Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - 8point3 Energy Partners LP | cafd-ex322_7.htm |

| EX-32.1 - EX-32.1 - 8point3 Energy Partners LP | cafd-ex321_9.htm |

| EX-31.2 - EX-31.2 - 8point3 Energy Partners LP | cafd-ex312_8.htm |

| EX-31.1 - EX-31.1 - 8point3 Energy Partners LP | cafd-ex311_10.htm |

| EX-23.2 - EX-23.2 - 8point3 Energy Partners LP | cafd-ex232_6.htm |

| EX-23.1 - EX-23.1 - 8point3 Energy Partners LP | cafd-ex231_11.htm |

| EX-21 - EX-21 - 8point3 Energy Partners LP | cafd-ex21_1011.htm |

i

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended November 30, 2016

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission File Number 001-37447

8point3 Energy Partners LP

(Exact name of Registrant as specified in its Charter)

|

Delaware |

|

47-3298142 |

|

( State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

77 Rio Robles San Jose, California |

|

95134 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (408) 240-5500

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Exchange on Which Registered |

|

Class A Shares representing limited partner interests |

|

NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☒ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ (Do not check if a small reporting company) |

|

Small reporting company |

|

☐ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s Class A Shares held by non-affiliates on May 31, 2016, the last business day of the Registrant’s most recently completed second fiscal quarter (based on the closing sale price of $15.42 of the Registrant’s Class A shares, as reported by the NASDAQ Global Select Market on such date) was approximately $307.9 million.

The number of shares of Registrant’s Class A Shares outstanding as of January 23, 2017 was 28,072,680.

Documents incorporated by reference:

None.

GLOSSARY

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

|

|

|

|

|

Page |

|

PART I |

|

|

|

|

|

Item 1. |

|

|

11 |

|

|

Item 1A. |

|

|

30 |

|

|

Item 1B. |

|

|

60 |

|

|

Item 2. |

|

|

60 |

|

|

Item 3. |

|

|

60 |

|

|

Item 4. |

|

|

61 |

|

|

|

|

|

|

|

|

PART II |

|

|

|

|

|

Item 5. |

|

|

62 |

|

|

Item 6. |

|

|

66 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

67 |

|

Item 7A. |

|

|

86 |

|

|

Item 8. |

|

|

88 |

|

|

Item 9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

131 |

|

Item 9A. |

|

|

131 |

|

|

Item 9B. |

|

|

131 |

|

|

|

|

|

|

|

|

PART III |

|

|

|

|

|

Item 10. |

|

|

132 |

|

|

Item 11. |

|

|

137 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

141 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

142 |

|

Item 14. |

|

|

160 |

|

|

|

|

|

|

|

|

PART IV |

|

|

|

|

|

Item 15. |

|

|

161 |

2

Unless the context provides otherwise, references herein to “we,” “us,” “our” and “the Partnership” or like terms, when used for time periods prior to June 24, 2015, refer to the projects that our Sponsors contributed to us in connection with the IPO. When used for time periods on or subsequent to June 24, 2015, such terms refer to 8point3 Energy Partners LP together with its consolidated subsidiaries, including OpCo.

References in this Annual Report on Form 10-K to:

“(ac)” refers to alternating current.

“AMAs” refers to asset management agreements.

“AROs” refers to asset retirement obligations.

“Blackwell Project” refers to the solar energy project located in Kern County, California, that is held by the Blackwell Project Entity and has a nameplate capacity of 12 MW.

“Blackwell Project Entity” refers to Blackwell Solar, LLC.

“BLM” refers to the U.S. Bureau of Land Management.

“C&I Holdings” refers to SunPower Commercial Holding Company I, LLC, an indirect subsidiary of OpCo and the holder of the Macy’s California Project Entities and the UC Davis Project Entity.

“C&I Project Entities” refers to, collectively, the Kern Project Entity, the Macy’s California Project Entities, the Macy’s Maryland Project Entity and the UC Davis Project Entity.

“CAISO” refers to the California Independent System Operator.

“COD” refers to the commercial operation date.

“DG Solar” refers to distributed solar generation. DG Solar systems are deployed at the site of end-use, such as businesses and homes.

“EPC” refers to engineering, procurement and construction.

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended.

“FASB” refers to the Financial Accounting Standards Board.

“FERC” refers to the U.S. Federal Energy Regulatory Commission.

“First Solar” refers to First Solar, Inc., a corporation formed under the laws of the State of Delaware, in its individual capacity or to First Solar, Inc. and its subsidiaries, as the context requires. Unless otherwise specifically noted, references to First Solar and its subsidiaries exclude us, the General Partner, Holdings and our subsidiaries, including OpCo.

“First Solar MSA” refers to the Management Services Agreement, dated as of June 24, 2015, as amended, among the Partnership, OpCo, the General Partner and First Solar 8point3 Management Services, LLC.

“First Solar Project Entities” refers to, collectively, the IPO First Solar Project Entities and the Kingbird Project Entities.

“First Solar ROFO Agreement” refers to the Right of First Offer Agreement, dated as of June 24, 2015, as amended, by and between OpCo and First Solar.

“First Solar ROFO Projects” refers to, collectively, the projects set forth in the chart in Part I, Item 1, under the heading “Business—Our Portfolio—ROFO Projects” with First Solar listed as the “Developing Sponsor” and as to which we have a right of first offer under the First Solar ROFO Agreement should First Solar decide to sell them (but excluding the Stateline Project, which we

3

acquired on December 1, 2016, as further described in Part II, Item 8. “Financial Statements and Supplementary Data—Notes to Consolidated Financial Statements—Note 17—Subsequent Events”).

“FPA” refers to the U.S. Federal Power Act.

“FSEC” refers to First Solar Electric (California), Inc., a Delaware corporation and an affiliate of First Solar.

“General Partner” or “our general partner” refers to 8point3 General Partner, LLC, our general partner, a limited liability company formed under the laws of the State of Delaware and a wholly-owned subsidiary of Holdings.

“GW” refers to a gigawatt, or 1,000,000,000 watts. As used in this Annual Report on Form 10-K, all references to watts (e.g., MW or GW) refer to measurements of alternating current, except where otherwise noted.

“Henrietta Holdings” refers to Parrey Holding Company, LLC.

“Henrietta Project” refers to the solar energy project that is located in Kings County, California and is held by the Henrietta Project Entity.

“Henrietta Project Entity” refers to Parrey, LLC.

“Holdings” refers to 8point3 Holding Company, LLC, a limited liability company formed under the laws of the State of Delaware, which is jointly owned by First Solar and SunPower and is the parent of the General Partner.

“Hooper Class B Partnership” refers to SSCO III Class B Holdings, LLC.

“Hooper Project” refers to the solar energy project located in Alamosa County, Colorado, that is held by the Hooper Project Entity and has a nameplate capacity of 50 MW.

“Hooper Project Entity” refers to Solar Star Colorado III, LLC.

“IPO” refers to the Partnership’s initial public offering of its Class A shares, which was completed on June 24, 2015.

“IPO First Solar Project Entities” refers to the Lost Hills Project Entity, the Blackwell Project Entity, the Maryland Solar Project Entity, the North Star Project Entity and the Solar Gen 2 Project Entity and, with respect to certain of the foregoing, one or more of its direct or indirect holding companies.

“IPO Project Entities” refers to, collectively, the IPO First Solar Project Entities and the IPO SunPower Project Entities.

“IPO SunPower Project Entities” refers to the Macy’s California Project Entities, the Quinto Project Entity, the RPU Project Entity, the UC Davis Project Entity and the Residential Portfolio Project Entity and, with respect to certain of the foregoing, one or more of its direct or indirect holding companies.

