Attached files

EXHIBIT 10.2

SECURITIES PURCHASE AGREEMENT

THIS SECURITIES PURCHASE AGREEMENT (this “Agreement”), dated as of February 5, 2014, by and between Westport Energy Holdings Inc., a Delaware corporation (the “Company”) and YA Global Investments, L.P. (the “Buyer”).

WITNESSETH

WHEREAS, the Company and the Buyer are executing and delivering this Agreement in reliance upon an exemption from securities registration pursuant to Section 4(2) and/or Rule 506 of Regulation D (“Regulation D”) as promulgated by the U.S. Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”);

WHEREAS, the parties desire that, upon the terms and subject to the conditions contained herein, the Company shall issue and sell to the Buyer, as provided herein, secured Convertible Debentures in the original principal amount of $1,080,000 in the form attached hereto as “Exhibit A” (the “Convertible Debentures”), which shall be convertible into shares of the Company’s common stock, par value $0.0001 (the “Common Stock”) (as converted, the “Conversion Shares” and collectively along with the Convertible Debentures, the “Securities”)) and the Buyer shall purchase the Convertible Debentures for a purchase price equal to $1,000,000 (the “Purchase Price”) at a closing to take place within two (2) business days of the date hereof (the “Closing”);

WHEREAS, the Company’s obligations under the Convertible Debentures shall be secured by the assets, and in the manner, set forth in the financing documents identified in “Exhibit B” in accordance with the terms of such financing documents (the “Existing Financing Documents”;

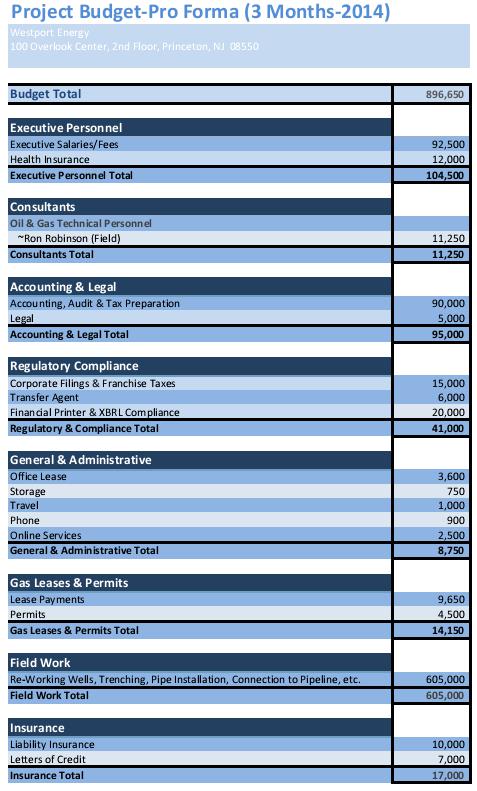

WHEREAS, the proceeds from the issuance of the Convertible Debentures will be used to support the operations of the Company and its subsidiaries in accordance with the Approved Budget attached hereto as “Exhibit C”;

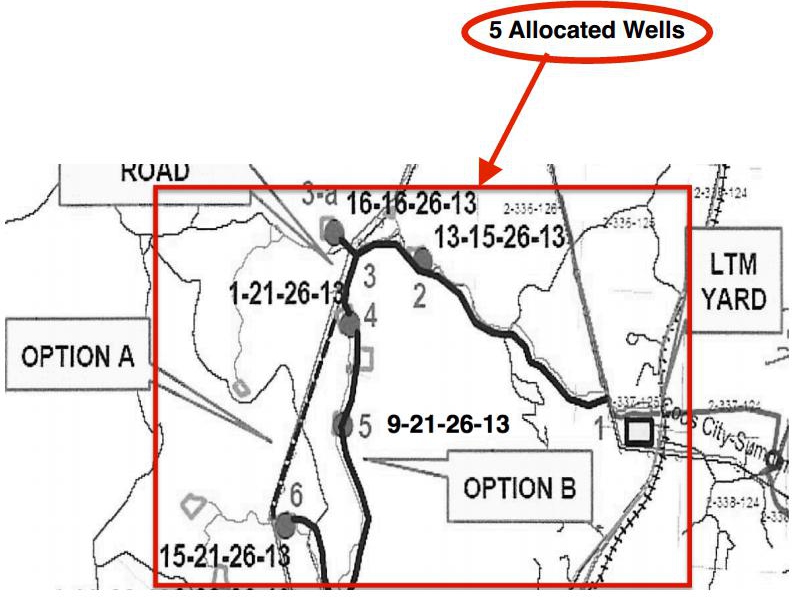

WHEREAS, after repayment of all amounts outstanding under the Convertible Debentures, the Company will pay to the holders of the Convertible Debentures (pro rata in accordance with each holder’s ownership of the Convertible Debentures compared to all outstanding Convertible Debentures) an amount equal to 25% of the net cash flow from certain wells located in Coos Bay, Oregon that are being developed by the Company as identified in “Exhibit D” attached hereto (the “Allocated Wells”), which payments shall be made in accordance with the terms and conditions set forth in the form of royalty agreement attached hereto as “Exhibit E” (the “Royalty Agreement”);

NOW, THEREFORE, in consideration of the mutual covenants and other agreements contained in this Agreement the Company and the Buyer hereby agree as follows:

1. PURCHASE AND SALE OF CONVERTIBLE DEBENTURES.

(a) Purchase of Convertible Debentures. Subject to the satisfaction (or waiver) of the terms and conditions of this Agreement, the Buyer agrees to purchase at the Closing and the Company agrees to sell and issue to the Buyer at the Closing, the Convertible Debentures in exchange for the Purchase Price.

(b) Closing Date. The Closing of the purchase and sale of the Convertible Debentures shall take place at 10:00 a.m. Eastern Standard Time on February 5, 2014, subject to notification of satisfaction of the conditions to the Closing set forth herein and in Sections 6 and 7 below (or such later date as is mutually agreed to by the Company and the Buyer) (the “Closing Date”). The Closing shall occur on the Closing Date at the offices of Yorkville Advisors, LLC, 1012 Springfield Avenue, Mountainside, New Jersey 07092 (or such other place as is mutually agreed to by the Company and the Buyer).

(c) Form of Payment. Subject to the satisfaction of the terms and conditions of this Agreement, on the Closing Date, (i) the Buyer shall pay the Purchase Price as follows: (A) $200,000 of the Purchase Price shall be paid by the surrender by the Buyer for cancelation of the Secured Convertible Debenture issued by the Company to the Buyer on August 20, 2013 in the original principal amount of $100,000 (“Debenture CICS-25”), the Secured Convertible Debenture issued by the Company to the Buyer on November 1, 2013 in the original principal amount of $50,000 (“Debenture CICS-26”) and the Secured Convertible Debenture issued by the Company to the Buyer on December 19, 2013 in the original principal amount of $50,000 (“Debenture CICS-27”) , and (B) $800,000 by wire transfer of immediately available funds to the account of the Company set forth on “Exhibit F” attached hereto, and (ii) the Company shall deliver to the Buyer the Convertible Debentures duly executed on behalf of the Company. If instructed in writing by the Buyer, the Company shall, in lieu of issuing a single Convertible Debenture to the Buyer at the Closing, issue multiple Convertible Debentures to the Buyer and such nominees or assigns as the Buyer may designate in writing, which Convertible Debentures shall, in the aggregate, not exceed $1,080,000 in original principal amount.

