Attached files

| file | filename |

|---|---|

| S-1 - S-1 - Aeglea BioTherapeutics, Inc. | d903767ds1.htm |

| EX-10.2 - EX-10.2 - Aeglea BioTherapeutics, Inc. | d903767dex102.htm |

| EX-3.3 - EX-3.3 - Aeglea BioTherapeutics, Inc. | d903767dex33.htm |

| EX-10.5 - EX-10.5 - Aeglea BioTherapeutics, Inc. | d903767dex105.htm |

| EX-10.12 - EX-10.12 - Aeglea BioTherapeutics, Inc. | d903767dex1012.htm |

| EX-10.10 - EX-10.10 - Aeglea BioTherapeutics, Inc. | d903767dex1010.htm |

| EX-10.15 - EX-10.15 - Aeglea BioTherapeutics, Inc. | d903767dex1015.htm |

| EX-10.9 - EX-10.9 - Aeglea BioTherapeutics, Inc. | d903767dex109.htm |

| EX-3.1 - EX-3.1 - Aeglea BioTherapeutics, Inc. | d903767dex31.htm |

| EX-21.1 - EX-21.1 - Aeglea BioTherapeutics, Inc. | d903767dex211.htm |

| EX-10.14 - EX-10.14 - Aeglea BioTherapeutics, Inc. | d903767dex1014.htm |

| EX-10.13 - EX-10.13 - Aeglea BioTherapeutics, Inc. | d903767dex1013.htm |

| EX-23.1 - EX-23.1 - Aeglea BioTherapeutics, Inc. | d903767dex231.htm |

| EX-4.2 - EX-4.2 - Aeglea BioTherapeutics, Inc. | d903767dex42.htm |

Exhibit 10.11

Barton Oaks Plaza One

Austin, Texas

OFFICE LEASE

BETWEEN

BARTON OAKS OFFICE CENTER, LLC

(“LANDLORD”)

AND

AEGLEA DEVELOPMENT COMPANY, INC.

(“TENANT”)

TABLE OF CONTENTS

| Page | ||||||

| 1. |

Basic Lease Information |

1 | ||||

| 2. |

Lease Grant |

3 | ||||

| 3. |

Term; Adjustment of Commencement Date; Early Access |

3 | ||||

| 4. |

Rent |

4 | ||||

| 5. |

Tenant’s Use of Premises |

9 | ||||

| 6. |

Security Deposit |

10 | ||||

| 7. |

Services to be Furnished by Landlord |

11 | ||||

| 8. |

Use of Electrical Services by Tenant |

13 | ||||

| 9. |

Repairs and Alterations |

14 | ||||

| 10. |

Entry by Landlord |

16 | ||||

| 11. |

Assignment and Subletting |

16 | ||||

| 12. |

Liens |

18 | ||||

| 13. |

Indemnity |

19 | ||||

| 14. |

Insurance |

19 | ||||

| 15. |

Mutual Waiver of Subrogation |

20 | ||||

| 16. |

Casualty Damage |

21 | ||||

| 17. |

Condemnation |

22 | ||||

| 18. |

Events of Default |

22 | ||||

| 19. |

Remedies |

23 | ||||

| 20. |

Limitation of Liability |

25 | ||||

| 21. |

No Waiver |

26 | ||||

| 22. |

Tenant’s Right to Possession |

26 | ||||

| 23. |

Relocation |

26 | ||||

| 24. |

Holding Over |

27 | ||||

| 25. |

Subordination to Mortgages; Estoppel Certificate |

27 | ||||

| 26. |

Attorneys’ Fees |

27 | ||||

| 27. |

Notice |

28 | ||||

| 28. |

Reserved Rights |

28 | ||||

| 29. |

Surrender of Premises |

28 | ||||

| 30. |

Hazardous Materials |

29 | ||||

| 31. |

Miscellaneous |

30 | ||||

EXHIBITS AND RIDERS:

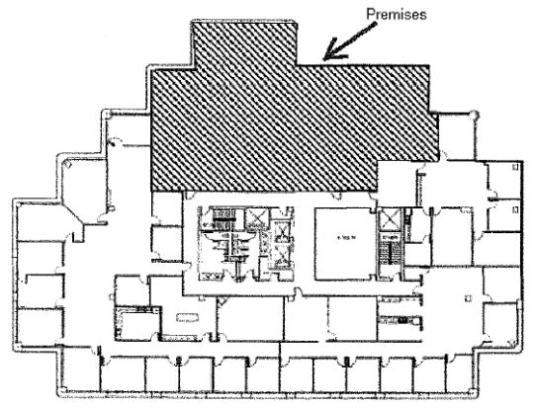

| EXHIBIT A-1 |

OUTLINE AND LOCATION OF PREMISES | |

| EXHIBIT A-2 |

LEGAL DESCRIPTION OF PROPERTY | |

| EXHIBIT B |

RULES AND REGULA TIONS | |

| EXHIBIT C |

COMMENCEMENT LETTER | |

| EXHIBIT D |

WORK LETTER | |

| EXHIBIT E |

PARKING AGREEMENT |

i

OFFICE LEASE

This Office Lease (this “Lease”) is entered into by and between BARTON OAKS OFFICE CENTER, LLC, a Delaware limited liability company (“Landlord”), and AEGLEA DEVELOPMENT COMPANY, INC., a Delaware corporation (“Tenant”), and shall be effective as of the date set forth below Landlord’s signature (the “Effective Date”).

1. Basic Lease Information. The key business terms used in this Lease are defined as follows:

A. “Building”: The building commonly known as Barton Oaks Plaza, Building One, and located at 901 MoPac Expressway South, Austin, Texas.

B. “Rentable Square Footage of the Building” is agreed and stipulated to be 99,404 square feet.

C. “Premises”: The area shown on Exhibit A-1to this Lease. The Premises are located on floor two (2) of the Building and known as suite number 250. The “Rentable Square Footage of the Premises” is deemed to be 5,771 square feet. If the Premises include, now or hereafter, one or more floors in their entirety, all corridors and restroom facilities located on such full floor(s) shall be considered part of the Premises. Landlord and Tenant stipulate and agree that the Rentable Square Footage of the Building and the Rentable Square Footage of the Premises are correct and shall not be remeasured.

D. “BaseRent”:

| Period (in Lease Months) |

Annnal Rate Per Square Foot |

Monthly Base Rent |

||||||

| 1 to 12 | $ | 23.50 | $ | 11,301.54 | ||||

| 13 to 24 | $ | 24.21 | $ | 11,642.99 | ||||

| 25 to 36 | $ | 24.93 | $ | 11,989.25 | ||||

As used herein, a “LeaseMonth” means a period of time commencing on the same numeric day as the Commencement Date and ending on (but not including) the day in the next calendar month that is the same numeric date as the Commencement Date; provided, however, that if the Commencement Date does not occur on the first day of a calendar month, then the first (!st) Lease Month shall be extended to end on the last day of the first (1st) full calendar month following the Commencement Date, Tenant shall pay Base Rent during the resulting partial calendar month at the same rate payable for the first (!st) Lease Month (prorated based on the number of days in such partial calendar month), and the succeeding Lease Months shall commence on the first day of each calendar month thereafter.

E. “Tenant’s Pro Rata Share”: The percentage equal to the Rentable Square Footage of the Premises divided by the Rentable Square Footage of the Building.

F. “Term”: The period of approximately thirty-six (36) months starting on the Commencement Date, subject to the provisions of Article 3.

G. “Estimated Commencement Date”: February 1, 2015, subject to adjustment, if any, as provided in Section 3.A and the Work Letter.

H. “Guarantor(s)”: Any person or entity who agrees to guarantee the obligations of the Tenant under this Lease. As of the date of this Lease, there are no Guarantors.

1

I. “Business Day(s)”: Monday through Friday of each week, exclusive of New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, and Christmas Day (“Holidays”). Landlord may designate additional Holidays, provided that the additional Holidays are commonly recognized by other office buildings in the area where the Building is located.

