Attached files

| file | filename |

|---|---|

| 8-K - ANNUAL SHAREHOLDERS MEETING - Diversicare Healthcare Services, Inc. | a8k-6415annualshareholders.htm |

Nasdaq: DVCR Annual Meeting of Shareholders June 4, 2015

Nasdaq: DVCR Forward-looking statements made in this presentation involve a number of risks and uncertainties, but not limited to, our ability to successfully operate the new nursing centers in Alabama, Kansas, Kentucky, Missouri, Ohio, and Indiana, our ability to increase patients served at our renovated centers, changes in governmental reimbursement, government regulation, the impact of the recently adopted federal health care reform or any future healthcare reform, any increases in the cost of borrowing under our credit agreements, our ability to comply with covenants contained in those credit agreements, the outcome of professional liability lawsuits and claims, our ability to control ultimate professional liability costs, the accuracy of our estimate of our anticipated professional liability expense, the impact of future licensing surveys, the outcome of proceedings alleging violations of state or Federal False Claims Acts, laws and regulations governing quality of care or other laws and regulations applicable to our business including laws governing reimbursement from government payers, impacts associated with the implementation of our electronic medical records plan, the costs of investing in our business initiatives and development, our ability to control costs, changes to our valuation of deferred tax assets, changes in occupancy rates in our centers, changing economic and competitive conditions, changes in anticipated revenue and cost growth, changes in the anticipated results of operations, the effect of changes in accounting policies as well as other risk factors detailed in the Company's Securities and Exchange Commission filings. The Company has provided additional information in its Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as well as in other filings with the Securities and Exchange Commission, which readers are encouraged to review for further disclosure of other factors that could cause actual results to differ materially from those indicated in the forward-looking statements. Forward-Looking Statements 2

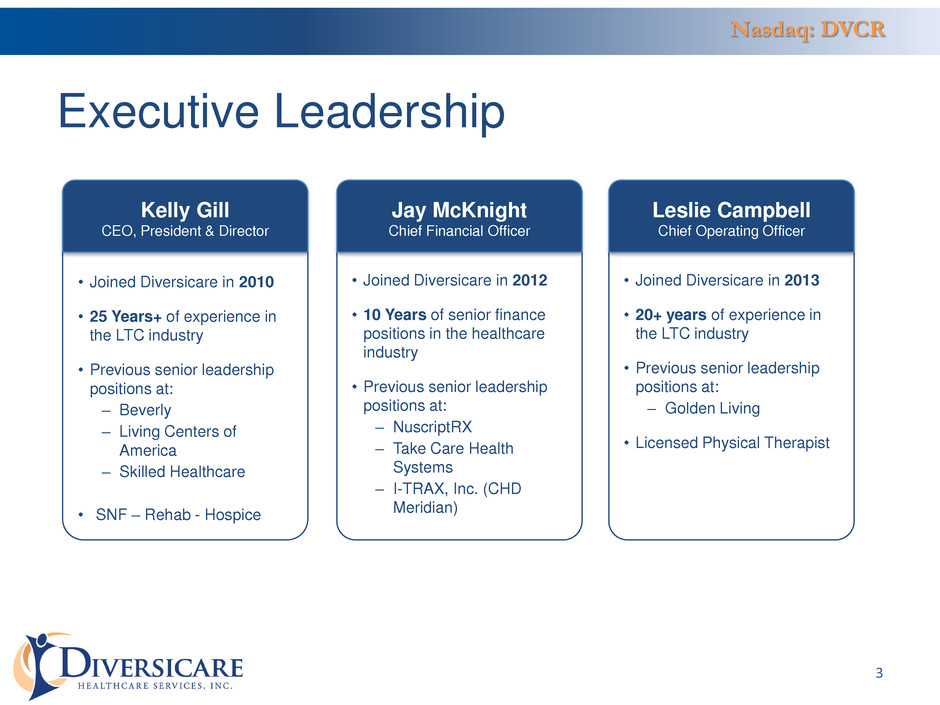

Nasdaq: DVCR • Joined Diversicare in 2013 • 20+ years of experience in the LTC industry • Previous senior leadership positions at: ‒ Golden Living • Licensed Physical Therapist Executive Leadership • Joined Diversicare in 2012 • 10 Years of senior finance positions in the healthcare industry • Previous senior leadership positions at: ‒ NuscriptRX ‒ Take Care Health Systems ‒ I-TRAX, Inc. (CHD Meridian) • Joined Diversicare in 2010 • 25 Years+ of experience in the LTC industry • Previous senior leadership positions at: ‒ Beverly ‒ Living Centers of America ‒ Skilled Healthcare • SNF – Rehab - Hospice Jay McKnight Chief Financial Officer Kelly Gill CEO, President & Director Leslie Campbell Chief Operating Officer 3

