Attached files

| file | filename |

|---|---|

| 8-K - 8-K 2015 ANNUAL MEETING - SEARS HOMETOWN & OUTLET STORES, INC. | a8-k2015annualmeeting.htm |

Annual Meeting of Stockholders May 27, 2015

1 2014 Performance Business Strategy Q&A Topics

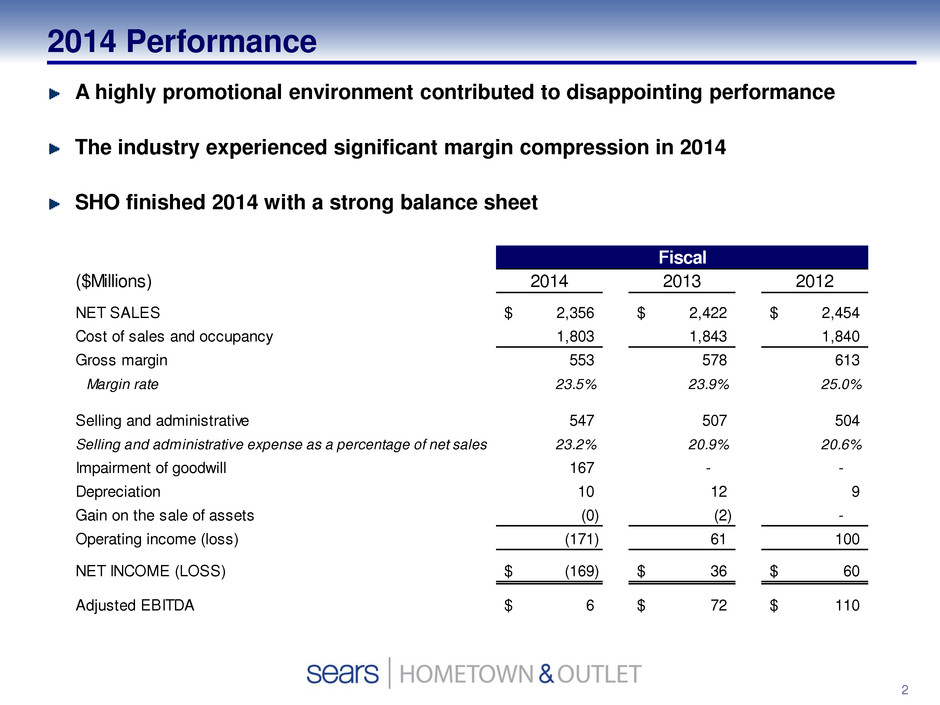

2 2014 Performance A highly promotional environment contributed to disappointing performance The industry experienced significant margin compression in 2014 SHO finished 2014 with a strong balance sheet ($Millions) 2014 2013 2012 NET SALES 2,356$ 2,422$ 2,454$ Cost of sales and occupancy 1,803 1,843 1,840 Gross margin 553 578 613 Margin rate 23.5% 23.9% 25.0% Selling and administrative 547 507 504 S lling and administrative expense as a percentage of net sales 23.2% 20.9% 20.6% Impairment of goodwill 167 - - Depreciation 10 12 9 Gain on the sale of assets (0) (2) - Operating income (loss) (171) 61 100 NET INCOME (LOSS) (169)$ 36$ 60$ Adjusted EBITDA 6$ 72$ 110$ Fiscal