J. “Law(s)”: All applicable statutes, codes, ordinances, orders, rules and regulations of any municipal or governmental entity, now or hereafter adopted, including the Americans with Disabilities Act and any other law pertaining to disabilities and architectural barriers (collectively, “ADA”), and all laws pertaining to the environment, including the Comprehensive Environmental Response, Compensation and Liability Act, as amended, 42 U.S.C. §9601 et seq. (“CERCLA”), and all restrictive covenants existing of record and all rules and requirements of any existing association or improvement district affecting the Property.

K. “Normal Business Hours”: 8:00 A.M. to 6:00 P.M. on Business Days and 8:00 A.M. to 1:00 P.M. on Saturdays, exclusive of Holidays.

L. “Notice Addresses”:

Tenant: On or after the Commencement Date, all notices shall be sent to Tenant at the Premises. Prior to the Commencement Date, notices shall be sent to Tenant at the following address:

| Aeglea Development Company, Inc. 815 Brazos, Suite 101A Austin, Texas 78701-2562 Attn: David Lowe Phone #: Fax #: |

||

| Landlord: |

||

| Barton Oaks Office Center, LLC c/o MIG Real Estate 660 Newport Center Drive Suite 1300 Newport Beach, CA 92660 Attn: Director of Asset Management |

Landlord’s address for payment of Rent: Barton Oaks Office Center, LLC c/o PM Realty Group, LP 18201 Von Karman Avenue, Suite 500 Irvine, CA 92612 Attention: Kari Blevins | |

| With a copy to: |

||

| Barton Oaks Office Center, LLC c/o TIG Real Estate Services, Inc. 901 South Mopac Expressway Barton Oaks Plaza IV, Suite 285 Austin, TX 78746 |

||

M. “Security Deposit”: $53,756.86 (see Article 6 of this Lease).

2

N. “Other Defined Terms”: In addition to the terms defined above, an index of some of the other defined terms used in the text of this Lease is set forth below, with a cross-reference to the paragraph in this Lease in which the definition of such term can be found:

2. Lease Grant. Landlord leases the Premises to Tenant and Tenant leases the Premises from Landlord, together with the right in common with others to use any portions of the Property (defined below) that are designated by Landlord for the common use of tenants and others, such as sidewalks, common corridors, elevators, vending areas, lobby areas and, with respect to multi-tenant floors, restrooms and elevator foyers (the “Common Areas”). As used herein, “Property” means the Building and the parcel(s) of land on which it is located as more fully described on Exhibit A-2, together with all other buildings and improvements located thereon; and the Building garage(s) and other improvements serving the Building, if any, and the parcel(s) of land on which they are located.

3. Term; Adjustment of Commencement Date; Early Access.

A. Term. This Lease shall govern the relationship between Landlord and Tenant with respect to the Premises from the Effective Date through the last day of the Term specified in Section 1.F (the “Expiration Date”), unless terminated early in accordance with this Lease. The Term of this Lease (as specified in Section 1.F) shall commence on the “Commencement Date”, which shall be the earliest of (1) the date on which Landlord delivers the Premises to Tenant with the Landlord Work (defined below) Substantially Complete, as determined pursuant to the Work Letter (defined below), or (2) the date on which the Landlord Work would have been Substantially Complete but for Tenant Delay, as such term is defined in the Work Letter, or (3) the date on which Tenant first occupies the Premises for the conduct of its business therein. If Landlord is delayed in delivering possession of the Premises or any other space due to any reason, including Landlord’s failure to Substantially Complete the Landlord Work by the Estimated Commencement Date, or for any other reason, such delay shall not be a default by

3

Landlord, render this Lease void or voidable, or otherwise render Landlord liable for damages. Promptly after the determination of the Commencement Date and the Expiration Date, Landlord shall prepare and deliver to Tenant a commencement letter agreement substantially in the form attached as Exhibit C. If such commencement letter is not executed by Tenant within 30 days after delivery of same by Landlord, then Tenant shall be deemed to have agreed with the matters set forth therein. Notwithstanding any other provision of this Lease to the contrary, if the Expiration Date would otherwise occur on a date other than the last day of a calendar month, then the Term shall be automatically extended to include the last day of such calendar month, which shall become the Expiration Date. “Landlord Work” means the work that Landlord is obligated to perform in the Premises pursuant to a separate work letter agreement (the “Work Letter”) attached as Exhibit D.

B. Acceptance of Premises. The Premises are accepted by Tenant in “as is” condition and configuration subject to (1) any Landlord obligation to perform Landlord Work, (2) any defects in the Landlord Work of which Tenant notifies Landlord within 180 days after the Commencement Date, and (3) Landlord’s repair and maintenance obligations hereunder. EXCEPT AS OTHERWISE EXPRESSLY SET FORTH HEREIN, NO WARRANTIES, EXPRESS OR IMPLIED, ARE MADE REGARDING THE CONDITION OR SUITABILITY OF THE PREMISES ON THE COMMENCEMENT DATE. FURTHER, TO THE EXTENT PERMITTED BY LAW, TENANT WAIVES ANY IMPLIED WARRANTY OF SUITABILITY OR OTHER IMPLIED WARRANTIES THAT LANDLORD WILL MAINTAIN OR REPAIR THE PREMISES OR ITS APPURTENANCES EXCEPT AS MAY BE CLEARLY AND EXPRESSLY PROVIDED IN THIS LEASE. The foregoing shall not reduce or otherwise affect Landlord’s express repair and maintenance obligations under this Lease.

C. Early Access. Prior to the date the Landlord Work is Substantially Complete, Tenant’s access to the Premises shall be permitted only with the prior written consent of Landlord. Early access to the Premises shall be subject to all of the terms and conditions of this Lease; provided that Tenant shall not be required to pay Rent (defined in Section 4.A) during such early access period. Notwithstanding the foregoing, provided such access does not unreasonably interfere with the Landlord Work, Landlord shall permit Tenant to have early access to the Premises approximately two (2) weeks prior to the Commencement Date for the sole purpose of installing furniture, equipment or other personal property, and except for the cost of services requested by Tenant (e.g., freight elevator usage), Tenant shall not be required to pay Base Rent and the OE Payment (defined in Section 4.B) for any days of such early access. Notwithstanding the foregoing, if Tenant begins to conduct business in the Premises during such early access period, the date Tenant begins conducting business shall thereupon be deemed the Commencement Date, and Base Rent and the OE Payment shall thereupon commence.

4. Rent.

A. Payments. As consideration for this Lease, commencing on the Commencement Date, Tenant shall pay Landlord, without any demand, setoff or deduction (except as otherwise expressly set forth herein), the total amount of Base Rent, Tenant’s Pro Rata Share of the Operating Expenses (defined in Section 4.D) and all other sums payable by Tenant under this Lease (all of which are sometimes collectively referred to as “Rent”). Tenant shall pay and be liable for all rental, sales and use taxes (but excluding income taxes), if any, imposed upon or measured by Rent under applicable Law. The monthly Base Rent and the OE Payment (defined in Section 4.B) shall be due and payable in advance on the first day of each calendar month without notice or demand, provided that the installment of Base Rent and the OE Payment for the first (1st) Lease Month of the Term shall be payable upon the execution of this Lease by Tenant. All other items of Rent shall be due and payable by Tenant on or before 30 days after billing by Landlord. All payments of Rent shall be by good and sufficient check or by other means (such as automatic debit or electronic transfer) acceptable to Landlord. If the Term commences on a day other

4

than the first day of a calendar month, the monthly Base Rent and the OE Payment for the month shall be prorated on a daily basis based on a 365 day calendar year. Landlord’s acceptance of less than the correct amount of Rent shall be considered a payment on account of the earliest Rent due. No endorsement or statement on a check or letter accompanying a check or payment shall be considered an accord and satisfaction, and either party may accept such check or payment without such acceptance being considered a waiver of any rights such party may have under this Lease or applicable Law. Tenant’s covenant to pay Rent is independent of every other covenant in this Lease.