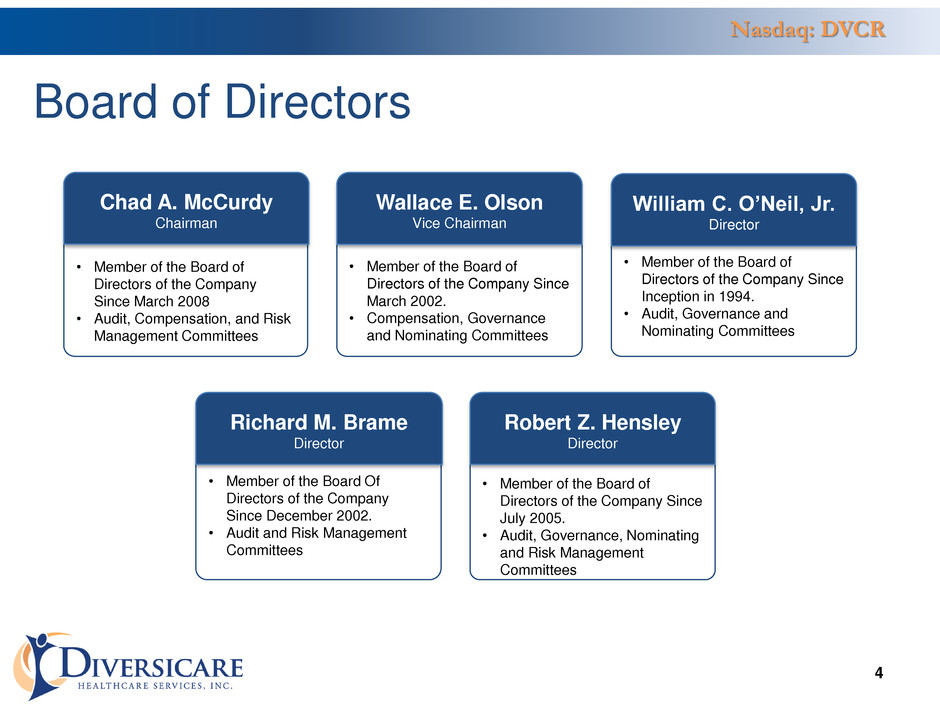

Nasdaq: DVCR • Member of the Board of Directors of the Company Since Inception in 1994. • Audit, Governance and Nominating Committees Board of Directors 4 • Member of the Board of Directors of the Company Since March 2002. • Compensation, Governance and Nominating Committees • Member of the Board of Directors of the Company Since March 2008 • Audit, Compensation, and Risk Management Committees Wallace E. Olson Vice Chairman Chad A. McCurdy Chairman William C. O’Neil, Jr. Director • Member of the Board of Directors of the Company Since July 2005. • Audit, Governance, Nominating and Risk Management Committees • Member of the Board Of Directors of the Company Since December 2002. • Audit and Risk Management Committees Robert Z. Hensley Director Richard M. Brame Director

Nasdaq: DVCR Leading Skilled Nursing Provider Compelling Demographic Trends Management’s Strategic Vision Yielding Results Improving Patient Quality Measures, Census And Skilled Mix Demonstrated Ability To Grow And Enhance Portfolio Positively Trending Financial Results Investment Highlights 5

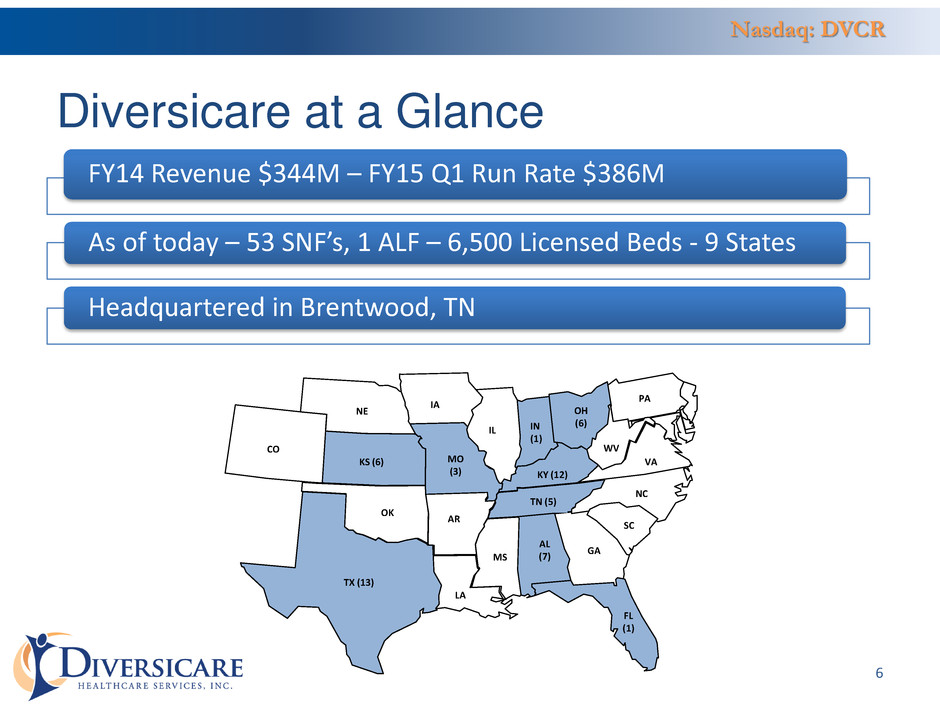

Nasdaq: DVCR FY14 Revenue $344M – FY15 Q1 Run Rate $386M As of today – 53 SNF’s, 1 ALF – 6,500 Licensed Beds - 9 States Headquartered in Brentwood, TN NE CO OK LA FL (1) IA IL KS (6) OH (6)IN (1) MO (3) AR KY (12) TN (5) PA MS AL (7) SC NC GA VA WV TX (13) Diversicare at a Glance 6

Nasdaq: DVCR • Operating since 1989 • Traded on NASDAQ: DVCR • Publicly traded since 1994 • Added to Russell Microcap Index in 2014 • 52 week range $6.29 – $17.15 • Highest 2014 share price growth in peer group with 109% • Historically paid $0.22 annual dividend 7 Company Profile

Nasdaq: DVCR 8 Long Term Care Industry Overview • Compelling Demographic Trends • High Quality Clinical Outcomes • Relative Low Cost of Care

