Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PBF Holding Co LLC | a8-kpbf5x14x15.htm |

PBF Energy (NYSE: PBF) Morgan Stanley Refining Corporate Access Day May 14, 2015

2 Safe Harbor Statements This presentation contains forward-looking statements made by PBF Energy Inc. and PBF Logistics LP (together, the “Companies”, or “PBF” or “PBFX”) and their management teams. Such statements are based on current expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are based on information available at the time, and are subject to various risks and uncertainties that could cause the Companies’ actual performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products; the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics infrastructure; effects of litigation and government investigations; the timing and announcement of any potential acquisitions and subsequent impact of any future acquisitions on our capital structure, financial condition or results of operations; changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business or industry, including any lifting by the federal government of the restrictions on exporting U.S. crude oil; actions taken or non-performance by third parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other labor interruptions; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; inability to complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; inability to successfully integrate acquired refineries or other acquired businesses or operations; effects of existing and future laws and governmental regulations, including environmental, health and safety regulations; and, various other factors. Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Companies assume no responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information after such date.

3 PBF Energy Company Profile Market capitalization of ~$2.5 billion(1) BB- / Ba3 credit ratings Operates three oil refineries in Ohio, Delaware and New Jersey Aggregate throughput capacity of ~540,000 bpd Weighted-average Nelson Complexity of 11.3 East Coast rail infrastructure provides PBF with the optionality to source cost-advantaged North American crude oil or waterborne crude oil depending on economics PBF's core strategy is to grow and diversify through acquisitions PBF indirectly owns 100% of the general partner and 52.1% of the limited partner interest of PBF Logistics LP (NYSE: PBFX) PBFX market capitalization of ~$850 million(1) Region Throughput Capacity (bpd) Nelson Complexity Mid-continent 170,000 9.2 East Coast 370,000 12.2 Total 540,000 11.3 (2) ___________________________ 1. As of 5/8/15 2. Represents weighted average Nelson Complexity for PBF’s three refineries Paulsboro Delaware City Toledo

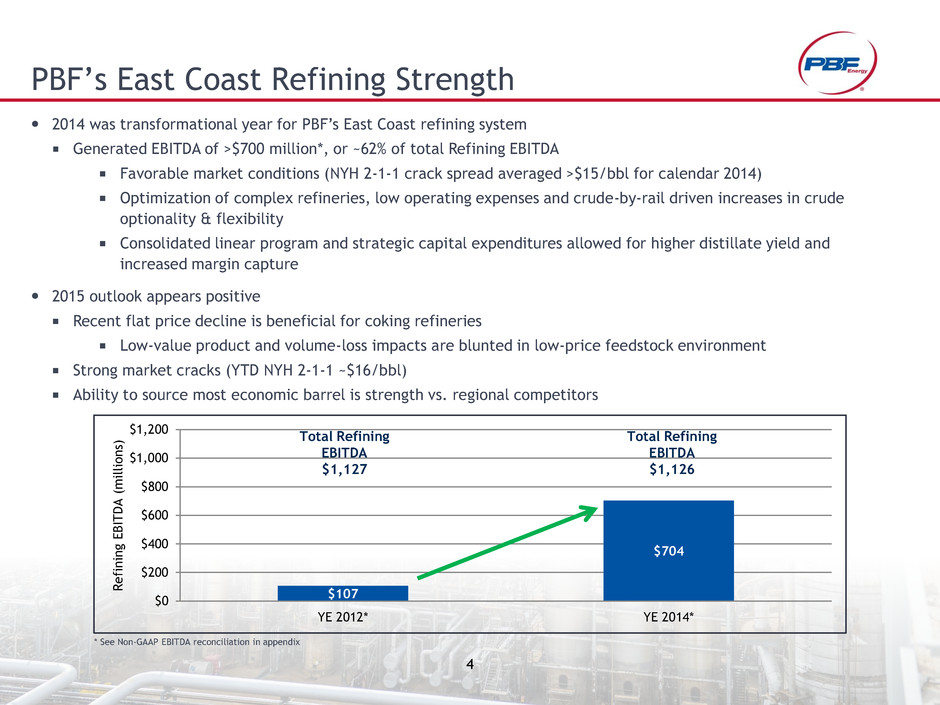

4 PBF’s East Coast Refining Strength $107 $704 $0 $200 $400 $600 $800 $1,000 $1,200 YE 2012* YE 2014* R ef in in g E BI T DA ( m il li o n s) 2014 was transformational year for PBF’s East Coast refining system Generated EBITDA of >$700 million*, or ~62% of total Refining EBITDA Favorable market conditions (NYH 2-1-1 crack spread averaged >$15/bbl for calendar 2014) Optimization of complex refineries, low operating expenses and crude-by-rail driven increases in crude optionality & flexibility Consolidated linear program and strategic capital expenditures allowed for higher distillate yield and increased margin capture 2015 outlook appears positive Recent flat price decline is beneficial for coking refineries Low-value product and volume-loss impacts are blunted in low-price feedstock environment Strong market cracks (YTD NYH 2-1-1 ~$16/bbl) Ability to source most economic barrel is strength vs. regional competitors * See Non-GAAP EBITDA reconciliation in appendix Total Refining EBITDA $1,127 Total Refining EBITDA $1,126

