Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROADCOM CORP | d935187d8k.htm |

| EX-99.6 - EX-99.6 - BROADCOM CORP | d935187dex996.htm |

| EX-99.1 - EX-99.1 - BROADCOM CORP | d935187dex991.htm |

| EX-99.7 - EX-99.7 - BROADCOM CORP | d935187dex997.htm |

| EX-99.3 - EX-99.3 - BROADCOM CORP | d935187dex993.htm |

| EX-99.5 - EX-99.5 - BROADCOM CORP | d935187dex995.htm |

| EX-99.4 - EX-99.4 - BROADCOM CORP | d935187dex994.htm |

| EX-99.2 - EX-99.2 - BROADCOM CORP | d935187dex992.htm |

Exhibit 99.8

Filed pursuant to Rule 425 under the

Securities Act of 1933, as amended, and

deemed filed under Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Filer: Broadcom Corporation

Commission File No.: 000-23993

Subject Company: Broadcom Corporation

Your

Imagination, Our Innovation Avago to Acquire Broadcom

Creates World’s Leading Diversified Communications Semiconductor Company

Investor Presentation May 28, 2015 |

Your

Imagination, Our Innovation Cautions Regarding Forward-Looking Statements

Forward-Looking Statements

Page 1

This communication contains forward-looking statements (including within the

meaning of Section 21E of the United States Securities Exchange Act of 1934, as

amended, and Section 27A of the United States Securities Act of 1933, as amended)

concerning Avago, Broadcom, Pavonia Limited (“HoldCo”), Safari Cayman

LP (“New LP”), the proposed transactions and other matters. These

statements may discuss goals, intentions and expectations as to future plans, trends, events,

results of operations or financial condition, or otherwise, based on current beliefs of

the management of Avago and Broadcom, as well as assumptions made by, and

information currently available to, such management. Forward-looking statements may be accompanied by words such as “aim,” “anticipate,” “believe,”

“plan,” “could,” “would,” “should,”

“estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project” or

similar words, phrases or expressions. These forward-looking

statements are subject to various risks and uncertainties, many of which are outside the parties’ control.

Therefore, you should not place undue reliance on such statements.

Factors which could cause actual results to differ from those projected or contemplated

in any such forward-looking statements include, but are not limited to, the

following factors: (1) the risk that the conditions to the closing of the transaction

are not satisfied, including the risk that required approvals from the shareholders

of Avago or Broadcom for the transaction are not obtained; (2) litigation relating to

the transaction; (3) uncertainties as to the timing of the consummation of the

transaction and the ability of each party to consummate the transaction; (4) risks that

the proposed transaction disrupts the current plans and operations of Avago or

Broadcom; (5) the ability of Avago and Broadcom to retain and hire key personnel; (6) competitive responses to the proposed transaction; (7) unexpected costs,

charges or expenses resulting from the transaction; (8) potential adverse reactions or

changes to business relationships resulting from the announcement or completion

of the transaction; (9) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays,

challenges and expenses associated with integrating the combined companies’

existing businesses and the indebtedness planned to be incurred in connection

with the transaction; and (10) legislative, regulatory and economic

developments. The foregoing review of important factors that could cause actual events to

differ from expectations should not be construed as exhaustive and should be read in

conjunction with statements that are included herein and elsewhere, including

the risk factors included in Broadcom’s and Avago’s most recent Quarterly Report on Form 10-Q and Annual Report on Form 10-K, respectively, and

Broadcom’s and Avago’s more recent reports filed with the SEC. Neither

Broadcom nor Avago undertakes any intent or obligation to publicly update or revise any

of these forward looking statements, whether as a result of new information, future

events or otherwise, except as required by law. |

Your

Imagination, Our Innovation Strategically and Financially Compelling

Transaction Significantly enhances long-term shareholder value for both

companies Creates world’s leading diversified communications semiconductor

company Non-GAAP metrics exclude, where applicable, amortization of

intangibles, restructuring charges, stock-based compensation, discontinued operations and

loss on extinguishment of debt.

