Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Endo International plc | d928010d8k.htm |

| EX-99.1 - EX-99.1 - Endo International plc | d928010dex991.htm |

Exhibit 99.2

Endo International plc

Par Pharmaceutical

Acquisition

May 18, 2015

©2015 Endo Pharmaceuticals Inc. All rights reserved.

Forward Looking Statements

This presentation contains information relating to the acquisition of Par by Endo that includes or is based on “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act and Canadian securities legislation. These statements include statements regarding the timing and the closing of the transaction, the expected benefits of the transaction, the expected accretion to earnings resulting from the transaction, expected product approvals and Endo’s plans to operate Par. Forward-looking statements include the information concerning our possible or assumed results of operations. We have tried, whenever possible, to identify such statements by words such as “believes,”

“expects,” “anticipates,” “intends,” “estimates,” “plan,” “projected,” “forecast,” “will,” “may” or similar expressions. Wehave based these forward-looking statements on our current expectations of future events. Because these statements reflect our current views concerning future events, these forward-looking statements involve risks and uncertainties. If underlying assumptions prove inaccurate or unknown, or unknown risks or uncertainties materialize, actual results could differ material from those expressed in the forward-looking statements contained in this presentation. Risks and uncertainties include, among other things, uncertainties as to the timing of the acquisition; the possibility that various closing conditions to the transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay, or refuse to grant approval for the consummation of the transaction; that the FDA or other regulatory authorities do not approve any product(s) in the manner desired by Endo on a timely basis, or at all; that there is a material adverse change to Par; that the integration of Par business into Endo is not as successful as expected; the failure of Endo to achieve the expected financial and commercial results from the transaction; other business effects, including effects of industry, economic or political conditions outside Endo’s control; transaction costs; the outcome of litigation, actual or contingent liabilities; as well as other cautionary statements contained elsewhere herein and in Endo’s periodic reports filed with the Securities and Exchange Commission (SEC) and with securities regulators in Canada on the System for Electronic Document Analysis and Retrieval (SEDAR), including current reports on Form 8-K, quarterly reports on Form 10-Q and annual reports on Form 10-K. We do not undertake any obligation to update our forward-looking statements after the date of this presentation for any reason, even if new information becomes available or other events occur in the future, except as may be required under applicable securities law. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider this to be a complete discussion of all potential risks or uncertainties.

©2015 Endo Pharmaceuticals Inc. All rights reserved.

1

Non-GAAP Financial Measures

This presentation may refer to non-GAAP financial measures, including EBITDA and adjusted gross margin, which are financial measures that are not prepared in conformity with accounting principles generally accepted in the United States (GAAP). We define adjusted gross margin as total revenues, less cost of revenues, adjusted for amortization of intangible assets; certain upfront and milestone payments to partners; certain cost reduction and integration-related initiatives; inventory step-up recorded as part of our acquisitions; certain excess costs that will be eliminated pursuant to integration plans and certain other items that we believe do not reflect our core operating performance. Our presentation of EBITDA and adjusted gross margin may be different from non-GAAP financial measures presented by other companies. We believe that our presentation of non-GAAP financial measures provides useful supplementary information regarding operational performance because it enhances an investor’s overall understanding of the financial performance and prospects for future core business activities by providing a basis for the comparison of results of core business operations between current, past and future periods. Management uses non-GAAP financial measures to prepare operating budgets and forecasts and to measure performance against those budgets and forecasts on a corporate and segment level. Endo also uses non-GAAP financial measures for evaluating management performance for compensation purposes. Reconciliation of non-GAAP financial measures to the nearest comparable GAAP amounts have been provided within the appendix at the end of this presentation.

Additional Information

This presentation is provided for informational purposes only and is neither an offer to purchase nor a solicitation of an of fer to sell shares of Endo. Endo and Par shareholders should read any filings made by Endo with the SEC in connection with the proposed combination, as they will contain important information. Those documents, if and when filed, as well as Endo’s other public filings with the SEC, may be obtained without charge at the SEC’s website at www.sec.gov and at Endo’s website at endo.com. 2

©2015 Endo Pharmaceuticals Inc. All rights reserved.

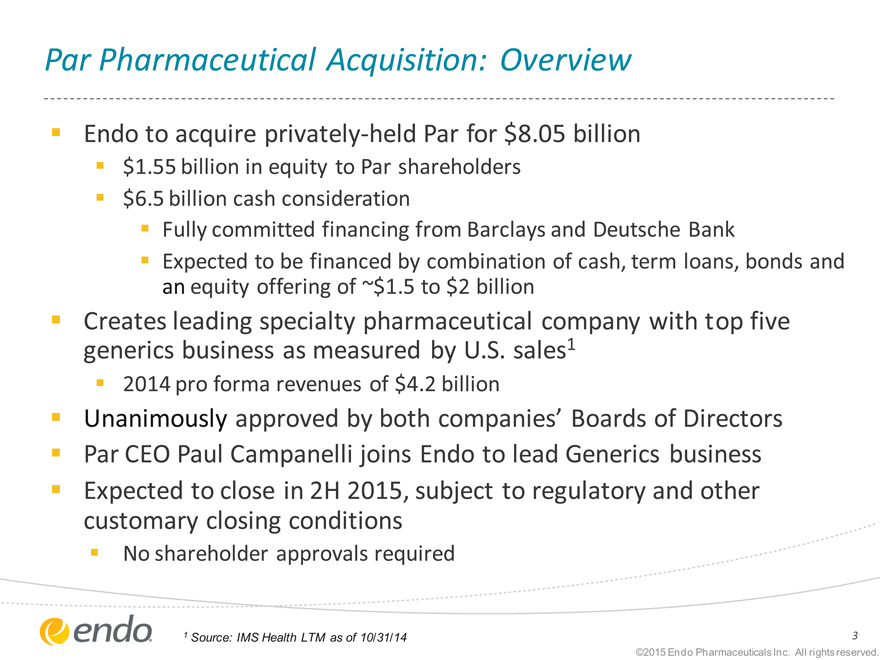

Par Pharmaceutical Acquisition: Overview

Endo to acquire privately-held Par for $8.05 billion

$1.55 billion in equity to Par shareholders

$6.5 billion cash consideration

Fully committed financing from Barclays and Deutsche Bank

Expected to be financed by combination of cash, term loans, bonds and an equity offering of ~$1.5 to $2 billion

Creates leading specialty pharmaceutical company with top five generics business as measured by U.S. sales1

2014 pro forma revenues of $4.2 billion

Unanimously approved by both companies’ Boards of Directors

Par CEO Paul Campanelli joins Endo to lead Generics business

Expected to close in 2H 2015, subject to regulatory and other customary closing conditions

No shareholder approvals required

1 Source: IMS Health LTM as of 10/31/14

©2015 Endo Pharmaceuticals Inc. All rights reserved.

