Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HomeStreet, Inc. | form8-kshareholdersmeeting.htm |

| EX-99.2 - HOMESTREET, INC. RECONCILIATION OF CERTAIN NON-GAAP MEASURES - HomeStreet, Inc. | nongaaprecon2015annualsh.htm |

Annual Meeting of Shareholders Seattle, Washington May 28, 2015 NASDAQ:HMST

Welcome • Introductory remarks • Notice • Appointment of Inspector of Election & confirmation of quorum • Description of proposals • Proceed to voting • Report on 2014 • Results of voting • Adjournment 2

Proposals I. Elect five directors, three Class I directors to serve for a term of three years or until their respective successors are elected and qualified, and two Class II directors to serve for one year or until their respective successors are elected and qualified: Three-year term: • Scott M. Boggs • Timothy R. Chrisman • Douglas I. Smith One-year term: • Mark K. Mason • Donald R. Voss II. Ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015 Preliminary results will be announced following the vote. 3

Report on 2014 4 Presentation by Mark K. Mason, Chairman, President and CEO of HomeStreet, Inc.

Important Disclosures Forward-Looking Statements In accordance with the Private Securities Litigation Reform Act of 1995, we caution you that we may make forward-looking statements about our industry, our future financial performance and business activity in this presentation that are subject to many risks and uncertainties. These forward-looking statements are based on our management's and other experts’ current expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts, as well as a number of assumptions concerning future events. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our 2014 Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q for the quarter ended March 31, 2015. Many of these factors are beyond our control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward-looking statements. For instance, our ability to expand our banking operations geographically and across market sectors, grow our franchise and capitalize on market opportunities may be limited due to future risks and uncertainties. Actual results may fall materially short of our expectations and projections, and we may change our plans or take additional actions that differ in material ways from our current intentions. Accordingly, we can give no assurance of future performance, and you should not rely unduly on forward-looking statements. All forward looking statements are based on information available to the Company as of the date hereof, and we do not undertake to update or revise any forward looking statements, for any reason. Basis of Presentation of Financial Data Unless noted otherwise in this presentation, all reported financial data is being presented as of the period ending December 31, 2014. Non-GAAP Financial Measures Information on any non-GAAP financial measures referenced in today’s presentation, including a reconciliation of those measures to GAAP measures, may also be found in our SEC filings and in the earnings release available on our web site. 5

Overview • 2014 Highlights • 2014 Results of Operations • Our Business Strategy • Looking Ahead • Questions 6

Strategic Growth Activity Strategic Growth Activity – 2014 • Grew branch network organically Opened 11 new home loan centers, including first location in Arizona (Phoenix) Added 3 de novo retail deposit branches in Seattle Added residential construction lending teams in Salt Lake City and Southern California • Became rated originator and servicer, allowing us to pool and sell non-conforming loans • Average interest-earning assets grew by approximately 18%, net interest income by 33% • Loan portfolio growth of 23%, excluding portfolio loan sales • Deposits increased by 11% • Ended year with #1 ranking for purchase mortgage origination in the three-state Pacific Northwest region First Quarter 2015 – Merger with Simplicity • Merger with Simplicity Bancorp and Simplicity Bank in Southern California Announced on September 29, 2014; completed on March 1, 2015 Expands Commercial & Consumer Banking business into Southern California Added $850 million in assets, including $664 million in loans, $651 million in deposits, and seven retail branches Bargain purchase gain of $6.6 million (not taxable) Significant step toward goal of earnings diversification • Launched HomeStreet Commercial Capital, small balance commercial real estate lending team • Added SBA lending team in Southern California 7