2. BUYER’S REPRESENTATIONS AND WARRANTIES.

The Buyer represents and warrants, severally and not jointly, that:

(a) Investment Purpose. The Buyer is acquiring the Securities for its own account for investment only and not with a view towards, or for resale in connection with, the public sale or distribution thereof, except pursuant to sales registered or exempted under the Securities Act; provided, however, that by making the representations herein, such Buyer reserves the right to dispose of the Securities at any time in accordance with or pursuant to an effective registration statement covering such Securities or an available exemption under the Securities Act.

(b) Accredited Investor Status. The Buyer is an “Accredited Investor” as that term is defined in Rule 501(a)(3) of Regulation D.

(c) Reliance on Exemptions. The Buyer understands that the Securities are being offered and sold to it in reliance on specific exemptions from the registration requirements of United States federal and state securities laws and that the Company is relying in part upon the truth and accuracy of, and such Buyer’s compliance with, the representations, warranties, agreements, acknowledgments and understandings of such Buyer set forth herein in order to determine the availability of such exemptions and the eligibility of such Buyer to acquire the Securities.

(d) Information. The Buyer and its advisors (and his or, its counsel), if any, have been furnished with all materials relating to the business, finances and operations of the Company and information he deemed material to making an informed investment decision regarding his purchase of the Securities, which have been requested by such Buyer. The Buyer and its advisors, if any, have been afforded the opportunity to ask questions of the Company and its management. Neither such inquiries nor any other due diligence investigations conducted by such Buyer or its advisors, if any, or its representatives shall modify, amend or affect such Buyer’s right to rely on the Company’s representations and warranties contained in Section 3 below. The Buyer understands that its investment in the Securities involves a high degree of risk. The Buyer is in a position regarding the Company, which, based upon employment, family relationship or economic bargaining power, enabled and enables such Buyer to obtain information from the Company in order to evaluate the merits and risks of this investment. The Buyer has sought such accounting, legal and tax advice, as it has considered necessary to make an informed investment decision with respect to its acquisition of the Securities.

(e) No Governmental Review. The Buyer understands that no United States federal or state agency or any other government or governmental agency has passed on or made any recommendation or endorsement of the Securities, or the fairness or suitability of the investment in the Securities, nor have such authorities passed upon or endorsed the merits of the offering of the Securities.

(f) Transfer or Resale. The Buyer understands that: (i) the Securities have not been and are not being registered under the Securities Act or any state securities laws, and may not be offered for sale, sold, assigned or transferred unless (A) subsequently registered thereunder, (B) with respect to the Convertible Debentures, such offer, sale, assignment, or transfer has been made pursuant to an exemption from such registration requirements, (C) with respect to the Conversion Shares, such Buyer shall have delivered to the Company an opinion of counsel, in a generally acceptable form, to the effect that such Securities to be sold, assigned or transferred may be sold, assigned or transferred pursuant to an exemption from such registration requirements, or (D) such Buyer provides the Company with reasonable assurances (in the form of seller and broker representation letters) that such Securities can be sold, assigned or transferred pursuant to Rule 144 or Rule 144A promulgated under the Securities Act, as amended (or a successor rule thereto) (collectively, “Rule 144”), in each case following the applicable holding period set forth therein; (ii) any sale of the Securities made in reliance on Rule 144 may be made only in accordance with the terms of Rule 144 and further, if Rule 144 is not applicable, any resale of the Securities under circumstances in which the seller (or the person through whom the sale is made) may be deemed to be an underwriter (as that term is defined in the Securities Act) may require compliance with some other exemption under the Securities Act or the rules and regulations of the SEC thereunder; and (iii) neither the Company nor any other person is under any obligation to register the Securities under the Securities Act or any state securities laws or to comply with the terms and conditions of any exemption thereunder.

(g) Legends. The Buyer agrees to the imprinting, so long as is required by this Section 2(g), of a restrictive legend in substantially the following form:

THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES HAVE BEEN ACQUIRED SOLELY FOR INVESTMENT PURPOSES AND NOT WITH A VIEW TOWARD RESALE AND MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS, OR AN OPINION OF COUNSEL, IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR APPLICABLE STATE SECURITIES LAWS.

Certificates evidencing the Conversion Shares shall not contain any legend (including the legend set forth above), (i) while a registration statement covering the resale of such security is effective under the Securities Act, (ii) following any sale of such Conversion Shares pursuant to Rule 144, (iii) if such Conversion Shares are eligible for sale under Rule 144, or (iv) if such legend is not required under applicable requirements of the Securities Act (including judicial interpretations and pronouncements issued by the staff of the SEC). The Buyer agrees that the removal of restrictive legend from certificates representing Securities as set forth in this Section 2(g) is predicated upon the Company’s reliance that the buyer will sell any Securities pursuant to either the registration requirements of the Securities Act, including any applicable prospectus delivery requirements, or an exemption therefrom, and that if Securities are sold pursuant to a registration statement, they will be sold in compliance with the plan of distribution set forth therein.

(h) Authorization, Enforcement. This Agreement has been duly and validly authorized, executed and delivered on behalf of such Buyer and is a valid and binding agreement of such Buyer enforceable in accordance with its terms, except as such enforceability may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and other similar laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies.

(i) Receipt of Documents. The Buyer and his or its counsel has received and read in their entirety: (i) this Agreement and each representation, warranty and covenant set forth herein and the Transaction Documents (as defined herein); (ii) all due diligence and other information necessary to verify the accuracy and completeness of such representations, warranties and covenants; and (iii) the Company’s most recent Form 10-K; (iv) the Company’s most recent Form 10-Q; and The Buyer has relied on the information contained therein and has not been furnished any other documents, literature, memorandum or prospectus.

(j) Due Formation of Corporate and Other Buyers. If the Buyer is a corporation, trust, partnership or other entity that is not an individual person, it has been formed and validly exists and has not been organized for the specific purpose of purchasing the Securities and is not prohibited from doing so.

(k) No Legal Advice From the Company. The Buyer acknowledges, that it had the opportunity to review this Agreement and the transactions contemplated by this Agreement with his or its own legal counsel and investment and tax advisors. The Buyer is relying solely on such counsel and advisors and not on any statements or representations of the Company or any of its representatives or agents for legal, tax or investment advice with respect to this investment, the transactions contemplated by this Agreement or the securities laws of any jurisdiction.

3. REPRESENTATIONS AND WARRANTIES OF THE COMPANY.

Except as set forth under the corresponding section of the “Disclosure Schedule” contained in “Exhibit G ” attached hereto, which Disclosure Schedules shall be deemed a part hereof, and to qualify any representation or warranty otherwise made herein to the extent of such disclosure, the Company hereby makes the representations and warranties set forth below to the Buyer:

(a) Subsidiaries. All of the direct and indirect subsidiaries of the Company are set forth in 3(a) of the Disclosure Schedule. The Company owns, directly or indirectly, all of the capital stock or other equity interests of each subsidiary free and clear of any liens, and all the issued and outstanding shares of capital stock of each subsidiary are validly issued and are fully paid, non-assessable and free of preemptive and similar rights to subscribe for or purchase securities.

