Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - 180 DEGREE CAPITAL CORP. /NY/ | v412556_8k.htm |

| EX-99.2 - PRESS RELEASE DATED JUNE 5, 2015 - 180 DEGREE CAPITAL CORP. /NY/ | v412556_ex99-2.htm |

FIRST QUARTER REPORT 2015

Fellow Shareholders:

In conjunction with our Annual Meeting of Shareholders, we have provided a link on the home page of our website (http://www.hhvc.com) to a PowerPoint presentation. The purpose of this presentation and accompanying letter is to present three features of our strategic roadmap and three strategic initiatives we are focused on accomplishing. Our goal is that this information helps shareholders understand what we believe is necessary to make Harris & Harris Group successful and the timeframe in which we believe it can happen.

In 2002, we focused the Company on investing in hard science companies enabled at the nanoscale and microscale. As of December 31, 2001, we had $13.4 million in net cash on our balance sheet. Over the next 13 years we raised over approximately $140 million in capital in the public markets and recycled approximately $100 million in realized capital from portfolio investments back into the Company.

Beginning in 2009, because of the overlap with companies enabled at the nanoscale, many of our new initial investments were in BIOLOGY+ companies. We define BIOLOGY+ investments as investments in interdisciplinary life science companies where biology is intersecting with innovations in areas such as electronics, physics, materials science, chemistry, information technology, engineering and mathematics. In 2013, we announced that all new initial investments would be in BIOLOGY+ companies. We focused our efforts on BIOLOGY+ because in looking back through our decade of investing in nanotechnology and microtechnology, we observed that our gross returns in the life sciences significantly outperformed our gross returns in electronics and in energy.

Why? All three of our historical areas of investment are capital intensive industries. Our companies are built from discoveries made in the hard sciences. We observed that technology became rapidly commoditized in many areas of electronics and semiconductors. We observed that the manufacturing plants took more of the economic return than technology in energy, especially when the end products were commodities. However, we observed that the value of technology remains realizable in the types of life science companies in which we invest.

| 1 |

We are leveraging our experience in the electronics and energy industries, markets and technologies actively as we execute on investments in BIOLOGY+ companies. These companies merge electronics, software and hardware innovations into life science market segments to address unmet needs and enable us to participate and take advantage of exciting innovations and trends such as those in big data and machine learning. We already have companies like D-Wave Systems, Inc., Metabolon, Inc., Echopixel, Inc., Uberseq, Inc., and Phylagen, Inc., operating within these areas. Another advantage of investing in these types of companies are that they can be relatively more capital efficient than pure electronics or energy-related companies. We believe this increased capital efficiency could translate into higher return potential for Harris & Harris Group.

As one can see below, since 2009, the vast majority of our initial investments have migrated to the life sciences. We believe that for our current size, companies in the life sciences afford the ability to grow successful companies with better return profiles.

In 2011, we began realizing the first exits from the portfolio we began building in 2002. As one can see below, since 2001, we have realized multiple exits from this portfolio that have generated both gains and losses on invested capital. However, as we have discussed previously in letters to shareholders, most recently in our Annual Letter to Shareholders, we have not yet generated the “home-run” return that we need to impact significantly and positively net asset value per share (“NAV”) and potentially lead to stock price appreciation.

| 2 |

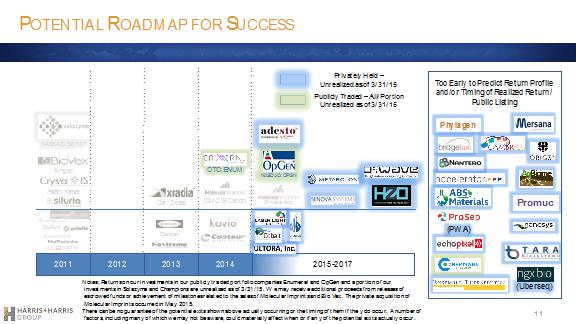

As we look forward, we believe our potential roadmap to success will have the following features:

First, we believe we will continue to have additional realized exits in 2015-2016 that will provide us with cash and secondary liquidity to manage the company. We have already had one small initial public offering (“IPO”), OpGen, Inc., in 2015. Also, in 2015, we sold the remainder of Molecular Imprints, Inc., that was not purchased by Canon, Inc., in 2014. We are currently working to close on the sale of our position in one additional portfolio company and to have one additional portfolio company complete an IPO. The portfolio company position sale is currently contemplated to occur above our value of those securities as of the prior quarter. It is uncertain what the value will be of our securities of the company seeking to complete an IPO at the time of such IPO. While we are actively working on completing these liquidity events, there can be no assurance that they will be completed this year, or at all.