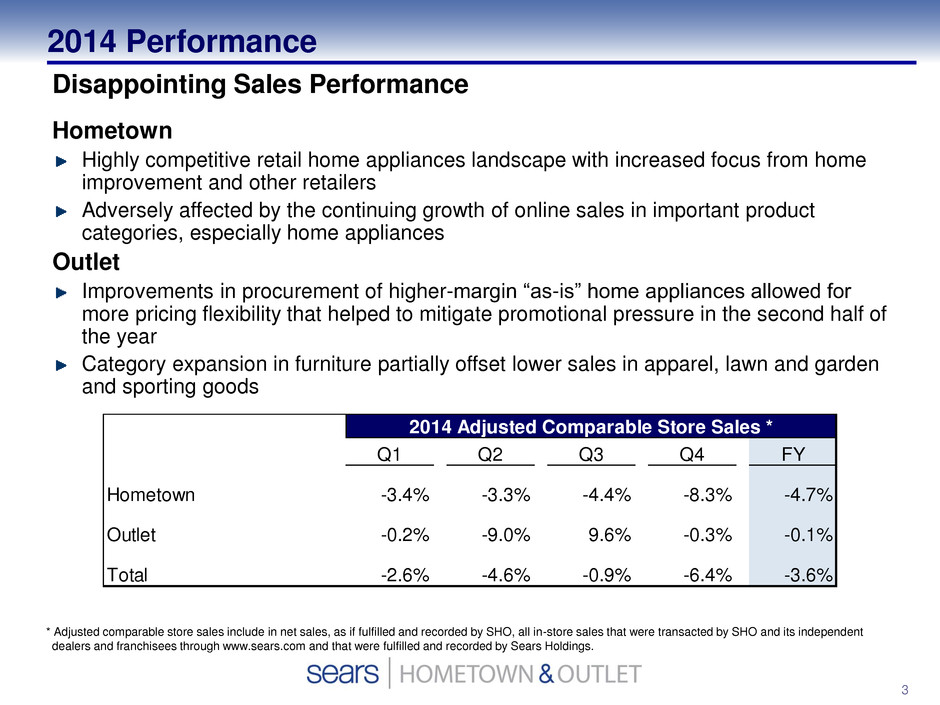

3 Disappointing Sales Performance Hometown Highly competitive retail home appliances landscape with increased focus from home improvement and other retailers Adversely affected by the continuing growth of online sales in important product categories, especially home appliances Outlet Improvements in procurement of higher-margin “as-is” home appliances allowed for more pricing flexibility that helped to mitigate promotional pressure in the second half of the year Category expansion in furniture partially offset lower sales in apparel, lawn and garden and sporting goods 2014 Performance * Adjusted comparable store sales include in net sales, as if fulfilled and recorded by SHO, all in-store sales that were transacted by SHO and its independent dealers and franchisees through www.sears.com and that were fulfilled and recorded by Sears Holdings. Q1 Q2 Q3 Q4 FY Hometown -3.4% -3.3% -4.4% -8.3% -4.7% Outlet -0.2% -9.0% 9.6% -0.3% -0.1% Total -2.6% -4.6% -0.9% -6.4% -3.6% 2014 Adjusted Comparable Store Sales *

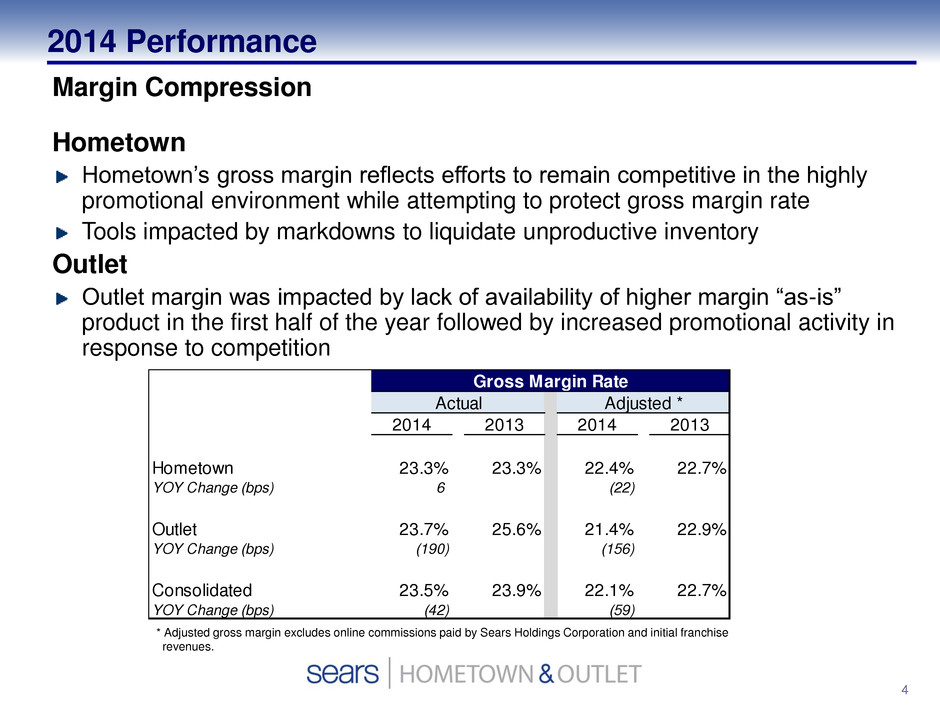

4 2014 Performance Margin Compression Hometown Hometown’s gross margin reflects efforts to remain competitive in the highly promotional environment while attempting to protect gross margin rate Tools impacted by markdowns to liquidate unproductive inventory Outlet Outlet margin was impacted by lack of availability of higher margin “as-is” product in the first half of the year followed by increased promotional activity in response to competition * Adjusted gross margin excludes online commissions paid by Sears Holdings Corporation and initial franchise revenues. 2014 2013 2014 2013 H metown 23.3% 23.3% 22.4% 22.7% YOY Chang (bps) 6 (22) Outlet 23.7% 25.6% 21.4% 22.9% YOY Change (bps) (190) (156) Consolidated 23.5% 23.9% 22.1% 22.7% YOY Change (bps) (42) (59) Gross Margin Rate Actual Adjusted *

