Attached files

| file | filename |

|---|---|

| EX-10.7 - EX-10.7 - Rapid7, Inc. | d908531dex107.htm |

| EX-3.2 - EX-3.2 - Rapid7, Inc. | d908531dex32.htm |

| EX-10.13 - EX-10.13 - Rapid7, Inc. | d908531dex1013.htm |

| EX-10.6 - EX-10.6 - Rapid7, Inc. | d908531dex106.htm |

| EX-23.1 - EX-23.1 - Rapid7, Inc. | d908531dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 26, 2015.

Registration Statement No. 333-204874

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

RAPID7, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 7372 | 35-2423994 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

100 Summer Street Boston, Massachusetts 02110

Tel: (617) 247-1717

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Corey Thomas

President and Chief Executive Officer

Rapid7, Inc.

100 Summer Street

Boston, Massachusetts 02110

Tel: (617) 247-1717

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Nicole Brookshire, Esq. Richard Segal, Esq. Cooley LLP 500 Boylston Street Boston, Massachusetts 02116 (617) 937-2300 |

Christopher Austin, Esq. Orrick, Herrington & Sutcliffe LLP 51 West 52nd Street New York, New York 10019 (212) 506-5000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ¨ | Accelerated Filer ¨ | Non-accelerated Filer x | Smaller Reporting Company ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Securities Being Registered | Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||

| Common Stock, $0.01 par value per share |

$80,000,000 | $9,296 | ||

|

| ||||

|

| ||||

| (1) | In accordance with Rule 457(o) under the Securities Act of 1933, as amended, the number of shares being registered and the proposed maximum offering price per share are not included in this table. |

| (2) | Estimated solely for purposes of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes the offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (3) | Previously paid. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued , 2015

Shares

COMMON STOCK

Rapid7, Inc. is offering shares of its common stock. This is our initial public offering and no public market currently exists for our common stock. We anticipate that the initial public offering price of our common stock will be between $ and $ per share.

We have applied to list our common stock on the NASDAQ Global Market under the symbol “RPD.”

We are an “emerging growth company” under the U.S. federal securities laws and are subject to reduced public company reporting requirements. Investing in our common stock involves risks. See “Risk Factors” beginning on page 14.

PRICE $ A SHARE

| Price to |

Underwriting |

Proceeds to |

||||||||||

| Per Share |

$ | $ | $ | |||||||||

| Total |

$ | $ | $ | |||||||||

Entities affiliated with Technology Crossover Ventures have agreed to purchase $5.0 million of our common stock in a separate private placement concurrent with the completion of this offering at a price per share equal to the initial public offering price. The sale of such shares will not be registered under the Securities Act of 1933, as amended. The closing of this offering is not conditioned upon the closing of such concurrent private placement. The shares of common stock purchased in the concurrent private placement will not be subject to any underwriting discounts or commissions.

We have granted the underwriters the right to purchase up to an additional shares of our common stock to cover over-allotments.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our common stock to purchasers on , 2015.

| MORGAN STANLEY | BARCLAYS | |||||

| PACIFIC CREST SECURITIES | WILLIAM BLAIR | RAYMOND JAMES | COWEN AND COMPANY |

, 2015

Table of Contents

Table of Contents

Table of Contents

You should rely only on the information contained in this document and any free writing prospectus we provide to you. Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Through and including , 2015 (25 days after the date of this prospectus), all dealers that effect transactions in our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

For investors outside the United States: We have not and the underwriters have not done anything that would permit this offering, or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes and the information set forth under the sections titled “Risk Factors,” “Special Note Regarding Forward-Looking Statements,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case included in this prospectus. Unless the context otherwise requires, we use the terms “Rapid7,” “company,” “our,” “us,” and “we” in this prospectus to refer to Rapid7, Inc. and, where appropriate, our consolidated subsidiaries.

RAPID7, INC.

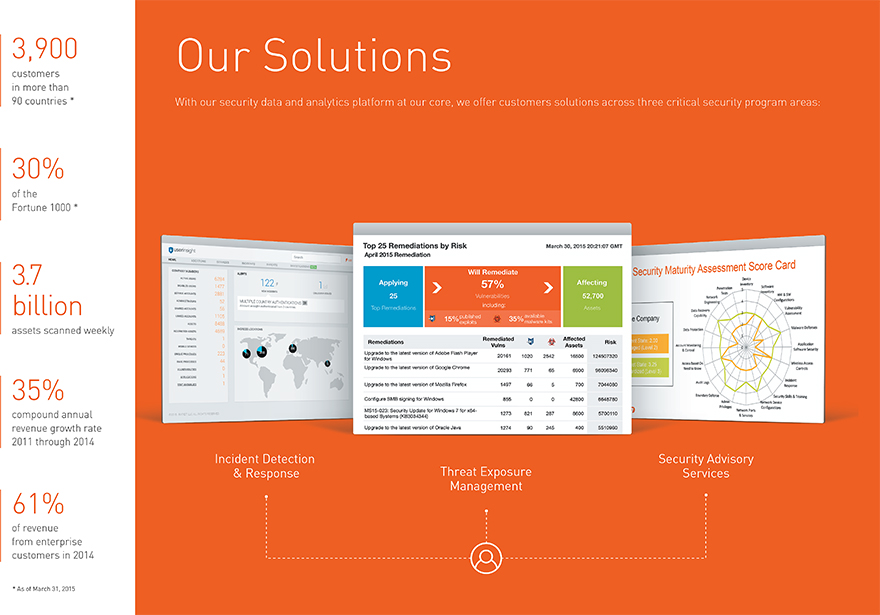

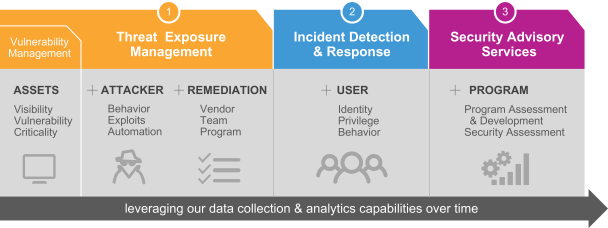

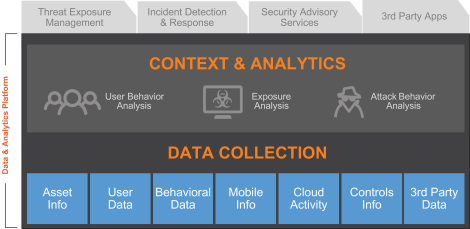

Rapid7 is a leading provider of security data and analytics solutions that enable organizations to implement an active, analytics-driven approach to cyber security. Our security data and analytics platform was purpose built for today’s increasingly complex and chaotic IT environment. We combine our extensive experience in security data and analytics and deep insight into attacker behaviors and techniques to make sense of the wealth of data available to organizations about their IT environments and users. There has been an explosion of increasingly sophisticated cyber attacks as the proliferation of mobile devices, cloud-based applications and solutions relying on user credentials has eliminated the boundaries that previously defined an organization’s network perimeter and expanded the threat surface that organizations must now defend. Our powerful and proprietary analytics enable organizations to contextualize and prioritize the threats facing their physical, virtual and cloud assets, including those posed by the behaviors of their users. Leveraging our security data and analytics platform, our solutions enable organizations to strategically and dynamically manage their cyber security exposure. Our solutions empower organizations to prevent attacks by providing visibility into vulnerabilities and to rapidly detect compromises, respond to breaches and correct the underlying causes of attacks. This balanced and analytics-focused approach ultimately better secures organizations’ environments and reduces the likelihood of, and risks associated with, cyber attacks. We believe our technology and solutions revolutionize the practice of cyber security and are central and critical to implementing a modern security program.