3

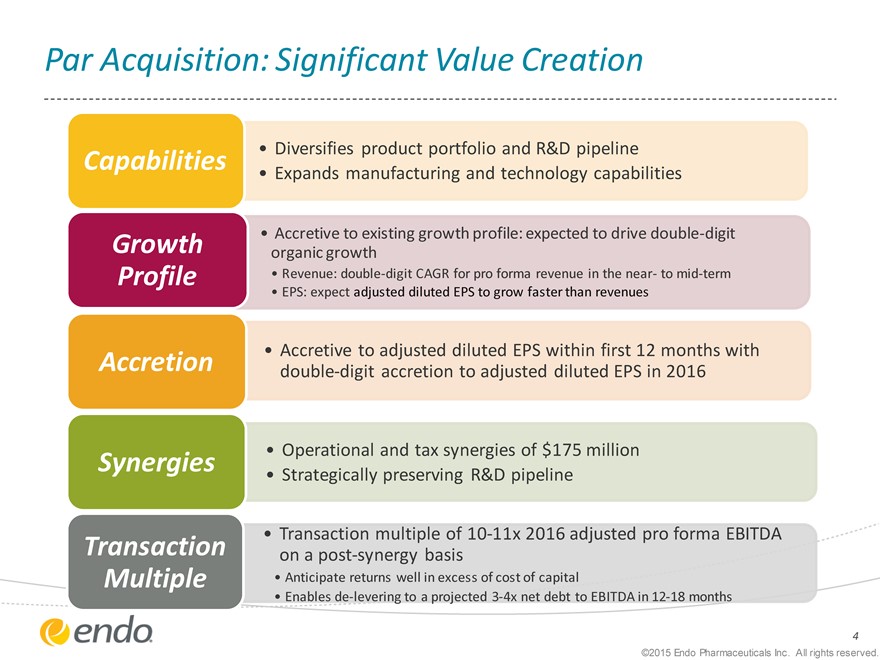

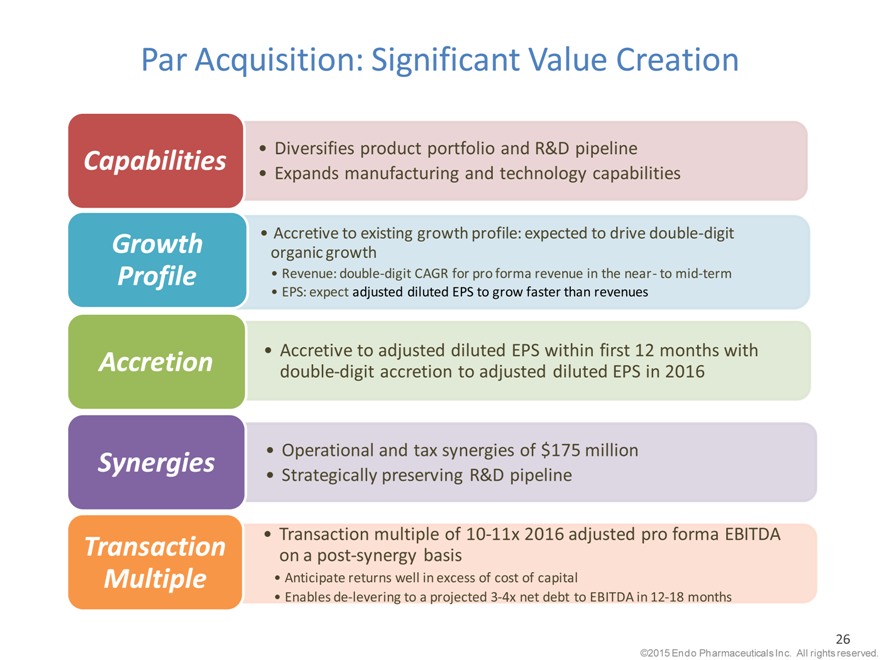

Par Acquisition: Significant Value Creation

• Diversifies product portfolio and R&D pipeline

Capabilities

• Expands manufacturing and technology capabilities

Growth • Accretive to existing growth profile: expected to drive double-digit organic growth

Profile • Revenue: double-digit CAGR for pro forma revenue in the near- to mid-term

• EPS: expect adjusted diluted EPS to grow faster than revenues

Accretion • Accretive to adjusted diluted EPS within first 12 months with double-digit accretion to adjusted diluted EPS in 2016

• Operational and tax synergies of $175 million

Synergies

• Strategically preserving R&D pipeline

• Transaction multiple of 10-11x 2016 adjusted pro forma EBITDA

Transaction on a post-synergy basis

Multiple • Anticipate returns well in excess of cost of capital

• Enables de-levering to a projected 3-4x net debt to EBITDA in 12-18 months

4

©2015 Endo Pharmaceuticals Inc. All rights reserved.

Compelling Strategic & Financial Rationale

Strategically expands product portfolio, R&D pipeline, capabilities and long-term growth drivers

Adds extensive range of dosage forms and delivery systems Focus on specialized, market leading products

Designed to accelerate Endo growth:

Double-digit revenue growth in mid-term, accretive to adjusted diluted EPS, meaningful synergies, increased generics adjusted gross margins Strong R&D pipeline capable of fueling long-term organic growth

Drives strategic expansion of overall corporate profile, scope, and size, establishing a powerful platform for future M&A

Strong cash flow expected to lead to rapid de-levering back to 3-4x net debt to EBITDA in 12-18 months

Aligned with Endo’s strategy of pursuing accretive, value-creating growth opportunities

Creates shareholder value and drives benefits for patients & customers

5

©2015 Endo Pharmaceuticals Inc. All rights reserved.

Transaction Aligns with Endo’s Strategic Direction

Build a leading global specialty pharmaceutical company

Focus on maximizing the value of each of our core businesses

Participate in specialty areas offering above average growth and favorable margins

Transform operating model to maximize growth potential and cash flow generation

Continue our commitment to serving our patients & customers

Improving lives while creating value

6

@2015 Endo Pharmaceuticals Inc. All rights reserved.

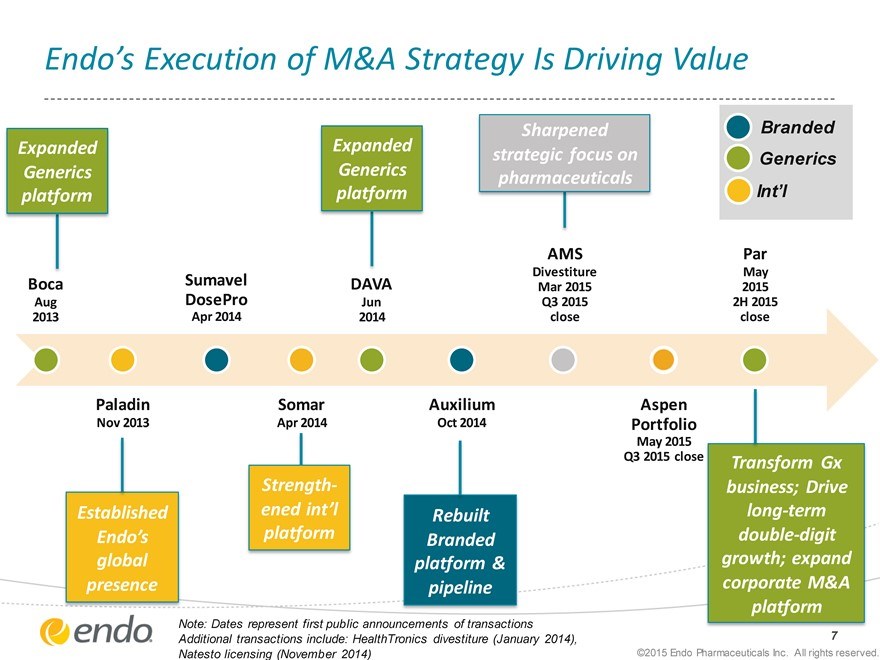

Endo’s Execution of M&A Strategy Is Driving Value

Expanded Generics platform

Expanded Generics platform

Sharpened strategic focus on pharmaceuticals

Branded Generics

Int’l

Boca

Aug 2013

Sumavel DosePro

Apr 2014

DAVA

Jun 2014

AMS

Divestiture Mar 2015 Q3 2015 close

Par

May 2015

2H 2015 close

Paladin

Nov 2013

Established

Endo’s global presence

Somar

Apr 2014

Strengthened int’l platform

Auxilium

Oct 2014

Rebuilt Branded platform & pipeline

Aspen Portfolio

May 2015 Q3 2015 close

Transform Gx business; Drive long-term double-digit growth; expand corporate M&A platform

Note: Dates represent first public announcements of transactions

Additional transactions include: HealthTronics divestiture (January 2014), Natesto licensing (November 2014)

©2015 Endo Pharmaceuticals Inc. All rights reserved.

7

Endo’s Vision: Leading Specialty Pharmaceutical Co.

U.S. Branded

U.S. Generics International Pharmaceuticals

Transaction closed January 2015

8

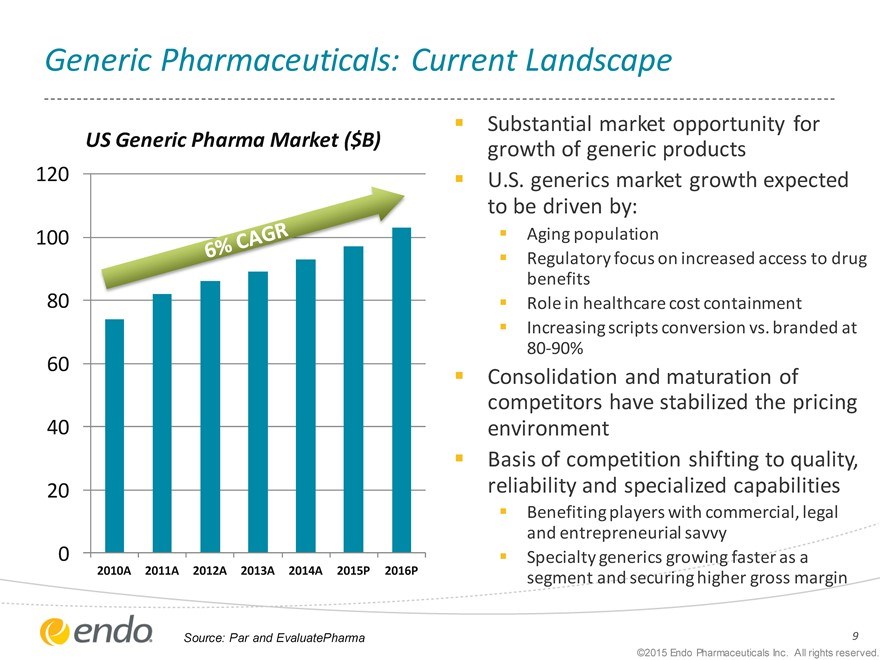

Generic Pharmaceuticals: Current Landscape

US Generic Pharma Market ($B)

120 100 80 60 40 20 0

2010A 2011A 2012A 2013A 2014A 2015P 2016P

Substantial market opportunity for growth of generic products U.S. generics market growth expected to be driven by:

Aging population

Regulatory focus on increased access to drug benefits Role in healthcare cost containment Increasing scripts conversion vs. branded at 80-90%

Consolidation and maturation of competitors have stabilized the pricing environment Basis of competition shifting to quality, reliability and specialized capabilities

Benefiting players with commercial, legal and entrepreneurial savvy Specialty generics growing faster as a segment and securing higher gross margin

Source: Par and EvaluatePharma

9

©2015 Endo Pharmaceuticals Inc. All rights reserved.

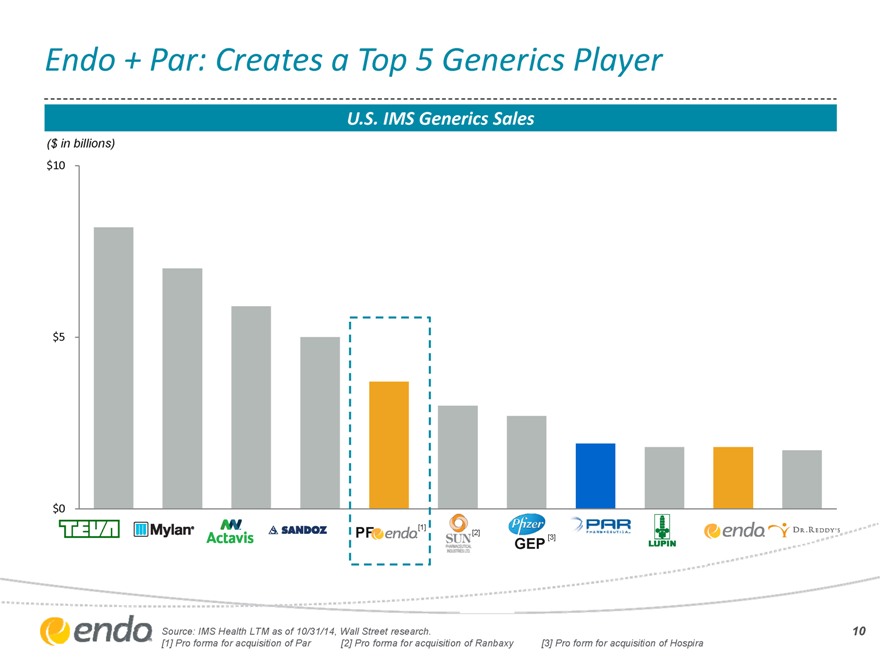

Endo + Par: Creates a Top 5 Generics Player

U.S. IMS Generics Sales

($ in billions) $10

$5

$0

[1]

PF [2]

GEP[3]

Source: IMS Health LTM as of 10/31/14, Wall Street research.

[1] Pro forma for acquisition of Par

[2] Pro forma for acquisition of Ranbaxy

[3] Pro form for acquisition of Hospira

10

About Qualitest

Founded in 1983 Acquired by Endo in 2010 Headquarters: Huntsville, AL

Manufacturing Facilities: Huntsville, AL & Charlotte, NC 1,750 employees

Double digit organic growth performance and outlook

Strong volume growth across balanced portfolio of over 700 products

Controlled substances, specialty generics, Liquids / semi-solids, commodity generics

Pipeline of approximately 90 programs Strong expertise in controlled substances

11

©2015 Endo Pharmaceuticals Inc. All rights reserved.

About Par Pharmaceutical

Founded in 1978

Headquarters: Woodcliff Lake, NJ

Manufacturing Facilities: NY/CT, MI, CA and India 2,000 employees

Privately-held pharmaceutical company operating in the U.S. as two business segments:

Generics : approx. 95 products with 215 pipeline programs

Multiple dosage forms and delivery systems with a focus on high barrier-to-entry products, Paragraph IV, first-to-file and first-to-market opportunities

Branded : 2 approved, marketed products

12

©2015 Endo Pharmaceuticals Inc. All rights reserved.

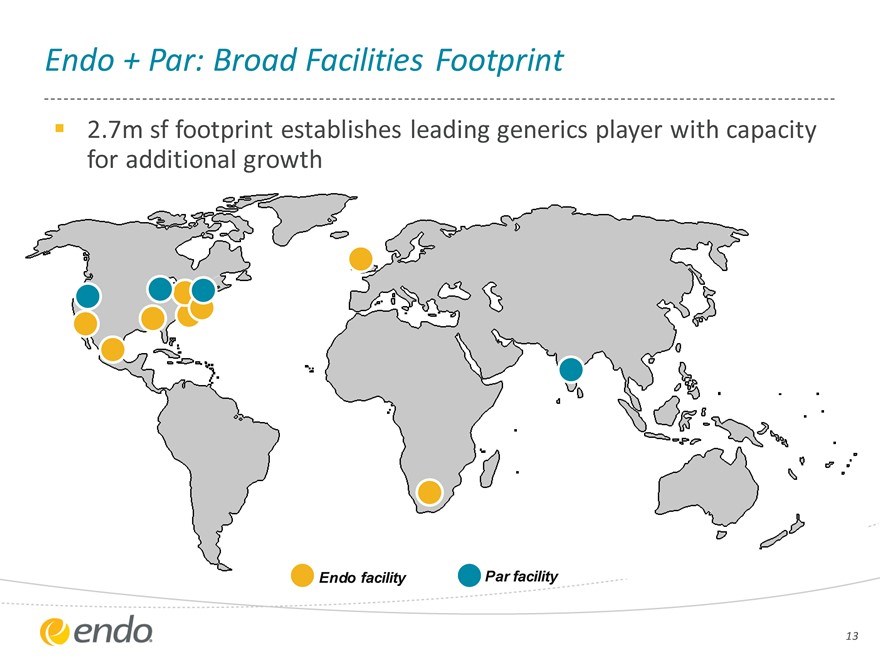

Endo + Par: Broad Facilities Footprint

2.7m sf footprint establishes leading generics player with capacity for additional growth

Endo facility Par facility

13

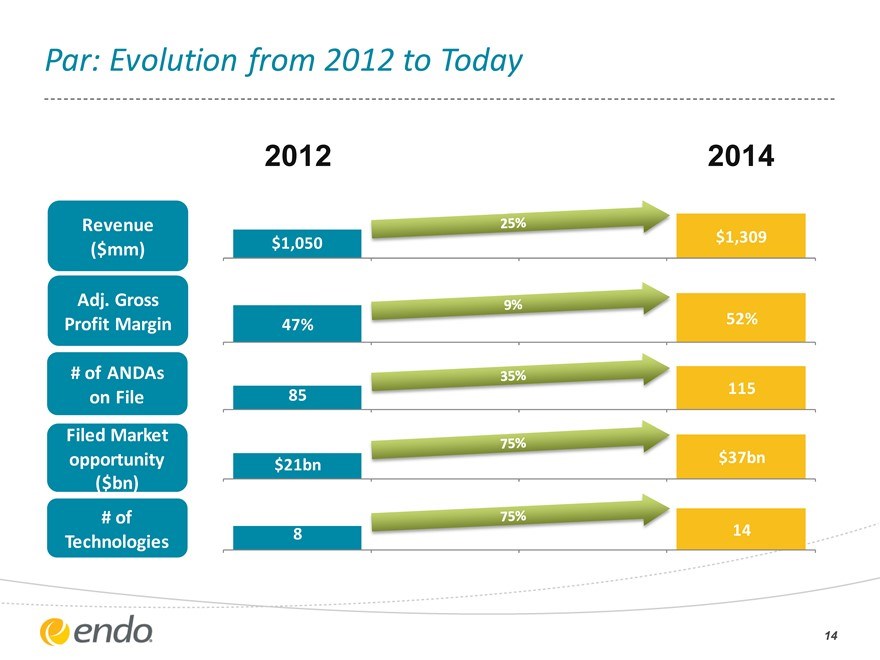

Par: Evolution from 2012 to Today

2012

2014

Revenue ($mm)

Adj. Gross Profit Margin

# of ANDAs on File

Filed Market opportunity ($bn)

# of Technologies

$1,050 47% 85 $21bn

8

$1,309 52% 115 $37bn

14

14

Par Today: High-Value, Long-Term Growth Products

Focus of core business is attractive high-value generics

Paragraph IV, first-to-file and first-to-market opportunities

Specialized products that are difficult to manufacture and/or present complex legal and regulatory challenges, including the generics of:

Lovaza® (complex and difficult-to-source API) Precedex™ (unique dosage form) Luvox CR® (controlled-release product) Focalin XR (controlled substance)

Emphasis on market leading products

Majority of Par’s top 10 generic drugs by revenue are market leaders

Significant number of products are either exclusive or have two or fewer competitors

Current product base is relatively more profitable and longer-lived than competitors

Lovaza® is a registered trademark of GlaxoSmithKline; Precedex™ is a registered trademark of Hospira; Luvox CR® is a

15 registered trademark of Jazz Pharmaceuticals; Focalin XR is a trademark of Novartis AG

Par Snapshot: Extended Release Products Leader

Generics Extended Release (ER) market size: ~$10 billion1

Key market drivers: High barrier to entry Difficult to manufacture

Par is one of the largest suppliers of ER products

13% generics ER market share for Par in 20141

In 2014, Par offered 6 of the top 10 ER molecules, with two more in development1

Key Par ER products and 2014 revenues include:

Buproprion HCl ER - $84m Propafenone ER - $76m Lamotrigine ER - $41m Fluvoxamine ER - $24m

1 IMS data for year ended December 31, 2014

16

Par Snapshot: Injectables Products Driving Growth

Generics injectables market size: ~$20 billion1

Key market drivers: Difficult to manufacture High regulatory scrutiny

Par injectables capabilities rapidly expanding; goal to be leading generic injectables provider within 3-5 years

Par entered the market in 2014 with acquisition of JHP Pharmaceuticals Currently markets 8 generics and 12 branded products 15 products filed and 20 more in development

Par injectables net revenues in 2014: ~$140 million

1 IMS data for year ended December 31, 2014

17

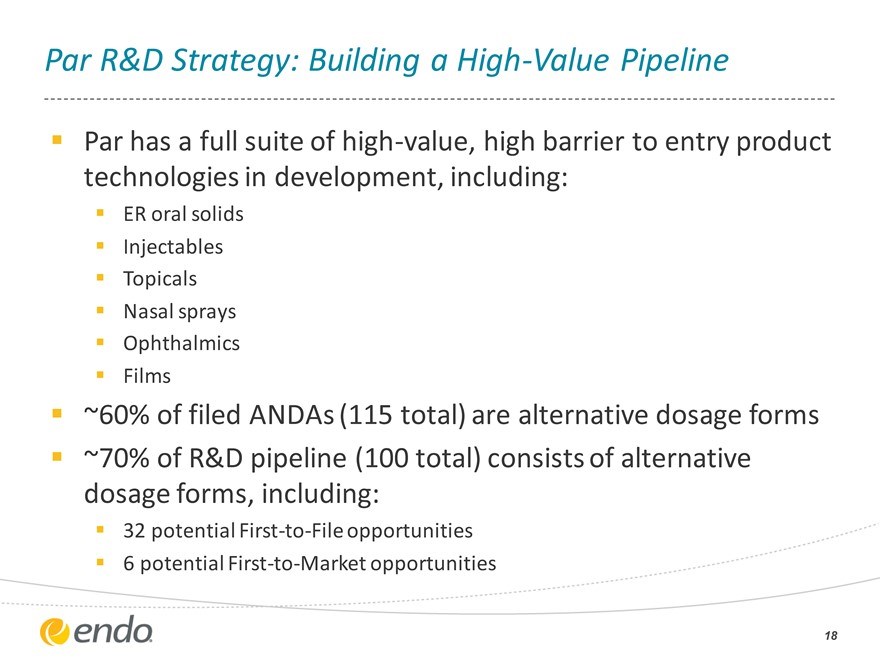

Par R&D Strategy: Building a High-Value Pipeline

Par has a full suite of high-value, high barrier to entry product technologies in development, including:

ER oral solids Injectables Topicals Nasal sprays Ophthalmics Films

~60% of filed ANDAs (115 total) are alternative dosage forms ~70% of R&D pipeline (100 total) consists of alternative dosage forms, including:

32 potential First-to-File opportunities 6 potential First-to-Market opportunities

18

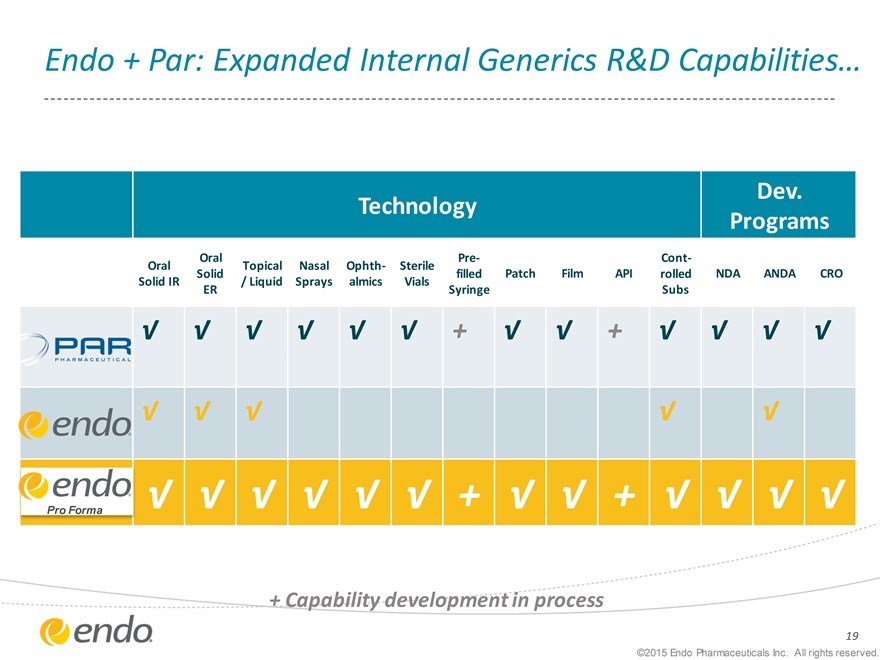

Endo + Par: Expanded Internal Generics R&D Capabilities…

Technology

Dev. Programs

Oral Pre- Cont-Oral Topical Nasal Ophth- Sterile

Solid filled Patch Film API rolled NDA ANDA CRO Solid IR / Liquid Sprays almics Vials ER Syringe Subs

+ Capability development in process

19

©2015 Endo Pharmaceuticals Inc. All rights reserved.

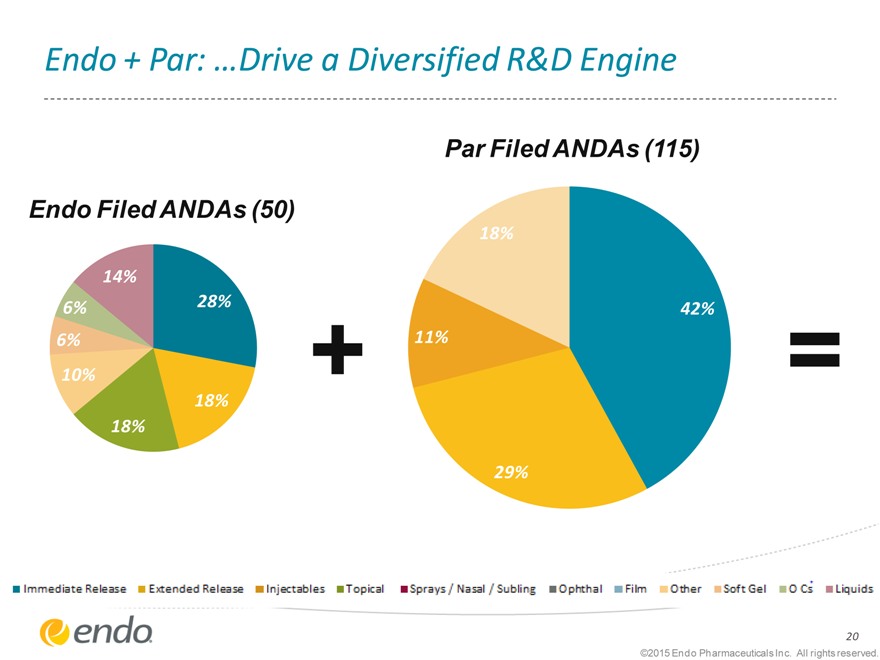

Endo + Par: …Drive a Diversified R&D Engine

Endo Filed ANDAs (50)

Par Filed ANDAs (115)

14%

6% 28%

6%

10%

0 18%

0 0 18%

18%

42%

11%

29%

Immediate Release Extended Release Injectables Topical Sprays/Nasal/Subling Ophthal Film Other SoftGel O C’s Liquids

20

©2015 Endo Pharmaceuticals Inc. All rights reserved.

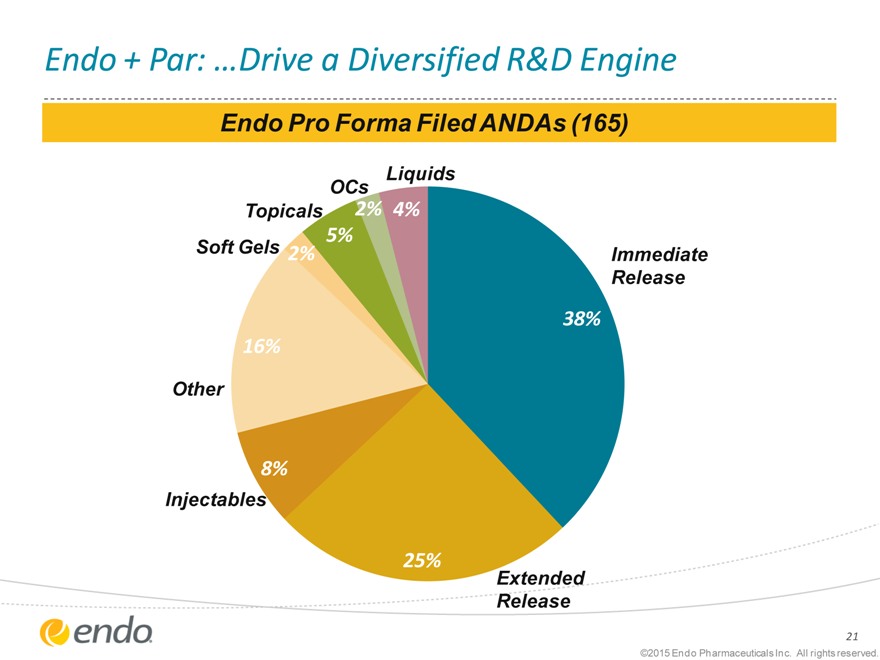

Endo + Par: …Drive a Diversified R&D Engine

Endo Pro Forma Filed ANDAs (165)

Liquids

OCs

Topicals 2% 4%

Soft Gels 5%

0 0 2% Immediate

0% Release

38%

16%

Other

8%

Injectables

25%

Extended

Release

21

©2015 Endo Pharmaceuticals Inc. All rights reserved.

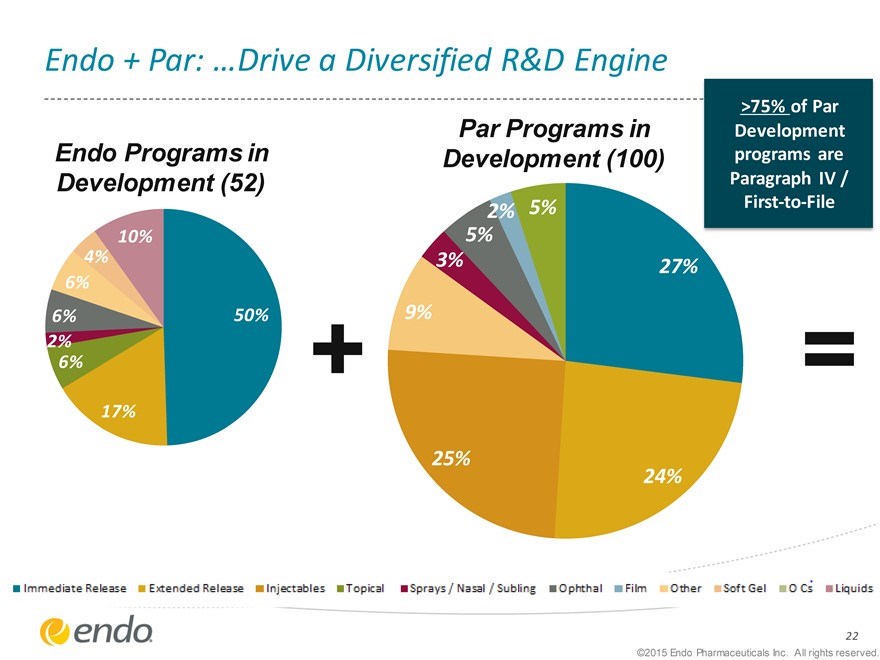

Endo + Par: …Drive a Diversified R&D Engine

Endo Programs in Development (52)

Par Programs in

Development (100)

>75% of Par Development programs are Paragraph IV / First-to-File

10% 4%

0 6%

6% 50% 2% 6%

0

17%

2% 5% 5%

3% 27% 9% 25% 24%

22

©2015 Endo Pharmaceuticals Inc. All rights reserved.

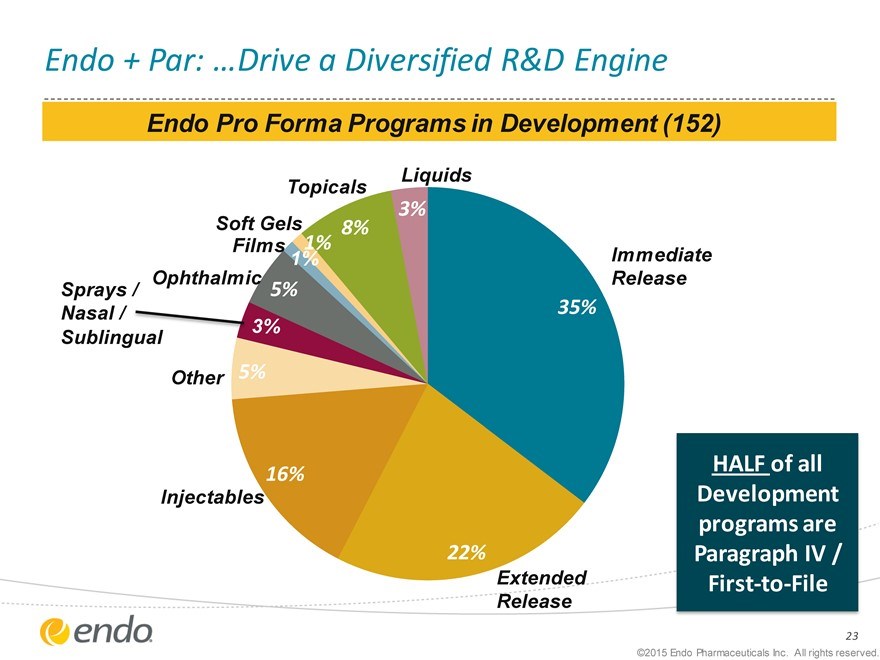

Endo + Par: …Drive a Diversified R&D Engine

Endo Pro Forma Programs in Development (152)

Liquids Topicals

3%

Soft Gels 8%

1%Films 1% 1%

Ophthalmic Release Sprays / 5% Nasal / 35% 3% Sublingual Other 5%

16%

Injectables

22%

Extended Release

HALF of all Development programs are Paragraph IV / First-to-File

23

©2015 Endo Pharmaceuticals Inc. All rights reserved.

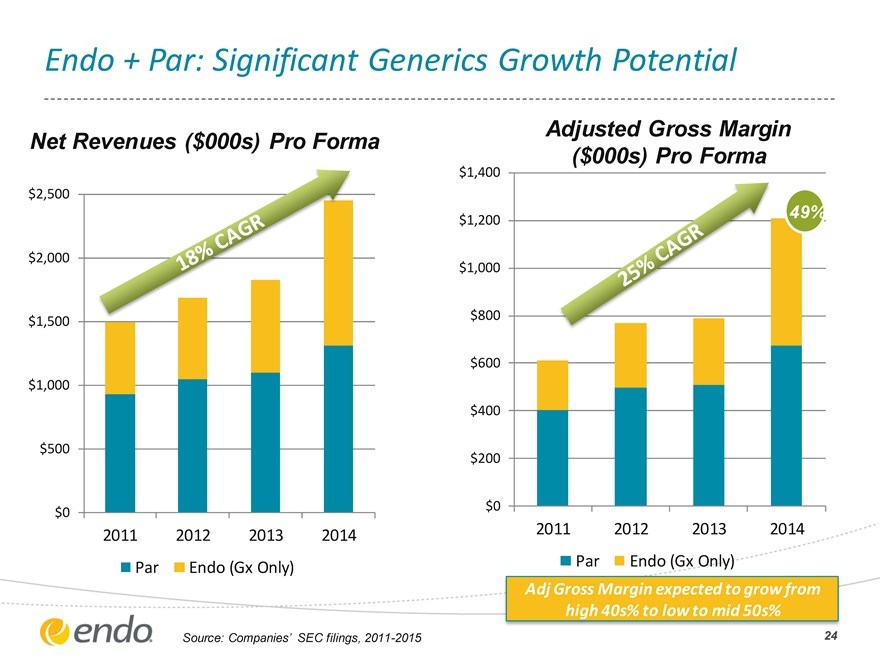

Endo + Par: Significant Generics Growth Potential

Net Revenues ($000s) Pro Forma

$2,500 $2,000 $1,500 $1,000 $500

$0

2011 2012 2013 2014

Par Endo (Gx Only)

Adjusted Gross Margin

($000s) Pro Forma

$1,400

49%

$1,200

$1,000

$800

47%

$600 $400 $200

$0

2011 2012 2013 2014

Par Endo (Gx Only)

Adj Gross Margin expected to grow from high 40s% to low to mid 50s%

Source: Companies’ SEC filings, 2011-2015

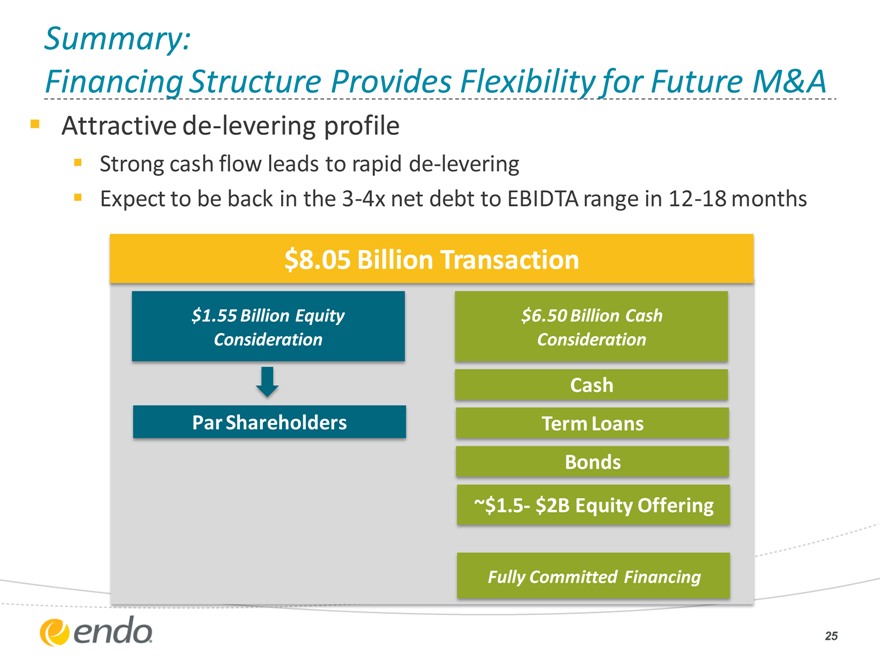

Summary:

