Attached files

EXHIBIT 10.3

ROYALTY AGREEMENT

THIS ROYALTY AGREEMENT (this “Royalty Agreement”), made and entered into as of February 5, 2014 (the “Execution Date”), is by and between WESTPORT ENERGY LLC, a Delaware limited liability company (the “Westport”) and YA GLOBAL INVESTMENTS, L.P. (the “Holder”). Collectively, Westport and the Holder are referred to as the “Parties.”

WHEREAS, YA Global Investments, L.P. (“YA Global”) and Westport have previously executed that certain Securities Purchase Agreement dated as February 5, 2014 (the “SPA”) pursuant to which Westport issued and sold that certain secured convertible debenture in the original principal amount of $1,080,000 (the “Convertible Debentures”) wherein;

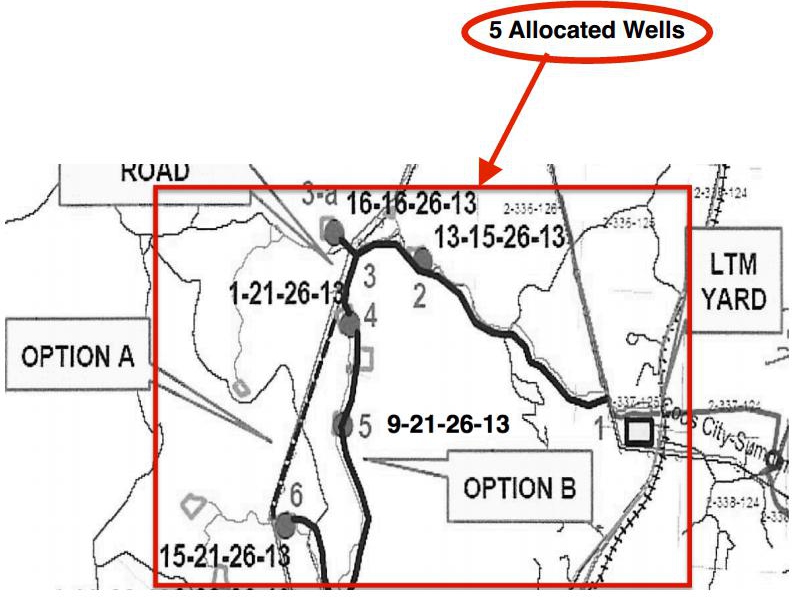

WHEREAS, pursuant to the terms of the SPA and in consideration of YA Global purchasing the Convertible Debenture, YA Global received a transferable right to receive royalty payments with respect to 25% of net gas sales resulting from certain Westport wells identified in Appendix B attached hereto (the “Allocated Wells”); and

WHEREAS, YA Global’s rights to the net gas sales shall be set forth in and controlled by this Royalty Agreement;

NOW THEREFORE, the Parties agree as follows:

| 1. | DEFINITIONS |

| 1.1 | Definitions of capitalized terms used in this Royalty Agreement shall have the meanings given in Appendix A or elsewhere in the Royalty Agreement. |

| 2. | ROYALTY PAYMENTS |

| 2.1 | Royalties. Westport shall pay the Holder royalties on Net Sales from each of the Allocated Wells during the Royalty Term according to the following rates: |

| (a) | Allocated Wells: 25% of Net Sales |

| 2.3 | Manner of Payment. Royalty payments due under this Section 2 are due 30 days after the end of each Accounting Period and shall be paid in United States dollars. |