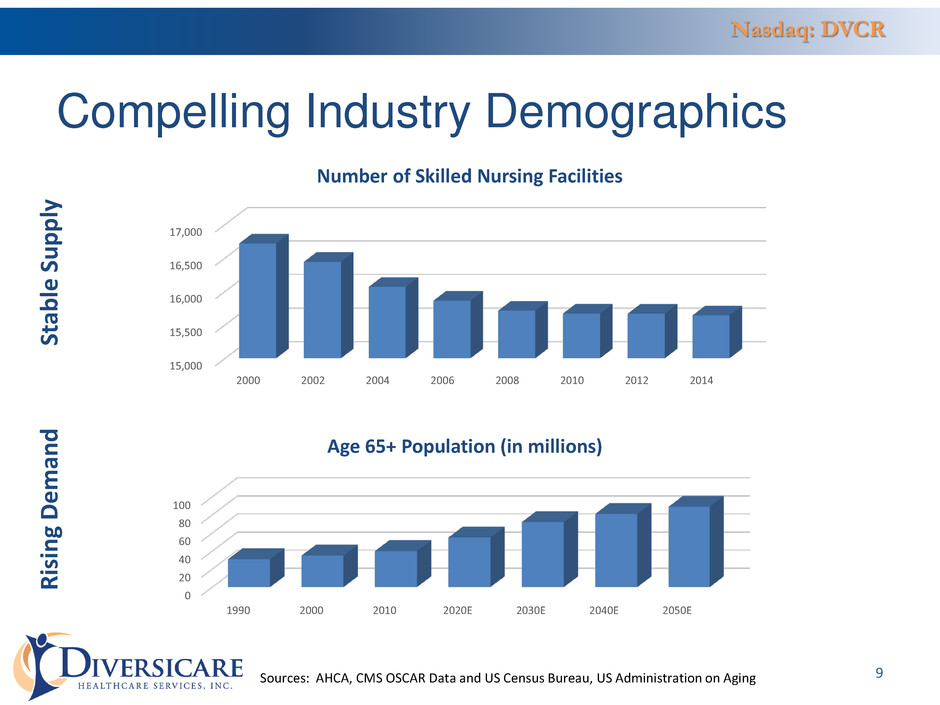

Nasdaq: DVCR 9 Compelling Industry Demographics Risi n g Deman d St able Su p pl y Sources: AHCA, CMS OSCAR Data and US Census Bureau, US Administration on Aging 15,000 15,500 16,000 16,500 17,000 2000 2002 2004 2006 2008 2010 2012 2014 Number of Skilled Nursing Facilities 0 20 40 60 80 100 1990 2000 2010 2020E 2030E 2040E 2050E Age 65+ Population (in millions)

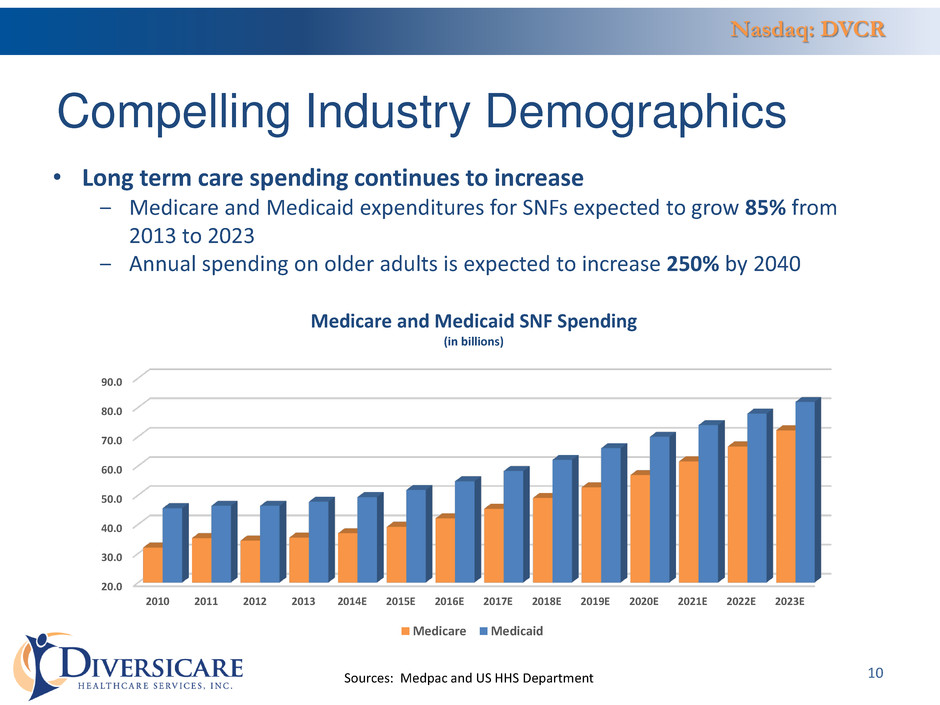

Nasdaq: DVCR 10 • Long term care spending continues to increase ‒ Medicare and Medicaid expenditures for SNFs expected to grow 85% from 2013 to 2023 ‒ Annual spending on older adults is expected to increase 250% by 2040 Sources: Medpac and US HHS Department Compelling Industry Demographics 20.0 30.0 40.0 50.0 60.0 70.0 80.0 90.0 2010 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E Medicare and Medicaid SNF Spending (in billions) Medicare Medicaid

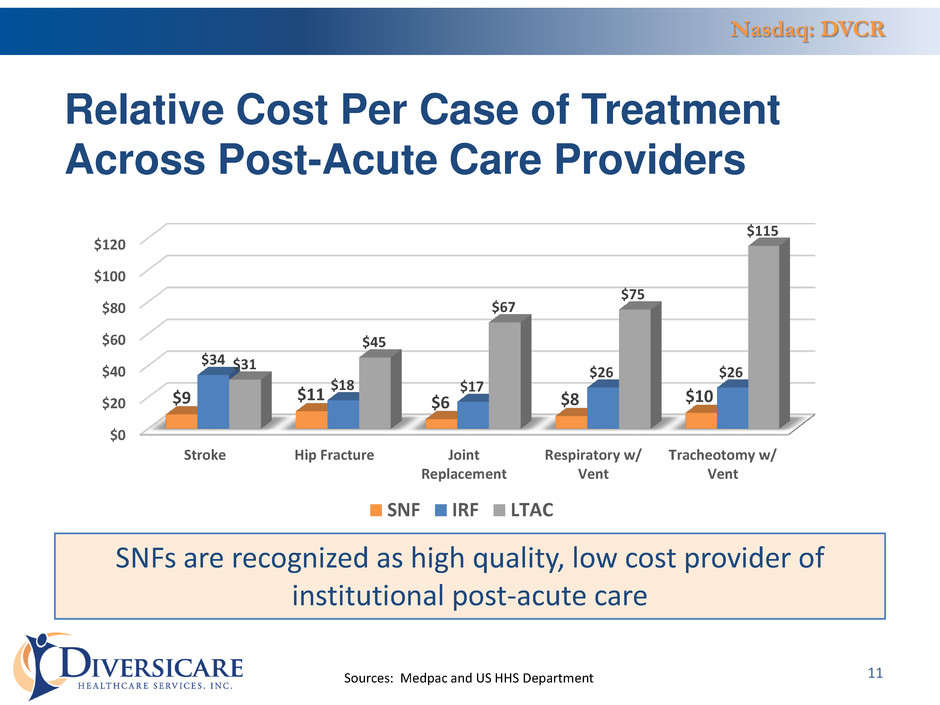

Nasdaq: DVCR 11 Relative Cost Per Case of Treatment Across Post-Acute Care Providers Sources: Medpac and US HHS Department $0 $20 $40 $60 $80 $100 $120 Stroke Hip Fracture Joint Replacement Respiratory w/ Vent Tracheotomy w/ Vent $9 $11 $6 $8 $10 $34 $18 $17 $26 $26 $31 $45 $67 $75 $115 SNF IRF LTAC SNFs are recognized as high quality, low cost provider of institutional post-acute care

