Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROADCOM CORP | d935187d8k.htm |

| EX-99.6 - EX-99.6 - BROADCOM CORP | d935187dex996.htm |

| EX-99.1 - EX-99.1 - BROADCOM CORP | d935187dex991.htm |

| EX-99.8 - EX-99.8 - BROADCOM CORP | d935187dex998.htm |

| EX-99.7 - EX-99.7 - BROADCOM CORP | d935187dex997.htm |

| EX-99.5 - EX-99.5 - BROADCOM CORP | d935187dex995.htm |

| EX-99.4 - EX-99.4 - BROADCOM CORP | d935187dex994.htm |

| EX-99.2 - EX-99.2 - BROADCOM CORP | d935187dex992.htm |

| Exhibit 99.3

|

Filed pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed under Rule 14a-12 under the Securities Exchange Act of 1934, as amended

Filer: Broadcom Corporation Commission File No.: 000-23993

Subject Company: Broadcom Corporation

BROADCOM AND AVAGO ANNOUNCEMENT

CEO All Hands

May 28, 2015

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved.

|

|

CAUTIONARY STATEMENT AND IMPORTANT INFORMATION

Forward Looking Statements

All statements included or incorporated by reference in this document, other than statements or characterizations of historical fact, are forward-looking statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on Broadcom’s current expectations, estimates and projections about its business and industry, management’s beliefs, and certain assumptions made by Broadcom and Avago, all of which are subject to change. Forward-looking statements can often be identified by words such as

“anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,” similar expressions, and variations or negatives of these words. Examples of such forward-looking statements include, but are not limited to, references to the anticipated benefits of the proposed transaction and the expected date of closing of the transaction. These forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially and adversely from those expressed in any forward-looking statement.

Important risk factors that may cause such a difference in connection with the proposed transaction include, but are not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals from the shareholders of Avago or Broadcom for the transaction are not obtained; (2) litigation relating to the transaction; (3) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (4) risks that the proposed transaction disrupts the current plans and operations of Avago or Broadcom; (5) the ability of Avago and Broadcom to retain and hire key personnel; (6) competitive responses to the proposed transaction; (7) unexpected costs, charges or expenses resulting from the transaction; (8) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (9) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses and the indebtedness planned to be incurred in connection with the transaction; and (10) legislative, regulatory and economic developments. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on Form S-4 that will be filed with the SEC in connection with the proposed transaction. The forward-looking statements in this document speak only as of this date. Neither Broadcom nor Avago undertake any obligation to revise or update publicly any forward-looking statement to reflect future events or circumstances.

In addition, actual results are subject to other risks and uncertainties that relate more broadly to Broadcom Corporation’s overall business, including those more fully described in Broadcom Corporation’s filings with the Securities and Exchange Commission (“SEC”) including its annual report on Form 10-K for the fiscal year ended December 31, 2014, and its quarterly reports filed on Form 10-Q for the current fiscal year, and Avago’s overall business and financial condition, including those more fully described in Avago’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended November 2, 2014, and its quarterly reports filed on Form 10-Q for its current fiscal year. The forward-looking statements in this document speak only as of date of this document. We undertake no obligation to revise or update publicly any forward-looking statement, except as required by law.

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved. 2

|

|

CAUTIONARY STATEMENT AND IMPORTANT INFORMATION CON’T

Additional Information and Where to Find it

This document does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

The proposed transaction will be submitted to the shareholders of each of Broadcom and Avago for their consideration. Avago will file with the SEC a Registration Statement on Form S-4 that will include a joint proxy statement/prospectus of Broadcom and Avago. Each of Broadcom and Avago will provide the joint proxy statement/prospectus to their respective shareholders. Broadcom and Avago also plan to file other documents with the SEC regarding the proposed transaction. This document is not a substitute for any prospectus, proxy statement or any other document which Broadcom or Avago may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF BROADCOM AND AVAGO ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). In addition, investors and shareholders will be able to obtain free copies of the joint proxy statement/prospectus and other documents filed with the SEC by the parties on Broadcom’s Investor Relations website (www.broadcom.com/investors) (for documents filed with the SEC by Broadcom) or Avago Investor Relations at (408) 435-7400 or investor.relations@avagotech.com (for documents filed with the SEC by Avago, Holdco or New LP).