B. Payment of Operating Expenses. Tenant shall pay Tenant’s Pro Rata Share of the Operating Expenses (the “OE Payment”) for each calendar year during the Term. On or about January 1 of each calendar year, Landlord shall provide Tenant with a good faith estimate of the OE Payment for such calendar year during the Term. On or before the first day of each month, Tenant shall pay to Landlord a monthly installment equal to one-twelfth of Landlord’s estimate of the OE Payment for such calendar year. If Landlord determines that its good faith estimate of the OE Payment was incorrect, Landlord may provide Tenant with a revised good faith estimate. After its receipt of the revised good faith estimate, Tenant’s monthly payments shall be based upon the revised good faith estimate. If Landlord does not provide Tenant with a good faith estimate of the OE Payment by January 1 of a calendar year, Tenant shall continue to pay monthly installments based on the most recent good faith estimate(s) until Landlord provides Tenant with the new good faith estimate. Upon delivery of the new estimate, an adjustment shall be made for any month for which Tenant paid monthly installments based on the same year’s prior incorrect good faith estimate(s). Tenant shall pay Landlord the amount of any underpayment within 30 days after receipt of the new estimate. Any overpayment shall be credited against the next sums due and owing by Tenant or, if no further Rent is due, refunded directly to Tenant within 30 days of determination. The obligation of Tenant to pay the OE Payment as provided herein shall survive the expiration or earlier termination of this Lease.

C. Reconciliation of Operating Expenses. Within 120 days after the end of each calendar year or as soon thereafter as is reasonably practicable, Landlord shall furnish Tenant with a statement of the actual Operating Expenses and the OE Payment for such calendar year. If the estimated OE Payment actually paid by Tenant for such calendar year is more than the actual OE Payment for such calendar year, Landlord shall apply any overpayment by Tenant against Rent due or next becoming due; provided, if the Term expires before the determination of the overpayment, Landlord shall, within 30 days of determination, refund any overpayment to Tenant after first deducting the amount of Rent due. If the estimated OE Payment actually paid by Tenant for the prior calendar year is less than the actual OE Payment for such year, Tenant shall pay Landlord, within 30 days after its receipt of the statement of Operating Expenses and the OE Payment, any underpayment for the prior calendar year.

D. Operating Expenses Defined. “Operating Expenses” means all costs and expenses incurred or accrued in each calendar year in connection with the ownership, operation, maintenance, management, repair and protection of the Property, including Landlord’s personal property used in connection with the Property and including without limitation all costs and expenditures relating to the following:

(1) Operation, maintenance, repair and replacements of any part of the Property (subject to paragraph (9) below), including the mechanical, electrical, plumbing, HVAC, vertical transportation, fire prevention and warning and access control systems; materials and supplies (such as light bulbs and ballasts); equipment and tools; floor, wall and window coverings; personal property; required or beneficial easements; and related service agreements and rental expenses.

(2) Administrative and management fees and expenses, including fees and expenses for accounting, auditing, legal, information and other professional services (except for such fees and

5

expenses incurred in connection with negotiating or enforcing any leases); management office(s); and wages, salaries, benefits, reimbursable expenses and taxes (or allocations thereof) for full and part time personnel involved in operation, maintenance and management; provided, however, in no event shall management fees exceed five percent (5%) if the gross revenue of the Property for such year.

(3) Janitorial service; window cleaning; waste disposal; and landscaping, including all applicable tools and supplies.

(4) Property, liability and other insurance coverages carried by Landlord, including deductibles and risk retention programs and a proportionate allocation of the cost of blanket insurance policies maintained by Landlord and/or its Affiliates (defined below).

(5) “Real Estate Taxes”, which shall mean (i) all real estate taxes and assessments on the Property, the Building or the Premises, and taxes and assessments levied in substitution or supplementation in whole or in part of such taxes, (ii) all personal property taxes for the Building’s personal property which are owned by Landlord and used in connection with the operation, maintenance and repair of the Property, including license expenses, (iii) all franchise taxes and all sales, use and other taxes (excluding state and/or federal income tax) now or hereafter imposed by any governmental authority upon rent received by Landlord or revenue from the Property (provided that for the purposes of calculating the taxes under this part (iii), the Property shall be treated as the only property used for the computation of such taxes), and (iv) all other taxes, fees or assessments now or hereafter levied by any governmental authority on the Property, the Building or its contents or on the operation and use thereof (except as relate to specific tenants). Estimates of Real Estate Taxes for any calendar year during the Lease Term shall be determined based on Landlord’s good faith estimate of the Real Estate Taxes. Real Estate Taxes hereunder are those accrued with respect to such calendar year, as opposed to the Real Estate Taxes paid or payable for such calendar year. Notwithstanding anything to the contrary contained herein, Real Estate Taxes shall not include Landlord’s estate, excise, income, excess profits, inheritance, succession, grantor’s, recordation, transfer, or other taxes imposed on or measured by the net income of Landlord from the operation of the Property (except to the extent provided in subsection (iii) above), and shall not include any interest or penalties for late payment of taxes.

(6) Compliance with Laws, including license, permit and inspection fees (but not in duplication of capital expenditures amortized as provided in Section 4.D(9)), but only to the extent that such compliance related to Laws that are amended, become effective, or are interpreted or enforced differently, after the Commencement Date; and all expenses and fees, including attorneys’ fees and court or other venue of dispute resolution costs, incurred in negotiating or contesting Real Estate Taxes or the validity and/or applicability of any governmental enactments which may affect Operating Expenses; provided Landlord shall credit against Operating Expenses any refunds received from such negotiations or contests to the extent originally included in Operating Expenses (less Landlord’s reasonable costs actually incurred).

(7) Building safety services, to the extent provided or contracted for by Landlord.

(8) Goods and services purchased from Landlord’s subsidiaries and Affiliates to the extent the cost of same is generally consistent with rates charged by unaffiliated third parties for similar goods and services.

(9) Amortization of capital expenditures incurred: (a) to conform with Laws but only to the extent that such compliance is related to Laws that are amended, become effective, or are interpreted or enforced differently, after the Commencement Date; (b) to provide or maintain Building standards (other than Building standard tenant improvements); or (c) with the intention of promoting

6

safety or reducing or controlling increases in Operating Expenses, such as lighting retrofit and installation of energy management systems. Capital expenditures shall be amortized on a straight-line basis on a over the useful life of the capital item at an interest rate reasonably determined by Landlord.

(10) The cost of all utilities for the Property, including without limitation water, sewer, power, fuel, heating, lighting, air conditioning and ventilation, as well as the cost of changing utility providers and the sales, use, excise and other taxes assessed by governmental authorities on such utility services.

E. Exclusions from Operating Expenses. Operating Expenses exclude the following expenditures:

(1) Leasing commissions, attorneys’ fees and other expenses related to leasing tenant space and constructing improvements for the sole benefit of an individual tenant.

(2) Goods and services furnished to an individual tenant of the Building which are above Building standard and which are separately reimbursable directly to Landlord in addition to the OE Payment.

(3) Repairs, replacements and general maintenance paid by insurance proceeds (or which would have been paid by insurance proceeds had Landlord maintained the insurance required to be maintained by Landlord under this Lease), condemnation proceeds, another tenant (except as a component of operating expenses), or a responsible third party.

(4) Except as provided in Section 4.D(9), depreciation, amortization, interest payments on any encumbrances on the Property and the cost of capital improvements or additions.

(5) Expenses for repairs or maintenance related to the Property which have been reimbursed to Landlord pursuant to warranties or service contracts.

(6) Interest or principal payments on indebtedness secured by liens against the Property, or costs of refinancing such indebtedness, or any ground lease payments.

(7) Costs of installing any specialty service, such as an observatory, broadcasting facility, luncheon club, or athletic or recreational club.

(8) Expenses for repairs or maintenance related to the Property which have been reimbursed to Landlord pursuant to warranties or service contracts.

(9) Costs of purchasing any art work (such as sculptures or paintings) used to decorate the Building.

(10) Costs of correcting defects in the original construction or any renovation of the Building.

(11) Compensation paid to clerks, attendants or other persons in commercial concessions operated by Landlord which customarily sell products or services to the public, including tenants of the Building.

7

(12) Expenses incurred in leasing or procuring new tenants, including advertising and marketing expenses and expenses for preparation of leases or renovating space for new tenants, rent allowances, lease takeover costs, payment of moving costs and similar costs and expenses.