“IRS” refers to the Internal Revenue Service.

“ITCs” refers to investment tax credits.

“Kern Class B Partnership” refers to SunPower Commercial II Class B, LLC.

“Kern Phase 1(a) Assets” refers to the assets comprising the first phase of the Kern Project, with a nameplate capacity of approximately 3 MW.

“Kern Phase 1(b) Assets” refers to the assets comprising the second phase of the Kern Project, with a nameplate capacity of approximately 5 MW.

“Kern Phase 2(a) Assets” refers to the assets comprising the third phase of the Kern Project, with a nameplate capacity of approximately 5 MW.

4

“Kern Phase 2(b) Assets” refers to the assets comprising the fourth phase of the Kern Project, with a nameplate capacity of up to approximately 8 MW.

“Kern Project” refers to the solar energy project located in Kern County, California, that is held by the Kern Project Entity and has an aggregate nameplate capacity of up to approximately 21 MW. OpCo’s acquisition of the Kern Project is being effectuated in four phases, with the closing for the Kern Phase 1(a) Assets having occurred on January 26, 2016 (the “Kern Phase 1(a) Acquisition”), the closing for the Kern Phase 1(b) Assets having occurred on September 9, 2016 (the “Kern Phase 1(b) Acquisition”), the closing for the Kern Phase 2(a) Assets having occurred on November 30, 2016 (the “Kern Phase 2(a) Acquisition”), and the closing for the Kern Phase 2(b) Assets to occur in the future.

“Kern Project Entity” refers to Kern High School District Solar (2), LLC.

“Kingbird Project” refers to the solar energy project located in Kern County, California, that is held by the Kingbird Project Entities and has an aggregate nameplate capacity of 40 MW.

“Kingbird Project Entities” refers to, collectively, Kingbird Solar A, LLC and Kingbird Solar B, LLC.

“LMP” refers to “Locational Marginal Pricing,” as further defined in the CAISO open access transmission tariff.

“Lost Hills Blackwell Holdings” refers to Lost Hills Blackwell Holdings, LLC.

“Lost Hills Blackwell Project” refers to the solar energy project held collectively by the Lost Hills Project Entity and the Blackwell Project Entity that is comprised of the Lost Hills Project and the Blackwell Project and has a nameplate capacity of 32 MW.

“Lost Hills Project” refers to the solar energy project located in Kern County, California, that is held by the Lost Hills Project Entity and has a nameplate capacity of 20 MW.

“Lost Hills Project Entity” refers to Lost Hills Solar, LLC.

“Macy’s California Project” refers to the solar energy project consisting of seven sites in Northern California that is held by the Macy’s California Project Entities and has an aggregate nameplate capacity of 3 MW.

“Macy’s California Project Entities” refers to, collectively, Solar Star California XXX, LLC and Solar Star California XXX (2), LLC.

“Macy’s Maryland Class B Partnership” refers to SunPower Commercial III Class B, LLC.

“Macy’s Maryland Project” refers to the solar energy project which holds roof-mounted solar photovoltaic systems with an aggregate system size of approximately 5 MW, which is being installed at certain Macy’s department stores in Maryland and is held by the Macy’s Maryland Project Entity.

“Macy’s Maryland Project Entity” refers to Northstar Macys Maryland 2015, LLC.

“Maryland Solar Project” refers to the solar energy project located in Washington County, Maryland, that is held by the Maryland Solar Project Entity and has a nameplate capacity of 20 MW.

“Maryland Solar Project Entity” refers to Maryland Solar LLC.

“MSAs” refers, collectively, to the First Solar MSA and the SunPower MSA.

“MW” refers to a megawatt, or 1,000,000 watts. As used in this Annual Report on Form 10-K, all references to watts (e.g., MW or GW) refer to measurements of alternating current, except where otherwise noted.

“NASDAQ” refers to the NASDAQ Global Select Market.

“NERC” refers to the North American Electric Reliability Corporation.

“NOLs” refers to net operating losses.

5

“North Star Holdings” refers to NS Solar Holdings, LLC.

“North Star Project” refers to the solar energy project located in Fresno County, California, that is held by the North Star Project Entity and has a nameplate capacity of 60 MW.

“North Star Project Entity” refers to North Star Solar, LLC.

“NPV” refers to net present value.

“O&M” refers to operations and maintenance services.

“offtake agreements” refers to PPAs, leases and other offtake agreements.

“offtake counterparties” refers to the customer under a PPA lease or other offtake agreement.

“Omnibus Agreement” refers to the Amended and Restated Omnibus Agreement, dated as of April 6, 2016, among the Partnership, OpCo, the General Partner, Holdings, First Solar and SunPower. Please read Part II, Item 8. “Financial Statements and Supplementary Data—Notes to Consolidated Financial Statements—Note 14—Related Parties” for further details.

“OpCo” refers to 8point3 Operating Company, LLC and its subsidiaries.

“OSHA” refers to Occupational Safety and Health Act.

“P50 production level” is the amount of annual energy production that a particular asset or group of assets is expected to meet or exceed 50% of the time.

“Partnership Agreement” refers to our partnership agreement.

“PBI Rebates” refers to performance based incentives.

“PG&E” refers to Pacific Gas and Electric Company.

“Portfolio” refers to, collectively, our portfolio of solar energy projects as of November 30, 2016, which consists of the Henrietta Project, the Hooper Project, the Kern Phase 1(a) Assets, the Kern Phase 1(b) Assets, the Kern Phase 2(a) Assets, the Kingbird Project, the Lost Hills Blackwell Project, the Macy’s California Project, the Macy’s Maryland Project, the Maryland Solar Project, the North Star Project, the Quinto Project, the Solar Gen 2 Project, the RPU Project, the UC Davis Project and the Residential Portfolio. Interests in the Stateline Project were acquired by us on December 1, 2016.

“PPA” refers to a power purchase agreement.

“Predecessor” refers to the operation of the IPO SunPower Project Entities prior to the completion of the IPO.

“Project Entities” refers to, collectively, the IPO First Solar Project Entities, the IPO SunPower Project Entities, the Henrietta Project Entity, the Hooper Project Entity, the Kern Project Entity, the Kingbird Project Entities and the Macy’s Maryland Project Entity.

“PUHCA 2005” refers to the U.S. Public Utility Holding Company Act of 2005.

“Quinto Holdings” refers to SSCA XIII Holding Company, LLC, an indirect subsidiary of OpCo and the indirect holder of the Quinto Project Entity.

“Quinto Project” refers to the solar energy project located in Merced County, California, that is held by the Quinto Project Entity and has a nameplate capacity of 108 MW.

“Quinto Project Entity” refers to Solar Star California XIII, LLC.

“RECs” refers to renewable energy certificates.

6

“Residential Portfolio” refers to the approximately 5,900 solar installations located at homes in Arizona, California, Colorado, Hawaii, Massachusetts, New Jersey, New York, Pennsylvania and Vermont, that is held by the Residential Portfolio Project Entity and has an aggregate nameplate capacity of 39 MW.

“Residential Portfolio Project Entity” refers to SunPower Residential I, LLC.

“ROFO Agreements” refers, collectively, to the First Solar ROFO Agreement and the SunPower ROFO Agreement.

“ROFO Portfolio” refers to, collectively, our portfolio of ROFO Projects.

“ROFO Projects” refers to, collectively, the First Solar ROFO Projects and the SunPower ROFO Projects.

“RPS” refers to renewable portfolio standards mandated by state law that require a regulated retail electric utility to procure a specified percentage of its total electricity delivered to retail customers in the state from eligible renewable energy resources, such as solar energy projects, by a specified date.

