Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FNCB Bancorp, Inc. | v411197_8k.htm |

Exhibit 99.1

First National Community Bancorp, Inc. Annual Meeting of Shareholders May 20, 2015 1

Forward - Looking Statements This communication contains “forward - looking statements,” including statements contained in the Company’s filings with the Securities and Exchange Commission (“SEC”), in its reports to shareholders, and in other communications by the Company, which are made in good faith by the Company pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 . These forward - looking statements include statements with respect to the Company’s beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, that are subject to significant risks and uncertainties, and are subje ct to change based on various factors (some of which are beyond the Company’s control). The words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan” and similar expressions are intended to identify for war d - looking statements. The following factors, among others, could cause the Company’s financial performance to differ materiall y from the plans, objectives, expectations, estimates and intentions expressed in such forward - looking statements: the strength of the United States economy in general and the strength of the local economies in the Company’s markets; the effects of, and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Fe der al Reserve System; inflation, interest rate, market and monetary fluctuations; the timely development of and acceptance of new products and services; the ability of the Company to compete with other institutions for business; the composition and concentrations of the Company’s lending risk and the adequacy of the Company’s reserves to manage those risks; the valuation of the Company’s investment securities; the ability of the Company to pay dividends or repurchase common shares; the ability of the Company to retain key personnel; the impact of any pending or threatened litigation against the Company; the marketability of shares of the Company and fluctuations in the value of the Company’s share price; the impact of the Company ’s ability to comply with its regulatory agreements and orders; the effectiveness of the Company’s system of internal controls; the ability of the Company to attract additional capital investment; the impact of changes in financial services’ laws and regula tio ns (including laws concerning capital adequacy, taxes, banking, securities and insurance); the impact of technological changes a nd security risks upon the Company’s information technology systems; changes in consumer spending and saving habits; the nature, extent, and timing of governmental actions and reforms, and the success of the Company at managing the risks involved in the foregoing and other risks and uncertainties, including those detailed in the Company’s filings with the SEC . The Company cautions that the foregoing list of important factors is not all inclusive. Readers are also cautioned not to place undue reliance on any forward - looking statements, which reflect management’s analysis only as of the date of this report, even if subsequently made available by the Company on its website or otherwise. The Company does not undertake to update any forward - looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company to reflect events or circumstances occurring after the date of this report. 2

Welcome FNCB Shareholders 3 Steven R. Tokach President & Chief Executive Officer

Introduction of Meeting Secretary Mary Griffin Cummings General Counsel 4

Annual Meeting Proposa ls 5 2015 Annual Meeting Proposals The Board recommends that you vote: 1. To elect four (4) directors to the Board of Directors for terms expiring in 2018 and until their successors are elected Nominees for Class B Directors - Term Expires 2018 William G. Bracey Louis A. Denaples, Jr. Thomas J. Melone Steven R. Tokach FOR FOR FOR FOR 2. To approve the compensation of the Company’s named executive officers (referred to as the Company’s 2015 say - on - pay proposal) FOR 3. To ratify the appointment of Baker Tilly Virchow Krause, LLP as the Company’s independent registered public accounting firm for the year ended December 31, 2015 FOR

First National Community Bancorp, Inc. Annual Meeting Management Presentation May 20, 2015 Steven R. Tokach, President & CEO 6

Productive and Successful Year 7 • Termination of Consent Order on March 25, 2015 • Resolution of legal and regulatory matters • Cure and payment of deferred interest on trust preferred securities • Stock trading moved to bank industry specific OTCQX marketplace to increase visibility and liquidity • Improved balance sheet and capital position • Continued and significant ongoing improvement in asset quality • Best financial results since 2008

8 James M. Bone, Jr. CPA Executive Vice President & Chief Financial Officer Financial Review

9 Profitability Review $(13,711) $6,382 $13,420 $(20,000) $(15,000) $(10,000) $(5,000) $- $5,000 $10,000 $15,000 2012 2013 2014 $ in thousands Annual Net Income (Loss) $3,513 $3,475 $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 Q1 2014 Q1 2015 $ in thousands Q1 2015 and Q1 2014 Net Income o 2014 Net income of $13.4 million increased 110.3% over 2013 o Highest profitability since December 31, 2008 o Return on Average Assets was 1.38% in 2014 and 0.67% in 2013 o Q1 2015 profitability (March 31, 2015) similar to Q1 2014 o Continued growth in core profitability

10 Net Loan Growth $579,396 $629,880 $658,747 $661,221 $520,000 $540,000 $560,000 $580,000 $600,000 $620,000 $640,000 $660,000 $680,000 2012 2013 2014 3/31/2015 $ in thousands Net Loans o 4.6% Net Loan growth in 2014 leading to 2.9% Net Interest Income Growth o $81.8 million loan growth from December 2012 to March 2015

11 Asset Quality 1.77% 1.60% 1.44% 1.44% 3.10% 2.18% 1.72% 1.63% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 2012 2013 2014 3/31/2015 ALLL / Total Loans (%) National Peer FNCB $9,709 $6,375 $5,522 $5,184 $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 2012 2013 2014 3/31/2015 $ in thousands Non - Performing Loans 2.13% 1.54% 1.21% 1.10% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 2012 2013 2014 3/31/2015 Total Delinquencies / Total Loans (%) o Non - Performing Loans at lowest levels in 5 years o Asset quality and Loan Loss reserves metrics superior to Uniform Bank Performance Report (UBPR) Peer Banks* * Insured commercial banks having assets between $300 million and $1 billion.

12 Capital Management 11.79% 13.43% 15.42% 15.86% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 2012 2013 2014 3/31/2015 Total Risk - Based Capital Ratio (Bank) 7.20% 8.32% 9.78% 10.45% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 2012 2013 2014 3/31/2015 Tier I Leverage Ratio (Bank) o Strong Capital Ratios o Highest Bank capital levels since December 31, 2008 o Basel III implemented

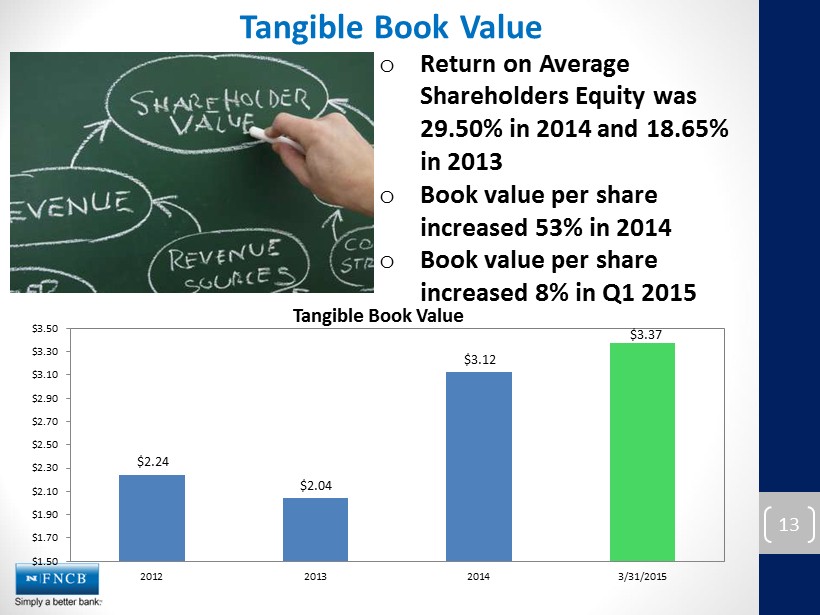

13 Tangible Book Value $2.24 $2.04 $3.12 $3.37 $1.50 $1.70 $1.90 $2.10 $2.30 $2.50 $2.70 $2.90 $3.10 $3.30 $3.50 2012 2013 2014 3/31/2015 Tangible Book Value o Return on Average Shareholders Equity was 29.50% in 2014 and 18.65% in 2013 o Book value per share increased 53% in 2014 o Book value per share increased 8% in Q1 2015

Looking Forward: Well Positioned for the Next Step 14 Jerry A. Champi Chief Operating Officer

Strategic Direction 15

Next Steps • FRB Written Agreement Status • Address balance sheet leverage at Company • Solid and stable asset quality metrics • Increase Market Share and Wallet Share • Experienced and outcome - driven management team and Board 16

Thank You for Attending the 2015 Annual Meeting of Shareholders Management Q&A 17