(b) Organization and Qualification. The Company and its subsidiaries are corporations duly organized and validly existing in good standing under the laws of the jurisdiction in which they are incorporated, and have the requisite corporate power to own their properties and to carry on their business as now being conducted. Each of the Company and its subsidiaries is duly qualified as a foreign corporation to do business and is in good standing in every jurisdiction in which the nature of the business conducted by it makes such qualification necessary, except to the extent that the failure to be so qualified or be in good standing would not have or reasonably be expected to result in (i) a material adverse effect on the legality, validity or enforceability of any Transaction Document (as defined below), (ii) a material adverse effect on the results of operations, assets, business or condition (financial or otherwise) of the Company and the subsidiaries, taken as a whole, or (iii) a material adverse effect on the Company’s ability to perform in any material respect on a timely basis its obligations under any Transaction Document (any of (i), (ii) or (iii), a “Material Adverse Effect”) and no proceeding has been instituted in any such jurisdiction revoking, limiting or curtailing or seeking to revoke, limit or curtail such power and authority or qualification.

(c) Authorization, Enforcement, Compliance with Other Instruments. (i) The Company has the requisite corporate power and authority to enter into and perform its obligations under this Agreement, the Convertible Debentures, the Royalty Agreement, and each of the other agreements entered into by the parties hereto in connection with the transactions contemplated by this Agreement (collectively the “Transaction Documents”) and to issue the Securities in accordance with the terms hereof and thereof, (ii) the execution and delivery of the Transaction Documents by the Company and the consummation by it of the transactions contemplated hereby and thereby, including, without limitation, the issuance of the Securities, the reservation for issuance and the issuance of the Conversion Shares, have been duly authorized by the Company’s Board of Directors and no further consent or authorization is required by the Company, its Board of Directors or its stockholders, (iii) the Transaction Documents have been duly executed and delivered by the Company, (iv) the Transaction Documents constitute the valid and binding obligations of the Company enforceable against the Company in accordance with their terms, except as such enforceability may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or similar laws relating to, or affecting generally, the enforcement of creditors’ rights and remedies.

(d) Capitalization. The authorized capital stock of the Company consists of 2,000,000,000 shares of Common Stock and 1,000,000 shares of Series C Preferred Stock (“Preferred Stock”) of which 575,861 shares of Common Stock and 921,890 shares of Preferred Stock are issued and outstanding. All of the outstanding shares of capital stock of the Company are validly issued, fully paid and nonassessable, have been issued in compliance with all federal and state securities laws, and none of such outstanding shares was issued in violation of any preemptive rights or similar rights to subscribe for or purchase securities. Except as disclosed in Schedule 3(d): (i) none of the Company’s capital stock is subject to preemptive rights or any other similar rights or any liens or encumbrances suffered or permitted by the Company; (ii) there are no outstanding options, warrants, scrip, rights to subscribe to, calls or commitments of any character whatsoever relating to, or securities or rights convertible into, or exercisable or exchangeable for, any capital stock of the Company or any of its subsidiaries, or contracts, commitments, understandings or arrangements by which the Company or any of its subsidiaries is or may become bound to issue additional capital stock of the Company or any of its subsidiaries or options, warrants, scrip, rights to subscribe to, calls or commitments of any character whatsoever relating to, or securities or rights convertible into, or exercisable or exchangeable for, any capital stock of the Company or any of its subsidiaries; (iii) there are no outstanding debt securities, notes, credit agreements, credit facilities or other agreements, documents or instruments evidencing indebtedness of the Company or any of its subsidiaries or by which the Company or any of its subsidiaries is or may become bound; (iv) there are no financing statements securing obligations in any material amounts, either singly or in the aggregate, filed in connection with the Company or any of its subsidiaries; (v) there are no outstanding securities or instruments of the Company or any of its subsidiaries which contain any redemption or similar provisions, and there are no contracts, commitments, understandings or arrangements by which the Company or any of its subsidiaries is or may become bound to redeem a security of the Company or any of its subsidiaries; (vi) there are no securities or instruments containing anti-dilution or similar provisions that will be triggered by the issuance of the Securities; (vii) the Company does not have any stock appreciation rights or “phantom stock” plans or agreements or any similar plan or agreement; and (viii) the Company and its subsidiaries have no liabilities or obligations required to be disclosed in the SEC Documents but not so disclosed in the SEC Documents, other than those incurred in the ordinary course of the Company’s or its subsidiaries’ respective businesses and which, individually or in the aggregate, do not or would not have a Material Adverse Effect. The Company has furnished to the Buyers true, correct and complete copies of the Company’s Certificate of Incorporation, as amended and as in effect on the date hereof (the “Certificate of Incorporation”), and the Company’s Bylaws, as amended and as in effect on the date hereof (the “Bylaws”), and the terms of all securities convertible into, or exercisable or exchangeable for, shares of Common Stock and the material rights of the holders thereof in respect thereto. No further approval or authorization of any stockholder, the Board of Directors of the Company or others is required for the issuance and sale of the Securities. There are no stockholders agreements, voting agreements or other similar agreements with respect to the Company’s capital stock to which the Company is a party or, to the knowledge of the Company, between or among any of the Company’s stockholders.

(e) Issuance of Securities. The issuance of the Convertible Debentures are duly authorized and free from all taxes, liens and charges with respect to the issue thereof. Upon conversion in accordance with the terms of the Convertible Debentures, the Conversion Shares, when issued will be validly issued, fully paid and nonassessable, free from all taxes, liens and charges with respect to the issue thereof. The Company has reserved from its duly authorized capital stock the appropriate number of shares of Common Stock as set forth in this Agreement.

(f) No Conflicts. The execution, delivery and performance of the Transaction Documents by the Company and the consummation by the Company of the transactions contemplated hereby and thereby (including, without limitation, the issuance of the Convertible Debentures) will not (i) result in a violation of any certificate of incorporation, certificate of formation, any certificate of designations or other constituent documents of the Company or any of its subsidiaries, any capital stock of the Company or any of its subsidiaries or bylaws of the Company or any of its subsidiaries or (ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default) in any respect under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which the Company or any of its subsidiaries is a party, or (iii) result in a violation of any law, rule, regulation, order, judgment or decree (including foreign, federal and state securities laws and regulations and the rules and regulations of the National Association of Securities Dealers Inc.’s OTC Bulletin Board) applicable to the Company or any of its subsidiaries or by which any property or asset of the Company or any of its subsidiaries is bound or affected; except in the case of each of clauses (ii) and (iii), such as could not, individually or in the aggregate, have or reasonably be expected to result in a Material Adverse Effect. The business of the Company and its subsidiaries is not being conducted, and shall not be conducted in violation of any material law, ordinance, or regulation of any governmental entity. Except as specifically contemplated by this Agreement and as required under the Securities Act and any applicable state securities laws, the Company is not required to obtain any consent, authorization or order of, or make any filing or registration with, any court or governmental agency in order for it to execute, deliver or perform any of its obligations under or contemplated by this Agreement in accordance with the terms hereof or thereof. All consents, authorizations, orders, filings and registrations which the Company is required to obtain pursuant to the preceding sentence have been obtained or effected on or prior to the date hereof. The Company and its subsidiaries are unaware of any facts or circumstance, which might give rise to any of the foregoing.