Second, although many of these realized events demonstrate our ability to build successful companies that offset our losses, we do not define them as “impactful” events. We believe we need to realize one or more liquidity events that have the potential to be “impactful” to Harris & Harris Group’s investors within the next two years. We define “impactful” as the ability to return in excess of $30 million to Harris & Harris Group. Furthermore, we believe it is important to have at least one impactful event that returns six to ten times our investment to create meaningful growth to NAV. We currently believe we have such potentially “impactful” companies in our existing portfolio today.

| 3 |

Third, in the slide above, the box on the far right side includes current companies in our portfolio where we do not have the visibility necessary to predict the timing or magnitude of a liquidity event. Many of these companies are early-stage, and we plan to continue to build them over the coming years.

In the slide above, we have categorized the portfolio companies in this box into a) companies we currently believe have substantial return potential to Harris & Harris Group owing to our ownership or control or other factors, and b) the remaining companies, some of which we may seek to monetize in the near term.

| 4 |

As we have discussed previously, there is sometimes a difference between high-quality companies and high-quality companies that can provide impactful returns to Harris & Harris Group. In order to grow NAV, we need to build the latter. As a publicly traded company, we have the unique ability to recycle our capital from lower performing assets to assets that have better return profiles. This is becoming an important part of our portfolio management strategy.

Before discussing our three initiatives, we would like to once again reiterate that we believe we are involved in some of the most important market areas of the coming decade. This is why we believe we have the opportunity to generate impactful returns into the future. We have built, and we continue to build companies that are leaders in the emerging fields of the internet of things (IoT), the microbiome, machine learning, AgTech and regenerative medicine.

These companies and markets are now attracting tremendous attention, and we believe many of our portfolio companies are positioned to be leaders in their respective markets. In the coming months, we are going to write a series of blogs on each of these transformative markets. These blogs will provide information on what these areas are, how we believe these areas will emerge, who the incumbent and emerging companies are within them, and what our companies are doing in these spaces. We hope these blogs will bring some attention to our work in these areas, as well as provide insights into how our companies and these areas will impact business in the coming years.

We would now like to address our three initiatives. First, we recognize expenses are a hot button issue. Our 2015 expenses are currently estimated to be between $6.5 and $7 million. Approximately $3.5 million to $4 million of this expense is related to our public company structure. The expenses related to our public company structure have increased over the years owing primarily to the requirements of the current regulatory environment. We are committed to increase the amount of revenue we generate to reduce the difference between our current expenses of $6.5 to $7 million and those expenses required to only manage the public company structure, currently, $3.5 to $4 million. This will take time, but we will be a stronger company if we successfully reduce these net expenses.

| 5 |

Second, achieving scale has never been more important than it is today to generate growth. We are evaluating a number of strategic opportunities that would permit our shareholders to gain access to scale and growth. We are open to both organic and inorganic means to reach scale and have been involved in multiple discussions to achieve this goal over the past six months.

Lastly, as we discussed in previous shareholder letters, we are making fewer initial investments in new companies, but in the companies we are building, we believe we have the potential to have greater ownership, impact and control. The number of companies in our portfolio will decrease over the coming years, but the potential impact of each company within our portfolio will become greater. We believe that this is the best way to build companies that can create the necessary impact for our shareholders.

Executing on these initiatives is also important for building value over the coming years. We believe our focus is rightfully placed. We will continue to focus on execution. Please remember to visit our website and read our blog postings at www.hhvc.com/blogs. Thank you for your support.

| Douglas W. Jamison | |

| Chairman, Chief Executive Officer | |

| and Managing Director |

June 5, 2015

This letter may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company's current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this letter. Please see the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as well as subsequent filings, filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company's business, including but not limited to, the risks and uncertainties associated with venture capital investing and other significant factors that could affect the Company's actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The references to the website www.HHVC.com has been provided as a convenience, and the information contained on such website is not incorporated by reference into this letter.

| 6 |