Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Presbia PLC | d932860d8k.htm |

Jefferies

Healthcare Conference New York

June 2015

Exhibit 99.1 |

CONFIDENTIAL

| 1 | To

the

extent

statements

contained

in

this

presentation

are

not

descriptions

of

historical

facts

regarding

Presbia

PLC

and

its

subsidiaries

(collectively

“Presbia,”

“we,”

“us,”

or

“our”),

they

are

forward-looking

statements

reflecting

management’s

current

beliefs

and

expectations.

Forward-looking

statements

are

subject

to

known

and

unknown

risks,

uncertainties,

and

other

factors

that

may

cause

our

or

our

industry’s

actual

results,

levels

of

activity,

performance,

or

achievements

to

be

materially

different

from

those

anticipated

by

such

statements.

You

can

identify

forward-looking

statements

by

terminology

such

as

“may,”

“will,”

“should,”

“expects,”

“plans,”

“anticipates,”

“believes,”

“estimates,”

“predicts,”

“potential,”

“intends,”

or

“continue,”

or

the

negative

of

these

terms

or

other

comparable

terminology.

Forward-looking

statements

contained

in

this

presentation

include,

but

are

not

limited

to,

statements

regarding:

(i)

the

initiation,

timing,

progress

and

results

of

our

clinical

trials,

our

regulatory

submissions

and

our

research

and

development

programs;

(ii)

our

ability

to

advance

our

products

into,

and

successfully

complete,

clinical

trials;

(iii)

our

ability

to

obtain

pre-market

approvals;

(iv)

the

commercialization

of

our

products;

(v)

the

implementation

of

our

business

model,

strategic

plans

for

our

business,

products

and

technology;

(vi)

the

scope

of

protection

we

are

able

to

establish

and

maintain

for

intellectual

property

rights

covering

our

products

and

technology;

(vii)

estimates

of

our

expenses,

future

revenues,

growth

of

operations,

capital

requirements

and

our

needs

for

additional

financing;

(viii)

the

timing

or

likelihood

of

regulatory

filings

and

approvals;

(ix)

our

use

of

proceeds

from

the

contemplated

offering;

(x)

our

financial

performance;

(xi)

developments

relating

to

our

competitors

and

our

industry;

and

(xii)

statements

regarding

our

markets,

including

the

estimated

size

and

anticipated

growth

in

those

markets.

Various

factors

may

cause

differences

between

our

expectations

and

actual

results,

including

those

risks

discussed

under

“Risk

Factors”

in

our

Annual

Report

on

Form

10-K

filed

with

the

Securities

and

Exchange

Commission

on

March

31,

2015

and

those

risks

discussed

under

“Risk

Factors”

in

our

Quarterly

Report

on

Form

10-Q

filed

with

the

Securities

and

Exchange

Commission

on

May

15,

2015.

Except

as

required

by

law,

we

assume

no

obligation

to

update

these

forward-looking

statements

publicly

or

to

update

the

reasons

actual

results

could

differ

materially

from

those

anticipated

in

the

forward-looking

statements,

even

if

new

information

becomes

available

in

the

future.

Disclosure |

CONFIDENTIAL

| 2 | Key Contributors

Name

Title

Previous Experience

Randy

Thurman

Executive Chairman

•

Named Executive Chairman in January 2014

•

Director since October 2013

•

Held President and CEO positions in the medical device and pharmaceutical industries

for 25 years

–

VIASYS Healthcare Inc., Founder, Chairman and CEO; $1.45bn company

–

Corning Life Sciences Inc., Chairman and CEO; $2.3bn company

–

Rhone-Poulenc

Rorer

Pharma,

Inc.,

President

(now

Sanofi-

Aventis);

$4bn

company

Todd

Cooper

President, Chief

Executive Officer, and

Director

•

Named President, Director, and Chief Executive Officer in January 2015

•

More than 20 years of experience in the medical, pharmaceutical and consumer

products industries:

