Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Ignyta, Inc. | d933944d8k.htm |

| EX-99.2 - EXHIBIT 99.2 - Ignyta, Inc. | d933944dex992.htm |

| EX-99.3 - EXHIBIT 99.3 - Ignyta, Inc. | d933944dex993.htm |

| EX-99.1 - EXHIBIT 99.1 - Ignyta, Inc. | d933944dex991.htm |

Catalyzing

Precision Medicine with Integrated Rx/Dx in Oncology ASCO 2015

May 31

st

, 2015

Exhibit

99.4 |

Safe Harbor

Statement 2

This document contains forward-looking statements, as that term is defined in Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, about Ignyta,

Inc. (“us” or the “Company”). Statements that are not purely historical are

forward-looking statements. These include statements regarding, among other things: the clinical

and/or non-clinical data or plans underlying entrectinib or any of our other development programs;

our ability to design and conduct development activities for entrectinib and our other

development programs; our ability to develop or access companion diagnostics for our product

candidates; our ability to obtain and maintain intellectual property protection for our product

candidates; our ability to adequately fund our development programs; the Teva transaction serving as a

transformative event for us and the development and market potential of our pipeline; our ability to

obtain regulatory approvals in order to market any of our product candidates; and our ability

to successfully commercialize any approved products. Forward-looking statements

involve known and unknown risks that relate to future events or the Company’s future

financial performance, some of which may be beyond our control, and the actual results could differ

materially from those discussed in this document. Accordingly, the Company cautions

investors not to place undue reliance on the forward- looking statements contained in, or

made in connection with, this document.

Important factors that could cause actual results to differ materially from those indicated by such

forward-looking statements, include, among others, the potential for results of past or

ongoing clinical or non-clinical studies to differ from expectations or previous results;

the interpretation of data from our clinical and non-clinical studies; our ability to initiate

and complete clinical trials and non-clinical studies; regulatory developments; the potential

advantages of our product candidates; the markets any approved products are intended to serve;

and our capital needs; as well as those set forth under the headings “Special Note

Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” contained in the

Company’s Form 10-K filed with the Securities and Exchange Commission

(“SEC”) on March 12, 2015, and similar disclosures made in the Company’s Form

10-Q filings and other SEC filings and press releases.

The forward-looking statements contained in this document represent our estimates and assumptions

only as of the date of this document, and we undertake no duty or obligation to update or

revise publicly any forward-looking statements contained in this document as a result of

new information, future events or changes in our expectations.

Third-party information included herein has been obtained from sources believed to be reliable,

but the accuracy or completeness of such information is not guaranteed by, and should not be

construed as a representation by, the Company.

|

Contents

Ignyta overview

Entrectinib preclinical data

ASCO clinical program update

Entrectinib future plans

Vision and milestones

3 |

Company

History and Financial Highlights San Diego based biotechnology company (NASDAQ: RXDX),

incorporated in 2011 ~75 employees: more than half with M.D.’s, Ph.D.’s or

other graduate degrees Robust Rx Pipeline:

-

In-licensed from Nerviano Medical Sciences exclusive worldwide rights to entrectinib in

Oct. 2013 and RXDX-103 in Aug. 2014

-

Acquired oncology R&D pipeline of 4 clinical and preclinical assets from Teva in Mar.

2015 -

Lead

program

entrectinib

granted

FDA

orphan

drug

designation

for

NSCLC,

CRC

and

neuroblastoma, and rare pediatric disease designation for neuroblastoma

In-house Dx: CLIA certified, QSR compliant diagnostic lab with multi-modality assay

capabilities

Cash, cash equivalents & marketable securities of ~$108mm at end

of 1Q 2015

4

Ignyta’s vision is to catalyze precision medicine for the benefit of cancer

patients everywhere, with an integrated approach to "Rx/Dx" in

oncology |

Jonathan Lim,

M.D., Chairman, CEO, and Co-Founder. Former Chair, CEO of Eclipse; CEO at

Halozyme; McKinsey; NIH post-doc at Harvard; Surgical resident at NYH-Cornell.

Jacob Chacko, M.D., Chief Financial Officer. Marshall Scholar at

Oxford University; UCLA Med; Harvard Business School. Zachary Hornby, Chief Operating

Officer. Former Senior Director of Business Development at Fate

Therapeutics; Director of BD at Halozyme; L.E.K. Consulting; Harvard Business School.

Pratik Multani, M.D., Chief Medical Officer.

Former CMO at Fate; VP, Clinical Development at

Kalypsys; CMO at Kanisa; VP, Clinical Development at Salmedix (sold to Cephalon); Sr. Director

of Medical Research at Biogen Idec; MD, MS at Harvard; Residency, MGH; Oncology, Dana

Farber. Robert Wild, Ph.D., Chief Scientific Officer.

Former CSO, Oncology Research/Drug Discovery at Eli

Lilly; Sr. Dir., Oncology Research at OSI Pharma; BMS; SUGEN. Has contributed to multiple

discovery/preclinical/translational

programs,

including

Tarceva,

Erbitux,

Sprycel

and

Sutent.

Matt Onaitis, General Counsel and Secretary.

Former GC at Trius and Somaxon; Associate GC at

Biogen Idec; Director of Legal Affairs at Elan; Stanford Law School.

Senior Management Team

5

Former

Vice

President

at

TPG

Capital;

McKinsey; |

Ignyta’s

Strategic Approach to Generating Value from Novel Targets and Optimally Positioned

Assets 6

External Targets

Identify attractive

targets: If target of

interest is being

developed externally,

engage in discussion for

potential in-licensing

Internal Targets

Identify attractive

targets: If target of

interest is not being

developed externally,

then initiate internal

discovery program

Oncology Assets

Identify oncology assets to

optimally position, using Rx/Dx

expertise; i.e.: (a) developed

without a biomarker strategy;

(b) failed due to lack of

sufficient efficacy; or (c) were

deprioritized for strategic

reasons

Examples

•

Spark discovery

programs

•

Acquisition of RXDX-

105/106/107/108 assets

from Teva

•

In-licensing of

entrectinib and

RXDX-103 from

Nerviano

Approach |

Ignyta’s

Pipeline 7

1

In-licensed from Nerviano Medical Sciences (NMS); ²Acquired from Teva Pharmaceutical Industries |

