Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Prestige Consumer Healthcare Inc. | a8-kpressreleaseq42015.htm |

| EX-99.1 - EXHIBIT 99.1 - Prestige Consumer Healthcare Inc. | exhibit991fy15-q4earningsr.htm |

Review of Fourth Quarter and Full Year FY 15 Results May 14, 2015 Exhibit 99.2

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 2 This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements about the Company’s product expansion and development plans, investments in brand building and marketing, debt reduction and future financing capacity, consumption growth and market position of the Company’s brands, M&A strategy and market activity, future financial performance, and creation of shareholder value. Words such as "continue," "will," “expect,” “project,” “anticipate,” “likely,” “estimate,” “may,” “should,” “could,” “would,” and similar expressions identify forward-looking statements. Such forward-looking statements represent the Company’s expectations and beliefs and involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include, among others, the inability to identify and consummate future acquisitions at attractive valuations, the failure to successfully commercialize new products, the severity of the cold and flu season, the inability of third party suppliers to meet demand, competitive pressures, the effectiveness of the Company’s brand building and marketing investments, fluctuating foreign exchange rates, and other risks set forth in Part I, Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K for the year ended March 31, 2014 and in Part II, Item 1A. Risk Factors in the Company’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2014. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this presentation. Except to the extent required by applicable law, the Company undertakes no obligation to update any forward-looking statement contained in this presentation, whether as a result of new information, future events, or otherwise. Safe Harbor Disclosure

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 3 Agenda for Today’s Discussion I. Fourth Quarter FY 15 Performance Highlights II. FY 15 Year in Review III. Financial Overview IV. FY 16 Outlook and the Road Ahead

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 4

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 5 Fourth Quarter FY 15 Performance Highlights Q4 consolidated Revenue of $190.0 million, up 32.9% versus PY Q4 – Organic growth of +2.4%(1) on a constant currency basis, and +1.1% on a reported basis versus PY Q4 Core OTC consumption growth of +7.0% (ex. PediaCare), and +3.3% (total Core OTC) – 84% of Core OTC portfolio with consumption growth Adjusted Gross Margin of 57.9%(2) versus 55.1% in the PY Q4, and up from 57.2% in Q3 Adjusted EPS of $0.47(2), up 34.3% versus the PY Q4 Strong Adjusted Free Cash Flow of $50.1(2) million, up 45.0% versus the PY Q4 – Leverage of ~5.2x(3), down from 5.7x at the time of Insight acquisition Consistent and innovative marketing support building long-term brand equity in core OTC brands – Clear Eyes achieved #1 market share for the first time – Chloraseptic and Luden’s gained 4.3 share points through strong digital programs – Little Remedies experienced strong consumption gains across all segments as a result of TV and digital marketing support

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 6

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 7 FY 15: Successful Execution Against Drivers of Long-Term Shareholder Value Creation Strong organic growth in Core OTC and international Portfolio strategy achieving desired results Margin expansion and efficiency gains allow for re-investment in A&P Consistent and increasing free cash flow Proven and repeatable M&A strategy 1 2 3 4 5 Well-Positioned for FY 16 and Beyond

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 8 5.2% 3.9% (3.5%) 3.5% 7.7% 4.8% (6.9%) 0.4% FY 12 FY 13 FY 14 FY 15 Accelerated Core OTC Growth Trends 5.2% 7.1% (1.8%) 4.1% 8.7% 8.3% (4.9%) 0.9% O rg a n ic Sa les G ro w th C o n s u m p ti o n G ro w th (0.8%) (1.1%) 10.7% 5.8% (2.5%) (4.9%) 4.3% 5.4% Q1 Q2 Q3 Q4 0.5% 3.6% 5.6% 7.0% (1.9%) 1.5% 2.4% 3.3% FY 15 1 Accelerating Performance Through the Year Total Core OTC Brands (Excl. Insight) Total Core OTC Brands excluding PediaCare (Excl. Insight) Source: IRI multi-outlet + C-Store retail dollar sales growth for relevant period. Data reflects retail dollar sales percentage growth versus prior period.