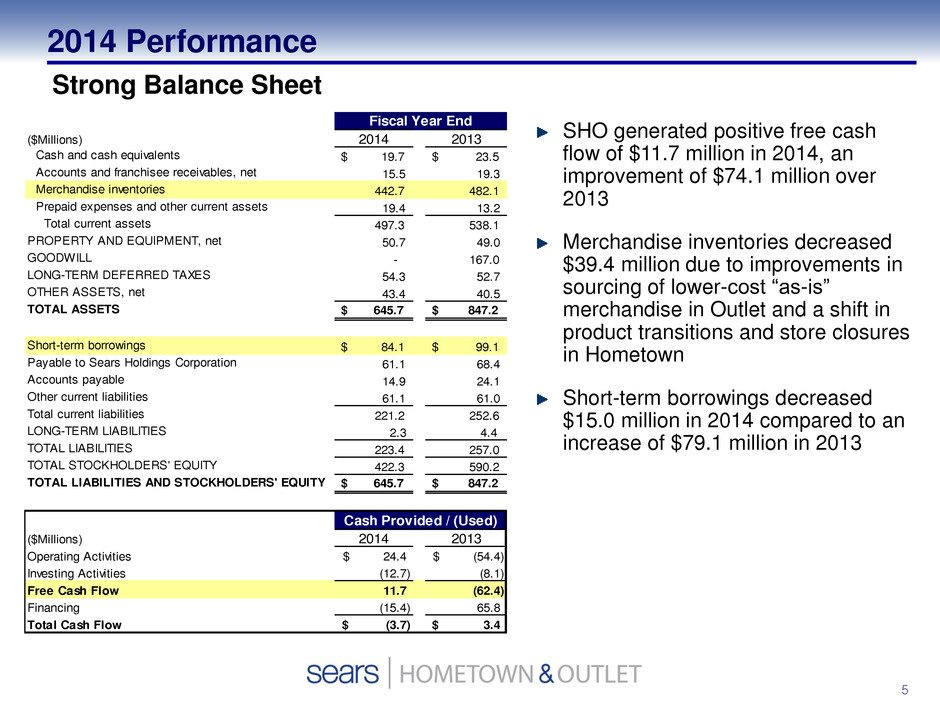

5 2014 Performance Strong Balance Sheet SHO generated positive free cash flow of $11.7 million in 2014, an improvement of $74.1 million over 2013 Merchandise inventories decreased $39.4 million due to improvements in sourcing of lower-cost “as-is” merchandise in Outlet and a shift in product transitions and store closures in Hometown Short-term borrowings decreased $15.0 million in 2014 compared to an increase of $79.1 million in 2013 ($Millions) 2014 2013 Cash and cash equivalents $ 19.7 $ 23.5 Accounts and franchisee receivables, net 15.5 19.3 Merchandise inventories 442.7 482.1 Prepaid expenses and other current assets 19.4 13.2 Total current assets 497.3 538.1 PROPERTY AND EQUIPMENT, net 50.7 49.0 GOODWILL - 167.0 LONG-TERM DEFERRED TAXES 54.3 52.7 OTHER ASSETS, net 43.4 40.5 TOTAL ASSETS $ 645.7 $ 847.2 Short-term borrowings $ 84.1 $ 99.1 Payable to Sears Holdings Corporation 61.1 68.4 Accounts payable 14.9 24.1 Other current liabilities 61.1 61.0 Total current liabilities 221.2 252.6 LONG-TERM LIABILITIES 2.3 4.4 TOTAL LIABILITIES 223.4 257.0 TOTAL STOCKHOLDERS' EQUITY 422.3 590.2 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 645.7 $ 847.2 ($Millions) 2014 2013 Operating Activities 24.4$ (54.4)$ Investing Activities (12.7) (8.1) Free Cash Flow 11.7 (62.4) Financing (15.4) 65.8 Total Cash Flow (3.7)$ 3.4$ Fiscal Year End Cash Provided / (Used)

6 First Quarter Trends First Quarter 2015 results are expected to reflect: Positive EBITDA Improved sales trends vs. Q4 2014 Lower outstanding borrowings Improved cash flow We expect to file our first quarter 10-Q and release our first quarter earnings on June 5, 2015

7 Current Strategies: Store Portfolio Management America’s Appliance Experts Outlet Evolution Multi-Channel Capabilities Optimize Merchandise Assortments Business Process Outsourcing

8 Business Overview: Four formats Hometown Stores, Home Appliance Showrooms, Hardware Stores and Outlet Stores 1,260 locations* 926 Hometown stores with 919 operated by independent dealers 78 Hardware stores with 56 operated by franchisees 105 Home Appliance Showrooms with 80 operated by franchisees and two operated by independent dealers 151 Outlet stores with 63 operated by franchisees Multi-channel presence (searsoutlet.com, sears.com) * Store counts as of January 31, 2015