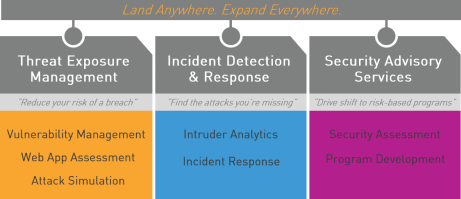

With our security data and analytics platform at our core, we are pioneering active, analytics-driven solutions to cyber security that enable organizations to find and eliminate critical weaknesses and detect attacks in their IT environments. Our threat exposure management offerings include our industry-leading vulnerability management products, which we enhance with deep security analytics capabilities to quickly deliver contextual risk prioritization, critical threat awareness and impactful remediation guidance. Similarly, we added analytics and automation to traditional manual penetration testing to be able to deliver robust ongoing attack simulation solutions that provide organizations with visibility into real-world threats. By providing and combining analytics and actionable insights related to both an organization’s attack surface and the dynamic threat landscape, our security data and analytics platform enables organizations to manage their threat exposure above and beyond traditional vulnerability management products on the market. Further leveraging our technology platform and analytics capabilities, we recently introduced our incident detection product to provide organizations with the ability to rapidly detect and respond to cyber security incidents and breaches. To complement our incident detection product, we also recently introduced our incident response services, which provide our customers with critical access to our security experts and experience, enabling them to accelerate incident response and containment. We also offer security advisory services that help organizations develop a holistic approach to their cyber security programs and advance their cyber security program maturity. All of our products have been designed with an intuitive user interface, focused on ease-of-use and fast time-to-value for our customers.

Cyber security has become a strategic imperative for organizations globally, driven by increased focus by boards of directors and senior management in the wake of numerous recent high profile breaches and data thefts. Organizations are increasingly at risk of being compromised, with the number of reported security incidents

1

Table of Contents

within enterprises increasing 48% in 2014 over the prior year, according to a report by PricewaterhouseCoopers LLP. There are three converging macro drivers that are changing the cyber security landscape for organizations and driving the increase in cyber breaches. First, mobile and connected devices, cloud-based applications and more open and interconnected networks have increased IT complexity, expanding the exploitable attack surface across an organization and resulting in more sources of potential vulnerability. Second, there has been a dramatic change in the tools available to cyber attackers. Attackers can now purchase highly effective and easy-to-use software at very low cost that is designed to circumvent traditional prevention-based tools, thereby lowering the bar for nearly anyone to launch advanced cyber attacks. Third, the economic motives for attackers are more compelling, with new, vibrant markets providing attackers an efficient and effective way to monetize stolen customer information and employee data.

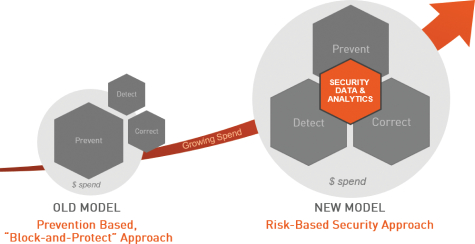

The confluence of these factors has rendered the old model of “block and protect” prevention-based cyber security programs ineffective. These traditional “block and protect” approaches to cyber security typically rely disproportionately on network perimeter protection tools such as firewalls and antivirus software to stop attackers. However, as the network perimeter rapidly disappears, the effectiveness of these legacy solutions diminishes greatly. Further, preventative solutions are generally not able to identify or deter attacks that involve stolen or weak credentials, which are used in 76% of cyber attacks according to the 2013 Verizon Data Breach Investigations Report. When an attacker gains access to an organization’s network through compromised credentials or otherwise, the attacker can freely exploit assets within the breached environment until they are detected, which took a median of 205 days in 2014 according to a report by Mandiant. The decreasing effectiveness of a traditional prevention-focused approach to cyber security is causing a significant shift to a new model that uses an active, analytics-driven approach to reduce and manage risks to the organization. This new model disrupts the historical focus on “block and protect” solutions and balances organizations’ investments in prevention, detection and correction to reduce the likelihood of, and risks associated with, cyber attacks. Effective implementation of this new model demands data and analytics to assess the effectiveness of tools and programs, identify attacker behaviors and prioritize and remediate exposures. Rapid7 empowers organizations to better secure their dynamic IT environments by providing the security data and analytics that are at the core of a holistic and active, analytics-driven approach to cyber security.

As of March 31, 2015, we had more than 3,900 customers, including over 30% of the organizations in the Fortune 1000. We have experienced strong revenue growth with revenue increasing from $31.0 million in 2011 to $76.9 million in 2014, representing a 35% compound annual growth rate. We have strong visibility to our revenue as 53% of the revenue recognized in 2014 was recorded on our balance sheet as deferred revenue as of December 31, 2013 and 85% of the revenue recognized in the first quarter of 2015 was recorded on our balance sheet as deferred revenue as of December 31, 2014. We incurred a net loss of $32.6 million in 2014 as we continued to invest for growth given our large market opportunity.

Industry Background

Increasing Cyber Security Breaches Driven by a Rapidly Evolving and Dynamic Threat Landscape

IT professionals face a rapidly evolving and dynamic threat landscape and an increasingly fragmented mosaic of security technology vendors offering point solutions to prevent specific threats and protect against specific attack vectors. Forced to make choices and allocate budgets with limited information, IT professionals are often left feeling overwhelmed. At the same time, threats continue to escalate due to three converging macro drivers:

Increasingly Complex IT Environment is Expanding Organizations’ Attack Surfaces. IT departments are required to deliver more applications faster, often in the cloud, in order to meet growing user demands for innovation and productivity tools. As a result, it has become increasingly difficult for IT departments to secure the increasing number of systems against the growing number of known security vulnerabilities. Increasing user empowerment has also led to an increase in the number of applications and devices that individual users can

2

Table of Contents

access with their credentials, which further expands the attack surface of an organization exposed to potential cyber criminals. Firewalls and other traditional prevention-based techniques are less capable of protecting this complex and expanded attack surface, leaving IT professionals overwhelmed by new threats and looking for new technologies and ways to respond.

