Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DOVER Corp | a201506098-k.htm |

William Blair Growth Stock Conference June 9, 2015 Bob Livingston President & Chief Executive Officer Exhibit 99.1

2 Forward looking statements We want to remind everyone that our comments may contain forward-looking statements that are inherently subject to uncertainties and risks. We caution everyone to be guided in their analysis of Dover by referring to the documents we file from time to time with the SEC, including our Form 10-K for 2014 and our Form 10-Q for the first quarter of 2015, for a list of factors that could cause our results to differ from those anticipated in any such forward-looking statements. We would also direct your attention to our website, www.dovercorporation.com, where considerably more information can be found.

3 Our strategy is focused on Expanding our businesses in key markets with significant growth potential Capitalizing on our expertise and providing products and solutions globally to customers who value our offerings Innovating to address our customers’ needs and help them win in their markets Maintaining and emphasizing our entrepreneurial culture with intense customer focus 3

4 Our strategy execution revolves around key objectives Invest in areas of growth – Markets with attractive growth characteristics – Profitable, with stable margins and opportunity for improvement – “Sticky” customer relationships Operate well, efficiently – Expand margins through Dover productivity processes – Share best practices and leverage our scale – Develop and recruit talent Drive high free cash flow / yield – Dividends – Organic investments – M & A – Share repurchases

5 We continue to execute on our guiding strategy and objectives Our business profile is more focused, with sustainable strong margins and returns We have invested in and expanded our businesses within our growth areas We have accelerated our efforts and processes around innovation, focusing on technologies which create tangible value for our customers We have implemented multiple development and training programs resulting in significant talent enhancement Our focus on productivity and continuous improvement, driven by Dover productivity processes, is broad-based 5

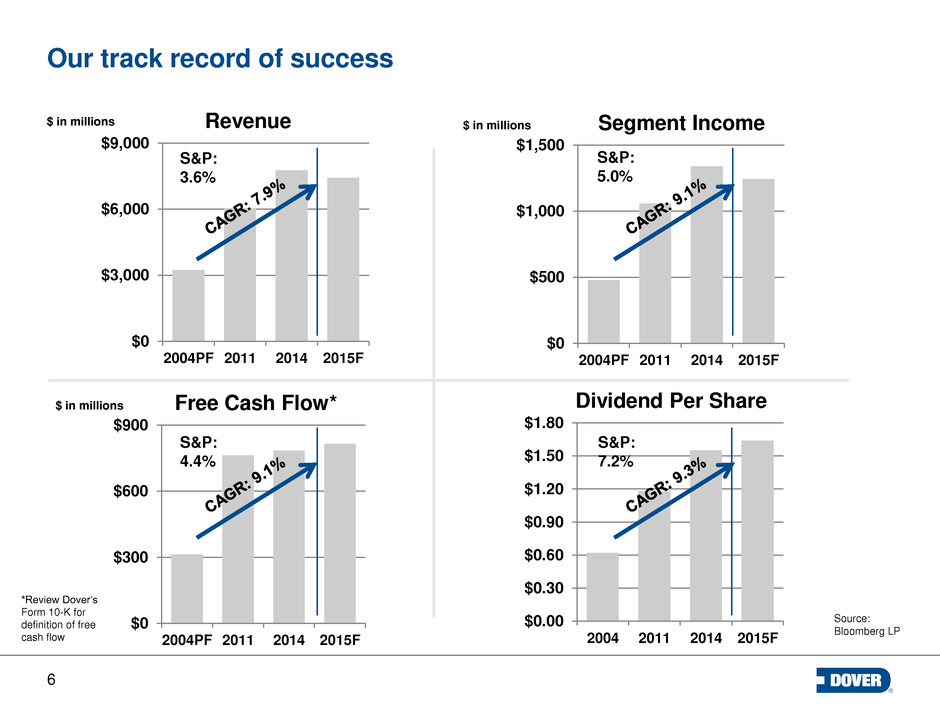

6 Our track record of success $0 $3,000 $6,000 $9,000 2004PF 2011 2014 2015F Revenue $ in millions $0 $500 $1,000 $1,500 2004PF 2011 2014 2015F Segment Income $ in millions $0 $300 $600 $900 2004PF 2011 2014 2015F Free Cash Flow* $ in millions $0.00 $0.30 $0.60 $0.90 $1.20 $1.50 $1.80 2004 2011 2014 2015F Dividend Per Share S&P: 3.6% S&P: 7.2% S&P: 4.4% S&P: 5.0% Source: Bloomberg LP *Review Dover’s Form 10-K for definition of free cash flow