Broad portfolio of category-leading franchises

Levered to numerous secular growth trends

$750 million of run rate cost synergies

Immediately accretive to non-GAAP EPS and free cash flow

Page 2 |

Your

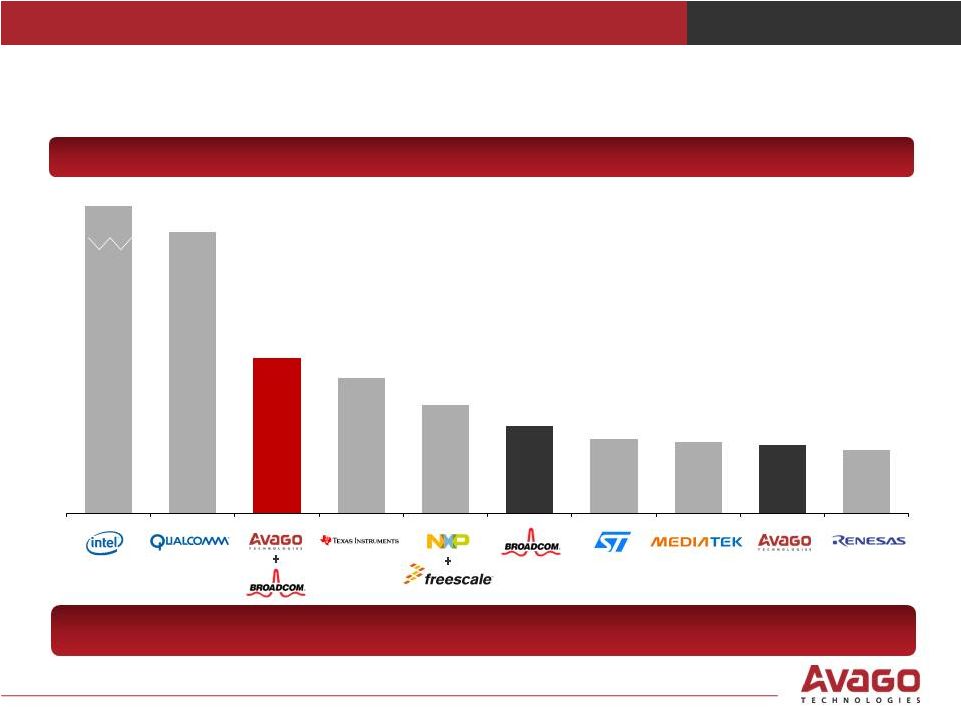

Imagination, Our Innovation Creates a Global Semiconductor Leader

LTM Revenue ($B)

