Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BRADY CORP | form8-kearningsreleasex430.htm |

| EX-99.1 - THIRD QUARTER FISCAL 2015 PRESS RELEASE - BRADY CORP | exhibit991-financials43015.htm |

May 21, 2015 Brady Corporation F’15 Q3 Financial Results

2 Forward-Looking Statements In this presentation, statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company's future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations. The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project” or “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady's control, that could cause actual results to differ materially from those expressed or implied by such forward- looking statements. For Brady, uncertainties arise from: implementation of the healthcare strategy; implementation of the Workplace Safety strategy; future competition; risks associated with restructuring plans; future financial performance of major markets Brady serves, which include, without limitation, telecommunications, hard disk drive, manufacturing, electrical, construction, laboratory, education, governmental, public utility, computer, healthcare and transportation; technology changes and potential security violations to the Company's information technology system; fluctuations in currency rates versus the U.S. dollar; risks associated with international operations; difficulties associated with exports; Brady's ability to develop and successfully market new products; risks associated with identifying, completing, and integrating acquisitions; changes in the supply of, or price for, parts and components; increased price pressure from suppliers and customers; Brady's ability to retain significant contracts and customers; risk associated with loss of key talent; risks associated with divestitures and businesses held for sale; risks associated with obtaining governmental approvals and maintaining regulatory compliance; risk associated with product liability claims; environmental, health and safety compliance costs and liabilities; potential write-offs of Brady's substantial intangible assets; risks associated with our ownership structure; unforeseen tax consequences; Brady's ability to maintain compliance with its debt covenants; increase in our level of debt; and numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady's U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2014. These uncertainties may cause Brady's actual future results to be materially different than those expressed in its forward-looking statements. Brady does not undertake to update its forward-looking statements except as required by law.

3 Summary Comments Significant 3rd Quarter Events: • Organic sales growth of 1.7%. • Facility consolidation physical moves completed, but we need to improve our customer service and operational efficiency. F’15 Priorities: • Facility Consolidations – Complete this process to optimize customer service and operational performance. • Operational Excellence – Deliver the best possible end-to-end customer experience. • Emerging Technologies – Continued investment in emerging technologies. • Innovation Development Process – Develop and deliver the highest-value new products in a timely and cost-effective manner. • Focused Market Sales Expansion – Increase sales in selected vertical markets. • One Digital Platform – Drive towards a single platform to sell more products to more customers.

4 Q3 F’15 Financial Summary • Sales down 6.3% to $290.2M vs. $309.6M in Q3 of F’14. – Organic sales growth of 1.7% while foreign currency decreased sales by 8.0%. • Gross profit margin of 48.6% in Q3 of F’15, down from 50.1% in Q3 of F’14. • SG&A expense of $103.0M (35.5% of sales) in Q3 of F’15 vs. $116.7M (37.7% of sales) in Q3 of F’14. • Earnings from continuing operations of $22.2M in Q3 of F’15 vs. $24.3M in Q3 of F’14. – Non-GAAP Net Earnings from Continuing Operations* of $17.6M vs. $22.3M in Q3 of F’14. • Earnings from continuing operations per Class A Diluted Nonvoting Share of $0.33 in Q3 of F’15 vs. $0.39 in Q3 of F’14. – Non-GAAP Net Earnings from Continuing Operations per Class A Diluted Nonvoting Share* of $0.34 in Q3 of F’15 vs. $0.43 in Q3 of F’14. * Net Earnings from Continuing Operations, Excluding Certain Items and Net Earnings from Continuing Operations Per Class A Diluted Nonvoting Share Excluding Certain Items, are non-GAAP measures. See appendix.