–

NVISION Laser Eye Centers, CEO; leading operator of ophthalmic surgery centers

–

Henry Schein, Vice President and General Manager; $10bn company

–

Discus, Senior Vice President; aesthetic based dental company owned by Philips

Healthcare

Vlad

Feingold

Chief Technology

Officer and Director

•

Innovator and leader with > 30 years in ophthalmic industry:

–

Principle inventor, with more than 50 patents issued, principally in optics

(ICL, injector, foldable IOLs)

–

STAAR Surgical AG |

CONFIDENTIAL

| 3 | Business Highlights

•

113 million presbyopes in the U.S.; 1.8 billion presbyopes worldwide (2013)

Large, Underserved

Presbyopia Opportunity

Best-in-Class

Microlens Technology

Strong Leadership and

Compelling Business

Model

•

Refractive corneal inlay restores reading vision—on average 6 lines of improvement

better than competitors (AcuFocus and Revision)

•

Wide range of lens size refractive powers to offer patients a customized

therapy—competitors offer single size

•

Compatible with other ophthalmic surgical procedures (e.g. cataract surgery)—competitors

are not •

Senior ophthalmic and global medical device experience; major KOLs worldwide supporting

Presbia •

Compelling surgery center economics: 100% private pay, ~10 minute procedure time, leverage

large installed base of femtosecond lasers

•

Irish domicile

Clear FDA Pathway

Developed Ophthalmic

Surgery Market

•

Over 4,000 ophthalmic surgery centers with no effective treatment of presbyopia

•

Ophthalmic surgeons are highly motivated to develop this market to replace lost LASIK volumes

and utilize installed base of expensive femtosecond lasers

•

CE-marked, 700 lenses implanted globally with industry’s best safety profile

•

Ongoing U.S. pivotal trial targeting FDA approval Q4 2017 |

CONFIDENTIAL

| 4 | Presbyopia

A Loss of Near Vision Affecting the Majority of People over the Age of 40

•

Clinical Advantages of the Presbia MicroLens

–

Presbia MicroLens is tailorable to a patient’s specific, desired near visual

acuity reading distance

–

Crystal clear material that is not visible to the naked eye

–

Outstanding safety profile and compatible with other ophthalmic

procedures

–

Average of 6 lines improvement

•

The Inconvenience of Presbyopia

–

Glasses off / on; lost glasses (can’t find them when you need them), etc.

–

Hassle of daily maintenance of contact lenses, especially among active

people

–

Difficulty seeing text/images on personal electronic devices such as cell

phones, tablets

•

The Vanity Factor

–

Reading glasses are one of the most ubiquitous signs of aging

–

Recent Bausch & Lomb survey found “almost half of women over the

age of 40 admit to feeling embarrassed, frumpy, or annoyed when

reaching for reading glasses” |

CONFIDENTIAL

| 5 | Large, Underserved Presbyopia Opportunity

(billions)

Demographic-Driven Market Growth

1.8 Billion Presbyopes in Targeted Markets

Source: 2013 Market Scope.

United States

(113)

Western

Europe

(165)

Latin America

(140)

China

(423)

India

(249)

Rest of World

(542)

Other Wealthy

Nations

(71)

Japan

(58)

(millions) |

CONFIDENTIAL

| 6 | No Capital Investment Required

Source: 2013 Market Scope.

