

• Leverage Field Services technician-based workforce to meet the growing market demand for NextGen

services (across all targeted industries)

• Leverage and expand our current maintenance and operations solutions to provide compelling and

proprietary NextGen solutions • Accelerate expansion into NextGen services through the acquisition of a software company, providing solutions, such as network monitoring, network virtualization, network security, content management and

performance optimization via data analytics

|

Scott Willis EVP, Sales & Marketing |

Customer Diversification –

Leveraging Professional Services Capabilities

13 Major US Wireless Service Providers Backhaul & WiFi Providers Infrastructure / Tower Owners OEMs Carrier Eco-system (Recent Wins)

Goodman Networks Strategic Targets

Enterprise Market Experience (Recent

Wins) Meadowlands

SFO Airport World Trade Center Hudson Yards |

©2015 Goodman Networks. Proprietary and Confidential

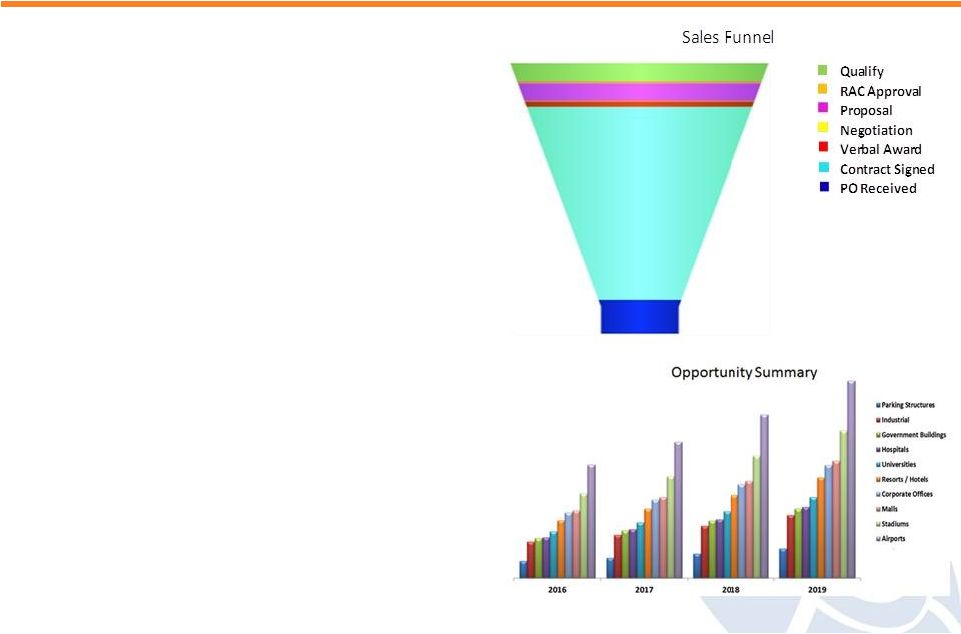

Maximize Profitability and Growth

Sales & Marketing

• Over $1B plus in new sales opportunities leads in Salesforce • Continue to grow and deepen strategic relationships with key wireless customers • Focus In-Building Wireless sales on target markets: o Target large campus, Enterprise and healthcare segments • Continue to expand and diversify sales with broadband providers including Wireless Carriers, MSO Neutral Host provider, and ISP • Focus on higher value add services, such as consulting for public safety and in-building systems with potential REIT, Enterprise and Neutral Host customers. 14 |