(13) Landlord’s general overhead and general administrative expenses except to the extent permitted in Section 4.D(2), including any costs incurred related to maintaining Landlord’s existence as an entity.

(14) Overtime and other costs of performing work which is required to be performed by Landlord at Landlord’s sole cost and expense.

(15) Salaries of officers and executives of Landlord above the level of Property manager, except to the extent permitted in Section 4.D(2).

(16) Costs relating to disputes between Landlord and a specific tenant of the Building.

(17) The cost of any work or service performed for any tenant (including Tenant) at such tenant’s cost.

(18) Any fees paid to parties related to, or affiliated with, Landlord to the extent the cost of same is not generally consistent with rates charged by unaffiliated third parties for similar goods and services.

(19) Political contributions, charitable contributions, contributions to civic organizations, entertainment charges (except for entertainments made available to all of the Building tenants), and other similar expenses.

(20) Payments for rented equipment, the cost of which would constitute a capital expenditure not permitted hereunder if the equipment were purchased, except equipment which is used in providing janitorial services and which is not affixed to the Building or during repairs to the Building.

(21) Any late fees or fines for non-compliance with Laws applicable to the Building or due to late payment of taxes, utility bills or other such costs.

F. Proration of Operating Expenses; Adjustments. If Landlord incurs Operating Expenses for the Property together with one or more other buildings or properties, whether pursuant to a reciprocal easement agreement, common area agreement or otherwise, the shared costs and expenses shall be equitably prorated and apportioned by Landlord between the Property and the other buildings or properties. If the Building is not 100% occupied during any calendar year or partial calendar year or if Landlord is not supplying services to the entire Building at any time during a calendar year or partial calendar year, Operating Expenses shall be determined as if the Building had been 100% occupied and Landlord had been supplying services to the entire Building during that calendar year. The extrapolation of Operating Expenses under this Section shall be performed by Landlord by adjusting the cost of those components of Operating Expenses that are impacted by changes in the occupancy of the Building.

G. Tenant’s Audit Right. Tenant may, within 120 days after receiving Landlord’s reconciliation statement of the Operating Expenses, give Landlord written notice (“Review Notice”) that Tenant intends to review Landlord’s records of the Operating Expenses for the calendar year which is covered by the reconciliation statement. Within a reasonable time after receipt of the Review Notice, Landlord shall make all pertinent records available for inspection that are reasonably necessary for Tenant to conduct its review. If Tenant retains an agent to review Landlord’s records, the agent must be a

8

licensed CPA or with a CPA firm and shall not be compensated on a contingency fee basis. Tenant shall be solely responsible for all costs, expenses and fees incurred for the audit. Within 45 days after the records are made available to Tenant, Tenant shall have the right to give Land lord written notice (an “Objection Notice”) stating in reasonable detail any objection to Landlord’s statement of Operating Expenses for that year. If Tenant fails to give Landlord an Objection Notice within the 45 day period or fails to provide Landlord with a Review Notice within the 120 day period described above, Tenant shall he deemed to have approved Landlord’s statement of Operating Expenses and shall be barred from raising any claims regarding the Operating Expenses for that year. If Landlord and Tenant determine that Operating Expenses for the calendar year are less than reported, Landlord shall provide Tenant with a credit against the next installment(s) of Rent in the amount of the overpayment by Tenant or, if no further Rent is due, refund the overpayment directly to Tenant within 30 days after determination. Likewise, if Landlord and Tenant determine that Operating Expenses for the calendar year are greater than reported, Tenant shall pay Landlord the amount of any underpayment within 30 days after such determination. The records obtained by Tenant and its agent shall he treated as confidential and each shall execute Landlord’s confidentiality agreement for Landlord’s benefit prior to commencing the audit. This paragraph shall not be construed to limit, suspend, or abate Tenant’s obligation to pay Rent when due, including the OE Payment. Notwithstanding the foregoing, Tenant shall not be entitled to conduct such an audit if Tenant is in default under this Lease beyond the expiration of any applicable notice and cure period.

5. Tenant’s Use of Premises.

A. Permitted Use. The Premises shall be used only for general office use (the “Permitted Use”) and for no other use whatsoever. Tenant shall not use or permit the use of the Premises for any purpose which is illegal, creates obnoxious odors (including tobacco smoke), noises or vibrations, is dangerous to persons or property, could increase Landlord’s insurance costs, or which, in Landlord’s reasonable opinion, unreasonably disturbs any other tenants of the Building or interferes with the operation or maintenance of the Property. The following uses are expressly prohibited in the Premises: schools, government offices or agencies; personnel agencies; collection agencies; credit unions; operating of a data processing business, telemarketing or reservation centers; medical treatment and health care; radio, television or other telecommunications broadcasting; restaurants and other retail; customer service offices of a public utility company; or any other purpose which would overburden any of the Building Systems, Common Areas or parking facilities (including any use which would create a population density in the Premises which is in excess of the density which is standard for the Building) or otherwise interfere with the operation of the Property. Subject to the terms and conditions of this Lease, including without limitation, the Building rules and regulations set forth on Exhibit B attached hereto, Tenant, its permitted assigns and subtenants, and their respective employees, licensees and guests, shall have access to the Building and the Premises at all times, 24-hours per day, every day of the year. Landlord will provide Tenant with a reasonable amount of space (if necessary) in Building risers and on the second (2nd) floor of the Building for the installation of Cable for Tenant’s use in the Premises.

B. Compliance with Laws. Tenant shall comply with all Laws regarding the operation of Tenant’s business and the use, condition, configuration and occupancy of the Premises (including without limitation all Alterations installed by Tenant) and the use of the Common Areas. Without limiting the foregoing, Tenant shall, at its expense, be responsible for ADA (and any applicable state accessibility standard) compliance in the Premises, including restrooms on any floor now or hereafter leased or occupied in its entirety by Tenant, its Affiliates or transferees. Landlord shall, as an Operating Expense (to the extent permitted under Article 4 above), be responsible for ADA (and any applicable state accessibility standard) compliance for the core areas of the Building and the exterior areas of the Property (including elevators, Common Areas, and service areas), the Property’s parking facilities and all points of access into the Property. Landlord shall not be responsible for determining whether Tenant is a public accommodation under ADA or whether the Approved Construction Documents (as defined in Exhibit D)

9

or any plans and specifications for any Alterations (hereinafter defined) comply with ADA requirements, including submission of the Approved Construction Documents or the plans and specifications for any other Alterations for review by appropriate state agencies. Such determinations, if desired by Tenant, shall be the sole responsibility of Tenant. Tenant, within 20 days after receipt, shall provide Landlord with copies of any notices Tenant receives regarding a violation or alleged or potential violation of any Laws. Notwithstanding anything to the contrary contained herein, Landlord, at its expense (subject to reimbursement pursuant to Article 4 above, if and to the extent permitted thereby), shall comply with all applicable Laws to the extent the same apply directly to the structural elements of the Building, including the Premises except to the extent such compliance is necessitated as a result of Tenant’s Alterations or specific use of the Premises (as opposed to general office use), the Building Systems, the Common Areas of the Property as a whole, and any other portions of the Building located outside of Premises, including, without limitation, telecommunications rooms and mechanical and electrical rooms and closets. Tenant shall comply with the rules and regulations of the Building attached as Exhibit B and such other reasonable rules and regulations (or modifications thereto) adopted by Landlord from time to time; provided that such modifications shall not materially reduce Tenant’s rights, or materially increase Tenant’s obligations, under this Lease or materially interfere with Tenant’s use of the Premises for the Permitted Use. Such rules and regulations will be applied in an equitable manner as determined by Landlord and Landlord shall not discriminate against Tenant in enforcement of such rules and regulations. Tenant shall also cause its agents, contractors, subcontractors, employees, customers, and subtenants to comply with all rules and regulations. Landlord shall not discriminate against Tenant in enforcement of the Building rules and regulations. In the event of any conflict between any such rules and regulations (or modifications thereto) and this Lease, the latter shall control.

