Attached files

| file | filename |

|---|---|

| EX-10.1 - OPTION AGREEMENT WITH EASTFIELD RESOURCES INC. DATED MAY 18, 2015 - Rise Gold Corp. | ex10-1.htm |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 18, 2015

RISE

RESOURCES INC.

(Exact Name of Registrant as Specified in Charter)

| Nevada | 000-53848 | 30-0692325 | ||

| (State

or other jurisdiction of incorporation) |

(Commission

File Number) |

(IRS Employer Identification No.) |

700

– 510 West Hastings Street

Vancouver, British Columbia

Canada

(Address of principal executive offices)

V6B

1L8

(Zip Code)

Registrant’s telephone number, including area code: (604) 687-7130

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the exchange Act (17 CFR 240.13e -4) |

FORWARD-LOOKING STATEMENTS

This current report on Form 8-K (this “Report”) contains “forward-looking statements” relating to Rise Resources Inc. (“we”, “our”, “us”) which represent our current expectations or beliefs, including statements concerning our operations, performance, financial condition and growth. For this purpose, any statements contained in this Report that are not statements of historical fact are forward-looking statements. Without limiting the generality of the foregoing, words such as “may”, “anticipate”, “intend”, “could”, “estimate”, or “continue” or the negative or other comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, such as credit losses, dependence on management and key personnel, our ability to continue our growth strategy and competition, certain of which are beyond our control. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual outcomes and results could differ materially from those indicated in the forward-looking statements.

INTRODUCTION

On May 18, 2015, we entered into an option agreement (the “Option Agreement”) with Eastfield Resources Ltd., a British Columbia company with its common shares listed for trading on the TSX Venture Exchange under the symbol “ETF” (“Eastfield”), pursuant to which Eastfield granted us the exclusive and irrevocable option to acquire up to a 75% undivided interest in and to certain mineral claims known as the Indata property located in the Omineca Mining Division in British Columbia, Canada (the “Property”). In order to earn the initial 60% interest, we are required to pay Eastfield an aggregate of $350,000 in cash and incur a minimum of $2,000,000 in aggregate exploration expenditures on the Property by April 3, 2019. In order to earn the additional 15% interest, we are required to pay Eastfield $100,000 within 90 days of earning the 60% interest and incur a further $500,000 in aggregate annual exploration expenditures on the Property until such time as we are able to complete a feasibility study on the Property. Upon the completion of a feasibility study, the additional 15% interest will be deemed to have been earned.

Prior to the entry into the Option Agreement, we were a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) since we were not generating revenues, did not own an operating business, had only nominal assets other than cash and cash equivalents, and had no specific plan other than to explore and evaluate potential strategic transactions in multiple industries, including but not limited to mineral properties and technology. Since we were a shell company, and in accordance with the requirements of Item 2.01(f) of Form 8-K, this Report sets forth information that would be required if we were required to file a general form for registration of securities on Form 10 under the Exchange Act with respect to our common stock (which is the only class of our securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act).

| Item 1.01 | Entry into a Material Definitive Agreement |

On May 18, 2015, we entered into the Option Agreement with Eastfield, and on May 25, 2015, we paid Eastfield $20,000 in cash and provided Eastfield with a copy of a completed technical report on the Property in compliance with National Instrument 43-101 of the Canadian Securities Administrators (the “Technical Report”), thereby completing the first milestone required to earn an undivided 60% interest in and to the Property.

At this time, the Property is owned 91.1% by Eastfield and 8.9% by Imperial Metals Corporation, a British Columbia company with its common shares listed for trading on the Toronto Stock Exchange under the symbol “III” (“Imperial”).

| 1 |

Option Agreement

The Option Agreement sets out our obligations in respect of the Property as well as the terms and conditions governing our relationship with Eastfield. In order to earn the initial 60% interest in the Property, we are required to pay Eastfield an aggregate of $350,000 in cash and incur a minimum of $2,000,000 in aggregate exploration expenditures on the Property by April 3, 2019, as follows:

| Completion Date | Cash Payment ($) | Exploration Expenditure ($) | % Interest Earned | |||||||||

| October 3, 2015 | 20,000 plus completion of NI 43-101 technical report on the Property | - | - | |||||||||

| April 3, 2016 | 30,000 | 50,000 | - | |||||||||

| April 3, 2017 | 100,000 | 200,000 | - | |||||||||

| April 3, 2018 | 100,000 | 250,000 | - | |||||||||

| April 3, 2019 | 100,000 | 1,500,000 | 60 | |||||||||

| Total | 350,000 | 2,000,000 | 60 | |||||||||

In order to earn the additional 15% interest in the Property, we are required to pay Eastfield $100,000 within 90 days of earning the 60% interest and incur a further $500,000 in aggregate annual exploration expenditures on the Property until such time as we are able to complete a feasibility study on the Property.

During the term of the Option Agreement, Eastfield is not required to fund any exploration expenditures on the Property.

In addition, the Option Agreement provides that we will act as the operator on the Property and that until we earn a 75% interest in the Property a management committee consisting of one representative from our company and one from Eastfield will be responsible for approving work programs and budgets for all exploration work to be conducted on the Property. Such decisions will be made by a majority vote, with our company having the deciding vote.

As the operator on the Property, we are also obliged to perform a number of functions, including the following:

| ● | comply with the Mines Act (British Columbia), the Mineral Tenure Act (British Columbia), and any other laws dealing with miners and the exploration for and mining of minerals; |

| ● | keep the Property in good standing; |

| ● | use all reasonable endeavours to have our exploration operations recorded for assessment credit against the Property to the fullest possible extent; |

| ● | provide Eastfield with a report summarizing the results of our exploration work on the Property, on at least an annual basis. |

| 2 |

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

The disclosure in Item 1.01 regarding the Option Agreement is incorporated herein by reference in its entirety.

FORM 10 DISCLOSURE

As disclosed elsewhere in this Rreport, on May 18, 2015 we entered into the Option Agreement and on May 25, 2015 we paid Eastfield the sum of $20,000 and provided Eastfield with a copy of the Technical Report, thereby completing the first milestone required to earn a 60% interest in and to the Property. Item 2.01(f) of Form 8-K provides that if we were a shell company, other than a business combination related shell company (as those terms are defined in Rule 12b-2 under the Exchange Act) immediately before the entry into the Option Agreement, then we must disclose the information that would be required if we were filing a general form for registration of securities on Form 10 under the Exchange Act reflecting all classes of our securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon the entry into the Option Agreement.

Since we were a shell company immediately before the entry into the Option Agreement, we are providing the information that we would be required to disclose on Form 10 under the Exchange Act if we were to file such a form.

BUSINESS

Our History

Prior to entering into the Option Agreement, we were a development stage company engaged in exploring and evaluating potential strategic transactions in multiple industries, including but not limited to mineral properties and technology.

We were incorporated in the State of Nevada on February 9, 2007 under the name “Atlantic Resources, Inc.”

On April 11, 2012, we completed a merger with our wholly-owned subsidiary, Patriot Minefinders Inc., and formally assumed the subsidiary’s name by filing Articles of Merger with the Nevada Secretary of State. The subsidiary was incorporated entirely for the purpose of effecting the name change and the merger did not affect our Articles of Incorporation or corporate structure in any other way.

Effective April 19, 2012, in accordance with approval from the Financial Industry Regulatory Authority (“FINRA”), we changed our name from Atlantic Resources Inc. to Patriot Minefinders Inc. In addition, we effected a forward split of our common stock on a 24 new for 1 old basis such that our authorized capital increased from 70,000,000 to 1,680,000,000 shares of common stock and correspondingly, our issued and outstanding common stock increased from 4,700,000 to 112,800,000 shares, all with a par value of $0.001. The name change and forward split became effective in the market at the open of business on April 19, 2012, and effective June 1, 2012, our stock symbol changed from “AARI” to “PROF” to better reflect our new name.

On June 19, 2012 our board of directors approved the cancellation and sale of a portion of 72,000,000 post-split shares of common stock held by our former director, officer and majority shareholder. Effective that day, the shareholder cancelled and returned to treasury 52,000,000 shares of our common stock and sold an aggregate of 3,000,000 shares of our common stock to certain of our current and former directors at a price of $0.0014 per share. The shareholder currently holds the balance of 17,000,000

| 3 |

shares of our common stock (212,500 shares following the completion of the 1 for 80 reverse split described below). Following the cancellation, there were 61,800,000 shares of our common stock issued and outstanding.

On January 14, 2015, we completed a merger with our wholly owned subsidiary, Rise Resources Inc., and formally assumed the subsidiary’s name by filing Articles of Merger with the Nevada Secretary of State (the “Name Change”). The subsidiary was incorporated entirely for the purpose of effecting the Name Change and the merger did not affect our Articles of Incorporation or corporate structure in any other way.