Broadcom, Avago, and certain of their respective directors, executive officers and other members of management and employees, under SEC rules may be deemed to be participants in the solicitation of proxies from Broadcom and Avago shareholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of Broadcom and Avago shareholders in connection with the proposed transaction will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find more detailed information about Broadcom’s executive officers and directors in its definitive proxy statement filed with the SEC on March 27, 2015. You can find more detailed information about Avago’s executive officers and directors in its definitive proxy statement filed with the SEC on February 20, 2015. Additional information about Broadcom’s executive officers and directors and Avago’s executive officers and directors can be found in the above-referenced Registration Statement on Form S-4 when it becomes available.

Participants in the Solicitation

Broadcom, Avago, and certain of their respective directors, executive officers and other members of management and employees, under SEC rules may be deemed to be participants in the solicitation of proxies from Broadcom and Avago shareholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of Broadcom and Avago shareholders in connection with the proposed transaction will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find more detailed information about Broadcom’s executive officers and directors in its definitive proxy statement filed with the SEC on March 27, 2015. You can find more detailed information about Avago’s executive officers and directors in its definitive proxy statement filed with the SEC on February 20, 2015. Additional information about Broadcom’s executive officers and directors and Avago’s executive officers and directors can be found in the above-referenced Registration Statement on Form S-4 when it becomes available.

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved. 3

|

|

AGENDA

Transaction Overview

About Avago & the New Broadcom Ltd. What This Means for Employees Q&A

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved. 4

|

|

TRANSACTION RATIONALE

1. Financially compelling for Broadcom shareholders

2. Creates scale that is increasingly important as the industry matures

3. Strengthens our footprint in handsets

4. Strengthens our infrastructure business

5. Accelerates our time-to-market for leading process nodes

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved. 5

|

|

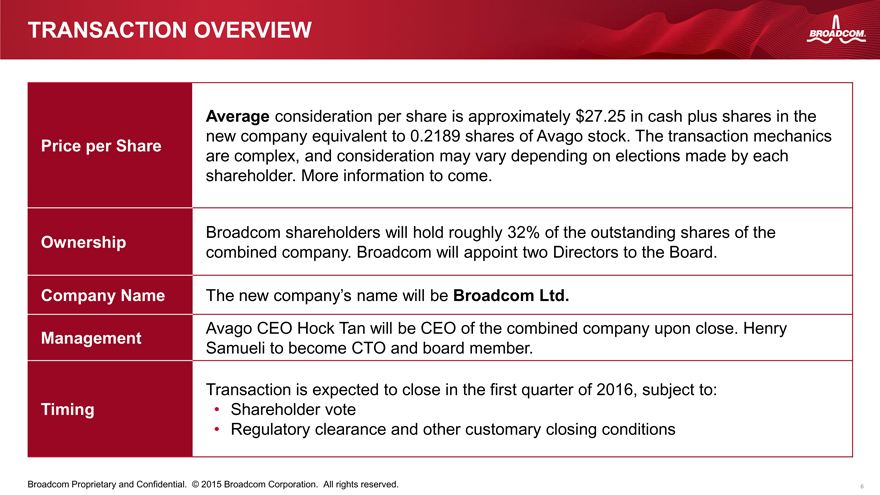

TRANSACTION OVERVIEW

Average consideration per share is approximately $27.25 in cash plus shares in the new company equivalent to 0.2189 shares of Avago stock. The transaction mechanics

Price per Share are complex, and consideration may vary depending on elections made by each shareholder. More information to come.

Broadcom shareholders will hold roughly 32% of the outstanding shares of the

Ownership combined company. Broadcom will appoint two Directors to the Board.

Company Name The new company’s name will be Broadcom Ltd.

Avago CEO Hock Tan will be CEO of the combined company upon close. Henry

Management

Samueli to become CTO and board member.