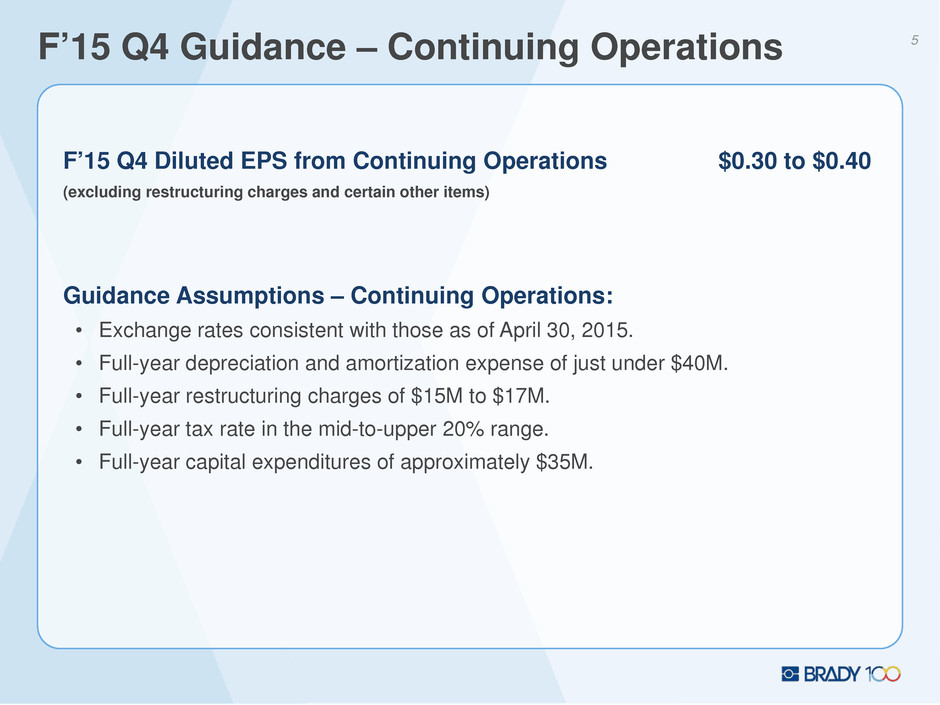

5 F’15 Q4 Guidance – Continuing Operations F’15 Q4 Diluted EPS from Continuing Operations $0.30 to $0.40 (excluding restructuring charges and certain other items) Guidance Assumptions – Continuing Operations: • Exchange rates consistent with those as of April 30, 2015. • Full-year depreciation and amortization expense of just under $40M. • Full-year restructuring charges of $15M to $17M. • Full-year tax rate in the mid-to-upper 20% range. • Full-year capital expenditures of approximately $35M.

6 Sales Overview • 1.7% organic sales growth: • ID Solutions – Organic sales growth of 3.0%. • Workplace Safety – Organic sales decline of 1.1%. • 8.0% decrease due to currency translation. Q3 F’15 SALES: • Organic growth continues in the IDS platform while there was a slight decline in the WPS platform. • The strengthening of the U.S. dollar is having a significant impact on reported sales. Q3 F’15 SALES COMMENTARY: $200 $225 $250 $275 $300 $325 Q4 F'12 1.9% Q1 F'13 (0.8%) Q2 F'13 (1.8%) Q3 F'13 (4.8%) Q4 F'13 (2.1%) Q1 F'14 (2.1%) Q2 F'14 (1.1%) Q3 F'14 2.5% Q4 F'14 1.1% Q1 F'15 2.4% Q2 F'15 1.4% Q3 F'15 1.7% Organic Sales Growth SALES (millions of USD)

Gross Profit Margin & SG&A Expense 7 • GPM of 48.6% in Q3 of F’15 compared to 50.1% in Q3 of F’14. • Facilities consolidated, but operating inefficiencies continue. • GPM impacted by organic sales decline in WPS. GROSS PROFIT MARGIN: • SG&A expense was down $13.7M to $103.0M in Q3 of F’15 compared to $116.7M in Q3 of F’14. • SG&A expense was down vs. the prior year due to a benefit from the curtailment of a retiree medical plan, foreign currency exchange, lower amortization expense and overall cost containment in SG&A expenses. SG&A EXPENSE: $148 $150 $142 $159 $158 $158 $143 $155 $154 $150 $138 $141 55% 55% 52% 53% 51% 51% 49% 50% 49% 48% 49% 49% 25% 30% 35% 40% 45% 50% 55% 60% $100 $150 $200 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 GROSS PROFIT & GPM% (millions of USD) $100 $99 $110 $112 $107 $113 $111 $117 $111 $109 $108 $103 37% 36% 40% 37% 34% 37% 38% 38% 35% 35% 38% 35% 20% 25% 30% 35% 40% 45% $50 $100 $150 $200 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 SG&A and SG&A% as of SALES (millions of USD)