On January 22, 2015, we completed a 1 for 80 reverse split of our common stock and effected a corresponding decrease in our authorized capital by filing a Certificate of Change with the Nevada Secretary of State (the “Reverse Split”). As a result of the Reverse Split, our authorized capital decreased from 1,680,000,000 shares to 21,000,000, and our issued and outstanding common stock decreased from 63,400,000 shares to 792,500, with each fractional share being rounded up to the nearest whole share.

Both the Name Change and Reverse Split became effective in the market at the open of business on February 9, 2015.

On February 11, 2015, we entered into debt conversion agreements with five non-U.S. investors pursuant to which such investors agreed to convert an aggregate of Cnd$400,000 in debt into 20,000,000 shares of our common stock at a price of Cnd$0.02 per share.

On February 16, 2015, the holders of a majority of our issued and outstanding common stock approved an increase in our authorized capital from 21,000,000 shares of common stock, par value $0.001, to 400,000,000 shares of common stock, par value $0.001 (the “Authorized Capital Increase”). The purpose of the Authorized Capital Increase was to reorganize our capital structure in connection with the Reverse Split, which management believed would better position us to attract financing. On April 9, 2015, we formally effected the Authorized Capital Increase by filing a Certificate of Amendment with the Nevada Secretary of State.

On March 31, 2015, we entered into debt conversion agreements with 12 non-U.S. investors and one U.S. investor pursuant to which such investors agreed to convert an aggregate of Cnd$206,675.42 in debt into 10,333,771 shares of our common stock at a price of Cnd$0.02 per share. On April 9, 2015, following the completion of the Authorized Capital Increase, we formally issued these shares.

On April 3, 2015, we entered into a letter of intent with Eastfield that was subsequently replaced by the Option Agreement.

Our common stock is currently eligible for quotation on the OTC markets under the name “Rise Resources Inc.” and the trading symbol “RYES”. As of the date of this Report, we have 38,297,179 shares of common stock issued and outstanding.

Previous Business

On April 18, 2007, we entered into a mineral property staking and purchase agreement with 1698727 Ontario Inc., a private Ontario corporation, whereby we purchased a 100% interest in the Vic Vein mining claim, located approximately 250 kilometers west of Williams Lake, British Columbia, Canada, for $7,500. We no longer own any rights to the claim as it lapsed on October 6, 2010 and we no longer own any rights in relation to the property.

| 4 |

On February 28, 2012, we identified an opportunity with respect to the option to acquire a 50% interest in the La Buena Project from San Marco Resources Inc. (“San Marco”). On May 17, 2012, we entered into an assignment agreement with Skanderbeg Partners Inc. (“Skanderbeg”) to acquire an option to purchase the La Buena Project. We were unable to meet the terms of the option agreement and it was terminated during the year ended July 31, 2013.

We subsequently identified an opportunity with respect to the option to acquire a 75% interest in the KM 66 property from Bearing Resources Ltd. We were unable to meet the terms of the option agreement and it was terminated during the year ended July 31, 2014.

On November 12, 2013, we entered in to a binding letter of intent with Wundr Software Inc. (“Wundr”), pursuant to which we expected to acquire 100% of the issued and outstanding common shares of Wundr. Due to unforeseen circumstances we decided not to proceed with the transaction, and we announced that the letter of intent had expired on January 10, 2014.

On May 23, 2014, we entered into a share exchange agreement (the “Share Exchange Agreement”) with Juliet Press Inc., a private British Columbia, Canada corporation (“Juliet”), and all the shareholders of Juliet (the “Juliet Shareholders”), to acquire 100% of the issued and outstanding common shares of Juliet (the “Juliet Shares”) from the Juliet Shareholders. Pursuant to the Share Exchange Agreement, we expected to issue 14,000,000 shares of our common stock to the Juliet Shareholders in consideration for the acquisition of the Juliet Shares, with the result that Juliet would become our wholly owned subsidiary upon the closing of the transaction. On September 25, 2014 and pursuant to section 13.4(d) of the Share Exchange Agreement, we mutually agreed in writing with Juliet and the Juliet Shareholders to terminate the Share Exchange Agreement. As a result of such termination, the Share Exchange Agreement is of no further force and effect except for certain non-disclosure and confidentiality obligations of the parties.

Glossary

Ag – silver

Allochthonous – referring to a large block of rock which has been moved from its original site of formation

Anomaly – any departure from the norm which may indicate the presence of mineralization in the underlying bedrock

Assay – a chemical test performed on a sample of ores or minerals to determine the amount of valuable metals contained therein

Au – gold

Base metal – any non-precious metal (e.g., copper, lead, zinc, nickel, etc.)

Breccia – a rock composed of broken fragments of minerals that can either be similar to or different from the composition of the fragments

Chalcopyrite – a copper iron sulfide mineral

Cu – copper

Dacite – an igneous, volcanic rock

| 5 |

Diorite – a grey to dark-grey intermediate intrusive igneous rock

Epithermal – deposited from warn waters at shallow depth under conditions in the lower ranges of temperature and pressure

G/T – grams per tonne

Granodiorite – a medium- to coarse-grained intermediate to acid igneous rock

Greenschist – metamorphic rocks that formed under the lowest temperatures and pressures usually produced by regional metamorphism

Igneous rocks – rocks formed by the solidification of molten material from far below the earth’s surface

Intrusive – a body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface

Karst topography – a landscape formed from the dissolution of soluble rocks

Mafic – an adjective describing a silicate mineral or rock that is rich in magnesium and iron

Magma – the molten material deep in the Earth from which rocks are formed

Metamorphic rocks – rocks which have undergone a change in texture or composition as the result of heat and/or pressure

Mineral – a naturally occurring homogeneous substance having definite physical properties and chemical composition and, if formed under favorable conditions, a definite crystal form

Mineralization – a natural aggregation of one or more minerals, which has not been delineated to the extent that sufficient average grade or dimensions can be reasonably estimated or called a “deposit” or “ore”. Further exploration or development expenditures may or may not be warranted by such an occurrence depending on the circumstances.

Ore – a mixture of ore minerals and gangue from which at least one of the metals can be extracted at a profit.

PPB – parts per billion

PPM – parts per million

Pluton – a body of intrusive igneous rock that is crystallized from magma slowly cooling below the surface of the Earth

Porphyry – a variety of igneous rock consisting of large-grained crystals dispersed in a fine-grained matrix or groundmass

Silica – silicon dioxide, of which quartz is a common example

Silicification – the process in which organic matter becomes saturated with silica

| 6 |

Terrane – a fragment of material formed on, or broken off from, one tectonic plate and accreted or sutured to crust lying on another tectonic plate

Tuff – a type of rock consisting of consolidated volcanic ash ejected from vents during a volcanic eruption

Ultramafic – igneous and meta-igneous rocks with very low silica content

Vein – A fissure, fault or crack in a rock filled by minerals that have travelled upwards from some deep source

Volcanic rocks – Igneous rocks formed from magma that has flowed out or has been violently ejected from a volcano

Zone – an area of distinct mineralization

The Property

Location and Means of Access

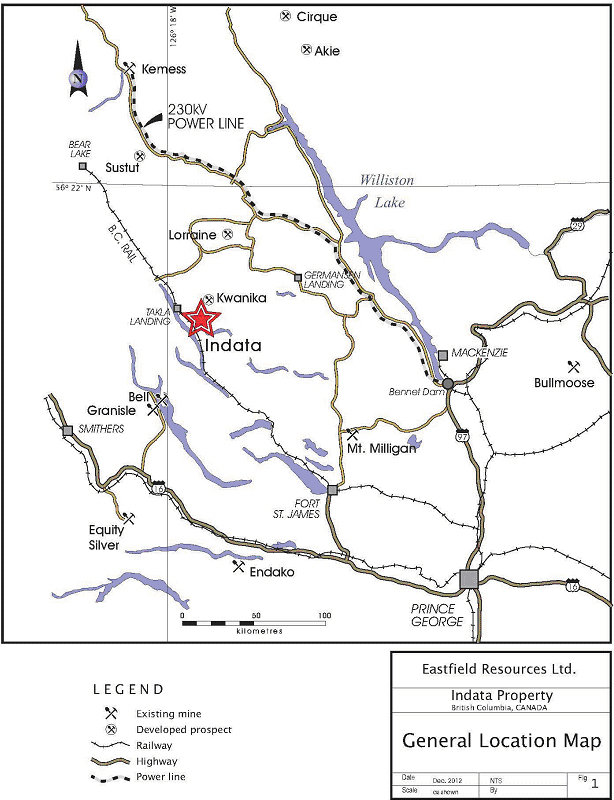

The Property is situated in north-central British Columbia on the east side of Albert Lake, two kilometres west of the north end of Indata Lake. It is approximately 130 kilometres northwest of the community of Fort St James and 230 kilometres northwest of the city of Prince George. The Property is located in the Omineca Mining Division of British Columbia.