INTERNAL USE ONLY

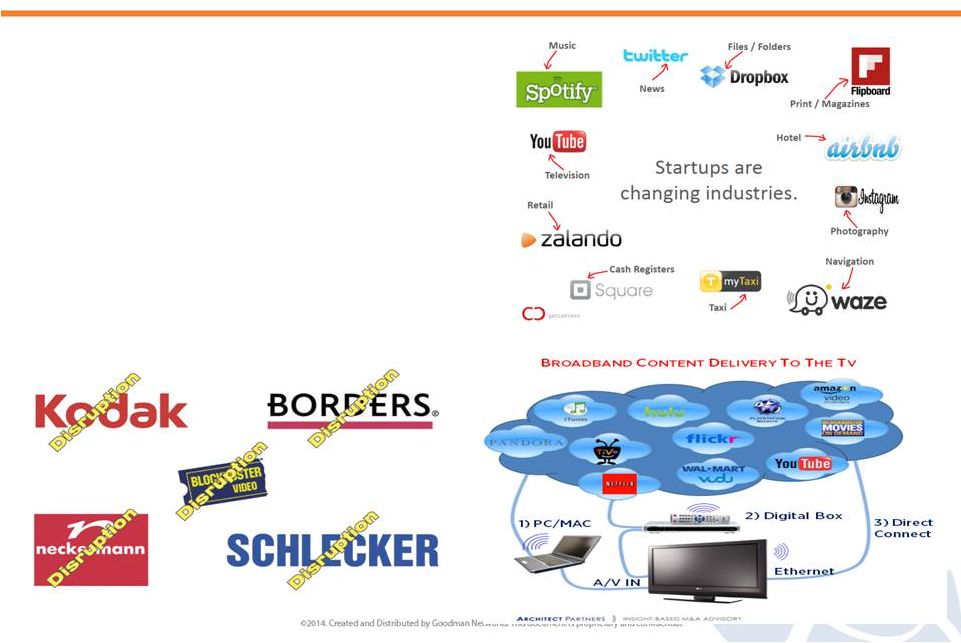

Strategic Growth Profile for Success

15 • Goodman needs to be a key disruptor in the marketplace • Investment in key strategic areas • NextGen services initiative underway • Leverage Professional Services capability • Develop adjacent and growth solutions in the portfolio |

Ernie Carey COO |

©2015 Goodman Networks. Proprietary and Confidential

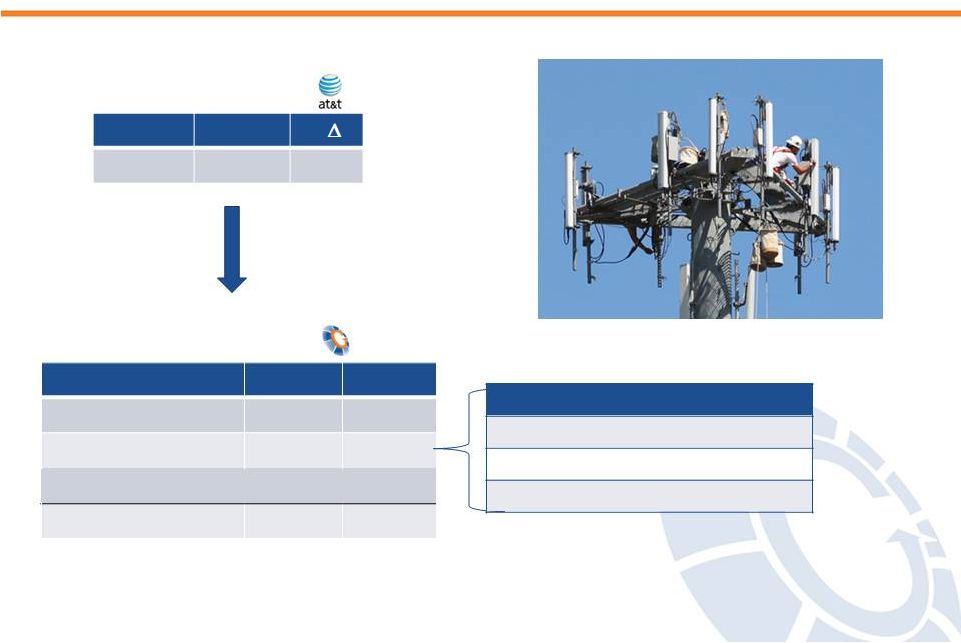

Infrastructure Services Market Trends

17 2014 2015E % $21.4B $18.0B -15% AT&T Capital Spend Program 2014 2015E LTE 1C 3200 200 LTE Carrier Adds 4800 8000* NSB 400 100 Total 8400 8300 Goodman Project Count Configuration Average Revenue Gold $82,000 Silver $58,000 Bronze $35,000 |

©2015 Goodman Networks. Proprietary and Confidential

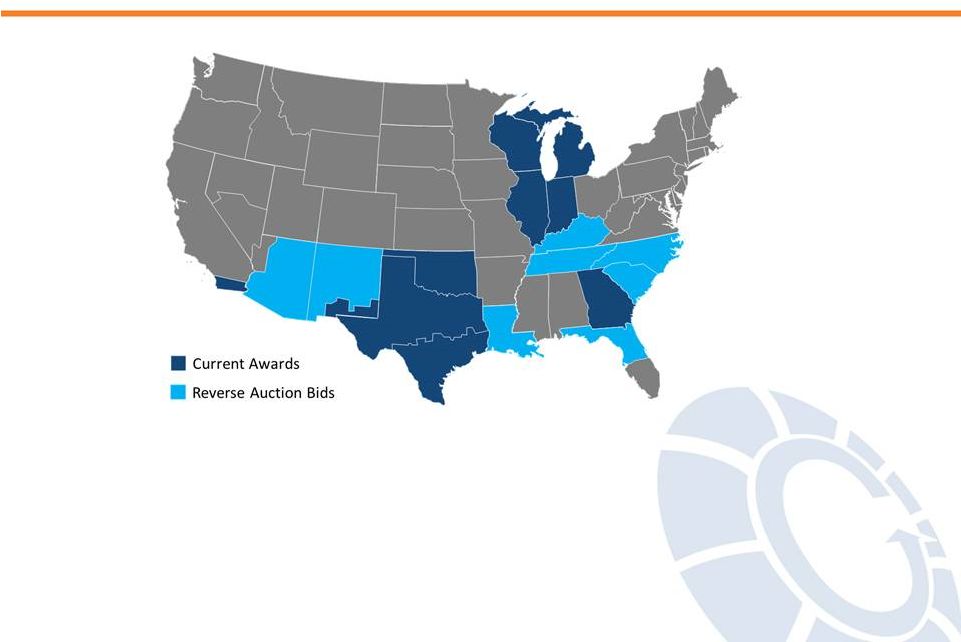

Turf Market Update and Strategy

18 • Competitive bids in recent reverse auction for new adjacent markets to leverage local support structure • Focus on operational excellence • End-to-end delivery capabilities is key differentiator – PS and IS Goodman Infrastructure Services Turf Markets |

©2015 Goodman Networks. Proprietary and Confidential

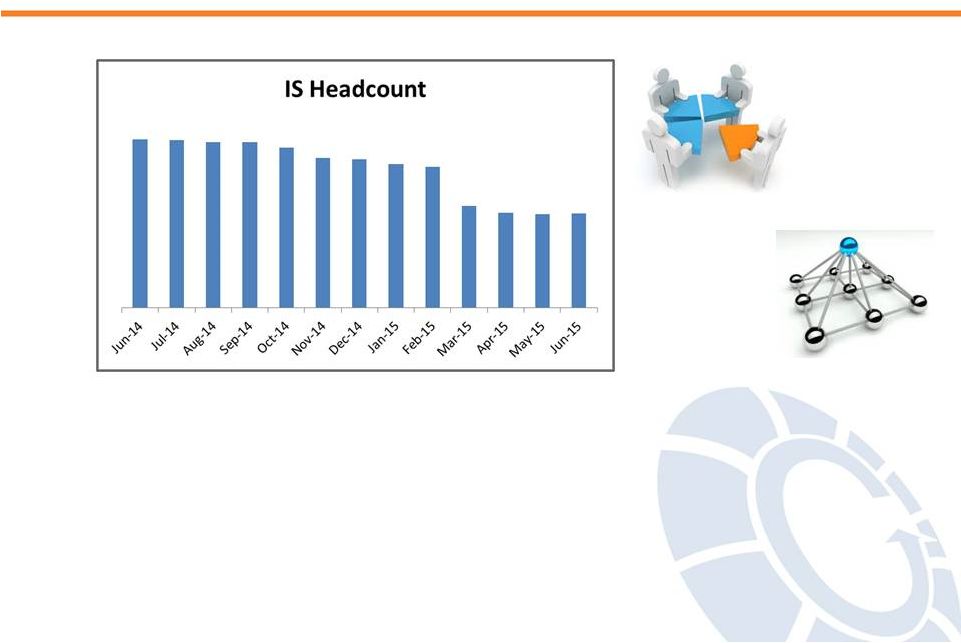

Alignment of Business to Customer Demand

19 Right-Sizing of Organization • Layers and spans-of-control • 44% Workforce reduction from June 2014 to June 2015 • 36% Reduction from end of 2014 • Small incremental reductions in Q315 |

©2015 Goodman Networks. Proprietary and Confidential

Operational Excellence Standards

20 Quality & Safety Improvement • Site visit standard protocol for construction managers • Material increase in internal audits • Strict enforcement of liquidated damages on failed internal audits • Strict enforcement of corrections driven back to the contractor Performance to Schedule • Not mutually exclusive relative to quality • Large focus on cycle time improvement – aligned with AT&T market specific targets |

©2015 Goodman Networks. Proprietary and Confidential

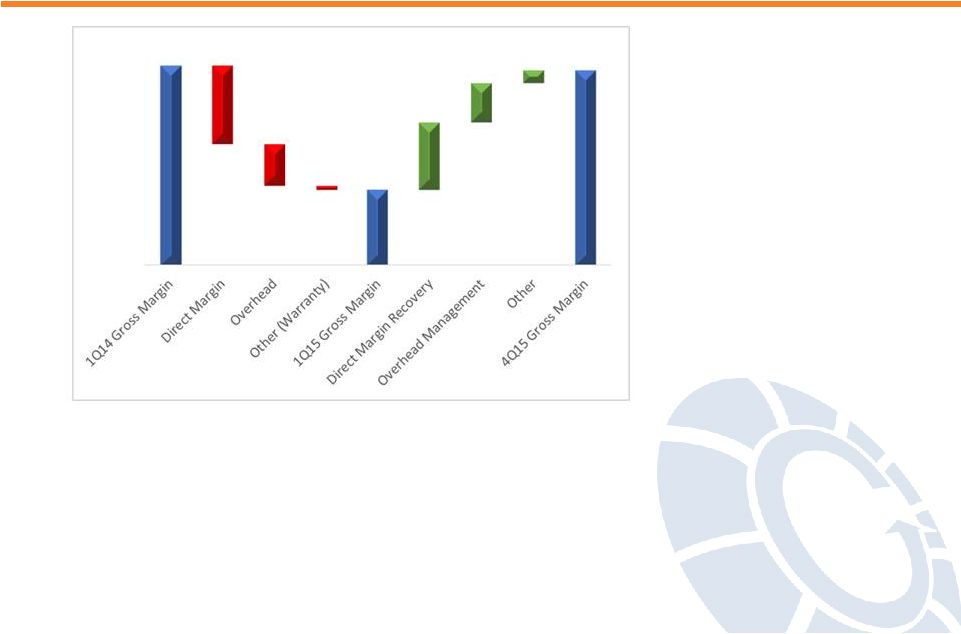

Improving Infrastructure Services Gross Margins

21 • Project mix and configuration shifts negatively impacting direct margin • Carry over erosion resulted direct margin pressure in 1Q15 • Alarm clearing & quality cleanup caused temporary direct margin pressure

• Focus on direct margin recovery in 3Q & 4Q 4Q15 Margin Recovery |

©2015 Goodman Networks. Proprietary and Confidential

Growth Opportunity –

Field Services 22 Goodman’s DIRECTV Business Goodman Field Services is the second largest DIRECTV Home Service Provider (HSP) in North America, handling around 18% of all DIRECTV’s installations, maintenance, and upgrades for residents of single family homes. Long-term contract through May 2018 ~40% of work is on highly profitable installations HSP Partner of the Year in 2014 Leading HSP performance vs. others by an increasing margin Goodman Field Services DIRECTV Footprint 2015 Focus Areas Reengineered training Enhance scorecard position & remain Partner of the Year Position for assumed DirecTV – AT&T deal closure Growth opportunities in AT&T Digital Life, DIRECTV LifeShield |

Cari Shyiak President of Professional Services |

• 15 year strategic relationship • Current stockholder of Goodman • Continue to exceed performance SLA’s and metrics • Customer Satisfaction Scorecard results up 14% • 7 of the 11 work streams renewed in Q1 2015 o Exited low margin businesses o Strategic growth through direct sales to customers • Expected revenue decline due to technology obsolescence, market conditions,

and Nokia acquisition

• Jointly pursuing new opportunities with ALU o CenturyLink – Switch conversion services o AT&T – Switch consolidation services Alcatel-Lucent Overview 24 |

• Continue to exit low margin businesses and services that not fit our strategy

• Focus front-end pre-sales process on screening for profitable business

• Focus In-Building Wireless execution on target markets with self perform resources

• Operational execution excellence through the use of more automation & tools,

reducing overhead needs

• Continue to develop high margin consulting and system integration opportunities

Improving Professional Services Gross Margins

25 4Q15 Margin Recovery |

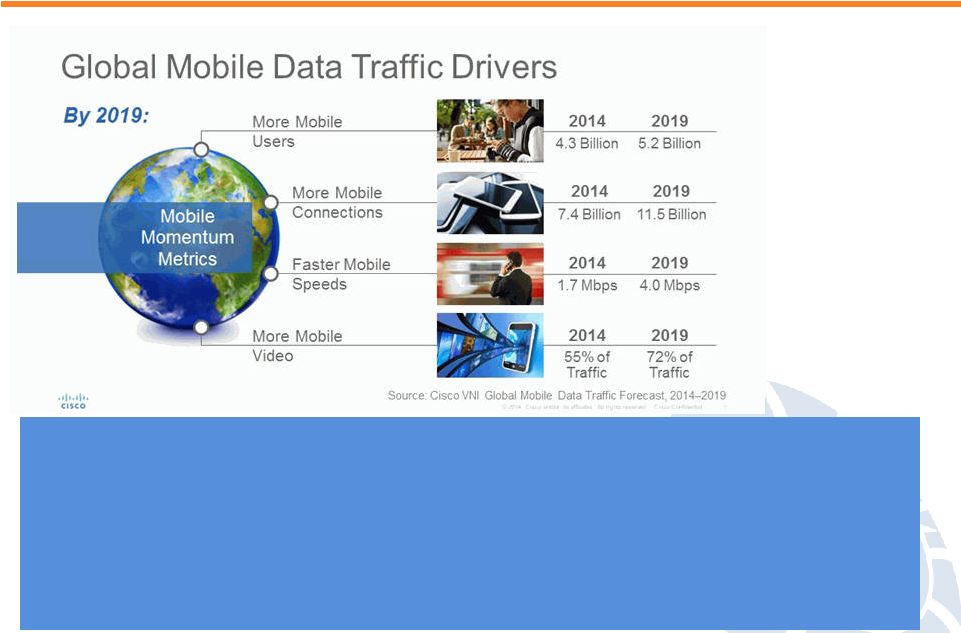

Industry Drivers and Trends

26 Trends: • Newly deployed broadband networks will continue to move toward being designed to provision bandwidth-enabling 1-gig speeds • Mobile Data moves to the Cloud • Carrier grade VoWi-Fi is introduced and >50% of mobile data is offloaded to Wi-Fi

• SDN and network virtualization introduction addresses the explosive capacity demand of mobile traffic and Internet of Everything (IoE) “Over the last eight years, mobile data traffic on our wireless network increased 100,000 percent – driven by people downloading and sharing videos” - AT&T’s Randall Stephenson quote from 2014 Annual report - |

©2015 Goodman Networks. Proprietary and Confidential

Solution Diversification Strategy

27 Vertical market expansion using existing solution portfolio, with HetNets a key component Neutral Host DAS/WiFi/uLTE Content Delivery (CDN) Internet of Things (Home Automation, Security, OTT, etc.) Network Virtualization (NFV/SDN) Managed Services, including Maintenance |

©2015 Goodman Networks. Proprietary and Confidential

Professional Services Migration Path

28 Big Data Video Mobility Predictive Analysis Spectrum Management ENABLERS uLTE Neutral Host In-Building Wireless Public Safety Connected Media Vision Home & Small Business Automation & Security RF Design Deployment Engineering IP Networking Backhaul DAS, WiFi, Small Cell Professional Consulting Managed Services FOUNDATION FUTURE Provisioning Tools Optimization Cloud Services Content Management Consulting & System Integration of Network Applications Network Virtualization OSS/BSS GPS Bandwidth |

©2015 Goodman Networks. Proprietary and Confidential

Goodman Networks -

Services’ Future Highlights

29 History of diversification and execution Already transitioning away from a pure wireless player Defining future service offerings Continued expansion into new market segments and services Reputation for consistent, high customer satisfaction and technical expertise

Experienced management team with exceptional track record

|

Geoff Miller Interim CFO |

©2015 Goodman Networks. Proprietary and Confidential

Financial Strategy

31 • Working capital management • Liquidity management • Capital expenditure management • Goodman recapitalization – monitor financial markets for opportunities to reduce interest expense • Re-evaluation of credit facility • Exit low-margin businesses • Accretive acquisitions • Accounting improvements |

©2015 Goodman Networks. Proprietary and Confidential

Liquidity Trend 32 • Active daily cash management • Debt servicing commitment • Anticipate sufficient liquidity for working capital for the next 12 months

• Anticipate slight increase in total liquidity for Q2 $ millions 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 Consolidated cash 60.4 23.9 21.7 59.4 33.8 70.7 82.2 76.7 35.2 Revolver availability 45.5 45.5 37.9 45.5 42.1 25.3 22.9 26.4 27.8 Total liquidity $105.9 $69.4 $59.6 $104.9 $75.9 $96.0 $105.1 $103.1 $63.0 Total Liquidity at Quarter End *Total liquidity is a non-GAAP financial measure that we define as our total cash on hand and availability under our credit

facility. Total liquidity is useful to investors because it

shows our access to capital on short notice. Management uses total liquidity for business forecasting and planning purposes. |

©2015 Goodman Networks. Proprietary and Confidential

SG&A and Headcount Expense Savings

33 • Further SG&A savings anticipated in Q2 results • Match workforce with project load • Almost 22% overall headcount reduction from 1Q14 to 1Q15 • Continued monitoring of SG&A and other expenses Headcount |

Q & A |