Financing Structure Provides Flexibility for Future M&A

Attractive de-levering profile

Strong cash flow leads to rapid de-levering

Expect to be back in the 3-4x net debt to EBIDTA range in 12-18 months

$8.05 Billion Transaction

$1.55 Billion Equity $6.50 Billion Cash

Consideration Consideration

Cash

Par Shareholders Term Loans

Bonds

~$1.5- $2B Equity Offering

Fully Committed Financing

25

Par Acquisition: Significant Value Creation

Capabilities Diversifies product portfolio and R&D pipeline

Expands manufacturing and technology capabilities

Accretive to existing growth profile: expected to drive double-digit

Growth organic growth

Profile Revenue: double-digit CAGR for pro forma revenue in the near - to mid-term

EPS: expect adjusted diluted EPS to grow faster than revenues

Accretive to adjusted diluted EPS within first 12 months with

Accretion double-digit accretion to adjusted diluted EPS in 2016

Synergies Operational and tax synergies of $175 million

Strategically preserving R&D pipeline

Transaction multiple of 10-11x 2016 adjusted pro forma EBITDA

Transaction on a post-synergy basis

Multiple Anticipate returns well in excess of cost of capital

Enables de-levering to a projected 3-4x net debt to EBITDA in 12-18 months

26

©2015 Endo Pharmaceuticals Inc. All rights reserved.

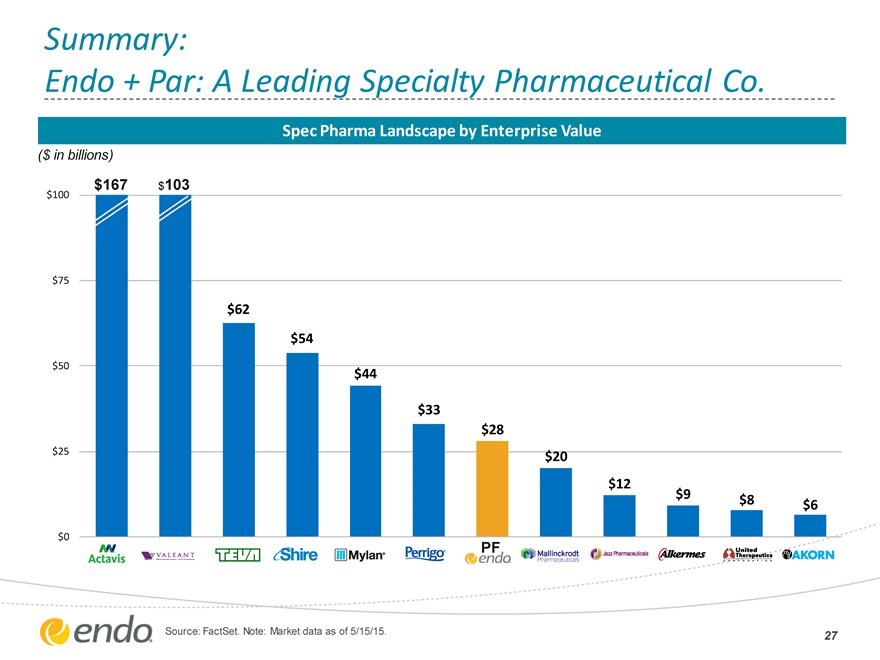

Summary:

Endo + Par: A Leading Specialty Pharmaceutical Co.

Spec Pharma Landscape by Enterprise Value

($ in billions)

$100 $167 $103

$75

$62

$54

$50

$44

$33 $28

$25 $20

$12 $9

$8 $6

$0 PF

Source: FactSet. Note: Market data as of 5/15/15.

27

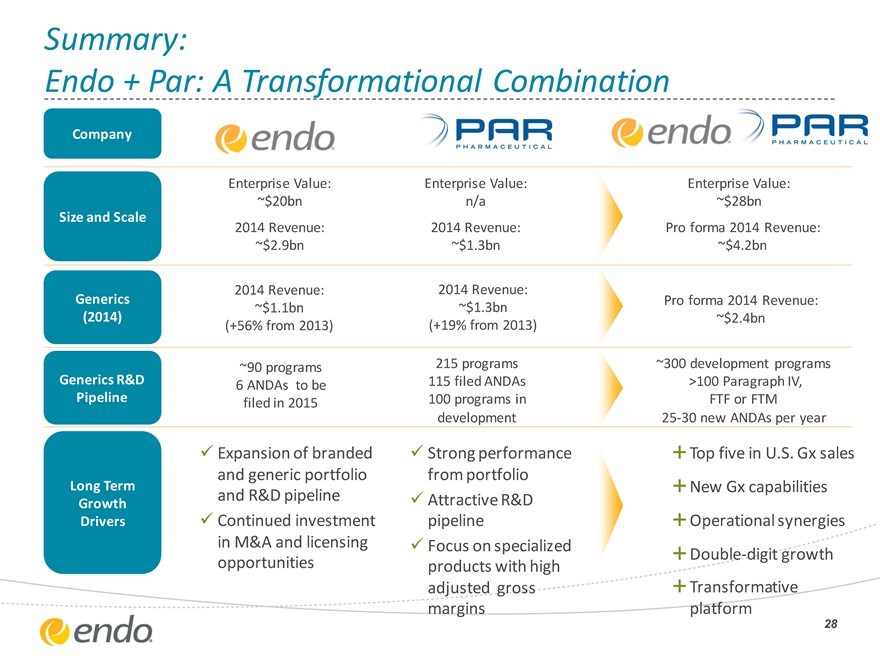

Summary:

Endo + Par: A Transformational Combination

Company

Size and Scale

Generics

(2014)

Generics R&D

Pipeline

Long Term Growth

Drivers

Enterprise Value:

~$20bn 2014 Revenue:

~$2.9bn

2014 Revenue:

~$1.1bn (+56% from 2013)

~90 programs

6 ANDAs to be filed in 2015

Expansion of branded and generic portfolio and R&D pipeline Continued investment in M&A and licensing opportunities

Enterprise Value: n/a 2014 Revenue:

~$1.3bn

2014 Revenue:

~$1.3bn

(+19% from 2013)

215 programs 115 filed ANDAs

100 programs in development

Strong performance from portfolio Attractive R&D pipeline Focus on specialized products with high adjusted gross margins

Enterprise Value:

~$28bn

Pro forma 2014 Revenue:

~$4.2bn

Pro forma 2014 Revenue:

~$2.4bn

~300 development programs >100 Paragraph IV,

FTF or FTM 25-30 new ANDAs per year

Top five in U.S. Gx sales New Gx capabilities

Operational synergies

Double-digit growth

Transformative platform

28

Appendix

©2015 Endo Pharmaceuticals Inc. All rights reserved.

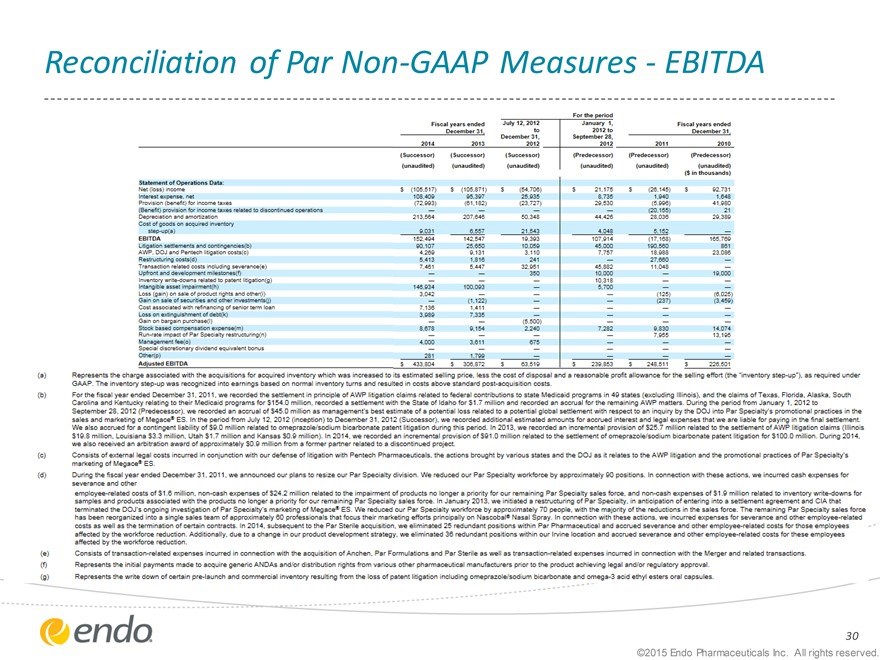

Reconciliation of Par Non-GAAP Measures - EBITDA

30

©2015 Endo Pharmaceuticals Inc. All rights reserved.