The Property is roughly centered on UTM coordinates 351900E / 6141200N (datum NAD 83 Zone 10) and 55 23‘N / 125 19, West latitude / longitude on NTS sheets 093N034 and 035. The Property location is shown in Figure 1 below.

| 7 |

Figure 1: General Location Map

Access to the Property is from Fort St. James via the Leo Creek Forestry Road to near Tchentlo Lake and then on a road built by Eastfield to the northern part of the Property. This road was built to British

| 8 |

Columbia Ministry of Forests’ logging road standards and provides good access for trucks and heavy machinery such as drill rigs and bulldozers. Driving time from Fort St. James to the Property is approximately two hours. Smaller haul and tote roads have been constructed from the main road to other areas of the Property. Away from the roads, access is on foot only except for a few areas where helicopter landing sites have been prepared.

All of the land within the Property is held by the Crown, and there are no permanent structures in the area.

Description of the Property

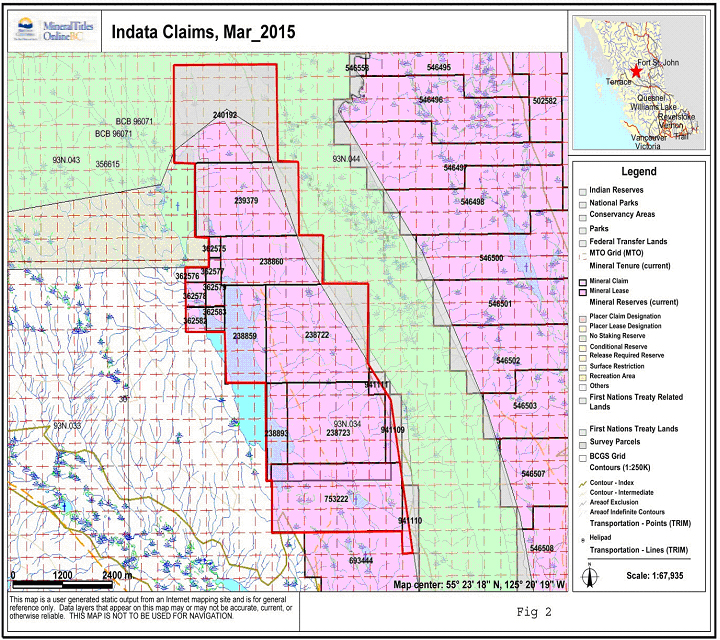

The Property consists of 18 mineral claims totaling 3,170.03 hectares and is situated in a complex geological setting adjacent to the Pinchi Fault, a major structure separating the Cache Creek and Quesnel Terranes. All of the claims that comprise the Property are in good standing according to Mineral Titles Online (British Columbia’s internet-based electronic mineral titles administration system). Importantly, a holder of mineral claims in British Columbia is not entitled to surface rights.

The characteristics of the 18 claims are as follows:

| Claim Name | Record No. | Area (Hectares) | Expiry Date | |||

| Indata 2 | 239379 | 375 | 18-Oct-19 | |||

| Indata 3 | 240192 | 500 | 18-Oct-19 | |||

| Schnapps 1 | 238722 | 500 | 18-Oct-19 | |||

| Schnapps 2 | 238723 | 500 | 14-Nov-19 | |||

| Schnapps 3 | 238859 | 200 | 20-Oct-19 | |||

| Schnapps 4 | 238860 | 250 | 18-Oct-19 | |||

| Schnapps 5 | 238893 | 100 | 18-Oct-19 | |||

| Schnapps 6 | 362575 | 25 | 31-Dec-18 | |||

| IN-6 | 362576 | 25 | 31-Dec-18 | |||

| IN-7 | 362577 | 25 | 31-Dec-18 | |||

| IN-8 | 362578 | 25 | 31-Dec-18 | |||

| IN-9 | 362579 | 25 | 31-Dec-18 | |||

| IN-10 | 362582 | 25 | 31-Dec-18 | |||

| IN-11 | 362583 | 25 | 20-Dec-18 | |||

| Limestone | 753222 | 441.33 | 20-Apr-18 | |||

| Triangle A | 941109 | 55.15 | 16-Jan-18 | |||

| Triangle B | 941110 | 55.17 | 16-Jan-18 | |||

| Triangle C | 941111 | 18.38 | 16-Jan-18 | |||

| Total | 3,170.03 |

| 9 |

The Nation Lakes Provincial Park abuts the Property on its north and east sides and partially overlaps the claims. However, the claims were staked prior to the creation of the park and the entirety of the claims area remains valid. On June 29, 2000, the Order in Council of the Government of British Columbia creating the Nation Lakes Park (published on April 9, 2003) specifically excluded the Schnapps #1 (238722), Schnapps #2 (238723), Schnapps #4 (238860), Indata #2 (239379) and Indata #3 (240192) mineral claims from the park, as is currently stipulated in the Protected Areas of British Columbia Act, Schedule D. The park boundaries are included in Figure 2.

Figure 2: Map of Indata Claims

In British Columbia, a “Notice of Work” filed with the Department of Energy and Mines is generally required in order for exploration work to be carried out, though exceptions can be made for small programs with limited surface disturbance. There is a current Notice of Work (#100038) filed on the Property which allows for the installation of “Grids, Camps and Helicopter Pads”, “Access Construction,

| 10 |

Modification or Reclamation”, and seven holes of “Surface Drilling”. As a condition of granting this Notice of Work, an Archeological Review was requested and conducted. This Notice of Work is valid until December 15, 2015.

History

The initial claims on the Property were staked by Imperial in 1983, and in 1984, Imperial began to explore the Property. Following initial soil sampling and the staking of additional claims, a four-hole diamond drilling program was completed to explore copper mineralization observed in outcrop near the northeast side of Albert Lake (the Lake Zone). This program resulted in the discovery of low grade chalcopyrite mineralization including 9.3 metres of 0.20% Cu in one drill hole. Hole depths were relatively shallow; to a maximum of 76.8 metres.

On March 3, 1986, Imperial sold the claims to Eastfield pursuant to a sale agreement that also covered the sale of other of Imperial properties, for a total sum of $1, subject to a number of terms that included the right of Imperial to acquire up to a 30% interest in the Property at a later date.

In 1986, Eastfield undertook a program of grid establishment, soil sampling, hand trenching and geophysical surveying. This was followed by diamond drilling in 1987, 1988 and 1989 and trenching with a bulldozer-mounted backhoe in 1989. The drilling programs resulted in the discovery of polymetallic quartz and quartz-carbonate veins some 500 metres east of the copper mineralization. These veins contained elevated precious metal values (commonly in the range of several hundred ppb gold to 6 g/t with the most significant intercept being 47 g/t gold over 4 metres). The veins generally strike north and dip to the east, and are commonly enveloped by a zone of silicification in volcanic rocks and a thickening-downwards zone of talc-magnesite alteration in ultramafic rocks.

On February 25, 1988, Imperial acquired a 30% interest in the Property from Eastfield and the two parties entered into a joint venture. Imperial has not participated in exploration funding in recent years and its interest in the joint venture has therefore been diluted. As of the date of this Report, it stands at 8.9%, while Eastfield retains the remaining 91.1%.

In 1988 a heavy mineral sampling program was conducted on streams on the claims. Most results were unimpressive, even those that drained the area of the precious metal bearing polymetallic vein mineralization, except for an east draining creek which returned a value of 3360 ppb Au in the southeast corner of the Property.

In 1995, after construction of an access road through the southern part of the Property, built to standards for log haulage, a trenching program was completed near the northeast corner of Albert Lake, over the copper zone previously defined by soil sampling and the 1985 drilling. One of these trenches returned analyses which averaged 0.36% copper over a length of 75 metres.

In 1996, Clear Creek Resources Limited (“Clear Creek”) carried out a small diamond drilling program in the copper zone northeast of Albert Lake. Results confirmed the existence of copper mineralization identified in the 1985 drilling and encountered mineralization over significantly larger intervals: up to 97.5 metres of 0.12% Cu in one drill hole, and 21.0 metres of 0.23% Cu in another drill hole. This program tested only a very small part of the area covered by anomalous soil copper geochemistry.

Clear Creek returned with another drill program in the copper zone area in 1998 which confirmed and exceeded the 1996 drilling results and also identified an altered granodiorite stock with copper mineralization adjacent to the eastern edge of Albert Lake. A new zone of copper mineralization was also discovered in a fan of three holes: 98-I-4, 5 and 9, located 350 metres southeast of the previous drill

| 11 |

intercepts, halfway to the zone of polymetallic veins. Road construction exposed silicified volcanic rocks in a road cut in the southern part of the existing grid where grab samples showed the presence of copper sulfides along with enriched gold values, demonstrating for the first time an association of copper and gold on the Property.

In 2000, a helicopter borne very low frequency (VLF) and magnetic survey was flown across the Property. A total of 595 east-west line kilometres were flown by Aerodat Ltd. The data was later reprocessed by Furgo Airborne Surveys Corp. No new exploration targets were derived from this work.

A program of linecutting, soil sampling and induced polarization surveying was completed in 2003, funded by Castillian Resources Corp., with 11.2 line kilometres of induced polarization survey completed and 16 line kilometers of soil grid expansions established, and 304 soil samples collected. The bulk of this work was completed in the northwestern side of the currently explored area. New anomalies consisting of anomalous arsenic and/or antimony soil values associated with a moderate induced polarization chargeability response were defined.

In 2005, two diamond drill holes were completed with a total meterage of 262 metres in a program funded by Aberdeen International Inc. The first hole of the 2005 program, hole 2005-I-1, was designed to test below hole 98-I-4 which returned 145.4 metres grading 0.20% copper including 24.1 metres grading 0.37%. Unfortunately, significant drilling difficulties were encountered and this hole was abandoned at a depth of 99.1 metres, approximately 50 metres short of the top of the target. The rest of the 2005 drilling was located approximately 1400 metres to the south where hole 2005-I-03 encountered narrow intervals of anomalous copper mineralization in a dioritic intrusive. Another hole designated 2005-I-02, located adjacent to 2005-I-03, was abandoned without successfully setting casing.

Soil sampling was conducted in 2007 to extend the grids to the west and north in the area north of the Lake Zone. A zone of anomalous gold, arsenic, antimony and bismuth in soils was located in the northwest corner of the new sampling in an area underlain by recrystallized limestone which is in fault contact with volcanic rocks to the south (the “Northwest Soil Anomaly”). A short excavator trenching program targeting 2003 induced polarization (“IP”) and soil anomalies discovered a new polymetallic quartz vein well to the west of those previously known. The 10 centimetre vein returned assay values of 17.16 and 7.84 g/t Au. This work was funded by Redzone Resources Ltd.

Max Resource Corp. optioned the property in 2008 and funded a five hole 1056.2 metre diamond drill program, focusing mostly on the polymetallic vein zone. Highlights included hole 08-I-2, which returned 8.20g/t Au over 0.3 metres and 08-I-3 which returned 209g/t Ag over 0.5 metres.

In 2010, the Property was optioned to Oceanside Capital Corporation (“Oceanside”). During that year a program of ground geophysics and soil sampling was conducted. Four north-south lines totaling 5.4 kilometres were emplaced and an IP and magnetic survey was run along these. One of the lines ran along the east side of the north end of Albert Lake across the area of the previously known copper in soil anomaly and where previous porphyry copper mineralization encountered in the 2005 drilling (the Lake Zone). The other three lines tested the area of the strong gold, arsenic, antimony and bismuth in soil anomaly discovered in 2007 in the northwest part of the property (the Northwest Soil Anomaly).

A strong chargeability high was returned from the Lake Zone area, coincidental with the copper in soil anomaly. Chargeability highs were also discovered in the northwest and southeast areas of the other three lines in the Northwest Soil Anomaly, roughly flanking a prominent ridge of recrystallized limestone.

Also in 2010, a total of 471 soil samples were collected. The four IP lines were sampled and three other widely spaced reconnaissance type east-west lines were emplaced and sampled in the southern part of the

| 12 |

Property to the south of the existing grids. The multi-element “epithermal-type” soil anomaly in the northwest part of the Property was confirmed and spotty gold and copper anomalies were discovered on the southern lines.

The 2011 program was made up of an IP/magnetics survey along the three southern 2010 soil lines, which totaled 8.1 line kilometres. Two north-south trending chargeability highs were encountered near the eastern end of the two northern lines (L100N and L300S). A strong copper in soil anomaly coincides with the western chargeability high on L100N. The southernmost line (L1850S) is 1550 metres south of the other two lines and has three prominent chargeability highs.

In 2012, Oceanside and Eastfield constructed 3.2 kilometers of drill road access along with the construction of six drill sites. Eighteen rock samples were collected during this work, one of which returned an analysis of 0.78% copper in dacitic volcanic float from a new road in the southern part of the Property, in the area of the 2010-2011 soil sampling and geophysical work.

The 2013 program was focused on the southern part of the property in the area where the copper bearing float was discovered in 2012. Minor prospecting and rock sampling was conducted and additional mineralized float and rubble was found in the area. Three 1000 metre east-west soil lines were emplaced in the same area with samples collected at 50 metre intervals, to a total of 62 samples. A number of localized copper anomalies were discovered. As well, 17 silt samples were taken from a number of areas of the Property. A single high gold value was returned from a sample in the southeast corner of the Property. Subsequent to this work, Oceanside terminated its option on the Property in October 2013.

Geologic Setting

Regional Geology

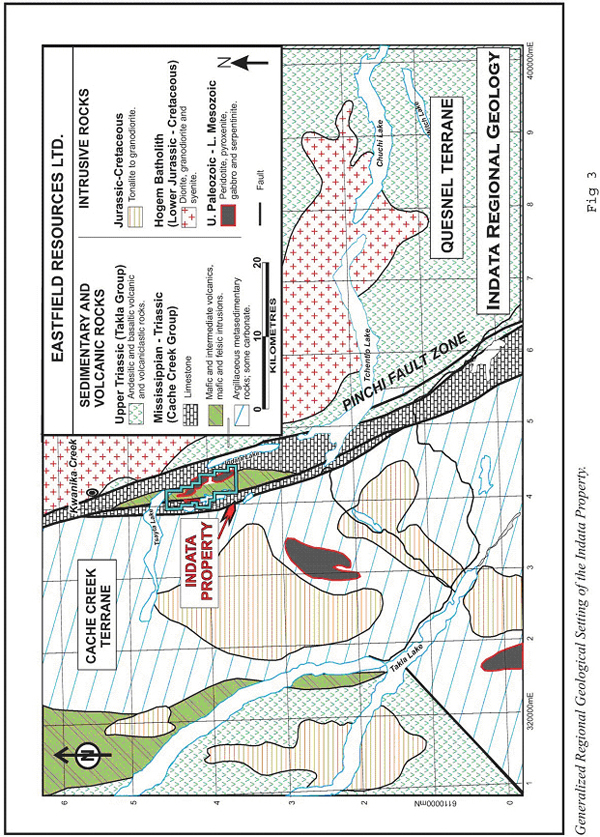

The Property lies west of and along splay faults related to the contact of two major terranes of the Canadian Cordillera: the Quesnel and Cache Creek Terranes. The contact between these terranes is marked by the Pinchi Fault Zone, a high angle reverse fault of regional extent, and associated splay faults where Cache Creek strata to the west have been thrust over Takla strata to the east. The fault zone is up to 10 kilometres in width. The regional geology of the Property area is shown in Figure 3.

| 13 |

Figure 3: Indata Regional Geology

The Quesnel Terrane consists of mafic to intermediate volcanic rocks of the Upper Triassic – Lower Jurassic Takla Group intruded by the Hogem Batholith, which is composed of intrusive phases which

| 14 |

range in composition from granite to monzonite to quartz syenite, which range in age from Lower Jurassic to Cretaceous.

The Cache Creek Terrane in the region comprises mainly argillaceous metasedimentary rocks intruded by diorite to granodiorite plutons (which may be pre-Triassic or Lower Cretaceous in age) and by small ultramafic stocks. Some of these latter intrusions may be of ophiolitic origin.

A northwest-striking fault bounded block situated between the two terranes (within the Pinchi Fault Zone) underlies the Property. This block is underlain largely by limestone within which a sliver of mafic and intermediate volcanic rocks is preserved. Both the limestone and volcanic rocks are considered here to be part of the Cache Creek Group but the evidence for this is equivocal as similar strata occur within the Takla Group elsewhere in the region. As well, the volcanic rocks in this block have been subjected to greenschist facies metamorphism, similar to what is normally found in Cache Creek rocks, whereas generally the metamorphic grade of the Takla Group volcanic rocks is rarely higher than zeolite facies. But the area’s proximity to such a major fault may locally have raised the metamorphic grade as has been demonstrated further to south along the Pinchi fault at Pinchi Lake where metamorphic grade increases to blueschist grade at the fault. It is also possible that the major fault movements along the Pinchi Lake Fault have juxtaposed Cache Creek limestone against Takla volcanic rocks within this fault block.

The dominant structural style of the Takla Group is that of extensional faulting, mainly to the northwest. In general Takla Group rocks are tilted but not folded. In contrast, strata of the Cache Creek Group have been folded and metamorphosed to lower to middle greenschist facies and a penetrative deformational fabric has been preserved in argillaceous rocks. Extensional faults are also common within the Cache Creek Group and probably represent the effects of post-collision uplift.

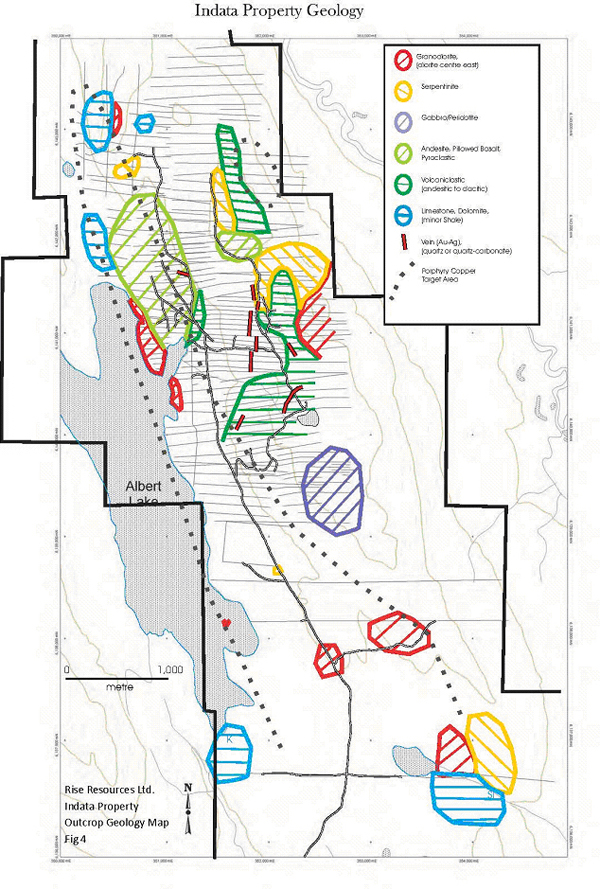

Property Geology

There are no comprehensive geological maps of the Property. A generalized map showing outcrop locations of the various lithologies is shown in Figure 4.

| 15 |

Figure 4: Property Geology

| 16 |

Lithologies

The Property is underlain by two main supracrustal assemblages: limestone with minor intercalated shale; and andesitic volcanic rocks that were deposited under marine conditions. As discussed above, it is uncertain whether these rocks belong to the Cache Creek or Quesnel Terranes.

Limestone crops out as prominent hills and bluffs in the northern, western and southern parts of the area. Although generally massive, in places bedding is defined by thin shaley partings and by intraformational limestone conglomerate. Breccias formed by carbonate dissolution are displayed within karst topography in the southwestern part of the Property at the southern end of Albert Lake.

Volcanic rocks underlying the Property are of andesitic composition and can be subdivided into two broad units. In the western part of the Property, volcanic rocks consist of pillow lava, pillow breccia, coarse tuff breccia and fine-grained crystal lithic tuff. The dominant mafic mineral in these rocks is amphibole, now represented by tremolite/actinolite but was probably hornblende prior to alteration. The second volcanic unit consists of massive to poorly bedded volcanic tuff with variable amounts of amphibole phenocrysts. Although commonly poorly bedded, bedding planes and fining upwards sequences can be recognized in places.

Intrusive rocks recognized on the Property range in composition from ultramafic to granite and underlie the central part of the Property area. Hornblende diorite occurs as a pluton which extends along part of the eastern side of the central part of the property and as dykes. The bulk of this pluton has a fine to medium-grained hypidiomorphic granular texture although both marginal phases of the pluton and the dykes are porphyritic. A small part of the pluton is of quartz diorite composition although primary quartz is generally absent. While diorite dykes are common within the volcanic rocks of the property, no diorite intrusions have been observed within the limestone unit, suggesting that the diorite and volcanic rocks are of similar age and are either older than the massive limestone or that the limestone is allochthonous with respect to the volcanics and was emplaced adjacent to the volcanic strata after volcanism and plutonism had ceased.

Intruding both volcanic rocks and diorite are ultramafic bodies, serpentinite to varying degrees but which preserve textures suggesting that the original rocks were peridotite and pyroxenite. Cross fibre chrysotile veins and veinlets occur throughout these bodies. To the south of Radio Lake (see Figure 4) a differentiated and zoned ultramafic-mafic intrusion occurs, consisting of a coarse-grained clinopyroxenite core, surrounded by peridotite and, in turn, enclosed by medium to coarse-grained hornblende-clinopyroxene gabbro.

The youngest intrusive rocks of the Property consist of medium to coarse-grained grey and reddish grey biotite quartz monzonite and granite. Whereas all other intrusive rocks in the area have been emplaced only into volcanic strata, this unit also intrudes limestone of the Cache Creek Group.

A large part of the Property is covered by glacial and fluvioglacial deposits. Extensive areas of glacial derived clay in low-lying areas complicate geochemical soil results.

Structure and Metamorphism

The area covered by the Property can be divided into two structural domains: (i) the area underlain by carbonate rocks which is characterized by concentric folds and the development of a penetrative fabric in finer grained clastic interbeds; and (ii) that area underlain by volcanic strata which has undergone brittle deformation only. Contacts between carbonate and volcanic strata are obscured by young cover but are inferred to be northwesterly-striking faults. Drilling and geological mapping in the central part of the Property has indicated the presence of a number of westerly-striking faults which show normal displacements of up to a few tens of metres.

| 17 |

Carbonate rocks have generally been recrystallized with the common development of sparry calcite while fine grained clastic interbeds display a greenschist facies mineral assemblage. The assemblage actinolite/tremolite-chlorite-epidote within the matrix of volcanic rocks also suggests the attainment of greenschist grade of regional metamorphism in these strata.

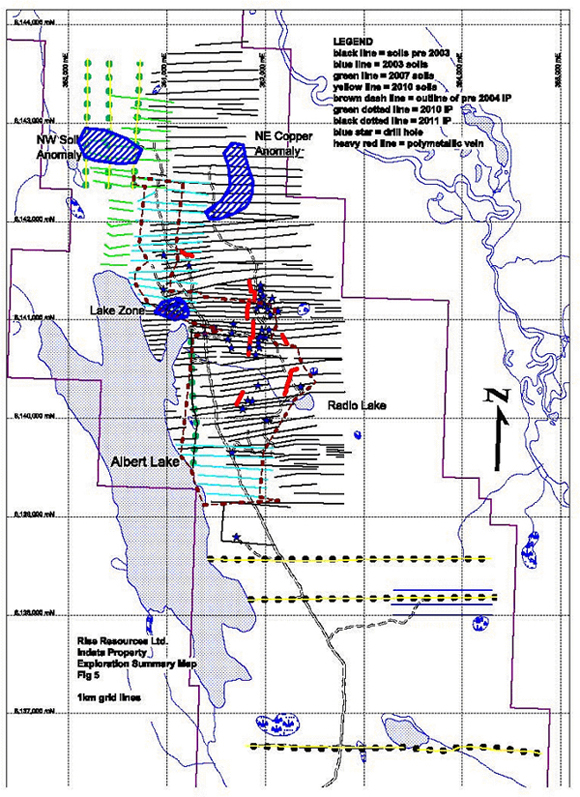

Mineralization

Exploration on the Property has resulted in the discovery of a number of metallic mineral occurrences which can be divided into two main types: porphyry copper mineralization and quartz-carbonate polymetallic vein mineralization. The location of these zones of mineralization is shown in Figure 5.

| 18 |

Figure 5: Exploration Summary Map

The currently known area of porphyry copper mineralization occurs on the east side of the north end of Albert Lake (Lake Zone). Here a strong and consistent >250 ppm Cu in soil anomaly often coincides

| 19 |

with chargeability anomalies from the induced polarization surveys. This soil anomaly is approximately 2,000 metres north to south and averages 400 to 600 metres east to west and sometimes attains soil copper values in excess of 7,000 ppm. Porphyry copper type mineralization is known at the north end of this feature in outcrops, trenches and drill core occurring as disseminated and fracture controlled pyrite-chalcopyrite-pyrrhotite in volcanic and granodiorite rock units. The best drill results from this area have been 145.4 metres averaging 0.20% copper, including 24.1 metres of 0.37% Cu in drillhole 98-I-4. Minor work has been conducted in the southern part of the soil anomaly/chargeability high where exploration work in 2012 and 2013 has discovered similar mineralized rubble 3,800 metres to the south indicating that the area of porphyry copper mineralization may extend across a considerable area.

Polymetallic veins have been recognized in the central part of the Property to the east of the porphyry copper mineralization (see Figures 5 and 6) within andesitic volcanic rocks and serpentinized ultramafics. The veins generally occupy a northerly-striking fault zone dipping shallowly to the east. Within ultramafic rocks, the veins are accompanied by zones of intense carbonate and talc alteration zones which range in width from a few metres to over 50 metres in deeper and more easterly parts of the fault. Proximal to the veins in volcanic rocks, especially adjacent to ultramafic contacts, alteration is dominated by silicification and the formation of quartz-carbonate veinlets but silicification is not common within ultramafic rocks.

To date, five separate mineralized polymetallic veins have been located on the Property. Four of these are in the central part of the Property on top of the ridge between Indata and Albert Lakes, and all have general north-south orientations. The longest of these has been traced in drilling for over 450 metres. The fifth vein occurs to the northwest, halfway towards the Lake Zone porphyry copper mineralization, where a 10 centimetre vein was discovered in 2007. This vein has an east-west orientation.

Polymetallic veins often exhibit a subtle banded appearance with bands of quartz dominant material interrupted with sulphide rich sections where the sulphide content can exceed 50%. Sulphides are dominantly pyrrhotite, arsenopyrite and stibnite with lesser pyrite and minor chalcopyrite. Veins average approximately 1.5 metres in width but vary between 0.5 and 5.6 metres. Trace amounts of gersdorffite (a nickel arsenide), bismuthinite (a bismuth telluride), pentlandite (a nickel sulphide) and free gold have been documented in petrographic samples taken from high-grade intercepts. A review of 24 diamond drill intercepts grading at least 1.0 g/t gold indicates that the average vein intercept is 1.54 metres wide with an average grade of 8.41 g/t gold and 52.43 g/t silver. It must, however, be pointed out that one very high grade intercept in hole 88-11 biases this number such that if it is removed from the calculation then the remaining 23 drill intercepts have an average thickness of 1.43 metres with an average grade of 3.06 g/t gold and 59.40 g/t silver. These drill intercepts are generally close to true thicknesses (g/t have been converted from ppb).

Antimony, arsenic and gold are the best soil geochemical pathfinders for the polymetallic veins. The high sulfide content of the veins also makes them a good target for closely spaced induced polarization surveys.

The relationship between the porphyry copper mineralization and the polymetallic veins has yet to be established although it is possible that the polymetallic vein mineralization represents an outer zone to a central, copper-dominated part of the same hydrothermal system. The host volcanic rocks of the porphyry copper mineralization exhibit a mineral assemblage consistent with both propylitic hydrothermal alteration and greenschist faces regional metamorphism and could be a result of either one of, or both processes. Because of poor outcrop and the paucity of drilling within the copper zone and in areas away from the polymetallic veins, a regional hydrothermal zonation has not been adequately interpreted within the Property. Alternatively the veins and porphyry copper style mineralization may be

| 20 |

unrelated and are present together as coincidence, centered on the strong structural provenance of the Pinchi Fault Zone.

Deposit Type

The Property is host to mineralization of two deposit types: polymetallic precious metal veins and porphyry copper. Porphyry copper mineralization is known on the Property from the Lake Zone on the east side of Albert Lake, some 500 metres west of the area of the polymetallic veins. Drill results here include 145.4 metres averaging 0.20% Cu, which includes a higher grade interval of 24.1 metres of 0.37% Cu. There are a number of other porphyry copper occurrences in the area. The Central Zone of Serengeti Resources’ Kwanika Project, located 14 kilometres north of the Property, contains an indicated resource of 244 million tonnes averaging 0.23% Cu, 0.21 g/t Au and 0.69 g/t Ag. (Roscoe Postle and Associates NI 43-101 Technical Report for Kwanika Property Preliminary Economic Assessment, 2013, Report filed on SEDAR March 4, 2013).

“Homestake” style gold mineralization, similar to the Property vein occurrences, occurs at the Snowbird deposit located near Fort St. James to the south of the Indata region, and at Mt. Sir Sidney Williams to the north of the Property. Arsenopyrite-stibnite-chalcopyrite-pyrite veins with enriched precious metals occur at these occurrences at or near the contact of mafic and ultramafic rocks. Drill results from polymetallic veins on the Property have reached as high as 4.0 metres of 46.20g/t Au and 2.0g/t Ag in hole 88-I-11, and 3.2 metres of 0.01 g/t Au and 354.1 g/t Ag in hole 89-I-6.

Other mineralization styles are known from elsewhere in the region. Epithermal mercury mineralization in carbonate rocks occurs at the former producing Bralorne-Takla Mercury Mine, located 26 kilometres north of the Property, and Pinchi Mine, located 100 kilometres to the southeast. The Lustdust skarn deposit is located 1.5 kilometres west of the Bralorne-Takla Mine, and has returned drill results including 0.80% copper and 0.67g/t gold over 59 metres and 2.19% copper and 24.04 g/t gold over 15 metres.

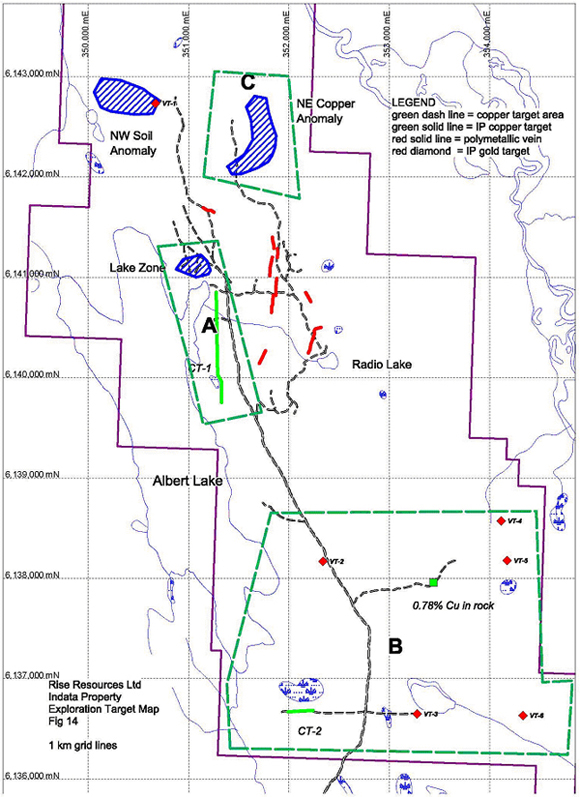

Plan of Operations

We plan to explore the under-explored southern part of the Property (Area B of Figure 6), where recent exploration has discovered indications of porphyry mineralization. These indicators include coincidental copper in soil-chargeability anomalies, float rock samples with up to 0.78% Cu, and the existence of intrusive rocks in outcrop.

A two-phase program is proposed: an initial phase of surface work to cover the area with soil sampling and an IP-magnetics survey, along with prospecting, mapping and rock sampling. This phase is budgeted at Cnd$270,000. The surface program should be followed up by diamond drilling of the best targets. A 2,000 metre program, costing Cnd$270,000 is proposed for this, bringing the total budget to Cnd$540,000.

| 21 |

Figure 6: Exploration Target Map

| 22 |

Intellectual Property

We claim common law trademark rights in our corporate name. We do not hold any registered copyright, trademark, patent or other intellectual property right.

Employees

We do not currently have any full-time or part-time employees. Our officers and directors provide services to us on an as-needed basis, as we plan to rely on their efforts, as well as those of a number of independent consultants, to manage our operations for the foreseeable future.

Government Regulations

We plan to engage in mineral exploration and development activities and will accordingly be exposed to environmental risks associated with mineral exploration activity. Pursuant to the Option Agreement, we are now the operator of the Property.

Our exploration and development activities will be subject to extensive federal, provincial and local laws, regulations and permits governing protection of the environment. Among other things, our operations must comply with authorizations issued under the Mines Act (British Columbia) and the Environmental Management Act (British Columbia).

Our plan is to conduct our operations in a way that safeguards public health and the environment. We believe that our operations comply with applicable environmental laws and regulations in all material respects. As of the date of this Report, the only environmental permit or authorization we require to conduct our proposed work program is the “Notice of Work” filed with the British Columbia Department of Energy and Mines; however, we expect that regular monitoring and compliance with periodic reporting requirements will be integral components of any such permits or authorizations that we apply for or receive in the future.

The costs associated with implementing and complying with environmental requirements can be substantial and possible future legislation and regulations could cause us to incur additional operating expenses, capital expenditures, restrictions and delays in developing or conducting operations on the Property, the extent of which cannot be predicted with any certainty.

To the best of our knowledge, there are no existing environmental liabilities on the Property.

RISK FACTORS

An investment in our common stock involves a high degree of risk. Investors should carefully consider the risks described below, together with all of the other information included in this Report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer and they may lose all or part of their investment. See “Forward Looking Statements” above for a discussion of forward-looking statements and the significance of such statements in the context of this Report.

Risks Related to Our Business

We have a history of operating losses and there can be no assurance that we can achieve or maintain profitability.

We have a history of operating losses and may not achieve or sustain profitability. We cannot guarantee that we will become profitable. Even if we achieve profitability, given the competitive and evolving

| 23 |

nature of the industry in which we operate, we may be unable to sustain or increase profitability and our failure to do so could adversely affect our business, including our ability to raise additional funds.

Because our auditors have issued a going concern opinion, there is substantial uncertainty that we will be able to continue our operations.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue to operate over the next 12 months. Our financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern. As such, if we are unable to obtain sufficient financing to execute our business plan we may be required to cease our operations.

The Property may not contain mineral reserves that are economically recoverable and we cannot accurately predict the effect of certain factors affecting such a determination.

We have not determined if the Property contains mineral reserves that are economically recoverable. Exploration for mineral reserves involves a high degree of risk, which even a combination of careful evaluation, experience and knowledge, may not eliminate. Few properties which are explored are ultimately developed into producing properties. Regardless, we plans to complete the first and second phases of our exploration program, which, pursuant to the Option Agreement, we are required to do in order to earn an initial 60% interest in the Property.

Estimates of mineral reserves and any potential determination as to whether a mineral deposit will be commercially viable can be affected by such factors as deposit size; grade; unusual or unexpected geological formations and metallurgy; proximity to infrastructure; metal prices which are highly cyclical; environmental factors; unforeseen technical difficulties; work interruptions; and government regulations, including regulations relating to permitting, prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted.

The long term profitability of our operations will be in part directly related to the cost and success of our exploration and development program. Substantial expenditures are required to establish reserves through drilling, to develop processes to extract the ore and, in the case of new properties, to develop the extraction and processing facilities and infrastructure at any site chosen for extraction. Although substantial benefits may be derived from the discovery of a major deposit, we cannot provide any assurance that any such deposit will be commercially viable or that we will be able to obtain the funds required for development on a timely basis.

If the Property is ultimately placed into production, we will encounter hazards and risks that could result in significant legal liability.

In the event that we are ultimately able to commence commercial production on the Property, our operations will be subject to all of the hazards and risks normally encountered in the exploration, development and production of mineral deposits, including unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, the mine and other producing facilities, damage to life or property, environmental damage and possible legal liability. Although we plan to take appropriate precautions to mitigate these hazards and risks by, among other things, obtaining liability insurance in an amount considered to be adequate by management, their nature is such that the liabilities might exceed policy limits, they might not be insurable, or we may not elect to insure against them due to high premium costs or other reasons, which could have a material adverse effect upon our financial condition and results of operations.

| 24 |

We face significant competition in the mineral resource industry that presents an ongoing threat to the success of our business.

The mining industry is intensely competitive in all of its phases, and we will be forced to compete with many companies that possess greater financial resources and technical facilities than we do. Significant competition exists for the limited number of mineral acquisition opportunities available in our sphere of operations. As a result of this competition, our ability to acquire additional attractive mining properties on terms we consider acceptable may be adversely affected.

Fluctuating mineral prices may negatively affect our ability to secure financing or our results of operations.

Our future revenues, if any, will likely be derived from the extraction and sale of base and precious metals. The price of those commodities has fluctuated widely, particularly in recent years, and is affected by numerous factors beyond our control including economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global and regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and therefore the economic viability of our business, could negatively affect our ability to secure financing or our results of operations.

We are subject to government laws and regulations particular to our operations with which we may be unable to comply.

We may not be able to comply with all current and future government environmental laws and regulations that apply to our business. Our operations are subject to all government regulations normally incident to conducting business: occupational safety and health acts, workmen’s compensation statutes, unemployment insurance legislation, income tax and social security laws and regulations, and most importantly, environmental laws and regulations. In addition, we are subject to laws and regulations regarding the development of mineral properties in the Province of British Columbia. We are also subject to governmental laws and regulations applicable to small public companies and their capital formation efforts.

We are engaged in mineral exploration and development and are accordingly exposed to environmental risks associated with such activities. We are currently in the exploration stage and have not determined whether significant site reclamation costs will be required on the Property in the future, which we will likely be responsible for as well. Although we will make every effort to comply with all applicable laws and regulations, we cannot provide any assurance that we will be able to deal with evolving environmental attitudes and regulations, nor can we predict the effect of any future changes to environmental regulations on our proposed business activities. We only plan to record liabilities for site reclamation when reasonably determinable and when such costs can be reliably quantified. Other costs of compliance with environmental regulations may also be burdensome.

Our failure to comply with material regulatory requirements could have an adverse effect on our ability to conduct our business. The expenditure of substantial sums on environmental matters would have a materially negative effect on our ability to implement our business plan and could require us to cease operations.

Our business depends substantially on the continuing efforts of our two officers, and our business may be severely disrupted if we lose their services.

| 25 |

Our future success heavily depends on the continued service of our two officers. Although we plan to increase the size of our Board of Directors, appoint additional officers and engage various consultants as our business grows, if they are unable or unwilling to continue to work for us in their present capacities, we may have to spend a considerable amount of time and resources searching, recruiting and integrating one or more replacements into our operations, which would severely disrupt our business. This may also adversely affect our ability to execute our business strategy.

Our new officer’s limited experience managing a publicly traded company in the United States may divert his attention from operations and harm our business.

Cale Thomas, our Chief Financial Officer, Treasurer and director, has no experience managing a publicly traded company in the United States and complying with federal securities laws, including compliance with recently adopted disclosure requirements on a timely basis. He, together with Fred Tejada, our President, Chief Executive Officer, Secretary and director, will be required to design and implement appropriate programs and policies in responding to increased legal, regulatory compliance and reporting requirements, and any failure to do so could lead to the imposition of fines and penalties and harm our business.

We may be unable to attract and retain qualified, experienced, highly skilled personnel, which could adversely affect the implementation of our business plan.

Our success depends to a significant degree upon our ability to attract, retain and motivate skilled and qualified personnel. As we become a more mature company in the future, we may find recruiting and retention efforts more challenging. If we do not succeed in attracting, hiring and integrating such personnel, or retaining and motivating existing personnel, we may be unable to grow effectively. The loss of any key employee, including members of our management team, and our inability to attract highly skilled personnel with sufficient experience in our industry could harm our business.

Since our officers and directors are located in Canada, investors may be limited in their ability to enforce U.S. civil actions against them for damages to the value of our common stock.

Our officers and directors are residents of Canada. Consequently, U.S. investors may experience difficulty affecting service of process on our officers and directors within the United States or enforcing a civil judgment of a U.S. court in Canada if a Canadian court determines that the U.S. court in which the judgment was obtained did not have jurisdiction in the matter. There is also substantial doubt whether an original action predicated solely upon civil liability may successfully be brought in Canada against our officers and directors. As a result, investors may not be able to recover damages as compensation for a decline in the value of their investment.

We may indemnify our officers and directors against liability to us and our security holders, and such indemnification could increase our operating costs.

Our Bylaws allow us to indemnify our officers and directors against claims associated with carrying out the duties of their offices. Our Bylaws also allow us to reimburse them for the costs of certain legal defenses. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our officers, directors or control persons, we have been advised by the SEC that such indemnification is against public policy and is therefore unenforceable.

Since our officers and directors are aware that they may be indemnified for carrying out the duties of their offices, they may be less motivated to meet the standards required by law to properly carry out such

| 26 |

duties, which could increase our operating costs. Further, if any of our officers and directors files a claim against us for indemnification, the associated expenses could also increase our operating costs.

Failure to comply with the Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

As a Nevada corporation, we are subject to the Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Some foreign companies, including some that may compete with us, may not be subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices may occur from time-to-time in the countries in which we conduct our business. However, our employees or other agents may engage in conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

Current global financial and economic conditions could adversely impact our operations and financial condition.

Current global financial and economic conditions, while improving, remain volatile. Many industries, including the mineral resource industry, are impacted by these market conditions. Some of the key impacts of the current financial market turmoil include contraction in credit markets resulting in a widening of credit risk; devaluations and high volatility in global equity, commodity, foreign exchange and precious metal markets; and a lack of market liquidity. Such factors may impact our ability to obtain financing on favourable terms or at all. Additionally, global economic conditions may cause a long term decrease in asset values. If such global volatility and market turmoil continue, our operations and financial condition could be adversely impacted.

Risks Related to Ownership of Our Common Stock

Because there is a limited public trading market for our common stock, investors may not be able to resell their shares.

There is currently a limited public trading market for our common stock. Therefore, there is no central place, such as stock exchange or electronic trading system, to resell any shares of our common stock. If investors wish to resell their shares, they will have to locate a buyer and negotiate their own sale. As a result, they may be unable to sell their shares or may be forced to sell them at a loss.

We cannot assure investors that there will be a market in the future for our common stock. The trading of securities on in the over-the-counter markets is often sporadic and investors may have difficulty buying and selling our shares or obtaining market quotations for them, which may have a negative effect on the market price of our common stock. Investors may not be able to sell shares at their purchase price or at any price at all.

A company controlled by one of our directors has voting control over a substantial portion of our common stock, and he may take actions that conflict with the interests of our other stockholders.

Scharfe Holdings Inc., a company over which Bradley Scharfe, our director, has sole voting and investment power, controls approximately 35.4% of the votes eligible to be cast by our stockholders in the election of directors and generally. As a result, Mr. Scharfe may have the ability to control certain

| 27 |

matters requiring the approval of our stockholders, including the election of directors and the approval of mergers and other significant corporate transactions.

The sale of securities by us in any equity or debt financing could result in dilution to our existing stockholders and have a material adverse effect on our earnings.

Any sale of common stock by us in a future private placement offering could result in dilution to the existing stockholders as a direct result of our issuance of additional shares of our capital stock. In addition, our business strategy may include expansion through the acquisition of additional property interests or through business combinations with entities operating in our industry. In order to do so, or to finance the cost of our operations, we may issue additional equity securities that could dilute our stockholders’ stock ownership. We may also pursue debt financing, if and when available, and this could negatively impact our earnings and results of operations.

We are subject to penny stock regulations and restrictions and investors may have difficulty selling shares of our common stock.

Our common stock is subject to the provisions of Section 15(g) and Rule 15g-9 of the Exchange Act, commonly referred to as the “penny stock rules”. Section 15(g) sets forth certain requirements for transactions in penny stock, and Rule 15g-9(d) incorporates the definition of “penny stock” that is found in Rule 3a51-1 of the Exchange Act. The SEC generally defines a penny stock to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. We are subject to the SEC’s penny stock rules.

Since our common stock is deemed to be penny stock, trading in the shares of our common stock is subject to additional sales practice requirements on broker-dealers who sell penny stock to persons other than established customers and accredited investors. “Accredited investors” are generally persons with assets in excess of $1,000,000 (excluding the value of such person’s primary residence) or annual income exceeding $200,000 or $300,000 together with their spouse. For transactions covered by these rules, broker-dealers must make a special suitability determination for the purchase of such security and must have the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the rules require the delivery, prior to the first transaction, of a risk disclosure document relating to the penny stock market. A broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information for the penny stocks held in an account and information to the limited market in penny stocks. Consequently, these rules may restrict the ability of broker-dealer to trade and/or maintain a market in our common stock and may affect the ability of our stockholders to sell their shares of common stock.

There can be no assurance that our common stock will qualify for exemption from the penny stock rules. In any event, even if our common stock was exempt from the penny stock rules, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock if the SEC finds that such a restriction would be in the public interest.

We do not expect to pay dividends for the foreseeable future.

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any future earnings in the development and growth of our business. Therefore, our stockholders will not receive any funds unless they sell their common stock, and stockholders may be unable to sell their shares on favorable terms or at all.

| 28 |

Investors may face significant restrictions on the resale of their shares due to state “blue sky” laws.

Each state has its own securities laws, commonly known as “blue sky” laws, which (1) limit sales of securities to a state’s residents unless the securities are registered in that state or qualify for an exemption from registration, and (2) govern the reporting requirements for broker-dealers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or it must be exempt from registration. The applicable broker-dealer must also be registered in that state.

We do not know whether our securities will be registered or exempt from registration under the laws of any state. A determination regarding registration will be made by those broker-dealers, if any, who agree to serve as market makers for our common stock. There may be significant state blue sky law restrictions on the ability of investors to sell, and on purchasers to buy, our securities. Investors should therefore consider the resale market for our common stock to be limited, as they may be unable to resell their shares without the significant expense of state registration or qualification.

FINANCIAL INFORMATION

Selected Financial Data

Not required.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with the information set forth in our audited financial statements for the period ended July 31, 2014 and our interim unaudited financial statements for the six months ended January 31, 2015.

Plan of Operations

As at January 31, 2014, we had a cash balance of $1,833, compared to a cash balance of $72 as of July 31, 2014. Our plan of operations for the next 12 months is to carry out a two-phase exploration program on the Property at a total cost of approximately Cnd$540,000, as follows:

Phase One: Surface Exploration

| Description | Amount (Cnd$) | |||

| Field supervision / mapping / sampling | 40,800 | |||

| Line cutting (including personnel costs, room & board and vehicle expenses) | 86,400 | |||

| Soil sampling (including personnel costs, room & board and vehicle expenses) | 9,180 | |||

| Sample analysis | 20,000 | |||

| IP-magnetics survey | 68,000 | |||

| Geophysical contractor costs (including room & board and vehicle expenses) | 24,800 | |||

| Reporting and drafting | 10,000 | |||

| Contingency | 10,820 | |||

| Total | 270,000 | |||

| 29 |

Phase Two: Drilling

| Description | Amount (Cnd$) | |||

| Drilling costs | 160,000 | |||

| Site preparation | 10,000 | |||

| Sample analysis | 10,000 | |||

| Geologist / supervisor expenses | 30,000 | |||

| Field crew expenses (including room & board, vehicle expenses and equipment expenses) | 50,000 | |||

| Data compilation / report preparation | 10,000 | |||

| Total | 270,000 | |||

In addition, we anticipate spending approximately $210,000 on general operating expenses, including fees payable in connection with our filing obligations as a reporting issuer, as follows:

| Description | Amount (Cnd$) | |||

| Consulting fees | 120,000 | |||

| Professional fees | 42,000 | |||

| Filing and regulatory expenses | 5,500 | |||

| Rent | 12,000 | |||

| Marketing and website development expenses | 9,000 | |||

| General and administrative expenses | 21,500 | |||

| Total | 210,000 | |||

We do not currently have sufficient funds to carry out the two-phase exploration program or cover our anticipated general operating expenses for the year, so we will require additional funding. We anticipate that additional funding will be in the form of equity financing from the sale of our common stock or from director loans. We do not have any arrangements in place for any future equity financing or loans, and if we are not successful in raising additional financing, we anticipate that we will not be able to proceed with our business plan.

| 30 |

We anticipate incurring operating losses for the foreseeable future. We base this expectation, in part, on the fact that very few mineral claims in the exploration stage ultimately develop into producing, profitable mines. Our future financial results are also uncertain due to a number of factors, some of which are outside our control. These factors include the following:

| ● | our ability to raise additional funding; |

| ● | the market price for any minerals that may be discovered on the Property; |

| ● | the results of our proposed exploration program on the Property. |

We have not attained profitable operations and are dependent upon obtaining financing to pursue our proposed exploration activities. For these reasons our auditors believe that there is substantial doubt that we will be able to continue as a going concern.

Results of Operations

We have not generated any revenue since inception and are dependent upon obtaining financing to pursue our business activities. Our activities have been financed from the proceeds of share subscriptions and loans from related parties. For these reasons, our auditors believe that there is substantial doubt that we will be able to continue as a going concern.

For the Three Months Ended January 31, 2015 and 2014

Our operating expenses for the three month periods ended January 31, 2015 and 2014 and the changes between those periods for the respective items are summarized as follows:

| For the three months ended January 31, 2015 ($) | For the three months ended January 31, 2014 ($) | |||||||

| Consulting fees | 12,813 | 13,866 | ||||||

| Filing and regulatory fees | 7,252 | 2,979 | ||||||

| Foreign exchange | (72,871 | ) | (42,223 | ) | ||||

| Gain on settlement of payables | (1,998 | ) | Nil | |||||

| General and administrative expenses | 4,734 | 7,983 | ||||||

| Professional fees | 7,340 | 26,813 | ||||||

| Promotion and shareholder communication expenses | - | 133 | ||||||

| Net income (loss) | 42,730 | (8,551 | ) | |||||

In general, our expenses between the two periods were relatively consistent except for our professional fees, which decreased during the three months ended January 31, 2015 from the same period in the prior year largely because our level of activity in searching for a potential strategic transaction also decreased.

| 31 |

For the Six Months Ended January 31, 2015 and 2014

Our operating expenses for the six month periods ended January 31, 2015 and 2014 and the changes between those periods for the respective items are summarized as follows:

| For the six months ended January 31, 2015 ($) | For the six months ended January 31, 2014 ($) | |||||||

| Consulting fees | 47,917 | 41,264 | ||||||

| Filing and regulatory fees | 11,398 | 4,010 | ||||||

| Foreign exchange | (95,097 | ) | (42,462 | ) | ||||