Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PBF Holding Co LLC | a8-kpbf6x24x15.htm |

PBF Logistics LP (NYSE: PBFX) Credit Suisse MLP and Energy Logistics Conference June 24, 2015

2 Safe Harbor Statements This presentation contains forward-looking statements made by PBF Logistics LP, PBF Energy Inc. and PBF Holding Company LLC (together, the “Companies”, or “PBFX” or “PBF”) and their management teams. Such statements are based on current expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are based on information available at the time, and are subject to various risks and uncertainties that could cause the Companies’ actual performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products; the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics infrastructure; effects of litigation and government investigations; the timing and announcement and successful closing of any potential acquisitions (including the acquisition of Chalmette Refining, L.L.C.) and subsequent impact of any future acquisitions on our capital structure, financial condition or results of operations; changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business or industry, including any lifting by the federal government of the restrictions on exporting U.S. crude oil; actions taken or non-performance by third parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other labor interruptions; operating hazards, natural disasters, weather- related delays, casualty losses and other matters beyond our control; inability to complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; inability to successfully integrate acquired refineries or other acquired businesses or operations; effects of existing and future laws and governmental regulations, including environmental, health and safety regulations; and, various other factors. Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Companies assume no responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information after such date.

3 PBF Logistics launched in May 2014 Market capitalization of ~$800 million(1) PBF Energy owns ~54% of PBFX, 100% of the GP and IDRs Revenues supported by long-term agreements with minimum volume commitments (MVCs) 100% of forecast revenues generated by MVCs No direct commodity exposure Revenues generated by a mixture of assets including pipeline, storage, truck loading and unloading facilities and rail unloading facilities Focused on growing through third-party acquisitions, additional drop-down transactions and organic projects Significant portfolio of logistics assets retained at PBF that support refinery operations PBF Logistics LP Overview (NYSE: PBFX) ___________________________ 1. As of 6/22/2015