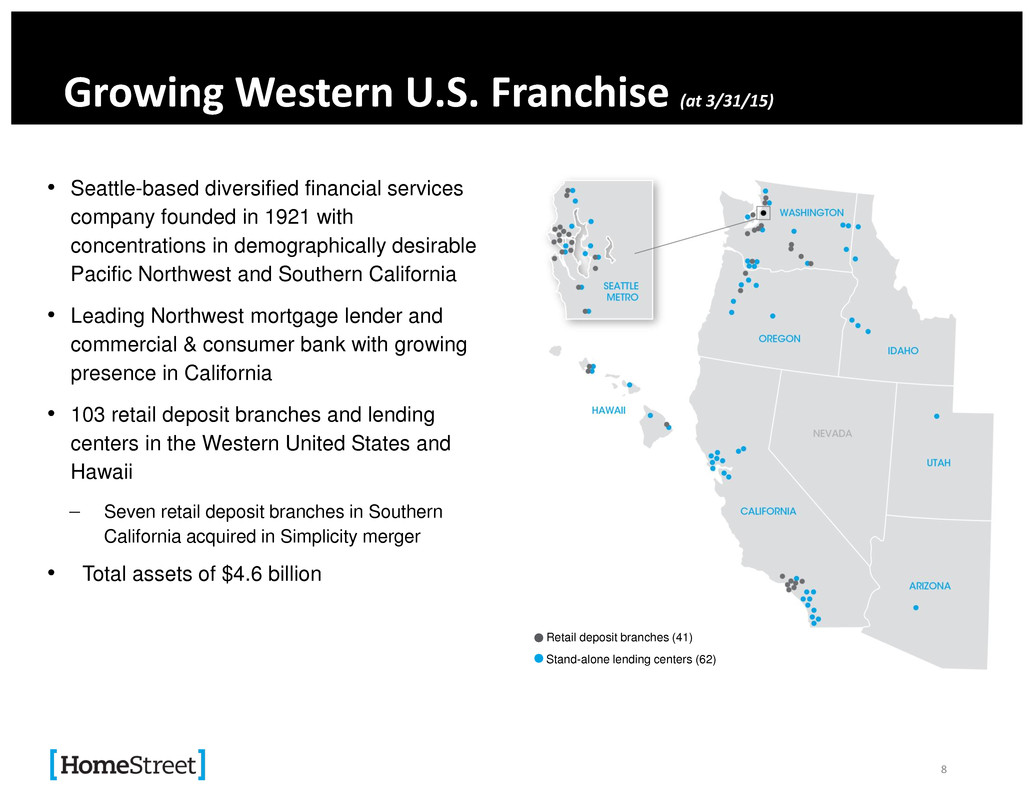

8 Growing Western U.S. Franchise (at 3/31/15) • Seattle-based diversified financial services company founded in 1921 with concentrations in demographically desirable Pacific Northwest and Southern California • Leading Northwest mortgage lender and commercial & consumer bank with growing presence in California • 103 retail deposit branches and lending centers in the Western United States and Hawaii Seven retail deposit branches in Southern California acquired in Simplicity merger • Total assets of $4.6 billion Retail deposit branches (41) Stand-alone lending centers (62)