8 Net Earnings & EPS From Continuing Operations – Non-GAAP* * Non-GAAP Net Earnings from Continuing Operations and Non-GAAP Net Earnings from Continuing Operations Per Class A Diluted Nonvoting Share are non-GAAP measures. See appendix. • Q3 F’15 Non-GAAP net earnings from continuing operations* were $17.6M compared to $22.3M in Q3 of F’14. • Decrease in earnings driven by reduced gross profit margins in IDS, lack of organic growth in WPS, and foreign currency translation. Q3 F’15 – Non-GAAP Net Earnings* • Q3 F’15 Non-GAAP diluted EPS from continuing operations* was $0.34 compared to $0.43 in Q3 of F’14. Q3 F’15 – Non-GAAP EPS* $0.57 $0.51 $0.38 $0.55 $0.55 $0.43 $0.25 $0.43 $0.41 $0.36 $0.29 $0.34 $0.00 $0.20 $0.40 $0.60 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 NET EARNINGS FROM CONTINUING OPERATIONS PER CLASS A DILUTED NONVOTING SHARE, EXCLUDING CERTAIN ITEMS* $30 $26 $20 $29 $29 $23 $13 $22 $21 $18 $15 $18 $0 $10 $20 $30 $40 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 NET EARNINGS FROM CONTINUING OPERATIONS, EXCLUDING CERTAIN ITEMS* (millions of USD)

9 Cash Generation • Cash flow from operating activities of $28.8M in Q3 of F’15. • Returned $10.3M to our shareholders in the form of dividends. CASH FLOWS IN Q3 OF F’15:

Net Debt & EBITDA 10 0.1 1.4 1.3 1.2 1.2 1.3 1.5 1.2 1.2 1.2 1.2 0.0x 0.5x 1.0x 1.5x Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 NET DEBT / TTM EBITDA* • April 30, 2015 Cash = $100.5M, Debt = $268.4M (net debt = $167.9M), and TTM EBITDA (continuing operations) = $144.4M. • Net Debt/EBITDA* = 1.2:1. • Balance sheet continues to provide flexibility for future cash uses. STRONG BALANCE SHEET: * EBITDA is a non-GAAP measure. See appendix for the reconciliation of net income to EBITDA. $10 $297 $261 $222 $210 $209 $221 $181 $174 $184 $168 $0 $50 $100 $150 $200 $250 $300 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 NET DEBT (millions of USD)

Q3 F’15 vs. Q3 F’14 PERFORMANCE (millions of USD) 11 Identification Solutions • Revenues down 2.7%: • Organic = +3.0% • Fx = -(5.7)% • Organic sales growth strongest in Safety & Facility ID and Product ID categories. • Segment profit continues to be impacted by customer service challenges and operational inefficiencies. Q3 F’15 SUMMARY: • Expect low single-digit organic sales growth for the remainder of F’15. • Expect segment profit as a % of sales to approximate 20% in fiscal 2015. OUTLOOK: Q3 F’15 Q3 F’14 Change Sales $ 200.8 $ 206.4 - 2.7 % Segment Profit 41.6 44.3 - 6.1% Segment Profit % 20.7% 21.5% - 0.8 pts 23% 24% 19% 22% 20% 21% 19% 21% 0% 5% 10% 15% 20% 25% $0 $50 $100 $150 $200 $250 $300 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 SALES & SEGMENT PROFIT % (millions of USD)