Nasdaq: DVCR 12 Company Overview • Mature Company • Provides a full spectrum of post-acute healthcare services • Robust operating platform capable of significant growth expansion

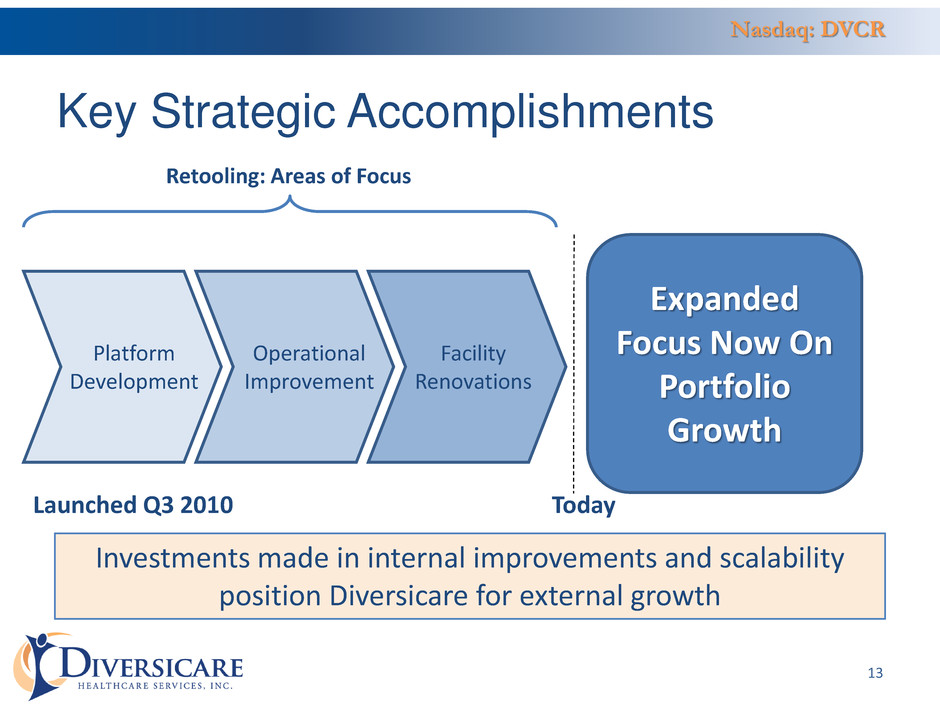

Nasdaq: DVCR Investments made in internal improvements and scalability position Diversicare for external growth Launched Q3 2010 Today Expanded Focus Now On Portfolio Growth Retooling: Areas of Focus Platform Development Operational Improvement Facility Renovations Key Strategic Accomplishments 13

Nasdaq: DVCR 14 Key Results and Outcomes • Improved Quality Measures • Improved patient mix and reimbursement rates • Improved operating and G&A leverage • Demonstrated growth through acquisitions

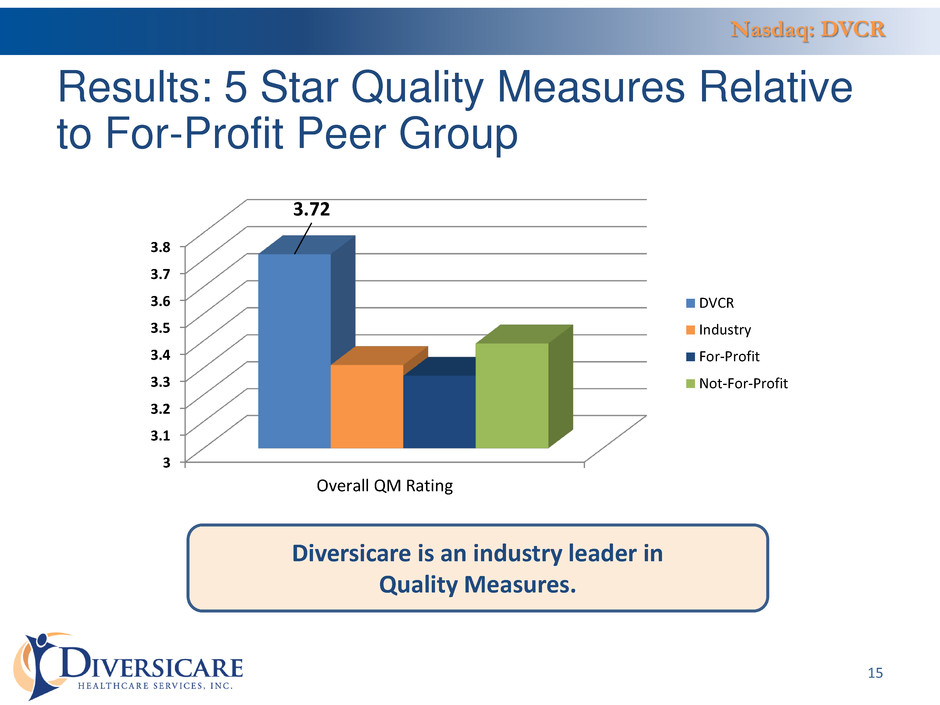

Nasdaq: DVCR Results: 5 Star Quality Measures Relative to For-Profit Peer Group 15 3 3.1 3.2 3.3 3.4 3.5 3.6 3.7 3.8 Overall QM Rating 3.72 DVCR Industry For-Profit Not-For-Profit Diversicare is an industry leader in Quality Measures.