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 9 FY 15 Core OTC Growth Broad Based Led by Largest Brands % of Core OTC Portfolio with Consumption Growth in FY 15 84% 6.0% 13.3% 15.6% 16.2% Q1 Q2 Q3 Q4 Growth of Largest Brands Accelerating 1.6% 2.5% 5.1% 4.6% Q1 Q2 Q3 Q4 Y/Y Retail Sales % Growth Core OTC, includes Insight Pharmaceuticals. Source: IRI multi-outlet + C-Store, L-52 period ending March 22, 2015. % of Core OTC Retail Sales Represented by Growing Brands Recently Acquired 0.4% 3.6% 4.5% 5.3% Q1 Q2 Q3 Q4 1

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 10 Core OTC International Other OTC Household Contribution to Portfolio: # of Brands: Investment: Targeted Mix Over Time(4)(5): FY 15 % Organic Growth: (Constant Currency)(1) Invest for Growth Manage for Cash Flow Generation ~25% of Total Brands ~75% of Total Brands 63% 15% Portfolio Strategy Achieving Desired Results +2.9%* (0.3%) +2.0%(1) Organic Growth* High Maintain ~78% ~85% Current Target ~22% ~15% Current Target 2 11% 11% * Excluding PediaCare

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 11 10.3% 8.6% 7.3% 7.9% 8.0% FY 11 FY 12 FY 13 FY 14 FY 15 52.4% 51.6% 56.3% 56.3% 57.2% FY 11 FY 12 FY 13 FY 14 FY 15 Adjusted Gross Margin(2) Margin Expansion and Efficiency Gains Drives Increased A&P Investment Adjusted G&A % Net Sales(2) $39.3 $53.9 $87.2 $85.0 $99.7 FY 11 FY 12 FY 13 FY 14 FY 15 A&P (% of Net Sales) 11.8% 12.3% 14.0% 14.2% 13.9% 3 Dollar values in millions.

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 12 Increasing Our A&P Spend and Expanding Our Marketing Toolkit In Store Merchandising and Sports Marketing Broad Media Support 3 New and Innovative Products

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 13 Little Remedies Differentiation Positions it well for Long-Term Success 3 New Products Driving Growth Digital Execution Connecting with Moms Consumption +3.7% in L-26 Weeks; +8.5% in L-12 Weeks Source: IRI multi-outlet + C-Store, L-26 and L-12 periods ending March 22, 2015. BabyCenter Integration Website Facebook Page Reformulated Extensions Effective solutions that are more natural with no artificial flavors or unnecessary ingredients

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 14 FY 15 Learnings Are Positioning A $100MM Brand for Growth New Marketing Campaign Developing HCP Relationship Letting consumers know that yeast infections are “No Big Deal” because there’s Monistat “Prescription strength cure without the prescription” “Starts curing on contact” Reinforcing strategy, messaging and communication with Health Care Professionals 3

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 15 Strong and Consistent Cash Flow Leads to Rapid Delevering and Increased M&A Capacity FY 15 FY 16E FY 17E ~$1.5 BN +$2.0 BN ~$0.5 BN Leverage Ratio(3) Illustrative Financing Capacity(6) ~5.6x ~5.2x ~4.4x ~4.0x Q2 FY 15 FY 15 FY 16E FY 17E Reduced Net Debt by >$150 million in FY 15 excluding acquisitions Projected expanded M&A capability of $1.6 billion in FY 16E and +$2.0 billion by FY 17E $59 $86 $67 $127 $130 $164 FY 10 FY 11 FY 12 FY 13 FY 14 FY 15 Adjusted Free Cash Flow(2) +26% Dollar values in millions. 4

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 16 Proven and Repeatable M&A Strategy in Favorable Environment Six Acquisitions Completed in Past Five Years for TEV of ~$2BN 5 TEV Acquired by Year ~$190 ~$76 ~$660 ~$50 ~$800 FY 11 FY 12 FY 13 FY 14 FY 15 North American Brands Dollar values in millions.

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 17 M&A Has Established A Portfolio of Strong Brands Creating Attractive Category Platforms Sleep Aids Oral Care Skin Care Analgesics GI Women’s Health Cough & Cold Eye & Ear Care 5 International Sales <$50MM

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 18 M&A Has Established A Portfolio of Strong Brands Creating Attractive Category Platforms Sleep Aids Oral Care Skin Care Analgesics GI Women’s Health Cough & Cold Eye & Ear Care 5 International Sales >$100MM