(g) SEC Documents; Financial Statements. The Company has filed all reports, schedules, forms, statements and other documents required to be filed by it with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for the two years preceding the date hereof (or such shorter period as the Company was required by law or regulation to file such material) (all of the foregoing filed prior to the date hereof or amended after the date hereof and all exhibits included therein and financial statements and schedules thereto and documents incorporated by reference therein, being hereinafter referred to as the “SEC Documents”) on timely basis or has received a valid extension of such time of filing and has filed any such SEC Document prior to the expiration of any such extension. The Company has delivered to the Buyers or their representatives, or made available through the SEC’s website at http://www.sec.gov., true and complete copies of the SEC Documents. As of their respective dates, the SEC Documents complied in all material respects with the requirements of the Exchange Act and the rules and regulations of the SEC promulgated thereunder applicable to the SEC Documents, and none of the SEC Documents, at the time they were filed with the SEC, contained any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. As of their respective dates, the financial statements of the Company included in the SEC Documents complied as to form in all material respects with applicable accounting requirements and the published rules and regulations of the SEC with respect thereto. Such financial statements have been prepared in accordance with generally accepted accounting principles, consistently applied, during the periods involved (except (i) as may be otherwise indicated in such financial statements or the notes thereto, or (ii) in the case of unaudited interim statements, to the extent they may exclude footnotes or may be condensed or summary statements) and fairly present in all material respects the financial position of the Company as of the dates thereof and the results of its operations and cash flows for the periods then ended (subject, in the case of unaudited statements, to normal year-end audit adjustments).

(h) Absence of Litigation. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending against or affecting the Company, the Common Stock or any of the Company’s subsidiaries, wherein an unfavorable decision, ruling or finding would (i) have a Material Adverse Effect.

(i) No General Solicitation. Neither the Company, nor any of its affiliates, nor any person acting on its or their behalf, has engaged in any form of general solicitation or general advertising (within the meaning of Regulation D under the Securities Act) in connection with the offer or sale of the Securities.

(j) No Integrated Offering. Neither the Company, nor any of its affiliates, nor any person acting on its or their behalf has, directly or indirectly, made any offers or sales of any security or solicited any offers to buy any security, under circumstances that would require registration of the Securities under the Securities Act or cause this offering of the Securities to be integrated with prior offerings by the Company for purposes of the Securities Act.

(k) Private Placement. Assuming the accuracy of the Buyers’ representations and warranties set forth in Section 2, no registration under the Securities Act is required for the offer and sale of the Securities by the Company to the Buyers as contemplated hereby. The issuance and sale of the Securities hereunder does not contravene the rules and regulations of the Primary Market.

(l) Listing and Maintenance Requirements. The Company’s Common Stock is registered pursuant to Section 12(b) or 12(g) of the Exchange Act, and the Company has taken no action designed to terminate, or which to its knowledge is likely to have the effect of, terminating the registration of the Common Stock under the Exchange Act nor has the Company received any notification that the SEC is contemplating terminating such registration. The Company has not, in the twelve (12) months preceding the date hereof, received notice from any Primary Market on which the Common Stock is or has been listed or quoted to the effect that the Company is not in compliance with the listing or maintenance requirements of such Primary Market. The Company is, and has no reason to believe that it will not in the foreseeable future continue to be, in compliance with all such listing and maintenance requirements.

(m) Reporting Status. With a view to making available to the Buyer the benefits of Rule 144 or any similar rule or regulation of the SEC that may at any time permit the Buyer to sell securities of the Company to the public without registration, and as a material inducement to the Buyer’s purchase of the Securities, the Company represents and warrants to the following: (i) the Company is, and has been for a period of at least 90 days immediately preceding the date hereof, subject to the reporting requirements of section 13 or 15(d) of the Exchange Act (ii) the Company has filed all required reports under section 13 or 15(d) of the Exchange, as applicable, during the 12 months preceding the date hereof (or for such shorter period that the Company was required to file such reports), and (iii) the Company is not an issuer defined as a “Shell Company.” For the purposes hereof, the term “Shell Company” shall mean an issuer that meets the description defined in paragraph (i)(1)(i) of Rule 144.

(n) Disclosure. The Company has made available to the Buyer and its counsel all the information reasonably available to the Company that the Buyer or its counsel have requested for deciding whether to acquire the Securities. No representation or warranty of the Company contained in this Agreement (as qualified by the Disclosure Schedule) or any of the other Transaction Documents, and no certificate furnished or to be furnished to the Buyer at the Closing, or any due diligence evaluation materials furnished by the Company or on behalf of the Company, including without limitation, due diligence questionnaires, or any other documents, presentations, correspondence, or information contains any untrue statement of a material fact or omits to state a material fact necessary in order to make the statements contained herein or therein not misleading in light of the circumstances under which they were made.

(o) Dilutive Effect. The Company understands and acknowledges that the number of Conversion Shares issuable upon conversion of the Convertible Debentures will increase in certain circumstances. The Company further acknowledges that its obligation to issue Conversion Shares upon conversion of the Convertible Debentures in accordance with this Agreement and the Convertible Debentures is absolute and unconditional regardless of the dilutive effect that such issuance may have on the ownership interests of other stockholders of the Company.

(p) Acknowledge assignment. The Company acknowledges and agrees that the Buyer intends to sell and assign up to $540,000 of the Convertible Debentures to an Accredited Investor in a private transaction that is exempt from registration under the Securities Act.

4. COVENANTS.

(a) Reporting Status. With a view to making available to the Buyer the benefits of Rule 144 or any similar rule or regulation of the SEC that may at any time permit the Buyer to sell securities of the Company to the public without registration, and as a material inducement to the Buyer’s purchase of the Securities, the Company represents, warrants, and covenants to the following:

(i) The Company is subject to the reporting requirements of section 13 or 15(d) of the Exchange Act and has filed all required reports under section 13 or 15(d) of the Exchange Act during the 12 months prior to the date hereof (or for such shorter period that the issuer was required to file such reports), other than Form 8-K reports;

(ii) from the date hereof until all the Securities either have been sold by the Buyer, or may permanently be sold by the Buyer without any restrictions pursuant to Rule 144, (the “Registration Period”) the Company shall file with the SEC in a timely manner all required reports under section 13 or 15(d) of the Exchange Act and such reports shall conform to the requirement of the Exchange Act and the SEC for filing thereunder;

(iii) The Company shall furnish to the Buyer so long as the Buyer owns Securities, promptly upon request, (i) a written statement by the Company that it has complied with the reporting requirements of Rule 144, (ii) a copy of the most recent annual or quarterly report of the Company and such other reports and documents so filed by the Company, and (iii) such other information as may be reasonably requested to permit the Buyers to sell such securities pursuant to Rule 144 without registration; and

(iv) During the Registration Period the Company shall not terminate its status as an issuer required to file reports under the Exchange Act even if the Exchange Act or the rules and regulations thereunder would otherwise permit such termination.