Source: Company filings as of May 27, 2015

Combined enterprise value of $77 billion

Page 3

$55.9

$27.5

$15.1

$13.2

$10.5

$8.5

$7.3

$6.9

$6.6

$6.6 |

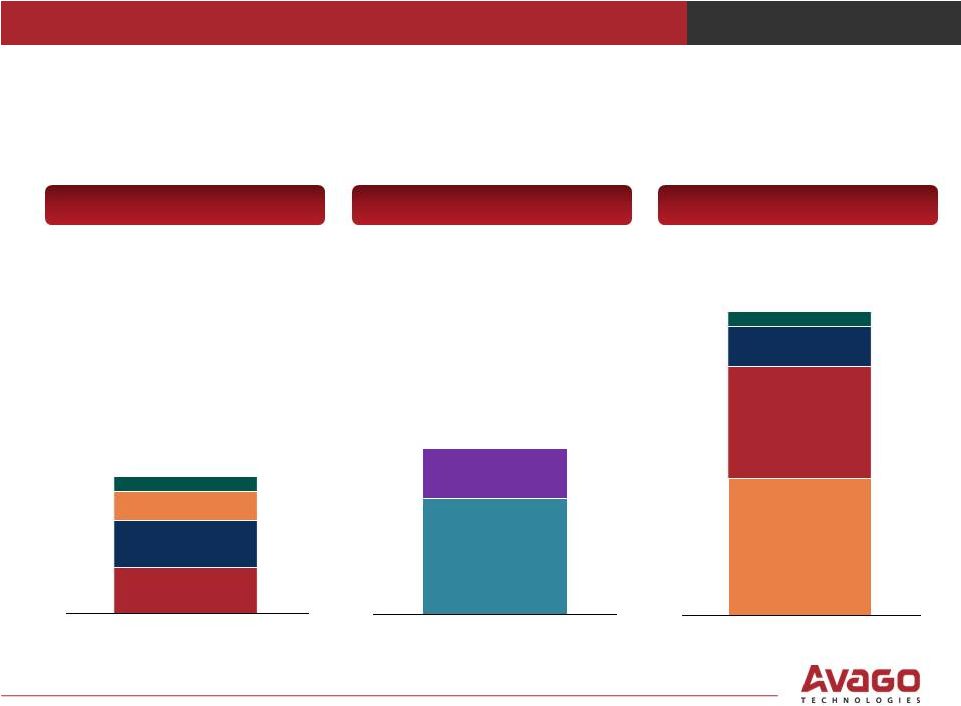

Your

Imagination, Our Innovation World’s Leading Diversified Communications

Semiconductor Company

Avago

(1)

LTM Rev: $6.6B

Wired Infrastructure

Enterprise Storage

Wireless Comm

Industrial & Other

Broadband &

Connectivity

Infrastructure &

Networking

LTM Rev: $8.5B

LTM Rev: $15.1B

Enterprise Storage

Wireless Comm

Wired Infrastructure

Industrial & Other

Broadcom

Combined

(2)

(1) Avago financials are pro forma for a full year of impact from the acquisition of

Emulex and PLX (2)