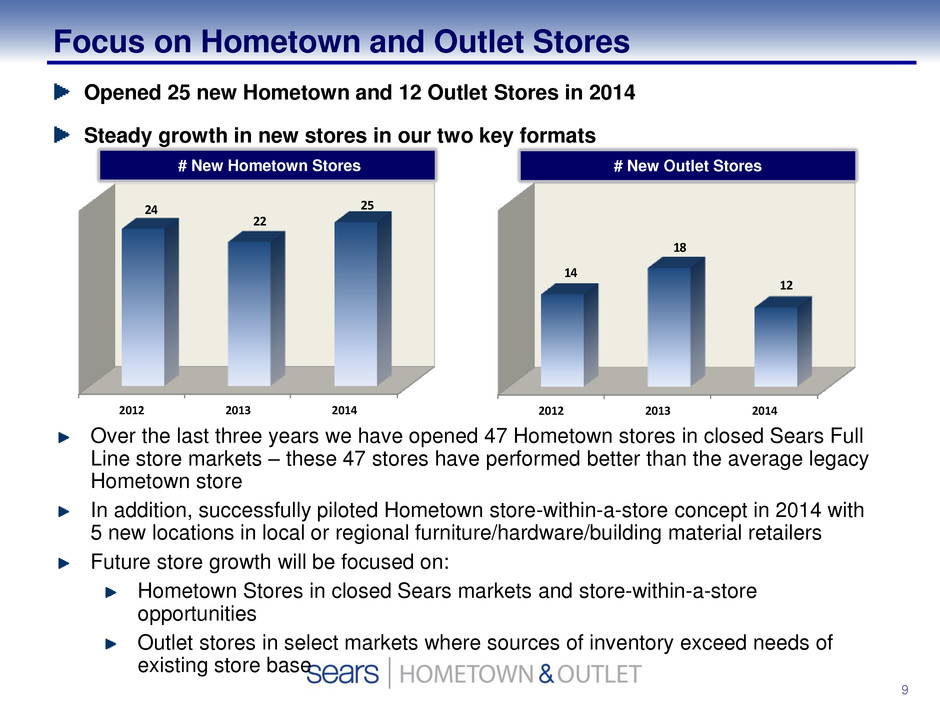

9 2012 2013 2014 14 18 12 2012 013 2014 24 22 25 Focus on Hometown and Outlet Stores Over the last three years we have opened 47 Hometown stores in closed Sears Full Line store markets – these 47 stores have performed better than the average legacy Hometown store In addition, successfully piloted Hometown store-within-a-store concept in 2014 with 5 new locations in local or regional furniture/hardware/building material retailers Future store growth will be focused on: Hometown Stores in closed Sears markets and store-within-a-store opportunities Outlet stores in select markets where sources of inventory exceed needs of existing store base Opened 25 new Hometown and 12 Outlet Stores in 2014 Steady growth in new stores in our two key formats # New Hometown Stores # New Outlet Stores

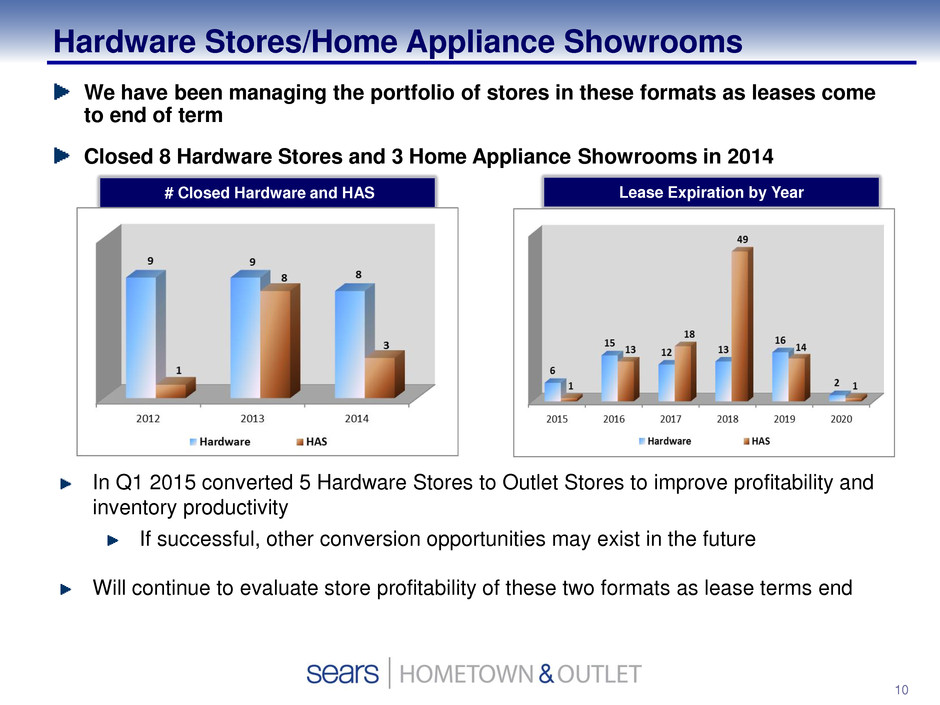

10 Hardware Stores/Home Appliance Showrooms In Q1 2015 converted 5 Hardware Stores to Outlet Stores to improve profitability and inventory productivity If successful, other conversion opportunities may exist in the future Will continue to evaluate store profitability of these two formats as lease terms end We have been managing the portfolio of stores in these formats as leases come to end of term Closed 8 Hardware Stores and 3 Home Appliance Showrooms in 2014 # Closed Hardware and HAS Lease Expiration by Year