5 Atlantic Basin Asset Rationalization Tightens Market PADD 1 remains a product short market that is reliant on imports to satisfy demand Refinery closures on the East Coast, in Canada, Europe and the Caribbean have reduced competitiveness of imports to PADD 1 and have shifted the advantage to PADD 1 refiners Paulsboro and Delaware City have transportation advantages versus incoming pipelines and waterborne products Owner Location CDU Capacity (bpd) Year Closed Sunoco (Eagle Point) Westville, NJ 145,000 2009 Western Refining Yorktown, VA 66,300 2010 Shell Montreal, Canada 130,000 2010 Sunoco Marcus Hook, PA 175,000 2011 Hess Port Reading, NJ 70,000 2012 Aruba Aruba 235,000 2012 Hovensa St Croix, USVI 500,000 2012 Imperial (Dartmouth) Dartmouth, Nova Scotia 88,000 2013 Total East Coast Closures and Capacity Reductions 1,409,300 Petroplus Teeside, UK 117,000 2009 Total Dunkirk, France 137,000 2009 ConocoPhillips Wilhelmshaven, Germany 260,000 2010 Petroplus Reichstett, France 85,000 2010 Tamoil Cremona, Italy 95,000 2011 LyondellBasell Berre L'Etang, France 105,000 2012 Petroplus Essex, England 175,000 2012 Petroplus Petit Courronne, France 162,000 2012 Shell Harburg, Germany 110,000 2013 Murphy Oil Milfordhaven, UK 130,000 2014 European Atlantic Basin Refinery Closures 1,376,000 Total Closures and Reductions 2,785,300 *Figures include capacity reductions and closures but do not include all closures within Europe