“RPU Holdings” refers to SSCA XXXI Holding Company, LLC, an indirect subsidiary of OpCo and the holder of the RPU Project Entity.

“RPU Project” refers to the solar energy project located in Riverside, California, that is held by the RPU Project Entity and has a nameplate capacity of 7 MW.

“RPU Project Entity” refers to Solar Star California XXXI, LLC.

“SDG&E” refers to San Diego Gas & Electric Company.

“SEC” refers to the U.S. Securities and Exchange Commission.

“Securities Act” refers to the Securities Act of 1933, as amended.

“SG&A” refers to selling, general and administrative services.

“SG2 Holdings” refers to SG2 Holdings, LLC.

“Solar Gen 2 Project” refers to the solar energy project located in Imperial County, California, that is held by the Solar Gen 2 Project Entity and has a nameplate capacity of 150 MW.

“Solar Gen 2 Project Entity” refers to SG2 Imperial Valley, LLC.

“Sponsors” refers, collectively, to First Solar and SunPower.

“Stateline Project” refers to the solar energy project located in San Bernardino, California that is held by the Stateline Project Entity and has a nameplate capacity of 300 MW.

“Stateline Project Entity” refers to Desert Stateline, LLC.

“Stateline Promissory Note” means the Promissory Note in the principal amount of $50.0 million issued by OpCo in favor of First Solar Asset Management, LLC, a wholly-owned subsidiary of First Solar, in connection with our acquisition of interests in the Stateline Project.

“SunPower” refers to SunPower Corporation, a corporation formed under the laws of the State of Delaware, in its individual capacity or to SunPower Corporation and its subsidiaries, as the context requires. Unless otherwise specifically noted, references to SunPower and its subsidiaries exclude us, the General Partner, Holdings and our subsidiaries, including OpCo.

“SunPower Capital” refers to SunPower Capital Services, LLC, a wholly owned subsidiary of SunPower.

“SunPower MSA” refers to the Management Services Agreement, dated as of June 24, 2015, as amended, among the Partnership, OpCo, the General Partner and SunPower Capital.

7

“SunPower Project Entities” refers to, collectively, the IPO SunPower Project Entities, the Henrietta Project Entity, the Hooper Project Entity, the Kern Project Entity and the Macy’s Maryland Project Entity.

“SunPower ROFO Agreement” refers to the Right of First Offer Agreement, dated as of June 24, 2015, as amended, by and between OpCo and SunPower.

“SunPower ROFO Projects” refers to, collectively, the projects set forth in the chart in Part I, Item 1, under the heading “Business—Our Portfolio—ROFO Projects” with SunPower listed as the Developing Sponsor and as to which we have a right of first offer under the SunPower ROFO Agreement should SunPower decide to sell them.

“SunPower Systems” refers to SunPower Corporation, Systems, a wholly owned subsidiary of SunPower.

“UC Davis Project” refers to the solar energy project located in Solano County, California, that is held by the UC Davis Project Entity and has a nameplate capacity of 13 MW.

“UC Davis Project Entity” refers to Solar Star California XXXII, LLC.

“U.S. GAAP” refers to U.S. generally accepted accounting principles.

“Utility Project Entities” refers to the Henrietta Project Entity, the Hooper Project Entity, the Kingbird Project Entities, the Lost Hills Project Entity, the Blackwell Project Entity, the Maryland Solar Project Entity, the North Star Project Entity, the Quinto Project Entity, the RPU Project Entity and the Solar Gen 2 Project Entity.

8

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give our current expectations, contain projections of results of operations or of financial condition or forecasts of future events. Words such as “could,” “will,” “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “project,” “budget,” “potential” or “continue” and similar expressions are used to identify forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this Annual Report on Form 10-K include our expectations of plans, strategies, objectives, growth and anticipated financial and operational performance. Forward-looking statements can be affected by assumptions used or by known or unknown risks or uncertainties.

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement, including industry data referenced elsewhere in this Annual Report on Form 10-K. We have chosen these assumptions or bases in good faith and believe that they are reasonable. However, when considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this Annual Report on Form 10-K. Actual results may vary materially. You are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include:

|

|

• |

changes in the capital markets or interest rate environment, including changes in market sentiment toward growth vehicles similar to us in general, which could impair our ability to raise capital, on terms that are economically acceptable to us, to fund future project acquisitions; |

|

|

• |

a failure to locate and acquire interests in additional attractive projects at favorable prices, or the inability to obtain adequate financing for such projects; |

|

|

• |

risks inherent in newly constructed solar energy projects, including underperformance relative to our expectations, system failures and outages; |

|

|

• |

an inability or decreased ability to acquire interests in projects until we pay in full the principal of and interest on the Stateline Promissory Note; |

|

|

• |

changes in U.S. federal, state, provincial and local laws, regulations, policies and incentives, including those related to taxation and environmental regulation; |

|

|

• |

the failure of our projects, including our Portfolio, or any project we may acquire, including any SunPower ROFO Project or any First Solar ROFO Project, to perform as we expect or, in the case of the ROFO Projects, to reach its commercial operation date; |

|

|

• |

the risk that our limited number of offtake counterparties will be unwilling or unable to fulfill their contractual obligations to us or that they otherwise terminate their agreements with us; |

|

|

• |

risks inherent in the operation and maintenance of solar energy projects; |

|

|

• |

the impairment or loss of any one or more of the projects in our Portfolio, such as the Henrietta Project, the Quinto Project, the Solar Gen 2 Project, the Stateline Project (interests in which we acquired on December 1, 2016), or any other projects in our Portfolio or that we may otherwise acquire; |

|

|

• |

the failure of a supplier to fulfill its warranty or other contractual obligations; |

|

|

• |

the failure of our Sponsors to fulfill their respective indemnification obligations under the Omnibus Agreement; |

|

|

• |

the inability of our projects to operate or deliver energy for any reason, including if interconnection or transmission facilities on which we rely become unavailable; |

|

|

• |

a natural disaster or other severe weather or meteorological conditions or other event of force majeure; |

|

|

• |

risks to our Sponsors and third party development companies relating to pricing under offtake agreements, project siting, financing, construction, permitting, the environment, governmental approvals and the negotiation of project development agreements, reducing opportunities available to us; |

|

|

• |

risks associated with our ownership or acquisition of projects that remain under construction; |

|

|

• |

terrorist or other attacks and responses to such acts; |

9

|

|

• |

liabilities and operating restrictions arising from environmental, health and safety laws and regulations; |

|

|

• |

risks associated with litigation and administrative proceedings; |

|

|

• |

a failure to comply with anti-corruption laws and regulations in the United States and elsewhere; |

|

|

• |

our inability to renew or replace expiring or terminated agreements, such as our offtake agreements, at favorable rates or on a long-term basis; |

|

|

• |

energy production by our projects or availability of our projects that does not satisfy the minimum obligations under our offtake agreements; |

|

|

• |

limits on OpCo’s ability to grow and make acquisitions because of its obligations under its limited liability company agreement to distribute available cash; |

|

|

• |

lower prices for fuel sources used to produce energy from other technologies, which could reduce the demand for solar energy; |

|

|

• |

risks inherent in the acquisition of existing solar energy projects; |

|

|

• |

substantial competition from utilities, independent power producers and other industry participants; |

|

|

• |

conflicts arising from our general partner’s or our Sponsors’ relationship with us; |

|

|

• |

increases in our tax liability; and |

|

|

• |

certain factors discussed elsewhere in this Annual Report on Form 10-K. |

Each forward-looking statement speaks only as of the date of the particular statement and we undertake no obligation to publicly update or revise any forward-looking statements except as required by law.