Weaponized Malware Evades Traditional Prevention-Based Tools and Expands the Cyber Attacker Universe. There are sophisticated software toolkits and malware that can be used to launch a cyber attack, which are readily available online for free or at a low cost. These toolkits are specifically designed to circumvent the preventative security measures typically put in place by organizations, allowing cyber criminals with rudimentary IT knowledge to launch sophisticated attacks on enterprise users and networks. With this weaponized software, cyber attacks are no longer just the domain of advanced attackers, and the number of security breaches is rapidly increasing.

A Vibrant Cyber-Crime Economy Further Incents Cyber Attackers. Economic incentives for attackers continue to become more compelling, as new and vibrant black markets for stolen data, including credit card information, email account information and healthcare information, enable attackers to efficiently and effectively monetize stolen information. This more recent dynamic has led to a proliferation of data from successful attacks being offered for sale by cyber criminals, and the formation of a lucrative and growing underground economy.

Enterprise Security Shifting from Passive “Block and Protect” to Actively-Managed Security Programs

Organizations have traditionally taken a passive approach to cyber security, relying on deploying “block and protect” security tools aimed at thwarting attackers at the perimeter of the network. However, sophisticated software-enabled technologies and techniques are increasingly used by attackers to evade prevention-based security solutions. Additionally, the explosion of cloud-based applications and mobile devices accessing enterprise data are blurring the previously rigid lines that once defined enterprise network boundaries. Without these boundaries, prevention-based tools are easily circumvented by cyber criminals. Equally problematic for today’s organizations, traditional “block and protect” solutions are ineffective against cyber attacks using compromised user credentials. Many users have administrator-level credentials on their devices to maximize their productivity, but these credentials are relatively easily stolen and can be exploited by attackers in order to gain access to an organization’s network, assets and information. Use of stolen credentials in cyber attacks is becoming a significant issue, and once an attacker has gained access to an IT system with valid credentials, most prevention-based technologies cannot identify the threat. Without knowledge of a breach, IT professionals cannot react to limit the damage and attackers may have months to explore an organization’s network and steal critical data before being detected.

In light of high profile and costly security breaches, IT professionals are increasingly focused on developing comprehensive security programs to better protect their organizations against attacks. An actively-managed approach to an organization’s cyber security program improves the program’s overall effectiveness by focusing on analytics and an understanding of risks and threats in context. This approach further assists IT professionals in allocating security budgets to the specific tools that enable organizations to process and analyze significant amounts of data in real time to quickly identify, understand and react to attacks and breaches as they occur. Through security data and analytics, organizations can recognize behavior patterns associated with breaches, even if the attack vector is completely novel. The organization can then develop and improve its cyber security programs in order to reduce its exposures and better detect and respond to compromises using a holistic approach that balances investments in prevention, detection and correction. Analytics provides the critical context and prioritization to underlying security data to facilitate effective, informed and proactive decisions that allow for the systemic and dynamic management of security programs across each of these areas. An active, analytics-driven security program can prevent attacks through increased visibility into vulnerabilities, rapidly detecting and responding to compromises and correcting the underlying causes of attacks.

3

Table of Contents

Our Market Opportunity

According to Gartner, Inc., advanced targeted attacks make prevention-centric strategies obsolete. Securing enterprises in 2020 will require a shift to information- and people-centric security strategies, combined with pervasive internal monitoring and sharing of security intelligence. Accordingly, we believe that our market opportunity is large and growing and will be positively impacted by the ongoing shift in security spending from a traditional passive, “block and protect” approach to an active, analytics-driven approach to cyber security. Gartner, Inc. estimates that by 2020, 60% of enterprise information security budgets will be allocated for rapid detection and response approaches – up from less than 10% in 2014.

Our estimate, based on International Data Corporation data, is that the overall market for security data and analytics is a $12.6 billion opportunity in 2015. Included in our estimates are all or a portion of the markets for Security and Vulnerability Management, Network Intrusion Detection and Prevention, Endpoint Security Suites and Security Services. We believe that our market opportunity will grow as organizations continue to move away from prevention-based solutions and toward analytics-driven security environments.

Benefits of Our Solutions

We are a leading provider of security data and analytics solutions that enable organizations to implement an active, analytics-driven approach to cyber security. Key benefits of our solutions include:

| l | Decreased Risk of Security Breach. Our technology platform and solutions provide IT professionals with a complete view of their dynamic attack surface and automatically assess an organization’s vulnerabilities relative to the evolving threat landscape. We provide robust and relevant analytics and insight into attacker behaviors and techniques so that IT professionals are able to identify and prioritize risks effectively to reduce risks and ultimately create a more secure IT environment for their organization. |

| l | Enhanced Attack Preparedness. Our solutions allow our customers to test their defenses by simulating real-world attacks on their IT environments, using the same techniques and exploits as attackers. Our attack simulation solutions leverage our security data and analytics expertise as well as the insights from our community of thousands of active Metasploit users, who provide us with real-time, real-world insight into attacker behavior across the global IT attack surface. |

| l | Fast, Effective and Confident Intrusion Response. Our product offerings can help mitigate the impact of a breach by automatically identifying the root cause of a breach and providing clear and actionable insight into effective mitigation and correction. Our solutions provide timely, prioritized and clear analysis and instructions to IT professionals so that they can quickly, confidently and effectively respond to cyber security breaches. |

| l | A Continually Relevant and Effective Security Program. Our solutions are continually relevant as they evolve with, and react to, the dynamic threat landscape. Guided by our holistic approach balancing prevention, detection and correction solutions, we provide strategic, technology-agnostic guidance tailored to an organization’s security maturity and optimized to an organization’s IT environment. |

Our Competitive Strengths

We have developed the following key competitive advantages that we believe will allow us to maintain a leadership position in the market for security data and analytics:

| l | Automated Data Collection from the Endpoint to the Cloud. Our technology platform provides robust data collection capabilities across multiple data sources, from endpoint information, to user behaviors, to |