(b) Use of Proceeds. The Company will use the proceeds from the sale of the Convertible Debentures to (i) fund the operations of the Company and its subsidiaries, and (ii) for general corporate and working capital purposes, and (iii) for development of the Allocated Wells, all in accordance with the Approved Budget. The Company shall not deviate in any material way (deviations of less than 10% shall not be deemed material) from any line item in the budget.

(c) Reservation of Shares. On the date hereof, the Company shall reserve for issuance to the Buyers 20,000,000 shares for issuance upon conversions of the Convertible Debentures (the “Share Reserve”). The Company shall take all action reasonably necessary to at all times have authorized, and reserved for the purpose of issuance, such number of shares of Common Stock as shall be necessary to effect the full conversion of the Convertible Debentures. If at any time the Share Reserve is insufficient to effect the full conversion of the Convertible Debentures the Company shall increase the Share Reserve accordingly. If the Company does not have sufficient authorized and unissued shares of Common Stock available to increase the Share Reserve, the Company shall call and hold a special meeting of the shareholders within thirty (30) days of such occurrence, for the sole purpose of increasing the number of shares authorized. The Company’s management shall recommend to the shareholders to vote in favor of increasing the number of shares of Common Stock authorized. Management shall also vote all of its shares in favor of increasing the number of authorized shares of Common Stock.

(d) Listings or Quotation. The Company’s Common Stock shall be listed or quoted for trading on any of the (a) NYSE Amex, (b) New York Stock Exchange, (c) NASDAQ Stock Market, (e) NASDAQ Capital Market; (f) NASDAQ OTC Bulletin Board (“OTCBB”), (g) OTCQX, (h) OTCQB, (i) OTC Pink or (j) any successor to any of the foregoing markets or exchanges (each, a “Primary Market”). The Company shall promptly secure the listing of all of the Conversion Shares upon each national securities exchange and automated quotation system, if any, upon which the Common Stock is then listed (subject to official notice of issuance) and shall maintain such listing of all Conversion Shares from time to time issuable under the terms of the Transaction Documents.

(e) Corporate Existence. So long as any of the Convertible Debentures remains outstanding, the Company shall not directly or indirectly consummate any merger, reorganization, restructuring, reverse stock split consolidation, sale of all or substantially all of the Company’s assets or any similar transaction or related transactions (each such transaction, an “Organizational Change”) unless, prior to the consummation an Organizational Change, the Company obtains the written consent of The Buyer. In any such case, the Company will make appropriate provision with respect to such holders’ rights and interests to insure that the provisions of this Section 4(e) will thereafter be applicable to the Convertible Debentures.

(f) Transactions With Affiliates. So long as any Convertible Debentures are outstanding, the Company shall not, and shall cause each of its subsidiaries not to, enter into, amend, modify or supplement, or permit any subsidiary to enter into, amend, modify or supplement any agreement, transaction, commitment, or arrangement with any of its or any subsidiary’s officers, directors, person who were officers or directors at any time during the previous two (2) years, stockholders who beneficially own five percent (5%) or more of the Common Stock, or Affiliates (as defined below) or with any individual related by blood, marriage, or adoption to any such individual or with any entity in which any such entity or individual owns a five percent (5%) or more beneficial interest (each a “Related Party”), except for (a) customary employment arrangements and benefit programs on reasonable terms, (b) any investment in an Affiliate of the Company, (c) any agreement, transaction, commitment, or arrangement on an arms-length basis on terms no less favorable than terms which would have been obtainable from a person other than such Related Party, (d) any agreement, transaction, commitment, or arrangement which is approved by a majority of the disinterested directors of the Company; for purposes hereof, any director who is also an officer of the Company or any subsidiary of the Company shall not be a disinterested director with respect to any such agreement, transaction, commitment, or arrangement. “Affiliate” for purposes hereof means, with respect to any person or entity, another person or entity that, directly or indirectly, (i) has a ten percent (10%) or more equity interest in that person or entity, (ii) has ten percent (10%) or more common ownership with that person or entity, (iii) controls that person or entity, or (iv) shares common control with that person or entity. “Control” or “controls” for purposes hereof means that a person or entity has the power, direct or indirect, to conduct or govern the policies of another person or entity.

(g) Restriction on Issuance of the Capital Stock. So long the Convertible Debentures remains outstanding, the Company shall not, without the prior written consent of the Buyer enter into any security instrument granting the holder a security interest in any or all assets of the Company or its subsidiaries.

(h) No Short Sales or Hedging Transactions. Neither the Buyer nor any of its affiliates have an open short position in the Common Stock of the Company, and the Buyer agrees that it shall not, and that it will cause its affiliates not to, engage in any short sales of or hedging transactions with respect to the Common Stock as long as the Convertible Debentures shall remain outstanding.

(i) Review of Public Disclosures. All SEC filings (including, without limitation, all filings required under the Exchange Act, which include Forms 10-Q and 10-QSB, 10-K and 10K-SB, 8-K, etc) and other public disclosures made by the Company, including, without limitation, all press releases, investor relations materials, and scripts of analysts meetings and calls, shall be reviewed and approved for release by the Company’s attorneys and, if containing financial information, the Company’s independent certified public accountants.

(j) Disclosure of Transaction. Within four Business Days following the date of this Agreement, the Company shall file a Current Report on Form 8-K describing the terms of the transactions contemplated by the Transaction Documents in the form required by the Exchange Act and attaching the material Transaction Documents (including, without limitation, this Agreement, the form of the Convertible Debentures and the Royalty Agreement) as exhibits to such filing.

(k) Cash Flow from Allocated Wells. Notwithstanding any payment schedules for interest and principal set forth in the Convertible Debentures, the Company shall apply, on a monthly basis, fifty percent of any net cash flow from the Allocated Wells to the repayment of the Convertible Debentures, which payments shall be applied in the following order: (i) costs, (ii) interest, and (iii) principal.

5. RATIFICATION OF FINANCING DOCUMENTS; CONFIRMATION OF COLLATERAL; CROSS-DEFAULT; CROSS-COLLATERALIZATION; FURTHER ASSURANCES.

(a) The Company hereby ratifies, confirms, and reaffirms all and singular the terms and conditions of the Existing Financing Documents, and acknowledges and agrees that, subject to the terms and conditions of this Agreement, all terms and conditions of the Existing Financing Documents shall remain in full force and effect and the Company remains liable to the Buyer for the payment and performance of all amounts due under the Existing Financing Documents, without offset, defense or counterclaim of any kind, nature or description whatsoever. This Agreement, the Existing Financing Documents, and all other documents, instruments and agreements executed in connection therewith or related thereto are referred to collectively as the “Financing Documents”

(b) The Company hereby ratifies, confirms, and reaffirms that (i) the obligations secured by the Financing Documents include, without limitation, all amounts hereafter owed or due under the Convertible Debentures and/or the Financing Documents (the “Obligations”), and any future modifications, amendments, substitutions, or renewals thereof, (ii) all collateral, whether now existing or hereafter acquired, granted to the Buyer pursuant to the Financing Documents, or otherwise, shall secure all of the Obligations until the full, final, and indefeasible payment of the Obligations, and (iii) the occurrence of a default and/or event of default under any Financing Document shall constitute a default and an event of default under all of the Financing Documents, it being the express intent of the Company that all of the Obligations be fully cross-collateralized, cross-guaranteed, and cross-defaulted.