10

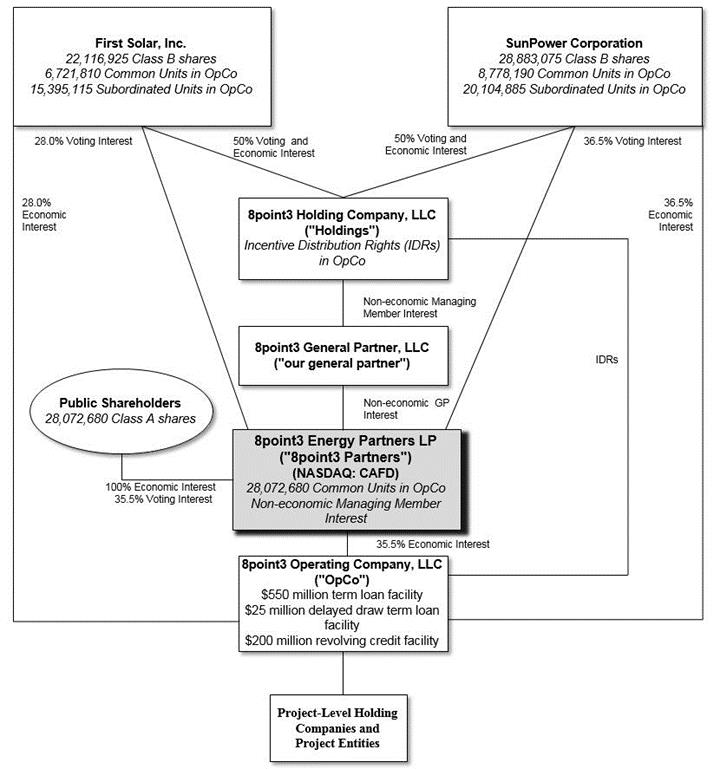

Overview

8point3 Energy Partners LP is a Delaware limited partnership formed on March 3, 2015, by our general partner, 8point3 General Partner, LLC, a wholly-owned subsidiary of 8point3 Holding Company, LLC (“Holdings”), a joint venture between First Solar, Inc. (“First Solar”) and SunPower Corporation (“SunPower” and collectively with First Solar, our “Sponsors”). We are a growth-oriented limited partnership formed to own, operate and acquire solar energy generation projects. On June 24, 2015, we completed our initial public offering (the “IPO”) of 20,000,000 Class A shares. Our Class A shares representing limited partner interests in 8point3 Energy Partners LP are traded on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “CAFD.” As of November 30, 2016, we owned a 35.5% limited liability interest in 8point3 Operating Company, LLC (“OpCo”), as well as a controlling non-economic managing member interest in OpCo. As of November 30, 2016, our Sponsors collectively own 51,000,000 Class B shares in the Partnership, with SunPower and First Solar owning 28,883,075 and 22,116,925 Class B shares, respectively, and together owning a noncontrolling 64.5% limited liability company interest in OpCo.

As of November 30, 2016, our Portfolio consisted of interests in 642 MW of solar energy projects. As of November 30, 2016, we owned interests in nine utility-scale solar energy projects, all of which are operational. As of November 30, 2016, we owned interests in four commercial and industrial (“C&I”) solar energy projects, two of which were operational and two of which were in late-stage construction, and a portfolio of residential DG Solar assets. Each utility-scale and C&I project in our Portfolio sells its energy output under long-term, fixed-price offtake agreements and our residential portfolios are comprised of solar installations which are leased to homeowners under a fixed monthly rate. Our operations comprise one reportable segment containing our Portfolio of solar energy projects. Please read Part II, Item 8. “Financial Statements and Supplementary Data—Notes to Consolidated Financial Statements—Note 16—Segment Information.”

Since November 30, 2015, we completed six acquisitions from our Sponsors, four from SunPower and two from First Solar. On January 26, 2016, we entered into an agreement with SunPower to acquire a controlling interest in a solar energy project located in Kern County, California that has an aggregate nameplate capacity of up to 21 MW (the “Kern Project”) that is being effectuated in four phases, of which three phases occurred on or before November 30, 2016. On March 31, 2016, we acquired from First Solar a controlling interest in a 40 MW photovoltaic solar energy project also located in Kern County, California (the “Kingbird Project”). On April 1, 2016, we acquired from SunPower a controlling interest in a 50 MW photovoltaic solar energy project located in Alamosa County, Colorado (the “Hooper Project”). On July 1, 2016, we acquired from SunPower a controlling interest in a solar energy project which holds roof-mounted solar photovoltaic systems with an aggregate system size of approximately 5 MW, which are being installed at certain Macy’s department stores in Maryland (the “Macy’s Maryland Project”). On September 29, 2016, we acquired from SunPower a 49.0% interest in a 102 MW photovoltaic solar generating facility located in Kings County, California (the “Henrietta Project”). On December 1, 2016, we acquired from First Solar a 34.0% interest in a 300 MW photovoltaic solar generating facility located in San Bernardino, California (the “Stateline Project”).

11

The following diagram depicts our simplified organizational and ownership structure as of November 30, 2016.

12

Our primary objective is to generate predictable cash distributions that grow at a sustainable rate. We intend to achieve this objective through the following strategies:

Own and operate long-term contracted solar generation assets

We believe that contracted solar energy projects generate predictable cash flows. Solar power is generally sold under long-term offtake agreements that require the purchaser to acquire the power that is produced by the solar energy project. The principal factor affecting the amount of power produced is the level of sunlight reaching the project, which is largely predictable over the long term. Solar energy systems generate most of their electricity during the time of peak demand, when energy from the sun is strongest. In addition, solar energy projects contain limited operational and technology risks given their modular nature and minimum number of moving parts, which results in relatively low, stable and predictable operations and maintenance (“O&M”) expenses. We intend to continue to own and operate long-term contracted solar energy systems as we grow our business and project portfolio over time.

Acquire assets in our target markets

We intend to pursue strategic opportunities to grow our company through acquisitions, primarily from our Sponsors, of long-term contracted solar energy projects that have commenced, or are close to commencing, commercial operations and that have characteristics similar to our Portfolio, including reliable technology with relatively stable cash flows. Under the ROFO Agreements with our Sponsors, our Sponsors are required until June 24, 2020 to offer us the opportunity to purchase their interests in certain solar energy projects should they seek to sell such interests to a third party. Approximately three-fourths of our ROFO Portfolio consists of utility-scale solar energy projects located in the United States, and our current focus is on acquiring domestic assets. As of November 30, 2016, the weighted average remaining life of the offtake agreements for the currently contracted projects in our ROFO Portfolio is over 20 years. In addition, we have in the past, and we intend in the future, to work with our Sponsors to make adjustments to our ROFO Portfolio to better align it with our targeted long-term growth plan. We believe that by making strategic adjustments to our ROFO Portfolio, we can maintain both a conservative capital structure and our long term distribution growth targets. In addition to making acquisitions from the ROFO Portfolio, we seek to acquire solar assets with similar long-term contracted cash flow profiles primarily from our Sponsors and in some cases from other third-party developers and owners of solar energy systems. Please read Part II, Item 8. “Financial Statements and Supplementary Data—Notes to Consolidated Financial Statements—Note 3—Business Combinations.”

Capitalize on our Sponsors’ leading solar O&M services

We benefit from our Sponsors’ vertically integrated business models across the solar value chain. We believe these business models enable our Sponsors to more effectively operate and maintain solar energy projects. Through various O&M agreements, each Sponsor, subject to oversight by the board of directors of our general partner, will continue to provide certain services to all but one of the contributed projects in our Portfolio, providing continuity and quality assurance of the O&M services.