C. Tenant’s Security Responsibilities. Tenant shall (I ) lock the doors to the Premises and take other reasonable steps to secure the Premises and the personal property of all Tenant Parties (defined in Article 13) and any of Tenant’s transferees, contractors or licensees in the Common Areas and parking facilities of the Building and Property, from unlawful intrusion, theft, fire and other hazards; (2) keep and maintain in good working order all security and safety devices installed in the Premises by or for the benefit of Tenant (such as locks, smoke detectors and burglar alarms); and (3) reasonably cooperate with Landlord and other tenants in the Building on Building safety matters. Tenant acknowledges that any security or safety measures employed by Landlord are for the protection of Landlord’s own interests; that Landlord is not a guarantor of the security or safety of the Tenant Parties or their property; and that such security and safety matters are the responsibility of Tenant and the local law enforcement authorities.

6. Security Deposit. Tenant will pay Landlord on the date this Lease is executed by Tenant the Security Deposit set forth in Section 1.M as security for the performance of the terms hereof by Tenant. Tenant shall not be entitled to interest thereon and Landlord may commingle such Security Deposit with any other funds of Landlord. The Security Deposit shall not be considered an advance payment of rental or a measure of Landlord’s damages in case of default by Tenant. If Tenant is in default with respect to any provision of this Lease beyond any applicable cure period, Landlord may, but shall not be required to, from time to time, without prejudice to any other remedy, use, apply or retain all or any part of this Security Deposit for the payment of any Rent or any other sum in default or for the payment of any other amount which Landlord may spend or become obligated to spend by reason of Tenant’s default or to compensate Landlord for any other loss or damage which Landlord may suffer by reason of Tenant’s default, including, without limitation, costs and attorneys’ fees incurred by Land lord to recover possession of the Premises. After any such application of any portion of the Security Deposit, Tenant shall pay to Landlord, immediately upon demand, the amount so applied so as to restore the Security Deposit to its original amount. The Security Deposit, less any amounts retained by Landlord pursuant to this Article 6, shall be returned to Tenant within thirty (30) days after the Expiration Date and otherwise in accordance with all applicable Laws. Tenant agrees that it will not assign or encumber or attempt to assign or encumber the monies deposited herein as the Security Deposit and that Landlord and its

10

successors and assigns shall not be bound by any such actual or attempted assignment or encumbrance. Regardless of any assignment of this Lease by Tenant, Landlord may return the Security Deposit to the original Tenant, in the absence of evidence satisfactory to Landlord of an assignment of the right to receive the Security Deposit or any part of the balance thereof. Notwithstanding the foregoing, provided that Tenant is not in default under this Lease beyond any applicable cure period as of the effective date of any reduction in the Security Deposit, the Security Deposit shall be reduced to the following amounts: (i) $35,837.91 effective as of the last day of Lease Month 12, and (ii) $17,918.95 effective as of the last day of Lease Month 24. If Tenant is in default under this Lease beyond any applicable cure period as of the effective date of any such reduction (or on the date Landlord would otherwise return the amount of the reduction as provided above), then the Security Deposit shall remain in place without reduction. Landlord shall return any excess Security Deposit held by Landlord pursuant to the foregoing provisions of this Article 6 within thirty (30) days after the effective date of any reduction. If Landlord transfers its interest in the Premises, Landlord shall assign the Security Deposit to the transferee. Landlord’s obligation to return the Security Deposit in accordance with this Article 6 shall survive the expiration or earlier termination of this Lease.

7. Services to be Furnished by Landlord.

A. Standard Services. Subject to the provisions of this Lease, Landlord agrees to furnish (or cause a third party provider to furnish) the following services to Tenant during the Term:

(1) Water service for use in the lavatories on each floor on which the Premises are located, and for use in the Premises, including any kitchenettes located therein (provided that Tenant shall be responsible for any improvements necessary to bring the water to the Premises).

(2) Heat and air conditioning in season during Normal Business Hours, at such temperatures and in such amounts as required by governmental authority or as Landlord determines are standard for the Building and which are comparable with that provided in other office buildings comparable to the Building in the southwest Austin submarket. Tenant, upon notice given no later than 3:00 p.m. on the Business Day preceding the day for which HVAC service is requested, and subject to the capacity of the Building Systems, may request HVAC service during hours other than Normal Business Hours. Tenant shall pay Landlord for such additional service at a rate equal to $35.00 per operating hour per floor (the “Hourly HVAC Charge”), with a two hour minimum charge. Landlord shall have the right, upon 30 days prior written notice to Tenant, to adjust the Hourly HVAC Charge from time to time, based upon increases in HVAC costs, which costs include utilities, taxes, surcharges, labor, equipment, maintenance and repair.

(3) Maintenance and repair of the Property as described in Section 9.B.

(4) Janitorial service five days per week (excluding Holidays) which are comparable with that provided in other office buildings comparable to the Building in the southwest Austin submarket. If Tenant’s use of the Premises, floor covering or other improvements require special services in excess of the standard services for the Building, Tenant shall pay the additional cost attributable to the special services.

(5) Elevator service, subject to proper authorization and Landlord’s policies and procedures for use of the elevator(s) in the Building.

(6) Electricity to the Premises for general office use, in accordance with and subject to the terms and conditions in Article 8.

11

Landlord agrees that the above described services and the maintenance of the Building and its components, including, without limitation, the Common Areas, shall be not less than the services and maintenance standards provided to other comparable buildings in the southwest Austin submarket, taking into account, the age and size of such buildings.

B. Service Interruptions. For purposes of this Lease, a “Service Failure” shall mean any interruption, suspension or termination of services being provided to Tenant by Landlord or by third-party providers, whether engaged by Tenant or pursuant to arrangements by such providers with Landlord, which are due to (1) the application of Laws; (2) the failure, interruption or malfunctioning of any electrical or mechanical equipment, utility or other service to the Building or Property; (3) the performance of repairs, maintenance, improvements or alterations; or (4) the occurrence of any other event or cause whether or not within the reasonable control of Landlord. No Service Failure shall render Landlord liable to Tenant, constitute a constructive eviction of Tenant, give rise to an abatement of Rent, or relieve Tenant from the obligation to fulfill any covenant or agreement. In no event shall Landlord be liable to Tenant for any loss or damage, including the theft of Tenant’s Property (defined in Article 14), arising out of or in connection with any Service Failure or the failure of any Building safety services, personnel or equipment. Notwithstanding the foregoing, if: (i) Landlord ceases to furnish any service described in Section 7.A(1), (2), (5) or (6) in the Premises and Common Areas necessary for use of the Premises for a period in excess of 5 consecutive Business Days after Tenant notifies Landlord of such cessation (the ‘‘Interruption Notice”; (ii) such cessation does not arise as a result of an act or omission of Tenant; (iii) such cessation is not caused by a fire or other casualty (in which case Article 16 shall control); (iv) the restoration of such service is reasonably within the control of Landlord; and (v) as a result of such cessation, the Premises or a material portion thereof, is rendered untenantable and Tenant in fact ceases to use the Premises, or material portion thereof, then Tenant, as its sole remedy, shall be entitled to receive an abatement of Base Rent payable hereunder during the period beginning on the 6th consecutive Business Day of such cessation and ending on the day when the service in question has been restored. In the event the entire Premises has not been rendered untenantable by the cessation in service, the amount of abatement that Tenant is entitled to receive shall be prorated based upon the percentage of the Premises so rendered untenantable and not used by Tenant.