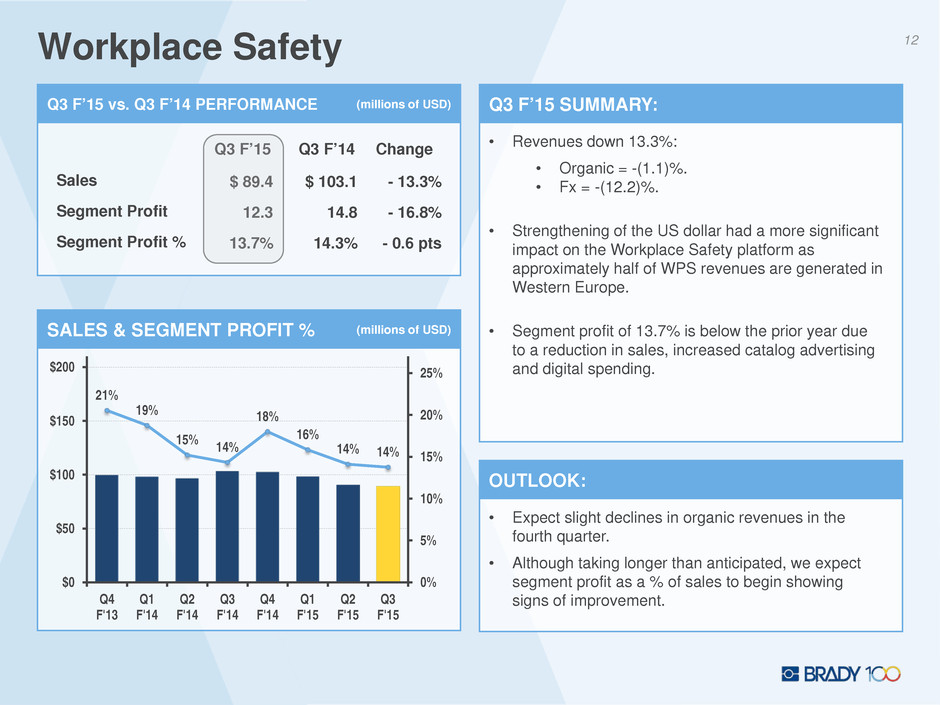

Q3 F’15 vs. Q3 F’14 PERFORMANCE (millions of USD) 12 Workplace Safety • Revenues down 13.3%: • Organic = -(1.1)%. • Fx = -(12.2)%. • Strengthening of the US dollar had a more significant impact on the Workplace Safety platform as approximately half of WPS revenues are generated in Western Europe. • Segment profit of 13.7% is below the prior year due to a reduction in sales, increased catalog advertising and digital spending. Q3 F’15 SUMMARY: • Expect slight declines in organic revenues in the fourth quarter. • Although taking longer than anticipated, we expect segment profit as a % of sales to begin showing signs of improvement. OUTLOOK: Q3 F’15 Q3 F’14 Change Sales $ 89.4 $ 103.1 - 13.3% Segment Profit 12.3 14.8 - 16.8% Segment Profit % 13.7% 14.3% - 0.6 pts 21% 19% 15% 14% 18% 16% 14% 14% 0% 5% 10% 15% 20% 25% $0 $50 $100 $150 $200 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 SALES & SEGMENT PROFIT % (millions of USD)

13 Investor Relations Brady Contact: Ann Thornton Investor Relations 414-438-6887 Ann_Thornton@Bradycorp.com See our web site at www.investor.bradycorp.com

Appendix 14

COMPARABLE INCOME STATEMENTS (millions of USD) 15 Comparable Income Statements

(‘000s of USD) 16 Debt Structure

Brady is presenting EBITDA because it is used by many of our investors and lenders, and is presented as a convenience to them. EBITDA represents net earnings before interest expense, income taxes, depreciation, amortization and impairment charges. EBITDA is not a calculation based on generally accepted accounting principles ("GAAP"). The amounts included in the EBITDA calculation, however, are derived from amounts included in the Consolidated Statements of Earnings data. EBITDA should not be considered as an alternative to net earnings or operating income as an indicator of the Company's operating performance, or as an alternative to net cash provided by operating activities as a measure of liquidity. The EBITDA measure presented may not always be comparable to similarly titled measures reported by other companies due to differences in the components of the calculation. EBITDA - Total Company (‘000s of USD) 17 EBITDA Reconciliation – Total Company