Maintain a sound capital structure and financial flexibility

We and our subsidiaries have various financing structures in place, including through tax equity financing arrangements, term loans, revolving credit facilities and a promissory note. We believe that our cash flow profile and the long-term nature of our contracts provide flexibility for optimizing our capital structure to increase distributions. We intend to continually evaluate opportunities to finance future acquisitions or refinance our existing debt, including through limited recourse project-level financings, and seek to limit recourse, optimize leverage, extend maturities and increase cash distributions to Class A shareholders over the long term.

13

The following table provides an overview of the assets that comprise our portfolio (the “Portfolio”) as of November 30, 2016:

|

Project |

|

Location |

|

Commercial Operation Date(1) |

|

MW(ac) (2) |

|

|

Counterparty |

|

Counterparty Credit Rating / Avg. FICO Score |

|

Remaining Term of Offtake Agreement (in years)(3) |

|

||

|

Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland Solar |

|

Maryland |

|

February 2014 |

|

|

20 |

|

|

FirstEnergy Solutions |

|

CCC+ |

|

|

16.3 |

|

|

Solar Gen 2 |

|

California |

|

November 2014 |

|

|

150 |

|

|

San Diego Gas & Electric |

|

A |

|

|

23.0 |

|

|

Lost Hills Blackwell |

|

California |

|

April 2015 |

|

|

32 |

|

|

City of Roseville/Pacific Gas and Electric |

|

AA+ / BBB |

|

27.1(4) |

|

|

|

North Star |

|

California |

|

June 2015 |

|

|

60 |

|

|

Pacific Gas and Electric |

|

BBB |

|

|

18.6 |

|

|

RPU |

|

California |

|

September 2015 |

|

|

7 |

|

|

City of Riverside |

|

A- |

|

|

23.8 |

|

|

Quinto |

|

California |

|

November 2015 |

|

|

108 |

|

|

Southern California Edison |

|

BBB+ |

|

|

19.0 |

|

|

Hooper |

|

Colorado |

|

December 2015 |

|

|

50 |

|

|

Public Service Company of Colorado |

|

A- |

|

|

19.1 |

|

|

Kingbird |

|

California |

|

April 2016 |

|

|

40 |

|

|

Southern California Public Power Authority (5) |

|

AA- |

|

|

19.4 |

|

|

Henrietta |

|

California |

|

October 2016 |

|

|

102 |

|

|

Pacific Gas and Electric |

|

BBB |

|

|

19.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial & Industrial |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UC Davis |

|

California |

|

September 2015 |

|

|

13 |

|

|

University of California |

|

AA |

|

|

18.8 |

|

|

Macy's California |

|

California |

|

October 2015 |

|

|

3 |

|

|

Macy's Corporate Services |

|

BBB+ |

|

|

18.9 |

|

|

Macy’s Maryland |

|

Maryland |

|

December 2016 |

|

|

5 |

|

|

Macy's Corporate Services |

|

BBB+ |

|

|

20.0 |

|

|

Kern(6) |

|

California |

|

June 2017 |

|

|

13 |

|

|

Kern High School District |

|

AA |

|

|

19.9 |

|

|

Residential Portfolio |

|

U.S. – Various |

|

June 2014 |

|

|

39 |

|

|

Approx. 5,900 homeowners(7) |

|

765 Average / 680 Minimum(8) |

|

15.8(9) |

|

|

|

Total |

|

|

|

|

|

642(10) |

|

|

|

|

|

|

|

|

|

|

|

(1) |

For the Macy’s California Project, the Macy’s Maryland Project, and the Kern Project (as defined below), commercial operation date (“COD”) represents the first date on which all of the solar generation systems within each of the Macy’s California Project, the Macy’s Maryland Project and the Kern Project, respectively, have achieved or are expected to achieve COD. Please read Part II, Item 8. “Financial Statements and Supplementary Data—Notes to Consolidated Financial Statements—Note 3—Business Combinations—2016 Acquisitions” for further details on the Kern Project and the Macy’s Maryland Project. For the Residential Portfolio, COD represents the first date on which all of the residential systems within the Residential Portfolio have achieved COD. |

|

(2) |

The megawatts (“MW”) for the projects in which the Partnership owns less than a 100% interest or in which the Partnership is the lessor under any sale-leaseback financing are shown on a gross basis. |

|

(3) |

Remaining term of offtake agreement is measured from the later of November 30, 2016 or the expected COD of the applicable project. |

14

|

(5) |

The Kingbird Project is subject to two separate PPAs with member cities of the Southern California Public Power Authority. |

|

(6) |

OpCo’s acquisition of the Kern Project is being effectuated in four phases, with the closing of the first phase, reflecting a nameplate capacity of 3 MW, having occurred on January 26, 2016, the closing of the second phase, reflecting a nameplate capacity of 5 MW, having occurred on September 9, 2016, and the closing of the third phase, reflecting a nameplate capacity of 5 MW, having occurred on November 30, 2016. |

|

(7) |

Comprised of the approximately 5,900 solar installations located at homes in Arizona, California, Colorado, Hawaii, Massachusetts, New Jersey, New York, Pennsylvania and Vermont, that are held by SunPower Residential I, LLC (the “Residential Portfolio Project Entity”) and have an aggregate nameplate capacity of 39 MW. |

|

(8) |

Measured at the time of initial contract. |

|

(9) |

Remaining term is the weighted average duration of all of the residential leases, in each case measured from November 30, 2016. |

|

(10) |

The Stateline Project was acquired by the Partnership on December 1, 2016 and increased the size of our Portfolio to 942 MW. Please read “—ROFO Projects” and Part II, Item 8. “Financial Statements and Supplementary Data—Notes to Consolidated Financial Statements—Note 17—Subsequent Events” for further details. |

Tax Equity Financing

Most of our projects are financed using partnership structures with investors, known as tax equity investors, who can more efficiently monetize the value of the tax benefits, primarily Investment Tax Credits (“ITCs”) and accelerated depreciation that support solar energy projects in the United States. These partnership structures usually allocate tax and cash items disproportionately to the share of the project capital contributed by the tax equity investor and OpCo. These partnership structures are designed to effectively allocate project attributes (e.g., tax benefits, cash flows and residual value) to the party best suited to monetize the attributes. Often these partnerships are structured with allocations that change over time or as the tax equity investor realizes its projected return on investment and are known as “flip partnerships.” Partnership allocations vary by project based on specific project characteristics and investor preferences.

For each of the Solar Gen 2 Project, the Lost Hills Blackwell Project, the North Star Project and the Henrietta Project, a modified flip partnership structure was utilized that distributes available cash on the basis of 51% to the tax equity investor and 49% to OpCo.

The flip partnership structures employed on the Kern Project, the Kingbird Project, the Hooper Project, the Macy’s California Project, the Macy’s Maryland Project, the Quinto Project, the RPU Project and the UC Davis Project allocate a certain share of project cash flow to OpCo pursuant to the project-specific distribution waterfall applicable to the project. Pursuant to each of these distribution waterfalls, the tax equity investor is entitled to a monthly or quarterly amount of project cash flow until a specified “flip” point is achieved. After the “flip” point, the cash allocations to OpCo are expected to generally increase. In addition, upon reaching the flip point, OpCo has a right to purchase the tax equity investor’s interests in the project for an amount that is not less than its fair market value.

The Maryland Solar Project Entity has leased the Maryland Solar Project to an affiliate of First Solar, with the lease term expiring on December 31, 2019 (unless terminated earlier pursuant to its terms). Under the arrangement, First Solar’s affiliate is obligated to pay a fixed amount of rent that is set based on the expected operations of the plant. Upon expiration of this lease, we will directly benefit from the operating results of the Maryland Solar Project. Please read Part I, Item 1A. “Risk Factors—Risks Related to Our Project Agreements—We rely on a limited number of offtake counterparties and we are exposed to the risk that they are unwilling or unable to fulfill their contractual obligations to us or that they otherwise terminate their offtake agreements with us.”