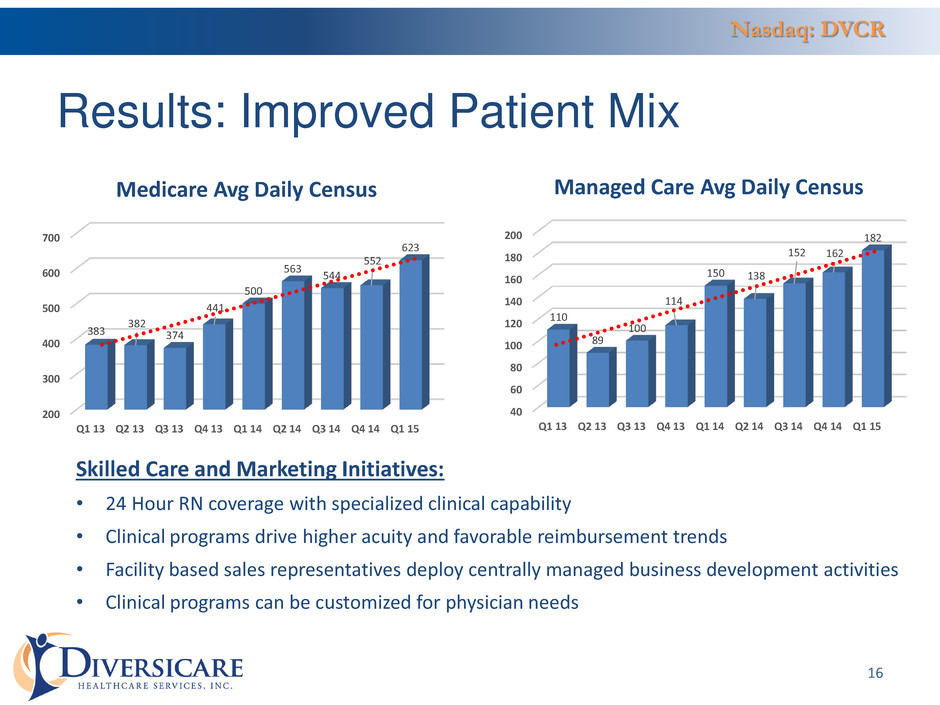

Nasdaq: DVCR Skilled Care and Marketing Initiatives: • 24 Hour RN coverage with specialized clinical capability • Clinical programs drive higher acuity and favorable reimbursement trends • Facility based sales representatives deploy centrally managed business development activities • Clinical programs can be customized for physician needs Results: Improved Patient Mix 16 200 300 400 500 600 700 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 383 382 374 441 500 563 544 552 623 Medicare Avg Daily Census 40 60 80 100 120 140 160 180 200 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 110 89 100 114 150 138 152 162 182 Managed Care Avg Daily Census

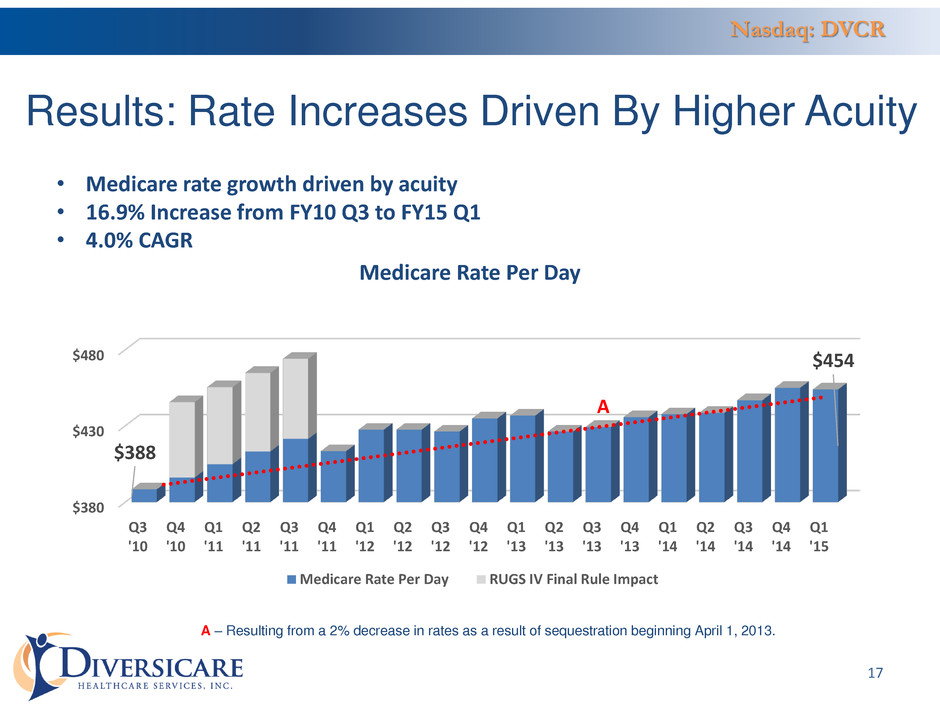

Nasdaq: DVCR A – Resulting from a 2% decrease in rates as a result of sequestration beginning April 1, 2013. Results: Rate Increases Driven By Higher Acuity • Medicare rate growth driven by acuity • 16.9% Increase from FY10 Q3 to FY15 Q1 • 4.0% CAGR 17 A $380 $430 $480 Q3 '10 Q4 '10 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 $388 $454 Medicare Rate Per Day Medicare Rate Per Day RUGS IV Final Rule Impact