Transaction is expected to close in the first quarter of 2016, subject to: Timing • Shareholder vote

Regulatory clearance and other customary closing conditions

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved. 6

|

|

COMBINED COMPANY STRENGTH

Creates World’s Leading Diversified Semiconductor Company

Global leader with unique scale and product breadth

Ability to offer a broader product set to wired and wireless customers

Combined company will have a unique portfolio of category-leading franchises

Increases exposure to numerous attractive end markets

Strong financial profile and significant synergies

Immediately accretive to free cash flow and non-GAAP EPS

Significantly Enhances Long-Term Shareholder Value for Both Companies

Non-GAAP results exclude, where applicable, amortization of intangibles, advisory agreement termination fee, selling shareholder expenses, restructuring charges, share based compensation, discontinued operations and loss on extinguishment of debt. All leverage multiples are based on pro forma EBITDA adjusted for divestitures / acquisitions for the particular time period.

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved. 7

|

|

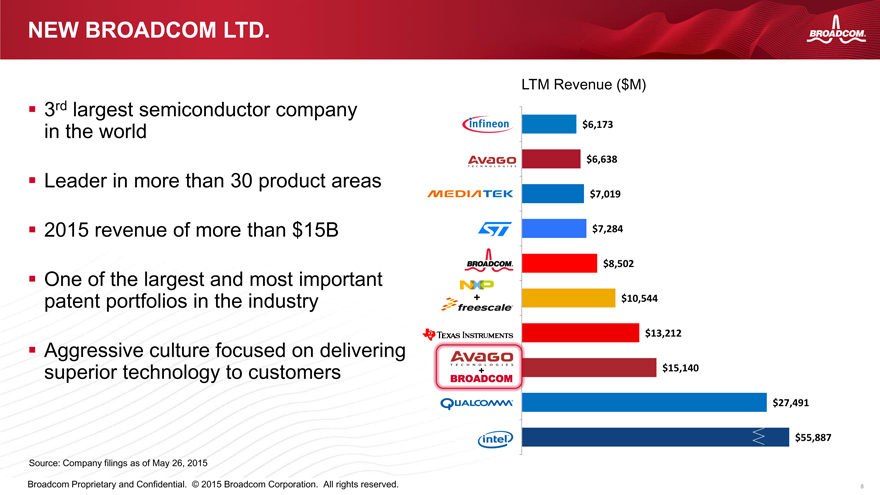

NEW BROADCOM LTD.

3rd largest semiconductor company in the world

Leader in more than 30 product areas

2015 revenue of more than $15B

One of the largest and most important patent portfolios in the industry

Aggressive culture focused on delivering superior technology to customers

Source: Company filings as of May 26, 2015

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved.

LTM Revenue ($M)

$6,173

$6,638

$7,019

$7,284

$8,502

+ $10,544

$13,212

$15,140

$27,491

$55,887

| 8 |

|

|

|

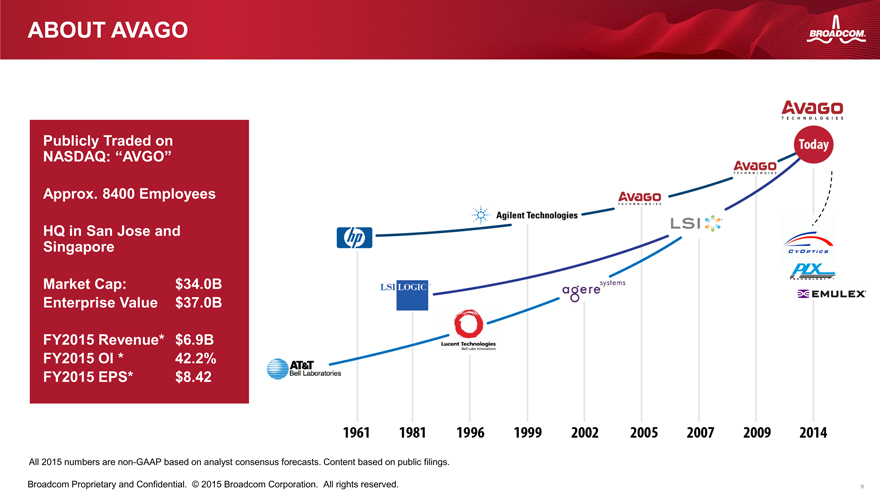

ABOUT AVAGO

Publicly Traded on

NASDAQ: “AVGO”

Approx. 8400 Employees

HQ in San Jose and Singapore

Market Cap: $34.0B Enterprise Value $37.0B

FY2015 Revenue* $6.9B FY2015 OI * 42.2% FY2015 EPS* $8.42

All 2015 numbers are non-GAAP based on analyst consensus forecasts. Content based on public filings.