| 3. | REPORTS AND PAYMENTS |

| 3.1 | Recordkeeping. Westport shall, and shall obligate its Affiliates to, keep full and accurate records (prepared in accordance with United States Generally Accepted Accounting Principles consistently applied) of Westport’s or its Affiliates’ gas sales and such other matters as may affect the determination of any amount payable to the Holder under this Royalty Agreement, in sufficient detail to reasonably enable the Holder or their representatives to determine any amounts payable to the Holder under this Royalty Agreement. Such records shall be kept at Westport’s or its Affiliates’ principal place of business and, with all necessary supporting data, books and ledgers, shall, during all reasonable times for the 2 years following the end of the Accounting Period to which each shall pertain, be open for inspection at reasonable times during normal business hours (and upon at least 30 days prior written notice) no more than one time per calendar year by an independent audit firm selected by the Holder (reasonably acceptable to Westport) for the purpose of verifying the accuracy of any payment report required under this Royalty Agreement or any amount payable hereunder. The results of each inspection shall be binding on the Holder and Westport absent mathematical error. The Holder shall bear all costs associated with such inspections. |

| 3.2 | Reports. With each quarterly payment, Recipient shall deliver to the Holder true and accurate report, giving such particulars of the business conducted by Westport or its Affiliates during the preceding four (4) Accounting Periods under this Royalty Agreement as are reasonably pertinent to an accounting for any royalty or other payments hereunder, along with the amount of royalties payable for such Accounting Period. If no payments are due, it shall be so reported. Such quarterly reports shall include, but not be limited to, the following information: |

| (a) | Quantity of gas sold by Westport or its Affiliates during the applicable Accounting Period; |

| (b) | The monetary amount of such sales; |

| (c) | Actual gross sales and Net Sales for the Allocated Wells; and |

| (d) | Total royalties payable to the Holder including a calculation thereof. |

| 2 |

| 4. | EFFECTIVE DATE AND EXPIRATION |

| 4.1 | Generally. This Royalty Agreement shall become effective on the Execution Date (the “Effective Date”) and shall expire on the expiration of the Royalty Term. |

| 4.2 | Post-Expiration Obligations. Upon the expiration of this Royalty Agreement, Westport shall submit all reports required by Section 3 and pay the Holder all royalties due or accrued on gas sales from the Allocated Wells up to and including the date of expiration. |

| 4.3 | Survival. Upon the expiration of this Royalty Agreement, nothing herein shall be construed to release either party from any obligation that matured prior to the date of such expiration and Section 5 shall survive any such expiration. |

| 5. | MISCELLANEOUS |

| 5.1 | Entire Agreement. This Royalty Agreement constitutes the entire agreement among the Parties and supersedes any prior understandings, agreements, or representations by or among the Parties, written or oral, that may have related in any way to the subject matter hereof. The appendices identified in this Royalty Agreement are incorporated herein by reference and made a part hereof. |

| 5.2 | Amendments and Waivers. No amendment or waiver of any provision of this Royalty Agreement shall be valid unless the same shall be in writing and signed by each Party. No waiver by any Party of any default, misrepresentation or breach of warranty or covenant hereunder, whether intentional or not, shall be deemed to extend to any prior or subsequent default, misrepresentation or breach of warranty or covenant hereunder or affect in any way any rights arising by virtue of any prior or subsequent such occurrence. |

| 5.3 | Succession and Assignment. This Royalty Agreement and all of the provisions hereof shall be binding upon, inure to the benefit of, and be enforceable by, the Parties and their respective successors and permitted assigns. Westport may not assign this Royalty Agreement, or any of its rights or obligations hereunder, without the prior written consent of the Holder. The Holder may assign this Royalty Agreement in whole or in part, and any of its rights or obligations hereunder, without the consent of Westport. |

| 5.4 | No Third-Party Beneficiaries. This Royalty Agreement shall not confer any rights or remedies upon any party other than the Parties and their respective successors and permitted assigns. |

| 5.5 | Governing Law. This Royalty Agreement shall be governed by and construed in accordance with the domestic Laws of the State of New Jersey, without giving effect to any choice of law or conflict of law provision or rule (whether of the State of New Jersey or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of New Jersey. The Recipient agrees that venue for any action, suit, litigation or other proceeding arising out of or in any way relating to this Royalty Agreement, or the matters referred to therein, shall be in Hudson County, New Jersey. The Recipient hereby waives and agrees not to assert by way of motion, as a defense, or otherwise, in any suit, action or proceeding, any claim that (A) the suit, action or proceeding is brought in an inconvenient forum or (B) the venue of the suit, action or proceeding is improper. |

