Attached files

| file | filename |

|---|---|

| 8-K - 8-K - 8point3 Energy Partners LP | d58403d8k.htm |

Exhibit 99.1

8point3 energy partners

Company Overview

July 2015

©2015 8point3 Energy Partners

Disclaimer

Cautionary

Statement Regarding Forward-Looking Statements

This presentation and the oral statements made in connection therewith contain “forward-looking

statements.” All statements, other than statements of historical fact, regarding the Partnership’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of

management are forward-looking statements. Any forward-looking statements involve risks, uncertainties and assumptions. The forward-looking statements contained herein are based on the Partnership’s management’s current expectations and

assumptions about future events and are based on currently available information as to the outcome and timing of future events. Although the Partnership believes that its plans, intentions and expectations reflected in or suggested by these

forward-looking statements are reasonable, it can give no assurance that these plans, intentions or expectations will be achieved when anticipated or at all. Actual results could differ materially from those expressed in any forward-looking

statements.

Except as otherwise required by applicable law, the Partnership disclaims any duty to update any forward-looking statements. The forward-looking

statements contained herein are expressly qualified by this cautionary notice to recipients.

Industry and Market Data

This presentation has been prepared by the Partnership and includes market and competitive position data and other statistical information from the Partnership’s own internal

estimates as well as from third-party sources, including independent industry publications, government publications or other published independent sources, including the U.S. Department of Energy, the International Energy Agency, the U.S. Energy

Information Administration, Bloomberg New Energy Finance, Renewable Energy Policy Network for the 21st Century, the Solar Energy Industries Association and Lazard Ltd. Although the Partnership believes these third-party sources are reliable as of

their respective dates, the Partnership has not independently verified the accuracy or completeness of this information.

Non-GAAP Financial Measures

This presentation includes certain non-GAAP financial measures, including EBITDA. Such non-GAAP financial measures should be considered only as supplemental to, and not as superior

to, financial measures prepared in accordance with GAAP. Please refer to the Appendix of this presentation for a reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable financial measures

prepared in accordance with GAAP.

8point3 energy partners

©2015 8point3

Energy Partners

2

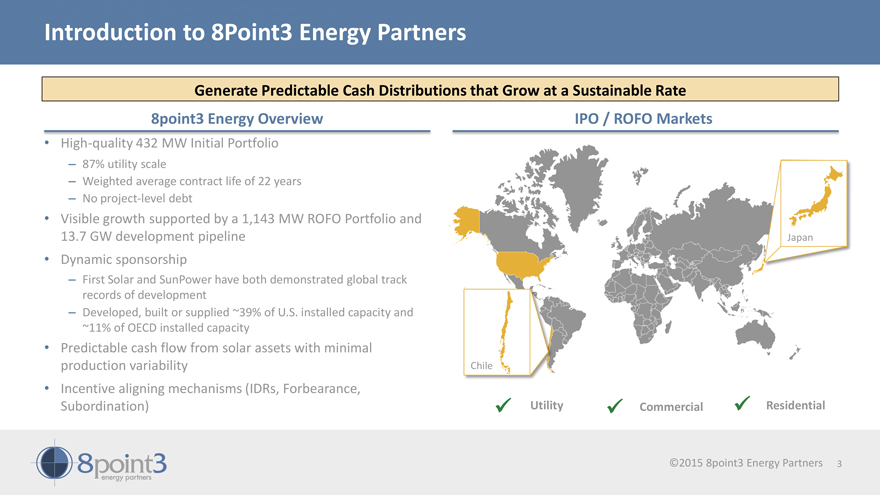

Introduction to 8Point3 Energy Partners

Generate Predictable Cash Distributions that Grow at a Sustainable Rate

8point3 Energy

Overview

High-quality 432 MW Initial Portfolio

– 87% utility scale

– Weighted average contract life of 22 years

– No project-level

debt

Visible growth supported by a 1,143 MW ROFO Portfolio and

13.7 GW

development pipeline

Dynamic sponsorship

– First Solar and SunPower have

both demonstrated global track records of development

– Developed, built or supplied

~39% of U.S. installed capacity and

~11% of OECD installed capacity

Predictable cash flow from solar assets with minimal production variability

Incentive aligning

mechanisms (IDRs, Forbearance,

Subordination)

IPO / ROFO Markets

Japan

Chile

Utility Commercial Residential

8point3 energy partners ©2015 8point3 Energy Partners 3

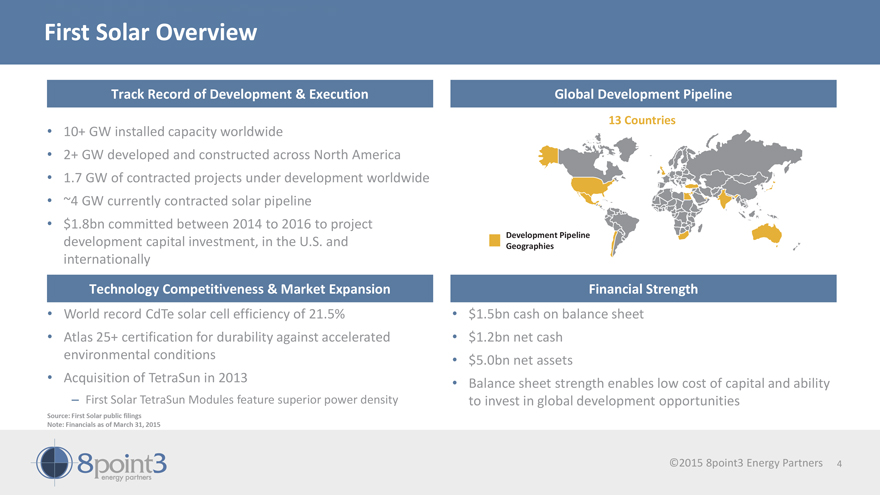

First Solar Overview

Track Record of Development & Execution

10+ GW installed capacity

worldwide

2+ GW developed and constructed across North America

1.7 GW of

contracted projects under development worldwide

~4 GW currently contracted solar pipeline

$1.8bn committed between 2014 to 2016 to project development capital investment, in the U.S. and internationally

Global Development Pipeline

13 Countries

Development Pipeline

Geographies

Technology Competitiveness & Market Expansion

World record CdTe solar cell efficiency of

21.5%

Atlas 25+ certification for durability against accelerated environmental conditions

Acquisition of TetraSun in 2013

– First Solar TetraSun Modules feature superior power

density

Financial Strength

$1.5bn cash on balance sheet

$1.2bn net cash

$5.0bn net assets

Balance sheet strength enables low cost of capital and ability to invest in global development opportunities