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved.

9

|

|

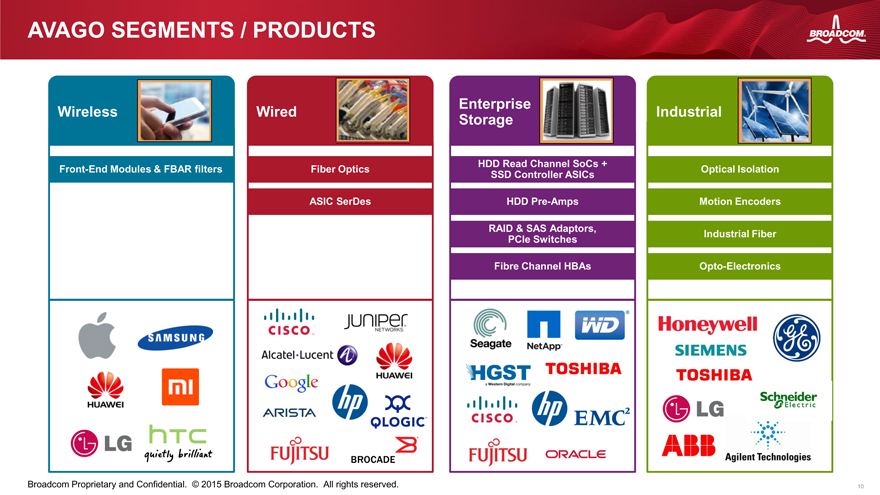

AVAGO SEGMENTS / PRODUCTS

Wireless

Front-End Modules & FBAR filters

Wireless

Front-End Modules & FBAR filters

Wired

Fiber Optics

ASIC SerDes

Enterprise Storage

HDD Read Channel SoCs + SSD Controller ASICs

HDD Pre-Amps

RAID & SAS Adaptors, PCIe Switches

Fibre Channel HBAs

Industrial

Optical Isolation Motion Encoders Industrial Fiber Opto-Electronics

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved.

10

|

|

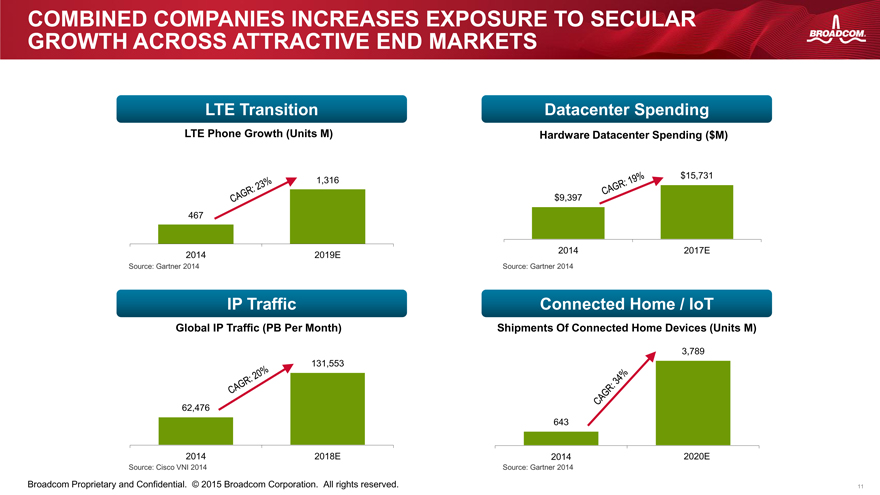

COMBINED COMPANIES INCREASES EXPOSURE TO SECULAR GROWTH ACROSS ATTRACTIVE END MARKETS

LTE Transition

LTE Phone Growth (Units M)

1,316

467

2014 2019E

Source: Gartner 2014

IP Traffic

Global IP Traffic (PB Per Month)

131,553

62,476

2014 2018E

Source: Cisco VNI 2014

Datacenter Spending

Hardware Datacenter Spending ($M)

$15,731

$9,397

2014 2017E

Source: Gartner 2014

Connected Home / IoT

Shipments Of Connected Home Devices (Units M)

3,789

643

2014 2020E

Source: Gartner 2014

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved.