Excess Capacity in U.S. LASIK Market

Microlens

TM

Procedure Uses Existing, Underutilized Femtosecond Laser Equipment

Existing Femtosecond Laser

(millions) |

Clearly

Differentiated Microlens Technology |

CONFIDENTIAL

| 8 | Microlens Surgical Procedure

10 Minute Procedure Utilizing Existing Femtosecond Laser

Femtosecond Laser

1

Creates a pocket in

patient’s cornea

3

Proprietary Insertion Tool

2

Proprietary Inserter

Surgeon uses inserter to implant

lens in patient’s cornea

Self-Sealing Pocket

Pocket self-seals, holding lens in

place at center of visual axis |

CONFIDENTIAL

| 9 | Mechanism of Action

NEAR VISION

with Presbia Flexivue Microlens™

Peripheral portion of microlens helps focus

light from near objects (blue light rays) onto

retina

FAR VISION

with Presbia Flexivue Microlens™

Central portion of microlens allows light from

far objects to enter eye and focus clearly

(yellow light rays) onto retina

Peripheral portion of microlens causes some

far light to focus in front of retina

No significant change in binocular vision

UCVDA |

CONFIDENTIAL

| 10 | Presbia Microlens Technology

•

Intracorneal

Refractive

Lens

implanted

in

a

pocket

in

cornea

of

non-dominant

eye

•

Hydrophilic

Acrylic

Material

similar

to

that

used

in

IOLs

for

>

20

years

•

A

True

“Microlens”

with

3.2

mm

diameter

and

edge

thickness

of

0.015

mm

•

Offered

In

A

Wide

Range

Of

Powers

ranging

from

+1.5

diopter

to

+3.5

diopter,

in

0.25

diopter

increments

•

Invisible

To

The

Naked

Eye

once

implanted

•

Compatible

with

other

ophthalmic

diseases (e.g., cataract)

•

Platform For Future Technologies

Presbia Flexivue Microlens™

Designed to Eliminate Need for

Reading Glasses

1.6 mm Central Zone Diameter

Boundary between Central and

Optic Zones Shown by Imaginary Line

0.51 mm Central Hole Diameter

3.2 mm Overall Diameter

Central Zone

Boundary between Central and

Optic Zones Shown by Imaginary Line

Optic Zone

Center Thickness Varies by

Lens Power

1.6 mm Central Zone Diameter

0.51 mm Central Hole Diameter

Actual Size

0.015 mm Edge Thickness |

CONFIDENTIAL

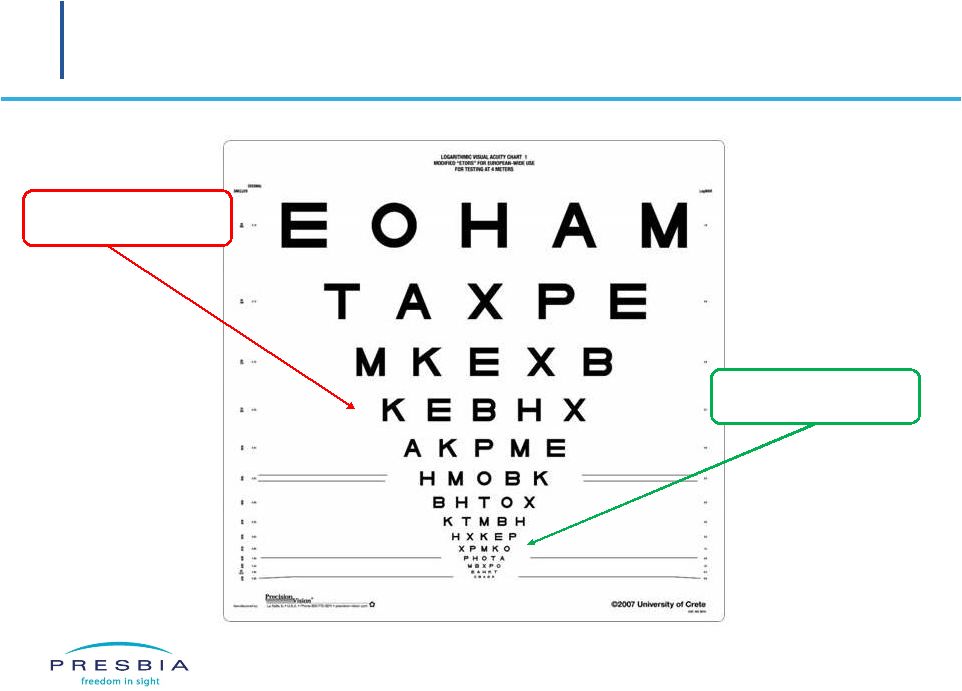

| 11 | Presbia’s Microlens Clinical Results

Average Preop UCVA-near

Starting Point = 20/110

Average Postop UCVA-near

Ending Point = 20/27

Average 6 Lines of Improvement in Near-Vision

Source: Presbia post-market surveillance study (CPL-10-002).