Under these tax equity financing structures, a tax equity investor may be entitled to indemnification or to a diversion to it of distributable cash from a project in order to compensate the tax equity investor (i) for a breach of representation, warranty or covenant made to it in connection with its tax equity investment, (ii) for a reduction in or change in allocation of ITCs, tax basis, fair market value or other tax-related matters on which its investment was based or (iii) with respect to tax equity arrangements where the determination of the flip date is based on the tax equity investor achieving a target after-tax internal rate of return, for a delay in achieving the target return due to a change in federal tax law that results in a reduction in the applicable corporate tax rate (which could reduce the value of depreciation deductions), a reduction in available ITCs or a change to available depreciations deductions . Except for indemnification or diversion caused by OpCo or diversions resulting from corporate tax rate reductions, OpCo is entitled to indemnification under the Omnibus Agreement for payments made to a tax equity investor in respect of indemnification or diversion obligations that arise under clauses (i) or (ii) above.

15

Our Sponsors have granted us rights of first offer on certain of their solar energy projects that are currently contracted or are expected to be contracted prior to being sold, should our Sponsors decide to sell such projects before June 24, 2020. Our ROFO Agreements include assets similar to the projects in our Portfolio and represent interests in 1,200 MW capacity as of November 30, 2016. In the year ended November 30, 2016, we and our Sponsors agreed to make several adjustments to our ROFO Portfolio to better align it with our targeted long-term growth plan. We intend in the future to work with our Sponsors to continue to make adjustments to our ROFO Portfolio, including to remove projects that we do not intend to acquire at the time our Sponsors plan to offer them, as necessary to meet our objectives.

The following table provides a brief description of the ROFO Projects as of November 30, 2016:

|

Project |

|

Location |

|

COD(1) |

|

MW(ac)(2) |

|

|

Developing Sponsor |

|

Counterparty |

|

Counterparty Credit Rating / Avg. FICO Score |

|

Remaining Term of Offtake Agreement (years)(3) |

|

||

|

Utility ROFO Projects |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contracted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Boulder Solar 1 |

|

Nevada |

|

December 2016 |

|

|

100 |

|

|

SunPower |

|

Nevada Power Company d/b/a NV Energy |

|

BBB+ |

|

|

20.0 |

|

|

Stateline(4) |

|

California |

|

August 2016 |

|

|

300 |

|

|

First Solar |

|

Southern California Edison |

|

BBB+ |

|

|

19.8 |

|

|

Switch Station(5) |

|

Nevada |

|

September 2017 |

|

|

179 |

|

|

First Solar |

|

NV Power/ Sierra Pacific Power |

|

A/A |

|

|

20.0 |

|

|

El Pelicano(5) |

|

Chile |

|

November 2017 |

|

|

100 |

|

|

SunPower |

|

Metro de Santiago |

|

A+ |

|

|

15.0 |

|

|

Cuyama |

|

California |

|

December 2017 |

|

|

40 |

|

|

First Solar |

|

Pacific Gas and Electric |

|

BBB |

|

25.0(6) |

|

|

|

CA Flats |

|

California |

|

December 2018 |

|

|

280 |

|

|

First Solar |

|

Apple Energy LLC/ Pacific Gas and Electric |

|

AA+/ BBB |

|

|

20.0 |

|

|

C&I ROFO Projects |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contracted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Commercial Portfolio 1 |

|

U.S. – Various |

|

December 2013 |

|

|

45 |

|

|

SunPower |

|

Various |

|

|

|

14.3(7) |

|

|

|

Commercial Portfolio 2 |

|

U.S. – Various |

|

August 2016 |

|

|

49 |

|

|

SunPower |

|

Various(8) |

|

|

|

14.5(9) |

|

|

|

Commercial Portfolio 3 |

|

U.S. – Various |

|

March 2018 |

|

|

42 |

|

|

SunPower |

|

Various |

|

|

|

24.0(10) |

|

|

|

CU Boulder |

|

Colorado |

|

March 2016 |

|

|

1 |

|

|

SunPower |

|

The Regents of The University of Colorado |

|

AA |

|

|

25.0 |

|

|

Rancho California Water District |

|

California |

|

April 2016 |

|

|

4 |

|

|

SunPower |

|

Rancho California Water District |

|

AA+ |

|

|

25.0 |

|

|

Macy’s Connecticut |

|

Connecticut |

|

June 2016 |

|

|

1 |

|

|

SunPower |

|

Macy’s Corporate Services |

|

BBB+ |

|

|

20.0 |

|

|

Napa Sanitation District |

|

California |

|

December 2015 |

|

|

1 |

|

|

SunPower |

|

Napa Sanitation District |

|

AA- |

|

|

25.0 |

|

|

Macy's SDG&E |

|

California |

|

September 2016 |

|

|

2 |

|

|

SunPower |

|

Macy’s Corporate Services |

|

BBB+ |

|

|

20.0 |

|

|

Macy's Massachusetts |

|

Massachusetts |

|

October 2016 |

|

|

1 |

|

|

SunPower |

|

Macy’s Corporate Services |

|

BBB+ |

|

|

20.0 |

|

|

Riverside Public Utility District - Water Division |

|

California |

|

December 2016 |

|

|

6 |

|

|

SunPower |

|

Riverside Public Utility District - Water Division |

|

AA- |

|

|

25.0 |

|

|

UC Santa Barbara |

|

California |

|

December 2016 |

|

|

5 |

|

|

SunPower |

|

The Regents of The University of California |

|

AA |

|

|

20.0 |

|

|

Awarded(11) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California 1 (12) |

|

California |

|

June 2016 |

|

|

2 |

|

|

SunPower |

|

|

|

|

|

|

|

|

|

Alabama |

|

Alabama |

|

September 2016 |

|

|

8 |

|

|

SunPower |

|

|

|

|

|

|

|

|

|

Residential ROFO Portfolio |

|

U.S. – Various |

|

October 2014 |

|

|

34 |

|

|

SunPower |

|

Approx. 5,000 homeowners |

|

766 Average / 700 Minimum(13) |

|

17.2(14) |

|

|

|

Total |

|

|

|

|

|

1,200(4) |

|

|

|

|

|

|

|

|

|

|

|

|

16

|

(1) |

For each utility project that has yet to reach its COD, COD is the expected COD. For C&I projects that have yet to reach COD, COD represents the first date on which all of the solar generation systems within such project are expected to achieve COD. For C&I Projects that have attained COD and for our Residential ROFO Portfolio, COD represents the first date on which all of the solar generation systems or residential systems within such project or portfolio, as applicable, have achieved COD. |

|

(2) |

The MW for the projects in which our Sponsors own less than a 100% interest are shown on a gross basis. At or prior to COD of the projects subject to our ROFO Agreements, our Sponsors may enter into arrangements, often referred to as tax equity financing, with investors seeking to utilize the tax attributes of their projects which may result in a reduction of our expected economic ownership of such ROFO Project. These arrangements have multiple potential structures which have differing impacts on our economic ownership. Please read Part I, Item 1. “Business—Tax Equity Financing”. With respect to certain utility-scale projects, these arrangements may result in our expected economic ownership percentage of such project being not less than 45% at the time of purchase, unless approved by the Partnership. Our Sponsors are also permitted to sell a partial economic interest in any ROFO Project as part of a tax equity investment in such ROFO Project. In addition, the Sponsors may sell a portion of the equity in non-U.S. projects to development partners. |