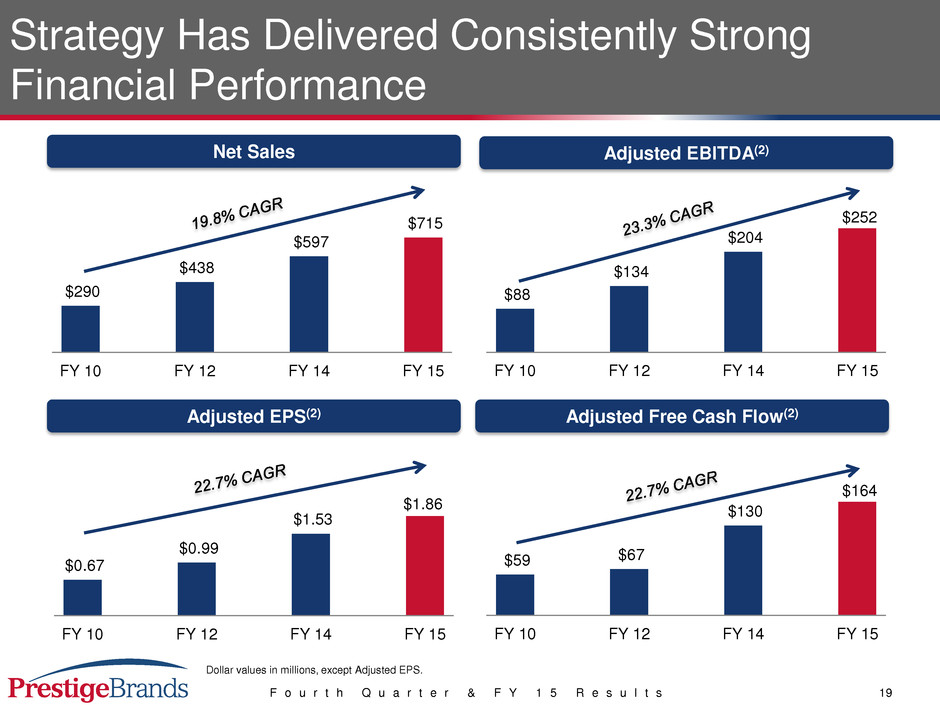

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 19 $88 $134 $204 $252 FY 10 FY 12 FY 14 FY 15 $290 $438 $597 $715 FY 10 FY 12 FY 14 FY 15 Net Sales Strategy Has Delivered Consistently Strong Financial Performance $0.67 $0.99 $1.53 $1.86 FY 10 FY 12 FY 14 FY 15 $59 $67 $130 $164 FY 10 FY 12 FY 14 FY 15 Dollar values in millions, except Adjusted EPS. Adjusted Free Cash Flow(2) Adjusted EPS(2) Adjusted EBITDA(2)

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 20

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 21 Key Financial Results for Fourth Quarter Performance Excellent overall financial performance in the quarter exceeded expectations − Achieved organic growth of 2.4%(1) excluding the impact of foreign currency − Revenue of $190.0 million, an increase of 32.9% − Adjusted EPS of $0.47(2), up 34.3% − Adjusted Free Cash Flow growth of 45.0% to $50.1 million(2) $143.1 $48.7 $34.5 $190.0 $68.6 $50.1 Total Revenue Adjusted EBITDA Adjusted EPS Adjusted Free Cash Flow Q4 FY 15 Q4 FY 14 32.9% 40.9% 34.3% 45.0% $0.35 $0.47 (2) (2) (2) Dollar values in millions, except per share data.