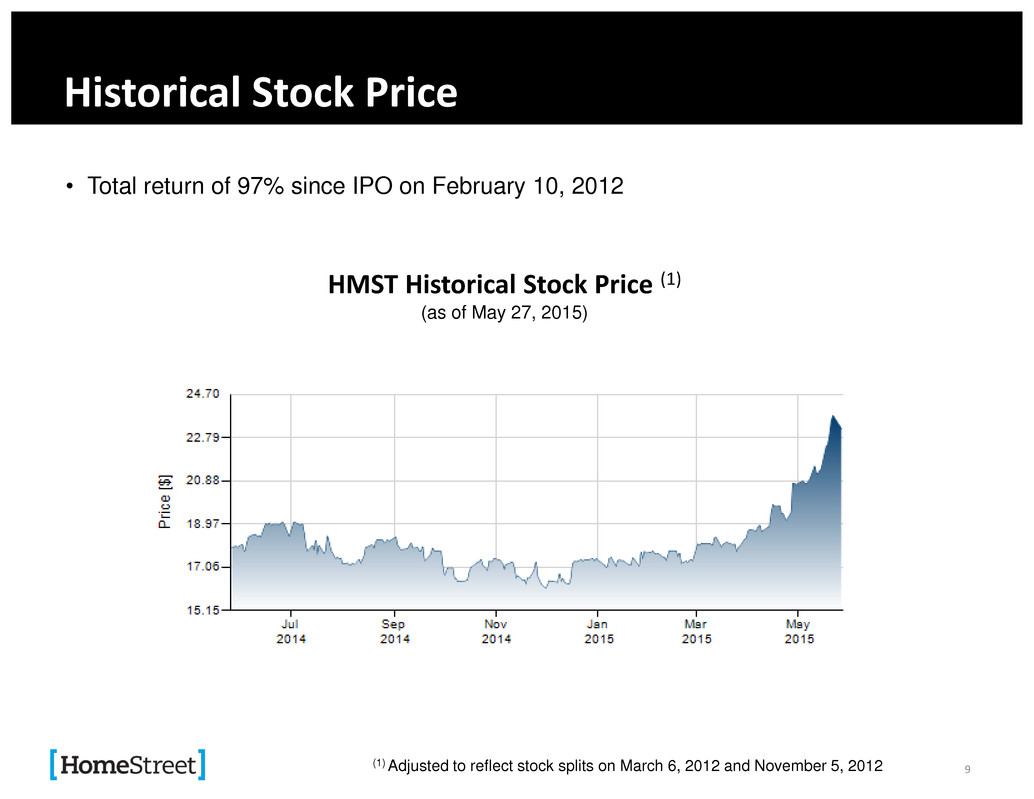

Historical Stock Price 9 • Total return of 97% since IPO on February 10, 2012 HMST Historical Stock Price (1) (as of May 27, 2015) (1) Adjusted to reflect stock splits on March 6, 2012 and November 5, 2012