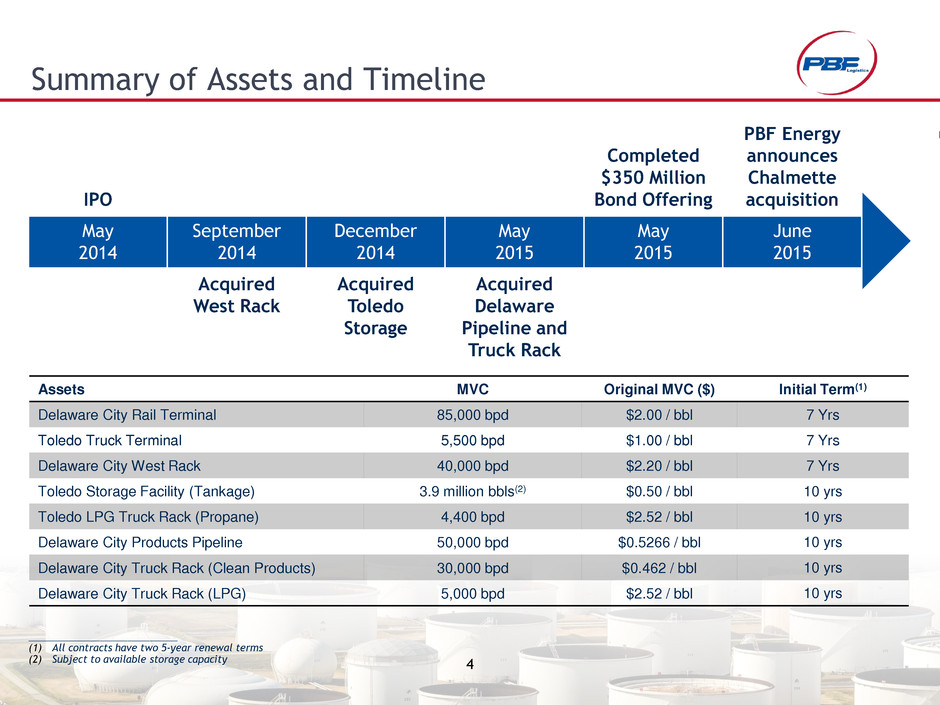

4 Summary of Assets and Timeline Assets MVC Original MVC ($) Initial Term(1) Delaware City Rail Terminal 85,000 bpd $2.00 / bbl 7 Yrs Toledo Truck Terminal 5,500 bpd $1.00 / bbl 7 Yrs Delaware City West Rack 40,000 bpd $2.20 / bbl 7 Yrs Toledo Storage Facility (Tankage) 3.9 million bbls(2) $0.50 / bbl 10 yrs Toledo LPG Truck Rack (Propane) 4,400 bpd $2.52 / bbl 10 yrs Delaware City Products Pipeline 50,000 bpd $0.5266 / bbl 10 yrs Delaware City Truck Rack (Clean Products) 30,000 bpd $0.462 / bbl 10 yrs Delaware City Truck Rack (LPG) 5,000 bpd $2.52 / bbl 10 yrs ___________________________ (1) All contracts have two 5-year renewal terms (2) Subject to available storage capacity IPO Completed $350 Million Bond Offering PBF Energy announces Chalmette acquisition May 2014 September 2014 December 2014 May 2015 May 2015 June 2015 Acquired West Rack Acquired Toledo Storage Acquired Delaware Pipeline and Truck Rack

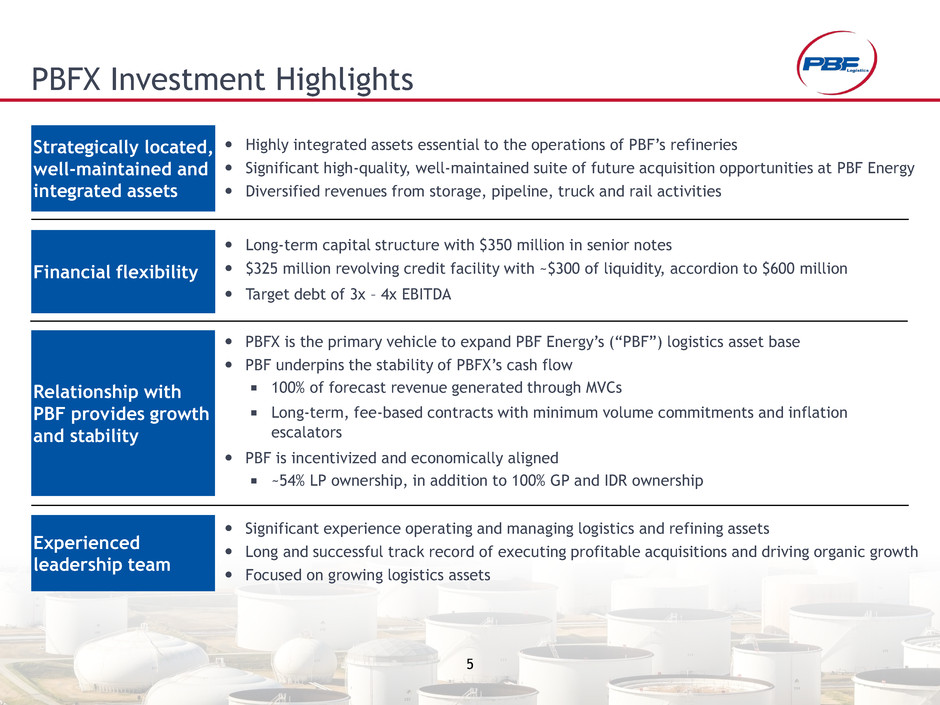

5 PBFX Investment Highlights PBFX is the primary vehicle to expand PBF Energy’s (“PBF”) logistics asset base PBF underpins the stability of PBFX’s cash flow 100% of forecast revenue generated through MVCs Long-term, fee-based contracts with minimum volume commitments and inflation escalators PBF is incentivized and economically aligned ~54% LP ownership, in addition to 100% GP and IDR ownership Strategically located, well-maintained and integrated assets Highly integrated assets essential to the operations of PBF’s refineries Significant high-quality, well-maintained suite of future acquisition opportunities at PBF Energy Diversified revenues from storage, pipeline, truck and rail activities Financial flexibility Long-term capital structure with $350 million in senior notes $325 million revolving credit facility with ~$300 of liquidity, accordion to $600 million Target debt of 3x – 4x EBITDA Experienced leadership team Significant experience operating and managing logistics and refining assets Long and successful track record of executing profitable acquisitions and driving organic growth Focused on growing logistics assets Relationship with PBF provides growth and stability