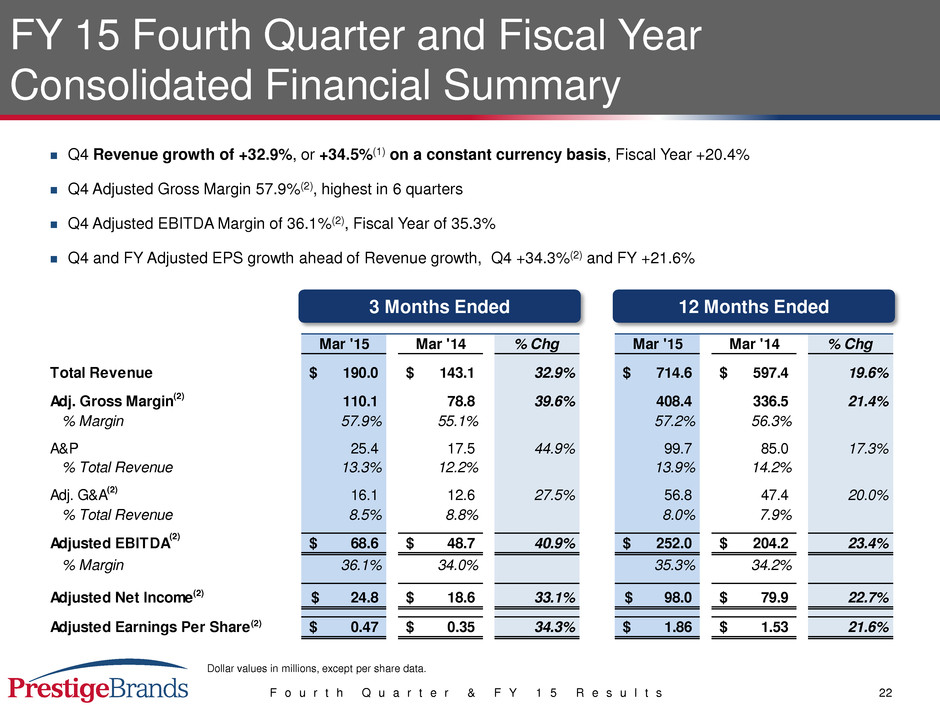

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 22 Mar '15 Mar '14 % Chg Mar '15 Mar '14 % Chg Total Revenue 190.0$ 143.1$ 32.9% 714.6$ 597.4$ 19.6% Adj. Gross Margin 110.1 78.8 39.6% 408.4 336.5 21.4% % Margin 57.9% 55.1% 57.2% 56.3% A&P 25.4 17.5 44.9% 99.7 85.0 17.3% % Total Revenue 13.3% 12.2% 13.9% 14.2% Adj. G&A 16.1 12.6 27.5% 56.8 47.4 20.0% % Total Revenue 8.5% 8.8% 8.0% 7.9% Adjusted EBITDA 68.6$ 48.7$ 40.9% 252.0$ 204.2$ 23.4% % Margin 36.1% 34.0% 35.3% 34.2% Adjusted Net Income 24.8$ 18.6$ 33.1% 98.0$ 79.9$ 22.7% Adjusted Earnings Per Share 0.47$ 0.35$ 34.3% 1.86$ 1.53$ 21.6% FY 15 Fourth Quarter and Fiscal Year Consolidated Financial Summary Q4 Revenue growth of +32.9%, or +34.5%(1) on a constant currency basis, Fiscal Year +20.4% Q4 Adjusted Gross Margin 57.9%(2), highest in 6 quarters Q4 Adjusted EBITDA Margin of 36.1%(2), Fiscal Year of 35.3% Q4 and FY Adjusted EPS growth ahead of Revenue growth, Q4 +34.3%(2) and FY +21.6% 3 Months Ended 12 Months Ended (2) (2) (2) (2) (2) Dollar values in millions, except per share data.

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 23 Q4 FY 15 Q4 FY 14 FY 15 FY 14 Net Income - As Reported 23.8$ 16.0$ 78.3$ 72.6$ Depreciation & Amortization 5.8 3.3 17.7 13.5 Other Non-Cash Operating Items 16.3 12.0 46.9 37.4 Working Capital 6.3 (0.6) 13.3 (11.9) Operating Cash Flow 52.1$ 30.7$ 156.3$ 111.6$ Premium Payment on Notes - 2.8 - 15.5 Accelerated Interest Payments - 1.2 - 4.7 Additions to Property and Equipment (2.4) (0.1) (6.1) (2.8) Integration, Transition and Other Payments Associated with Acquisitions 0.4 - 13.6 0.5 Adjusted Free Cash Flow 50.1$ 34.5$ 163.7$ 129.5$ Debt Profile & Financial Compliance: Net Debt at 3/31/15 of $1,572 million comprised of: – Cash on hand of $21 million – $944 million of term loan and revolver – $650 million of bonds Leverage ratio(3) of ~5.2x Recent term loan refinancing continues to support rapid deleveraging Exceptional Free Cash Flow Trends Cash Flow Comments (7) (2) Dollar values in millions.