C. Third Party Services. If Tenant desires any service which Landlord has not specifically agreed to provide in this Lease, such as private security systems or telecommunications services serving the Premises, Tenant shall procure such service directly from a reputable third party service provider (“Provider”) for Tenant’s own account. Tenant shall require each Provider to comply with the Building’s rules and regulations, all Laws, and Landlord’s reasonable policies and practices for the Building. Tenant acknowledges Landlord’s current policy that requires all Providers utilizing any area of the Property outside the Premises to be approved by Landlord and to enter into a written agreement reasonably acceptable to Landlord prior to gaining access to, or making any installations in or through, such area. Accordingly, Tenant shall give Landlord written notice sufficient for such purposes. Without limiting the generality of the foregoing, in the event that Tenant wishes at any time to utilize the services of a telephone or telecommunications Provider whose equipment is not then servicing the Building, no such Provider shall be permitted to install its lines or other equipment within the Building without first securing the prior written approval of the Landlord, which approval shall not be unreasonably withheld, conditioned, or delayed, and which approval shall include, without limitation, approval of the plans and specifications for the installation of the lines and/or other equipment within the Building. Landlord’s approval shall not be deemed any kind of warranty or representation by Landlord, including, without limitation, any warranty or representation as to the suitability, competence, or financial strength of the Provider. Without limitation of the foregoing standard, unless all of the following conditions are satisfied to Landlord’s satisfaction, it shall be reasonable for Landlord to refuse to give its approval: (i) Landlord shall incur no expense whatsoever with respect to any aspect of the Provider’s provision of its services, including without limitation, the costs of installation, materials and services; (ii) prior to commencement

12

of any work in or about the Building by the Provider, the Provider shall supply Landlord with such written indemnities, insurance, financial statements, and such other items as Landlord reasonably determines to be necessary to protect its financial interests and the interests of the Building relating to the proposed activities of the Provider; (iii) the Provider agrees to abide by such rules and regulations, building and other codes, job site rules and such other requirements as are reasonably determined by Landlord to be necessary to protect the interests of the Building, the tenants in the Building and Landlord, in the same or similar manner as Landlord has the right to protect itself and the Building with respect to repairs and Alterations as described in Article 9 of this Lease; (iv) Landlord determines that there is sufficient space in the Building for the placement of all of the Provider’s equipment and materials; (v) the Provider agrees to abide by Landlord’s requirements, if any, that the Provider use existing Building conduits and pipes or use Building contractors (or other contractors approved by Landlord); (vi) Landlord receives from the Provider such compensation as is determined by Landlord to compensate it for space used in the Building for the storage and maintenance of the Provider’s equipment, for the fair market value of a Provider’s access to the Building, and the costs which may reasonably be expected to be incurred by Landlord; (vii) the Provider agrees to deliver to Landlord detailed “as built” plans immediately after the installation of the Provider’s equipment is complete; and (viii) all of the foregoing matters are documented in a written license agreement between Landlord and the Provider, the form and content of which are reasonably satisfactory to Landlord.

8. Use of Electrical Services by Tenant.

A. Landlord’s Electrical Service. Subject to the terms of this Lease, Landlord shall furnish Building standard electrical service to the Premises sufficient to operate customary lighting, office machines and other equipment of similar electrical consumption. For purposes hereof, Building standard electrical shall mean 4.0 watts of low voltage power on a connected load basis per rentable square foot in the Premises. Landlord may, at any time and from time to time, calculate Tenant’s actual electrical consumption in the Premises by a survey conducted by a reputable consultant selected by Landlord. The cost of any electrical consumption in excess of that which Landlord determines is standard for the Building shall be paid by Tenant in accordance with Section 8.D. The furnishing of electrical services to the Premises shall be subject to the rules, regulations and practices of the supplier of such electricity and of any municipal or other governmental authority regulating the business of providing electrical utility service. Landlord shall not be liable or responsible to Tenant for any loss, damage or expense which Tenant may sustain or incur if either the quantity or character of the electrical service is changed or is no longer available or no longer suitable for Tenant’s requirements.

B. Selection of Electrical Service Provider. Landlord shall have and retain the sole right to select the provider of electrical services to the Building and/or the Property. To the fullest extent permitted by Law, Landlord shall have the continuing right to change such utility provider. All charges and expenses incurred by Landlord due to any such changes in electrical services, including maintenance, repairs, installation and related costs, shall be included in the electrical services costs referenced in Section 4.D(10), unless paid directly by Tenant.

C. Submetering. If Tenant’s consumption of electrical services is in excess of Building standard use levels, Landlord shall have the continuing right, upon 30 days written notice, to install a submeter for the Premises at Tenant’s expense. If submetering is installed for the Premises, Landlord may charge for Tenant’s actual electrical consumption monthly in arrears for the kilowatt hours used, a rate per kilowatt hour equal to that charged to Landlord by the provider of electrical service to the Building during the same period of time (plus, to the fullest extent permitted by applicable Laws, an administrative fee equal to 10% of such charge), except as to electricity directly purchased by Tenant from third party providers after obtaining Landlord’s consent to the same. In the event Landlord is unable to determine the exact kilowatt hourly charge during the period of time, Landlord shall use the average

13

kilowatt hourly charge to the Building for the first billing cycle ending after the period of time in question. Even if the Premises are submetered, Tenant shall remain obligated to pay Tenant’s Pro Rata Share of the cost of electrical services as provided in Section 4.B, except that Tenant shall be entitled to a credit against electrical services costs equal to that portion of the amounts actually paid by Tenant separately and directly to Landlord which are attributable to building standard electrical services submetered to the Premises.

D. Excess Electrical Service. Tenant’s use of electrical service shall not exceed Building standard levels in voltage, rated capacity, use beyond Normal Business Hours or overall load. If Tenant requests permission to consume excess electrical service, Landlord may refuse to consent or may condition consent upon conditions that Landlord reasonably elects (including the installation of utility service upgrades, meters, submeters, air handlers or cooling units). The costs of any approved additional consumption (to the extent permitted by Law), installation and maintenance shall be paid by Tenant.

9. Repairs and Alterations.

A. Tenant’s Repair Obligations. Tenant shall keep the Premises in good condition and repair, ordinary wear and tear excepted. Tenant’s repair obligations include, without limitation, repairs to: (1) floor covering and/or raised flooring; (2) interior partitions; (3) doors; (4) the interior side of demising walls; (5) electronic, phone and data cabling and related equipment (collectively, “Cable”) that is installed by or for the benefit of Tenant whether located in the Premises or in other portions of the Building; (6) supplemental air conditioning units, private showers and kitchens, including hot water heaters, plumbing, dishwashers, ice machines and similar facilities serving Tenant exclusively; (7) phone rooms used exclusively by Tenant; (8) Alterations (defined below) performed by contractors retained by Tenant, including related HVAC balancing; and (9) all of Tenant’s furnishings, trade fixtures, equipment and inventory. Prior to performing any such repair obligation, Tenant shall give written notice to Landlord describing the necessary maintenance or repair. All work shall be performed at Tenant’s expense in accordance with the rules and procedures described in Section 9.C below. If Tenant fails to make any repairs to the Premises for more than 15 days after notice from Landlord (although notice shall not be required if there is an emergency), Landlord may, in addition to any other remedy available to Landlord, make the repairs, and Tenant shall pay to Landlord the reasonable cost of the repairs within 30 days after receipt of an invoice, together with an administrative charge in an amount equal to 10% of the cost of the repairs. In the event the item requiring repair by Tenant hereunder is covered by a warranty, Tenant may utilize the contractor providing such warranty in order to perform such repairs, subject to Landlord’s prior written approval (such approval not to be unreasonably withheld, conditioned or delayed). In such event and upon Tenant’s written request, Landlord shall assign to Tenant on a non-exclusive basis, any warranties provided to Landlord relating to any such item requiring repair, to extent assignable.

B. Landlord’s Repair Obligations. Landlord shall keep and maintain in good repair and working order and make repairs to and perform maintenance upon: (I) structural elements of the Building, including, without limitation, exterior and load-bearing walls, any other load-bearing elements, slab floors and foundations; (2) standard mechanical (including HVAC), electrical, plumbing and fire/life safety systems serving the Building generally (including the Premises) (collectively, the “Building Systems”); (3) Common Areas; (4) the roof of the Building; (5) exterior windows of the Building, including the Premises; and (6) elevators serving the Building. Landlord shall promptly make repairs (taking into account the nature and urgency of the repair) for which Landlord is responsible. If any of the foregoing maintenance or repair is necessitated due to the acts or omissions of any Tenant Party (defined in Article 13), Tenant shall pay the costs of such repairs or maintenance to Landlord within 30 days after receipt of an invoice, together with an administrative charge in an amount equal to 10% of the cost of the repairs. Landlord agrees to cause the repairs and replacements to be effected in compliance with all applicable Laws.