8

Central

Lab

Clinical Sites

Specimens

•

QSRs

•

CLIA

Platforms

Output

FFPE

Fresh Tissue

FISH

IHC

PCR

NGS

Oncolome®

Trial Enrollment

CDx

Ignyta’s Dx Capabilities Enable Leadership

in Precision Medicine

•

SNPs

•

Splice variants

•

InDels

•

Amplifications

•

Overexpression

•

Rearrangements |

Contents

Ignyta overview

Entrectinib preclinical data

ASCO clinical program update

Entrectinib future plans

Vision and milestones

9 |

Entrectinib:

A Potent Inhibitor of Trk A/B/C, ROS1 and ALK

Entrectinib is a potent, selective, orally available ATP-competitive inhibitor

of 5 oncogenic drivers

In vitro,

entrectinib demonstrates inhibition of targets as well as

downstream effectors in the MAPK and PI3K/AKT pathways

In vivo,

entrectinib demonstrates tumor eradication and tumor growth

inhibition in multiple models

Composition of matter patent issued in the US and allowed in Europe, with

commercial protection out to 2029 (excluding patent term extension)

Target

TrkA

TrkB

TrkC

ROS1

ALK

IC50* (nM)

1.7

0.1

0.1

0.2

1.6

10

* Biochemical kinase assay |

TrkA/B/C

Signaling Pathways 11 |

Identified

NTRK Rearrangements in Human Malignancy PTC: papillary thyroid cancer

DIPG: diffuse intrinsic pontine glioma

NBS-HGG: non-brainstem high-grade glioma

12

CD74-NTRK1

TPM3-NTRK1

TPR-NTRK1

TP53-NTRK1

TM

Kinase Domain

NTRK1 (wild-type)

Signal Peptide/Extracellular Domain

MPRIP-NTRK1

NSCLC

NSCLC, GBM

RFWD2-NTRK1

NSCLC

CRC, PTC, AML, DIPG, NBS-HGG

LMNA-NTRK1

CRC, Spitzoid melanoma, Spitz tumors

Spitzoid melanoma, Spitz tumors

TFG-NTRK1

PTC, NSCLC

PTC

NFASC-NTRK1

GBM

QKI-NTRK2

Pilocytic astrocytoma

Pilocytic astrocytoma

NACC2-NTRK2

VCL-NTRK2

AGBL4-NTRK2

DIPG, NBS-HGG

DIPG, NBS-HGG

ETV6-NTRK3

Salivary gland tumor, Secretory BC, AML,

Sarcoma, Nephroma, DIPG, NBS-HGG

BTBD1-NTRK3

DIPG, NBS-HGG |

Entrectinib

Demonstrates Robust in vitro and in vivo Activity against

NTRK1-Rearranged Colorectal Cancer Cell Line (KM-12) KM-12 is a human CRC

line driven by a constitutively active TrkA fusion, TPM3-NTRK1 Entrectinib potently

inhibits TrkA phosphorylation and downstream signaling Entrectinib induces in vivo

tumor regression and durable tumor stabilization In vitro

13

Continuous dosing treatments started at

Day 9, bid; 21 treatments completed

In vivo xenograft

entrectinib

TPM3

(partial) TM TrkA

Kinase domain |

Patient-derived xenograft (PDX) model

established from tumor biopsy obtained prior to

entrectinib treatment from patient #20 in ALKA

trial. This patient showed partial response (PR) to

entrectinib (see clinical data section).

Entrectinib Demonstrates Potent in vivo

Efficacy in a Patient-

Derived Xenograft model (Patient with NTRK1-Rearranged CRC)

Tumor harbors an

activating NTRK1

fusion: LMNA-TrkA

High level of p-TrkA

detected in un-treated

tumor by Western blot

(preliminary data),

indicating constitutive

activation of the fusion

protein.

4 days on, 3 days off

per 7 day cycle, similar to

clinical regimen

Source: Siena, Niguarda; Bardelli, IRCC

P<0.001 vs vehicle

entrectinib

entrectinib

14

0

1

2

3

4

5

6

7

500

1000

1500

2000

2500

3000

3500

weeks

Vehicle

60mg/Kg

15mg/Kg |

Entrectinib

Pre-Clinical Summary Rearrangements of NTRK, ROS1 and ALK are known to be oncogenic

drivers in multiple tumor types

TrkA/B/C overexpression has been reported across a large array of tumor types,

suggesting that these tumors may rely on Trk pathway signaling

In vitro,

entrectinib effectively inhibits the proliferation of cells expressing

rearranged (fusion) and over-expressed wild-type Trks

In vivo,

entrectinib potently inhibits tumor growth in multiple preclinical tumor

models driven by NTRK, ROS1 or ALK molecular alterations

Our data support clinical exploration of entrectinib in cancers with NTRK, ROS1

and ALK rearrangements and other activating alterations

15 |

Contents

Ignyta overview

Entrectinib preclinical data

ASCO clinical program update

Entrectinib future plans

Vision and milestones

16 |

Entrectinib

Clinical Development Overview 17

STARTRK-1

Global Phase 1/2 study in U.S., EU

and Asia

* “RP2D”

= Recommended Phase 2 Dose

ALKA-372-001

Phase 1 dose escalation study of

intermittent dosing schedule in

Italy: patients with ALK,

ROS1 or TrkA alterations

•

First-in-human study initiated

by Nerviano in Oct. 2012

•

Ignyta assumed control in

Nov. 2013

•

Phase 1 initiated in the U.S. in

Jul. 2014

Dose escalation of daily continuous

dosing schedule in patients with

Trk, ROS1 or ALK molecular

alterations

“Basket trial”

expansion cohorts in

100 patients with TrkA, TrkB, TrkC,

ROS1 or ALK molecular alterations,

treated at the RP2D* |

ALKA and

STARTRK-1: Regimens and Doses 18

* Exploration of a fixed daily dosing regimen is ongoing

“RP2D”

= recommended phase 2 dose

Dose

Break

1

2

3

4

Week

Schedule A: PO, QD (4 on, 3 off) x 3 weeks, fasting

Dose

Break

1

2

3

4

Week

Schedule C: PO, QD (4 on, 3 off) x 4 weeks, fed

Dose

1

2

3

4

Week

Schedule B: PO, QD, fed

ALKA Study

STARTRK-1 Study

Dose

1

2

3

4

Week

Schedule: PO, QD, fed

Dose Cohorts

(mg/m²):

100->200->400->

800->1200->1600

(no longer enrolling)

200->400->…

(ongoing)

400->800

(no longer enrolling)

100->200->400->800*

(fixed)…

(ongoing)

RP2D |

Demographics

of ALKA and STARTRK-1 (n=67) ALKA-372-001 (n=38)

STARTRK-1 (n=29)