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 24

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 25 Staying the Strategic Course to continue Shareholder Value Creation Continue category platform expansion/development Capitalize on brand opportunities across channels of distribution Prioritize new product development and innovation Little Remedies point of difference creates greatest long-term brand potential in pediatric portfolio moving forward Power of Prestige’s portfolio growing and delivering results New and significant Monistat advertising and Health Care Professional “HCP” investments launching in Q1 Expand Nix distribution and product offering Prioritize and invest in feminine hygiene new product pipeline Industry dynamics resulting in continued robust environment Big pharma portfolio rationalization continues Committed to aggressive and disciplined M&A strategy Strong core OTC and international portfolio momentum going into FY 16 Consumer confidence improving Retailers cautiously optimistic, bottom line focused Fx impact on top line continues FY 16 outlook: — Revenue growth of +10% to +12% (including $10MM negative Fx impact) ● 1H +20% to +23%, 2H +1.5% to +2.0% — Adjusted EPS +10% to +13% ($2.05 to $2.10)(8) — Free cash flow of $175MM(9) or more — Continued A&P investment in portfolio, Insight brands in particular Insight Growth Plan FY 16 Full Year Outlook M&A Strategy Brand Building

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 26 Key Drivers of Long-Term Shareholder Value Develop a Portfolio of Leading Brands Capitalize on Efficient and Effective Operating Model Deliver Robust and Consistent Free Cash Flow Execute Proven and Repeatable M&A Strategy Portfolio of recognizable brands in attractive consumer health industry Established expertise in brand building and product innovation Demonstrated ability to gain market share long-term Target Revenue contribution from Core OTC and International brands from ~78% to ~85% Demonstrated track record of 6 acquisitions during the past 5 years Effective consolidation platform positioned for consistent pipeline of opportunities Proven ability to source from varied sellers Fragmented industry and recent wave of acquisitions creates a robust pipeline Strong and consistent cash flow driven by industry leading EBITDA margins, capital-lite business model and significant deferred tax assets Rapid deleveraging allows for expanded acquisition capacity and continued investment in brand building Non-core brands’ role contributes to cash flow Debt repayment reduces cash interest expense and adds to EPS Efficient asset-lite model with best-in-class outsourced manufacturing and distribution partners Scalable operating platform key to Revenue expansion from $300MM to $800MM and beyond Business model enables gross margin expansion and G&A absorption Continued cost efficiencies expected with GM targeted at 60% and savings reinvested in A&P

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 27 Q&A

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 28 Appendix (1) Revenue Growth on a constant currency basis is a Non-GAAP financial measure and is reconciled to its most closely related GAAP financial measure in our earnings release in the “About Non-GAAP Financial Measures” section. (2) Adjusted Gross Margin, Adjusted G&A, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted EPS and Adjusted Free Cash Flow are Non-GAAP financial measures and are reconciled to their most closely related GAAP financial measures in our earnings release in the “About Non-GAAP Financial Measures” section, and are also reconciled on slides 29 through 32. (3) Leverage ratio reflects net debt / covenant defined EBITDA. (4) Pro forma Net Sales is projected for FY 15 as if Insight and Hydralyte were acquired on April 1, 2014. (5) Based on Company's organic long-term plan. Source: Company data. (6) Assumes max leverage of 5.75x and average EBITDA acquisition multiple consistent with previous acquisitions. (7) Operating cash flow is equal to GAAP net cash provided by operating activities. (8) Adjusted EPS for FY 16 is a projected Non-GAAP financial measure, is reconciled to projected GAAP EPS in our earnings release in the “About Non-GAAP Financial Measures” section and is calculated based on projected GAAP EPS of $2.00 to $2.05 plus $0.05 of cost associated with term loan refinancing and CEO retirement totaling $2.05 to $2.10. (9) Adjusted Free Cash Flow for FY 16 is a projected Non-GAAP financial measure, is reconciled to projected GAAP Net Cash Provided by Operating Activities in our earnings release in the “About Non-GAAP Financial Measures” section and is calculated based on projected Net Cash Provided by Operating Activities of $181 million less projected capital expenditures of $6 million.