14

C. Alterations.

(1) When Consent Is Required. Tenant shall not make alterations, additions or improvements to the Premises or install any Cable in the Premises or other portions of the Building (collectively, “Alterations”) without first obtaining the written consent of Landlord in each instance (which consent shall not be unreasonably withheld, conditioned, or delayed). However, Landlord’s consent shall not be required for any Alteration that satisfies all of the following criteria (a “Minor Alteration”): (a) is of a cosmetic nature such as painting, hanging pictures and installing carpeting; (b) is not visible from outside the Premises or Building; (c) will not affect the systems or structure of the Building; (d) does not require work to be performed inside the walls or above the ceiling of the Premises, (e) does not require a building permit, and (f) the cost of the Alteration does not exceed $10,000.00 in the aggregate.

(2) Requirements For All Alterations, Including Minor Alterations. Prior to starting work on any Alteration, Tenant shall furnish to Landlord for review and approval: plans and specifications (provided, however, Tenant shall not be required to furnish plans and specifications for Minor Alterations); names of proposed contractors (provided that Landlord may designate specific contractors with respect to Building Systems); copies of contracts; necessary permits and approvals; evidence of contractors’ and subcontractors’ insurance; and Tenant’s security for performance of the Alteration. Changes to the plans and specifications must also be submitted to Landlord for its approval. Some of the foregoing requirements may be waived by Landlord for the performance of specific Minor Alterations; provided that such waiver is obtained in writing prior to the commencement of such Minor Alterations. Landlord’s waiver on one occasion shall not waive Landlord’s right to enforce such requirements on any other occasion. Alterations shall be constructed in a good and workmanlike manner using materials of a quality that is at least equal to the quality designated by Landlord as the minimum standard for the Building. Landlord may designate reasonable rules, regulations and procedures for the performance of Alterations in the Building. All Alterations shall be performed after Normal Business Hours, unless Landlord specifically consents to any work being performed during Normal Business Hours, which consent Landlord may withhold in its sole discretion. Tenant shall reimburse Landlord within 30 days after receipt of an invoice for reasonable out-of-pocket sums paid by Landlord for third party examination of Tenant’s plans for Alterations. In addition, within 30 days after receipt of an invoice from Landlord, Tenant shall pay to Landlord a fee equal to 5% of the total cost of such Alterations for Landlord’s oversight and coordination of any Alterations. No later than 30 days after completion of the Alterations, except for Minor Alterations, Tenant shall furnish “as-built” plans, completion affidavits, full and final waivers of liens, receipts and bills covering all labor and materials. Tenant shall assure that the Alterations comply with all insurance requirements and Laws. Tenant shall be liable for and shall pay, prior to their becoming delinquent, any and all taxes and assessments levied against, and any increases in Real Estate Taxes as a result of, any personal property or trade or other fixtures placed by Tenant in or about the Premises and any Alterations constructed in the Premises by or on behalf of Tenant. In the event Landlord pays any such additional taxes or increases, Tenant will, within I 0 days after Landlord’s written demand, together with substantiating proof of such additional taxes or increases, reimburse Landlord for the amount thereof.

(3) Landlord’s Liability For Alterations. Landlord’s approval of an Alteration shall not be a representation by Landlord that the Alteration complies with applicable Laws or will be adequate for Tenant’s use. Tenant acknowledges that Landlord is not an architect or engineer, and that the Alterations will be designed and/or constructed using independent architects, engineers and contractors. Accordingly, Landlord does not guarantee or warrant that the applicable construction documents will comply with Laws or be free from errors or omissions, or that the Alterations will be free from defects, and Landlord will have no liability therefor.

15

10. Entry by Landlord. Subject to the terms of this Article 10, Landlord, its agents, contractors and representatives may enter the Premises to inspect or show the Premises, to clean and make repairs, alterations or additions to the Premises, and to conduct or facilitate repairs, alterations or additions to any portion of the Building, including other tenants’ premises. Except in emergencies or to provide janitorial and other Building services after Normal Business Hours, Landlord shall provide Tenant with at least twenty-four (24) hours’ prior notice of entry into the Premises, which may be given orally. Landlord shall have the right to temporarily close all or a portion of the Premises to perform repairs, alterations and additions, if reasonably necessary for the protection and safety of Tenant and its employees. Except in emergencies, Landlord will not close the Premises if the work can reasonably be completed on weekends and after Normal Business Hours; provided, however, that Landlord is not required to conduct work on weekends or after Normal Business Hours if such work can be conducted without closing the Premises and such work does not materially and adversely interfere with Tenant’s use of the Premises. Entry by Landlord for any such purposes shall not constitute a constructive eviction or entitle Tenant to an abatement or reduction of Rent. In connection with any such entry, Landlord shall use commercially reasonable efforts not to interfere with the operations and normal office routine of Tenant. Tenant may, at its option, require that Landlord be accompanied by a representative of Tenant during any such entry (except in the event of emergency), provided that such representative of Tenant does not interfere with or delay Land lord in exercising its rights or satisfying its obligations hereunder.

11. Assignment and Subletting.

A. Landlord’s Consent Required. Subject to the remaining provisions of this Article 11, but notwithstanding anything to the contrary contained elsewhere in this Lease, except for Permitted Transfers, Tenant shall not assign, transfer or encumber any interest in this Lease (either absolutely or collaterally) or sublease or allow any third party to use any portion of the Premises (collectively or individually, a “Transfer”) without the prior written consent of Landlord. Landlord shall not unreasonably withhold, condition or delay its consent to a Transfer (other than a collateral assignment). Without limitation, Tenant agrees that Landlord’s consent shall not be considered unreasonably withheld if: (1)the proposed transferee is a governmental organization, or Landlord is otherwise actively engaged in lease negotiations with the proposed transferee for other premises in the Property; (2) any uncured event of default exists under this Lease; (3) any portion of the Building or Premises would likely become subject to additional or different Laws as a consequence of the proposed Transfer; (4) the proposed transferee’s use of the Premises conflicts with the Permitted Use or any exclusive usage rights granted to any other tenant in the Building; (5) the use, nature, business, activities or reputation in the business community of the proposed transferee (or its principals, employees or invitees) does not meet Landlord’s standards for Building tenants; (6) the proposed transferee is or has been involved in litigation with Landlord or any of its Affiliates; (7) the character of the business to be conducted within the Premises by the proposed subtenant or assignee is likely to substantially increase the expenses or costs of providing Building services, or the burden on parking, existing janitorial services or elevators in the Building, or (8) the proposed transferee’s financial condition does not meet the criteria Landlord uses to select Building tenants having similar leasehold obligations. Any attempted Transfer in violation of this Article is voidable at Landlord’s option.

B. Consent Parameters/Requirements. As part of Tenant’s request for, and as a condition to, Landlord’s consent to a Transfer, Tenant shall provide Landlord with financial statements for the proposed transferee, a complete copy (unexecuted) of the proposed assignment or sublease and other contractual documents, and such other information as Landlord may reasonably request. Landlord shall then have the right (but not the obligation) to terminate this Lease as of the date the Transfer would have

16

been effective (“Landlord Termination Date”) with respect to the portion of the Premises which Tenant desires to Transfer; provided, however, Landlord shall not have the right to terminate the portion of the Premises Tenant desires to sublease if such portion, together with all other portions of the Premises previously subleased, does not exceed 1,000 rentable square feet. In such event, Tenant shall vacate such portion of the Premises by the Landlord Termination Date and upon Tenant’s vacating such portion of the Premises, the rent and other charges payable shall be proportionately reduced. Consent by Landlord to one or more Transfer(s) shall not operate as a waiver of Landlord’s rights to approve any subsequent Transfers. In no event shall any Transfer (including without limitation any Permitted Transfer) release or relieve Tenant from any obligation under this Lease, nor shall the acceptance of Rent from any assignee, subtenant or occupant constitute a waiver or release of Tenant from any of its obligations or liabilities under this Lease. Tenant shall pay Landlord a review fee of $1,000 for Landlord’s review of any requested Transfer (including any Permitted Transfer), provided if Landlord’s actual reasonable costs and expenses (including reasonable attorney’s fees) exceed $1,000, Tenant shall reimburse Landlord for its actual reasonable costs and expenses in lieu of a fixed review fee.