| 3 |

| 5.6 | Severability. If any provision in this Royalty Agreement shall be invalid, illegal, or unenforceable in any jurisdiction, the validity, legality, and enforceability of the remaining provisions, or of such provision or obligation in any other jurisdiction, shall not in any way be affected or impaired thereby. |

| 5.7 | Expenses. Except as otherwise specifically provided in this Royalty Agreement, each Party will bear its own expenses (including fees and disbursements of legal counsel, accountants, financial advisors and other professional advisors) incurred in connection with the preparation, negotiation, execution, delivery and performance of this Royalty Agreement. |

| 5.8 | Notices. All notices, requests, demands, consents, instructions or other communications required or permitted hereunder shall be in writing and faxed, mailed or delivered to each party at the respective addresses of the parties as set forth in the SPA, or at such other address or facsimile number as the Parties shall have furnished to each other in writing. |

| 5.9 | Construction. In the construction of this Royalty Agreement, the rule of construction that a document is to be construed most strictly against a party who prepared the same shall not be applied, it being agreed that all parties have participated in the preparation of the final form of this Royalty Agreement. |

| 5.10 | Counterparts. This Royalty Agreement may be executed in two or more counterparts, each of which shall be deemed an original but all of which together will constitute one and the same instrument. This Royalty Agreement may be executed by facsimile, photo or electronic signature and such facsimile, photo or electronic signature shall constitute an original for all purposes. |

The Parties have duly executed this Royalty Agreement as of the Effective Date.

| WESTPORT ENERGY HOLDINGS INC. | YA GLOBAL INVESTMENTS, L.P. | |||

| By: | Yorkville Advisors, LLC | |||

| Its: | Investment Manager | |||

| By: | By: | |||

| Name: | Stephen Schoepfer | Name: | Mark Angelo | |

| Title: | Chief Executive Officer | Its: | Portfolio Manager] | |

| 4 |

APPENDIX A TO ROYALTY AGREEMENT

DEFINITIONS

“Accounting Period” shall mean each 3-month period ending March 31, June 30, September 30 and December 31.

“Affiliate” shall mean: (a) in the case of corporate entities, direct or indirect ownership of at least 50% of the stock or participating shares entitled to vote for the election of directors or the power to control such entity; and (b) in the case of non-corporate entities, direct or indirect ownership of at least 50% of the equity interest or the power to control such entity.

“Net Sales” shall mean, without duplication, all gross revenues invoiced by Westport or any of its Affiliates for gas sales from the Allocated Wells, less all reasonably related expenses or other accruals relating thereto including but not limited to: (1) royalties or the like paid to third parties on gas sales from the Allocated Wells; (2) discounts, rebates and deductions, or any other consideration accrued to customers based on volumes and/or revenues commercialized, or any other deductions or the like allowed (whether in cash or trade) to customers for quantity purchases, prompt payments or other special conditions; (3) credits, write-offs, collection fees, allowances or refunds, not exceeding the original invoice amount, for claims, returns, collections or bad debts, and any other allowances made for deficient goods or services; (4) transportation expenses, including any and all carriage or insurance charges, packaging, freight, and costs of delivery; and (5) sales and use taxes and other fees or taxes imposed by any government or governmental agency, including, but not limited to any import, export or customs duties. Net Sales shall be determined from books and records maintained in accordance with United States Generally Accepted Accounting Principles, consistently applied throughout the organization and across all Allocated Wells giving rise to Net Sales.

“Royalty Term” shall mean, with respect to each Allocated Well, the period commencing on the Effective Date and ending when such well is no longer capable of producing gas.

| 5 |

APPENDIX B TO ROYALTY AGREEMENT

ALLOCATED WELLS

| 6 |

| 7 |