|

(3) |

Remaining term of offtake agreement is measured from the later of November 30, 2016 or the expected COD of the applicable project. |

|

(4) |

Only 34% of the ownership of the Stateline Project was subject to the First Solar ROFO Agreement as of November 30, 2016. The Partnership acquired this 34% interest on December 1, 2016, which reduced the size of our ROFO Portfolio to 900 MW. Please read Part II, Item 8. “Financial Statements and Supplementary Data—Notes to Consolidated Financial Statements—Note 17—Subsequent Events” for further details. |

|

(5) |

SunPower has requested to remove the El Pelicano project from our ROFO Portfolio and First Solar has requested a waiver of the negotiation obligations with respect to a third-party sale of the Switch Station project. Such removal and waiver are subject to the approval of the board of directors of our General Partner and/or the conflicts committee. |

|

(6) |

Remaining term does not include one year of uncontracted merchant power prior to a 25-year PPA with PG&E starting in January 2019. |

|

(7) |

Remaining term is the weighted average duration of all of the commercial PPAs. The shortest remaining term is 12.2 years and the longest remaining term is 16.4 years. |

|

(8) |

This portfolio is partially contracted with a utility offtaker to assist such offtaker with its capacity requirements. |

|

(9) |

Remaining term is the weighted average duration of all of the commercial PPAs. The shortest remaining term is 12.5 years and the longest remaining term is 16.8 years. |

|

(10) |

Remaining term is the weighted average duration of all of the commercial PPAs. The shortest remaining term is 24.0 years and the longest remaining term is 25.0 years. |

|

(11) |

Awarded projects are projects that have been awarded by the offtake counterparty to the developing Sponsor and are expected to be contracted. |

|

(12) |

The California 1 Project has been cancelled. |

|

(13) |

Measured at the time of initial contract. |

|

(14) |

Remaining term is the weighted average duration of all of the residential leases. The shortest remaining term is 15.9 years and the longest remaining term is 17.9 years. |

Utility Projects

Typical Project Agreements

Our Utility Project Entities have entered into agreements that are customary for utility-scale solar energy projects. These include agreements for energy sales, interconnection, construction, equipment supply, O&M services, asset management services and real estate rights, among others. Our Utility Project Entities have also secured necessary and customary project permits.

Power Purchase Agreements. Our Utility Project Entities have entered into offtake agreements under which each Utility Project Entity generally receives a fixed price over the term of the offtake agreement with respect to 100% of its output, subject in some cases to annual escalations and/or time of delivery adjustments. Such offtake agreements are designed to provide a stable and predictable revenue stream.

17

Under our Utility Project Entities’ offtake agreements, each party typically has the right to terminate upon written notice ranging from ten to 60 days following the occurrence of an event of default that has not been cured within the applicable cure period, if any. In addition, following an uncured event of default under an offtake agreement by the applicable offtake counterparty, the applicable Utility Project Entity may withhold amounts due to such offtake counterparty, suspend performance, receive payment for damages and, in most cases, receive termination payments from the applicable offtake counterparty or pursue other remedies available at law or in equity. Events of default under these offtake agreements typically include:

|

|

• |

failure to pay amounts due; |

|

|

• |

bankruptcy proceedings; |

|

|

• |

failure to provide certain credit support; |

|

|

• |

failure to hold necessary licenses or permits; and |

|

|

• |

breach of material obligations. |

Our Utility Project Entities’ offtake agreements have certain availability or production requirements, and if such requirements are not met, then in some cases the applicable Utility Project Entity is required to pay the offtake counterparty a specified damages amount. In addition, such failure, in certain cases, may give the offtake counterparty a right to terminate the offtake agreement or reduce the contract quantity. Certain obligations (other than payment obligations) under our offtake agreements may be excused by force majeure events, and in some cases, the offtake agreement may be terminated if any such force majeure event continues for a continuous period of between 12 and 36 months (depending on the offtake agreement).

Interconnection Agreements. We depend on interconnection and transmission facilities owned and operated by third parties to deliver the energy from our utility projects. As such, our Utility Project Entities or their affiliates have entered into interconnection agreements with large regional utility companies, local distribution companies or independent system operators, which allow our projects to connect to the energy transmission system or, in some cases, to a distribution system. The interconnection agreements define the cost allocation and schedule for interconnection, as well as any upgrades required to connect the project to the transmission system or distribution system, as applicable.

Construction and Equipment Supply Agreements. Our Utility Project Entities have entered into construction agreements with qualified contractors and equipment supply agreements with industry leading suppliers, including our Sponsors. In addition to setting forth the terms and conditions of construction or equipment delivery, as applicable, our Utility Project Entities receive system-wide warranties and product warranties for the major equipment pursuant to these construction and equipment supply agreements (which vary in coverage and length by project).

O&M Agreements and Asset Management Agreements (“AMAs”). Our Utility Project Entities and certain other subsidiaries have entered into O&M agreements and AMAs with First Solar or SunPower affiliates, as applicable (except where such persons are otherwise subject to O&M agreements or AMAs with unaffiliated third parties). Under the terms of the O&M agreements and AMAs, such affiliates have agreed to provide a variety of operation, maintenance and asset management services, and certain performance warranties or availability guarantees, to our Utility Project Entities in exchange for fixed annual fees, which are subject to certain adjustments. For a detailed description of the terms of the O&M agreements and AMAs applicable to our projects, please read Part III, Item 13. “Certain Relationships and Related Transactions, and Director Independence.”

Real Estate Rights. Our Utility Project Entities and certain other subsidiaries have secured real property interests and access rights that we believe will allow our utility projects in our Portfolio to operate without material real estate claims until the expiration of the initial terms of applicable offtake agreements.

Our Utility Projects

Henrietta

The Henrietta Project Entity owns the 102 MW Henrietta Project. The Henrietta Project achieved commercial operation on October 1, 2016. Effective September 29, 2016, we indirectly control 100% of the class B membership interests in Parrey Holding Company, LLC (“Henrietta Holdings”), the indirect owner of 100% of the limited liability company membership interests of the Henrietta Project Entity. Such class B membership interests in Henrietta Holdings entitle us to a 49% economic interest and initially 1% of the tax allocations and the net income or loss of the Henrietta Project Entity. A subsidiary of Southern Company acts as the class A member of Henrietta Holdings. The class A member owns a 51% economic interest and initially 99% of the tax allocations and the net income or loss of the Henrietta Project Entity. After the Henrietta Project has been operational for approximately fifteen years, the allocation of tax-related items between the class A and class B members of Henrietta Holdings will shift to match the

18

economic interests. An affiliate of the class A member has managerial responsibilities, subject to the class A members’ and the class B members’ approval rights with respect to certain decisions, including expenditures in excess of budgeted amounts, certain sales of assets, execution, termination or amendment of certain contracts and the incurrence of debt. The Henrietta Project is located on leased property pursuant to a ground lease and ancillary beneficial easements executed on August 7, 2015, which provide the Henrietta Project Entity with an initial 31 years of site control and the ability to extend the lease term up to two additional five-year terms.