(c) The Company has previously granted the Buyer security interests in all of its assets, and to confirm the same the Company hereby grants the Buyer a security interest in all of its assets, whether now existing or hereafter acquired, including, without limitation, all accounts, inventory, goods, equipment, software and computer programs, securities, investment property, financial assets, deposit accounts, chattel paper, electronic chattel paper, instruments, patents, patent applications, copyrights, trademarks, trademark applications, trade names, domain names, documents, letter-of-credit rights, health-care-insurance receivables, supporting obligations, notes secured by real estate, commercial tort claims, and general intangibles including payment intangibles, to secure the Obligations free and clear of all liens and encumbrances, except those in favor of the Buyer.

(d) The Company shall, from and after the execution of this Agreement, execute and deliver to the Buyer whatever additional documents, instruments, and agreements that the Buyer may require in order to correct any document deficiencies, or to vest or perfect the Financing Documents and the collateral granted therein more securely in the Buyer and/or to otherwise give effect to the terms and conditions of this Agreement and/or any documents, instruments and agreement required in connection with, related to, or contemplated by this Agreement, and hereby irrevocably authorizes the Buyer to file any financing statements (including financing statements with a generic description of the collateral such as “all assets”), and take any other normal and customary steps, the Buyer deems necessary to perfect or evidence the Buyer’s security interests and liens in any such collateral.

(e) The Company acknowledges and agrees that this Agreement shall constitute an authenticated record as such term is defined in the Uniform Commercial Code.

(f) The Company acknowledges and agrees that nothing contained in this Agreement, the Convertible Debentures, or in any document, instrument or agreement required in connection with, related to or contemplated thereby shall be deemed to constitute (1) a waiver of any defaults or events of default now existing or hereafter arising, (2) an agreement to forbear by the Buyer with respect to such defaults or events of default, or (3) an amendment, modification, extension or waiver of any of the terms of the Financing Documents or of any of the Buyer’s rights and remedies thereunder.

6. CONDITIONS TO THE COMPANY’S OBLIGATION TO SELL.

The obligation of the Company hereunder to issue and sell the Convertible Debentures to the Buyer at the Closing is subject to the satisfaction, at or before the Closing Date, of each of the following conditions, provided that these conditions are for the Company’s sole benefit and may be waived by the Company at any time in its sole discretion:

(a) The Buyer shall have executed the Transaction Documents (which are to be executed by the Buyer) and delivered them to the Company.

(b) The Buyer shall have delivered or caused to be delivered to the Company the Purchase Price for the Convertible Debentures, by wire transfer of immediately available U.S. funds pursuant to the wire instructions attached hereto on Exhibit F for the portion of the Purchase Price payable in cash, and by surrendering to the Company Debenture CICS-25 and Debenture CICS-26 for cancelation.

(c) The representations and warranties of the Buyer shall be true and correct in all material respects as of the date when made and as of the Closing Date as though made at that time (except for representations and warranties that speak as of a specific date), and the Buyer shall have performed, satisfied and complied in all material respects with the covenants, agreements and conditions required by this Agreement to be performed, satisfied or complied with by the Buyer at or prior to the Closing Date.

7. CONDITIONS TO THE BUYER’S OBLIGATION TO PURCHASE.

The obligation of the Buyer hereunder to purchase the Convertible Debentures at the Closing is subject to the satisfaction, at or before the Closing Date, of each of the following conditions, provided that these conditions are for the Buyer’s sole benefit and may be waived by the Buyer at any time in its sole discretion:

(a) The Company shall have executed and delivered the Transaction Documents to the Buyer.

(b) The Common Stock shall be authorized for quotation or trading on the Primary Market, trading in the Common Stock shall not have been suspended for any reason, and all the Conversion Shares issuable upon the conversion of the Convertible Debentures shall be approved for listing or trading on the Primary Market.

(c) The representations and warranties of the Company shall be true and correct in all material respects (except to the extent that any of such representations and warranties is already qualified as to materiality in Section 3 above, in which case, such representations and warranties shall be true and correct without further qualification) as of the date when made and as of the Closing Date as though made at that time (except for representations and warranties that speak as of a specific date) and the Company shall have performed, satisfied and complied in all material respects with the covenants, agreements and conditions required by this Agreement to be performed, satisfied or complied with by the Company at or prior to the Closing Date

(d) The Company shall have provided to the Buyer a true copy of a certificate of good standing evidencing the formation and good standing of the Company from the secretary of state (or comparable office) from the jurisdiction in which the Company is incorporated, as of a date within 30 days of the Closing Date.

(e) The Company shall have delivered to the Buyer a certificate, executed by the Secretary of the Company and dated as of the Closing Date, as to (i) the resolutions consistent with Section 3(c) as adopted by the Company’s Board of Directors in a form reasonably acceptable to such Buyer, (ii) the Certificate of Incorporation and (iii) the Bylaws, each as in effect at the Closing.

8. INDEMNIFICATION.

(a) In consideration of the Buyer’s execution and delivery of this Agreement and acquiring the Convertible Debentures and the Conversion Shares hereunder, and in addition to all of the Company’s other obligations under this Agreement, the Company shall defend, protect, indemnify and hold harmless the Buyer and each other holder of the Convertible Debentures and the Conversion Shares, and all of their officers, directors, employees and agents (including, without limitation, those retained in connection with the transactions contemplated by this Agreement) (collectively, the “Buyer Indemnitees”) from and against any and all actions, causes of action, suits, claims, losses, costs, penalties, fees, liabilities and damages, and expenses in connection therewith (irrespective of whether any such Buyer Indemnitee is a party to the action for which indemnification hereunder is sought), and including reasonable attorneys’ fees and disbursements (the “Indemnified Liabilities”), incurred by the Buyer Indemnitees or any of them as a result of, or arising out of, or relating to (a) any misrepresentation or breach of any representation or warranty made by the Company in this Agreement, the Convertible Debentures or the other Transaction Documents or any other certificate, instrument or document contemplated hereby or thereby, (b) any breach of any covenant, agreement or obligation of the Company contained in this Agreement, or the other Transaction Documents or any other certificate, instrument or document contemplated hereby or thereby, or (c) any cause of action, suit or claim brought or made against such Buyer Indemnitee and arising out of or resulting from the execution, delivery, performance or enforcement of this Agreement or any other instrument, document or agreement executed pursuant hereto by any of the parties hereto, any transaction financed or to be financed in whole or in part, directly or indirectly, with the proceeds of the issuance of the Convertible Debentures or the status of the Buyer or holder of the Convertible Debentures the Conversion Shares, as a Buyer of Convertible Debentures in the Company. To the extent that the foregoing undertaking by the Company may be unenforceable for any reason, the Company shall make the maximum contribution to the payment and satisfaction of each of the Indemnified Liabilities, which is permissible under applicable law.

(b) In consideration of the Company’s execution and delivery of this Agreement, and in addition to all of the Buyer’s other obligations under this Agreement, the Buyer shall defend, protect, indemnify and hold harmless the Company and all of its officers, directors, employees and agents (including, without limitation, those retained in connection with the transactions contemplated by this Agreement) (collectively, the “Company Indemnitees”) from and against any and all Indemnified Liabilities incurred by the Indemnitees or any of them as a result of, or arising out of, or relating to (a) any misrepresentation or breach of any representation or warranty made by the Buyer in this Agreement, instrument or document contemplated hereby or thereby executed by the Buyer, (b) any breach of any covenant, agreement or obligation of the Buyer contained in this Agreement, the Transaction Documents or any other certificate, instrument or document contemplated hereby or thereby executed by the Buyer, or (c) any cause of action, suit or claim brought or made against such Company Indemnitee based on material misrepresentations or due to a material breach and arising out of or resulting from the execution, delivery, performance or enforcement of this Agreement, the Transaction Documents or any other instrument, document or agreement executed pursuant hereto by any of the parties hereto. To the extent that the foregoing undertaking by The Buyer may be unenforceable for any reason, The Buyer shall make the maximum contribution to the payment and satisfaction of each of the Indemnified Liabilities, which is permissible under applicable law.

9. GOVERNING LAW: MISCELLANEOUS.

(a) Governing Law. This Agreement shall be governed by and interpreted in accordance with the laws of the State of New Jersey without regard to the principles of conflict of laws. The parties further agree that any action between them shall be heard in Hudson County, New Jersey, and expressly consent to the jurisdiction and venue of the Superior Court of New Jersey, sitting in Hudson County and the United States District Court for the District of New Jersey sitting in Newark, New Jersey for the adjudication of any civil action asserted pursuant to this Paragraph.

(b) Counterparts. This Agreement may be executed in two or more identical counterparts, all of which shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to the other party.

(c) Headings. The headings of this Agreement are for convenience of reference and shall not form part of, or affect the interpretation of, this Agreement.

(d) Severability. If any provision of this Agreement shall be invalid or unenforceable in any jurisdiction, such invalidity or unenforceability shall not affect the validity or enforceability of the remainder of this Agreement in that jurisdiction or the validity or enforceability of any provision of this Agreement in any other jurisdiction.

(e) Entire Agreement, Amendments. This Agreement supersedes all other prior oral or written agreements between the Buyer, the Company, their affiliates and persons acting on their behalf with respect to the matters discussed herein, and this Agreement and the instruments referenced herein contain the entire understanding of the parties with respect to the matters covered herein and therein and, except as specifically set forth herein or therein, neither the Company nor any Buyer makes any representation, warranty, covenant or undertaking with respect to such matters. No provision of this Agreement may be waived or amended other than by an instrument in writing signed by the party to be charged with enforcement.

(f) Notices. Any notices, consents, waivers, or other communications required or permitted to be given under the terms of this Agreement must be in writing and will be deemed to have been delivered (i) upon receipt, when delivered personally; (ii) upon confirmation of receipt, when sent by facsimile; (iii) three (3) days after being sent by U.S. certified mail, return receipt requested, or (iv) one (1) day after deposit with a nationally recognized overnight delivery service, in each case properly addressed to the party to receive the same. The addresses and facsimile numbers for such communications shall be:

| If to the Company, to: | Westport Energy Holdings Inc. |

| 100 Overlook Center, 2nd Floor | |

| Princeton, NJ 08540 | |

| Fax: 609-498-7029 | |

| If to the Buyer: | YA Global Investments, L.P. |

| 1012 Springfield Avenue | |

| Mountainside, NJ 07092 | |

| Attention: Mark Angelo | |

| Fax: 201-985-8266 | |

| With copy to: | David Gonzalez, Esq. |

| c/o Yorkville Advisors, LLC | |

| 1012 Springfield Avenue | |

| Mountainside, NJ 07092 | |

| Fax: 201-985-8266 |

(g) Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their respective successors and assigns. Neither the Company nor any Buyer shall assign this Agreement or any rights or obligations hereunder without the prior written consent of the other party hereto.

(h) No Third Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective permitted successors and assigns, and is not for the benefit of, nor may any provision hereof be enforced by, any other person.

(i) Survival. Unless this Agreement is terminated under Section 9(l), all agreements, representations and warranties contained in this Agreement or made in writing by or on behalf of any party in connection with the transactions contemplated by this Agreement shall survive the execution and delivery of this Agreement and the Closing.

(j) Publicity. The Company and the Buyer shall have the right to approve, before issuance any press release or any other public statement with respect to the transactions contemplated hereby made by any party; provided, however, that the Company shall be entitled, without the prior approval of the Buyer, to issue any press release or other public disclosure with respect to such transactions required under applicable securities or other laws or regulations (the Company shall use its best efforts to consult the Buyer in connection with any such press release or other public disclosure prior to its release and Buyer shall be provided with a copy thereof upon release thereof).

(k) Further Assurances. Each party shall do and perform, or cause to be done and performed, all such further acts and things, and shall execute and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

(l) Brokerage. The Company represents that no broker, agent, finder or other party has been retained by it in connection with the transactions contemplated hereby and that no other fee or commission has been agreed by the Company to be paid for or on account of the transactions contemplated hereby.

(m) No Strict Construction. The language used in this Agreement will be deemed to be the language chosen by the parties to express their mutual intent, and no rules of strict construction will be applied against any party.

(n) Right of First Refusal. The Buyer shall have the right of first refusal with respect to any future financings undertaken by the Company. Notwithstanding anything to contrary contained in paragraph 10 (g) above, the Buyer shall also have the right to assign this right of first refusal, or a participation interested thereof, to any co-investor that has participated in this financing.

[REMAINDER PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF, The Buyer and the Company have caused their respective signature page to this Securities Purchase Agreement to be duly executed as of the date first written above.

| COMPANY: | ||

| WESTPORT ENERGY HOLDINGS INC. | ||

| By: | ||

| Name: | Stephen Schoepfer | |

| Title: | Chief Executive Officer | |

IN WITNESS WHEREOF, The Buyer and the Company have caused their respective signature page to this Securities Purchase Agreement to be duly executed as of the date first written above.

| BUYERS: | ||

| YA GLOBAL INVESTMENTS, L.P. | ||

| By: | Yorkville Advisors, LLC | |

| Its: | Investment Manager | |

| By: | ||

| Name: | Mark Angelo | |

| Its: | Portfolio Manager | |

LIST OF EXHIBITS:

Exhibit A – Form of Convertible Debentures

Exhibit B – Schedule of Existing Financing Documents

Exhibit C – Approved Budget

Exhibit D – The Allocated Wells

Exhibit E – Form of Royalty Agreement

Exhibit F – Company Wire Instructions

Exhibit G – Disclosure Schedule

EXHIBIT A

FORM OF CONVERTIBLE DEBENTURES

See Exhibit 10.1 of this Current Report on Form 8-K

EXHIBIT B

SCHEDULE OF EXISTING FINANCING DOCUMENTS

EXISTING FINANCING DOCUMENTS

DEBENTURES

| 1. | Secured Convertible Debenture dated February 8, 2008 issued by the Company to the Buyer in the original principal amount of $3,050,369 (Debenture No. CCP-4); | |

| 2. | Secured Convertible Debenture dated December 12, 2005 issued by the Company to the Buyer in the original principal amount of $1,475,000 (Debenture No. CCP-3); | |

| 3. | Secured Convertible Debenture dated June 26, 2007 issued by the Company to the Buyer in the original principal amount of $570,000 (Debenture No. GSHF-3-1); | |

| 4. | Secured Convertible Debenture dated June 30, 2009 issued by the Company to the Buyer in the original principal amount of $4,000,000 (Debenture No. CICS-5); | |

| 5. | Secured Convertible Debenture dated August 17, 2010 issued by the Company to the Buyer in the original principal amount of $650,000 (Debenture No. CICS-7); | |

| 6. | Secured Convertible Debenture dated May 26, 2011 issued by the Company to the Buyer in the original principal amount of $120,000 (Debenture No. CICS-8); | |

| 7. | Secured Convertible Debenture dated December 6, 2011 issued by the Company to the Buyer in the original principal amount of $910,000 (Debenture No. CICS-9); | |

| 8. | Secured Convertible Debenture dated December 6, 2011 issued by the Company to the Buyer in the original principal amount of $172,411 (Debenture No. CICS-10); | |

| 9. | Secured Convertible Debenture dated May 31, 2012 issued by the Company to the Buyer in the original principal amount of $200,000 (Debenture No. CICS-11); | |

| 10. | Secured Convertible Debenture dated August 13, 2012 issued by the Company to the Buyer in the original principal amount of $25,000 (Debenture No. CICS-12); | |

| 11. | Secured Convertible Debenture dated August 29, 2012 issued by the Company to the Buyer in the original principal amount of $25,000 (Debenture No. CICS-13); | |

| 12. | Secured Convertible Debenture dated September 7, 2012 issued by the Company to the Buyer in the original principal amount of $50,000 (Debenture No. CICS-14); | |

| 13. | Secured Convertible Debenture dated October 2, 2012 issued by the Company to the Buyer in the original principal amount of $50,000 (Debenture No. CICS-15); |

| 14. | Secured Convertible Debenture dated November 6, 2012 issued by the Company to the Buyer in the original principal amount of $75,000 (Debenture No. CICS-16); | |

| 15. | Secured Convertible Debenture dated December 1, 2012 issued by the Company to the Buyer in the original principal amount of $100,000 (Debenture No. CICS-17); | |

| 16. | Secured Convertible Debenture dated January 15, 2013 issued by the Company to the Buyer in the original principal amount of $50,000 (Debenture No. CICS-18); | |

| 17. | Secured Convertible Debenture dated February 12, 2013 issued by the Company to the Buyer in the original principal amount of $50,000 (Debenture No. CICS-19); | |

| 18. | Secured Convertible Debenture dated March 21, 2013 issued by the Company to the Buyer in the original principal amount of $50,000 (Debenture No. CICS-20); | |

| 19. | Secured Convertible Debenture dated May 14, 2013 issued by the Company to the Buyer in the original principal amount of $25,000 (Debenture No. CICS-21); | |

| 20. | Secured Convertible Debenture dated June 1, 2013 issued by the Company to the Buyer in the original principal amount of $200,000 (Debenture No. CICS-22); | |

| 21. | Secured Convertible Debenture dated June 14, 2013 issued by the Company to the Buyer in the original principal amount of $25,000 (Debenture No. CICS-23); | |

| 22. | Secured Convertible Debenture dated July 12, 2013 issued by the Company to the Buyer in the original principal amount of $25,000 (Debenture No. CICS-24); | |

| 23. | Secured Convertible Debenture dated August 20, 2013 issued by the Company to the Buyer in the original principal amount of $100,000 (Debenture No. CICS-25); | |

| 24. | Secured Convertible Debenture dated November 1, 2013 issued by the Company to the Buyer in the original principal amount of $50,000 (Debenture No. CICS-26); and | |

| 25. | Secured Convertible Debenture dated December 19, 2013 issued by the Company to the Buyer in the original principal amount of $50,000 (Debenture No. CICS-27). |

SECURITIES PURCHASE AGREEMENTS

| 26. | Securities Purchase Agreement dated as of August 17, 2010 entered into by and between the Company and the Buyer, as amended; |

SECURITY DOCUMENTS

| 27. | Security Agreement dated as of August 17, 2010 by and among the Company and each subsidiary or affiliate of the Company listed on Schedule 1 attached thereto, in favor of the Buyer; | |

| 28. | Guaranty Agreement dated as of August 17, 2010 by and among each of the entities listed on Schedule 1 attached thereto, in favor of the Buyer; | |

| 29. | Pledge and Escrow Agreement dated as of August 17, 2010 by and among by Four Sea-Sons LLC a Delaware limited liability company, Westport Energy, Acquisition, Inc., a Delaware corporation, the Company, and each subsidiary, direct and indirect, of the listed on Schedule I attached thereto or joined thereto in the future in favor of the Buyer; | |

| 30. | Leasehold Deed of Trust and Security Agreement dated August 17, 2010 by an among the Company and Chicago Title Insurance Company, for the benefit of the Buyer; | |

| 31. | Intercreditor and Subordination Agreement dated August 17, 2010 by and between the Buyer, New Earthshell Corporation, and acknowledged and agreed to by the Company, Westport Acquisition, Inc., Westport Energy, LLC, and Four Sea-Sons LLC; | |

| 32. | Ratification and Amendment Agreement dated August 17, 2010 by and among the Buyer and the parties listed on Schedule 1 attached thereto; | |

| 33. | Guaranty Agreement dated as of August 17, 2010 given by Viridis Capital LLC in favor of the Buyer; | |

| 34. | Security Agreement dated as of August 17, 2010 given by Viridis Capital LLC in favor of the Buyer; and | |

| 35. | Subordination Agreement dated August 17, 2010 by and among the Buyer, YA Corn Oil Systems, LLC, the Company and Greenshift Corporation. |

EXHIBIT C

APPROVED BUDGET

EXHIBIT D

THE ALLOCATED WELLS

allocated wells

EXHIBIT E

ROYALTY AGREEMENT

See Exhibit 10.3 of this Current Report on Form 8-K

EXHIBIT F

COMPANY’S WIRE INSTRUCTIONS

WIRING INSTRUCTIONS

| Bank: | Umpqua Bank |

| 479 N. Central Blvd. | |

| Coquille, OR 97423 | |

| Routing #: | 123205054 |

| Account Name: | Westport Energy, LLC (*) |

| Account #: |

* Note that the Beneficiary for this wire is Westport Energy, LLC rather than Westport Energy Holdings Inc. Westport Energy, LLC is a wholly owned subsidiary of Westport Energy Holdings Inc.

EXHIBIT G

DISCLOSURE SCHEDULE

EXHIBIT G

DISCLOSURE SCHEDULE

| (g) | 10-K (FY 2012), 10-Q (Q1 FY 2013), 10-Q (Q2 FY 2013), 10-Q (Q3 FY 2013) and 8-Ks in connection with Convertible Debentures CICS-20 thru 27. |