4

Table of Contents

| cloud activity. The platform collects data through an agentless architecture, which allows our platform to amass data from multiple sources quickly and without significant customer installation expertise. |

| l | Customer-Specific Security Analytics. Our technology platform collects and organizes data from each customer’s unique IT environment, which allows us to systemically and automatically profile the key risks specific to each customer. |

| l | Robust and Relevant Knowledge of Attacker Activity. We maintain the Metasploit open source framework, which is used to simulate attacks and test an organization’s defense against real-world threats. Our ties to the security research community through Metasploit provide us with real-time insight into new attacks and exploits. The size and accuracy of our exploit database and the speed at which our threat exposure management offerings are updated provides significant value to IT professionals looking to secure their networks in a dynamic and evolving threat environment. |

| l | Intuitive Product Design Focused on Speed to Insight. Our solutions are designed for ease-of-use by IT professionals, from the integration of our underlying technology platform to the clean user interface of our solutions. This enables our customers to develop actionable insights quickly and with limited training, providing them with a fast time-to-value. |

| l | Deep Security Domain Expertise Across Technology, Operations and People. We leverage our deep domain expertise in security data and analytics to better serve our customers, who frequently have limited ability to carry deep expertise in-house. We aim to serve as a trusted security advisor to our customers, encompassing a powerful combination of technology, services and operations expertise to support our customers’ success in managing their cyber security exposure. |

| l | User Behavior Analytics. Within our technology platform, our behavioral analytics tools and prioritization engine triangulate on the most important data to determine suspicious user behaviors and potentially compromised user credentials while reducing false signals and alerts. These powerful user-centric analytics allow IT professionals to make informed and proactive decisions about how to respond. |

Our Growth Strategy

Our mission is to deliver security data and analytics that revolutionize the practice of cyber security. Key elements of our growth strategy include:

| l | Drive New Customer Additions. We intend to continue to invest in building our global sales and go-to-market organizations, as we believe that most organizations with IT infrastructure would benefit from our products and services, regardless of size or industry. |

| l | Increase Customer Economics and Success. We have a dedicated customer success team focused on engagement and education to drive customer loyalty and increased purchases of our solutions. We believe that enterprise customers will increase their spending with us as they continue to shift their cyber security programs to security data and analytics-centric strategies. |

| l | Continue to Expand Internationally. We will continue to increase our international sales, service and support organizations to target additional sales across Europe and Asia and will also continue to expand our number of channel partners internationally. |

| l | Continue to Innovate with Our Products and Technology Platform. We plan to build upon our current performance and technology leadership in security data and analytics to enhance our technology platform and product capabilities. |

5

Table of Contents

| l | Serve as the Hub for Cyber Security. Our robust and comprehensive data collection capabilities, deep understanding of the attacker, analytics-driven approach and industry leadership through our Metasploit community position us to fundamentally change the way that organizations approach cyber security. We expect to continue to offer new analytics-based solutions for cyber security operations and that third-party application developers will continue to leverage our data collection and analytics capabilities. |

Selected Risks Affecting Our Business

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. These risks include, among others, the following:

| l | We are a rapidly growing company, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful. |

| l | If we are unable to sustain our revenue growth rate, we may not achieve or maintain profitability in the future. |

| l | If our products or professional services fail to detect vulnerabilities or incorrectly detect vulnerabilities, or if our products contain undetected errors or defects, our brand and reputation could be harmed, which could have an adverse effect on our business and results of operations. |

| l | We face intense competition in our market. |

| l | The market for our products and professional services is new and unproven and may not grow. |

| l | If we do not continue to innovate and offer products and professional services that address the dynamic threat landscape, we may not remain competitive, and our revenue and operating results could suffer. |

| l | Our business and operations are experiencing rapid growth, and if we do not appropriately manage our future growth, or are unable to scale our systems and processes, our operating results may be negatively affected. |

| l | We are subject to governmental export and import controls that could impair our ability to compete in international markets or subject us to liability if we are not in compliance with applicable laws. |

| l | Assertions by third parties of infringement or other violations by us of their intellectual property rights, whether or not correct, could result in significant costs and harm our business and operating results. |

| l | Concentration of ownership among our existing directors, executive officers and holders of 5% or more of our outstanding common stock may prevent new investors from influencing significant corporate decisions. |

Concurrent Private Placement

Entities affiliated with Technology Crossover Ventures have agreed to purchase $5.0 million of our common stock in a separate private placement concurrent with the completion of this offering at a price per share equal to the initial public offering price. The sale of such shares will not be registered under the Securities Act of 1933, as amended. The closing of this offering is not conditioned upon the closing of such concurrent private placement.

6

Table of Contents

Corporate Information

We were initially incorporated in July 2000 in Delaware. Rapid7 LLC, a limited liability company organized under the laws of the Commonwealth of Massachusetts, was formed in January 2004. In August 2004, pursuant to an exchange agreement among Rapid7 LLC and the stockholders of Rapid7, Inc., the stockholders exchanged their shares in Rapid7, Inc. for equity interests in Rapid7 LLC, after which Rapid7, Inc. was dissolved. In August 2008, Rapid7 LLC was merged with and into Rapid7 LLC, a newly-formed Delaware limited liability company. Rapid7, Inc. was reincorporated in Delaware in October 2011. In a series of transactions in November 2011, equity holders of Rapid7 LLC exchanged their equity interests in Rapid7 LLC for capital stock in Rapid7, Inc. and Rapid7 LLC became a wholly-owned subsidiary of Rapid7, Inc., which is the registrant and issuer of the shares of common stock in this offering.

Following this offering, our directors, executive officers and holders of more than 5% of our common stock, some of whom are represented on our board of directors, together with their affiliates will beneficially own % of the voting power of our outstanding capital stock.

Our principal executive offices are located at 100 Summer Street, Boston, Massachusetts. Our telephone number is (617) 247-1717. Our website address is www.rapid7.com. The information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock.

“Rapid7,” the Rapid7 logo, and other trademarks or service marks of Rapid7, Inc. appearing in this prospectus are the property of Rapid7, Inc. This prospectus contains additional trade names, trademarks and service marks of others, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| l | a requirement to have only two years of audited financial statements and only two years of related selected financial data and management’s discussion and analysis of financial condition and results of operations disclosure; |

| l | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; |

| l | an exemption from new or revised financial accounting standards until they would apply to private companies and from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation; |

| l | reduced disclosure about the emerging growth company’s executive compensation arrangements; and |

| l | no requirement to seek nonbinding advisory votes on executive compensation or golden parachute arrangements. |

7

Table of Contents

We may take advantage of some or all these provisions until we are no longer an emerging growth company. We will remain an emerging growth company until the earlier to occur of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenues of at least $1.0 billion or (c) in which we are deemed to be a “large accelerated filer” under the rules of the U.S. Securities and Exchange Commission, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

We are choosing to “opt out” of the provision of the JOBS Act that permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies and, as a result, we will comply with new or revised accounting standards as required when they are adopted. This decision to opt out of the extended transition period is irrevocable.

We have elected to adopt certain of the reduced disclosure requirements available to emerging growth companies. As a result of these elections, the information that we provide in this prospectus may be different than the information you may receive from other public companies in which you hold equity interests. In addition, it is possible that some investors will find our common stock less attractive as a result of these elections, which may result in a less active trading market for our common stock and higher volatility in our stock price.