Page 4

Infrastructure & Networking and Broadband are included in Wired Infrastructure

segment; Connectivity is included in Wireless segment

|

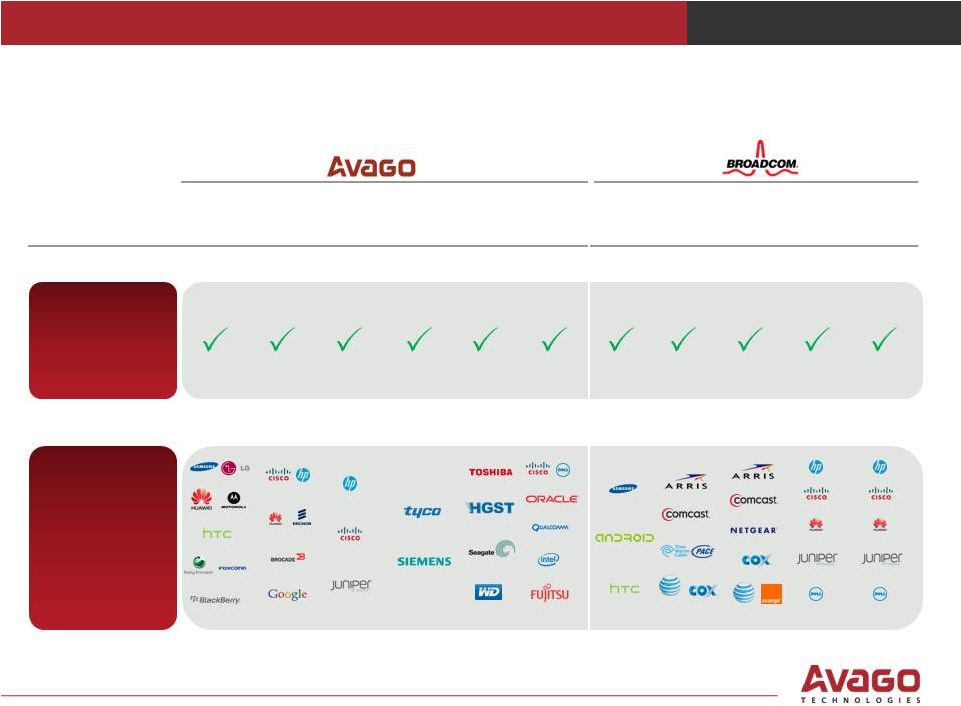

Your

Imagination, Our Innovation Broad Portfolio of Category-Leading Franchises

Leading

Positions

Key Customers

Page 5

RF

Fiber Optics

ASIC

Optocouplers

HDD

Storage

Connectivity

Wireless

Combo

Set Top Box

Broadband

Ethernet

Switching

PHY |

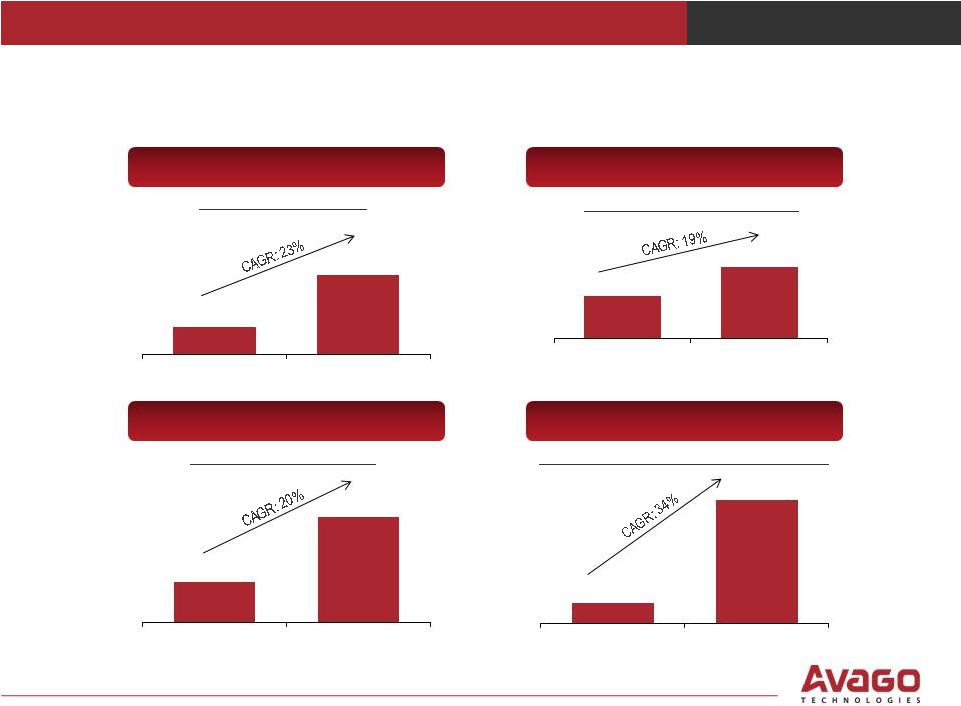

Your

Imagination, Our Innovation Levered to Numerous Secular Growth Trends

LTE Transition

Datacenter Spending

IP Traffic

Connected Home / IoT

LTE Phone Growth (Units M)

Global IP Traffic (PB per Month)

Hardware Datacenter Spending ($M)

Shipments

of

Connected

Home

Devices

(Units

M)

Source:

Gartner 2014

Source:

Cisco VNI 2014

Source:

Gartner 2014

Source:

Gartner 2014

2020E

Page 6

467

1,316

2014

2019E

$9,397

$15,731

2014

2017E

62,476

131,553

2014

2018E

643

3,789

2014 |

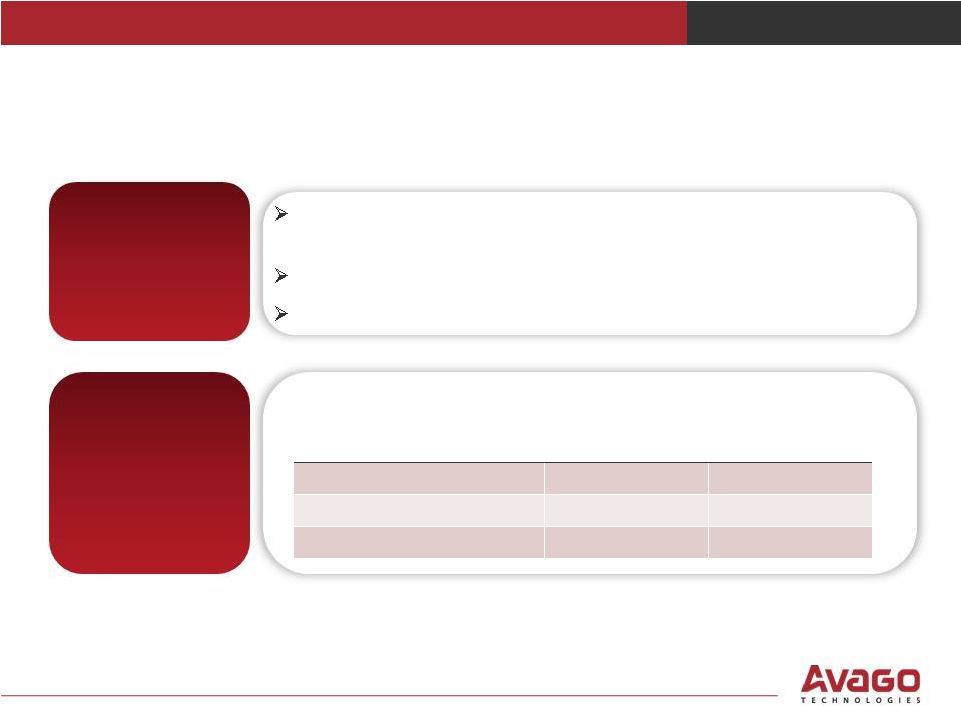

Highly

Profitable Financial Model ($ in B)

(5/03/2015)

(1)

(3/31/2015)

Long-term

model

Revenue

$6.6

$8.5

$15.1

5% CAGR

Gross margin

59%

55%

57%

60%

R&D % of revenue

15%

23%

20%

16%

SG&A % of revenue

6%

7%

7%

4%

Operating Income

$2.5

$2.1

$4.6

Op. Income margin

38%

24%

30%

~40%

EBITDA

$2.7

$2.2

$4.9

EBITDA margin

41%

26%

33%

~43%

+

Sustainable and

growing revenue

Proven operating

model with industry

leading margins

$750M of annual run

rate synergies within

18 months of closing

Strong cash flow

generation & liquidity

Track record of rapid

deleveraging

(1) Pro forma for LSI, PLX and Emulex transactions

(2) Depreciation estimated as 3% of revenues

Page 7

(2)

Your Imagination, Our Innovation

Note: Financials presented on non-GAAP basis, excluding stock-based

compensation, amortization of intangible assets, and other non-recurring expenses |

Your

Imagination, Our Innovation Transaction Overview

Per Share

Consideration

Sources of Financing

Expected Closing

Timetable

Approval Process

Approval by Avago and Broadcom shareholders required

Certain regulatory approvals

~140 million shares and share equivalents

~$9 billion of new debt

~$8 billion of estimated combined company’s cash

By the end of the first calendar quarter of 2016, subject to customary closing

conditions Shareholders can elect:

Final elections subject to proration based on total transaction consideration

Transaction

Consideration

$37 billion of total transaction consideration

Broadcom shareholders expected to own 32% of combined company

(1) Based on Avago closing share price of $141.49 on May 27, 2015; (2) Restricted

equity security that is the economic equivalent off 0.4378 ordinary shares of Avago that

will not be transferable or exchangeable for a period of one to two years from the

closing of the transaction Page 8

–

–

–

$54.50 in cash; or

–

0.4378 ordinary shares; or

–

0.4378 restricted equity securities

(2)

; or

–

A combination of the above

~$17 billion in cash

Economic

equivalent

of

~140

million

Avago

shares

(current

value

of

~$20

billion

(1)

) |

Your

Imagination, Our Innovation Transaction Financing

Credit Facility

$15.5 billion of new term loans at closing ($6.5 billion to refinance existing

debt facilities and $9 billion of new debt)