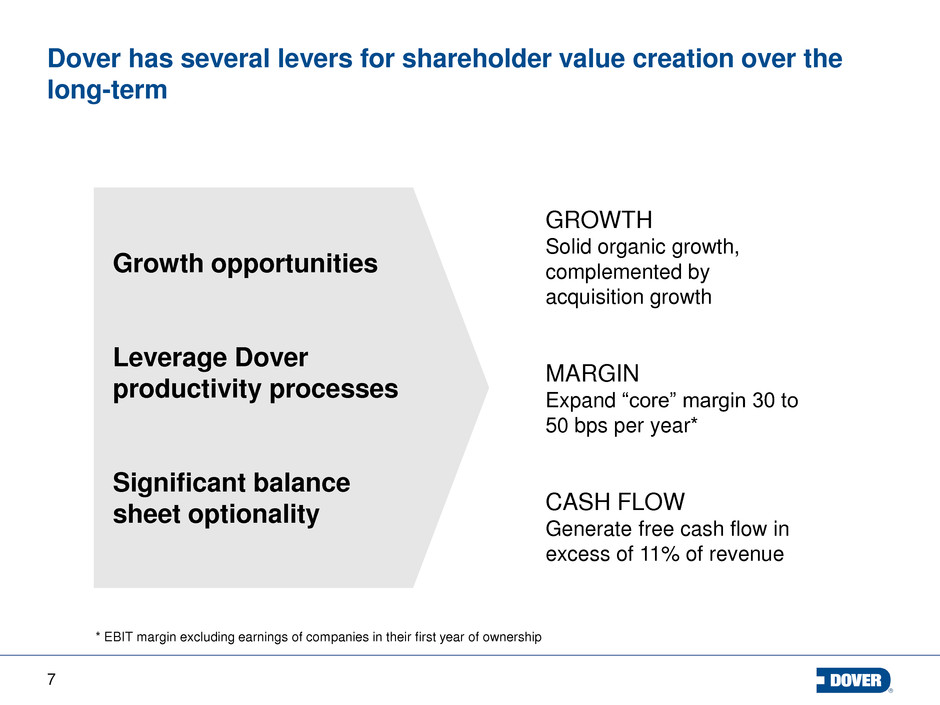

7 Dover has several levers for shareholder value creation over the long-term 7 GROWTH Solid organic growth, complemented by acquisition growth MARGIN Expand “core” margin 30 to 50 bps per year* CASH FLOW Generate free cash flow in excess of 11% of revenue Growth opportunities Leverage Dover productivity processes Significant balance sheet optionality * EBIT margin excluding earnings of companies in their first year of ownership