11

|

|

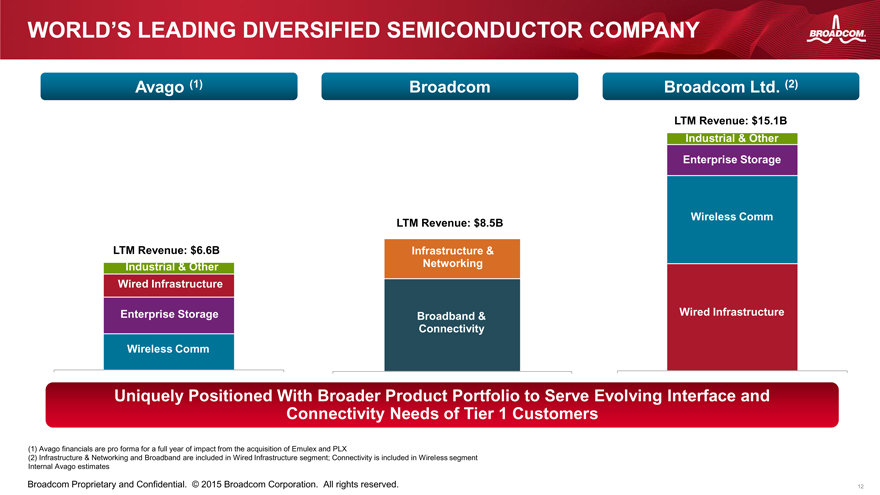

WORLD’S LEADING DIVERSIFIED SEMICONDUCTOR COMPANY

Avago (1) Broadcom Broadcom Ltd. (2)

LTM Revenue: $6.6B Industrial & Other Wired Infrastructure

Enterprise Storage

Wireless Comm

LTM Revenue: $8.5B

Infrastructure & Networking

Broadband & Connectivity

LTM Revenue: $15.1B Industrial & Other Enterprise Storage

Wireless Comm

Wired Infrastructure

Uniquely Positioned With Broader Product Portfolio to Serve Evolving Interface and

Connectivity Needs of Tier 1 Customers

| (1) |

|

Avago financials are pro forma for a full year of impact from the acquisition of Emulex and PLX |

(2) Infrastructure & Networking and Broadband are included in Wired Infrastructure segment; Connectivity is included in Wireless segment Internal Avago estimates

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved. 12

|

|

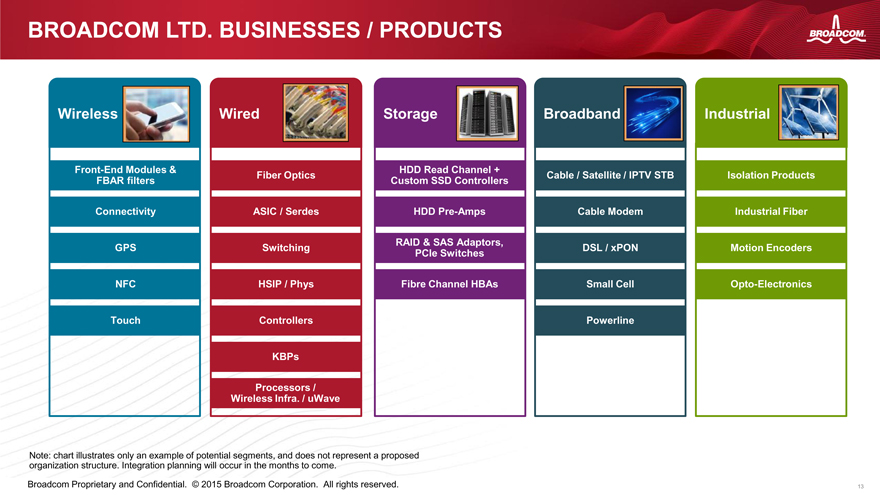

BROADCOM LTD. BUSINESSES / PRODUCTS

Wireless

Front-End Modules &

FBAR filters

Connectivity

GPS

NFC

Touch

Wired

Fiber Optics

ASIC / Serdes

Switching

HSIP / Phys

Controllers

KBPs

Processors /

Wireless Infra. / uWave

Storage

HDD Read Channel + Custom SSD Controllers

HDD Pre-Amps

RAID & SAS Adaptors, PCIe Switches

Fibre Channel HBAs

Broadband

Cable / Satellite / IPTV STB Cable Modem DSL / xPON

Small Cell

Powerline

Industrial

Isolation Products Industrial Fiber Motion Encoders Opto-Electronics

Note: chart illustrates only an example of potential segments, and does not represent a proposed organization structure. Integration planning will occur in the months to come.