Age, years, median (range)

52 (22-75)

55 (28-76)

Sex, male/female (%)

45/55

34/66

ECOG performance status, n (%)

0

19 (50)

8 (28)

1

18 (47)

18 (62)

2

1 (3)

3 (10)

Tumor type, n (%)

NSCLC

25 (66)

13 (45)

Neoplasms of the CNS

6 (16)

1 (3)

Gastrointestinal tract (CRC)

3 (8)

5 (17)

Gastrointestinal tract (non-CRC)

2 (5)

2 (7)

Head and neck

1 (3)

1 (3)

Sarcomas

1 (3)

0

Breast

0

2 (7)

Other

0

5 (17)

19

Note: Data as of May 1, 2015 |

Dose and

Safety Assessment of Entrectinib As of May 1, 2015

67 subjects have been treated with entrectinib in two Phase 1 trials

-

ALKA-372-001 and STARTRK-1

Doses explored were from 100 mg/m

2

to 1600 mg/m

2

-

ALKA Sch A (4 days on/3 days off x 3 weeks; 28-day cycle): 19 pts

-

ALKA Sch B and STARTRK-1 (both QD continuous): 42 pts

-

ALKA Sch C (4 days on/3 days off continuous): 6 pts

-

Majority of subjects (n=48, 72% total pts) have received doses

400 mg/m

2

No treatment-related serious adverse events (AEs)

Treatment-related AEs have been mostly Grade 1 or 2, and reversible

No evidence of cumulative AEs

No evidence of hepatic or renal toxicity

No evidence of QTc prolongation

20 |

Treatment-Related Adverse Events for ALKA and STARTRK-1

Adverse event term

ALKA-372-001 n(%)

STARTRK-1 n(%)

Paresthesia

16 (42)

6 (22)

Nausea

14 (37)

6 (22)

Myalgia

13 (34)

-

Asthenia

10 (27)

3 (11)

Fatigue

-

9 (33)

Dysgeusia

10 (27)

7 (26)

Constipation

-

6 (22)

Vomiting

8 (21)

4 (15)

Arthralgia

7 (19)

3 (11)

Diarrhea

7 (19)

3 (11)

Cognitive disorder

-

4 (15)

Pain in extremity

5 (13)

-

Attention disturbance

4 (11)

3 (11)

Peripheral neuropathy

-

3 (11)

Musculoskeletal pain

4 (11)

-

Rash

4 (11)

-

Dizziness

4 (11)

5 (19)

21

Note: Data as of May 1, 2015; all grades as per NCI CTCAE v4.03

|

Safety and

RP2D Determination ALKA-372-001

-

Two treatment-related Grade 3 AEs were observed:

Asthenia and Muscular Weakness; both resolved with dose reduction

-

No DLTs were observed in this study

STARTRK-1

-

Three treatment-related Grade 3 AEs were observed:

Neutropenia; resolved with dose reduction

2 DLTs at fixed daily dose of 800 mg:

Cognitive Impairment and Fatigue; both resolved upon study drug interruption

Based upon these two DLT events, the MTD was exceeded at 800 mg fixed

dose and 400 mg/m

2

per day was selected as the BSA-based RP2D

Further exploration of a fixed daily dose regimen and new formulation is

ongoing

22

Note: Data as of May 1, 2015 |

ALKA and

STARTRK-1: Pharmacokinetics •

With continuous daily dosing, exposure increased in a dose proportional manner

•

Plasma half-life is ~ 20-24 hours

compatible with QD dosing

•

At the RP2D (400 mg/m²

QD), the plasma protein binding corrected mean C

trough

is ~ 2.5X to 3X

that of Target Concentrations correlating with complete tumor growth inhibition in preclinical