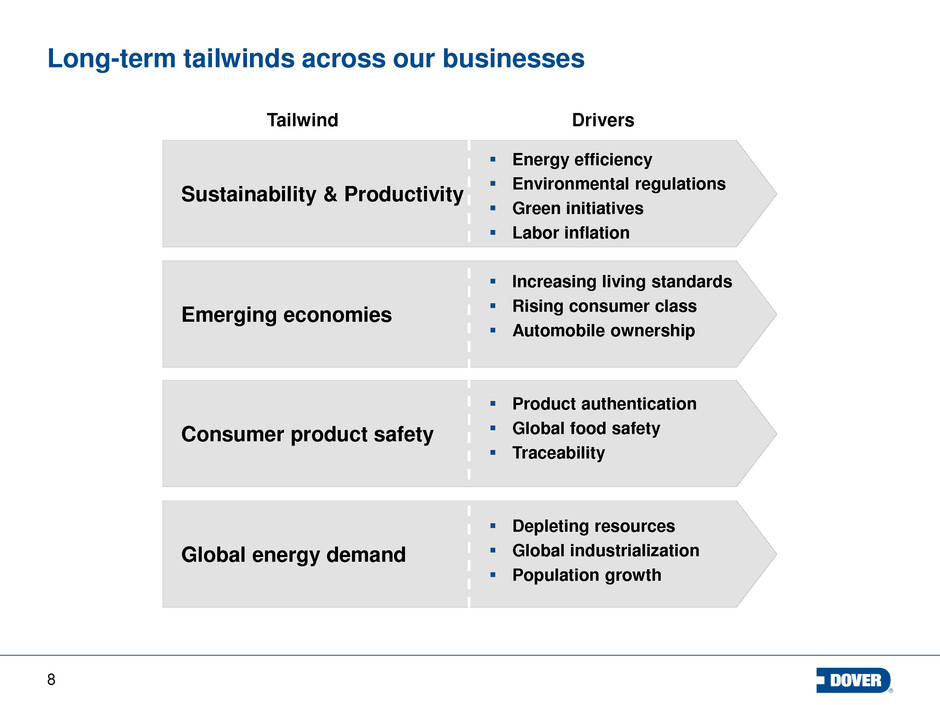

8 Long-term tailwinds across our businesses Emerging economies Sustainability & Productivity Consumer product safety Global energy demand Energy efficiency Environmental regulations Green initiatives Labor inflation Increasing living standards Rising consumer class Automobile ownership Product authentication Global food safety Traceability Depleting resources Global industrialization Population growth Tailwind Drivers

9 Mid-Quarter Update Energy markets continue to be weak as expected – Significant destocking continuing in Q2 – Price pressure continues – Q2 expected to be lowest revenue quarter in 2015 Demand environment remains soft in refrigeration, oil & gas related pump markets, and industrial businesses within Engineered Systems – Order trends are inconsistent Capital allocation – Pace of $600M share repurchase remains on target – Pipeline is very active 9

10 Near-term areas of focus Energy Align cost structure to demand environment Pursue share gains in Drilling & Production and expand international presence Engineered Systems Grow NA and Asia business in Printing & Identification, including conversion to digital print Focus on productivity solution delivery in Industrial platform 10 Fluids Leverage positive Fluid Transfer regulatory environment through product development and scale Look to expand verticals served through acquisition Refrigeration & Food Equipment Grow share of regional and national food retailers in refrigeration Improve margin through strong focus on productivity and cost management