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved. 13

|

|

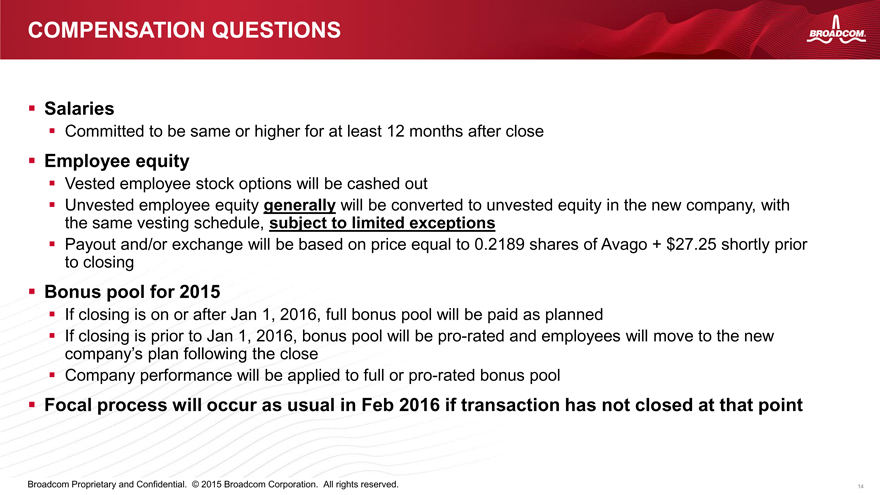

COMPENSATION QUESTIONS

Salaries

Committed to be same or higher for at least 12 months after close

Employee equity

Vested employee stock options will be cashed out

Unvested employee equity generally will be converted to unvested equity in the new company, with the same vesting schedule, subject to limited exceptions

Payout and/or exchange will be based on price equal to 0.2189 shares of Avago + $27.25 shortly prior to closing

Bonus pool for 2015

If closing is on or after Jan 1, 2016, full bonus pool will be paid as planned

If closing is prior to Jan 1, 2016, bonus pool will be pro-rated and employees will move to the new company’s plan following the close

Company performance will be applied to full or pro-rated bonus pool

Focal process will occur as usual in Feb 2016 if transaction has not closed at that point

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved. 14

|

|

TREATMENT OF EMPLOYEE RSUS AND STOCK OPTIONS

Vested Broadcom restricted stock units (“RSUs”) and stock options will be cashed out at closing of the transaction

Holders will receive $54.50 per share in cash, net of any applicable exercise price

Unvested Broadcom RSUs and stock options will be converted automatically into RSUs and stock options of Avago

The number of Avago ordinary shares to be subject to Avago RSUs and stock options will be determined pursuant to an exchange ratio set forth in the merger agreement

Vesting period will remain the same

Upon exercise of the stock options and vesting of the RSUs, holders will receive Avago ordinary shares No taxable event at the time of the merger; holders will continue to be taxed upon exercise or receipt of the shares

Employees will not receive restricted shares or partnership units (collectively, “restricted shares”) with respect to their RSUs and options

Similar to other shareholders, employees who hold shares will have the opportunity to defer tax on their shares and remain long-term shareholders of Avago by electing restricted shares

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved. 15

|

|

EMPLOYEE NEXT STEPS

Until the Transaction Closes, Broadcom and Avago Must Remain Two Separate Companies

DO

Continue to execute

Continue to focus on customers

Assist with integration planning if asked to do so

Ask your manager if unsure whether something is appropriate

DO NOT

Share competitive information with Avago

Coordinate customer-facing activities with Avago

Have informal meetings or discussions with Avago on integration

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved. 16

|

|

QUESTIONS & ANSWERS

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved. 17

|

|

MOST IMPORTANTLY…

Continue to Innovate

Continue to Execute

Stay Focused on Customers

Look Forward to Our Combined Future

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved.