Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MATERION Corp | mtrn_20150512x8kinvestorpr.htm |

Investor Presentation May 2015 EXHIBIT 99.1

These slides contain (and the accompanying oral discussion will contain) “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by these statements, including health issues, litigation and regulation relating to our business, our ability to achieve and/or maintain profitability, significant cyclical fluctuations in our customers’ businesses, competitive substitutes for our products, risks associated with our international operations, including foreign currency rate fluctuations, energy costs and the availability and prices of raw materials, and other factors disclosed in periodic reports filed with the Securities and Exchange Commission. Consequently, these forward-looking statements should be regarded as the Company’s current plans, estimates and beliefs. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. These slides include certain non-GAAP financial measures as defined by the rules and regulations of the Securities and Exchange Commission. A reconciliation of those measures to the most directly comparable GAAP equivalent is provided in the Appendix to this presentation as well as a glossary of non-GAAP definitions. Forward-looking Statements 2

Materion: Who We Are We are a global leader in advanced material solutions and services that enable our customers to excel in their markets while making a material difference in improving our world. 3

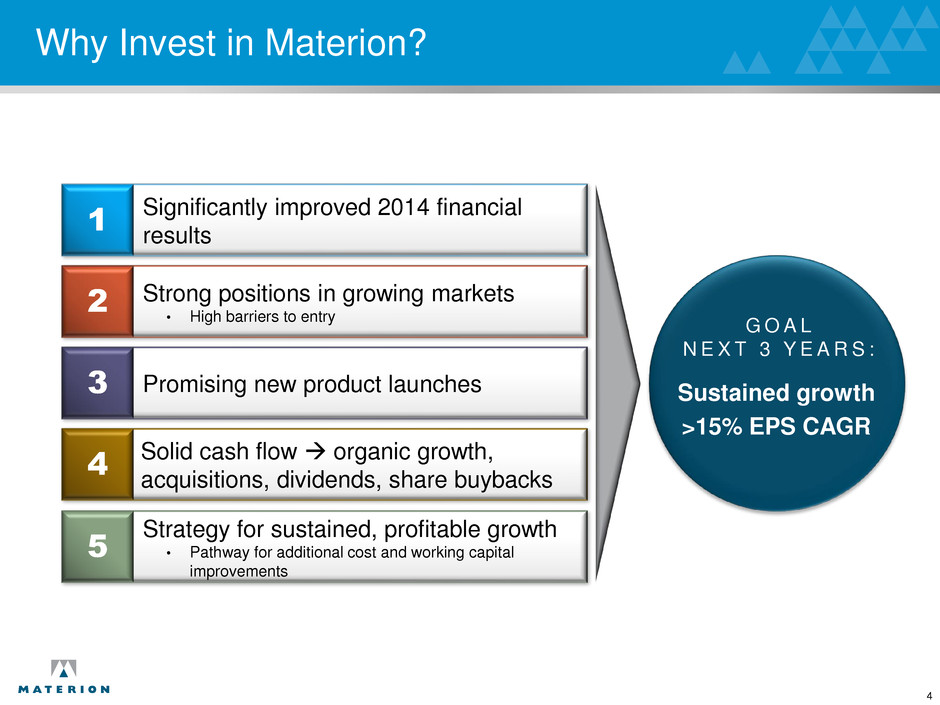

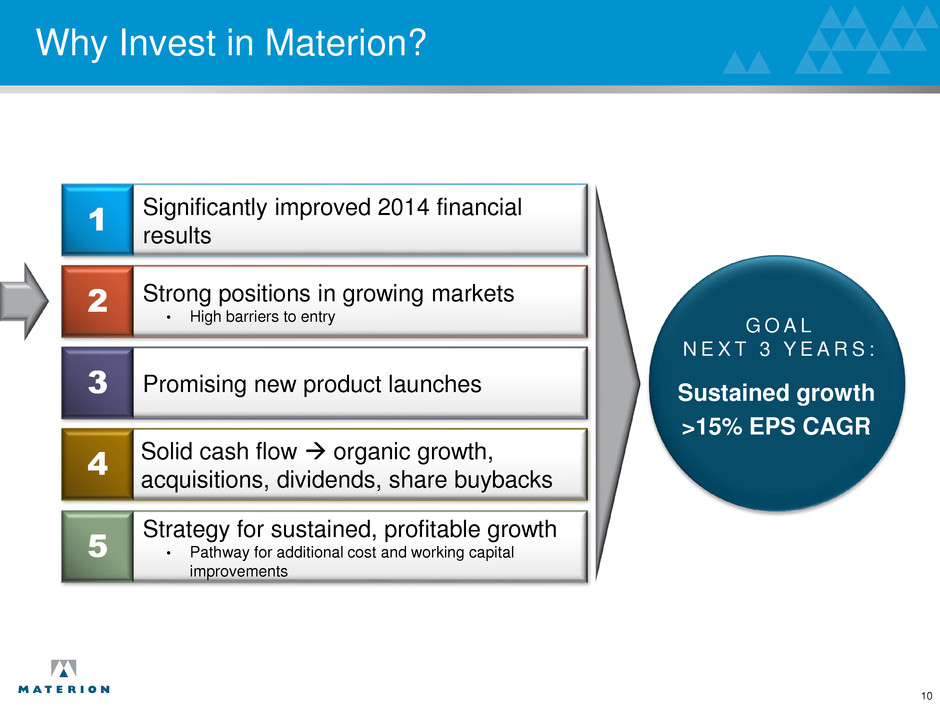

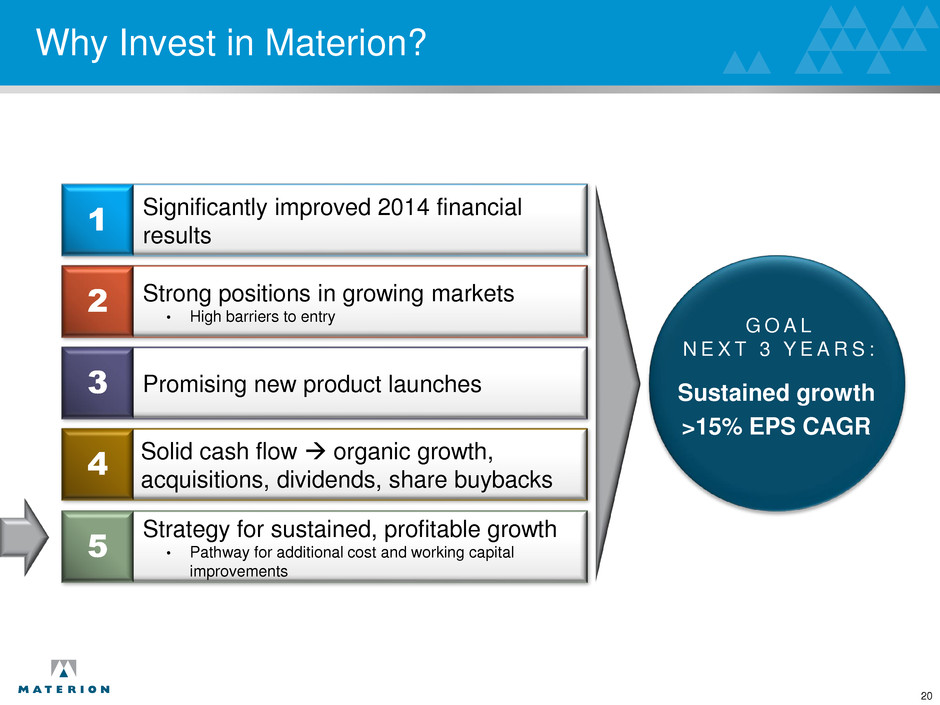

Why Invest in Materion? G O A L N E X T 3 Y E A R S : Sustained growth >15% EPS CAGR Significantly improved 2014 financial results 1 Strategy for sustained, profitable growth • Pathway for additional cost and working capital improvements 5 Strong positions in growing markets • High barriers to entry 2 Promising new product launches 3 4 Solid cash flow organic growth, acquisitions, dividends, share buybacks 4

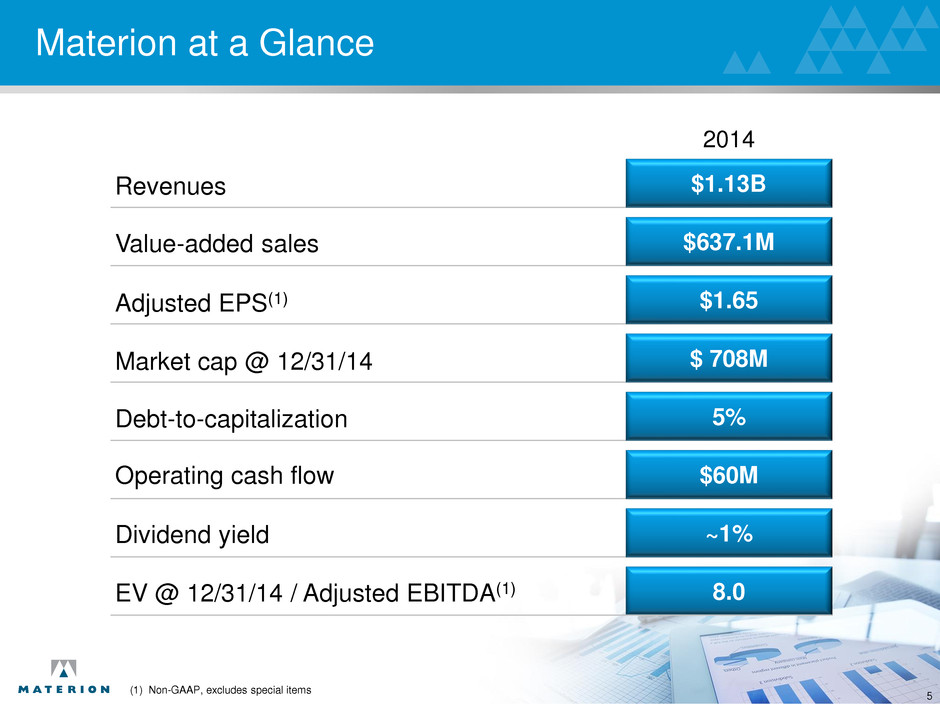

Materion at a Glance 5 Adjusted EPS(1) $1.65 Market cap @ 12/31/14 $ 708M Debt-to-capitalization 5% Operating cash flow $60M Dividend yield ~1% Revenues $1.13B Value-added sales $637.1M 2014 8.0 EV @ 12/31/14 / Adjusted EBITDA(1) (1) Non-GAAP, excludes special items

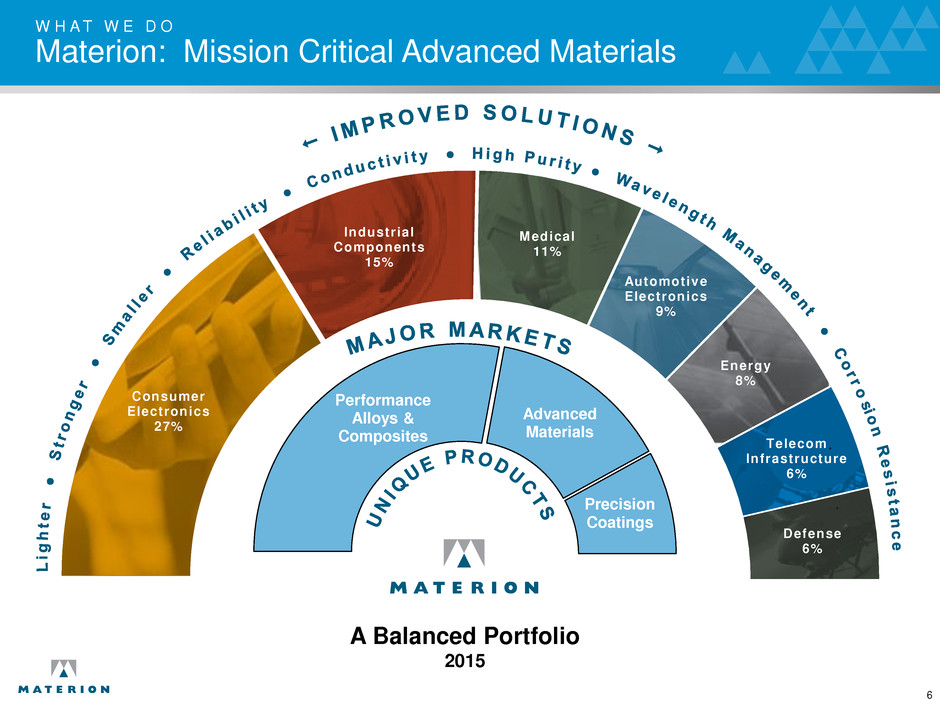

Performance Alloys & Composites Advanced Materials Precision Coatings W H A T W E D O Materion: Mission Critical Advanced Materials A Balanced Portfolio 2015 6 Consumer Electronics 27% Industrial Components 15% Medical 11% Automotive Electronics 9% Energy 8% Telecom Infrastructure 6% Defense 6% 0

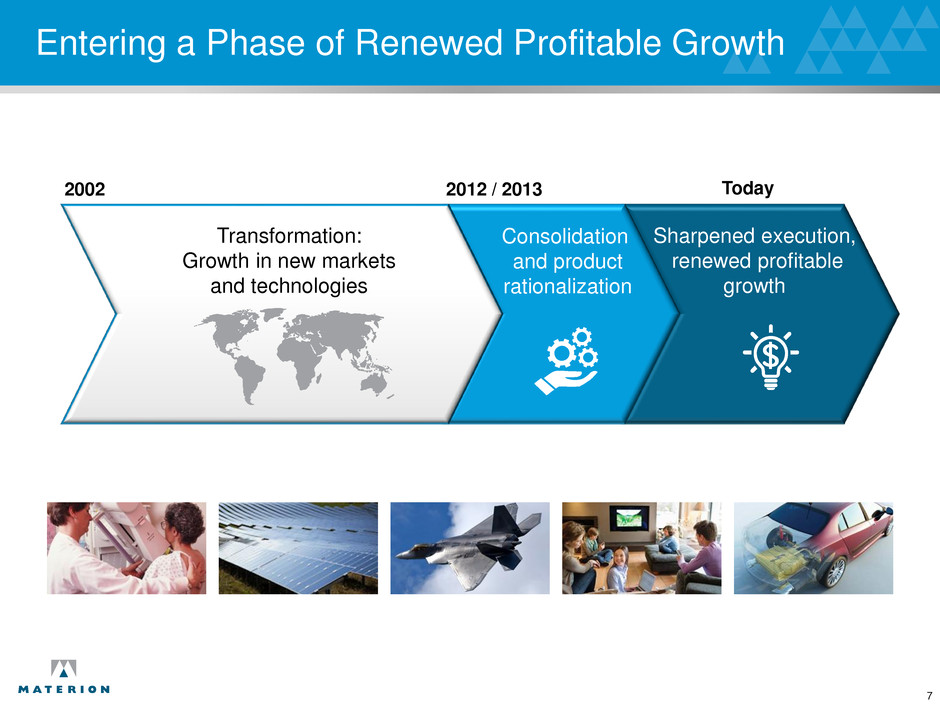

Entering a Phase of Renewed Profitable Growth Consolidation and product rationalization Sharpened execution, renewed profitable growth 2002 2012 / 2013 Today Transformation: Growth in new markets and technologies 7

Materion: The Transformation GDP growth Multiples of GDP Limited markets Broader market opportunities Low margin Higher margin High infrastructure Efficient infrastructure High fixed and working capital Lower capital intensity Slow cash to cash cycle Faster cash cycle Faster growth – Higher margins – Stronger balance sheet 8

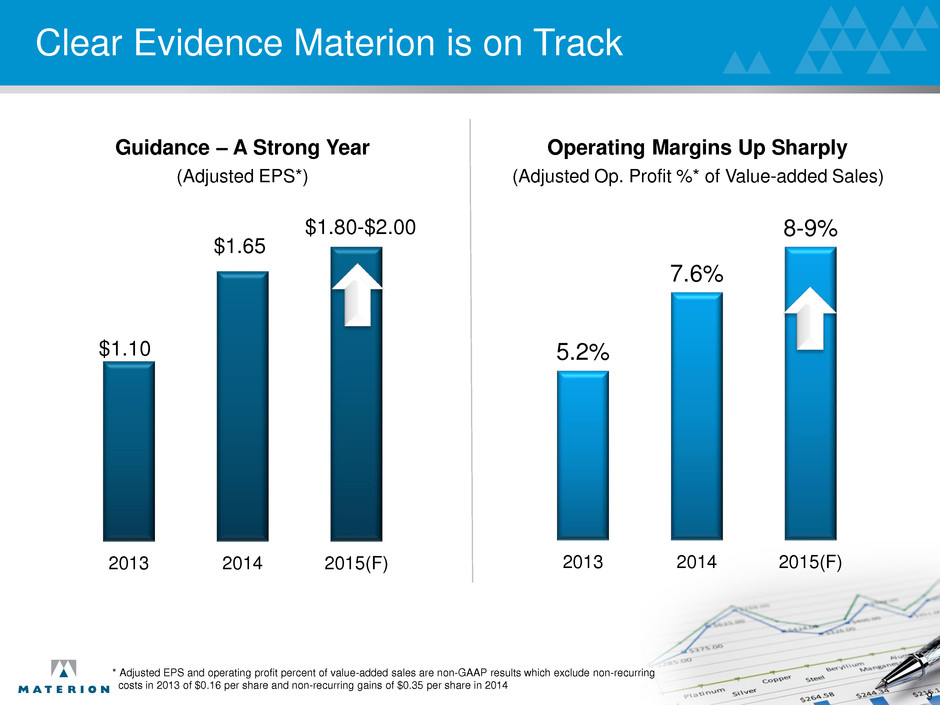

$1.65 2013 2014 2015(F) Clear Evidence Materion is on Track Guidance – A Strong Year Operating Margins Up Sharply (Adjusted EPS*) (Adjusted Op. Profit %* of Value-added Sales) 5.2% 7.6% 8-9% 2013 2014 2015(F) 9 * Adjusted EPS and operating profit percent of value-added sales are non-GAAP results which exclude non-recurring costs in 2013 of $0.16 per share and non-recurring gains of $0.35 per share in 2014 $1.10 $1.80-$2.00

Why Invest in Materion? G O A L N E X T 3 Y E A R S : Sustained growth >15% EPS CAGR Significantly improved 2014 financial results 1 Strategy for sustained, profitable growth • Pathway for additional cost and working capital improvements 5 Strong positions in growing markets • High barriers to entry 2 Promising new product launches 3 4 Solid cash flow organic growth, acquisitions, dividends, share buybacks 10

Secular Market Trends Play to our Strengths Key Trends • Miniaturization of electronics • Additional electronic instruments for autos, aircraft • Advancements in lighting (LED) • Expanding high performance optical device opportunities • Innovation in medical diagnostics • Extraction of oil and gas from previously inaccessible locations • New aircraft builds and retrofits Characteristics of our Materials Conductivity Corrosion resistance Weight savings (lighter) Purity Wavelength management Heat resistance Lubricity Reliability Durability Miniaturization Strength 11

Well-positioned with Leading Global Product Offering Product 2014 Percent of Value-added Sales Expected Annual Growth Next 3-5 Years Leading supplier of beryllium- containing products ~42% Leading supplier of high-purity precious metal for PVD market ~20% Only supplier of unique copper- nickel-tin materials, ToughMet® ~7% Leading supplier of high-end optical coatings ~10% Leading supplier of specialty coating test strips for medical diagnosis ~6% Double digit growth Single digit growth Key Differentiated Products 12

A C L O S E R L O O K Evolving Potential from Beryllium Supply Shortage Materion – leading position in beryllium market • Only global integrated producer – approximately 70 years of proven reserves in Utah – supplies over 70% of world’s mined beryllium • Over 40% of company sales include beryllium in some form Signs of shortage ahead • Global sources depleting • Materion positioned to support world demand • Significant incremental profit potential 13

Why Invest in Materion? G O A L N E X T 3 Y E A R S : Sustained growth >15% EPS CAGR Significantly improved 2014 financial results 1 Strategy for sustained, profitable growth • Pathway for additional cost and working capital improvements 5 Strong positions in growing markets • High barriers to entry 2 Promising new product launches 3 4 Solid cash flow organic growth, acquisitions, dividends, share buybacks 14

Wide Range of Strategic Investments… New Wafer Coating Facility New Optics Facility Increased Capacity LED Phosphor ToughMet® Capacity Expansion Expanded Beryllium Hydroxide Capacity Singapore Expansion 15

… Driving Record Number of New Product Launches Examples of New Products Sales Growth Sales from new products were 11% of total value-added sales for 2014 New products Existing products Gesture Controls LED Phosphorous ToughMet® Oil & Gas Bulk Metallic Glass (Liquidmetal) 50% 50% Wafer Level Processing Dovetail Connectors 16

Why Invest in Materion? G O A L N E X T 3 Y E A R S : Sustained growth >15% EPS CAGR Significantly improved 2014 financial results 1 Strategy for sustained, profitable growth • Pathway for additional cost and working capital improvements 5 Strong positions in growing markets • High barriers to entry 2 Promising new product launches 3 4 Solid cash flow organic growth, acquisitions, dividends, share buybacks 17

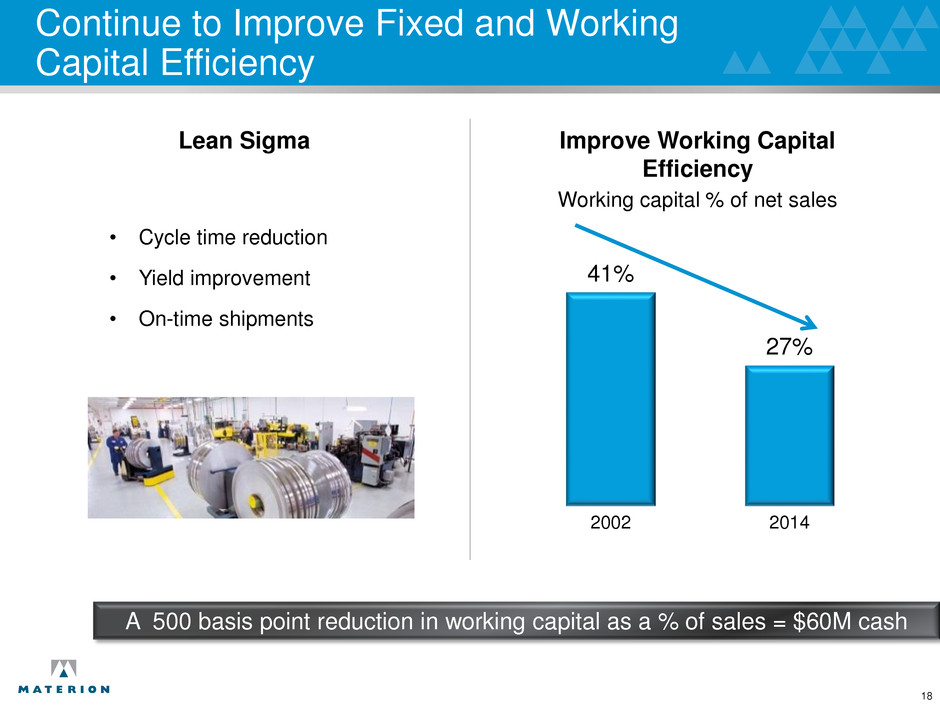

Continue to Improve Fixed and Working Capital Efficiency Lean Sigma • Cycle time reduction • Yield improvement • On-time shipments Improve Working Capital Efficiency Working capital % of net sales 41% 27% 2002 2014 A 500 basis point reduction in working capital as a % of sales = $60M cash 18

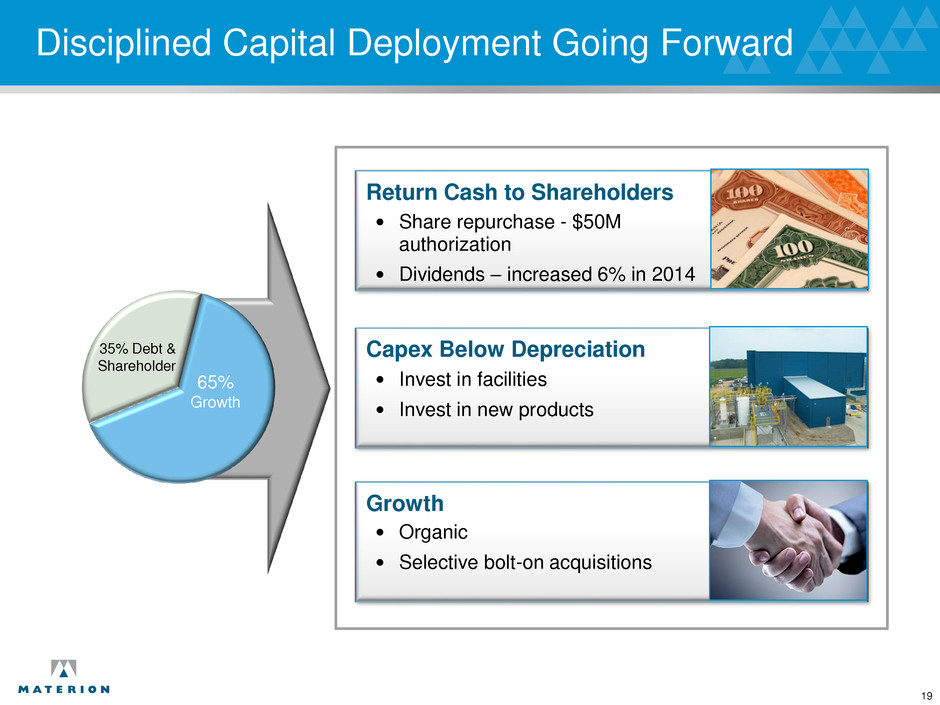

Disciplined Capital Deployment Going Forward Return Cash to Shareholders • Share repurchase - $50M authorization • Dividends – increased 6% in 2014 Capex Below Depreciation • Invest in facilities • Invest in new products Growth • Organic • Selective bolt-on acquisitions 19 35% Debt & Shareholder 65% Growth

Why Invest in Materion? G O A L N E X T 3 Y E A R S : Sustained growth >15% EPS CAGR Significantly improved 2014 financial results 1 Strategy for sustained, profitable growth • Pathway for additional cost and working capital improvements 5 Strong positions in growing markets • High barriers to entry 2 Promising new product launches 3 4 Solid cash flow organic growth, acquisitions, dividends, share buybacks 20

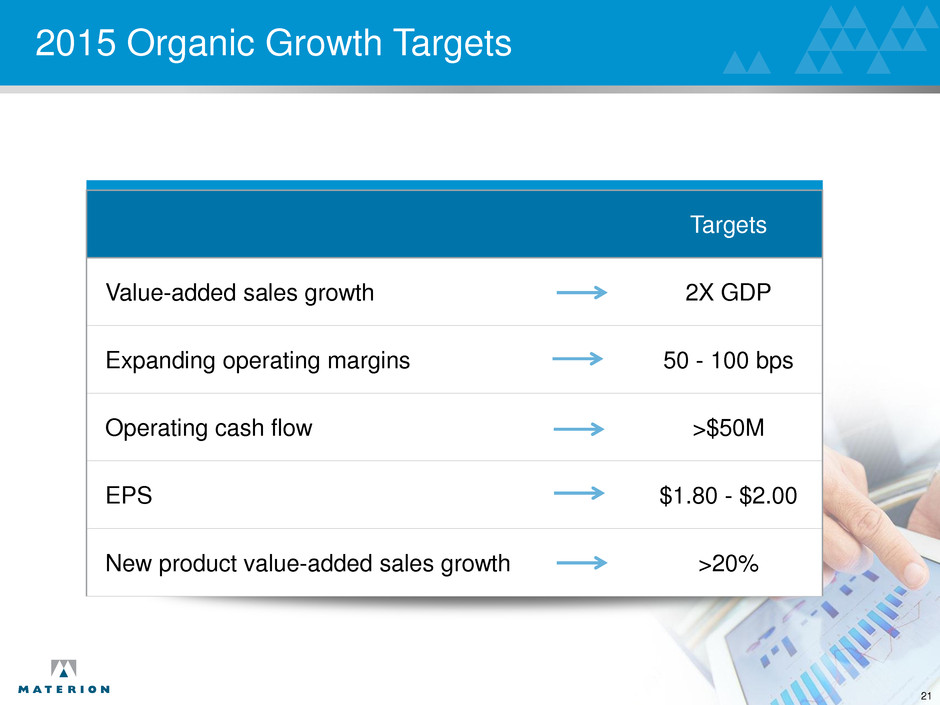

2015 Organic Growth Targets Targets Value-added sales growth 2X GDP Expanding operating margins 50 - 100 bps Operating cash flow >$50M EPS $1.80 - $2.00 New product value-added sales growth >20% 21

Financial Goals Next 3 Years 2014 Next 3 years(2) Value-added sales growth 4.6% 5% –10% annually Value-added sales $637.1M $740M - $850M Margins (adjusted OP % VA) 7.6%(1) 9% –11% Adjusted ROIC 7.0%(1) >2% over cost of capital Operating Cash Flow $60M >$50M Working capital % sales 27% <25% Debt-to-capitalization 5% <30% Acquisition Investment N/A $50M – $100M annually EPS $1.65(1) >$3.00 22 (1) Non-GAAP, excludes non-recurring items (2) Includes bolt-on acquisitions

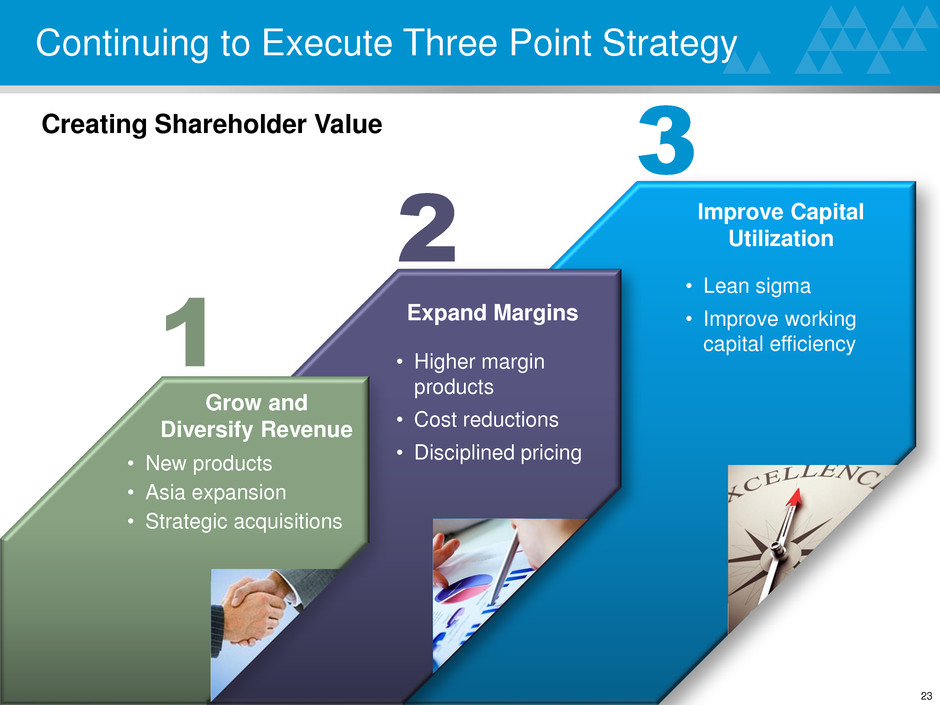

Continuing to Execute Three Point Strategy Grow and Diversify Revenue Expand Margins Improve Capital Utilization • New products • Asia expansion • Strategic acquisitions • Higher margin products • Cost reductions • Disciplined pricing • Lean sigma • Improve working capital efficiency 1 2 3 Creating Shareholder Value 23

Appendix

Higher Operating Margin Targets A-1 GAAP Margin Value-added Margin Gross Profit 18% – 20% 34% – 36% Operating Profit 4% – 7% 9% – 11% Removing High Value Metals Clarifies Margins 3 Year Target

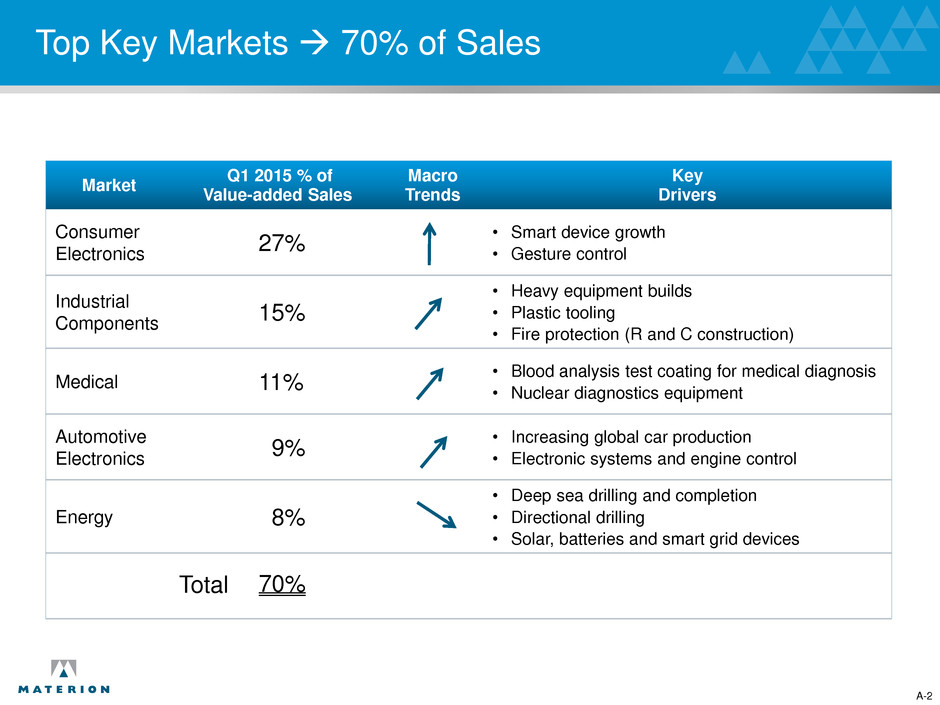

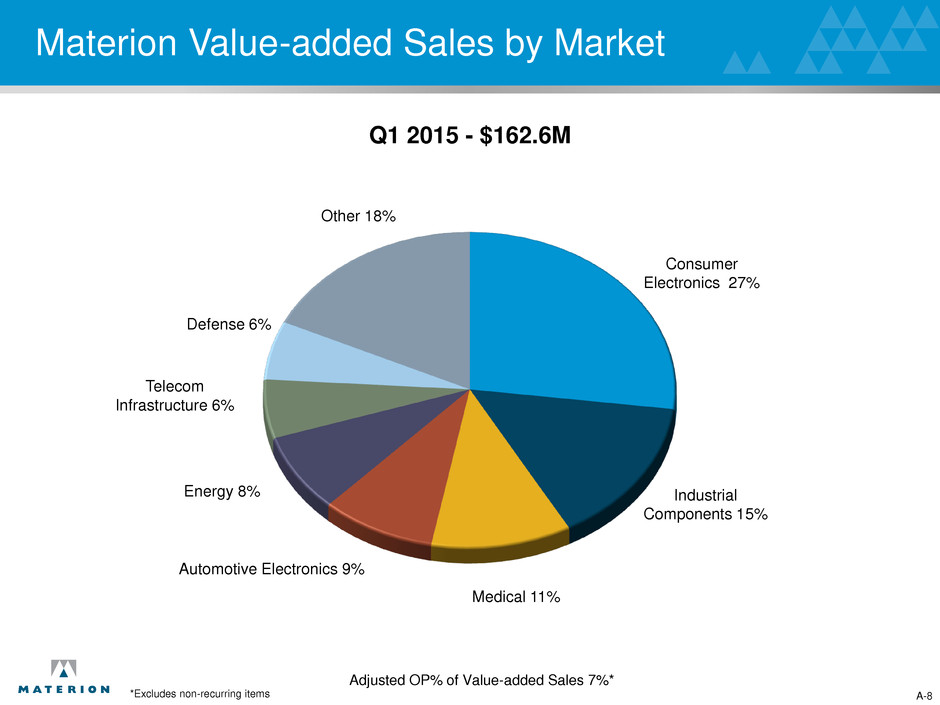

Top Key Markets 70% of Sales Market Q1 2015 % of Value-added Sales Macro Trends Key Drivers Consumer Electronics 27% • Smart device growth • Gesture control Industrial Components 15% • Heavy equipment builds • Plastic tooling • Fire protection (R and C construction) Medical 11% • Blood analysis test coating for medical diagnosis • Nuclear diagnostics equipment Automotive Electronics 9% • Increasing global car production • Electronic systems and engine control Energy 8% • Deep sea drilling and completion • Directional drilling • Solar, batteries and smart grid devices Total 70% A-2

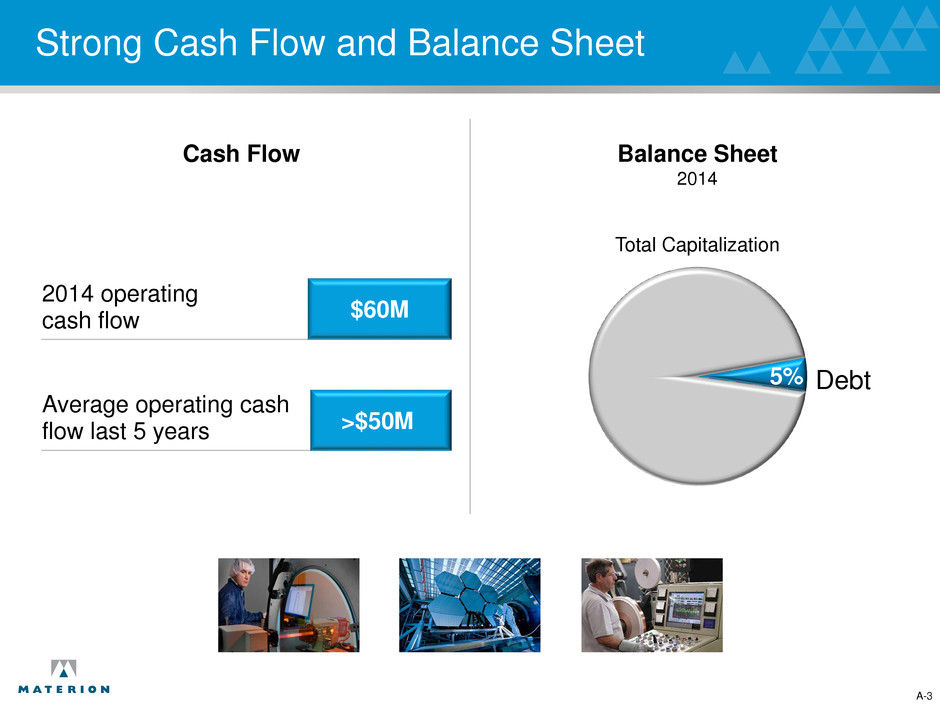

Strong Cash Flow and Balance Sheet Cash Flow Balance Sheet 2014 2014 operating cash flow Average operating cash flow last 5 years $60M >$50M Total Capitalization Debt 5% A-3

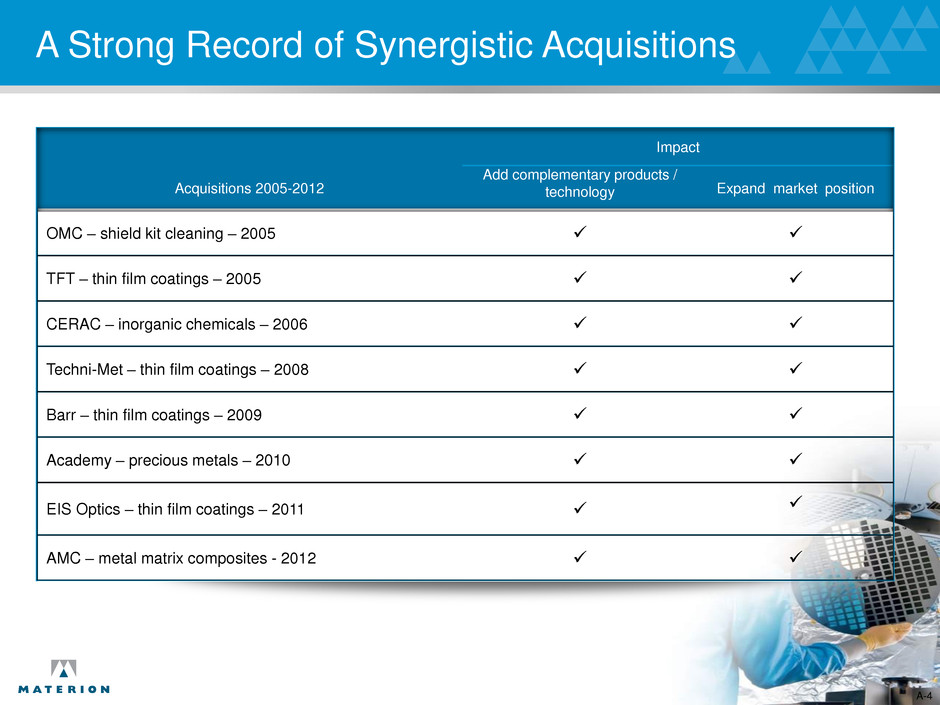

A Strong Record of Synergistic Acquisitions A-4 Impact Acquisitions 2005-2012 Add complementary products / technology Expand market position OMC – shield kit cleaning – 2005 TFT – thin film coatings – 2005 CERAC – inorganic chemicals – 2006 Techni-Met – thin film coatings – 2008 Barr – thin film coatings – 2009 Academy – precious metals – 2010 EIS Optics – thin film coatings – 2011 AMC – metal matrix composites - 2012

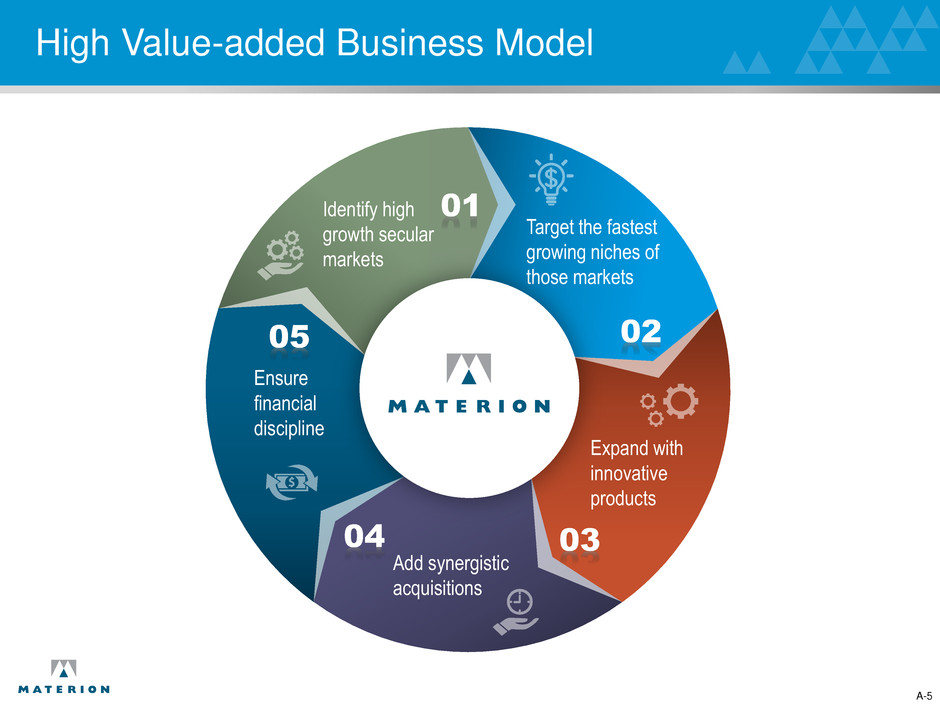

High Value-added Business Model A-5 Identify high growth secular markets Target the fastest growing niches of those markets Expand with innovative products Add synergistic acquisitions Ensure financial discipline 01 02 03 04 05

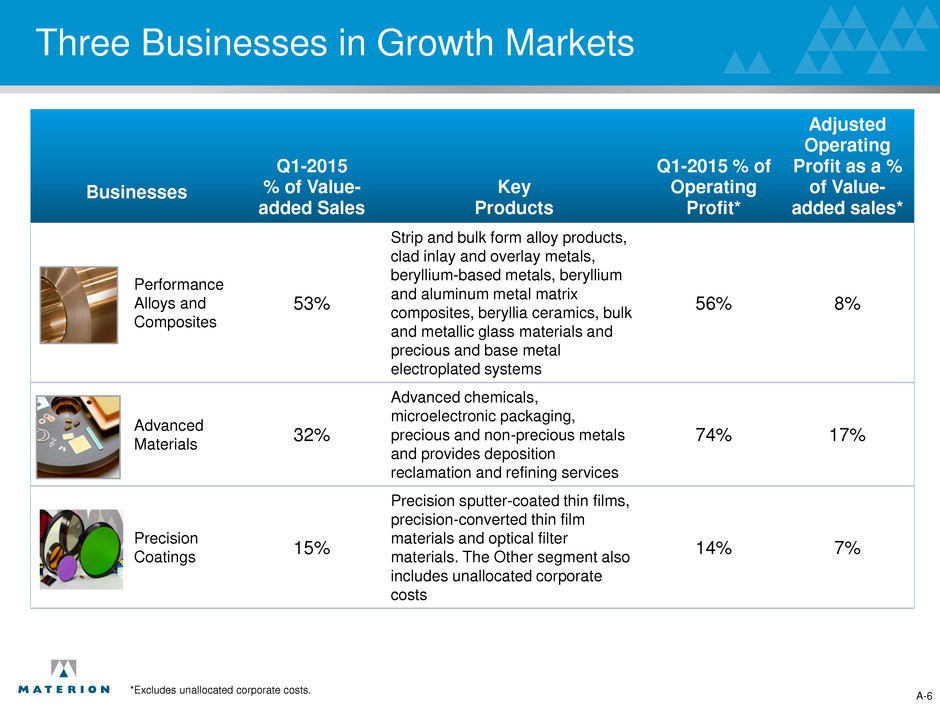

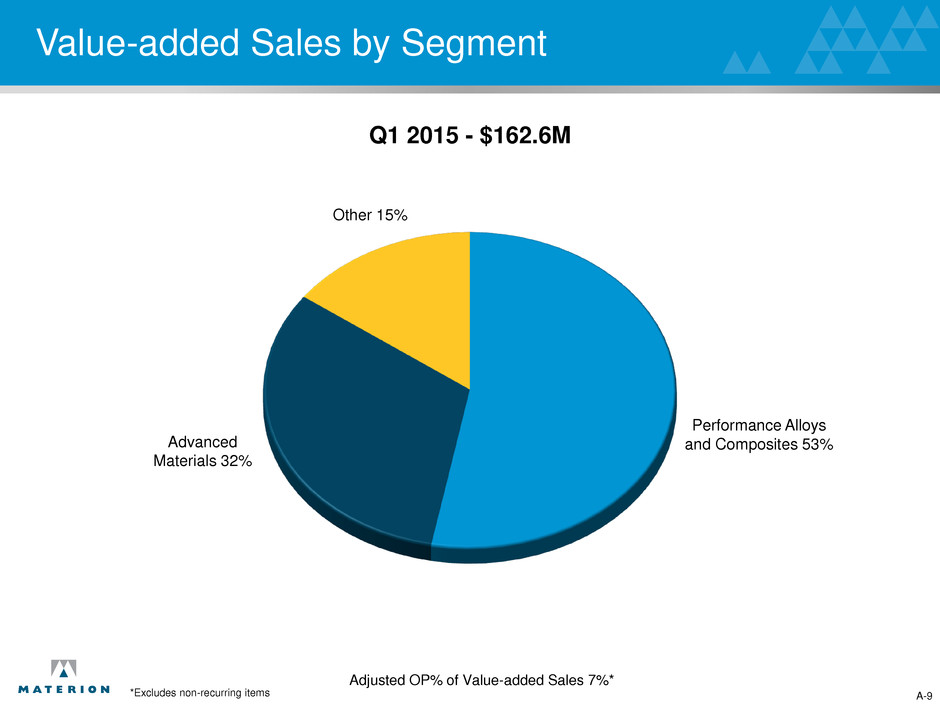

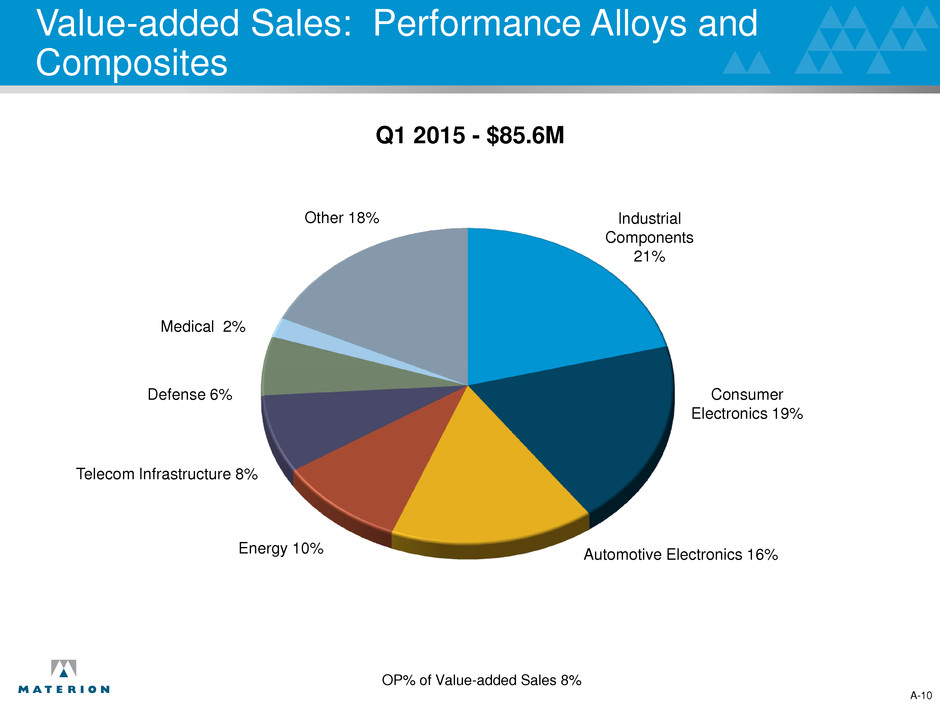

Three Businesses in Growth Markets A-6 *Excludes unallocated corporate costs. Businesses Q1-2015 % of Value- added Sales Key Products Q1-2015 % of Operating Profit* Adjusted Operating Profit as a % of Value- added sales* Performance Alloys and Composites 53% Strip and bulk form alloy products, clad inlay and overlay metals, beryllium-based metals, beryllium and aluminum metal matrix composites, beryllia ceramics, bulk and metallic glass materials and precious and base metal electroplated systems 56% 8% Advanced Materials 32% Advanced chemicals, microelectronic packaging, precious and non-precious metals and provides deposition reclamation and refining services 74% 17% Precision Coatings 15% Precision sputter-coated thin films, precision-converted thin film materials and optical filter materials. The Other segment also includes unallocated corporate costs 14% 7%

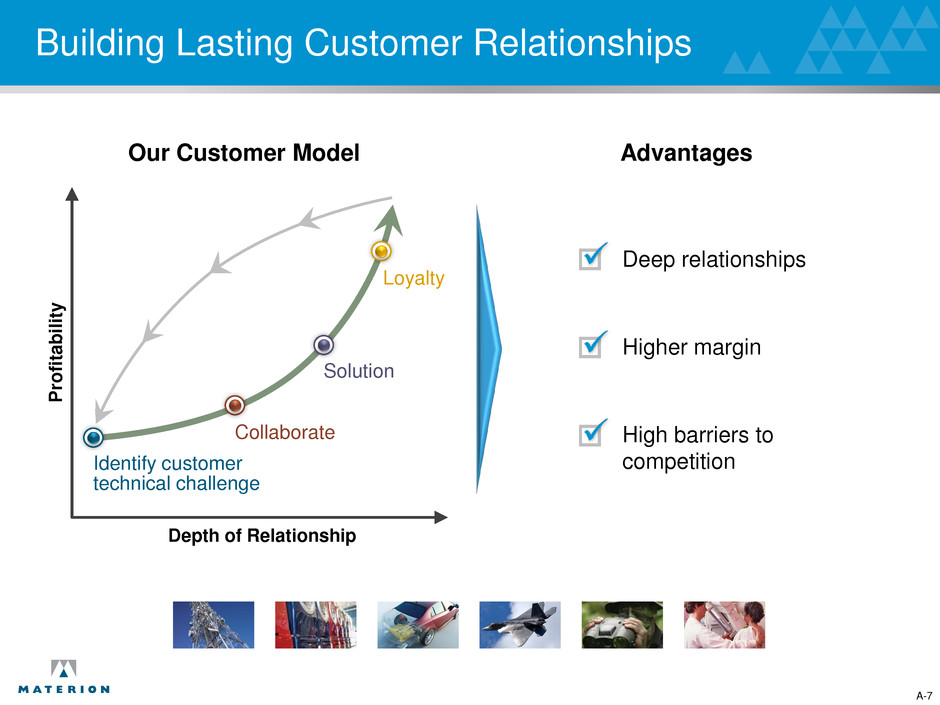

Building Lasting Customer Relationships Deep relationships Higher margin High barriers to competition Our Customer Model Advantages Identify customer technical challenge Solution Collaborate Loyalty Depth of Relationship P ro fi ta b il it y A-7

Materion Value-added Sales by Market Q1 2015 - $162.6M Adjusted OP% of Value-added Sales 7%* Automotive Electronics 9% Defense 6% Energy 8% Medical 11% Other 18% Telecom Infrastructure 6% Industrial Components 15% Consumer Electronics 27% *Excludes non-recurring items A-8

Value-added Sales by Segment A-9 Q1 2015 - $162.6M Adjusted OP% of Value-added Sales 7%* Other 15% Advanced Materials 32% Performance Alloys and Composites 53% *Excludes non-recurring items

Value-added Sales: Performance Alloys and Composites A-10 Telecom Infrastructure 8% Automotive Electronics 16% Defense 6% Other 18% Medical 2% Consumer Electronics 19% Industrial Components 21% Energy 10% Q1 2015 - $85.6M OP% of Value-added Sales 8%

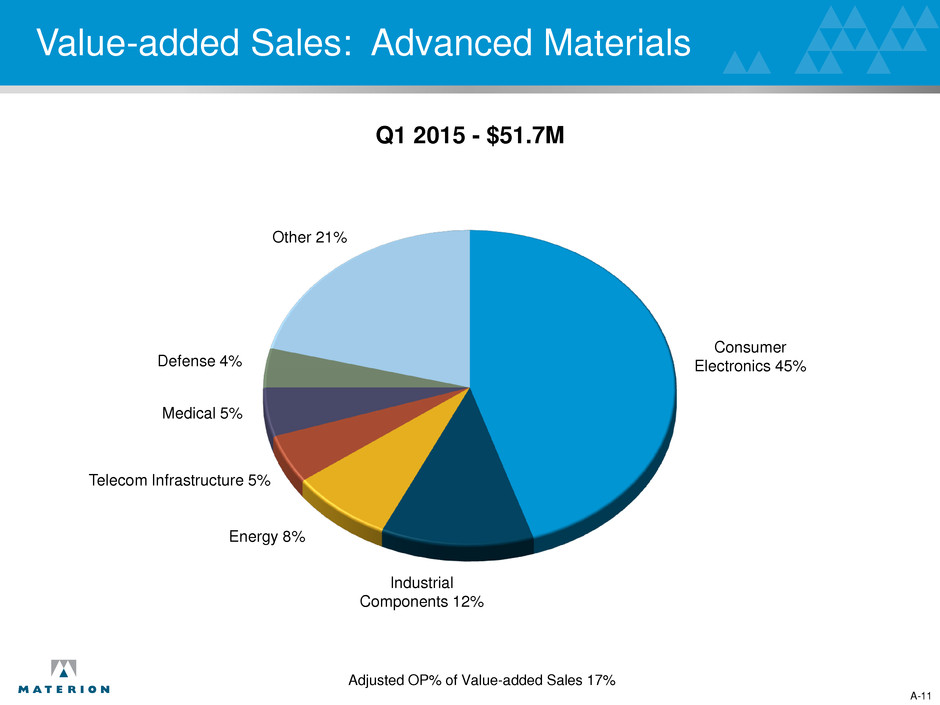

Value-added Sales: Advanced Materials A-11 Telecom Infrastructure 5% Defense 4% Other 21% Industrial Components 12% Consumer Electronics 45% Q1 2015 - $51.7M Adjusted OP% of Value-added Sales 17% Energy 8% Medical 5%

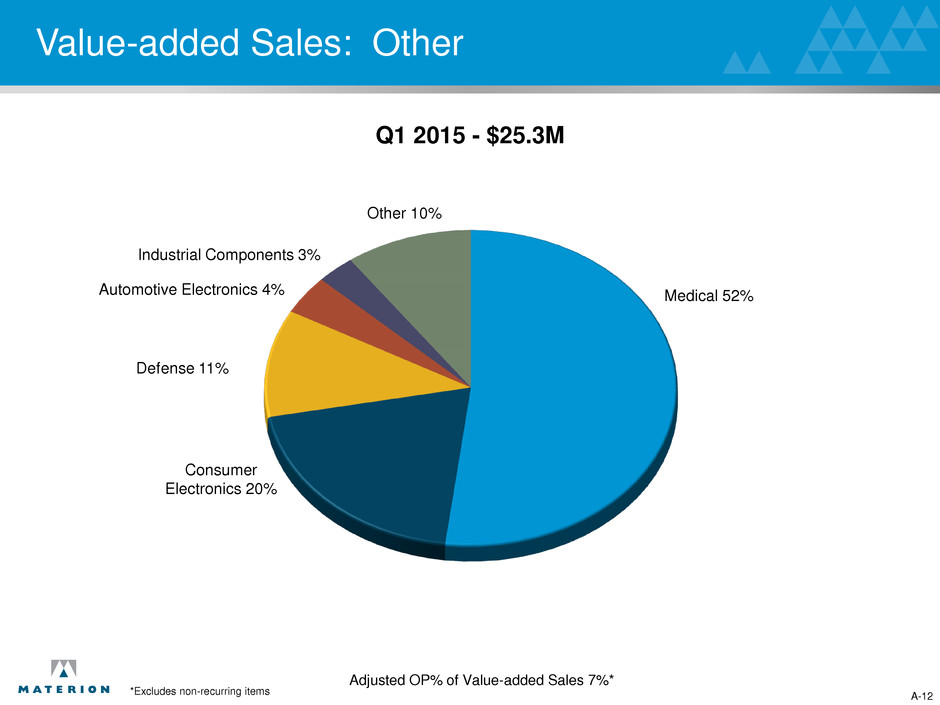

Value-added Sales: Other A-12 Other 10% Medical 52% Defense 11% Industrial Components 3% Q1 2015 - $25.3M Adjusted OP% of Value-added Sales 7%* Automotive Electronics 4% Consumer Electronics 20% *Excludes non-recurring items

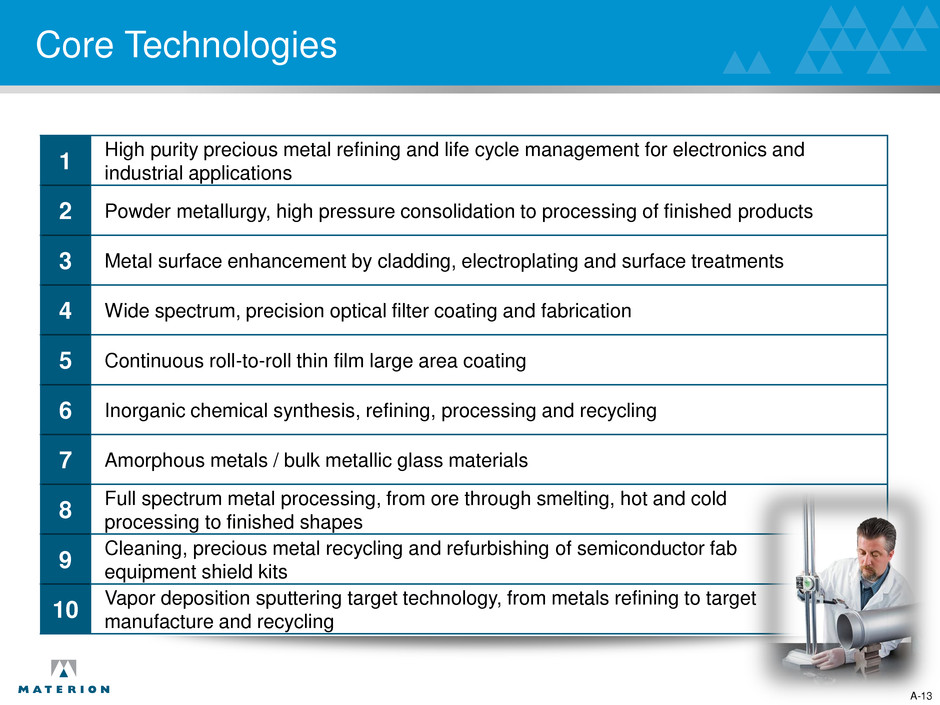

Core Technologies A-13 1 High purity precious metal refining and life cycle management for electronics and industrial applications 2 Powder metallurgy, high pressure consolidation to processing of finished products 3 Metal surface enhancement by cladding, electroplating and surface treatments 4 Wide spectrum, precision optical filter coating and fabrication 5 Continuous roll-to-roll thin film large area coating 6 Inorganic chemical synthesis, refining, processing and recycling 7 Amorphous metals / bulk metallic glass materials 8 Full spectrum metal processing, from ore through smelting, hot and cold processing to finished shapes 9 Cleaning, precious metal recycling and refurbishing of semiconductor fab equipment shield kits 10 Vapor deposition sputtering target technology, from metals refining to target manufacture and recycling

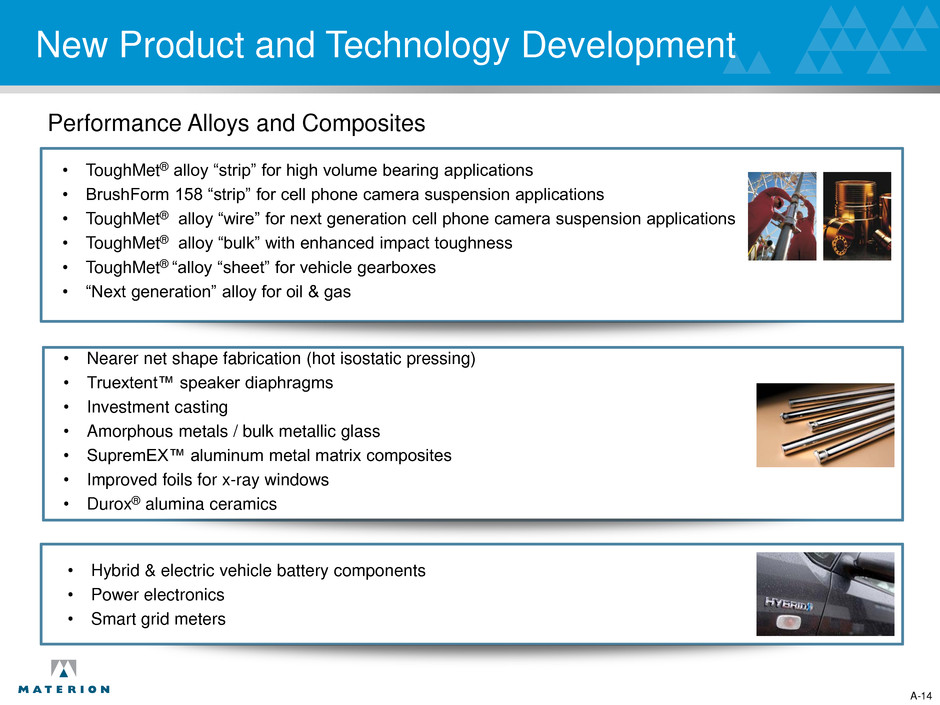

New Product and Technology Development A-14 • ToughMet® alloy “strip” for high volume bearing applications • BrushForm 158 “strip” for cell phone camera suspension applications • ToughMet® alloy “wire” for next generation cell phone camera suspension applications • ToughMet® alloy “bulk” with enhanced impact toughness • ToughMet® “alloy “sheet” for vehicle gearboxes • “Next generation” alloy for oil & gas • Nearer net shape fabrication (hot isostatic pressing) • Truextent™ speaker diaphragms • Investment casting • Amorphous metals / bulk metallic glass • SupremEX™ aluminum metal matrix composites • Improved foils for x-ray windows • Durox® alumina ceramics • Hybrid & electric vehicle battery components • Power electronics • Smart grid meters Performance Alloys and Composites

New Product and Technology Development • Expanded shield kit cleaning services – including new technology to improve precious metal returns • Materials for high brightness LEDs • Specialty inorganic compounds for thin film solar panels (solar, security) • High purity metals and chemicals for semiconductor, compound semiconductor and display applications • Next generation memory and thin film head materials A-15 Materials and Services Advanced Materials • RF packages for the latest infrastructure technology (3G and 4G) Packaging

New Product and Technology Development • Thin film vapor deposited electrodes for medical diagnostics • Precision optical thin film coatings (specialty filters) • Large area format serving astronomy, space, science • Multi-hyper – spectral array filters • Patterned medical large area coatings capabilities A-16 Coatings Packaging

I/O Connector Contacts Battery Contacts Internal Antenna Contacts Grounding Clips and Audio Jacks Micro Mezzanine Connectors for LCD Screen Internal Electronics and LED • Thin film materials – power amplifiers, LED, SAW and BAW devices, filters, and ICs • Hermetic solutions for SAW • Refining / recycling • Precision parts cleaning Other Smart Phone Applications: • Circuit board and IC inspection • RoHS compliance assurance • Cellular infrastructure with high power RF packaging Internal Electronics • Precursor materials for GaAs wafer production Applications: Smart Phones Voice Coil Motor (auto focus lens stabilizer) A-17

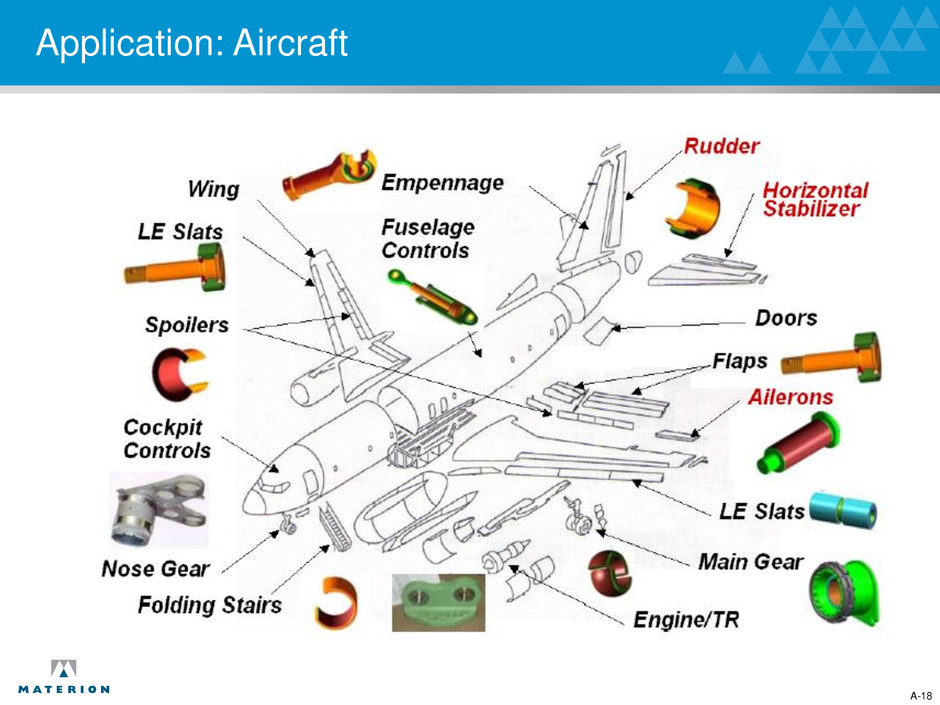

Application: Aircraft A-18

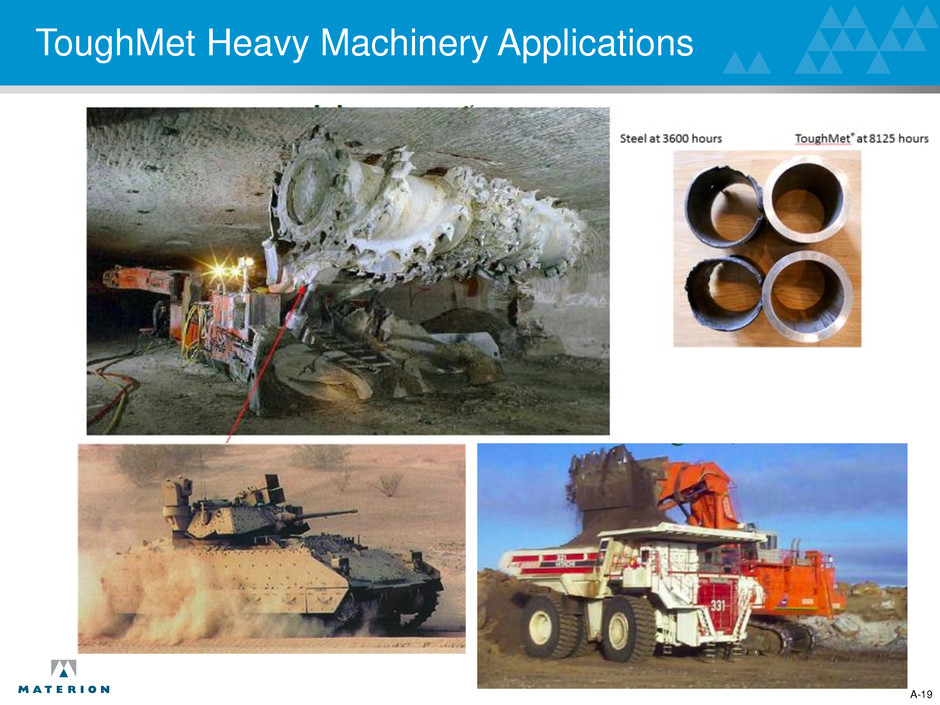

ToughMet Heavy Machinery Applications A-19

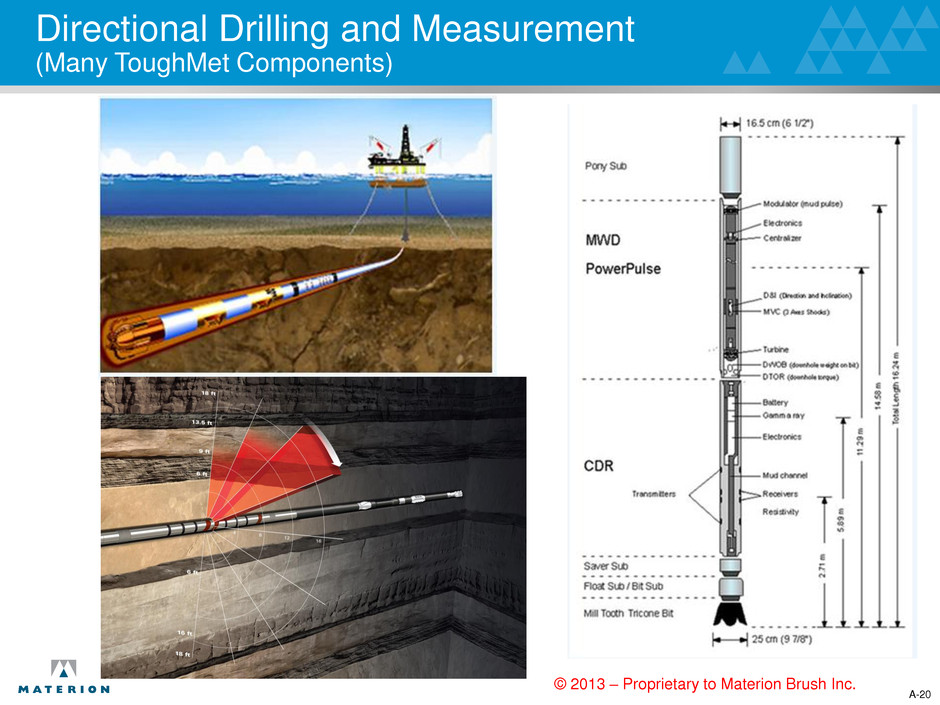

Directional Drilling and Measurement (Many ToughMet Components) A-20 © 2013 – Proprietary to Materion Brush Inc.

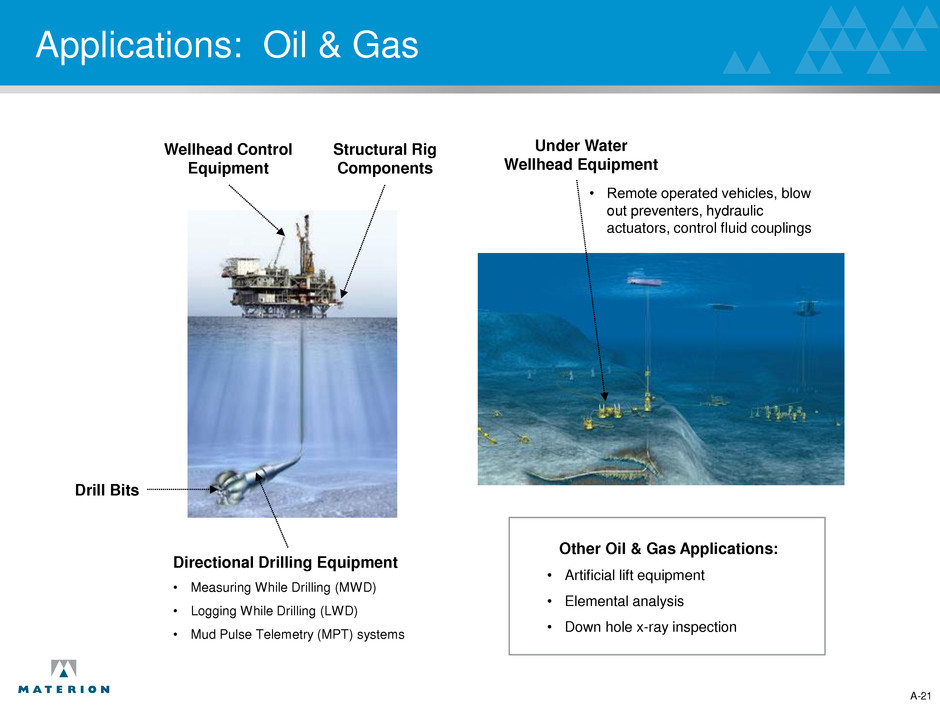

Under Water Wellhead Equipment Directional Drilling Equipment • Measuring While Drilling (MWD) • Logging While Drilling (LWD) • Mud Pulse Telemetry (MPT) systems Drill Bits Structural Rig Components Wellhead Control Equipment Other Oil & Gas Applications: • Artificial lift equipment • Elemental analysis • Down hole x-ray inspection • Remote operated vehicles, blow out preventers, hydraulic actuators, control fluid couplings Applications: Oil & Gas A-21

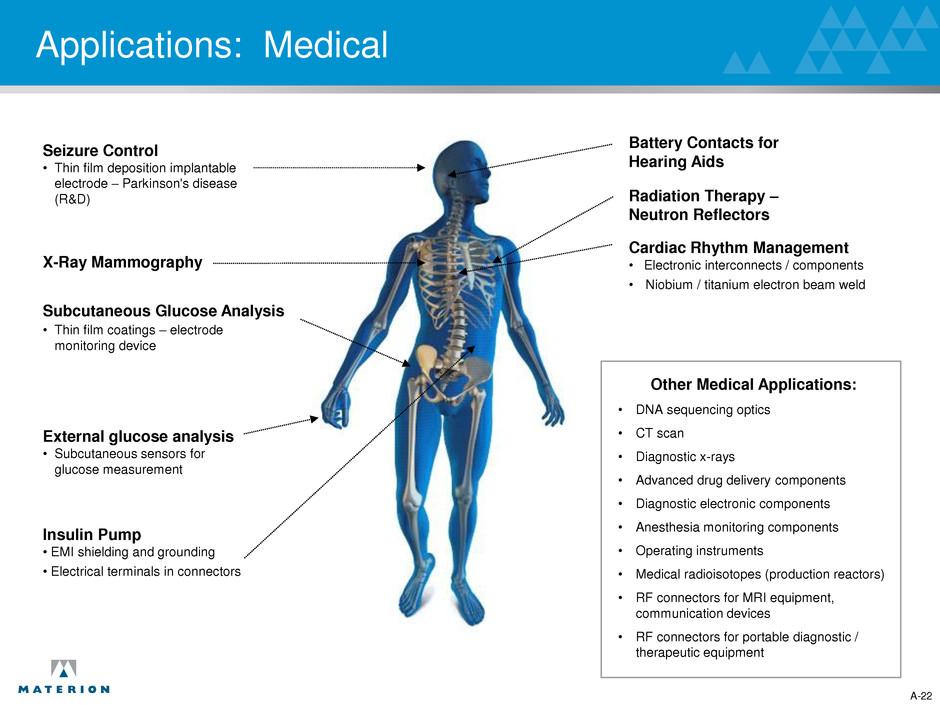

Cardiac Rhythm Management • Electronic interconnects / components • Niobium / titanium electron beam weld Insulin Pump • EMI shielding and grounding • Electrical terminals in connectors Seizure Control • Thin film deposition implantable electrode – Parkinson's disease (R&D) External glucose analysis • Subcutaneous sensors for glucose measurement Subcutaneous Glucose Analysis • Thin film coatings – electrode monitoring device Radiation Therapy – Neutron Reflectors X-Ray Mammography Other Medical Applications: • DNA sequencing optics • CT scan • Diagnostic x-rays • Advanced drug delivery components • Diagnostic electronic components • Anesthesia monitoring components • Operating instruments • Medical radioisotopes (production reactors) • RF connectors for MRI equipment, communication devices • RF connectors for portable diagnostic / therapeutic equipment Applications: Medical Battery Contacts for Hearing Aids A-22

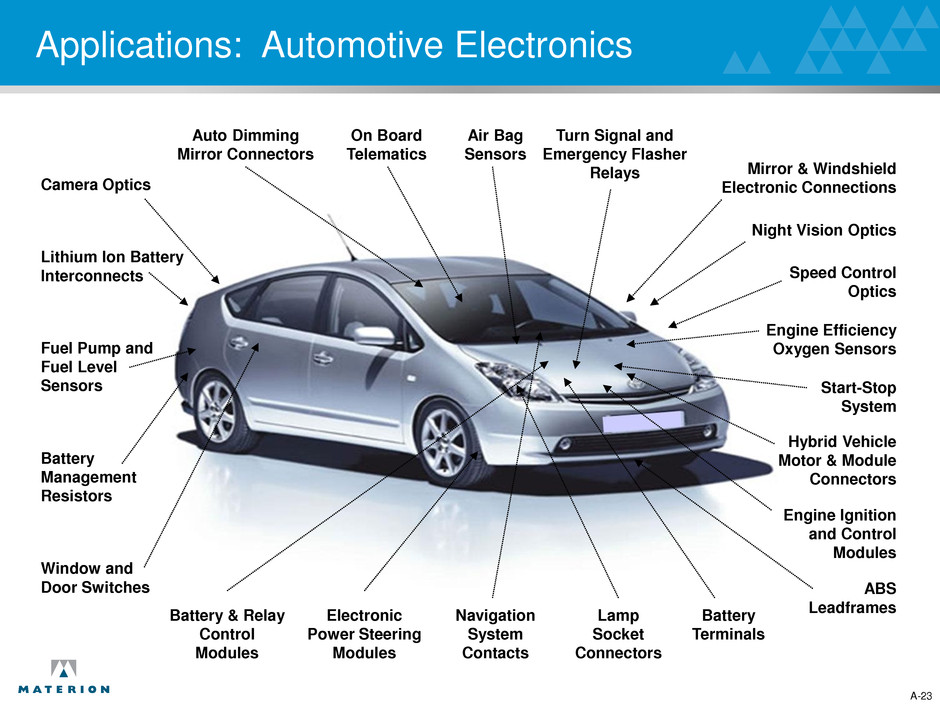

Lithium Ion Battery Interconnects Battery Management Resistors Electronic Power Steering Modules ABS Leadframes Engine Efficiency Oxygen Sensors Mirror & Windshield Electronic Connections Air Bag Sensors Lamp Socket Connectors Auto Dimming Mirror Connectors Hybrid Vehicle Motor & Module Connectors Window and Door Switches Fuel Pump and Fuel Level Sensors Battery Terminals Engine Ignition and Control Modules Battery & Relay Control Modules Turn Signal and Emergency Flasher Relays On Board Telematics Applications: Automotive Electronics Night Vision Optics Speed Control Optics Camera Optics Navigation System Contacts Start-Stop System A-23