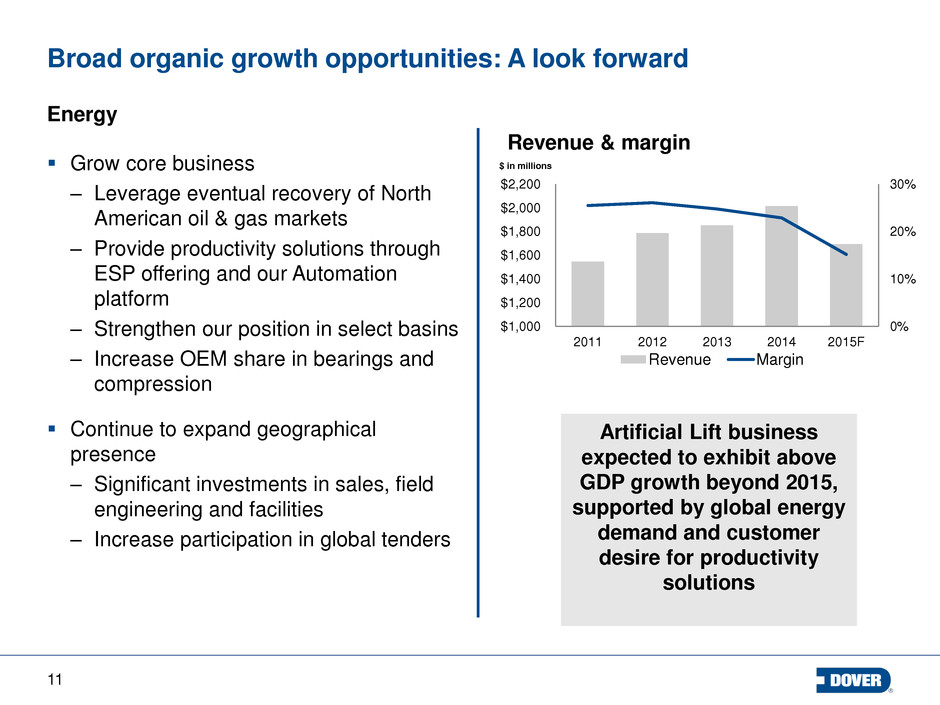

11 Broad organic growth opportunities: A look forward Energy Grow core business – Leverage eventual recovery of North American oil & gas markets – Provide productivity solutions through ESP offering and our Automation platform – Strengthen our position in select basins – Increase OEM share in bearings and compression Continue to expand geographical presence – Significant investments in sales, field engineering and facilities – Increase participation in global tenders 11 0% 10% 20% 30% $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 $2,200 2011 2012 2013 2014 2015F $ in millions Revenue & margin Revenue Margin Artificial Lift business expected to exhibit above GDP growth beyond 2015, supported by global energy demand and customer desire for productivity solutions

12 Broad organic growth opportunities: A look forward Engineered Systems Expand and extend markets served in Printing & Identification – Capitalize in fast growing textile market – Grow North American and China presence in core markets Make focused industrial investments – Concentrate on after-market customer productivity solutions – Expand in high growth recycling and waste-to-energy markets Extend geographic reach – Accelerate growth outside the US – Growing middle class consumption and higher operating costs driving automation solutions in emerging markets 12 0% 5% 9% 14% 18% $1,200 $1,600 $2,000 $2,400 $2,800 2011 2012 2013 2014 2015F $ in millions Revenue & margin Revenue Margin Printing businesses expected to significantly grow, supported by growing consumerism in emerging economies and global focus on product integrity and safety