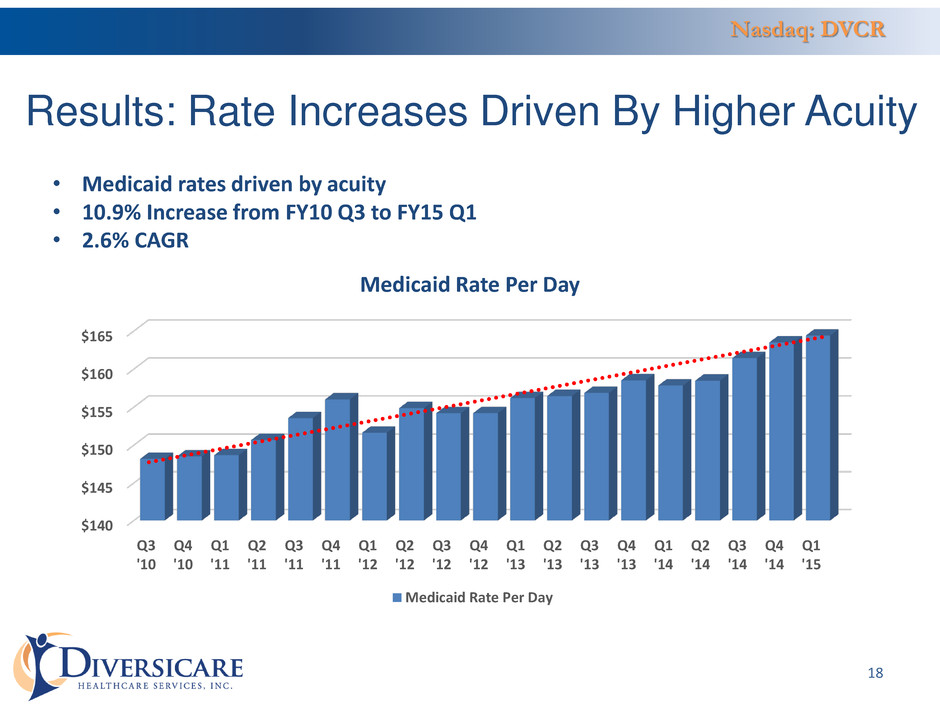

Nasdaq: DVCR • Medicaid rates driven by acuity • 10.9% Increase from FY10 Q3 to FY15 Q1 • 2.6% CAGR Results: Rate Increases Driven By Higher Acuity 18 $140 $145 $150 $155 $160 $165 Q3 '10 Q4 '10 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Medicaid Rate Per Day Medicaid Rate Per Day

Nasdaq: DVCR Results: Growth in Operated Facilities • Our ability to integrate facilities onto our platform is proven by our continuous growth and early accretion of new facilities. 19 25 30 35 40 45 50 55 60 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2013 Q1 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4 2015 Q1 32 54

Nasdaq: DVCR Acquisitions are Accretive to earnings within a quarter of acquisitions date – the exceptions being development opportunities like new construction, major renovations, etc. Demonstrated Platform Scalability by increasing revenues with a resulting reduction in G&A expense as percentage of revenue New Facility Integration, including EMR, implemented during the first quarter of operations at new facilities Results: Impact Of New Centers 20

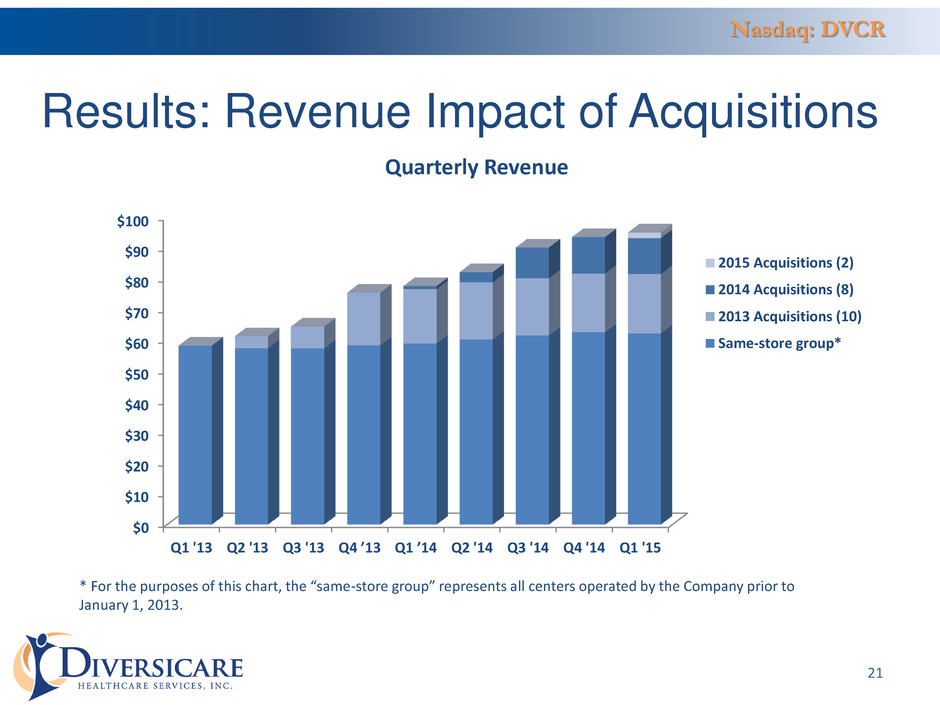

Nasdaq: DVCR $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 Q1 '13 Q2 '13 Q3 '13 Q4 ’13 Q1 ’14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Quarterly Revenue 2015 Acquisitions (2) 2014 Acquisitions (8) 2013 Acquisitions (10) Same-store group* Results: Revenue Impact of Acquisitions * For the purposes of this chart, the “same-store group” represents all centers operated by the Company prior to January 1, 2013. 21