6 0.30* 0.30 0.33 0.35 0.26 0.28 0.30 0.32 0.34 0.36 0.38 Q2-14 Q3-14 Q4-14 Q1-15 Di st / L P U n it ( $ ) PBFX Delivering Growth 5.8* 10.2 16.7 19.2 0.00 5.00 10.00 15.00 20.00 25.00 Q2-14 Q3-14 Q4-14 Q1-15 Di strib u ta b le C a sh Flow ( $ mil li o ns ) (MQD) (MQD) *Represents the minimum quarterly distribution (MQD) for Q2-14, actual distribution of $0.16 equal to prorated MQD based on May 14, 2014 IPO *Values for Q2-14 prorated from May 14, 2014 to June 30, 2014

7 PBF Energy Company Profile Market capitalization of ~$3.0 billion (1) Ba3 / BB- credit ratings Oil refineries in Ohio, Delaware, New Jersey and the pending Louisiana acquisition(2) Aggregate throughput capacity of ~729,000 bpd Weighted-average Nelson Complexity of 11.7(3) Flexible crude sourcing options for procuring the most economic domestic and international crudes Geographically diverse operations across three PADDs PBF's core strategy is to grow and diversify through acquisitions PBF indirectly owns 100% of the general partner and ~54% of the limited partner interest of PBF Logistics LP (NYSE: PBFX) PBFX market capitalization of ~$800 million(1) ___________________________ 1. As of 6/19/15 2. Pending successful closing of the announced transaction to acquire Chalmette Refining LLC 3. Represents weighted average Nelson Complexity for PBF’s four(2) refineries Paulsboro Delaware City Toledo Refinery Region Capacity (bpd) Delaware City PADD 1 190,000 Chalmette(2) PADD 3 189,000 Paulsboro PADD 1 180,000 Toledo PADD 2 170,000 Combined 729,000 Chalmette

8 PBF Energy’s Strengths as a Sponsor Financial Conservative financial profile with strong liquidity and access to capital markets PBF / PBFX have entered into long-term, fee-based contracts with minimum volume commitments and inflation escalators Substantial economic interest in PBFX Operational Significant acquisition experience Long history of operating logistics and refining assets Excellent safety record; early adopter of rail safety initiatives Strategic PBFX’s assets are critical to PBF’s refineries Continually evaluating growth and optimization projects PBFX provides PBF with vehicle to grow platform and enhance investor returns

9 Robust Drop-down Inventory Retained at PBF Significant growth potential through future drop- downs of logistics infrastructure retained by PBF Energy Approximately $200 million of drop-down EBITDA remaining at PBF Energy Additional potential drop-down inventory available at the Chalmette Refinery(1) East Coast Storage Facilities 10.0 million bbls at Delaware City 7.5 million bbls at Paulsboro Multiple marine terminals Adds future export optionality Refined products pipeline and heavy crude oil terminal Additional truck racks, rail terminals and LPG loading/unloading facilities ___________________________ 1. Pending successful closing of the announced transaction to acquire Chalmette Refining LLC

