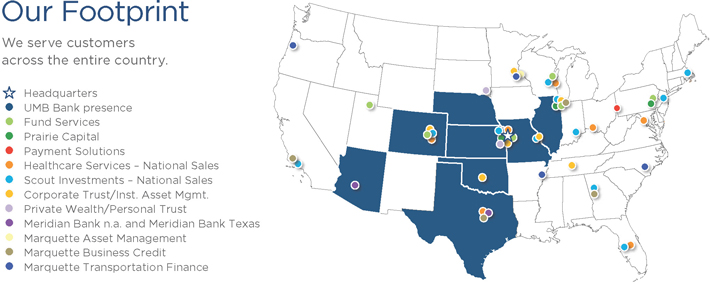

On May 31, 2015, UMB Financial Corporation completed its acquisition of Marquette Financial Companies

(MFC), which included Meridian Bank, N.A., Meridian Bank Texas, Marquette Transportation Finance, Marquette Business Credit and Marquette Asset Management.

This acquisition allows our customers to have access to an even wider range of meaningful products and services. From commercial banking to asset management

for individuals and institutions to healthcare financial services to specialty lending, UMB focuses on creating a customer experience that is more than people have become accustomed to expect.

The most successful acquisitions result when complementary cultures and values are brought together – and that’s what we are doing! This Fact Sheet

provides a financial glimpse of what UMB and MFC would have looked like on a combined, pro forma basis as of December 31, 2014. We are now even better positioned to serve our customers today and in the future.

|

|

|

|

|

|

|

|

|

| |

|

Industry Median1 |

|

|

UMBF |

|

| 5-Year Dividend Growth2 |

|

|

+4.8 |

% |

|

|

+28.2 |

%* |

| Nonperforming Loans to Total Loans |

|

|

1.21 |

% |

|

|

0.35 |

% |

| Loan-to-Deposit Ratio |

|

|

76.5 |

% |

|

|

58.3 |

% |

| 1 |

Industry median is defined as all regulated depositories, according to and as reported by SNL Financial, with 12/31/14 data reported as of 5/22/15, unless otherwise noted. |

| 2 |

Dividend growth is calculated using dividends declared in the years ended 12/31/09 and 12/31/14. Industry median is calculated for all publicly-traded banks and

thrifts that declared a dividend in 2009 and have data available from SNL Financial for both periods. |

Pro forma is defined as financial data as of 12/31/14 for UMB Financial Corporation and Marquette Financial Companies on a

combined basis with no purchase-accounting adjustments or growth projections.

Financial data for Marquette Financial Companies is based on its financial

reports and regulatory filings.