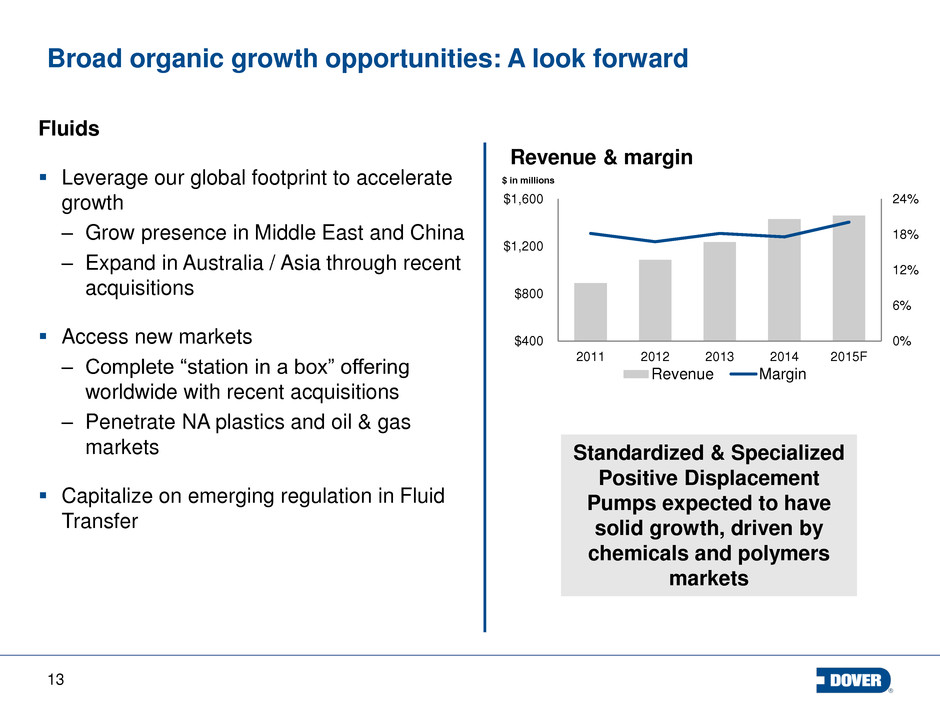

13 Broad organic growth opportunities: A look forward Fluids Leverage our global footprint to accelerate growth – Grow presence in Middle East and China – Expand in Australia / Asia through recent acquisitions Access new markets – Complete “station in a box” offering worldwide with recent acquisitions – Penetrate NA plastics and oil & gas markets Capitalize on emerging regulation in Fluid Transfer 13 0% 6% 12% 18% 24% $400 $800 $1,200 $1,600 2011 2012 2013 2014 2015F $ in millions Revenue & margin Revenue Margin Standardized & Specialized Positive Displacement Pumps expected to have solid growth, driven by chemicals and polymers markets

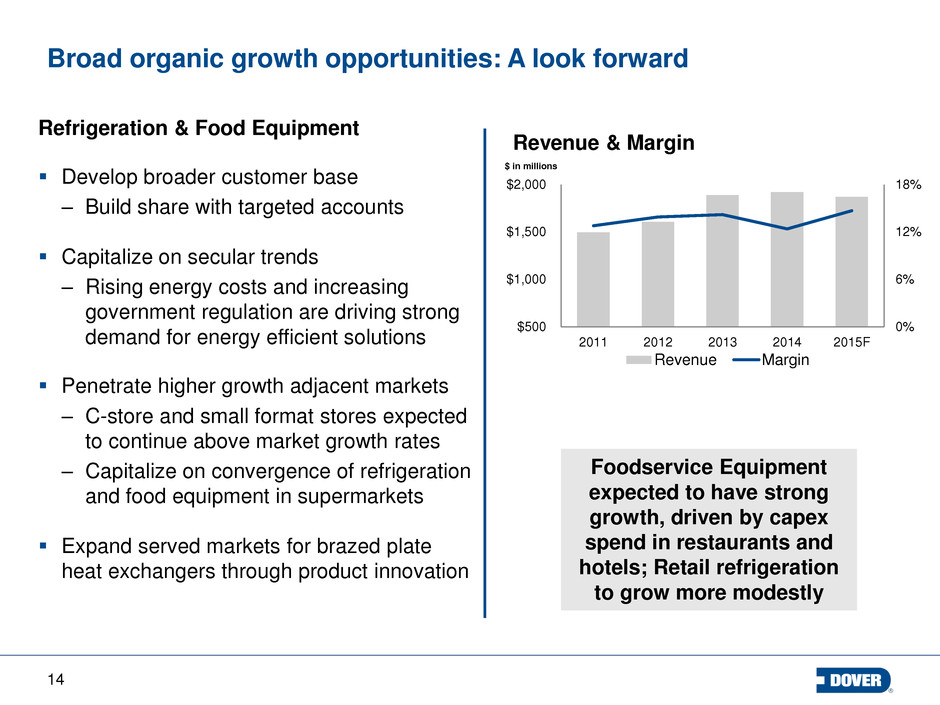

14 Broad organic growth opportunities: A look forward Refrigeration & Food Equipment Develop broader customer base – Build share with targeted accounts Capitalize on secular trends – Rising energy costs and increasing government regulation are driving strong demand for energy efficient solutions Penetrate higher growth adjacent markets – C-store and small format stores expected to continue above market growth rates – Capitalize on convergence of refrigeration and food equipment in supermarkets Expand served markets for brazed plate heat exchangers through product innovation 14 0% 6% 12% 18% $500 $1,000 $1,500 $2,000 2011 2012 2013 2014 2015F $ in millions Revenue & Margin Revenue Margin Foodservice Equipment expected to have strong growth, driven by capex spend in restaurants and hotels; Retail refrigeration to grow more modestly