xenograft models

23 |

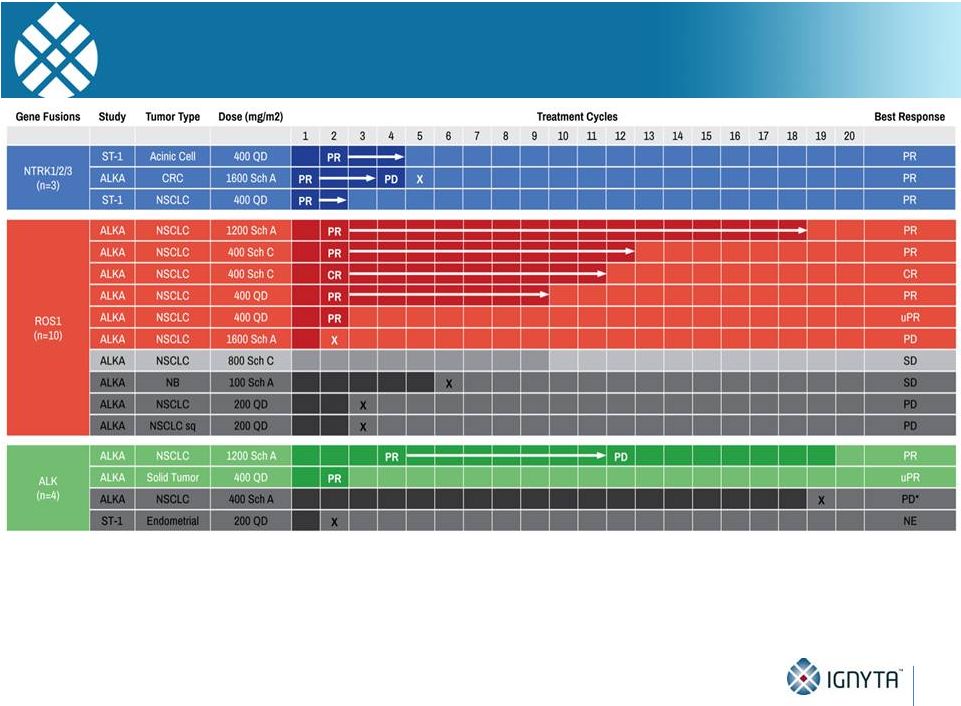

Entrectinib

Responses in STARTRK-1 and ALKA-372-001 Studies 24

17 patients were ALK/ROS1 TKI-naïve with NTRK1/2/3, ROS1, or ALK

fusions Note: Data as of May 1, 2015; responses per RECIST v1.1 and based

upon local assessment |

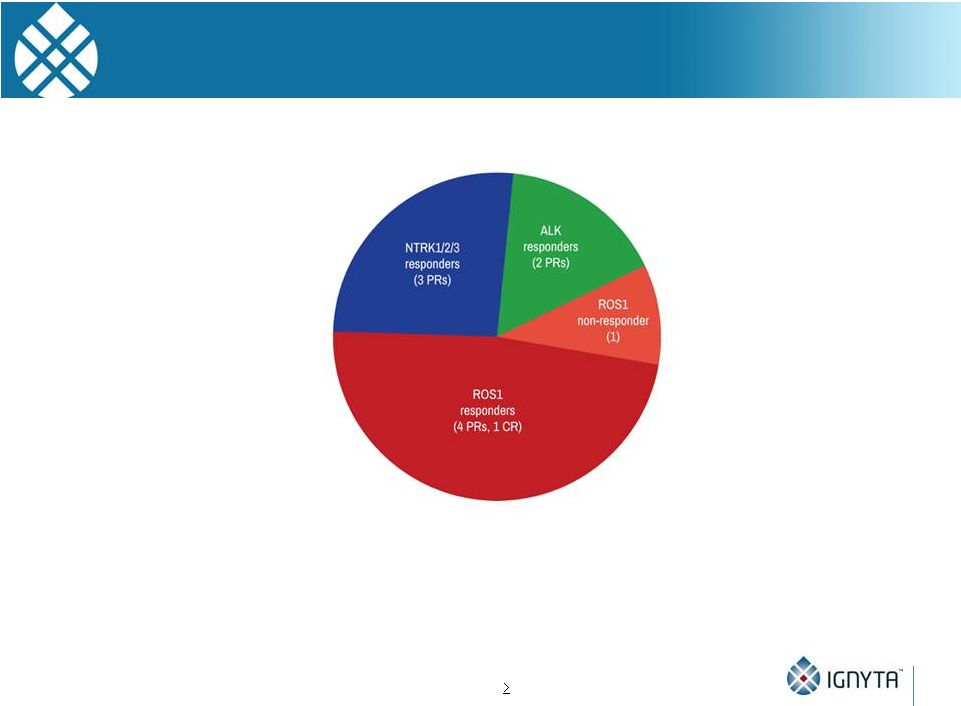

Entrectinib

Responses in STARTRK-1 and ALKA-372-001 Studies 25

91% response rate (10 out of 11) in Phase 2-Eligible Patient Population*

Phase 2-Eligible Patient Population*

Highlights

Note: Data as of May 1, 2015; one ALK responder was ALKi intolerant

*

NTRK1/2/3,

ROS1

or

ALK

fusion;

ALK/ROS1

TKI-naïve;

dosed

at

RP2D (400mg/m

2

)