$500 million revolving credit facility (undrawn)

Facility allows for dividends and share repurchases

Pro Forma

Capitalization

Statistics

($B)

xLTM EBITDA

(w/ $750M

Synergies)

Gross Debt

$15.5

2.7x

Cash

$1.3

0.2x

Net Debt

$14.2

2.5x

Page 9 |

Your

Imagination, Our Innovation No Offer or Solicitation

This

communication

is

not

intended

to

and

does

not

constitute

an

offer

to

sell

or

the

solicitation

of

an

offer

to

subscribe

for

or

buy

or

an

invitation

to

purchase

or subscribe for any securities or the solicitation of any vote in any jurisdiction

pursuant to the proposed transactions or otherwise, nor shall there be any sale,

issuance

or

transfer

of

securities

in

any

jurisdiction

in

contravention

of

applicable

law.

No

offer

of

securities

shall

be

made

except

by

means

of

a

prospectus

meeting

the

requirements

of

Section

10

of

the

United

States

Securities

Act

of

1933,

as

amended.

Subject

to

certain

exceptions

to

be

approved

by

the

relevant

regulators or certain facts to be ascertained, the public offer will not be made

directly or indirectly, in or into any jurisdiction where to do so would constitute a

violation of the laws of such jurisdiction, or by use of the mails or by any means or

instrumentality (including without limitation, facsimile transmission, telephone

and the internet) of interstate or foreign commerce, or any facility of a national

securities exchange, of any such jurisdiction. Important Additional Information

Will be Filed with the SEC HoldCo will file with the SEC a registration statement

on Form S-4, which will include the joint proxy statement of Avago and Broadcom that also constitutes a

prospectus of HoldCo and New LP (the “joint proxy

statement/prospectus”). INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE JOINT

PROXY STATEMENT/PROSPECTUS, AND OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC, IN

THEIR ENTIRETY CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT AVAGO, BROADCOM, HOLDCO, NEW LP, THE PROPOSED

TRANSACTIONS

AND

RELATED

MATTERS.

Investors

and

shareholders

will

be

able

to

obtain

free

copies

of

the

joint

proxy

statement/prospectus and other documents filed with the SEC by the parties through the

website maintained by the SEC at www.sec.gov. In addition, investors

and

shareholders

will

be

able

to

obtain

free

copies

of

the

joint

proxy

statement/prospectus

and

other

documents

filed

with

the

SEC

by

the

parties

by

contacting Avago Investor Relations at (408) 435-7400 or

investor.relations@avagotech.com (for documents filed with the SEC by Avago, HoldCo or New LP)

or andrewtp@broadcom.com (for documents filed with the SEC by Broadcom).

Participants in the Solicitation

Avago,

Broadcom,

HoldCo

and

New

LP

and

their

respective

directors

and

executive

officers

may

be

deemed

to

be

participants

in

the

solicitation

of

proxies

from the shareholders of Avago and Broadcom in respect of the proposed transactions

contemplated by the joint proxy statement/prospectus. Information

regarding the persons who are, under the rules of the SEC, participants in the

solicitation of the shareholders of Avago and Broadcom in connection with the

proposed

transactions,

including

a

description

of

their

direct

or

indirect

interests,

by

security

holdings

or

otherwise,

will

be

set

forth

in

the

joint

proxy

statement/prospectus

when

it

is

filed

with

the

SEC.

Information

regarding

Avago’s

directors

and

executive

officers

is

contained

in

Avago’s

Annual

Report

on

Form

10-K

for

the

year

ended

November

2,

2014

and

its

Proxy

Statement

on

Schedule

14A,

dated

February

20,

2015,

and

information

regarding

Broadcom’s

directors and executive officers is contained in Broadcom’s Annual Report on Form

10-K for the year ended December 31, 2014 and its Proxy Statement on

Schedule

14A,

dated

March

27,

2015,

each

of

which

are

filed

with

the

SEC

and

can

be

obtained

free

of

charge

from

the

sources

indicated

above.

Important Additional Information

Page 10 |