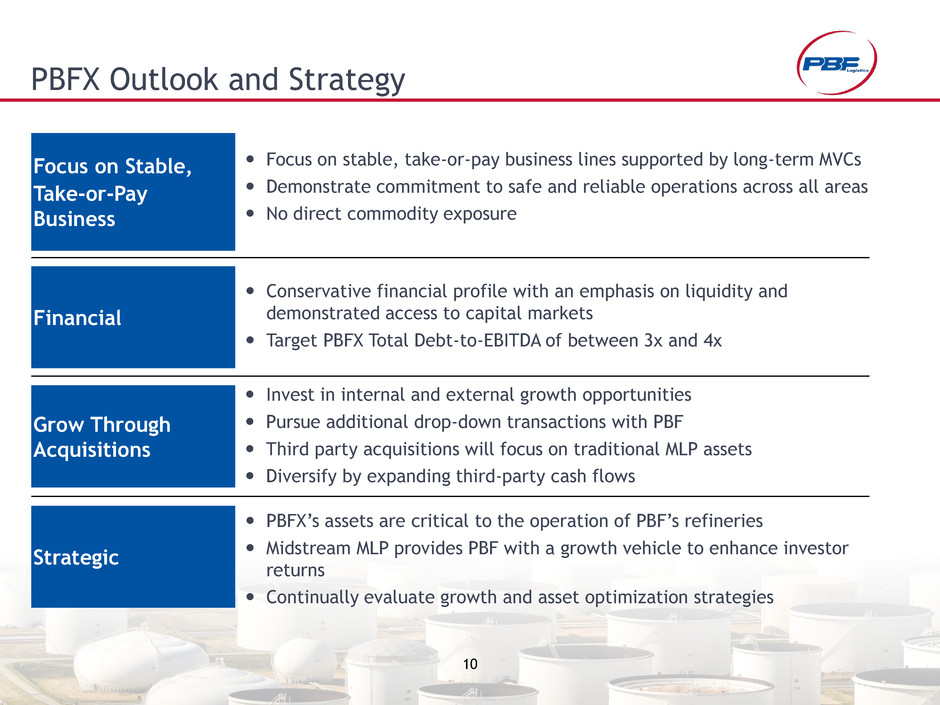

10 PBFX Outlook and Strategy Focus on Stable, Take-or-Pay Business Focus on stable, take-or-pay business lines supported by long-term MVCs Demonstrate commitment to safe and reliable operations across all areas No direct commodity exposure PBFX’s assets are critical to the operation of PBF’s refineries Midstream MLP provides PBF with a growth vehicle to enhance investor returns Continually evaluate growth and asset optimization strategies Financial Strategic Grow Through Acquisitions Invest in internal and external growth opportunities Pursue additional drop-down transactions with PBF Third party acquisitions will focus on traditional MLP assets Diversify by expanding third-party cash flows Conservative financial profile with an emphasis on liquidity and demonstrated access to capital markets Target PBFX Total Debt-to-EBITDA of between 3x and 4x

Appendix

12 Non-GAAP Financial Measures Our management uses EBITDA (earnings before interest, income taxes, depreciation and amortization) as a measure of operating performance to assist in comparing performance from period to period on a consistent basis and to readily view operating trends, as a measure for planning and forecasting overall expectations and for evaluating actual results against such expectations, and in communications with our board of directors, creditors, analysts and investors concerning our financial performance. EBITDA is not a presentation made in accordance with GAAP and our computation of EBITDA may vary from others in our industry. EBITDA should not be considered as an alternative to operating income or net income as measures of operating performance. In addition, EBITDA is not presented as, and should not be considered, an alternative to cash flows from operations as a measure of liquidity. EBITDA also has limitations as an analytical tool and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP.

13 PBFX 2015 Guidance Guidance provided constitutes forward-looking information and is based on current PBF Logistics operating plans, assumptions and configuration. All figures are subject to change based on market and macroeconomic factors, as well as management’s strategic decision-making and overall Partnership performance ($ in millions) FY 2015 (Initial Guidance) Q1 2015 (Actual) FY 2015 (Revised Guidance Q1 actual + Estimates) Revenues $122.0 $31.0 $135.3 Operating expenses $35.0 $7.5 $36.4 SG&A $10.5 $3.0 $11.6 D&A $5.8 $1.4 $6.2 Interest expense, net $8.5 $1.8 $19.5 Maintenance capital expenditures $5.2 $0 $5.2 Leverage target 3x-4x EBITDA 3x-4x EBITDA Units outstanding(1) 33.0 million 33.0 million 34.8 million • All figures are based on actual results and estimates based on minimum volume commitments under existing long-term agreements ___________________________ 1. Units outstanding figure represents the fully-diluted number of units issued during the IPO, subsequent transactions and under partnership compensation programs outstanding at 6/1/15

14 23 - mile, 16” interstate petroleum products pipeline with ~125,000 bpd of throughput capacity Transports refined products (gasoline, ULSD and heating oil) from the Delaware City Refinery to Sunoco Logistics’ Twin Oaks pump station in Delaware County, PA Access to Sunoco Logistics’ Northeast Pipeline systems serving New York and Buckeye’s Laurel Pipeline serving Western Pennsylvania In the future, activities could be expanded to include distribution of jet fuel and kerosene Revenue is secured through a ten-year contractual agreement with PBF which includes MVCs MVC = 50,000 bpd MVC payments: $0.5266 per barrel injected Annual maintenance capex is ~$0.5 million Delaware City Products Pipeline