8

Table of Contents

THE OFFERING

| Common stock offered by us |

shares |

| Common stock to be sold to entities affiliated with Technology Crossover Ventures |

shares |

| Common stock to be outstanding after this offering and the concurrent private placement |

shares |

| Over-allotment option |

We have granted the underwriters an option, exercisable for 30 days after the date of this prospectus, to purchase up to an additional shares from us to cover over-allotments. |

| Use of proceeds |

We estimate that we will receive net proceeds from this offering of approximately $ million, assuming an initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting the underwriter discounts and commissions and estimated offering expenses payable by us. Our net proceeds from the concurrent private placement will be $5.0 million. The principal purposes of this offering are to increase our financial flexibility, create a public market for our common stock, and facilitate our future access to the capital markets. We expect to use the net proceeds of this offering and the concurrent private placement for working capital and other general corporate purposes. We also intend to use $ million of the net proceeds to pay all remaining outstanding principal and interest, together with a termination fee, under our term loan with Silicon Valley Bank. Further, we may use a portion of the proceeds from this offering for acquisitions or strategic investments in complementary businesses or technologies, although we do not currently have any plans for any such acquisitions or investments. These expectations are subject to change. See “Use of Proceeds” for additional information. |

| Risk factors |

See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Proposed NASDAQ Global Market symbol |

“RPD” |

The number of shares of our common stock that will be outstanding after this offering and the concurrent private placement is based on shares of common stock outstanding as of March 31, 2015, and excludes:

| l | 4,006,962 shares of common stock issuable upon the exercise of options outstanding as of March 31, 2015, at a weighted-average exercise price of $5.44 per share; |

9

Table of Contents

| l | 200,000 shares of common stock issuable upon the exercise of warrants outstanding as of March 31, 2015, at an exercise price of $10.00 per share; |

| l | shares of our common stock reserved for future issuance pursuant to our 2015 Equity Incentive Plan, or 2015 Plan, which will become effective prior to the completion of this offering and will include provisions that automatically increase the number of shares of common stock reserved for issuance thereunder each year; and |

| l | shares of common stock reserved for future issuance under our 2015 Employee Stock Purchase Plan, which will become effective prior to the completion of this offering and will include provisions that automatically increase the number of shares of common stock reserved for issuance thereunder each year. |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| l | the conversion of all of our outstanding shares of our preferred stock into an aggregate of 16,382,615 shares of our common stock immediately prior to the closing of this offering; |

| l | additional shares of common stock to be issued upon the conversion of all of our outstanding shares of our Series D preferred stock immediately prior to the closing of this offering pursuant to provisions of our certificate of incorporation as currently in effect, assuming an initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, and which shares are referred to in this prospectus as the Additional Series D Conversion Shares; |

| l | shares of common stock to be issued and sold in the concurrent private placement to entities affiliated with Technology Crossover Ventures, assuming an initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus; |

| l | the filing and effectiveness of our amended and restated certificate of incorporation in Delaware and the adoption of our amended and restated bylaws, each of which will occur immediately prior to the completion of this offering; |

| l | no exercise of outstanding options or warrants after March 31, 2015; and |

| l | no exercise by the underwriters of their over-allotment option to purchase additional shares of our common stock. |

Additional Series D Conversion Shares

Holders of outstanding shares of our Series D preferred stock have the right to be issued additional shares of common stock upon the conversion of their shares of Series D preferred stock in an initial public offering, which we refer to as the Additional Series D Conversion Shares, regardless of the initial public offering price. The number of shares of our common stock to be issued as Additional Series D Conversion Shares depends on the initial public offering price of our common stock. Based on the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, we will issue Additional Series D Conversion Shares. For illustrative purposes only, the table below shows the number of Additional Series D Conversion Shares that would be issuable at various initial public offering prices, as well as the total number shares of our common stock that would be outstanding after this offering as a result:

| Assumed Initial Public Offering Price ($) |

Additional Series D Conversion Shares (#) |

Estimated Total Shares of Common

Stock |

10

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

We derived the summary consolidated statements of operations data for the years ended December 31, 2012, 2013 and 2014 from our audited consolidated financial statements included elsewhere in this prospectus. We derived the summary consolidated statement of operations data for the three months ended March 31, 2014 and 2015 and the summary consolidated balance sheet data as of March 31, 2015 from our unaudited financial statements included elsewhere in this prospectus. We have prepared the unaudited financial statements on the same basis as the audited financial statements, and the unaudited financial data include, in our opinion, all adjustments, consisting only of normal recurring adjustments, that we consider necessary for a fair presentation of our financial position and results of operations for these periods. Our historical results are not necessarily indicative of the results to be expected in the future.

When you read this summary consolidated financial data, it is important that you read it together with the historical consolidated financial statements and related notes to those statements, as well as “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included elsewhere in this prospectus.

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2014 | 2015 | ||||||||||||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||||||||||||

| Revenue: |

||||||||||||||||||||||||||||||

| Products |

$ | 29,414 | $ | 38,633 | $ | 47,030 | $ | 10,615 | $ | 13,645 | ||||||||||||||||||||

| Maintenance and support |

9,727 | 14,017 | 19,016 | 4,145 | 5,799 | |||||||||||||||||||||||||

| Professional services |

6,903 | 7,380 | 10,834 | 1,976 | 4,127 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total revenue |

46,044 | 60,030 | 76,880 | 16,736 | 23,571 | |||||||||||||||||||||||||

| Cost of revenue:(1) |

||||||||||||||||||||||||||||||

| Products |

1,691 | 4,048 | 4,557 | 1,239 | 1,546 | |||||||||||||||||||||||||

| Maintenance and support |

2,069 | 3,388 | 4,495 | 988 | 1,210 | |||||||||||||||||||||||||

| Professional services |

4,462 | 5,442 | 9,420 | 1,631 | 3,736 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total cost of revenue |

8,222 | 12,878 | 18,472 | 3,858 | 6,492 | |||||||||||||||||||||||||

| Operating expenses:(1) |

||||||||||||||||||||||||||||||

| Research and development |

17,820 | 21,411 | 25,570 | 6,120 | 6,414 | |||||||||||||||||||||||||

| Sales and marketing |

23,278 | 31,779 | 49,007 | 11,004 | 13,230 | |||||||||||||||||||||||||

| General and administrative |

9,436 | 12,586 | 12,972 | 3,482 | 4,053 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total operating expense |

50,534 | 65,776 | 87,549 | 20,606 | 23,697 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Loss from operations |

(12,712 | ) | (18,624 | ) | (29,141 | ) | (7,728 | ) | (6,618 | ) | ||||||||||||||||||||

| Interest income (expense), net |

(71 | ) | (122 | ) | (2,802 | ) | (695 | ) | (685 | ) | ||||||||||||||||||||

| Other income (expense), net |

(29 | ) | 43 | (305 | ) | 41 | (305 | ) | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Loss before income taxes |