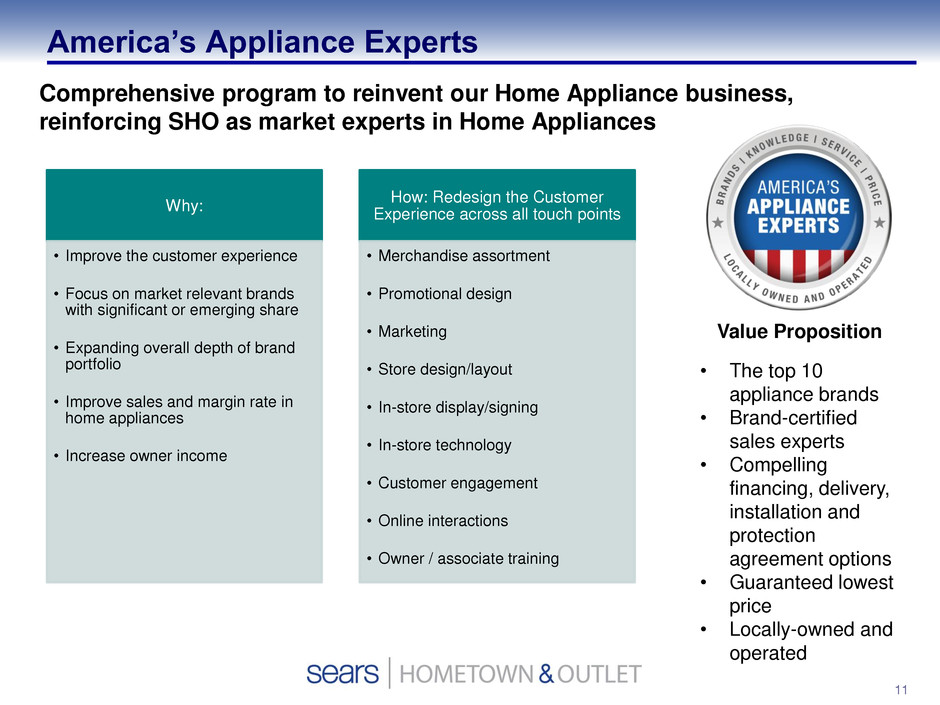

11 America’s Appliance Experts Comprehensive program to reinvent our Home Appliance business, reinforcing SHO as market experts in Home Appliances Why: • Improve the customer experience • Focus on market relevant brands with significant or emerging share • Expanding overall depth of brand portfolio • Improve sales and margin rate in home appliances • Increase owner income How: Redesign the Customer Experience across all touch points • Merchandise assortment • Promotional design • Marketing • Store design/layout • In-store display/signing • In-store technology • Customer engagement • Online interactions • Owner / associate training Value Proposition • The top 10 appliance brands • Brand-certified sales experts • Compelling financing, delivery, installation and protection agreement options • Guaranteed lowest price • Locally-owned and operated

12 America’s Appliance Experts 52 Pilot Hometown stores completed in March/April Early results are positive Increased comp sales in home appliances Balance of sale shifting to include more branded product while maintaining Kenmore volume 59 additional stores will be completed in July, including pilots in Home Appliance Showrooms and Hardware Stores Planning for wider roll-out in October (100-150 stores) pending continued positive results