Source: First Solar public filings

Note: Financials as of March 31, 2015

8point3 energy partners ©2015 8point3 Energy Partners 4

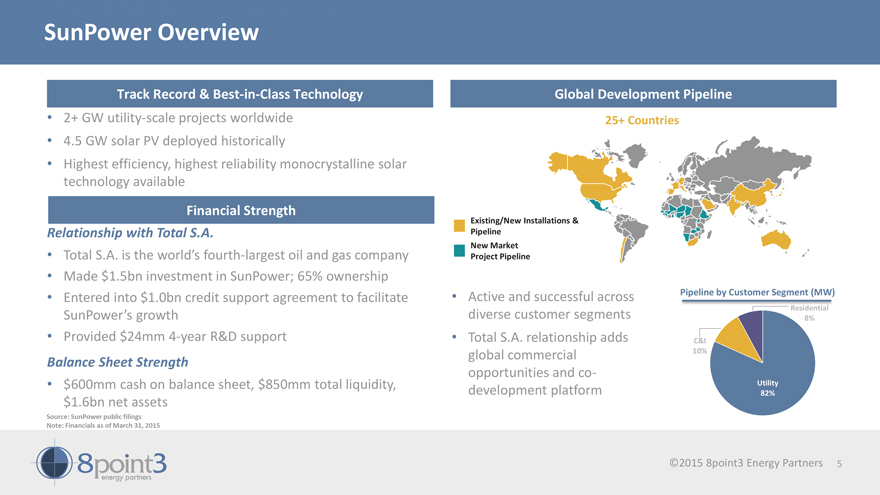

SunPower Overview

Track

Record & Best-in-Class Technology

2+ GW utility-scale projects worldwide

4.5 GW solar PV deployed historically

Highest efficiency, highest reliability monocrystalline

solar technology available

Financial Strength

Relationship with Total S.A.

Total S.A. is the world’s fourth-largest oil and gas company

Made $1.5bn

investment in SunPower; 65% ownership

Entered into $1.0bn credit support agreement to facilitate SunPower’s growth

Provided $24mm 4-year R&D support

Balance Sheet Strength

$600mm cash on balance sheet, $850mm total liquidity, $1.6bn net assets

Source: SunPower

public filings Note: Financials as of March 31, 2015

Global Development Pipeline

25+ Countries

Existing/New Installations & Pipeline

New Market

Project Pipeline

Active and successful across diverse customer segments

Total S.A. relationship adds global

commercial opportunities and co-development platform

Pipeline by Customer Segment (MW)

Residential

8%

C&I

10%

Utility

82%

8point3 energy partners ©2015 8point3 Energy Partners 5

Strategic Rationale | Why 8point3 Energy Matters to Our Sponsors

Pure-play vehicle that highlights the value of contracted solar power assets

Provides key

source of visible demand for Sponsors’ core module manufacturing businesses

Complementary technologies and market segments provide diversification of growth

opportunities

Broadens investor base and provides an attractive cost of capital

Enables Sponsors to retain ownership of assets and benefit from recurring cash flow and residual value upside

General Partner interest will represent significant and increasing value to Sponsors as 8point3 achieves growth targets

Sustainable competitive advantage for Sponsors and long-term, stable returns for Sponsors’ shareholders

8point3 energy partners ©2015 8point3 Energy Partners 6

Key Investment Highlights

1 Favorable Industry Dynamics

2 Stable Cash Flows Generated by Long-Term

Contracts with Credit-Worthy Counterparties

3 High Quality Portfolio of Newly Constructed Solar Assets with Significant Scale and Diversity

4 Ongoing Relationship with First Solar and SunPower Provides Visibility for Sustainable Growth

5 Conservative Financing Structure

6 Experienced Management Team

8point3 energy partners ©2015 8point3 Energy Partners 7

Our Portfolio

8point3

energy partners ©2015 8point3 Energy Partners

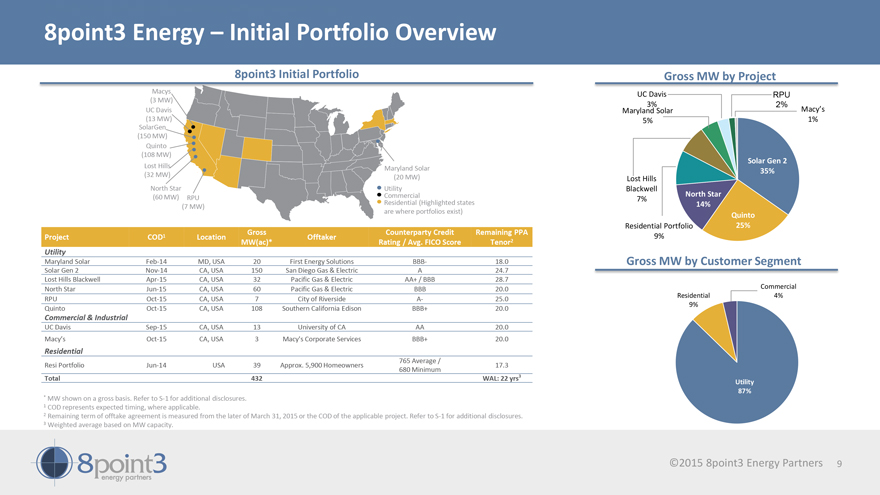

8point3 Energy – Initial Portfolio Overview

8point3 Initial Portfolio

Macys

(3 MW)

UC Davis

(13 MW)

SolarGen

(150 MW)

Quinto

(108 MW)

Lost Hills

(32 MW)

Maryland Solar

(20 MW)

North Star

(60 MW)

RPU

(7 MW)

Utility

Commercial

Residential (Highlighted states are where portfolios exist)

Project COD1 Location Gross MW(ac)* Offtaker Counterparty Credit Rating / Avg. FICO Score Remaining PPA Tenor2

Utility

Maryland Solar Feb-14 MD, USA 20 First Energy Solutions BBB- 18.0

Solar Gen 2 Nov-14 CA, USA 150 San Diego Gas & Electric A 24.7

Lost Hills Blackwell Apr-15

CA, USA 32 Pacific Gas & Electric AA+ / BBB 28.7

North Star Jun-15 CA, USA 60 Pacific Gas & Electric BBB 20.0

RPU Oct-15 CA, USA 7 City of Riverside A- 25.0

Quinto Oct-15 CA, USA 108 Southern California

Edison BBB+ 20.0

Commercial & Industrial UC Davis Sep-15 CA, USA 13 University of CA AA 20.0

Macy’s Oct-15 CA, USA 3 Macy’s Corporate Services BBB+ 20.0

Residential

Resi Portfolio Jun-14 USA 39 Approx. 5,900 Homeowners 765 Average / 680 Minimum 17.3

Total 432

WAL: 22 yrs3

Gross MW by Project

UC Davis 3% RPU 2%

Maryland Solar 5%

Macy’s 1%

Solar Gen 2 35%

Lost Hills Blackwell 7%

North Star 14%

Quinto 25%

Residential Portfolio 9%

Gross MW by Customer Segment

Commercial 4%

Residential 9%

Utility 87%

* MW shown on a gross basis. Refer to S-1 for additional disclosures.