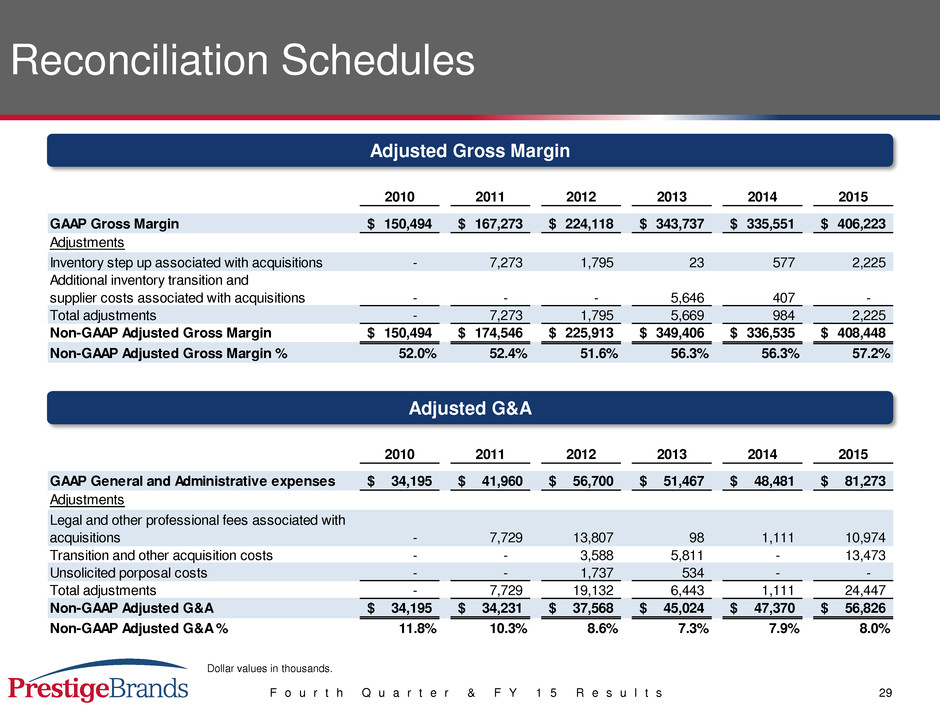

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 29 2010 2011 2012 2013 2014 2015 GAAP General and Administrative expenses 34,195$ 41,960$ 56,700$ 51,467$ 48,481$ 81,273$ Adjustments Legal and other professional fees associated with acquisitions - 7,729 13,807 98 1,111 10,974 Transition and other acquisition costs - - 3,588 5,811 - 13,473 Unsolicited porposal costs - - 1,737 534 - - Total adjustments - 7,729 19,132 6,443 1,111 24,447 Non-GAAP Adjusted G&A 34,195$ 34,231$ 37,568$ 45,024$ 47,370$ 56,826$ Non-GAAP Adjusted G&A % 11.8% 10.3% 8.6% 7.3% 7.9% 8.0% 2010 2011 2012 2013 2014 2015 GAAP Gross Margin 150,494$ 167,273$ 224,118$ 343,737$ 335,551$ 406,223$ Adjustments Inventory step up associated with acquisitions - 7,273 1,795 23 577 2,225 Additional inventory transition and supplier costs associated with acquisitions - - - 5,646 407 - Total adjustments - 7,273 1,795 5,669 984 2,225 Non-GAAP Adjusted Gross Margin 150 4 4 174 546 225 913 349 06 336 535 408 448 Non-GAAP Adjusted Gross Margin % 52.0% 52.4% 51.6% 56.3% 56.3% 57.2% Reconciliation Schedules Adjusted Gross Margin Dollar values in thousands. Adjusted G&A