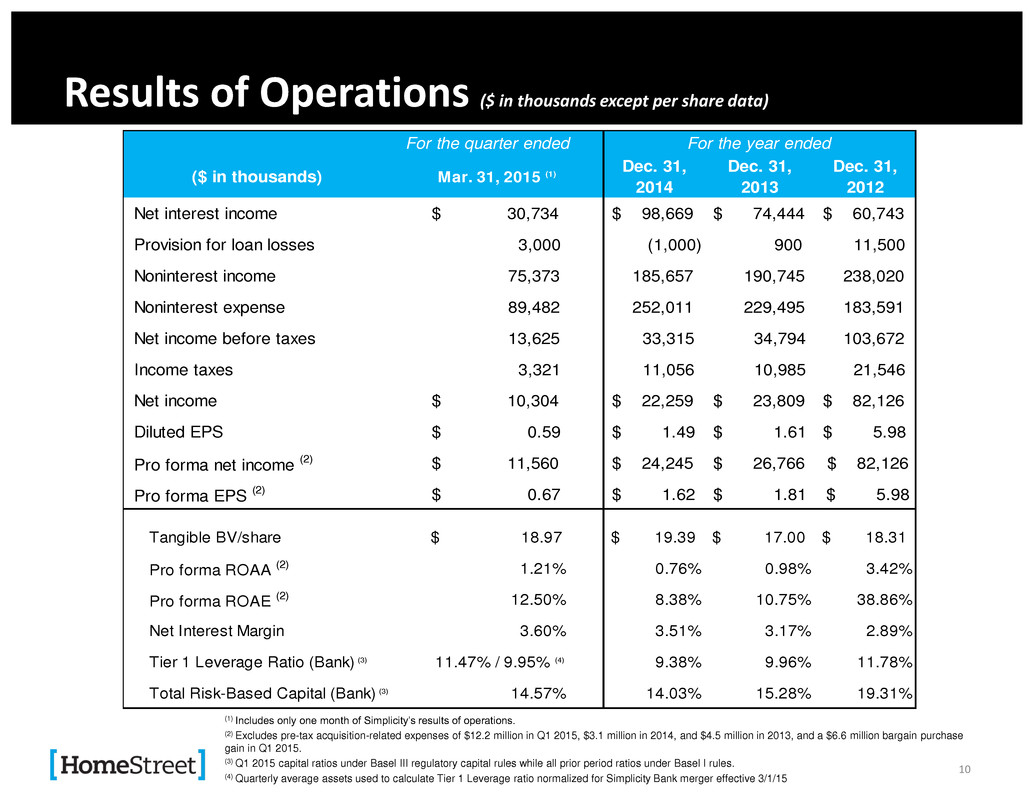

Results of Operations ($ in thousands except per share data) 10 For the three months ended At or for the Year Ended December 31, (1) Includes only one month of Simplicity’s results of operations. (2) Excludes pre-tax acquisition-related expenses of $12.2 million in Q1 2015, $3.1 million in 2014, and $4.5 million in 2013, and a $6.6 million bargain purchase gain in Q1 2015. (3) Q1 2015 capital ratios under Basel III regulatory capital rules while all prior period ratios under Basel I rules. (4) Quarterly average assets used to calculate Tier 1 Leverage ratio normalized for Simplicity Bank merger effective 3/1/15 ($ in thousands) Mar. 31, 2015 (1) Dec. 31, 2014 Dec. 31, 2013 Dec. 31, 2012 Net interest income $ 30,734 $ 98,669 $ 74,444 $ 60,743 Provision for loan losses 3,000 (1,000) 900 11,500 Noninterest income 75,373 185,657 190,745 238,020 Noninterest expense 89,482 252,011 229,495 183,591 Net income before taxes 13,625 33,315 34,794 103,672 Income taxes 3,321 11,056 10,985 21,546 Net income $ 10,304 $ 22,259 $ 23,809 $ 82,126 Diluted EPS $ 0.59 $ 1.49 $ 1.61 $ 5.98 Pro forma net income (2) $ 11,560 $ 24,245 $ 26,766 $ 82,126 Pro forma EPS (2) $ 0.67 $ 1.62 $ 1.81 $ 5.98 Tangible BV/share $ 18.97 $ 19.39 $ 17.00 $ 18.31 Pro forma ROAA (2) 1.21% 0.76% 0.98% 3.42% Pro forma ROAE (2) 12.50% 8.38% 10.75% 38.86% Net Interest Margin 3.60% 3.51% 3.17% 2.89% Tier 1 Leverage Ratio (Bank) (3) 11.47% / 9.95% (4) 9.38% 9.96% 11.78% Total Risk-Based Capital (Bank) (3) 14.57% 14.03% 15.28% 19.31% For the year endedFor the quarter ended