Applications: Defense • Infrared Sensors for fighter jet and UAV optical targeting • Electronic packaging for defense avionics, radar and electronic countermeasure systems • Structural and electronic components for satellites • X-ray windows in security imaging systems • Laser protection optical coatings • Night vision system optics A-24

Applications: Telecommunications Infrastructure Base Stations • Coaxial connectors • High power amplifiers Local Area Networks • Shielding • Modular jacks • PCB sockets • Processor sockets Other Telecommunications Infrastructure Applications • Undersea repeater housings A-25

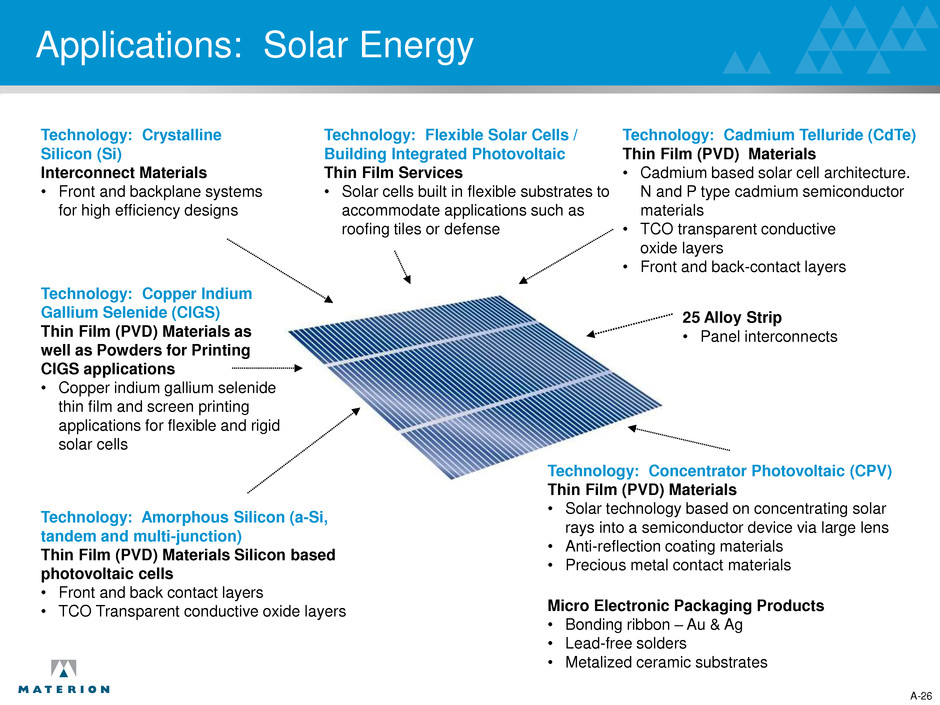

Technology: Amorphous Silicon (a-Si, tandem and multi-junction) Thin Film (PVD) Materials Silicon based photovoltaic cells • Front and back contact layers • TCO Transparent conductive oxide layers Technology: Cadmium Telluride (CdTe) Thin Film (PVD) Materials • Cadmium based solar cell architecture. N and P type cadmium semiconductor materials • TCO transparent conductive oxide layers • Front and back-contact layers Technology: Concentrator Photovoltaic (CPV) Thin Film (PVD) Materials • Solar technology based on concentrating solar rays into a semiconductor device via large lens • Anti-reflection coating materials • Precious metal contact materials Micro Electronic Packaging Products • Bonding ribbon – Au & Ag • Lead-free solders • Metalized ceramic substrates Technology: Flexible Solar Cells / Building Integrated Photovoltaic Thin Film Services • Solar cells built in flexible substrates to accommodate applications such as roofing tiles or defense Technology: Crystalline Silicon (Si) Interconnect Materials • Front and backplane systems for high efficiency designs Applications: Solar Energy A-26 Technology: Copper Indium Gallium Selenide (CIGS) Thin Film (PVD) Materials as well as Powders for Printing CIGS applications • Copper indium gallium selenide thin film and screen printing applications for flexible and rigid solar cells 25 Alloy Strip • Panel interconnects

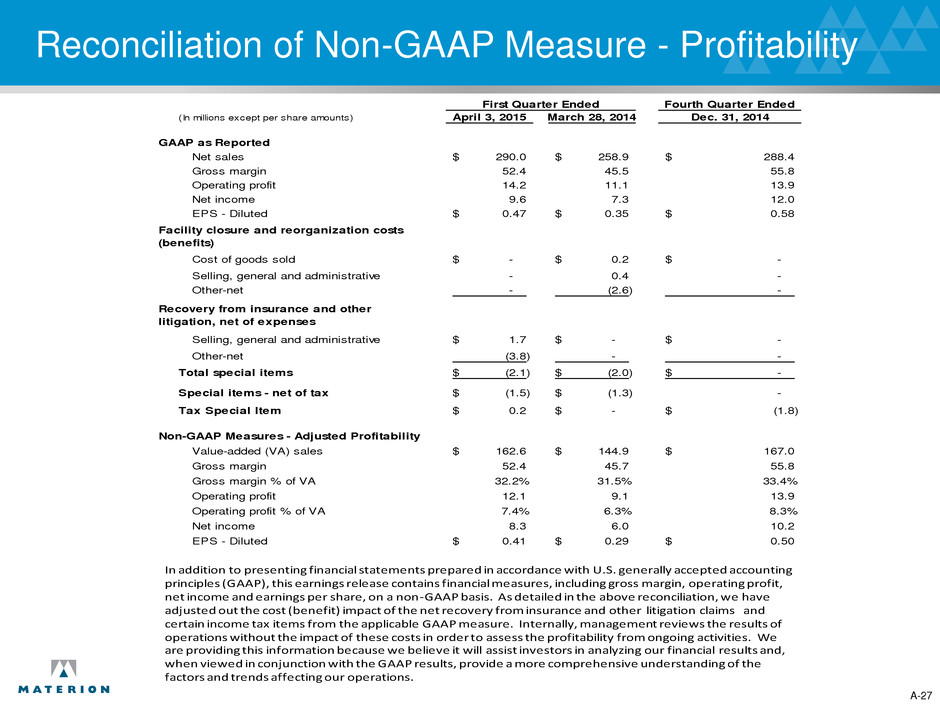

Reconciliation of Non-GAAP Measure - Profitability A-27 Fourth Quarter Ended (In millions except per share amounts) April 3, 2015 March 28, 2014 Dec. 31, 2014 GAAP as Reported Net sales 290.0$ 258.9$ 288.4$ Gross margin 52.4 45.5 55.8 Operating profit 14.2 11.1 13.9 Net income 9.6 7.3 12.0 EPS - Diluted 0.47$ 0.35$ 0.58$ Cost of goods sold -$ 0.2$ -$ Selling, general and administrative - 0.4 - Other-net - (2.6) - Selling, general and administrative 1.7$ -$ -$ Other-net (3.8) - - Total special items (2.1)$ (2.0)$ -$ Special items - net of tax (1.5)$ (1.3)$ - Tax Special Item 0.2$ -$ (1.8)$ Non-GAAP Measures - Adjusted Profitability Value-added (VA) sales 162.6$ 144.9$ 167.0$ Gross margin 52.4 45.7 55.8 Gross margin % of VA 32.2% 31.5% 33.4% Operating profit 12.1 9.1 13.9 Operating profit % of VA 7.4% 6.3% 8.3% Net income 8.3 6.0 10.2 EPS - Diluted 0.41$ 0.29$ 0.50$ First Quarter Ended Facility closure and reorganization costs (benefits) Recovery from insurance and other litigation, net of expenses In addition to presenting financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP), this earnings release contains financial measures, including gross margin, operating profit, net income and earnings per share, on a non-GAAP basis. As detailed in the above reconciliation, we have adjusted out the cost (benefit) impact of the net recovery from insurance and other litigation claims and certain income tax items from the applicable GAAP measure. Internally, management reviews the results of operations without the impact of these costs in order to assess the profitability from ongoing activities. We are providing this information because we believe it will assist investors in analyzing our financial results and, when viewed in conjunction with the GAAP results, provide a more comprehensive understanding of the factors and trends affecting our operations.

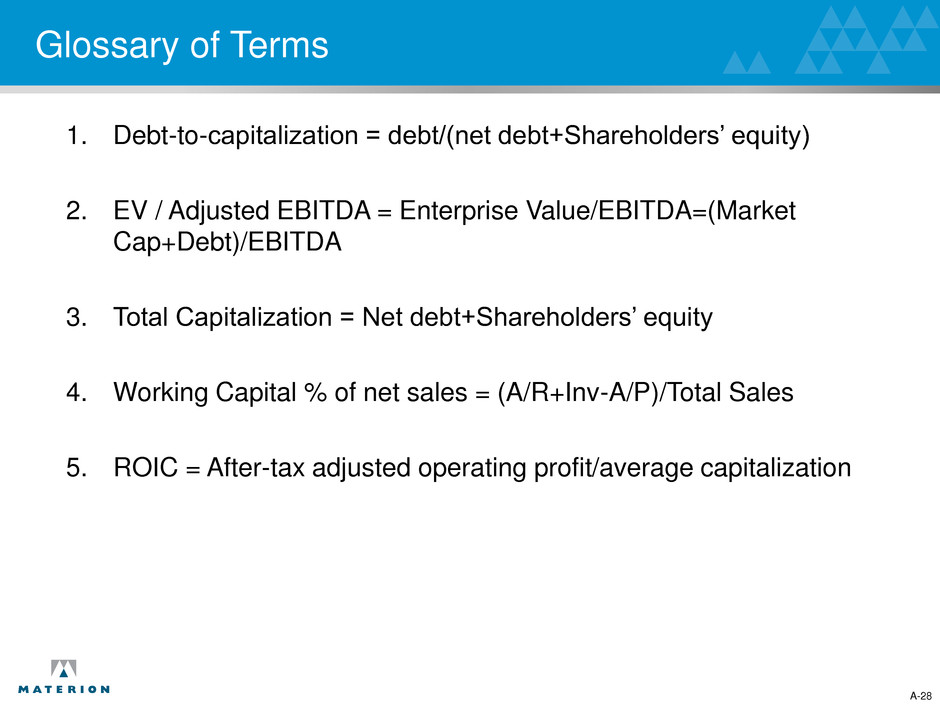

Glossary of Terms 1. Debt-to-capitalization = debt/(net debt+Shareholders’ equity) 2. EV / Adjusted EBITDA = Enterprise Value/EBITDA=(Market Cap+Debt)/EBITDA 3. Total Capitalization = Net debt+Shareholders’ equity 4. Working Capital % of net sales = (A/R+Inv-A/P)/Total Sales 5. ROIC = After-tax adjusted operating profit/average capitalization A-28