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 30 2010 2011 2012 2013 2014 2015 Net Income EPS Net Income EPS Net Income EPS Net Income EPS Net Income EPS Net Income EPS GAAP Net Income 32,115$ 0.64$ 29,220$ 0.58$ 37,212$ 0.73$ 65,505$ 1.27$ 72,615$ 1.39$ 78,260$ 1.49$ Adjustments Income from discontinued ops. - - (591) (0.01) - - - - - - - - Loss on sale of discontinued ops. - - 550 0.01 - - - - - - - - Incremental interest expense to finance Acquisition - - 800 0.02 - - - - - - - - Sales costs related to acquisitions - - - - - - 411 0.01 - - - - Inventory step up - - 7,273 0.14 1,795 0.04 23 - 577 0.01 2,225 0.04 Inventory related acquisition costs - - - - - - 220 - 407 0.01 - - Add'l supplier costs - - - - - - 5,426 0.11 - - - - Legal and other professional fees associated with acquisitions - - 7,729 0.15 13,807 0.27 98 - 1,111 0.02 10,974 0.21 Transition and other Acq costs - - - - 3,588 0.07 5,811 0.11 - - 10,533 0.20 Stamp Duty - - - - - - - - - - 2,940 0.05 Unsolicited porposal costs - - - - 1,737 0.03 534 0.01 - - - - Loss on extinguishment of debt 2,656 0.05 300 0.01 5,409 0.11 1,443 0.03 18,286 0.35 - - Impairment of GW - - - - - - - - - - - - Gain on settlement - - - - (5,063) (0.10) - - - - - - Gain on sale of asset - - - - - - - - - - (1,133) (0.02) Accelerated amortization of debt discounts and debt issue costs - - - - - - 7,746 0.15 5,477 0.10 218 - Tax impact on adjustments (1,009) (0.01) (5,513) (0.11) (8,091) (0.16) (8,329) (0.16) (9,100) (0.17) (5,968) (0.11) Impact of state tax adjustments (352) (0.01) - - (237) - (1,741) (0.03) (9,465) (0.18) - - Total adjustments 1,295 0.03 10,548 0.21 12,945 0.26 11,642 0.23 7,293 0.14 19,789 0.37 Non-GAAP Adjusted Net Income and Non-GAAP Adjusted EPS 33,410$ 0.67$ 39,768$ 0.79$ 50,157$ 0.99$ 77,147$ 1.50$ 79,908$ 1.53$ 98,049$ 1.86$ Reconciliation Schedules Cont’d Adjusted Net Income and Adjusted EPS Dollar values in thousands, except per share data.

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 31 2010 2011 2012 2013 2014 2015 GAAP Net Income 32,115$ 29,220$ 37,212$ 65,505$ 72,615$ 78,260$ Income from Disc Ops 112 (591) - - - - Loss on sale of disc ops (157) 550 - - - - Interest Expense, net 22,935 27,317 41,320 84,407 68,582 81,234 Provision for income taxes 20,664 19,349 23,945 40,529 29,133 49,198 Depreciation and amortization 10,001 9,876 10,734 13,235 13,486 17,740 Non-GAAP EBITDA 85,670 85,721 113,211 203,676 183,816 226,432 Sales costs related to acquisitions - - - 411 - - Inventory step up - 7,273 1,795 23 577 2,225 Inventory related acquisition costs - - - 220 407 - Add'l supplier costs - - - 5,426 - - Legal and other professional fees associated with acquisitions - 7,729 13,807 98 1,111 10,974 Transition and other Acq costs - - 3,588 5,811 - 10,533 Stamp Duty - - - - - 2,940 Unsolicited porposal costs - - 1,737 534 - - Loss on extinguishment of debt 2,656 300 5,409 1,443 18,286 - Impairment of GW - - - - - - Gain on settlement - - (5,063) - - - Gain on sale of asset - - - - - (1,133) Not shown in ER - - - - - - Adjustments to EBITDA 2,656 15,302 21,273 13,966 20,381 25,539 Non-GAAP Adjusted EBITDA 88,326$ 101,023$ 134,484$ 217,642$ 204,197$ 251,971$ Reconciliation Schedules Cont’d Adjusted EBITDA Dollar values in thousands.

F o u r t h Q u a r t e r & F Y 1 5 R e s u l t s 32 2010 2011 2012 2013 2014 2015 GAAP Net Income 32,115$ 29,220$ 37,212$ 65,505$ 72,615$ 78,260$ Adjustments Adjustments to reconcile net income to net cash provided by operating activities as shown in the statement of cash flows 31,137 26,095 35,674 59,497 50,912 64,668 Changes in operating assets and liabilities, net of effects from acquisitions as shown in the statement of cash flows (3,825) 31,355 (5,434) 12,603 (11,945) 13,327 Total adjustments 27,312 57,450 30,240 72,100 38,967 77,995 GAAP Net cash provided by operating activities 59,427 86,670 67,452 137,605 111,582 156,255 Purchases of property and equipment (673) (655) (606) (10,268) (2,764) (6,101) Non-GAAP Free Cash Flow 58,754 86,015 66,846 127,337 108,818 150,154 Premiuim payment on 2010 Senior Notes - - - - 15,527 - Accelerated interest payments due to debt refinancing - - - - 4,675 - Integration, transition and other payments associated with acquisitions - - - - 512 13,563 Total adjustments - - - - 20,714 13,563 Non-GAAP Adjusted Free Cash Flow 58,754$ 86,015$ 66,846$ 127,337$ 129,532$ 163,717$ Reconciliation Schedules Cont’d Adjusted Free Cash Flow Dollar values in thousands.