Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HomeStreet, Inc. | form8-kshareholdersmeeting.htm |

| EX-99.1 - HOMESTREET, INC. SLIDE PRESENTATION FROM THE 2015 ANNUAL SHAREHOLDER MEETING - HomeStreet, Inc. | annualshareholdersmeetin.htm |

NASDAQ:HMST

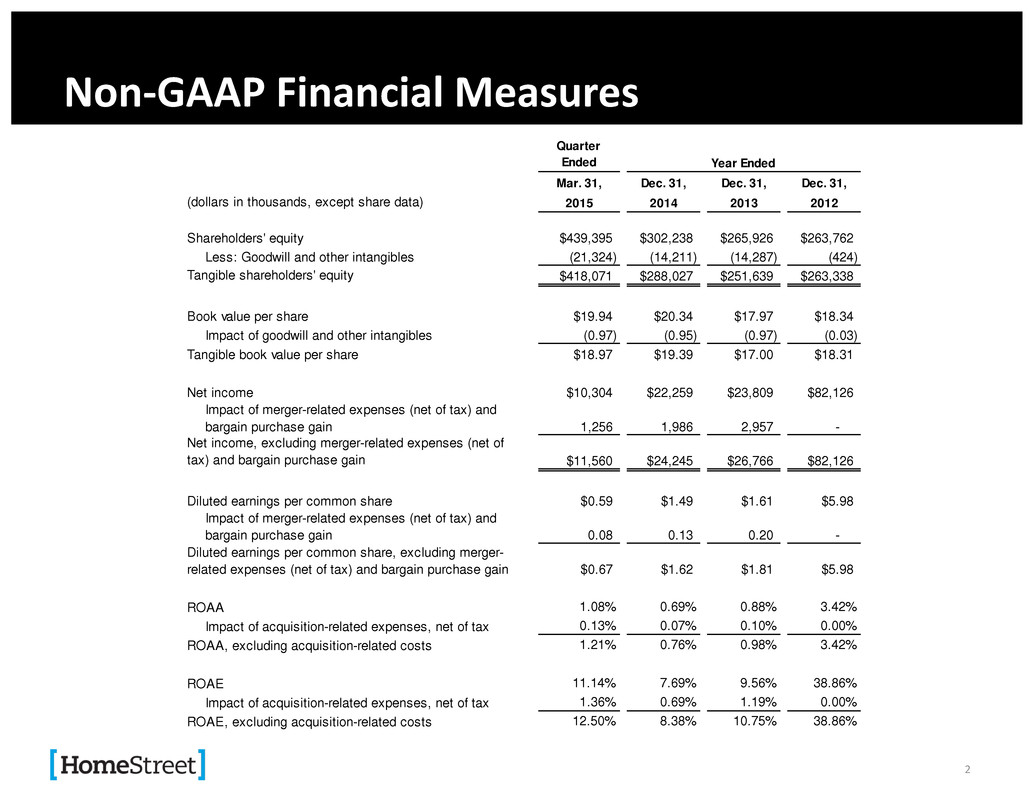

Non-GAAP Financial Measures 2 Quarter Ended Mar. 31, Dec. 31, Dec. 31, Dec. 31, (dollars in thousands, except share data) 2015 2014 2013 2012 Shareholders' equity $439,395 $302,238 $265,926 $263,762 Less: Goodwill and other intangibles (21,324) (14,211) (14,287) (424) Tangible shareholders' equity $418,071 $288,027 $251,639 $263,338 Book value per share $19.94 $20.34 $17.97 $18.34 Impact of goodwill and other intangibles (0.97) (0.95) (0.97) (0.03) Tangible book value per share $18.97 $19.39 $17.00 $18.31 Net income $10,304 $22,259 $23,809 $82,126 Impact of merger-related expenses (net of tax) and bargain purchase gain 1,256 1,986 2,957 - Net income, excluding merger-related expenses (net of tax) and bargain purchase gain $11,560 $24,245 $26,766 $82,126 Diluted earnings per common share $0.59 $1.49 $1.61 $5.98 Impact of merger-related expenses (net of tax) and bargain purchase gain 0.08 0.13 0.20 - Diluted earnings per common share, excluding merger- related expenses (net of tax) and bargain purchase gain $0.67 $1.62 $1.81 $5.98 ROAA 1.08% 0.69% 0.88% 3.42% Impact of acquisition-related expenses, net of tax 0.13% 0.07% 0.10% 0.00% ROAA, excluding acquisition-related costs 1.21% 0.76% 0.98% 3.42% ROAE 11.14% 7.69% 9.56% 38.86% Impact of acquisition-related expenses, net of tax 1.36% 0.69% 1.19% 0.00% ROAE, excluding acquisition-related costs 12.50% 8.38% 10.75% 38.86% Year Ended