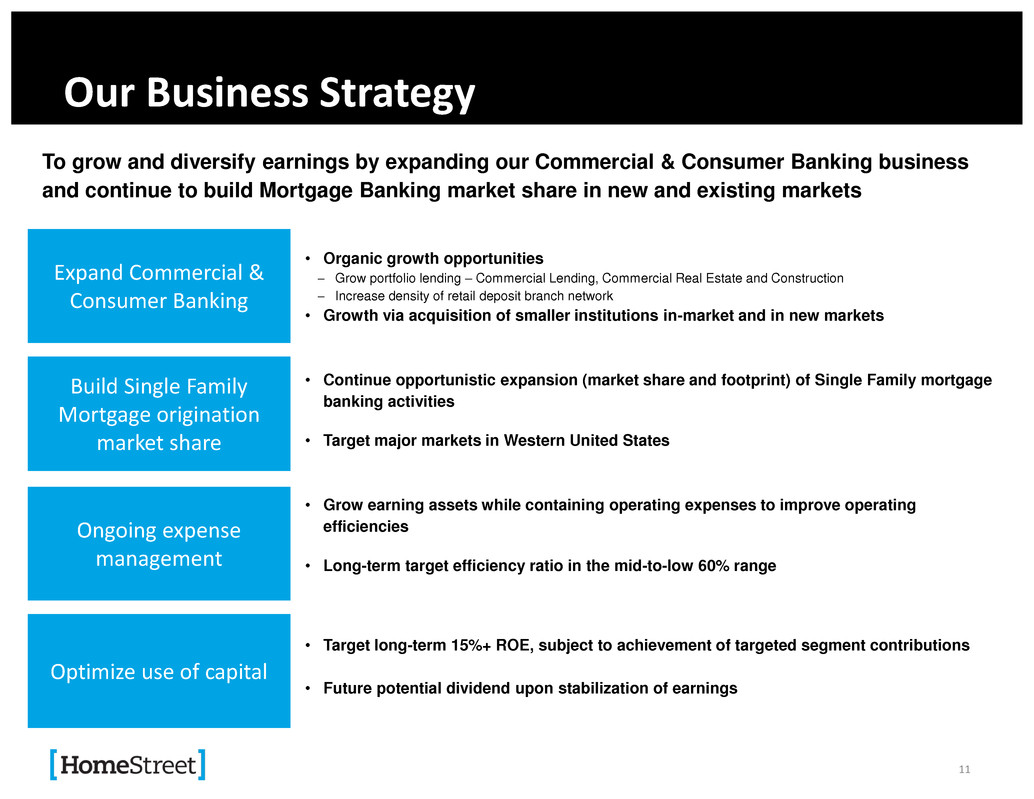

Our Business Strategy Build Single Family Mortgage origination market share • Organic growth opportunities Grow portfolio lending – Commercial Lending, Commercial Real Estate and Construction Increase density of retail deposit branch network • Growth via acquisition of smaller institutions in-market and in new markets • Continue opportunistic expansion (market share and footprint) of Single Family mortgage banking activities • Target major markets in Western United States • Grow earning assets while containing operating expenses to improve operating efficiencies • Long-term target efficiency ratio in the mid-to-low 60% range • Target long-term 15%+ ROE, subject to achievement of targeted segment contributions • Future potential dividend upon stabilization of earnings Expand Commercial & Consumer Banking Ongoing expense management Optimize use of capital To grow and diversify earnings by expanding our Commercial & Consumer Banking business and continue to build Mortgage Banking market share in new and existing markets 11

Commercial & Consumer Banking Business Segment Commercial and Consumer Banking business continues to expand consistent with our strategic plan. We continue to target net growth in our loans held for investment portfolio of 5% or more per quarter, subject to liquidity and capital constraints. Key Results • Net segment income of $14.7 million compared to $6.0 million in 2013 - Excluding one-time merger-related expenses, 2014 segment net income was $16.7 million • Segment net interest income was $82.0 million in 2014 compared to $59.2 million in 2013 • Deposit balances of $2.45 billion, an increase of 11% over 12/31/13 • Loans held for investment were $2.1 billion at December 31, 2014, an increase of 12% from one year earlier • Nonperforming assets were 0.72% of total assets at December 31, 2014 compared to 1.26% at December 31, 2013 12

Mortgage Banking Business Segment • Expanded home loan center network by 11 offices and grew mortgage personnel by 18% in 2014 • Despite decrease of 39% in industry loan volume in 2014, our single family volume was approximately the same as in 2013 Effect of mitigating decrease in origination volume by growing market share in existing markets and entering new markets • Net segment income of $7.5 million, compared to segment net income of $17.8 million in 2013 • Mortgage servicing income of $31.6 million, compared to $15.7 million in 2013 On January 1, 2015, HomeStreet became subject to new Basel lll-based regulatory capital standards In preparation for new standards, sold 25% of mortgage servicing rights in Q2 2014 13

Long-Term Outlook • Diversification of revenue under way Earning assets/loan portfolio growing average of 5% or more per quarter Simplicity merger accelerates earnings diversification and provides foundation for growth • Mortgage market share and market footprint expansion on track Opportunistic addition of strong originators Origination volume strong in Q1 2015 Mortgage Bankers Association anticipates total industry originations to increase 11% in 2015 over 2014 • Earnings multiple expansion expected as a result of growth of commercial and consumer banking 14

15 Questions?

Results of Votes Final tally of vote (if available) 16

Thank you for attending HomeStreet, Inc. NASDAQ:HMST http://ir.homestreet.com (Electronic copies of this presentation available upon request) 17