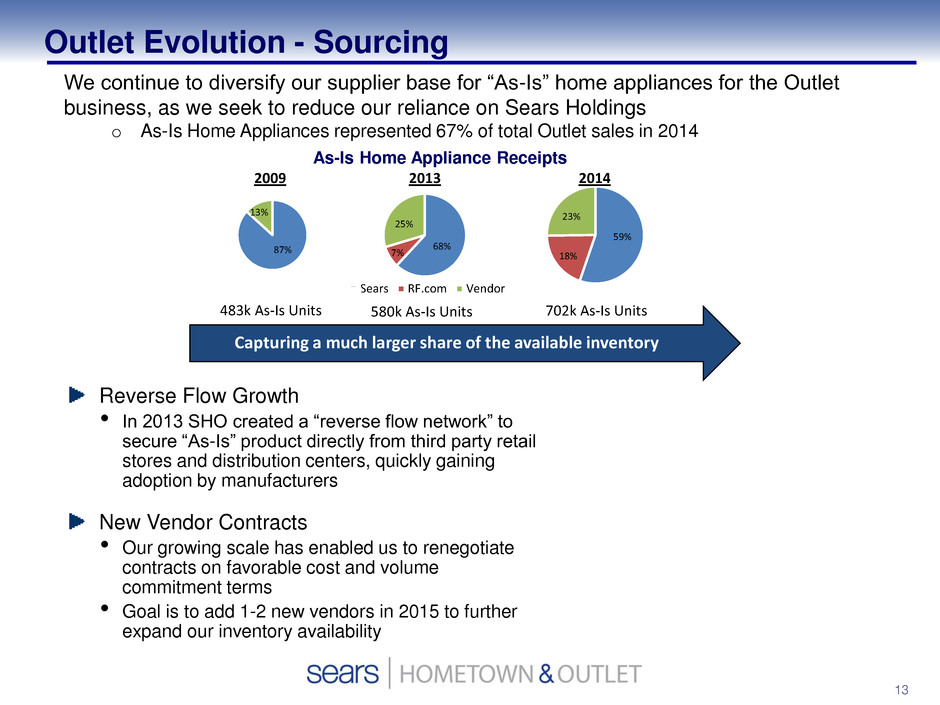

13 Outlet Evolution - Sourcing Reverse Flow Growth • In 2013 SHO created a “reverse flow network” to secure “As-Is” product directly from third party retail stores and distribution centers, quickly gaining adoption by manufacturers New Vendor Contracts • Our growing scale has enabled us to renegotiate contracts on favorable cost and volume commitment terms • Goal is to add 1-2 new vendors in 2015 to further expand our inventory availability We continue to diversify our supplier base for “As-Is” home appliances for the Outlet business, as we seek to reduce our reliance on Sears Holdings o As-Is Home Appliances represented 67% of total Outlet sales in 2014 As-Is Home Appliance Receipts Sears RF.com Vendor Sears RF.com Vendor Sears RF.com Vendor 87% 13% 68% 25% 7% 23% 18% 59% 483k As-Is Units 580k As-Is Units 702k As-Is Units Capturing a much larger share of the available inventory 2009 2013 2014

14 Outlet Evolution – As-Is Repair / Refurbishment SHO has developed As-Is product repair/refurbishment capabilities previously provided by SHC Reduced YOY repair cost per unit received by 20% Repairing all product categories Authorized service provider contracts in place with Whirlpool, GE, Electrolux and LG that enable collection of labor/parts reimbursement for warranty claims from these vendors Currently working to onboard additional manufacturers Additional initiatives for 2015 will focus on improving product service labor productivity and reducing parts costs

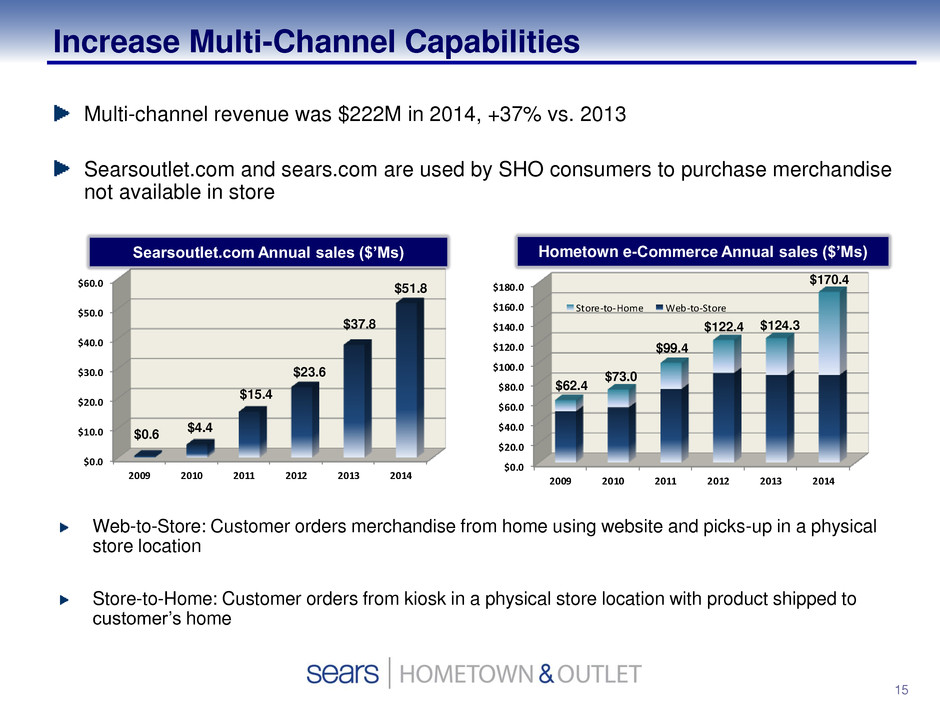

15 Increase Multi-Channel Capabilities Web-to-Store: Customer orders merchandise from home using website and picks-up in a physical store location Store-to-Home: Customer orders from kiosk in a physical store location with product shipped to customer’s home Multi-channel revenue was $222M in 2014, +37% vs. 2013 Searsoutlet.com and sears.com are used by SHO consumers to purchase merchandise not available in store $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 2009 2010 2011 2012 2013 2014 $0.6 $4.4 $15.4 $23.6 $37.8 $51.8 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 2009 2010 2011 2012 2013 2014 Store-to-Home Web-to-Store Searsoutlet.com Annual sales ($’Ms) Hometown e-Commerce Annual sales ($’Ms) $62.4 $73.0 $99.4 $122.4 $124.3 $170.4