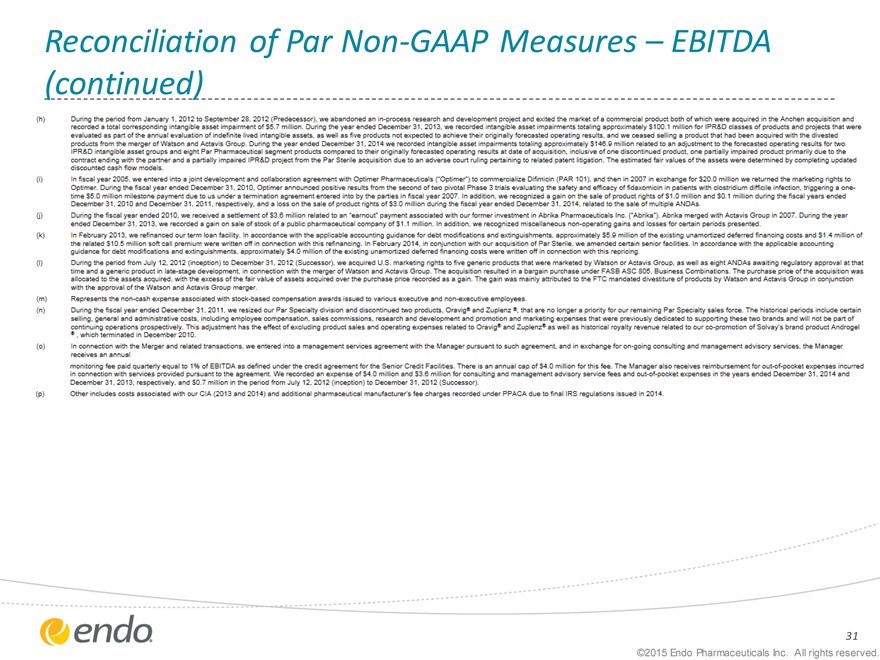

Reconciliation of Par Non-GAAP Measures – EBITDA (continued)

31

©2015 Endo Pharmaceuticals Inc. All rights reserved.

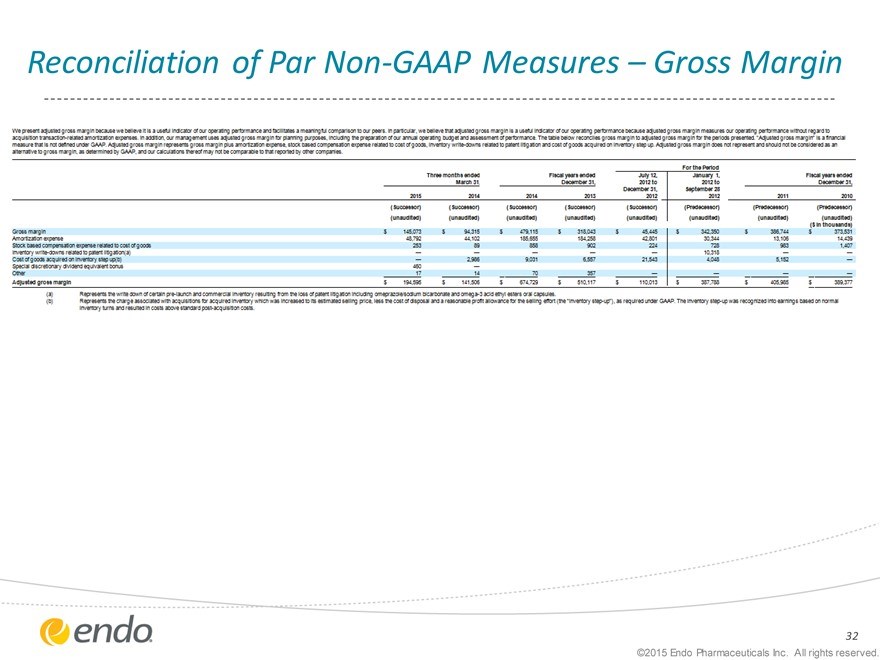

Reconciliation of Par Non-GAAP Measures – Gross Margin

32

©2015 Endo Pharmaceuticals Inc. All rights reserved.

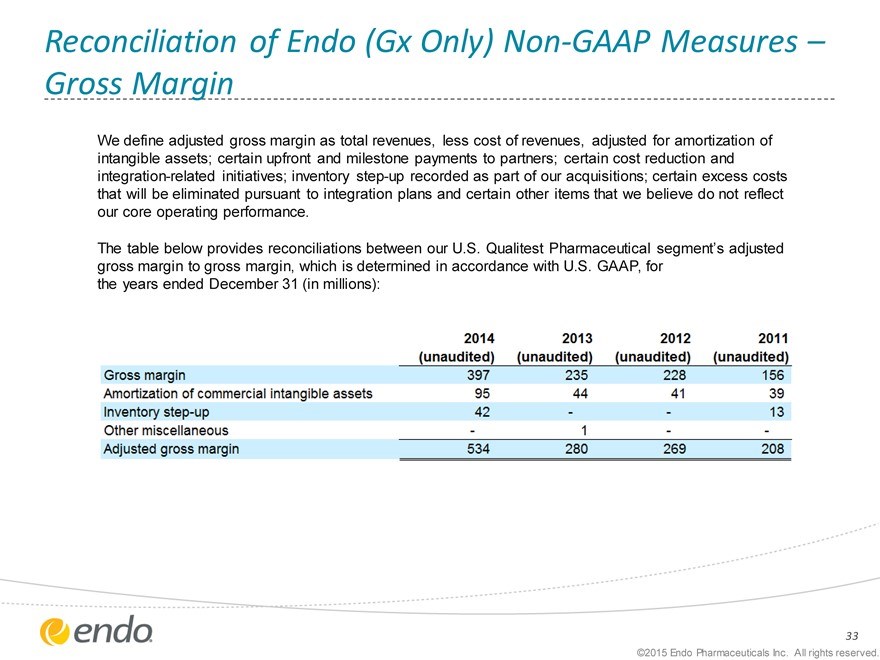

Reconciliation of Endo (Gx Only) Non-GAAP Measures – Gross Margin

We define adjusted gross margin as total revenues, less cost of revenues, adjusted for amortization of intangible assets; certain upfront and milestone payments to partners; certain cost reduction and integration-related initiatives; inventory step-up recorded as part of our acquisitions; certain excess costs that will be eliminated pursuant to integration plans and certain other items that we believe do not reflect our core operating performance.

The table below provides reconciliations between our U.S. Qualitest Pharmaceutical segment’s adjusted gross margin to gross margin, which is determined in accordance with U.S. GAAP, for the years ended December 31 (in millions):

33

©2015 Endo Pharmaceuticals Inc. All rights reserved.

Endo International plc

Par Acquisition

May 18, 2015

©2015 Endo Pharmaceuticals Inc. All rights reserved.