C. Payment to Landlord. If the aggregate consideration paid to a Tenant Party for a Transfer exceeds that payable by Tenant under this Lease (prorated according to the transferred interest), Tenant shall pay Landlord 50% of such excess (after deducting therefrom reasonable leasing commissions and reasonable costs of tenant improvements paid to unaffiliated third parties in connection with the Transfer, with proof of same provided to Landlord). Tenant shall pay Landlord for Landlord’s share of any excess within 10 days after Tenant’s receipt of such excess consideration. If any uncured event of default exists under this Lease, Landlord may require that all sublease payments be made directly to Landlord, in which case Tenant shall receive a credit against Rent in the amount of any payments received, but not to exceed the amount payable by Tenant under this Lease.

D. Change in Control of Tenant. Except for a Permitted Transfer, if Tenant is a corporation, limited liability company, partnership, or similar entity, and if the entity which owns or controls a majority of the voting shares/rights in Tenant at any time sells or disposes of such majority of voting shares/rights, or changes its identity for any reason (including a merger, consolidation or reorganization), such change of ownership or control shall constitute a Transfer. The foregoing shall not apply so long as, both before and after the Transfer, Tenant is an entity whose outstanding stock is listed on a recognized U.S. securities exchange, or if at least 80% of its voting stock is owned by another entity, the voting stock of which is so listed; provided, however, that Tenant shall give Landlord written notice at least 30 days prior to the effective date of such change in ownership or control.

E. Assignment and Bankruptcy.

(1) Assignments after Bankruptcy. If, pursuant to applicable bankruptcy law (as hereinafter defined), Tenant (or its successor in interest hereunder) is permitted to assign this Lease in disregard of the restrictions contained in this Article 11 (or if this Lease shall be assumed by a trustee for such person), the trustee or assignee shall cure any default under this Lease and shall provide adequate assurance of future performance by the trustee or assignee, including (i) the source of payment of Base Rent, OE Payment and performance of other obligations under this Lease (for which adequate assurance shall mean the deposit of cash security with Landlord in an amount equal to the sum of one (I ) year’s Base Rent, OE Payment and other Rent then reserved hereunder for the calendar year preceding the year in which such assignment is intended to become effective, which deposit shall be held by Landlord, without interest, for the balance of the Term as security for the full and faithful performance of all of the obligations under this Lease on the part of Tenant yet to be performed and that any such assignee of this Lease shall have a net worth exclusive of good will, computed in accordance with the generally accepted accounting principles, equal to at least ten (10) times the aggregate of the Base Rent reserved hereunder); and (ii) that the use of the Premises shall be in accordance with the requirements of Article 5 hereof and,

17

further, shall in no way diminish the reputation of the Building or impose any additional burden upon the Building or increase the services to be provided by Landlord. If all defaults are not cured and such adequate assurance is not provided within 60 days after there has been an order for relief under applicable bankruptcy law, then this Lease shall be deemed rejected, Tenant or any other person in possession shall immediately vacate the Premises, and Landlord shall be entitled to retain any Base Rent, OE Payment, and any other Rent, together with any Security Deposit previously received from the Tenant, and shall have no further liability to Tenant or any person claiming through Tenant or any trustee. For purposes hereof, “bankruptcy law” shall mean the federal Bankruptcy Code or any other present or future federal or state insolvency, bankruptcy or similar law.

(2) Bankruptcy of Assignee. If Tenant assigns this Lease to any party and such party or its successors or representatives causes termination or rejection of this Lease pursuant to applicable bankruptcy law, then, notwithstanding any such termination or rejection, Tenant (i) shall remain fully liable for the performance of all covenants, agreements, terms, provisions and conditions contained in this Lease, as though the assignment never occurred and (ii) shall, without in any way limiting the foregoing, in writing ratify the terms of this Lease, as same existed immediately prior to the termination or rejection.

F. No Consent Required. Tenant may assign its entire interest under this Lease or sublease all or a portion of the Premises to its Affiliate (defined below) or to a successor to Tenant by purchase, merger, consolidation or reorganization without the consent of Landlord, provided that all of the following conditions are satisfied in Landlord’s reasonable discretion (a “Permitted Transfer”): (1) no uncured event of default exists under this Lease; (2) Tenant’s successor shall own all or substantially all of the assets of Tenant; (3) such successor shall have a net worth which is at least equal to the greater of Tenant’s net worth at the date of this Lease or Tenant’s net worth as of the day prior to the proposed purchase, merger, consolidation or reorganizations; (4) no portion of the Building or Premises would likely become subject to additional or different Laws as a consequence of the proposed Transfer; (5) such Affiliate’s or successor’s use of the Premises shall not conflict with the Permitted Use or any exclusive usage rights granted to any other tenant in the Building; (6) neither the Permitted Transfer nor any consideration payable to Landlord in connection therewith adversely affects any real estate investment trust qualification tests applicable to Landlord or its Affiliates; (7) such Affiliate or successor is not and has not been involved in litigation with Landlord or any of Landlord’s Affiliates; and (8) Tenant shall give Landlord written notice at least 30 days prior to the effective date of the proposed Permitted Transfer, or if it is not reasonably possible to deliver such notice at least thirty (30) days prior to the effective date of the Permitted Transfer, then within five (5) days following the effective date of the Permitted Transfer, along with all applicable documentation and other information necessary for Landlord to determine that the requirements of this Section 11.F have been satisfied, including if applicable, the qualification of such proposed transferee as an Affiliate of Tenant. The term “Affiliate” means any person or entity controlling, controlled by or under common control with Tenant or Landlord, as applicable. If requested by Landlord, the Affiliate or successor shall sign a commercially reasonable form of assumption agreement.

12. Liens. Tenant shall not permit mechanic’s or other liens to be placed upon the Property, Premises or Tenant’s leasehold interest in connection with any work or service done or purportedly done by or for the benefit of Tenant. If a lien is so placed, Tenant shall, within 10 days of notice from Landlord of the filing of the lien, fully discharge the lien by settling the claim which resulted in the lien or by bonding or insuring over the lien in the manner prescribed by the applicable lien Law. If Tenant fails to discharge the lien, then, in addition to any other right or remedy of Landlord, Landlord may bond or insure over the lien or otherwise discharge the lien. Tenant shall, within 30 days after receipt of an invoice from Landlord, reimburse Landlord for any reasonable amounts paid by Landlord, including reasonable attorneys’ fees, to bond or insure over the lien or discharge the lien.

18

13. Indemnity. Subject to Article 15, Tenant shall hold Landlord, its trustees, Affiliates, subsidiaries, members, principals, beneficiaries, partners, officers, directors, shareholders, employees, Mortgagee(s) (defined in Article 25) and agents (including the manager of the Property) (collectively, “Landlord Parties”) harmless from, and indemnify and defend such parties against, all liabilities, obligations, damages, penalties, claims, actions, costs, charges and expenses, including reasonable attorneys’ fees and other professional fees that may be imposed upon, incurred by or asserted against any of such indemnified parties (each a “Claim” and collectively “Claims”) that arise out of or in connection with any damage or injury suffered by any third party which occurs in the Premises, EVEN IF THE CLAIM IS CAUSED BY THE NEGLIGENCE OF ANY LANDLORD PARTY, BUT NOT TO THE EXTENT SUCH CLAIM IS CAUSED BY THE GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF ANY LANDLORD PARTY. Subject to Articles 9.B, 15 and 20, Landlord shall hold Tenant, its trustees, Affiliates, members, principals, beneficiaries, partners, officers, directors, shareholders, employees and agents (collectively, “Tenant Parties”) harmless from, and indemnify and defend such parties against, all Claims that arise out of or in connection with any drainage or injury suffered by any third party which occurs in or on the Common Areas of the Property, to the same extent the Tenant Parties would have been covered had they been named as additional insureds on the commercial general liability insurance policy required to be carried by Landlord under this Lease, EVEN IF THE CLAIM IS CAUSED BY THE NEGLIGENCE OF ANY TENANT PARTY, BUT NOT TO THE EXTENT SUCH CLAIM IS CAUSED BY THE GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF ANY TENANT PARTY. This Article 13 shall survive the expiration or earlier termination of this Lease.

14. Insurance.

A. Tenant’s Insurance.