(12,812 | ) | (18,703 | ) | (32,248 | ) | (8,382 | ) | (7,608 | ) | ||||||||||||||||||||

| Provision for (benefit from) income taxes |

(418 | ) | 170 | 379 | 96 | 74 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net loss |

(12,394 | ) | (18,873 | ) | (32,627 | ) | (8,478 | ) | (7,682 | ) | ||||||||||||||||||||

| Accretion of preferred stock to redemption value(2) |

(25,606 | ) | (33,553 | ) | (52,336 | ) | (12,178 | ) | (11,273 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net loss attributable to common stockholders |

$ | (38,000 | ) | $ | (52,426 | ) | $ | (84,963 | ) | $ | (20,656 | ) | $ | (18,955 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net loss per share attributable to common stockholders, basic and diluted(2) | $ | (3.09 | ) | $ | (4.18 | ) | $ | (6.65 | ) | $ | (1.62 | ) | $ | (1.50 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Weighted-average common shares outstanding, basic and diluted | 12,308,428 | 12,549,266 | 12,770,916 | 12,716,675 | 12,642,188 | |||||||||||||||||||||||||

| Pro forma net loss per share attributable to common stockholders, basic and diluted(3) | $ | $ | ||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||

| Pro forma weighted-average common shares outstanding, basic and diluted(3) | ||||||||||||||||||||||||||||||

11

Table of Contents

| (1) | Includes stock-based compensation expense and depreciation and amortization expense as follows: |

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2012 | 2013 | 2014 | 2014 | 2015 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| Stock-based compensation expense: |

||||||||||||||||||||

| Cost of revenue |

$ | 61 | $ | 67 | $ | 167 | $ | 39 | $ | 49 | ||||||||||

| Research and development |

375 | 426 | 499 | 120 | 144 | |||||||||||||||

| Sales and marketing |

293 | 249 | 496 | 119 | 115 | |||||||||||||||

| General and administrative |

991 | 1,305 | 997 | 250 | 267 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total stock-based compensation expense |

$ | 1,720 | $ | 2,047 | $ | 2,159 | $ | 528 | $ | 575 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Depreciation and amortization expense: |

||||||||||||||||||||

| Cost of revenue |

$ | 547 | $ | 1,107 | $ | 1,275 | $ | 291 | $ | 352 | ||||||||||

| Research and development |

406 | 649 | 1,093 | 217 | 241 | |||||||||||||||

| Sales and marketing |

444 | 675 | 1,396 | 294 | 371 | |||||||||||||||

| General and administrative |

132 | 200 | 376 | 76 | 170 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total depreciation and amortization expense |

$ | 1,529 | $ | 2,631 | $ | 4,140 | $ | 878 | $ | 1,134 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (2) | See Note (11) to our consolidated financial statements appearing elsewhere in this prospectus for further details on the calculation of accretion of preferred stock to redemption value and basic and diluted net loss per share attributable to common stockholders. |

| (3) | Pro forma basic and diluted net loss per share represents net loss divided by the pro forma weighted-average shares of common stock outstanding. Pro forma weighted-average shares outstanding reflects the conversion of all outstanding shares of preferred stock (using the if-converted method) into common stock as though the conversion had occurred on the first day of the relevant period or the original issuance date, if later. |

| As of March 31, 2015 | ||||||||||||

| Actual | Pro forma(1) |

Pro forma as adjusted(2)(3) |

||||||||||

| (in thousands) | ||||||||||||

| (unaudited) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash |

$ | 33,343 | $ | $ | ||||||||

| Working capital, excluding deferred revenue |

45,927 | |||||||||||

| Total assets |

79,382 | |||||||||||

| Total deferred revenue |

88,643 | |||||||||||

| Total debt |

17,009 | |||||||||||

| Total liabilities |

121,345 | |||||||||||

| Redeemable convertible preferred stock |

222,871 | |||||||||||

| Accumulated deficit |

(261,435 | ) | ||||||||||

| Total stockholders’ (deficit) equity |

(264,834 | ) | ||||||||||

(1) Pro forma consolidated balance sheet data reflects the automatic conversion of all outstanding shares of preferred stock into common stock immediately prior to the closing of this offering, including the Additional Series D Conversion Shares. See “Prospectus Summary—The Offering” for a description of the Additional Series D Conversion Shares as the number of Additional Series D Conversion Shares that will be issued depends on the initial public offering price of our common stock.

(2) Pro forma as adjusted consolidated balance sheet data reflects the pro forma items described immediately above plus (1) our sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us and shares of common stock in the concurrent private placement to entities affiliated with Technology Crossover

12

Table of Contents

Ventures at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus and (2) repayment of our outstanding term loan and the elimination of the related debt discount.

(3) Pro forma as adjusted consolidated balance sheet data is illustrative only and will change based on the actual initial public offering price and other terms of this offering determined at pricing. Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, would increase or decrease pro forma as adjusted cash, total assets and total stockholders’ (deficit) equity by approximately $ , assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting underwriting discounts and commissions payable by us, and assuming that the number of shares that we sell to entities affiliated with Technology Crossover Ventures in the concurrent private placement remains the same. We may also increase or decrease the number of shares we are offering. A 1,000,000 share increase or decrease in the number of shares offered by us would increase or decrease pro forma as adjusted cash, total assets and total stockholders’ (deficit) equity by approximately $ million, assuming that the assumed initial public offering price remains the same, and after deducting underwriting discounts and commissions payable by us, and assuming that the number of shares that we sell to entities affiliated with Technology Crossover Ventures in the concurrent private placement remains the same.

Key Metrics

We regularly monitor a number of financial and operating metrics in order to measure our current performance and estimate our future performance. For a description of how we calculate these financial and operating metrics as well as their uses, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Metrics.”

| Year End December 31, | Three Months Ended March 31, |

|||||||||||||||||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2014 | 2015 | ||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||||||||||||||

| Total revenue |

$ | 46,044 | $ | 60,030 | $ | 76,880 | $ | 16,736 | $ | 23,571 | ||||||||||||||||||||||||||||||

| Year-over-year growth |

49 | % | 30 | % | 28 | % | 23 | % | 41 | % | ||||||||||||||||||||||||||||||

| Operating cash flow |

$ | (691 | ) | $ | (613 | ) | $ | (3,356 | ) | $ | (2,139 | ) | $ | (3,012 | ) | |||||||||||||||||||||||||

| Deferred revenue |

$ | 44,728 | $ | 59,855 | $ | 85,056 | $ | 61,137 | $ | 88,643 | ||||||||||||||||||||||||||||||

| Number of customers |

2,255 | 2,733 | 3,733 | 2,860 | 3,902 | |||||||||||||||||||||||||||||||||||

13

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, before deciding whether to purchase shares of our common stock. If any of the following risks is realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business and Industry

We are a rapidly growing company, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

We are a rapidly growing company. Our ability to forecast our future operating results is subject to a number of uncertainties, including our ability to plan for and model future growth. We have encountered and will continue to encounter risks and uncertainties frequently experienced by growing companies in rapidly evolving industries. If our assumptions regarding these uncertainties, which we use to plan our business, are incorrect or change in reaction to changes in our markets, or if we do not address these risks successfully, our operating and financial results could differ materially from our expectations, our business could suffer and the trading price of our stock may decline.