1 COD represents expected timing, where applicable.

2 Remaining term of offtake agreement is

measured from the later of March 31, 2015 or the COD of the applicable project. Refer to S-1 for additional disclosures.

3 Weighted average based on MW

capacity.

8point3 energy partners ©2015 8point3 Energy Partners 9

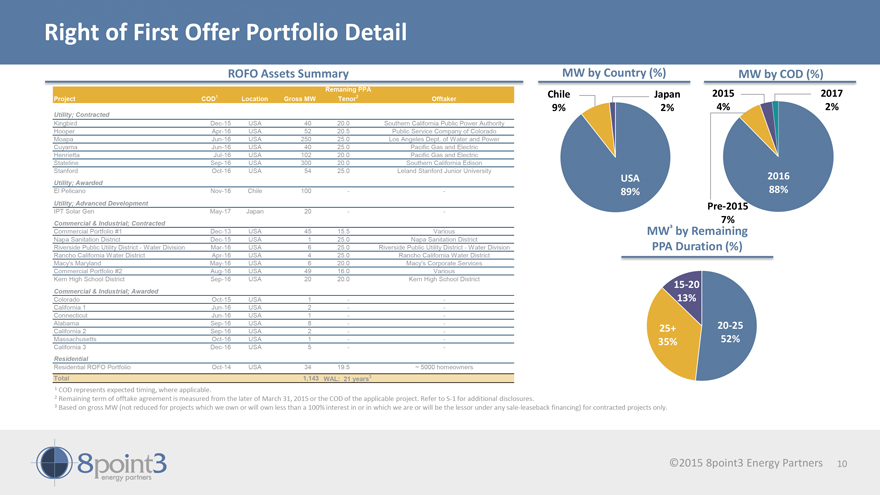

Right of First Offer Portfolio Detail

ROFO Assets Summary

Project COD1 Location Gross MW Remaning PPA Tenor2 Offtaker

Utility; Contracted

Kingbird Dec-15 USA 40 20.0 Southern California Public Power Authority

Hooper Apr-16 USA 52 20.5 Public Service Company of Colorado

Moapa Jun-16 USA

250 25.0 Los Angeles Dept. of Water and Power

Cuyama Jun-16 USA 40 25.0 Pacific Gas and Electric

Henrietta Jul-16 USA 102 20.0 Pacific Gas and Electric

Stateline Sep-16 USA 300 20.0 Southern

California Edison

Stanford Oct-16 USA 54 25.0 Leland Stanford Junior University

Utility; Awarded

El Pelicano Nov-16 Chile 100 - -

Utility; Advanced Development

IPT Solar Gen May-17 Japan 20 - -

Commercial & Industrial; Contracted

Commercial Portfolio #1 Dec-13 USA 45 15.5

Various

Napa Sanitation District Dec-15 USA 1 25.0 Napa Sanitation District

Riverside Public Utility District - Water Division Mar-16 USA 6 25.0 Riverside Public Utility District - Water Division

Rancho California Water District Apr-16 USA 4 25.0 Rancho California Water District

Macy’s Maryland May-16 USA 6 20.0 Macy’s Corporate Services

Commercial Portfolio #2 Aug-16 USA 49 16.0 Various

Kern High School District

Sep-16 USA 20 20.0 Kern High School District

Commercial & Industrial; Awarded

Colorado Oct-15 USA 1 - -

California 1 Jun-16 USA 2 - -

Connecticut Jun-16 USA 1 - -

Alabama Sep-16 USA 8 - -

California 2 Sep-16 USA 2 - -

Massachusetts Oct-16 USA 1 - -

California 3 Dec-16 USA 5 - -

Residential

Residential ROFO Portfolio Oct-14 USA 34 19.5 ~5000 homeowners

Total 1,143 WAL: 21 years3

MW by Country (%)

Chile 9%

Japan 2%

USA 89%

MW by COD (%)

2015 4%

2017 2%

2016 88%

Pre-2015 7%

2016 88%

MW3 by Remaining PPA Duration (%)

15-20 13%

25+ 35%

20-25 52%

1 COD represents expected timing, where applicable.

2 Remaining term of offtake agreement is

measured from the later of March 31, 2015 or the COD of the applicable project. Refer to S-1 for additional disclosures.

3 Based on gross MW (not reduced for

projects which we own or will own less than a 100% interest in or in which we are or will be the lessor under any sale-leaseback financing) for contracted projects only.

8point3 energy partners ©2015 8point3 Energy Partners 10

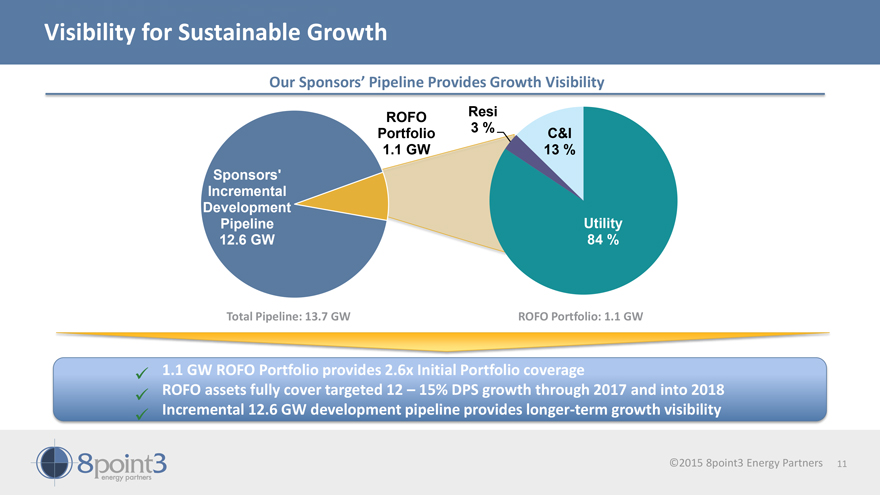

Visibility for Sustainable Growth

Our Sponsors’ Pipeline Provides Growth Visibility

ROFO Portfolio 1.1 GW Resi 3 % C&I

13 %

Sponsors’ Incremental Development Pipeline 12.6 GW Utility 84 %

Total Pipeline: 13.7 GW ROFO Portfolio: 1.1 GW

1.1 GW ROFO Portfolio provides

2.6x Initial Portfolio coverage

ROFO assets fully cover targeted 12 – 15% DPS growth through 2017 and into 2018

Incremental 12.6 GW development pipeline provides longer-term growth visibility

8point3 Energy

Partners ©2015 8point3 Energy Partners 11

Key Investment Highlights

8point3 Energy Partners ©2015 8point3 Energy Partners

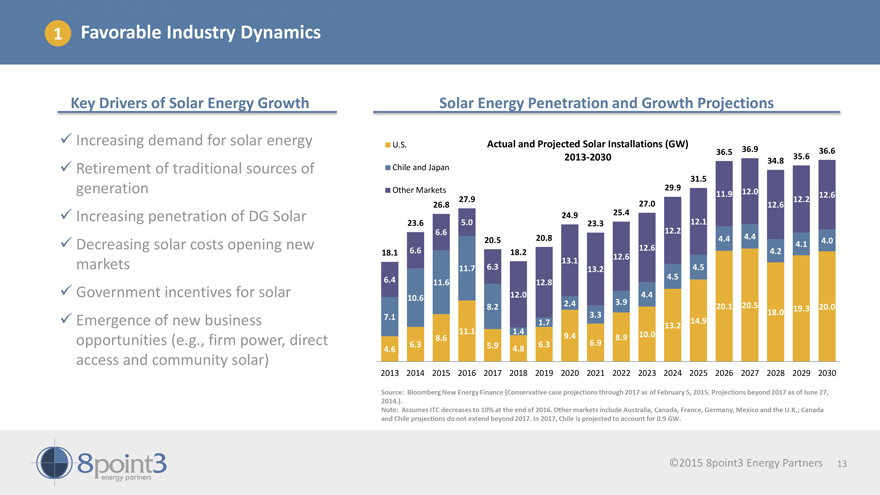

1 Favorable Industry Dynamics

Key Drivers of Solar Energy Growth

Increasing demand for solar energy

Retirement of traditional sources of generation

Increasing penetration of DG Solar

Decreasing solar costs opening new markets

Government incentives for solar

Emergence of new business opportunities (e.g., firm power, direct access and community solar)

Solar Energy Penetration and Growth Projections

U.S. Actual and Projected

Solar Installations (GW) 36.9

36.5 36.6

2013-2030 34.8 35.6

Chile and Japan

31.5

Other Markets 29.9 12.0

11.9 12.6

27.9 12.2

26.8 27.0 12.6

24.9 25.4

23.6 5.0 23.3 12.1

6.6 12.2

20.5 20.8 4.4 4.4 4.0

12.6 4.1

18.1 6.6 18.2 4.2

13.1 12.6

11.7 6.3 13.2 4.5

4.5

6.4 11.6 12.8

10.6 12.0 4.4

8.2 2.4 3.9 20.1 20.5 19.3 20.0

7.1 3.3 18.0

1.7 13.2 14.9

8.6 11.1 1.4 9.4 8.9 10.0

4.6 6.3 5.9 4.8 6.3 6.9

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

Source: Bloomberg New Energy Finance (Conservative case projections through 2017 as of February 5, 2015. Projections beyond 2017 as of June 27, 2014.).

Note: Assumes ITC decreases to 10% at the end of 2016. Other markets include Australia, Canada, France, Germany, Mexico and the U.K.; Canada and Chile projections

do not extend beyond 2017. In 2017, Chile is projected to account for 0.9 GW.

8point3 Energy Partners ©2015 8point3 Energy Partners 13

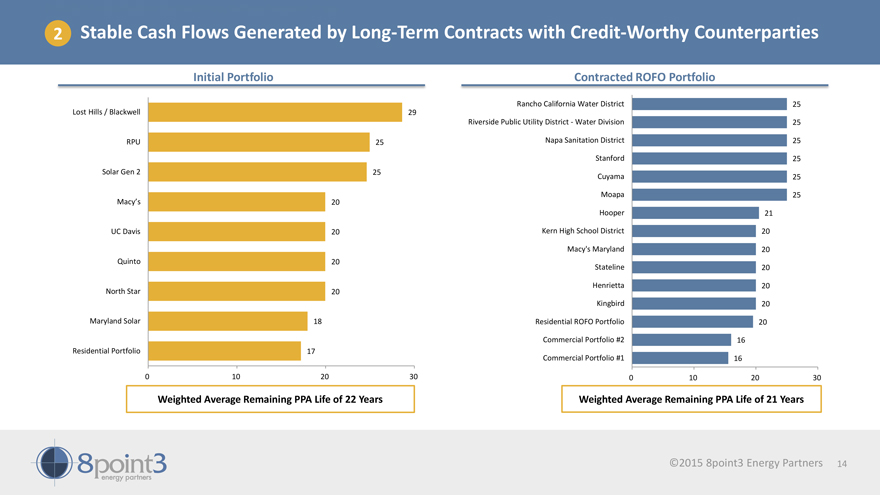

2 Stable Cash Flows Generated by Long-Term Contracts with Credit-Worthy Counterparties

Initial Portfolio

Lost Hills / Blackwell 29

RPU 25

Solar Gen 2 25

Macy’s 20

UC Davis 20

Quinto 20

North Star 20

Maryland Solar 18

Residential Portfolio 17

0 10 20 30

Weighted Average Remaining PPA Life of 22 Years

Contracted ROFO Portfolio

Rancho California Water District 25

Riverside Public Utility District - Water Division 25

Napa Sanitation District 25

Stanford 25

Cuyama 25

Moapa 25

Hooper 21

Kern High School District 20

Macy’s Maryland 20

Stateline 20

Henrietta 20

Kingbird 20

Residential ROFO Portfolio 20

Commercial Portfolio #2 16

Commercial Portfolio #1 16

0 10 20 30

Weighted Average Remaining PPA Life of 21 Years

8point3 energy partners ©2015 8point3 Energy Partners 14

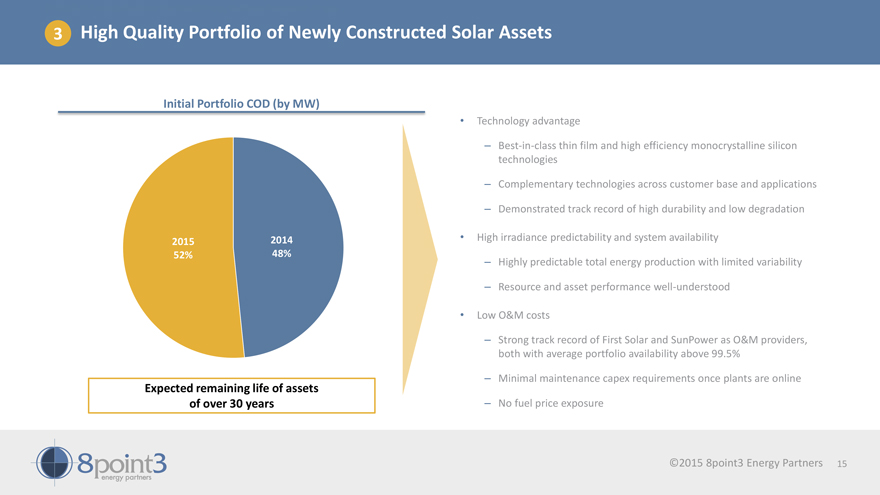

3 High Quality Portfolio of Newly Constructed Solar Assets

Initial Portfolio COD (by MW)

2015 2014 52% 48%

Expected remaining life of assets of over 30 years

Technology advantage

Best-in-class thin film and high efficiency monocrystalline silicon technologies

Complementary

technologies across customer base and applications

Demonstrated track record of high durability and low degradation

High irradiance predictability and system availability

Highly predictable total energy

production with limited variability

Resource and asset performance well-understood

Low O&M costs

Strong track record of First Solar and SunPower as O&M providers, both

with average portfolio availability above 99.5%

Minimal maintenance capex requirements once plants are online

No fuel price exposure

8point3 Energy Partners ©2015 8point3 Energy Partners 15

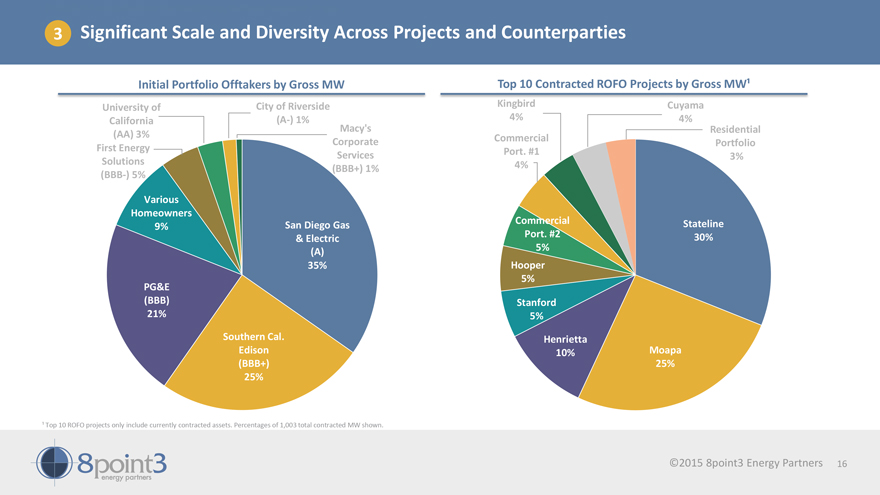

3 Significant Scale and Diversity Across Projects and Counterparties

Initial Portfolio Offtakers by Gross MW

University of California (AA) 3% City of Riverside

(A-) 1%

First Energy Solutions (BBB-) 5% Macy’s Corporate Services (BBB+) 1%

Various Homeowners 9% San Diego Gas & Electric (A) 35%

PG&E (BBB) 21% Southern Cal.

Edison (BBB+) 25%

Top 10 Contracted ROFO Projects by Gross MW1

Kingbird 4%

Cuyama 4%

Commercial Port. #1 4%

Residential Portfolio 3%

Commercial Port. #2 5%

Stateline 30%

Hooper 5%

Stanford 5%

Henrietta 10%

Moapa 25%

1 Top 10 ROFO projects only include currently contracted assets. Percentages of

1,003 total contracted MW shown.

8point3 Energy Partners ©2015 8point3 Energy Partners 16

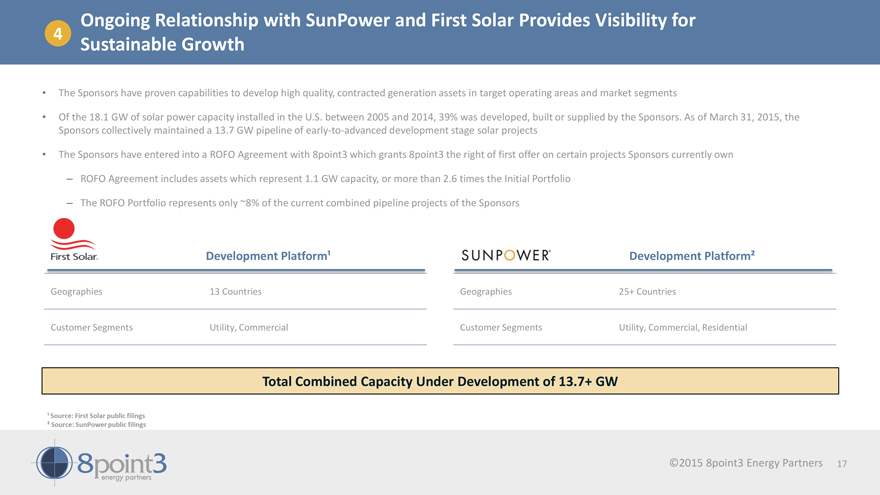

Ongoing Relationship with SunPower and First Solar Provides Visibility for

4

Sustainable Growth

The Sponsors have proven capabilities to develop high quality, contracted generation assets in target operating areas and market segments

Of the 18.1 GW of solar power capacity installed in the U.S. between 2005 and 2014, 39% was developed, built or supplied by the Sponsors. As of March 31, 2015, the Sponsors

collectively maintained a 13.7 GW pipeline of early-to-advanced development stage solar projects

The Sponsors have entered into a ROFO Agreement with 8point3 which

grants 8point3 the right of first offer on certain projects Sponsors currently own

ROFO Agreement includes assets which represent 1.1 GW capacity, or more than 2.6

times the Initial Portfolio

The ROFO Portfolio represents only ~8% of the current combined pipeline projects of the Sponsors

First Solar® Development Platform1 SUNPOWER® Development Platform2

Geographies

Customer Segments 13 Countries Utility, Commercial Geographies Customer Segments 25+ Countries Utility, Commercial, Residential

Total Combined Capacity Under

Development of 13.7+ GW

1 Source: First Solar public filings

2 Source:

SunPower public filings

8point3 Energy Partners

©2015 8point3 Energy

Partners 17

5 Conservative Financing Structure

No project-level debt on the Initial Portfolio

Modest consolidated leverage of approximately

4.0x CAFD

Long tenor of underlying asset contracts provides significant cash flows and remaining contract life to support future refinancings

Available liquidity with balance sheet cash, delayed draw term loan facility and revolver capacity

No equity capital required to achieve target growth for at least one year post offering

8point3 Energy Partners ©2015 8point3 Energy Partners 18

6 Experienced Management Team

Position at 8point3 Sponsor Background Experience

Chief Financial Officer Service Source®

COMMERCE ONE® KRAFT INTELLIDEN® Grant Thorton An instinct for growth®

Charles D. Boynton Chief Executive Officer SUNPOWER®

8point3 Energy Partners (5 Years) GRAFTECH International NCR DELL

Chief Financial Officer

Mark R. Widmar Chief Financial Officer First Solar®

(4 Years)

8point3 has access to the significant management resources of the Sponsors to support the operational, financial, legal and regulatory aspects of the business

Management Position Management Position

James A. Hughes Chief Executive Officer Tom Werner

Chief Executive Officer

Georges Antoun President, U.S. Peter Aschenbrenner EVP, Corporate Strategy

Joseph Kishkill President, International Lisa Bodensteiner EVP, General Counsel

Tymen de Jong

Chief Operating Officer

Howard Wenger President, Business Units

Paul Kaleta

EVP, General Counsel

8point3 Energy Partners ©2015 8point3 Energy Partners 19

Financial Overview

8point3 Energy Partners ©2015 8point3 Energy Partners

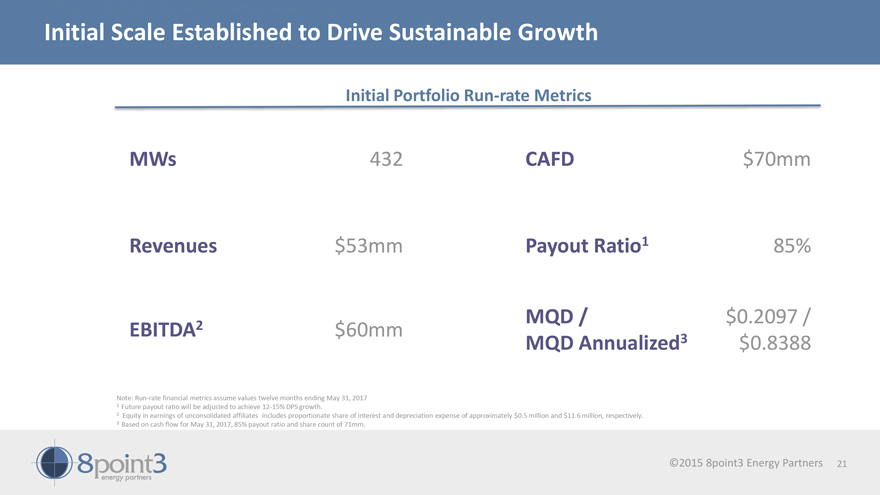

Initial Scale Established to Drive Sustainable Growth

Initial Portfolio Run-rate Metrics

MWs

Revenues

EBITDA2

432

$53mm

$60mm

CAFD

Payout Ratio1

MQD / MQD Annualized3

$70mm

85%

$0.2097 / $0.8388

Note: Run-rate financial metrics assume values twelve

months ending May 31, 2017

1 Future payout ratio will be adjusted to achieve 12-15% DPS growth.

2 Equity in earnings of unconsolidated affiliates includes proportionate share of interest and depreciation expense of approximately $0.5 million and $11.6 million, respectively.

3 Based on cash flow for May 31, 2017, 85% payout ratio and share count of 71mm.

8point3 Energy Partners

©2015 8point3 Energy Partners

21

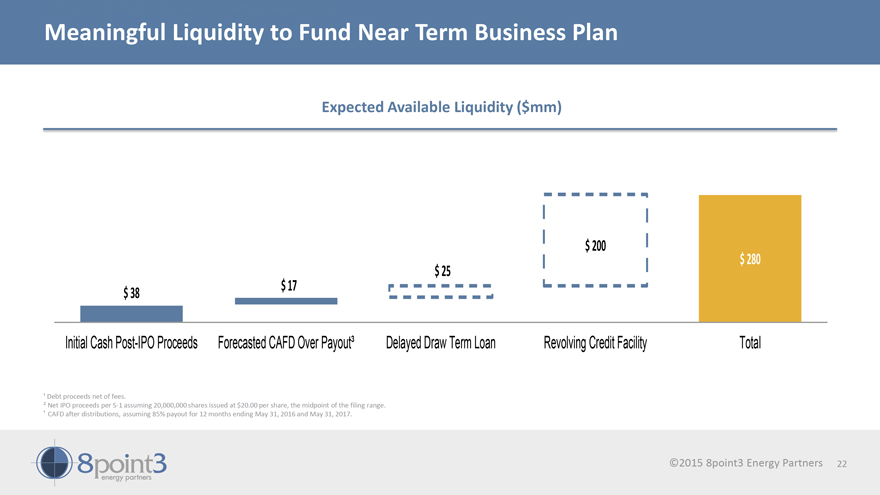

Meaningful Liquidity to Fund Near Term Business Plan

Expected Available Liquidity ($mm)

$ 38

Initial Cash Post-IPO Proceeds

$ 17

Forecasted CAFD Over Payout3

$ 25

Delayed Draw Term Loan

$ 200

Revolving Credit Facility

$ 280

Total

1 Debt proceeds net of fees.

2 Net IPO proceeds per S-1 assuming 20,000,000 shares issued at $20.00 per share, the midpoint of the filing range.

3 CAFD after distributions, assuming 85% payout for 12 months ending May 31, 2016 and May 31, 2017.

8point3 energy partners

©2015 8point3 Energy Partners 22

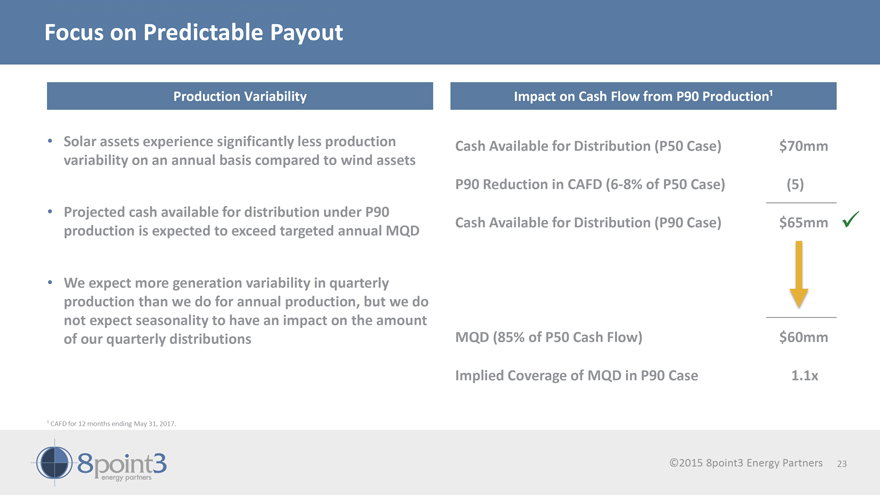

Focus on Predictable Payout

Production Variability

Solar assets experience significantly less production

variability on an annual basis compared to wind assets

Projected cash available for distribution under P90 production is expected to exceed targeted annual MQD

We expect more generation variability in quarterly production than we do for annual production, but we do not expect seasonality to have an impact on the amount of

our quarterly distributions

1 CAFD for 12 months ending May 31, 2017.

Impact

on Cash Flow from P90 Production1

Cash Available for Distribution (P50 Case)

P90 Reduction in CAFD (6-8% of P50 Case)

Cash Available for Distribution (P90

Case)

MQD (85% of P50 Cash Flow)

Implied Coverage of MQD in P90 Case

$70mm

(5)

$65mm

$60mm

1.1x

8point3 energy partners

©2015 8point3 Energy Partners 23

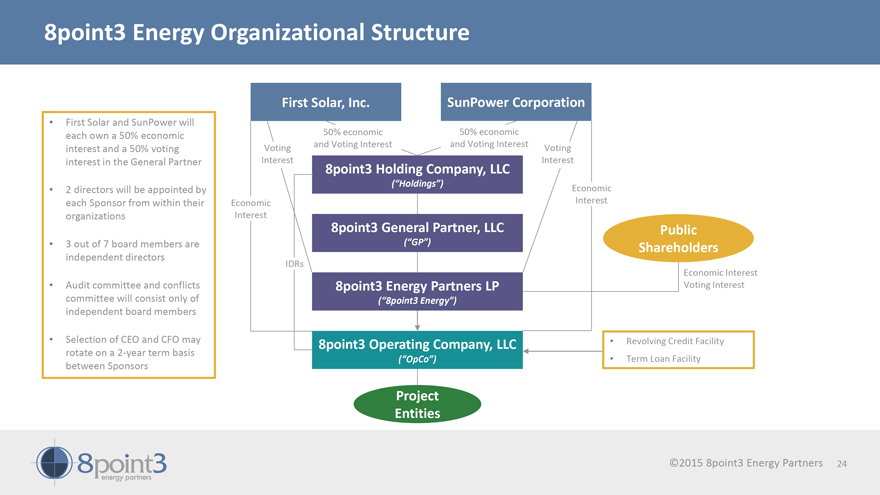

8point3 Energy Organizational Structure

First Solar and SunPower will each own a 50% economic interest and a 50% voting interest in the General Partner

2 directors will be appointed by each Sponsor from within their organizations

3 out of 7 board

members are independent directors

Audit committee and conflicts committee will consist only of independent board members

Selection of CEO and CFO may rotate on a 2-year term basis between Sponsors

First Solar, Inc.

50% economic and Voting Interest

Voting Interest

Economic Interest

IDRs

8point3 Holding Company, LLC

(“Holdings”)

8point3 General Partner, LLC

(“GP”)

8point3 Energy Partners LP

(“8point3 Energy”)

8point3 Operating Company, LLC

(“OpCo”)

Project

Entities

SunPower Corporation

50% economic

and Voting Interest

Voting Interest

Economic

Interest

Public

Shareholders

Economic Interest

Voting Interest

Revolving Credit Facility

Term Loan Facility

8point3 energy partners

©2015 8point3 Energy Partners 24

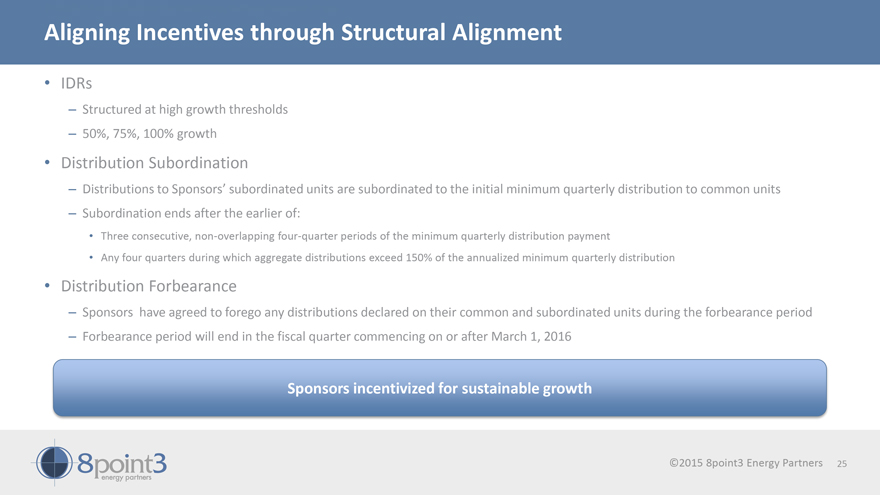

Aligning Incentives through Structural Alignment

IDRs

Structured at high growth thresholds

50%, 75%, 100% growth

Distribution Subordination

Distributions to Sponsors’ subordinated units are subordinated to the initial minimum quarterly distribution to common units

Subordination ends after the earlier of:

Three consecutive, non-overlapping four-quarter

periods of the minimum quarterly distribution payment

Any four quarters during which aggregate distributions exceed 150% of the annualized minimum quarterly

distribution

Distribution Forbearance

Sponsors have agreed to forego any

distributions declared on their common and subordinated units during the forbearance period

Forbearance period will end in the fiscal quarter commencing on or

after March 1, 2016

Sponsors incentivized for sustainable growth

8point3

energy partners

©2015 8point3 Energy Partners 25

Key Investment Highlights

1 Favorable Industry Dynamics

2 Stable Cash Flows Generated by Long-Term

Contracts with Credit-Worthy Counterparties

3 High Quality Portfolio of Newly Constructed Solar Assets with Significant Scale and Diversity

4 Ongoing Relationship with First Solar and SunPower Provides Visibility for Sustainable Growth

5 Conservative Financing Structure

6 Experienced Management Team

8point3 energy partners

©2015 8point3 Energy Partners 26

Appendix

8point3 energy

partners

©2015 8point3 Energy Partners

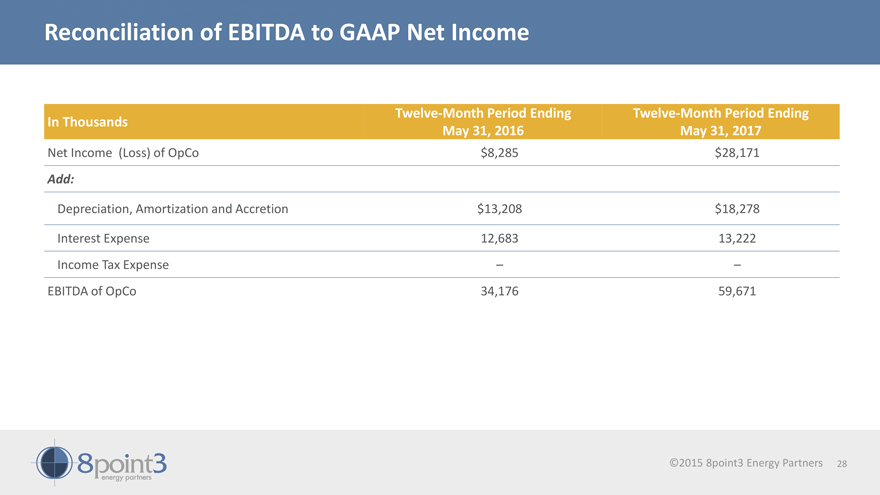

Reconciliation of EBITDA to GAAP Net Income

In Thousands

Net Income (Loss) of OpCo

Add:

Depreciation, Amortization and Accretion

Interest Expense

Income Tax Expense

EBITDA of OpCo

Twelve-Month Period Ending

May 31, 2016

$8,285

$13,208

12,683

–

34,176

Twelve-Month Period Ending

May 31, 2017

$28,171

$18,278

13,222

–

59,671

8point3 energy partners

©2015 8point3 Energy Partners 28

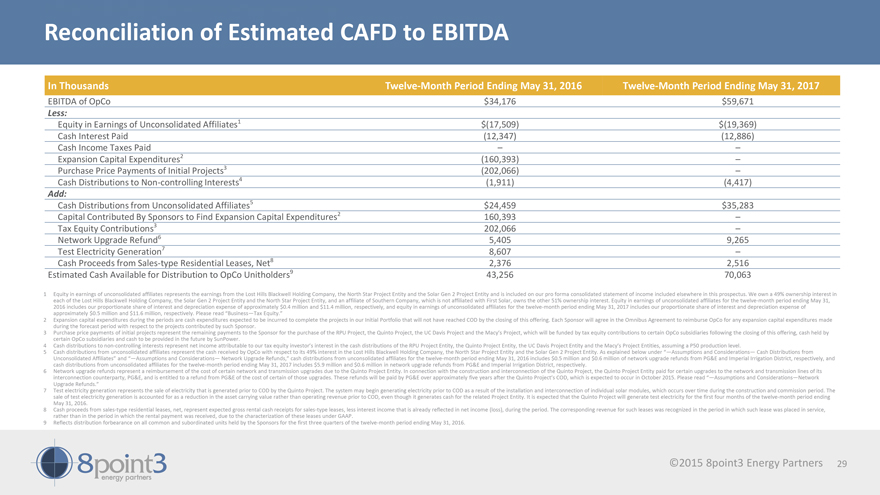

Reconciliation of Estimated CAFD to EBITDA

In Thousands

EBITDA of OpCo

Less:

Equity in Earnings of Unconsolidated Affiliates1

Cash Interest Paid

Cash Income Taxes Paid

Expansion Capital Expenditures2

Purchase Price Payments of Initial Projects3

Cash Distributions to Non-controlling Interests4

Add:

Cash Distributions from Unconsolidated Affiliates5

Capital Contributed By Sponsors to Find

Expansion Capital Expenditures2

Tax Equity Contributions3

Network Upgrade

Refund6

Test Electricity Generation7

Cash Proceeds from Sales-type

Residential Leases, Net8

Estimated Cash Available for Distribution to OpCo Unitholders9

Twelve-Month Period Ending May 31, 2016

$34,176

$(17,509)

(12,347)

–

(160,393)

(202,066)

(1,911)

$24,459

160,393

202,066

5,405

8,607

2,376

43,256

Twelve-Month Period Ending May 31, 2017

$59,671

$(19,369)

(12,886)

–

–

–

(4,417)

$35,283

–

–

9,265

–

2,516

70,063

1 Equity in earnings of unconsolidated affiliates represents the earnings from the Lost Hills Blackwell Holding Company, the North Star Project Entity and the Solar Gen 2 Project

Entity and is included on our pro forma consolidated statement of income included elsewhere in this prospectus. We own a 49% ownership interest in each of the Lost Hills Blackwell Holding Company, the Solar Gen 2 Project Entity and the North Star

Project Entity, and an affiliate of Southern Company, which is not affiliated with First Solar, owns the other 51% ownership interest. Equity in earnings of unconsolidated affiliates for the twelve-month period ending May 31, 2016 includes our

proportionate share of interest and depreciation expense of approximately $0.4 million and $11.4 million, respectively, and equity in earnings of unconsolidated affiliates for the twelve-month period ending May 31, 2017 includes our proportionate

share of interest and depreciation expense of approximately $0.5 million and $11.6 million, respectively. Please read “Business—Tax Equity.”

2

Expansion capital expenditures during the periods are cash expenditures expected to be incurred to complete the projects in our Initial Portfolio that will not have reached COD by the closing of this offering. Each Sponsor will agree in the Omnibus

Agreement to reimburse OpCo for any expansion capital expenditures made during the forecast period with respect to the projects contributed by such Sponsor.

3

Purchase price payments of initial projects represent the remaining payments to the Sponsor for the purchase of the RPU Project, the Quinto Project, the UC Davis Project and the Macy’s Project, which will be funded by tax equity contributions

to certain OpCo subsidiaries following the closing of this offering, cash held by certain OpCo subsidiaries and cash to be provided in the future by SunPower.

4

Cash distributions to non-controlling interests represent net income attributable to our tax equity investor’s interest in the cash distributions of the RPU Project Entity, the Quinto Project Entity, the UC Davis Project Entity and the

Macy’s Project Entities, assuming a P50 production level.

5 Cash distributions from unconsolidated affiliates represent the cash received by OpCo with respect

to its 49% interest in the Lost Hills Blackwell Holding Company, the North Star Project Entity and the Solar Gen 2 Project Entity. As explained below under “—Assumptions and Considerations— Cash Distributions from Unconsolidated

Affiliates” and “—Assumptions and Considerations— Network Upgrade Refunds,” cash distributions from unconsolidated affiliates for the twelve-month period ending May 31, 2016 includes $0.5 million and $0.6 million of network

upgrade refunds from PG&E and Imperial Irrigation District, respectively, and cash distributions from unconsolidated affiliates for the twelve-month period ending May 31, 2017 includes $5.9 million and $0.6 million in network upgrade refunds

from PG&E and Imperial Irrigation District, respectively.

6 Network upgrade refunds represent a reimbursement of the cost of certain network and transmission

upgrades due to the Quinto Project Entity. In connection with the construction and interconnection of the Quinto Project, the Quinto Project Entity paid for certain upgrades to the network and transmission lines of its interconnection counterparty,

PG&E, and is entitled to a refund from PG&E of the cost of certain of those upgrades. These refunds will be paid by PG&E over approximately five years after the Quinto Project’s COD, which is expected to occur in October 2015.

Please read “—Assumptions and Considerations—Network Upgrade Refunds.”

7 Test electricity generation represents the sale of electricity that is

generated prior to COD by the Quinto Project. The system may begin generating electricity prior to COD as a result of the installation and interconnection of individual solar modules, which occurs over time during the construction and commission

period. The sale of test electricity generation is accounted for as a reduction in the asset carrying value rather than operating revenue prior to COD, even though it generates cash for the related Project Entity. It is expected that the Quinto

Project will generate test electricity for the first four months of the twelve-month period ending May 31, 2016.

8 Cash proceeds from sales-type residential

leases, net, represent expected gross rental cash receipts for sales-type leases, less interest income that is already reflected in net income (loss), during the period. The corresponding revenue for such leases was recognized in the period in which

such lease was placed in service, rather than in the period in which the rental payment was received, due to the characterization of these leases under GAAP.

9

Reflects distribution forbearance on all common and subordinated units held by the Sponsors for the first three quarters of the twelve-month period ending May 31, 2016.

8point3 energy partners

©2015 8point3 Energy Partners 29