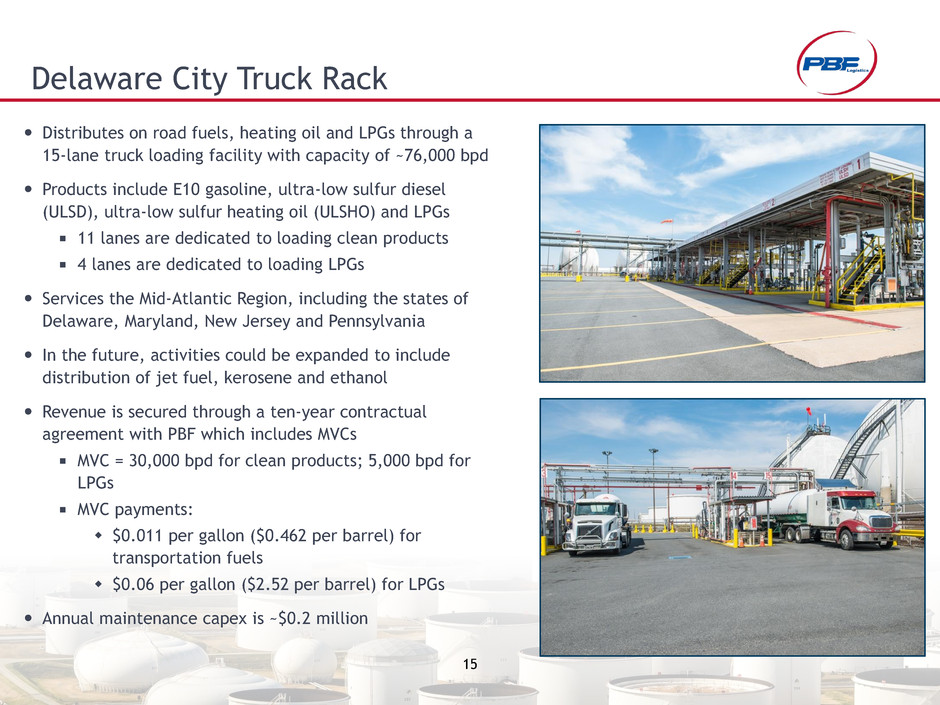

15 Distributes on road fuels, heating oil and LPGs through a 15-lane truck loading facility with capacity of ~76,000 bpd Products include E10 gasoline, ultra-low sulfur diesel (ULSD), ultra-low sulfur heating oil (ULSHO) and LPGs 11 lanes are dedicated to loading clean products 4 lanes are dedicated to loading LPGs Services the Mid-Atlantic Region, including the states of Delaware, Maryland, New Jersey and Pennsylvania In the future, activities could be expanded to include distribution of jet fuel, kerosene and ethanol Revenue is secured through a ten-year contractual agreement with PBF which includes MVCs MVC = 30,000 bpd for clean products; 5,000 bpd for LPGs MVC payments: $0.011 per gallon ($0.462 per barrel) for transportation fuels $0.06 per gallon ($2.52 per barrel) for LPGs Annual maintenance capex is ~$0.2 million Delaware City Truck Rack

16 Storage facility and LPG truck rack serve Toledo refinery’s operations and product distribution activities Services include: Crude oil and product storage Propane truck loading 30 tanks with total shell capacity of ~3.9 million barrels Crude – 7 tanks with ~1.3 million barrels of capacity Includes recently commissioned ~450,000 barrel crude storage tank Products – 23 tanks with ~2.6 million barrels of capacity Includes ~17.5 thousand barrels of propane storage capacity Toledo Storage Facility and LPG Truck Rack Revenue secured through ten-year agreement with minimum volume commitments (MVCs) $0.50 per barrel/month of available shell capacity $2.52 per barrel for propane storage and throughput MVC of 4,400 barrels per day Annual maintenance capital expenditures of ~$3.0 million