If we are unable to sustain our revenue growth rate, we may not achieve or maintain profitability in the future.

From the year ended December 31, 2011 to the year ended December 31, 2014, our revenue grew from $31.0 million to $76.9 million, which represents a compounded annual growth rate of approximately 35%. Although we have experienced rapid growth historically and currently have high renewal rates, we may not continue to grow as rapidly in the future and our renewal rates may decline. Any success that we may experience in the future will depend in large part on our ability to, among other things:

| l | maintain and expand our customer base; |

| l | increase revenues from existing customers through increased or broader use of our products and professional services within their organizations; |

| l | improve the performance and capabilities of our products through research and development; |

| l | continue to develop our cloud-based solutions; |

| l | maintain the rate at which customers purchase our content subscriptions and maintenance and support; |

| l | continue to successfully expand our business domestically and internationally; and |

| l | successfully compete with other companies. |

If we are unable to maintain consistent revenue or revenue growth, our stock price could be volatile, and it may be difficult to achieve and maintain profitability. You should not rely on our revenue for any prior quarterly or annual periods as any indication of our future revenue or revenue growth.

14

Table of Contents

We have not been profitable historically and may not achieve or maintain profitability in the future.

We have posted a net loss in each year since inception, including net losses of approximately $12.4 million in 2012, $18.9 million in 2013, $32.6 million in 2014 and $7.7 million in the three months ended March 31, 2015. As of March 31, 2015, we had an accumulated deficit of $261.4 million. While we have experienced significant revenue growth in recent periods, we are not certain whether or when we will obtain a high enough volume of sales of our products and professional services to sustain or increase our growth or achieve or maintain profitability in the future. We also expect our costs to increase in future periods, which could negatively affect our future operating results if our revenue does not increase. In particular, we expect to continue to expend substantial financial and other resources on:

| l | research and development related to our offerings, including investments in our research and development team; |

| l | sales and marketing, including a significant expansion of our sales organization, both domestically and internationally; |

| l | continued international expansion of our business; |

| l | expansion of our professional services organization; and |

| l | general administration expenses, including legal and accounting expenses related to being a public company. |

These investments may not result in increased revenue or growth in our business. If we are unable to increase our revenue at a rate sufficient to offset the expected increase in our costs, our business, financial position and results of operations will be harmed, and we may not be able to achieve or maintain profitability over the long term. Additionally, we may encounter unforeseen operating expenses, difficulties, complications, delays and other unknown factors that may result in losses in future periods. If our revenue growth does not meet our expectations in future periods, our financial performance may be harmed, and we may not achieve or maintain profitability in the future.

If our products or professional services fail to detect vulnerabilities or incorrectly detect vulnerabilities, or if our products contain undetected errors or defects, our brand and reputation could be harmed, which could have an adverse effect on our business and results of operations.

If our products or professional services fail to detect vulnerabilities in our customers’ cyber security infrastructure, or if our products or professional services fail to identify and respond to new and increasingly complex methods of cyber attacks, our business and reputation may suffer. There is no guarantee that our products or professional services will detect all vulnerabilities, especially in light of the rapidly changing security landscape to which we must respond. Additionally, our products may falsely detect vulnerabilities or threats that do not actually exist. For example, our Metasploit offering relies on information provided by an active community of more than 45,000 security researchers as of April 2015, who contribute new exploits, attacks and vulnerabilities. If the information from these third parties is inaccurate, the potential for false indications of security vulnerabilities increases. These false positives, while typical in the industry, may impair the perceived reliability of our offerings and may therefore adversely impact market acceptance of our products and professional services and could result in negative publicity, loss of customers and sales and increased costs to remedy any problem.

Our products may also contain undetected errors or defects when first introduced or as new versions are released. We have experienced these errors or defects in the past in connection with new products and product upgrades and we expect that these errors or defects will be found from time to time in the future in new or enhanced products after commercial release. Defects may cause our products to be vulnerable to attacks, cause them to fail

15

Table of Contents

to detect vulnerabilities, or temporarily interrupt customers’ networking traffic. Any errors, defects, disruptions in service or other performance problems with our products may damage our customers’ business and could hurt our reputation. If our products or professional services fail to detect vulnerabilities for any reason, we may incur significant costs, the attention of our key personnel could be diverted, our customers may delay or withhold payment to us or elect not to renew or other significant customer relations problems may arise. We may also be subject to liability claims for damages related to errors or defects in our products. A material liability claim or other occurrence that harms our reputation or decreases market acceptance of our products may harm our business and operating results.

An actual or perceived security breach or theft of the sensitive data of one of our customers, regardless of whether the breach is attributable to the failure of our products or professional services, could adversely affect the market’s perception of our offerings and subject us to legal claims.

We face intense competition in our market.

The market for cyber security solutions is highly fragmented, intensely competitive and constantly evolving. We compete with an array of established and emerging security software and services vendors. With the introduction of new technologies and market entrants, we expect the competitive environment to remain intense going forward. Our competitors include: vulnerability management and assessment vendors, including Qualys and Tenable Network Security; diversified security software and services vendors, including McAfee (a subsidiary of Intel), IBM and HP; security services specialists, including Mandiant (a subsidiary of FireEye); and providers of point solutions that compete with some of the features present in our solutions.

Some of our actual and potential competitors have advantages over us, such as longer operating histories, significantly greater financial, technical, marketing or other resources, stronger brand and business user recognition, larger intellectual property portfolios and broader global distribution and presence. In addition, our industry is evolving rapidly and is becoming increasingly competitive. Larger and more established companies may focus on cyber security and could directly compete with us. Smaller companies could also launch new products and services that we do not offer and that could gain market acceptance quickly.

Our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or customer requirements. With the introduction of new technologies, the evolution of our offerings and new market entrants, we expect competition to intensify in the future. In addition, some of our larger competitors have substantially broader product offerings and can bundle competing products and services with other software offerings. As a result, customers may choose a bundled product offering from our competitors, even if individual products have more limited functionality than our solutions. These competitors may also offer their products at a lower price as part of this larger sale, which could increase pricing pressure on our offerings and cause the average sales price for our offerings to decline. These larger competitors are also often in a better position to withstand any significant reduction in capital spending, and will therefore not be as susceptible to economic downturns.