Hooper Project

The Hooper Project owns a 50 MW photovoltaic solar generating project located on an approximately 320 acre site owned by the Hooper Project Entity in Alamosa County, Colorado. The Hooper Project commenced operations in December 2015. Effective April 1, 2016, we indirectly control 100% of the class B membership interests in SSCO III Holding Company, LLC (“Hooper Holdings”), the indirect owner of 100% of the limited liability company membership interests of the Hooper Project Entity. The class A membership interests in Hooper Holdings are held by an affiliate of Wells Fargo & Company, who is a tax motivated project equity investor, and the class C membership interests in Hooper Holdings are held by an affiliate of SunPower. Distributions of cash flows from the Hooper Project are subject to a waterfall. Until the date (the “Hooper Flip Point”), which is the later of the date that the class A member’s effective after-tax internal rate of return equals 7.0% per annum and December 29, 2020, the class A member, the class B member and the class C member are entitled to approximately 15.78%, 84.14% and 0.08%, respectively, of any distributions in excess of a monthly preferred distribution payable to the tax equity investor. The preferred distribution is currently estimated to be approximately $1,973,500 per year. After the Hooper Flip Point, the preferred distribution will terminate and the class A member, the class B member and the class C member will be entitled to approximately 5.48%, 94.425% and 0.095%, respectively, of all distributions. Notwithstanding the foregoing, the terms of the operating agreement of Hooper Holdings provide that, in the event that the class A member has not achieved an effective after-tax internal rate of return of at least 7.0% per annum as of the date that is eight years after the closing of the transaction contemplated by the purchase and sale agreement, the priority distribution plus 25% of net cash flow in excess thereof shall be distributed to the class A member until the class A member achieves such after-tax internal rate of return.

SunPower Capital Services, LLC, a wholly owned subsidiary of SunPower (“SunPower Capital”), is the managing member of Hooper Holdings, and holds the class C membership interests in Hooper Holdings. The class A member and the class B member are not involved in the day-to-day management of Hooper Holdings or the Hooper Project; however, the managing member of Hooper Holdings is required to obtain the other members’ consent for certain customary major decisions concerning the Hooper Holdings and the Hooper Project as set forth in the Hooper Holdings operating agreement. Such major decisions subject to the approval of the class A member and/or the class B member include, for example, incurring indebtedness other than permitted indebtedness, encumbering project assets other than permitted encumbrances, selling project assets other than permitted sales, terminating material project documents under certain conditions, certain changes in method of accounting, merging and consolidating the projects and other such major actions. The class B member has the right to remove the managing member for convenience, and, with the approval of the class A member, install a new managing member.

Kingbird Project

The Kingbird Project Entities own a solar energy project with an aggregate nameplate capacity of 40 MW, which is located on two adjoining sites in Kern County, California. We indirectly own 100% of the class B membership interests in Kingbird Solar, LLC (“Kingbird Holdings”), the direct owner of 100% of the limited liability company membership interests of the Kingbird Project Entities. The class A membership interests in Kingbird Holdings are held by an affiliate of State Street Bank, who is a tax motivated project equity investor. Distributions of cash flows from the Kingbird Project are subject to a waterfall. Until the date (the “Kingbird Flip Point”), which is the later of the date that the class A member’s effective after-tax internal rate of return equals 6.5% per annum and April 30, 2021, the class A member and the class B member are entitled to 30% and 70%, respectively, of any distributions. After the Kingbird Flip Point, the class A member and the class B member will be entitled to 6.42% and 93.58%, respectively, of all distributions. Notwithstanding the foregoing, the terms of the operating agreement of Kingbird Holdings provide that, in the event that the class A member has not achieved an effective after-tax internal rate of return of at least 6.5% per annum as of the date that is ten years after the closing of the transaction contemplated by the purchase and sale agreement, 40% of cash flow shall be distributed to the class A member until the earlier of the class A member achieving such after-tax internal rate of return or the eleventh anniversary. If the class A member did not achieve an effective after-tax internal rate of return of at least 6.5% per annum by the eleventh anniversary, 50% of cash flow shall be distributed to the class A member until the earlier of the class A member achieving such after-tax internal rate of return or the twelfth anniversary. If the class A member did not achieve an effective after-tax internal rate of return of at least 6.5% per annum by the twelfth anniversary, 100% of cash flows shall be distributed to the class A member until the class A member achieves such after-tax internal rate of return.

FSAM Kingbird Solar Holdings, LLC is also the managing member of Kingbird Holdings. The class A member is not involved in the day-to-day management of Kingbird Holdings or the Kingbird Project; however, the managing member of Kingbird Holdings is

19

required to obtain the class A member’s consent for certain customary major decisions concerning the Kingbird Holdings and the Kingbird Project as set forth in the Kingbird Holdings operating agreement. Such major decisions subject to the approval of the class A member include, for example, incurring indebtedness other than permitted indebtedness, encumbering project assets other than permitted encumbrances, selling project assets other than permitted sales, terminating material project documents under certain conditions, certain changes in method of accounting, merging and consolidating the projects and other such major actions.

The Kingbird Project is situated on an approximately 324 acre site and consists of a leasehold interest governed by two lease agreements that runs for an initial term of 30 years from February 2, 2015, with an option to extend the lease term for up to two additional ten-year renewal periods at the discretion of the Kingbird Project Entities.

Lost Hills Blackwell

The Lost Hills Project Entity and the Blackwell Project Entity own the 20 MW Lost Hills Project and the 12 MW Blackwell Project, respectively, which are located on adjoining sites in Kern County, California. Commercial operation of the Lost Hills Blackwell Project occurred in April 2015. We indirectly own 100% of the class B membership interests in Lost Hills Blackwell Holdings, LLC (“Lost Hills Blackwell Holdings”), the indirect owner of 100% of the limited liability company membership interests of the Lost Hills Project Entity and the Blackwell Project Entity. Such class B membership interests entitle us to a 49% economic interest and currently 1% of the tax allocations and net income or loss of both the Lost Hills Project Entity and the Blackwell Project Entity. A subsidiary of Southern Company acts as the class A member. The class A member owns a 51% economic interest and currently 99% of the tax allocations and net income or loss of the Lost Hills Project Entity and the Blackwell Project Entity. After the Lost Hills Blackwell Project has been operational for approximately eleven years, the allocation of tax-related items between the class A and class B members of Lost Hills Blackwell Holdings is expected to shift to match the economic interests. An affiliate of Southern Company has managerial responsibilities for Lost Hills Blackwell Holdings and the project entities subject to the class A members’ and the class B members’ approval rights with respect to certain decisions, including expenditures in excess of budgeted amounts, certain sales of assets, execution, termination or amendment of certain contracts and the incurrence of debt. Each of the Lost Hills Project and the Blackwell Project consists of a leasehold interest governed by separate lease agreements, which include commonly leased areas for shared uses. The initial term of both leases commenced on July 17, 2014, and each lease runs for a term of 30 years with an option to renew for an additional 10 years at the discretion of the Lost Hills Project Entity and the Blackwell Project Entity.

Maryland Solar

The Maryland Solar Project Entity owns the 20 MW Maryland Solar Project. The Maryland Solar Project has been operational since February 2014. The Maryland Solar Project is subject to a lease between the Maryland Solar Project Entity and Maryland Solar Holdings, Inc., an affiliate of First Solar, that runs until December 31, 2019 (unless terminated earlier pursuant to its terms). The lease requires fixed rent payments and does not feature any purchase option exercisable by the lessee. The Maryland Solar Project consists of a leasehold interest governed by a single ground lease, which expires on December 31, 2032, with the option to renew for five additional years at the discretion of the Maryland Solar Project Entity and an additional right to renew for a subsequent term of another five years upon the mutual agreement of the Maryland Solar Project Entity and the land owner and approval by the Maryland Board of Public Works. Please read Part I, Item 1A. “Risk Factors—Risks Related to Our Project Agreements—We rely on a limited number of offtake counterparties and we are exposed to the risk that they are unwilling or unable to fulfill their contractual obligations to us or that they otherwise terminate their offtake agreements with us” and Part III, Item 13. “Certain Relationships and Related Transactions, and Director Independence—Maryland Solar Lease Agreement.”

North Star