•

•

•

•

•

3 of 3 responses in NTRK1/2/3+

NSCLC, CRC and acinic cell

cancer

5 of 6 responses, including 1 CR,

in ROS1+ NSCLC

2 of 2 responses in ALK+ NSCLC

and other solid tumor

9 patients remain on study

treatment

Durable responses of up to 16

treatment cycles |

STARTRK-1

Subject with NTRK3 Fusion 42F

with

acinic

cell

CA

of

the

parotid,

first

diagnosed

in

March

2006

-

Prior therapies: surgery/EBRT, vinorelbine, carboplatin/paclitaxel,

additional surgery, doxorubicin, crizotinib

-

ECOG performance status of 1

-

Identified to have tumor harboring ETV6-NTRK3 fusion

-

Enrolled in STARTRK-1 at MSKCC in December 2014 with baseline

staging showing multiple paraspinal and pleural masses

26 |

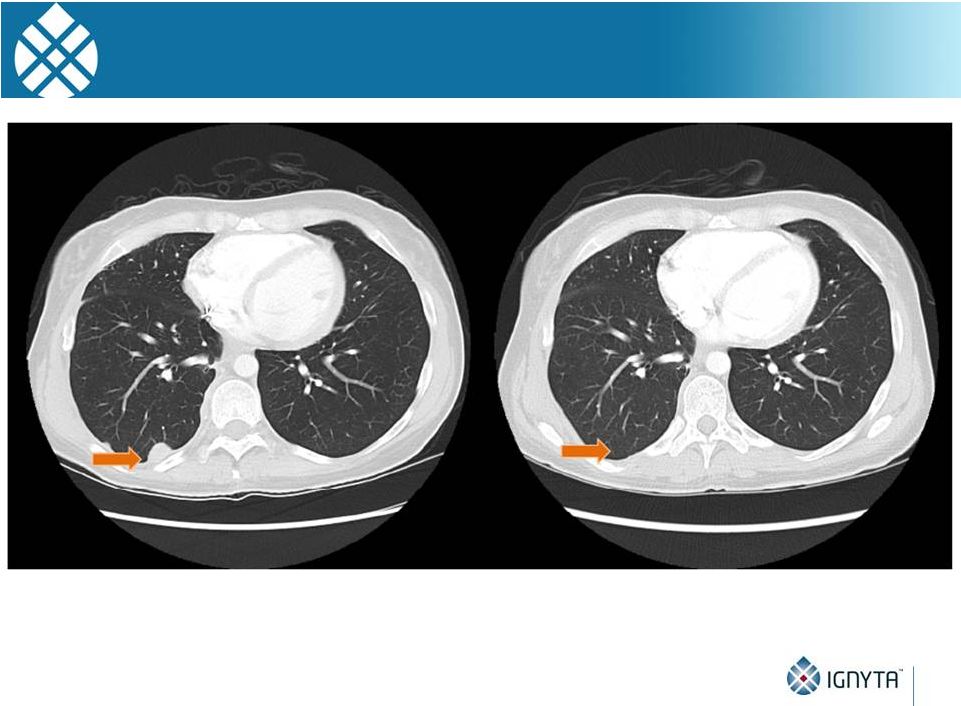

STARTRK-1

Subject with NTRK3 Fusion 27

•

Restaging during Cycle 2 (~8 wks) showed evidence for partial response

Images courtesy of A. Drilon, MD (MSKCC) |

STARTRK-1

Subject with NTRK3 Fusion 28

Images courtesy of A. Drilon, MD (MSKCC) |

STARTRK-1

Subject with NTRK3 Fusion 29

Images courtesy of A. Drilon, MD (MSKCC) |

STARTRK-1

Subject with NTRK1 Fusion 46M with metastatic NSCLC, first diagnosed in November

2013 -

30 pack-year smoking history

-

Prior therapies: carboplatin/pemetrexed, pembrolizumab, docetaxel,

vinorelbine

-

ECOG performance status of 2

-

Required supplemental O

2

-

Significant pain and dyspnea due to widely metastatic disease

-

Staging head CT also revealed numerous (15 to 20) asymptomatic

brain metastases measuring up to 1.7 cm that had not been previously

treated

-

In hospice

-

Identified to have tumor harboring SQSTM1-NTRK1 fusion

-

Enrolled in STARTRK-1 at MGH in March 2015

30 |

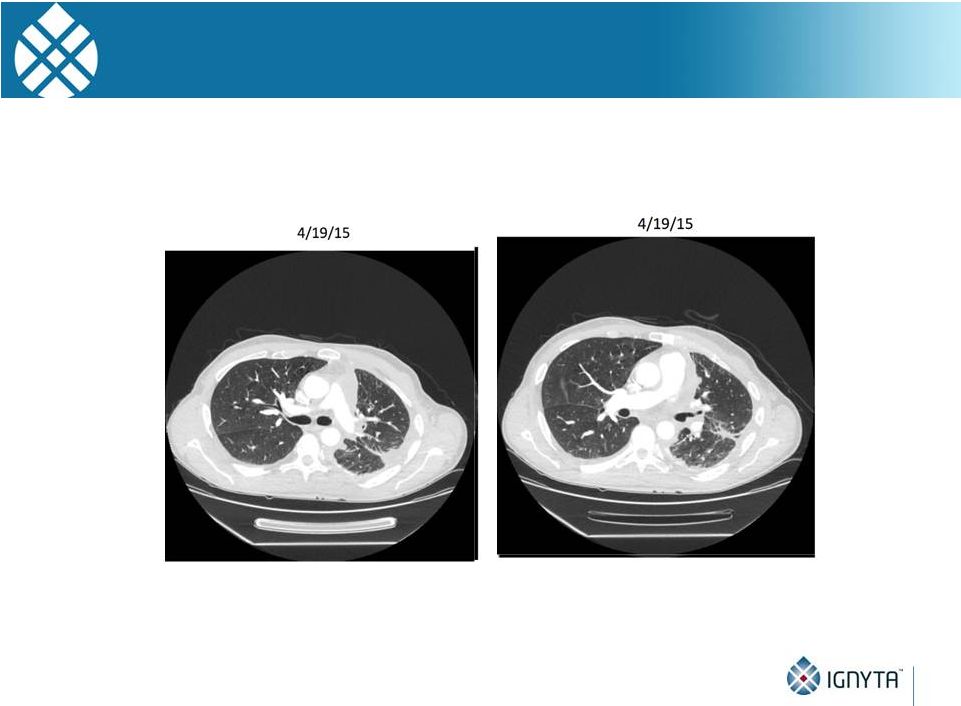

STARTRK-1

Subject with NTRK1 Fusion Images courtesy of A. Shaw, MD, PhD and A. Farago, MD, PhD

(MGH) •

Baseline scan showing extensive lung lesions and pleural effusions

31 |

STARTRK-1

Subject with NTRK1 Fusion Images courtesy of A. Shaw, MD, PhD and A. Farago, MD, PhD

(MGH) 32

•

Restaging during Cycle 1 (~4 wks) showed evidence for partial response

(and resolution of pleural effusions) |

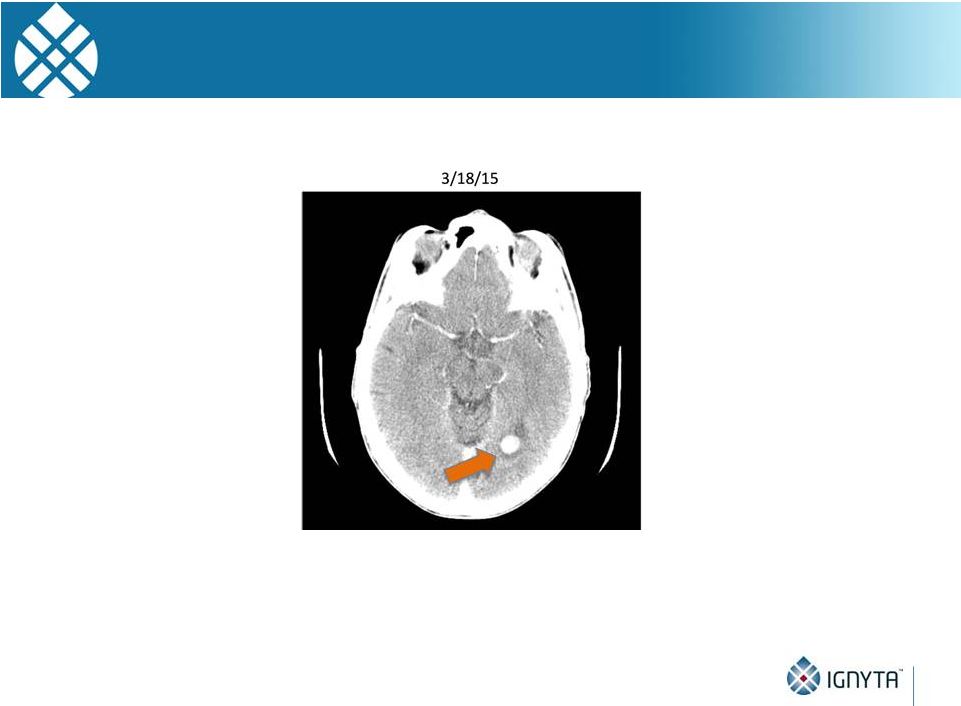

STARTRK-1

Subject with NTRK1 Fusion 33

•

Baseline scan showing brain metastases

Images courtesy of A. Shaw, MD, PhD and A. Farago, MD, PhD (MGH)