Furthermore, our current and potential competitors may establish cooperative relationships among themselves or with third parties that may further enhance their resources and product and services offerings in the markets we address. In addition, current or potential competitors may be acquired by third parties with greater available resources. As a result of such relationships and acquisitions, our current or potential competitors might be able to adapt more quickly to new technologies and customer needs, devote greater resources to the promotion or sale of their products and services, initiate or withstand substantial price competition, take advantage of other opportunities more readily or develop and expand their product and service offerings more quickly than we do. For all of these reasons, we may not be able to compete successfully against our current or future competitors.

16

Table of Contents

The market for our products and professional services is new and unproven and may not grow.

We believe our future success will depend in large part on the growth, if any, in the market for cyber security data and analytics. This market is nascent, and as such, it is difficult to predict important market trends, including the potential growth, if any. To date, the majority of enterprise spend on cyber security has been on threat protection products, such as network, endpoint and web security that are designed to stop threats from penetrating corporate networks. Organizations that use these security products may believe that their existing security solutions sufficiently protect access to their sensitive business data. Therefore, they may continue allocating their cyber security budgets to these products and may not adopt our products and professional services in addition to, or in lieu of, such traditional products. Further, sophisticated cyber attackers are skilled at adapting to new technologies and developing new methods of gaining access to organizations’ sensitive business data, and changes in the nature of advanced cyber threats could result in a shift in IT budgets away from products and professional services such as ours. In addition, while recent high visibility attacks on prominent enterprises and governments have increased market awareness of the problem of cyber attacks, if cyber attacks were to decline, or enterprises or governments perceived that the general level of cyber attacks have declined, our ability to attract new customers and expand our sale to existing customers could be materially and adversely affected. If products and professional services such as ours are not viewed by organizations as necessary, or if customers do not recognize the benefit of our offerings as a critical layer of an effective cyber security strategy, our revenue may not grow as quickly as expected, or may decline, and the trading price of our stock could suffer. It is therefore difficult to predict how large the market will be for our solutions.

In addition, it is difficult to predict customer adoption and renewal rates, customer demand for our products and professional services, the size and growth rate of the market for cyber security data analytics, the entry of competitive products or the success of existing competitive products. Any expansion in our market depends on a number of factors, including the cost, performance and perceived value associated with our offerings and those of our competitors. If these offerings do not achieve widespread adoption or there is a reduction in demand for solutions in our market caused by a lack of customer acceptance, technological challenges, competing technologies and products, decreases in corporate spending, weakening economic conditions, or otherwise, it could result in reduced customer orders, early terminations, reduced renewal rates or decreased revenue, any of which would adversely affect our business operations and financial results. You should consider our business and prospects in light of the risks and difficulties we encounter in this new and unproven market.

Forecasts of our market and market growth may prove to be inaccurate, and even if the markets in which we compete achieve the forecasted growth, there can be no assurance that our business will grow at similar rates, or at all.

Growth forecasts included in this prospectus relating to our market opportunity and the expected growth in the market for information and data security analytics are subject to significant uncertainty and are based on assumptions and estimates which may prove to be inaccurate. Even if these markets meet our size estimates and experience the forecasted growth, we may not grow our business at similar rates, or at all. Our growth is subject to many factors, including our success in implementing our business strategy, which is subject to many risks and uncertainties. Accordingly, the forecasts of market growth included in this prospectus should not be taken as indicative of our future growth.

Organizations may be reluctant to purchase cyber security data analytics offerings that are cloud-based due to the actual or perceived vulnerability of cloud solutions.

Some organizations have been reluctant to use cloud solutions for cyber security, such as UserInsight, because they have concerns regarding the risks associated with the reliability or security of the technology delivery model associated with this solution. If we or other cloud service providers experience security incidents, breaches of customer data, disruptions in service delivery or other problems, the market for cloud solutions as a whole may be negatively impacted.

17

Table of Contents

If we do not continue to innovate and offer products and professional services that address the dynamic threat landscape, we may not remain competitive, and our revenue and operating results could suffer.

The cyber security market is characterized by rapid technological advances, changes in customer requirements, frequent new product introductions and enhancements and evolving industry standards. Our success also depends on continued innovation to provide features that make our products and professional services responsive to the dynamic threat landscape. While we continue to invest significant resources in research and development in order to ensure that our products continue to address the cyber security risks that our customers face, the introduction of products and services embodying new technologies could render our existing products or services obsolete or less attractive to customers. In addition, developing new products and product enhancements is expensive and time consuming, and there is no assurance that such activities will result in significant cost savings, revenue or other expected benefits. If we spend significant time and effort on research and development and are unable to generate an adequate return on our investment, our business and results of operations may be materially and adversely affected. Further, we may not be able to successfully anticipate or adapt to changing technology or customer requirements or the dynamic threat landscape on a timely basis, or at all.

To date, we have derived a substantial majority of our revenue from customers using our threat exposure management offerings. If we are unable to renew or increase sales of our threat exposure management offerings, or if we are unable to increase sales of our other offerings, our business and operating results could be adversely affected.

Although we have recently introduced new products and professional services, we derive and expect to continue to derive a substantial majority of our revenue from customers using certain of our threat exposure management offerings, Nexpose and Metasploit. Approximately two-thirds of our revenue was attributable to Nexpose in each of the last three fiscal years. As a result, our operating results could suffer due to:

| l | any decline in demand for our threat exposure management offerings; |

| l | failure of our threat exposure management offerings to detect vulnerabilities in our customers’ IT environments; |

| l | the introduction of products and technologies that serve as a replacement or substitute for, or represent an improvement over, our threat exposure management offerings; |

| l | technological innovations or new standards that our threat exposure management offerings do not address; |

| l | sensitivity to current or future prices offered by us or competing solutions; and |

| l | our inability to release enhanced versions of our threat exposure management offerings on a timely basis in response to the dynamic threat landscape. |

Our inability to renew or increase sales of our threat exposure management offerings, including content subscriptions and maintenance and support, or a decline in prices of our threat exposure management offerings would harm our business and operating results more seriously than if we derived significant revenues from a variety of offerings. For example, our sales and marketing of our UserInsight product for incident detection and response is relatively new, and it is uncertain whether UserInsight will gain market acceptance. We are also investing heavily in the expansion of our security advisory services offerings, which we believe will help drive demand for our other products in addition to being a stand-alone service. Any factor adversely affecting sales of our products or professional services, including release cycles, market acceptance, competition, performance and reliability, reputation and economic and market conditions, could adversely affect our business and operating results.

18

Table of Contents

If Metasploit were to be used by attackers to exploit vulnerabilities in the cyber security infrastructures of third parties, our reputation and business could be harmed.