17 Delaware City Heavy Crude Unloading Rack “West Rack” - heavy crude oil rail unloading terminal Current discharge capacity: 40,000 bpd Unit-train capable, steam and nitrogen equipped to unload heavy crude oil and bitumen Construction completed and in-service in August 2014 Primarily supplies cost-advantaged, heavy crude oil and bitumen from Western Canada Revenue secured through seven-year agreement with minimum volume commitments (MVCs) $2.20 per barrel unloading fee up to MVC, $1.50 per barrel unloading fee above the MVC MVC of 40,000 bpd Annual maintenance capital expenditures of ~$1.25 million

18 Toledo Truck Terminal 15,000 bpd truck crude unloading facility Services PBF’s 170,000 bpd Toledo refinery Primarily receives locally-gathered, cost-advantaged crude oil Potential for growth through increased production in nearby shale basins, including Utica Shale in Ohio and New Albany Shale in Illinois Newly constructed assets Assets placed into service: Dec. 2012 – June 2014 Revenue secured through seven-year agreement with minimum volume commitments (MVCs) $1.00 per barrel unloading fee MVC of 5,500 barrels per day Annual maintenance capital expenditures of ~$0.8 million Illinois Basin Appalachian Basin New Albany Devonian (Ohio) Marcellus Utica Michigan Basin Antrim Forest City Basin Fayetteville Cherokee Platform Chattanooga Source: EIA Toledo Current Plays Prospective Plays Basins Shale Plays Stacked Plays Intermediate Depth / Age Deepest / Oldest Shallowest / Youngest

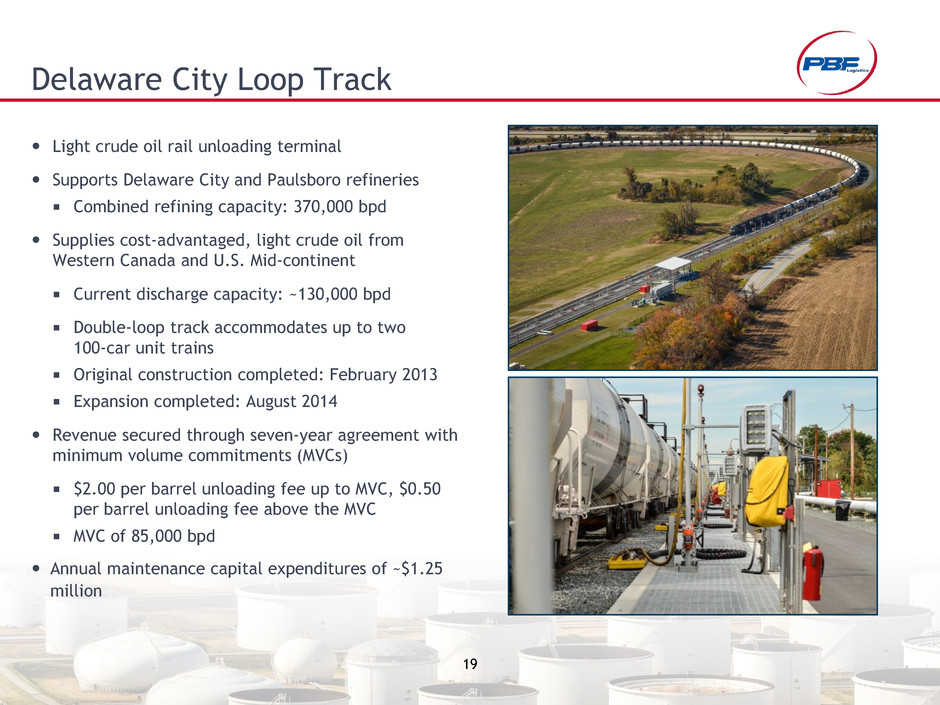

19 Delaware City Loop Track Light crude oil rail unloading terminal Supports Delaware City and Paulsboro refineries Combined refining capacity: 370,000 bpd Supplies cost-advantaged, light crude oil from Western Canada and U.S. Mid-continent Current discharge capacity: ~130,000 bpd Double-loop track accommodates up to two 100-car unit trains Original construction completed: February 2013 Expansion completed: August 2014 Revenue secured through seven-year agreement with minimum volume commitments (MVCs) $2.00 per barrel unloading fee up to MVC, $0.50 per barrel unloading fee above the MVC MVC of 85,000 bpd Annual maintenance capital expenditures of ~$1.25 million