|

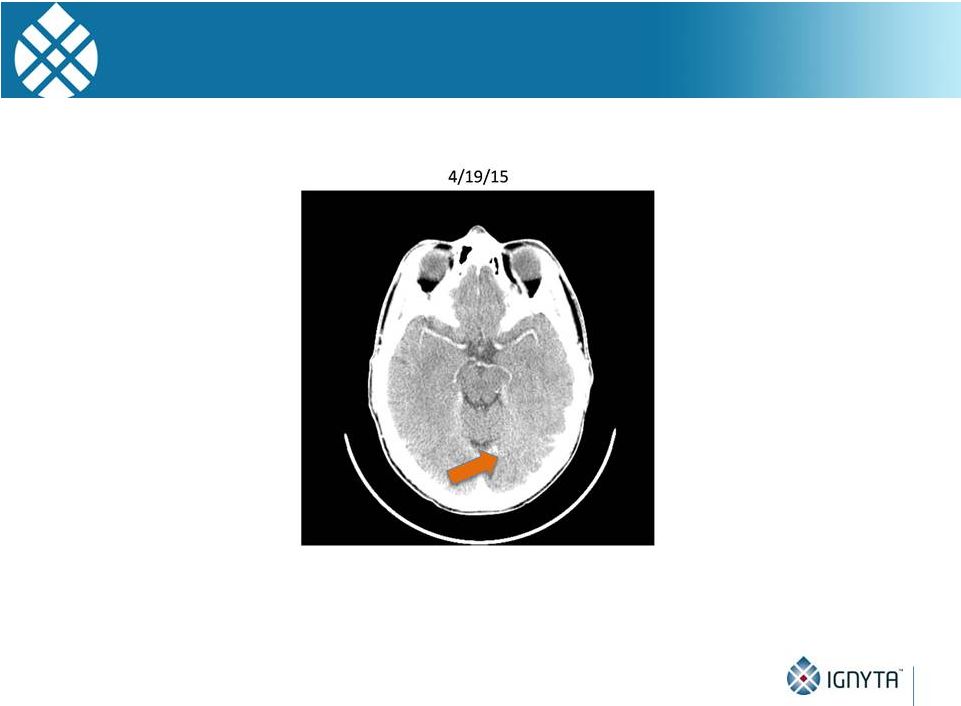

STARTRK-1

Subject with NTRK1 Fusion Images courtesy of A. Shaw, MD, PhD and A. Farago, MD, PhD

(MGH) 34

•

Evidence for tumor response in the CNS |

ALKA and

STARTRK-1: NTRK Rearrangements 35

•

Compelling clinical activity in 3 patients with NTRK rearrangements (100% response rate)

-

3 different tumor types: NSCLC, CRC, acinic cell cancer

-

2 different Trk targets (TrkA, TrkC) with 3 different fusion partners

•

Compelling CNS activity in the only patient with an NTRK rearrangement and brain

metastases treated to date

•

All responded (3 PRs) within 1-2 cycles; 2 responses ongoing

Note: Data as of May 1, 2015 |

ALKA and

STARTRK-1: ROS1 Rearrangements 36

•

10 patients with no prior ROS1i therapy

-

9 with NSCLC; 1 with neuroblastoma

-

3 treated below RP2D doses and one with nonevaluable disease

-

Remaining 5/6 responded (4 PRs, 1 CR) within 2 cycles; all responses ongoing

Note: Data as of May 1, 2015 |

ALKA and

STARTRK-1: ALK Rearrangements 37

•

4 patients with no prior ALKi therapy

-

2 with NSCLC; 2 with other solid tumors

-

2 treated below RP2D doses

-

Remaining 2/2 responded (1 PR, 1 uPR) within 4 cycles; 1 response ongoing

Note: Data as of May 1, 2015 |

Entrectinib

Responses in Phase 2 Population •

11 patients across both studies

•

NTRK: 3 of 3 responses, including in NSCLC, CRC and acinic cell cancer;

•

ROS1: 5 of 6 responses, including one complete response, in NSCLC;

•

ALK: 2 of 2 responses in NSCLC and another solid tumor;

•

9 patients remain on study treatment; and

•

Durable responses of up to 16 treatment cycles

38

Note: Data as of May 1, 2015; one ALK responder was ALKi intolerant

91% response rate (10 out of 11) in Phase 2-Eligible Patient Population*

•

NTRK1/2/3,

ROS1

or

ALK

fusion;

ALK/ROS1

TKI-naïve;

dosed

at

RP2D (400mg/m²) |

ALKA and

STARTRK-1: Other Alterations/Treatment History Among the remaining 50 patients,

most either had non-fusion alterations or were ALKi-

or ROS1i-resistant:

-

Non-fusion alterations (n=26)

NTRK1/2/3 SNPs, IHC+, amplifications: n=15 (6 ongoing)

ROS1 amplifications, deletions: n=4

ALK SNPs, amplifications, deletions: n=7

(2 ongoing : 1 patient with neuroblastoma had a PR for 9 cycles and remains on

study)

-

Resistant (n=20)

ROS1 fusions, ROS1i-resistant: n=3 (1 ongoing); all 3 pts had one prior TKI

ALK fusions, ALKi-resistant: n=17 (4 ongoing); 3 pts had 3 prior TKIs, 9 pts had 2

prior TKIs, and 5 pts had 1 prior TKI

-

Other (n=4):

False positives (n=2)

No alterations (n=2)

-

13 patients (26%) remain on study

39 |

Entrectinib

Clinical Summary Status: Two Phase 1 clinical studies of entrectinib are ongoing

Safety: Entrectinib has been well tolerated, including with daily dosing, with

no treatment-related SAEs and two reversible DLTs

RP2D:

The

BSA-based

RP2D

is

400

mg/m

2

daily with ongoing exploration of

fixed dose regimen

Preliminary efficacy:

-

Phase 2 studies will focus on rearrangements of NTRK1/2/3, ROS1 and ALK;

rearrangements are known to be oncogenic drivers in multiple tumor types

-

10 responses (1 CR, 7 PRs, 2 uPRs) have been demonstrated—across multiple

different tumor types and gene fusions—out of 11 Phase 2 eligible

patients (91% response rate)

-

1 additional response in a neuroblastoma patient with an activating ALK SNP

40

Note: Data as of May 1, 2015 |

Contents

Ignyta overview

Entrectinib preclinical data

ASCO clinical program update

Entrectinib future plans

Vision and milestones

41 |

Why

“Rx/Dx” Matters

42

Unlike ALK, which has one predominant fusion partner (EML4), NTRKs have at

least 17 fusion partners, each with different break points

Thus, a sophisticated diagnostic screening methodology is required

Ignyta’s NGS-based assay has been specifically optimized for the detection of

activating

NTRK1, NTRK2 and NTRK3 alterations, in addition to ROS1 and ALK

-

Multiplex NGS assay scalable to add future genes of interest

ALK gene fusion positive by FISH…

But no active protein expressed (IHC) |

Ignyta’s

Internal CDx Approach Is a Differentiator in the Competition to Identify and Recruit

Patients 43

Another difference from ALK, which predominantly occurs in one tumor type

(NSCLC), NTRK fusions are found in at least 13 different tumor types

Thus, a sophisticated trial design and clinical development strategy is required to

collect data across multiple tumor types, using the CDx as the common feature…

TrkA IHC+

NTRK1 FISH+

Ignyta NGS:

TPM3-NTRK1 |

Studies

Targeting Alterations Responsive to Targeted Receptor Kinase inhibition Patients with

Solid Tumors (any line of therapy) Tumor sample submission for CDx analysis at

Ignyta’s central lab Separate by molecular alteration and solid tumor type

NTRK1/2/3

fusions

STARTRK-2 Basket Study initiated at clinical sites globally

SIMON 2-STAGE RULES:

1

st

stage: 6 pts (

1 response)

2

nd

stage: + 8 pts (

5 responses)

Open new “basket” STARTRK-2: Entrectinib Global Phase 2 Basket

Study Combines Previously Described STARTRK-1 Ph 2a and STARTRK-2 Designs

ROS1

fusions

NTRK1/2/3

fusions

Separate analyses by Cohort (basket)

Primary endpoint = ORR

Key secondary endpoint = DOR

ROS1

fusions

NTRK1/2/3

fusions

ROS1

fusions

ALK fusions

ALK fusions

NTRK1/2/3,

ROS1, and ALK

non-fusion

alterations

Pancreatic Ca

NTRK1/2/3

overexpression

e.g.,

NSCLC

Possible chemotherapy per MD

44

Note: ORR = objective response rate; DOR = duration of response

CRC

All other non-NSCLC, non-CRC solid tumors

All solid tumors |

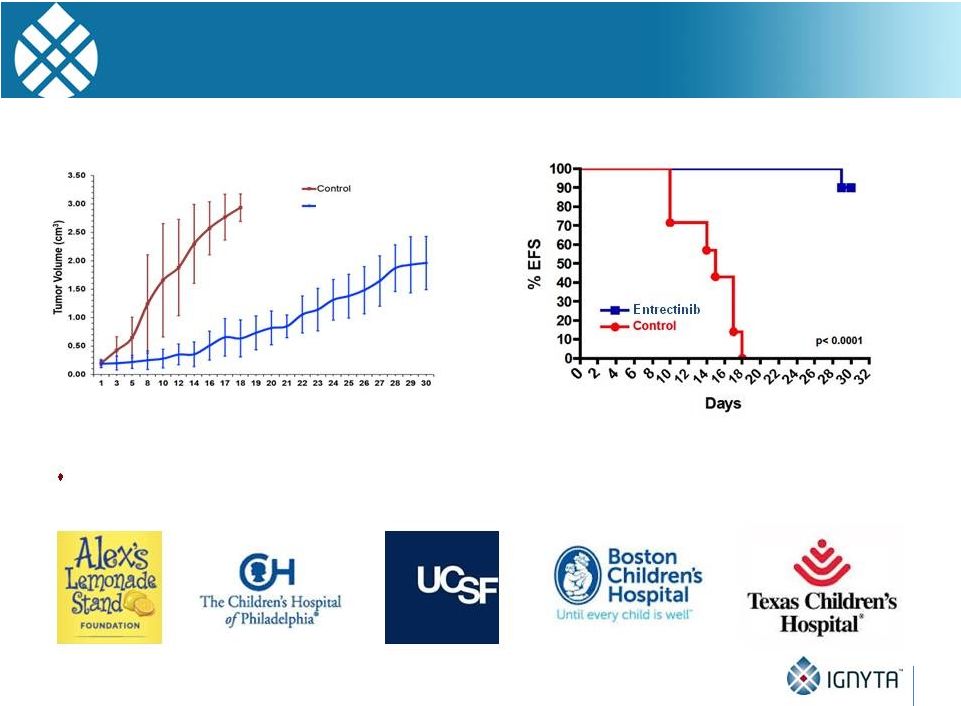

45

Indication Expansion Beyond Fusions

Pediatric Neuroblastoma

SY5Y-TrkB Neuroblastoma Xenograft Model

Ph 1/1b pediatric CNS tumor (including neuroblastoma) study planned for Q4:15

Days post treatment start

Entrectinib (60 mg/kg, BID) |

Contents

Ignyta overview

Entrectinib preclinical data

ASCO clinical program update

Entrectinib future plans

Vision and milestones

46 |

Ignyta’s

Precision Oncology Vision: A CRx for Each Oncogene Driver Identified by Our CDx

47

Ignyta’s Trailblaze™

Companion Diagnostic (CDx):

Multiplex assay(s) for identifying actionable oncogenes in various solid tumors

that can then be targeted with Ignyta’s pipeline of companion therapeutics (CRx)

NTRK1+

Entrectinib

ROS1+

mBRAF

RET+

cMET+

mKRAS

EGFR+

RXDX-105

RXDX-108

NTRK2+

NTRK3+

AXL+

RXDX-106

ALK+

Recently expanded oncogene targets and programs

Ignyta’s first-in-class and best-in-class CRx’s

|

Ignyta

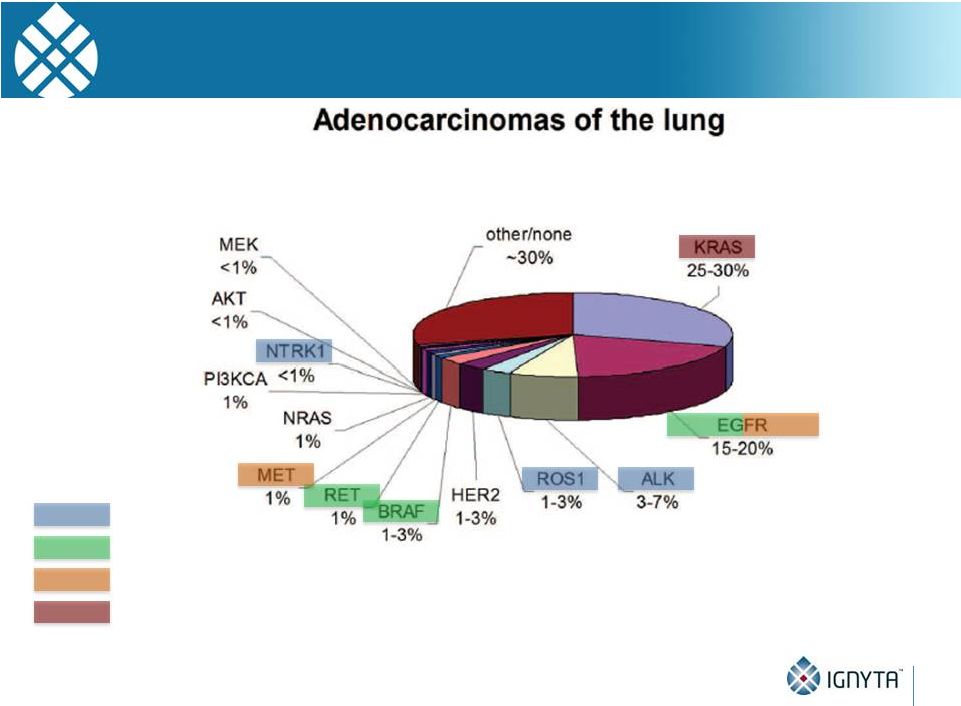

Pipeline Now Has Potential to Address More than 80% of Known Oncogenic Drivers in

NSCLC 48

entrectinib

RXDX-105

RXDX-106

RXDX-108

Gerber et al., 2014 ASCO Educational Book. |

Driver

Oncogenes in Just 2 Solid Tumor Indications Represent Substantial Market Opportunities

for Two Lead Programs >30,000 NSCLC or CRC patients

in the US each year have a newly detected known

oncogenic fusion kinase or activating mutation that may be targeted by entrectinib

or RXDX-105

49

NTRK1

fusions

NTRK2

fusions

NTRK3

fusions

ROS1

fusions

ALK

fusions

RET

fusions

BRAF

fusions

BRAF

mutations

Total

Patients

NSCLC

~1%

<1%

<1%

1-2%

4-7%

2%

<1%

1-3%

12,400

Colorectal

~1%

<1%

<1%

~1%

~1%

~1%

5-10%

18,000

Total

2,300

500

1,500

2,100

6,400

3,200

1,900

12,500

30,400

entrectinib:

12.8k pts

RXDX-105:

17.6k pts

Source: NCI; NHS; Shaw et al., Nature Reviews Cancer 2013; Gerber et al., 2014 ASCO

Educational Book; Stransky et al., Nature Communications

2014;

Wiesner

et

al.,

Nature

Communications

2014;

Lipson

et

al.,

Nature

Medicine

2012;

unpublished

communications

with

study

authors

Note: Estimates above based on US incidence only; assumed midpoint of incidence ranges

multiplied by published incidence data for each indication. Indication | Alteration

|

Driver

Oncogenes in Just 2 Solid Tumor Indications Represent Substantial Market Opportunities

for Two Lead Programs 50

NTRK1

fusions

NTRK2

fusions

NTRK3

fusions

ROS1

fusions

ALK

fusions

RET

fusions

BRAF

fusions

BRAF

mutations

Total

Patients

NSCLC

~1%

<1%

<1%

1-2%

4-7%

2%

<1%

1-3%

4,200

Colorectal

~1%

<1%

<1%

~1%

~1%

~1%

5-10%

7,300

Total

2,300

500

1,500

700

1,400

3,200

1,900

-

11,500

entrectinib:

6.4k pts

RXDX-105:

5.1k pts

We estimate over 11,000 patients

in

Source: NCI; NHS; Shaw et al., Nature Reviews Cancer 2013; Gerber et al., 2014 ASCO

Educational Book; Stransky et al., Nature Communications

2014;

Wiesner

et

al.,

Nature

Communications

2014;

Lipson

et

al.,

Nature

Medicine

2012;

unpublished

communications

with

study

authors

Note: Estimates above based on US incidence only; assumed midpoint of incidence ranges

multiplied by published incidence data for each indication. FIC opportunity

Indication | Alteration

represent potential FIC opportunities for entrectinib or RXDX-105

11 biomarker positive cohorts of

NSCLC and CRC |

Driver

Oncogenes in Just 2 Solid Tumor Indications Represent Substantial Market Opportunities

for Two Lead Programs 51

FIC opportunity

BIC upside opportunity

BIC BRAF-mutant metastatic CRC doubles the addressable market with upside

of >10,000 patients

for RXDX-105, or >22,000

patients

for entrectinib and

RXDX-105

NTRK1

fusions

NTRK2

fusions

NTRK3

fusions

ROS1

fusions

ALK

fusions

RET

fusions

BRAF

fusions

BRAF

mutations

Total

Patients

NSCLC

~1%

<1%

<1%

1-2%

4-7%

2%

<1%

1-3%

4,200

Colorectal

~1%

<1%

<1%

~1%

~1%

~1%

5-10%

18,000

Total

2,300

500

1,500

700

1,400

3,200

1,900

10,700

22,200

entrectinib:

6.4k pts

RXDX-105:

15.8k pts

Source: NCI; NHS; Shaw et al., Nature Reviews Cancer 2013; Gerber et al., 2014 ASCO

Educational Book; Stransky et al., Nature Communications

2014;

Wiesner

et

al.,

Nature

Communications

2014;

Lipson

et

al.,

Nature

Medicine

2012;

unpublished

communications

with

study

authors

Note: Estimates above based on US incidence only; assumed midpoint of incidence ranges

multiplied by published incidence data for each indication. Indication | Alteration

|

2015

– 2016 Corporate Milestones & Clinical Updates

52

2030 Vision

2015 -

2016 Milestones

Obtain US orphan drug designation for at least one indication

Identify RP2D, preferred dosing schedule for entrectinib, mid-2015

Initiate STARTRK-2 Ph 2, including internally developed CDx, 3Q15

Identify RP2D for RXDX-105, 2H15; initiate Study 1105 Ph 1b RET+ and BRAF+ solid tumors,

4Q15 File IND for RXDX-106 and/or RXDX-107, 2H15

Clinical data from ALKA-372-001 and STARTRK-1 at ASCO, 2Q15

Clinical data for entrectinib and RXDX-105 at ESMO or ENA, 2H15

Clinical study update from STARTRK-2 Ph 2 and Study 1105 Ph 1b at AACR/ASCO, 2Q16

Clinical update or data for entrectinib, RXDX-105, -106, -107 at ESMO/ENA,

2H16 2015 -

2016 Clinical Updates

2011 –

2015

Advance clinical

pipeline

2016 –

2020

Commercialize

RXDX lead

2021 –

2025

Scale pipeline

revenue

2026 –

2030

Drive sustainable

profitability

Leading precision

medicine

company |

Company

Highlights 53

Precision oncology company with integrated approach to Rx/Dx development

Experienced management team, excellent track record in oncology

Pipeline

with

of targeted first-in-class and

best-in-class product candidates under clinical

development in oncology Multiple potential registration-enabling studies initiating

in 2015 Comprehensive diagnostic capabilities and biomarker strategies for patient

screening and confirmation

Composition of matter IP for pipeline of development candidates

Strong financial position

20-year vision to be the leading precision oncology company

critical mass |