Brady is presenting EBITDA from Continuing Operations because it is used by many of our investors and lenders, and is presented as a convenience to them. EBITDA from Continuing Operations represents earnings from continuing operations before interest expense, income taxes, depreciation, amortization and impairment charges. EBITDA from Continuing Operations is not a calculation based on generally accepted accounting principles ("GAAP"). The amounts included in the EBITDA from Continuing Operations calculation, however, are derived from amounts included in the Consolidated Statements of Earnings data. EBITDA from Continuing Operations should not be considered as an alternative to net earnings or operating income as an indicator of the Company's operating performance, or as an alternative to net cash provided by operating activities as a measure of liquidity. The EBITDA from Continuing Operations measure presented may not always be comparable to similarly titled measures reported by other companies due to differences in the components of the calculation. EBITDA - Continuing Operations (‘000s of USD) 18 EBITDA Reconciliation – Continuing Operations

Brady is presenting the Non-GAAP measure "Net Earnings from Continuing Operations Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this Non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our sustainable results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of Net Earnings from Continuing Operations to Net Earnings from Continuing Operations Excluding Certain Items: Reconciliation of Non-GAAP Net Earnings from Continuing Operations (‘000s of USD) 19 Non-GAAP Earnings from Continuing Operations

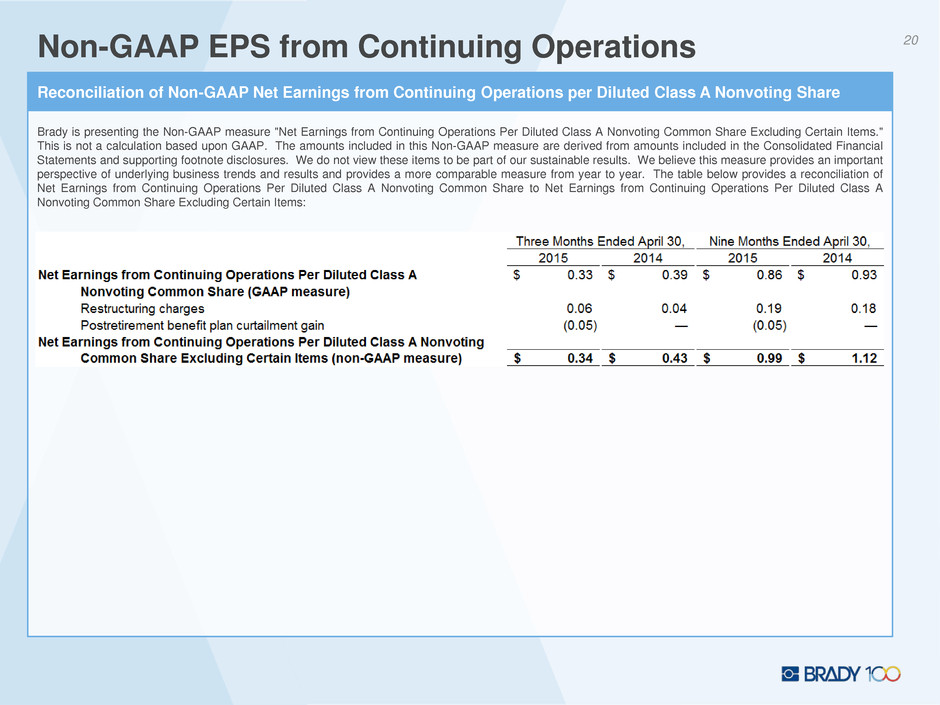

Brady is presenting the Non-GAAP measure "Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this Non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our sustainable results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share to Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share Excluding Certain Items: Reconciliation of Non-GAAP Net Earnings from Continuing Operations per Diluted Class A Nonvoting Share 20 Non-GAAP EPS from Continuing Operations