16 Optimize Merchandise Assortments Emphasize merchandise categories that leverage big ticket selling skills and distribution capabilities Expansion/introduction of higher margin products Continued investment in growth of the mattress business 100 stores with expanded footprint LY Flooring higher end beds in all locations to increase average ticket All new displays, featuring new bedding technology and POP, launching Q2 2015 Expansion of furniture in Outlet Stores Increased assortment with 21 new items LY New sourcing initiatives include opportunity buys and “As Is” from retailers and manufacturers Lawn and Garden assortment optimization Excellent results from Craftsman Pro launch in 2014 Expanding Craftsman Pro assortment, adding 6 new items Husqvarna brand tractors and mowers expanded via direct to store purchase Significant investment in addition of cordless specialty power assortment 2014-2015 Actions

17 Business Process Outsourcing • Our ability to drive sales and profit line growth is dependent on our systems capabilities and efficiencies of our processes • SHO has entered into a Master Services Agreement with Capgemini U.S. LLC to provide services and to assist in the migration of our information systems from our current systems environment to new systems, primarily provided by NetSuite Inc. Infrastructure • Asset light approach to back room operations • Modern, best-in- class technology, systems & business processes • Shifts burden to maintain IT to 3rd party • Access to continued technology improvements Strategic Fit • Fosters a lean, efficient home office • Future proof technology • Business processes and systems align with strategic objectives Service Level • True 3rd party service provides increased service levels to SHO • Ability to adapt business processes and systems aligned with strategic objectives

18 Business Process Outsourcing • We expect this change will: • Provide much greater strategic and operational flexibility, • Allow better control of our systems and processes, • Reduce our total cost of ownership over the term of the agreement, and • Reduce some of the risks relating to our relationship with, and dependence on, Sears Holdings. • The project enables us to refine new systems and processes well in advance of the April 2018 termination date of our Services Agreement with Sears Holdings. • We intend to replace most of our existing Sears Holdings information and technology systems. We intend to migrate many corporate services provided by Sears Holdings to Capgemini, other third party providers, or, on a limited-basis, internally within SHO. We hope to continue several mutually advantageous elements of our operating relationship with Sears Holdings well beyond the current term of our agreements. • We expect to incur increases in capital expenditures and corporate expenses in fiscal 2015 and 2016 as a result of this project. As we report our quarterly results, we will clarify the portion of capital expenditures and expenses that are related to this project • We intend will be fully operational by the end of the 2016 fiscal year

19 Conclusions • Major initiative underway to improve our core business – America’s Appliance Experts • Pro-actively managing our real estate portfolio and Shareholder’s assets • Growing our own capabilities, reducing our reliance on Sears Holdings • Strong balance sheet and liquidity

20 QUESTIONS

21 Forward-Looking Statements Certain statements made in this presentation contain forward-looking statements. Statements preceded or followed by, or that otherwise include, the words “believes,” “expects,” “anticipates,” “intends,” “project,” “estimates,” “plans,” “forecast,” “is likely to,” and similar expressions or future or conditional verbs such as “will,” “may,” “would,” “should,” and “could” are generally forward-looking in nature and not historical facts. The forward-looking statements are subject to significant risks and uncertainties that may cause our actual results, performance, and achievements in the future to be materially different from the future results, future performance, and future achievements expressed or implied by the forward-looking statements. The forward-looking statements include, without limitation, information concerning our future financial performance, business strategy, plans, goals, beliefs, expectations, and objectives. The forward-looking statements are based upon the current beliefs and expectations of our management. The following factors, among others, could cause our actual results, performance, and achievements to differ materially from those expressed in the forward-looking statements, and one or more of the differences could have a material adverse effect on our ability to operate our business and could have a material adverse effect on our results of operations, financial condition, liquidity, and cash flows: the possible material adverse effects on us if Sears Holdings Corporation’s financial condition were to significantly deteriorate, including if as a consequence Sears Holdings were to choose to seek the protection of the U.S. bankruptcy laws; our ability to offer merchandise and services that our customers want, including those under the KENMORE®, CRAFTSMAN®, and DIEHARD® marks (which marks are owned by subsidiaries of Sears Holdings and are collectively referred to as the “KCD Marks”); the Merchandising Agreement between us and Sears Holdings provides that (1) if a third party that is not an affiliate of Sears Holdings acquires the rights to one or more (but less than all) of the KCD Marks Sears Holdings may terminate our rights to buy merchandise branded with any of the acquired KCD Marks and (2) if a third party that is not an affiliate of Sears Holdings acquires the rights to all of the KCD Marks Sears Holdings may terminate the Merchandising Agreement in its entirety, over which events we have no control; the sale by Sears Holdings and its subsidiaries to other retailers that compete with us of major home appliances and other products branded with one of the KCD Marks; the willingness and ability of Sears Holdings to fulfill its contractual obligations to us; our ability to successfully manage our inventory levels and implement initiatives to improve inventory management and other capabilities; competitive conditions in the retail industry; worldwide economic conditions and business uncertainty, the availability of consumer and commercial credit, changes in consumer confidence, tastes, preferences and spending, and changes in vendor relationships; the fact that our past performance generally, as reflected on our historical financial statements, (Continued on Next Slide)