15 Multiple areas for acquisition growth Fluids Build on our position in select verticals and pump technologies Additional opportunities to expand in Fluid Transfer Engineered Systems Expand verticals served in Printing Selective industrial opportunities Refrigeration & Food Equipment Grow presence in Food Equipment Additional opportunities in fast growing heat exchangers Energy Continue to build the Automation platform Opportunities for geographic expansion 15 Significant achievements of our acquisition program: Average annual acquisition revenue growth of ≈ 5% over the last 10 years Focused on higher growth markets Created a more focused industrial portfolio with a consistent earnings profile

16 Dover productivity processes drive margin enhancement Dover productivity processes – Global supply chain Target $30 - $40 million in annual savings – Focus on continuous improvement (“CI”) and lean Productivity projects expected to be 30% of capex spend – Shared infrastructure in plants and ERP/back office Improving performance and reinvesting for growth – Actively reducing costs across all businesses – Continuing to invest in innovation 16 Supply chain expected to deliver over $40 million annually Recent restructuring actions expected to deliver benefits of around $75 million in 2015, other actions delivered another $30 million

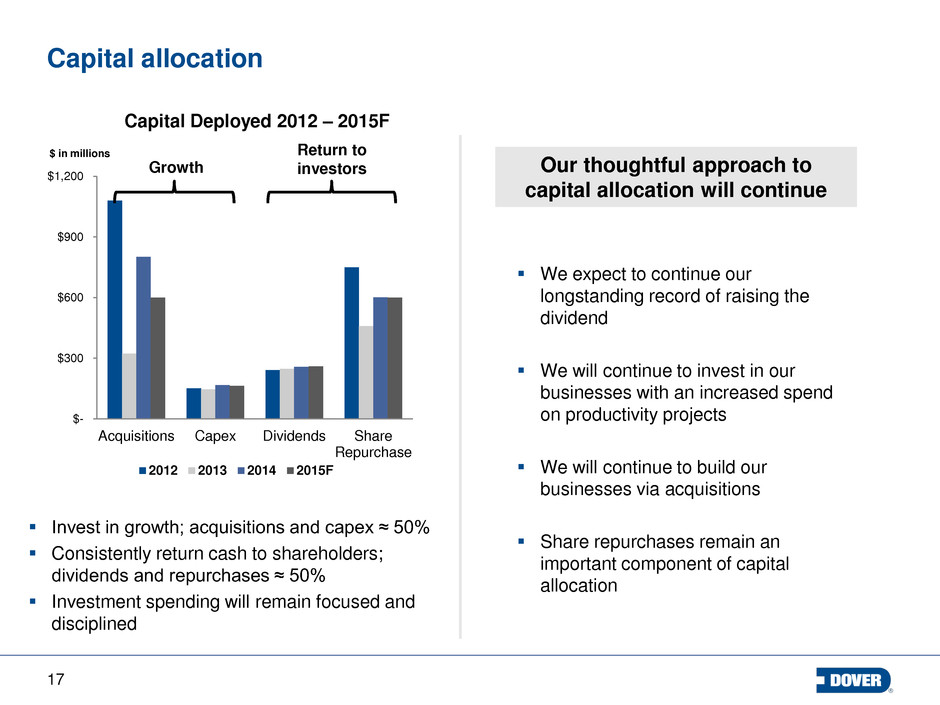

17 $- $300 $600 $900 $1,200 Acquisitions Capex Dividends Share Repurchase $ in millions 2012 2013 2014 2015F Return to investors Capital allocation Invest in growth; acquisitions and capex ≈ 50% Consistently return cash to shareholders; dividends and repurchases ≈ 50% Investment spending will remain focused and disciplined 17 Growth Capital Deployed 2012 – 2015F We expect to continue our longstanding record of raising the dividend We will continue to invest in our businesses with an increased spend on productivity projects We will continue to build our businesses via acquisitions Share repurchases remain an important component of capital allocation Our thoughtful approach to capital allocation will continue

18 Summary Multiple organic growth opportunities across each segment Prioritized roadmap of acquisition targets driven by strategy Our acquisition integration and restructuring enables higher investment for innovation and growth We remain focused on broad-based margin expansion opportunities and activities Core competency of consistently generating cash to fund growth continues Our strong financial position enables balanced and meaningful capital redeployment 18