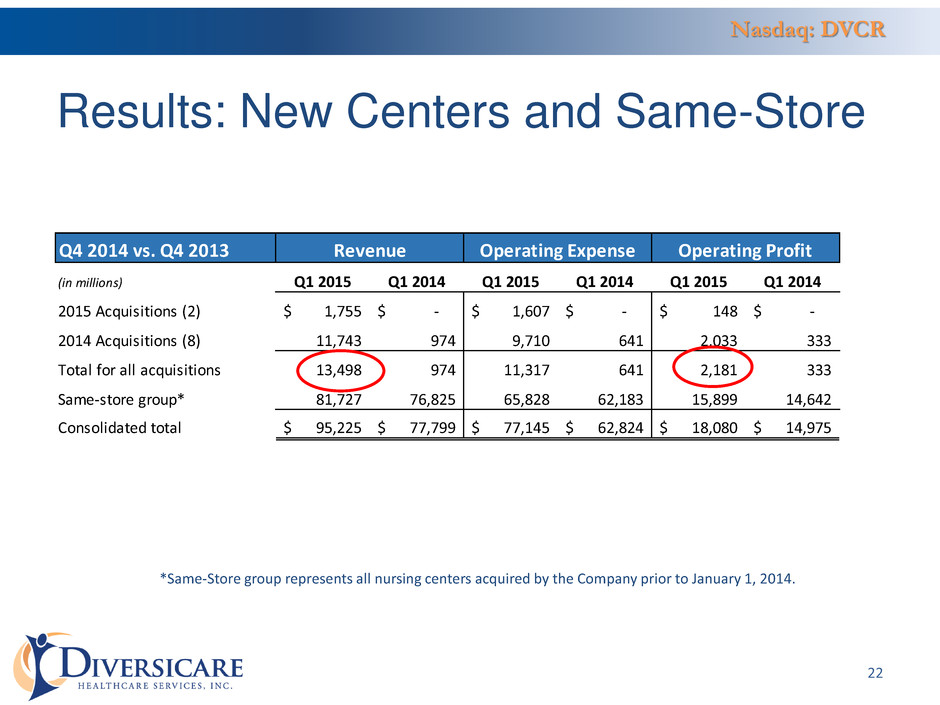

Nasdaq: DVCR Q4 2014 vs. Q4 2013 (in millions) Q1 2015 Q1 2014 Q1 2015 Q1 2014 Q1 2015 Q1 2014 2015 Acquisitions (2) 1,755$ -$ 1,607$ -$ 148$ -$ 2014 Acquisitions (8) 11,743 974 9,710 641 2,033 333 Total for all acquisitions 13,498 974 11,317 641 2,181 333 Same-store group* 81,727 76,825 65,828 62,183 15,899 14,642 Consolidated total 95,225$ 77,799$ 77,145$ 62,824$ 18,080$ 14,975$ Revenue Operating Expense Operating Profit *Same-Store group represents all nursing centers acquired by the Company prior to January 1, 2014. Results: New Centers and Same-Store 22

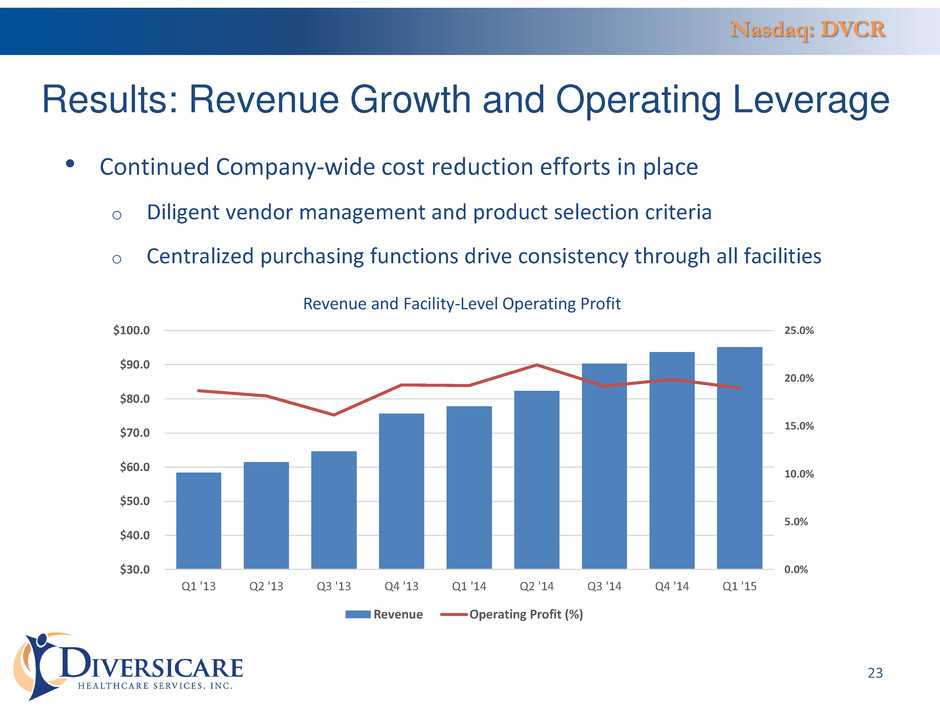

Nasdaq: DVCR Results: Revenue Growth and Operating Leverage • Continued Company-wide cost reduction efforts in place o Diligent vendor management and product selection criteria o Centralized purchasing functions drive consistency through all facilities 23 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 $100.0 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Revenue and Facility-Level Operating Profit Revenue Operating Profit (%)

Nasdaq: DVCR • Continued G&A reduction efforts in place o Right-sized overhead structure for new portfolio o Centralized core functions to leverage skilled teams • Savings from G&A reductions funded strategic investments • G&A increased in first half 2013 due to acquisition activity Results: Improving G&A Leverage 24 8.5% 6.4% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 G&A Expense as a % of Revenue

Nasdaq: DVCR 25 Current Areas of Focus • Continuous quality improvement • Enhancing existing portfolio • Growth through accretive acquisitions

Nasdaq: DVCR Continuous improvement of Quality Measures Continue to drive volume of patients served Improve skilled mix / provide high-acuity services Ongoing renovations of existing facilities Continue to Enhance Existing Portfolio 26

Nasdaq: DVCR Stated goal to double the Company within 5 years of Q3 2013 to 80 facilities Target: 5-10 new facilities per year Active pipeline and buyer friendly market Expanded operating infrastructure = Scalability Structure flexibility = Several sources of financial capacity Portfolio Growth 27

Nasdaq: DVCR Today2010 Portfolio has grown by more than 60% after divestitures • Exited Arkansas and West Virginia • Entered Missouri, Kansas, and Indiana • Added Facilities in Ohio, Alabama, and Kentucky Deepen and Expand Existing Footprint 28 OH (6) FL (1) IN (1) AL (7) KS (6) MO (3) TX (13) AR (12) TX (13) OH (1) AL (6) FL (1) WV (2)

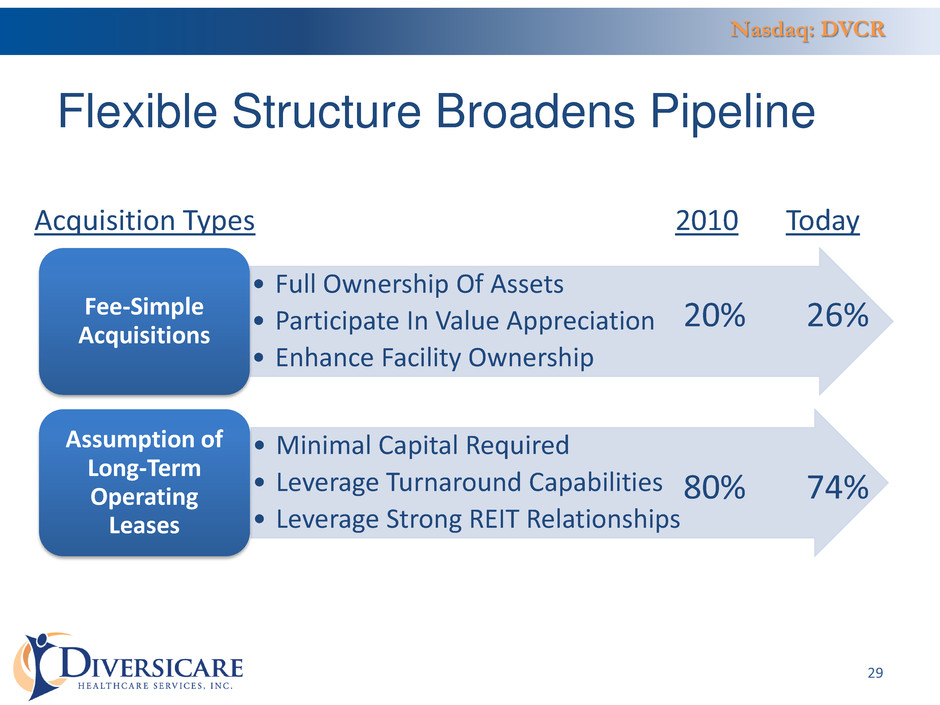

Nasdaq: DVCR • Full Ownership Of Assets • Participate In Value Appreciation • Enhance Facility Ownership Fee-Simple Acquisitions • Minimal Capital Required • Leverage Turnaround Capabilities • Leverage Strong REIT Relationships Assumption of Long-Term Operating Leases 2010 Today 20% 26% 80% 74% Flexible Structure Broadens Pipeline 29 Acquisition Types

Nasdaq: DVCR 30 Summary • Improved operational and financial results • Attractive investment dynamics • Repositioned for the future

Nasdaq: DVCR Key Financial and Operating Statistics Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Average Daily Census 3,986 4,090 4,414 4,473 4,580 Total Average Daily Census – Medicare & Managed Care 650 701 696 714 805 Skilled Mix % 16.3% 17.1% 15.7% 16.0% 17.6% Occupancy (Available Beds) 80.3% 81.3% 81.3% 79.6% 80.7% Medicare Rate Per Day $437.64 $438.46 $446.75 $454.94 $453.84 Medicaid Rate Per Day $157.83 $158.47 $161.43 $163.49 $164.39 Revenue (Millions) $77.8 $82.3 $90.3 $93.7 $95.2 Facility Level Operating Profit $15.0 $17.6 $17.3 $18.7 $18.1 G&A % of Revenue 6.6% 6.5% 6.2% 6.5% 6.4% Adjusted EBITDAR $7.9 $10.8 $10.1 $11.0 $10.1 Adjusted EBITDA $1.9 $4.6 $3.2 $3.9 $3.0 31

Nasdaq: DVCR Leading Skilled Nursing Provider Compelling Demographic Trends Management’s Strategic Vision Yielding Results Improving Patient Quality Measures, Census And Skilled Mix Demonstrated Ability To Grow And Enhance Portfolio Positively Trending Financial Results Investment Highlights 32

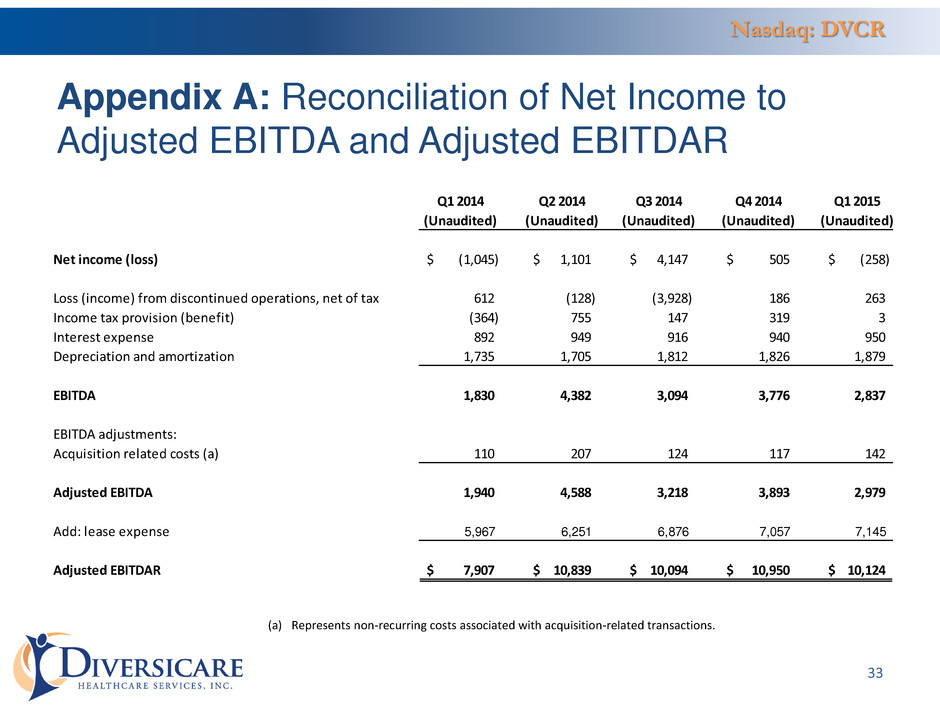

Nasdaq: DVCR Appendix A: Reconciliation of Net Income to Adjusted EBITDA and Adjusted EBITDAR (a) Represents non-recurring costs associated with acquisition-related transactions. 33 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) Net income (loss) (1,045)$ 1,101$ 4,147$ 505$ (258)$ Loss (income) from discontinued operations, net of tax 612 (128) (3,928) 186 263 Income tax provision (benefit) (364) 755 147 319 3 Interest expense 892 949 916 940 950 Depreciation and amortization 1,735 1,705 1,812 1,826 1,879 EBITDA 1,830 4,382 3,094 3,776 2,837 EBITDA adjustments: Acquisition related costs (a) 110 207 124 117 142 A justed EBITDA 1,940 4,588 3,218 3,893 2,979 Add: lease expense 5,967 6,251 6,876 7,057 7,145 Adjusted EBITDAR 7,907$ 10,839$ 10,094$ 10,950$ 10,124$