22 Forward-Looking Statements—Continued may not be indicative of our future performance as a result of, among other things, the consolidation of our Hometown and Outlet businesses into a single business entity, our October 2012 separation from Sears Holdings (the “Separation”), and operating as a standalone business entity; the impact of increased costs due to a decrease in our purchasing power following the Separation, and other losses of benefits (such as a more effective and productive business relationship with Sears Holdings) that were associated with having been wholly owned by Sears Holdings and its subsidiaries prior to the Separation; our continuing reliance on Sears Holdings for most products and services that are important to the successful operation of our business, and our potential need to rely on Sears Holdings for some products and services beyond the expiration, or earlier termination by Sears Holdings, of our agreements with Sears Holdings; the willingness of Sears Holdings’ appliance, lawn and garden, tools, and other vendors to continue to supply to Sears Holdings, on terms (including vendor payment terms for Sears Holdings’ merchandise purchases) that are acceptable to it and to us, merchandise that we would need to purchase from Sears Holdings to ensure continuity of merchandise supplies for our businesses; our ability to obtain the resolution, on commercially reasonable terms, of existing disputes and, when they arise, future disputes with Sears Holdings regarding many of the material terms and conditions of our agreements with Sears Holdings; our ability to establish information, merchandising, logistics, and other systems separate from Sears Holdings that would be necessary to ensure continuity of merchandise supplies for our businesses if vendors were to reduce, or cease, their merchandise sales to Sears Holdings or if Sears Holdings were to reduce, or cease, its merchandise sales to us; our ability to establish a more effective and productive business relationship with Sears Holdings, particularly in light of the existence of pending, and the likelihood of future, disputes with respect to the terms and conditions of our agreements with Sears Holdings; most of our agreements related to the Separation and our continuing relationship with Sears Holdings were negotiated while we were a subsidiary of Sears Holdings, and we may have received different terms from unaffiliated third parties (including with respect to merchandise-vendor and service-provider indemnification and defense for negligence claims and claims arising out of failure to comply with contractual obligations); our reliance on Sears Holdings to provide computer systems to process transactions with our customers (including the point-of-sale system for the stores we operate and the stores that our independent dealers and franchisees operate, which point-of-sale system captures, among other things, credit-card information supplied by our customers) and others, quantify our results of operations, and manage our business (“SHO’s SHC-Supplied Systems”); SHO’s SHC-Supplied Systems could be subject to disruptions and data/security breaches (Kmart, owned by Sears Holdings, announced in October 2014 that its payment-data systems had been breached), and Sears Holdings could be unwilling or unable to indemnify and defend us against third-party claims and other losses resulting from such disruptions and data/security breaches, (Continued on Next Slide)

23 Forward-Looking Statements—Continued (Kmart, owned by Sears Holdings, announced in October 2014 that its payment-data systems had been breached), and Sears Holdings could be unwilling or unable to indemnify and defend us against third-party claims and other losses resulting from such disruptions and data/security breaches, which could have one or more material adverse effects on SHO; limitations and restrictions in our Credit Agreement and related agreements governing our indebtedness and our ability to service our indebtedness; our ability to obtain additional financing on acceptable terms; our dependence on the ability and willingness of our independent dealers and independent franchisees to operate their stores profitably and in a manner consistent with our concepts and standards; our ability to sell profitably online all of our merchandise and services; our dependence on sources outside the U.S. for significant amounts of our merchandise inventories; fixed-asset impairment for long-lived assets; our ability to attract, motivate, and retain key executives and other employees; our ability to maintain effective internal controls as a publicly held company; our ability to realize the benefits that we expect to achieve from the Separation; litigation and regulatory trends challenging various aspects of the franchisor-franchisee relationship in the fast- food industry could expand to challenge or adversely affect our relationships with our independent dealers and independent franchisees; low trading volume of our common stock due to limited liquidity or a lack of analyst coverage; and the impact on our common stock and our overall performance as a result of our principal stockholders’ ability to exert control over us. The foregoing factors should not be understood as exhaustive and should be read in conjunction with the other cautionary statements, including the “Risk Factors,” that are included in our Annual Report on Form 10-K for the fiscal year ended January 31, 2015 and in our other filings with the Securities and Exchange Commission and our other public announcements. While we believe that our forecasts and assumptions are reasonable, we caution that actual results may differ materially. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we projected. Consequently, actual events and results may vary significantly from those included in or contemplated or implied by our forward-looking statements. The forward-looking statements included in this presentation are made only as of its date, and we undertake no obligation to publicly update or review any forward-looking statement made by us or on our behalf, whether as a result of new information, future developments, subsequent events or circumstances, or otherwise, except as required by law.