|

CONFIDENTIAL

| 12 | OUS 12-Month Multicenter Trial

Positive Clinical Results of 12-Month Multicenter

Binocular UCVA-distance remained

stable through Month 12

Uncorrected Near Visual Acuity Operated Eye

(33 cm chart) (N=70 at Month 12)

Uncorrected Binocular Distance Visual Acuity

(N=70 at Month 12)

Average of 6 lines gained

in UCVA-near by Month 3 |

CONFIDENTIAL

| 13 | U.S. Pivotal Trial

•

January 2015:

Submitted interim safety report to FDA, which included 6-month data on 52

subjects (a total of 75 subjects were implanted at six investigational sites in the first

stage of this trial)

•

February 2015:

–

Approved to begin 2

nd

stage enrollment; we are permitted to enroll up to an additional

337 subjects at up to nine additional investigational sites

–

Enrollment started and first surgery performed

•

May 2015:

–

Through May 1, 2015, 82 subjects have underwent insertion of our

microlens in the

second stage of this study

–

Currently, we are implanting patients at 11 investigational sites

–

TV / radio ads in progress to continue to recruit patients

U.S. Staged Pivotal Clinical Trial Timeline

•

No unanticipated adverse device effects reported; three adverse events reported for operated

eyes –

Foreign body sensation, dry eye signs/symptoms (identified Day 30

post-surgery; resolved Day 90) –

IOP

increase

due

to

postoperative

medication

tapering

(identified

Day

30

post-surgery;

resolved

Day

47)

–

Minor

corneal

abrasion

during

marking

of

cornea

prior

to

surgery

(identified

Day

1

post-surgery;

resolved

Day

2)

•

No

new

adverse

events

in

treated

eyes

(1

st

or

2

nd

stage)

reported

to

date

Safety Data

(75 Subjects through 6 Months Postoperative; 50 additional Subjects through at least 1 Day

Postoperative) *FDA capped us at 10 investigational site for statistical

reasons; we provided a counter argument for 15 sites and won |

CONFIDENTIAL

| 14 | Clear U.S. Regulatory Pathway

Targeted

U.S.

IDE

Regulatory

Pathway

–

Presbia

Flexivue

Microlens™

Q3 2014:

75

th

patient treated

(6 sites)

Q2 2015:

Continuance of

enrollment in U.S.

(337 total subjects at

up to 10 sites)

Q4 2017:

Receive PMA

approval

Q2 2018:

Submit final report

(36 month data)

Q1 2015:

Submit interim safety

report to FDA (6 month

data on 50 subjects)

Q4 2015/Q1 2016:

Submit PMA Modules

1, 2, and 3 to FDA for

review and approval

Q2 2017:

Submit PMA Module 4

to FDA (24 month data

on minimum of 300

subjects)

Q1 2018:

Initiate U.S. sales

Q2 2014:

Commencement of

pivotal trial (75

subjects)

Q4 2014:

Submitted interim

safety report to FDA (3

month data on 75

subjects); received FDA

letter stating no further

information required at

this time

Q1 2015: |

CONFIDENTIAL |

15 | Clearly Differentiated Microlens Technology

Intracorneal Refractive Lens;

Implanted in a Pocket

Creates a Pinhole Effect;

Implanted in a Pocket

AcuFocus KAMRA

Adds Bulk to Cornea;

Implanted under a LASIK-like Flap

ReVision Optics Raindrop

Wide Range of

Refractive Powers

X

X

Aesthetically

Appealing

X

Designed

to be

Exchangeable /

Removable

X

X

Tissue Sparing

Procedure

X

X

(Is if placed in pocket and patient is -0.75 D) |

CONFIDENTIAL

| 16 | •

Three patents issued:

–

Lens Holder Apparatus and System Method

–

Lens Inserter Apparatus and Method

–

Lens Injector Apparatus System and Method

Intellectual Property

U.S. Patents

Foreign Patents

•

Lens Holder Apparatus and System Method

–

Issued: Canada

–

Allowed, waiting for issue: China

–

Awaiting Examination: Australia, Europe, Israel,

Japan, Korea, Russia, India, Brazil

•

Lens Inserter Apparatus and Method

–

Issued: Japan

–

Allowed, waiting for issue: Australia, Israel

–

Pending: Canada, China, Europe, Korea

•

Five patents pending (patent applications):

–

Lens Injector Apparatus and Method

–

Method for Laser Cutting a Corneal Pocket

–

Lens Inserter Assembly

–

System for Monitoring and Tracking Patient

Outcomes After Surgical Implantation of an

Intracorneal Lens

•

Lens Injector Apparatus and Method

–

Pending: Japan, Korea

•

Method for Laser Cutting a Corneal Pocket

–

Pending: Australia, Canada, China, Europe,

Hong Kong, Israel, Japan, Korea

•

Recently issued GMP clearance from Korean

Ministry of Food and Drug Safety |

CONFIDENTIAL | 17

| New Product Pipeline New Microlens Delivery Systems Disposable 1 Estimated approval in Q3 2015; 510(k) Preloaded and Disposable 2 Estimated approval in Q3 2016; PMA submission required Molded Disposable Inserter: • Lens insertion technique and inserter design optimized on this inserter • Utilizes existing inventory of lenses • Requires doctor to load lens into inserter • Doctor inserts loaded lens into eye and disposes of inserter Molded Preloaded Disposable Inserter: • Lens preloaded into inserter tip assembly, wet- packed, and sterilized in the inserter • Inserter divided into handle and lens loaded tip assemblies • Doctor opens package, connects lens assembly to activation handle, inserts lens into eye, and discards used inserter |

Strong

Leadership and Compelling Business Model |

CONFIDENTIAL

| 19 | Presbyopia Surgery is the Missing Piece

in Refractive Surgery

•

Hit hard by flat-to-declining LASIK procedure

volumes, overcapacity, and LASIK procedure price

erosion

•

Highly receptive to new private pay presbyopia

procedure requiring no capital outlay

Refractive Surgery Centers

•

No capital expenditure required

•

Simple surgical procedure, short learning curve

•

100% private pay; ~10 minute procedure

Presbia

Flexivue

Microlens™

Procedure

20

30

40

50

60

70

80

Patient Age

Currently There is No Established Surgical Market for the 40–60 Year Old Patient

Pool LASIK

Presbyopia

Cataract |

CONFIDENTIAL | 20

| Presbia Sales Process • Presbia creates awareness through direct response media campaign (digital, print, television, radio) • Prospective patients contact Presbia call center • Presbia screens patients and directs inquiries to clinic • Presbia streamlines patient acquisition process, allowing clinic to focus on scheduling, exam, and surgical procedure Create Customer (Patient) Awareness by Direct Response Marketing Clinic Schedules Initial Exam and Procedure 1 3 Presbia-Sponsored Direct Response Marketing Call Center Screens and Directs Inquiries to Clinic 2 |

CONFIDENTIAL | 21

| The Patient Funnel – U.S. Clinical Trial Example: Stage 1 Conversion of Patients is the Primary Metric Showing Conversion Success at Each Clinic 1,166 Calls ($68 per Lead) 487 Qualified ($163 per Qualified Lead) 679 Disqualified by CC & Clinic 169 of 487 Enrolled 318 to be Treated Q1/Q2 2015 75 of 169 Treated (44%) 94 Disqualified ($370 per Surgery) Create Patient Awareness through DTC Advertising ($80,000 Expenditure for Advertising and Call Center during Trial) |

CONFIDENTIAL

| 22 | OUS Commercialization

Proven Commercialization Strategy, Creating Patient Awareness Generating Revenues

Phase I

Phase II

•

Focus on surgical

centers in selected region

–

Presbia educates and trains surgeons on

Microlens procedure

–

Presbia-funded direct response marketing

creates initial demand

–

Presbia call center screens inquiries and

directs patients to partner clinic

•

Regional teams

–

Business Development

–

Clinical Services Team

–

Commercialization Team

•

1-2 centers in region to lead as example

•

Go deep:

hands on with account

•

Current OUS presence:

–

Ireland: 1 account

–

Brazil: 3 accounts

–

Australia: 3 accounts

•

Expand existing accounts

–

Expand into more accounts in country

•

Go wide:

expand to more countries:

–

Asia-Pacific: New Zealand, South Korea,

Japan, Malaysian, Singapore, India, China

–

Europe: Netherlands, Central Europe,

Southern Europe, Nordics, United Kingdom

–

Latin America: Argentina, Peru, Colombia,

Costa Rica, Mexico

–

Africa & Middle East: Turkey, Lebanon,

South Africa, Saudi Arabia, United Arab

Emirates

–

North America: United States, Canada |

CONFIDENTIAL

| 23 | Manufacturing

•

Completed construction of 4,000 square-foot, two-part (wet/dry) manufacturing

facility in Q3 2013 •

Approved to manufacture devices for U.S. IDE by State of California FDA in 2013

•

Sufficient

capacity

to

handle

projected

Microlens

volume

through

U.S.

launch

•

Approved to manufacture devices for OUS sale by Intertek (ISO 13485:2012 certified)

•

Additional third-party manufacturing facility in Israel supplies product for all current

OUS requirements Irvine, CA Manufacturing Facility |

CONFIDENTIAL

| 24 | Experienced Leadership Team

Richard Fogarty

Chief Accounting Officer & VP Finance

Vanessa Tasso

Vice President of Clinical Affairs

John Strobel

Vice President of Sales

Vlad Feingold

Chief Technology Officer & Director

Todd Cooper

President,

Chief

Executive

Officer

&

Director

Randy Thurman

Executive

Chairman

Richard Ressler

Founder/CEO, CIM; Presbia Director

Mark Blumenkranz, MD

Head of Ophthalmics, Stanford Univ.; Presbia Director |

CONFIDENTIAL

| 25 | Business Highlights

•

113 million presbyopes in the U.S.; 1.8 billion presbyopes worldwide (2013)

Large, Underserved

Presbyopia Opportunity

Best-in-Class

Microlens Technology

Strong Leadership and

Compelling Business

Model

•

Refractive corneal inlay restores reading vision—on average 6 lines of improvement

versus competitors' (AcuFocus and Revision) 3 lines

•

Wide range of lens size refractive powers to offer patients a customized

therapy—competitors offer single size •

Compatible with other ophthalmic surgical procedures (e.g. cataract surgery)—competitors

are not •

Senior ophthalmic and global medical device experience; major KOLs worldwide supporting

Presbia •

Compelling surgery center economics: 100% private pay, ~10 minute procedure time, leverage

large installed base of femtosecond lasers

•

Irish domicile

Clear FDA Pathway

Developed Ophthalmic

Surgery Market

•

Over 4,000 ophthalmic surgery centers with no effective treatment of presbyopia

•

Ophthalmic surgeons are highly motivated to develop this market to replace lost LASIK volumes

and utilize installed base of expensive femtosecond lasers

•

CE-marked, 700 lenses implanted globally with industry’s best safety profile

•

Ongoing U.S. pivotal trial targeting FDA approval Q4 2017 |