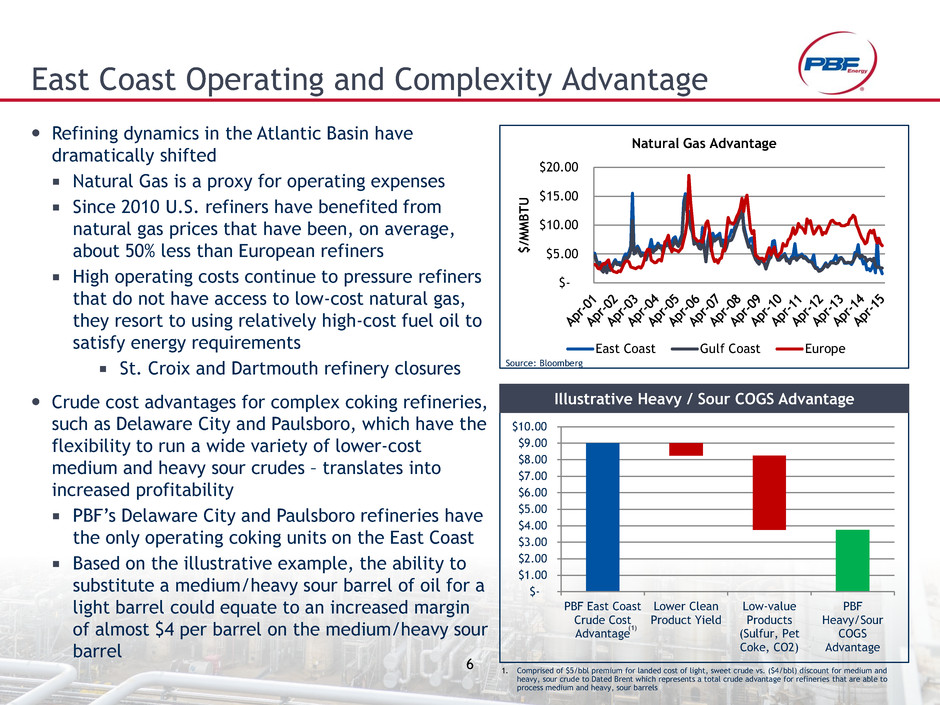

6 $- $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 PBF East Coast Crude Cost Advantage Lower Clean Product Yield Low-value Products (Sulfur, Pet Coke, CO2) PBF Heavy/Sour COGS Advantage Refining dynamics in the Atlantic Basin have dramatically shifted Natural Gas is a proxy for operating expenses Since 2010 U.S. refiners have benefited from natural gas prices that have been, on average, about 50% less than European refiners High operating costs continue to pressure refiners that do not have access to low-cost natural gas, they resort to using relatively high-cost fuel oil to satisfy energy requirements St. Croix and Dartmouth refinery closures Crude cost advantages for complex coking refineries, such as Delaware City and Paulsboro, which have the flexibility to run a wide variety of lower-cost medium and heavy sour crudes – translates into increased profitability PBF’s Delaware City and Paulsboro refineries have the only operating coking units on the East Coast Based on the illustrative example, the ability to substitute a medium/heavy sour barrel of oil for a light barrel could equate to an increased margin of almost $4 per barrel on the medium/heavy sour barrel East Coast Operating and Complexity Advantage Illustrative Heavy / Sour COGS Advantage ($0.75) ($4.50) $9.00 $3.75 (1) 1. Comprised of $5/bbl premium for landed cost of light, sweet crude vs. ($4/bbl) discount for medium and heavy, sour crude to Dated Brent which represents a total crude advantage for refineries that are able to process medium and heavy, sour barrels Source: Bloomberg $- $5.00 $10.00 $15.00 $20.00 $ /M M B T U Natural Gas Advantage East Coast Gulf Coast Europe

7 0 500 1,000 1,500 2,000 0 2,000 4,000 6,000 8,000 10,000 P rod u c tio n US Production (bpd) PADD 1 Imports (bpd) PBF’s Sourcing and Processing Advantage PADD 1 refiners have seen a benefit from the changing crude oil production and import landscape As PADD 1 access to rising domestic production has increased, East Coast refiners have been able to benefit from a lower feedstock cost advantage which has typically been held by the Gulf Coast and Europe, changing the WTI-Brent differential in favor of PADD 1 PBF is the only refiner in PADD 1 that has the flexibility to process heavy, medium and sour crudes delivered to our facilities by water or rail, depending on economics In a low cost crude environment, this flexibility translates to a margin uplift on low-value products such asphalt, petroleum coke and other products whose value does not fluctuate with crude oil $0 $20 $40 $60 $80 $100 $120 WTI Brent Source: EIA Source: Bloomberg Im po rts $/bbl FY-14 (Loss) / Gain Q2-15 (QTD) (Loss) / Gain WTI $93.28 $55.31 Asphalt $85.04 ($8.24) $48.63 ($6.68) Coke $6.01 ($87.27) $3.74 ($51.57) Propane $43.68 ($49.60) $22.85 ($32.46) Source: Platts

8 PBF Energy maintains a conservative financial profile with significant liquidity and access to capital markets Availability liquidity of just under ~$1 billion as of March 31, 2015 In 2014, obtained >$3.3 billion in committed credit facilities Balance sheet strengthened by successful PBF Logistics IPO and drop-downs of Delaware City West Rack and the Toledo Storage Facility Transactions with PBF Logistics have contributed net cash proceeds of ~$600 million(2,3) to PBF Energy Strong Balance Sheet Provides a Platform for Growth ___________________________ 1. Excludes the impact of the fourth quarter 2014 and first quarter 2015, non-cash “lower-of-cost-or-market” inventory adjustment 2. Net proceeds received by PBF Logistics from the sale of the 15,812,500 common units totaled approximately $341.0 million, after deducting the underwriting discount and structuring fee, but before taking into account estimated offering expenses 3. Net proceeds received by PBF Energy from the drop-down of the Delaware City West Rack and Toledo Storage Facility were approximately $270 million in cash and $30 million in PBF Logistics LP common units 10.0% 20.0% 30.0% 40.0% Q2-13 Q3-13 Q4-13 Q1-14 Q2-14 Q3-14 Q4-14 Q1-15 Net Debt to Net Capitalization (1) (1)

9 Increasing Shareholder Value 2014 Summary Returned $260 million to shareholders through dividends and share repurchases Enhanced margin by approximately $170 million, on an annualized basis, through projects implemented in 2014 Launched PBFX in 2014, which strengthened PBF and provides PBF with a valuable partner for growth Generated ~$600 million in net cash proceeds through the IPO and two subsequent drop- downs Increased size of Asset-backed Revolving Credit Facility from $1.6 billion to $2.5 billion, with an accordion to $2.75 billion (maturity extended to 2019) 2015 Outlook Continued focus on organic margin improvement projects in 2015, potential for third-party funding of high-return hydrogen plant project Generate additional cash through drop-down of assets to PBFX Pending completion of Delaware City Products Pipeline and Truck Rack Focus on growth through acquisitions

10 PBFX was launched in May 2014 Market capitalization is ~$850 million(1) PBF owns 52.1% of PBFX, 100% of PBF Logistics GP LLC (the General Partner) and 100% of the PBFX incentive distribution rights (“IDRs”) Cash flows are supported by long-term, take-or-pay MVCs No direct commodity exposure PBF Logistics LP Overview (NYSE: PBFX) Existing Assets Service Capacity Loop Track – rail Light crude oil unloading ~130,000 bpd West Rack – rail Heavy crude oil unloading ~40,000 bpd Toledo Truck Terminal Crude oil unloading ~22,500 bpd Toledo Storage Facility and LPG Truck Rack Crude oil and product storage, LPG storage and loading 3.9 million barrels Delaware City Products Pipeline and Truck Rack(2) Products movement and distribution ~125,000 bpd (pipe) ~76,000 bpd (rack) ___________________________ (1) As of 5/8/2015 (2) Pending acquisition of Delaware City Products Pipeline and Truck Rack expected to close in Q2-15

11 PBFX Investment Highlights PBFX is the primary vehicle to expand PBF Energy’s (“PBF”) logistics asset base PBF underpins the stability of PBFX’s cash flow 100% of forecast revenue generated through MVCs Long-term, fee-based contracts with minimum volume commitments and inflation escalators PBF is incentivized and economically aligned ~52% LP ownership, in addition to 100% GP and IDR ownership Strategically located, well- maintained and integrated assets Rail facilities supply PBF Energy’s East Coast refineries with North American crude oils Mid-continent crude oil truck unloading racks, feedstock and product storage facilities and LPG truck rack provide flexible supply, storage and off-take infrastructure for the Toledo refinery Current and anticipated future drop-down assets are integral to the operations of PBF’s refineries Financial flexibility Significant financial flexibility to execute growth strategy $325 million revolving credit facility with an accordion to $600 million Target debt of 3x – 4x EBITDA Experienced leadership team Significant experience operating and managing logistics and refining assets Long and successful track record of executing profitable acquisitions and driving organic growth Focused on growing logistics assets Relationship with PBF provides growth and stability

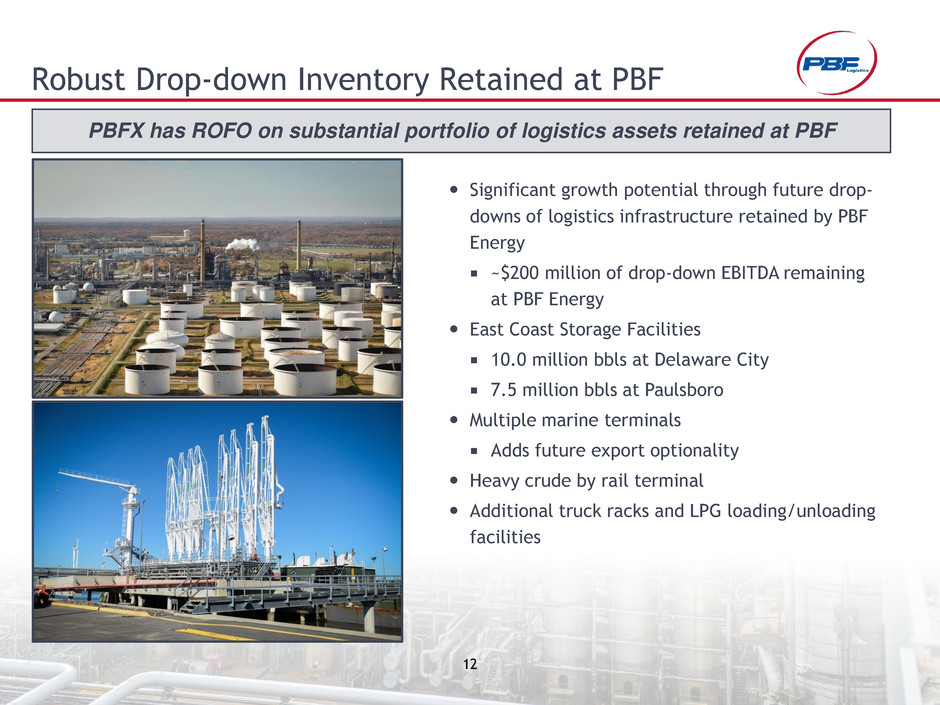

12 Robust Drop-down Inventory Retained at PBF Significant growth potential through future drop- downs of logistics infrastructure retained by PBF Energy ~$200 million of drop-down EBITDA remaining at PBF Energy East Coast Storage Facilities 10.0 million bbls at Delaware City 7.5 million bbls at Paulsboro Multiple marine terminals Adds future export optionality Heavy crude by rail terminal Additional truck racks and LPG loading/unloading facilities PBFX has ROFO on substantial portfolio of logistics assets retained at PBF

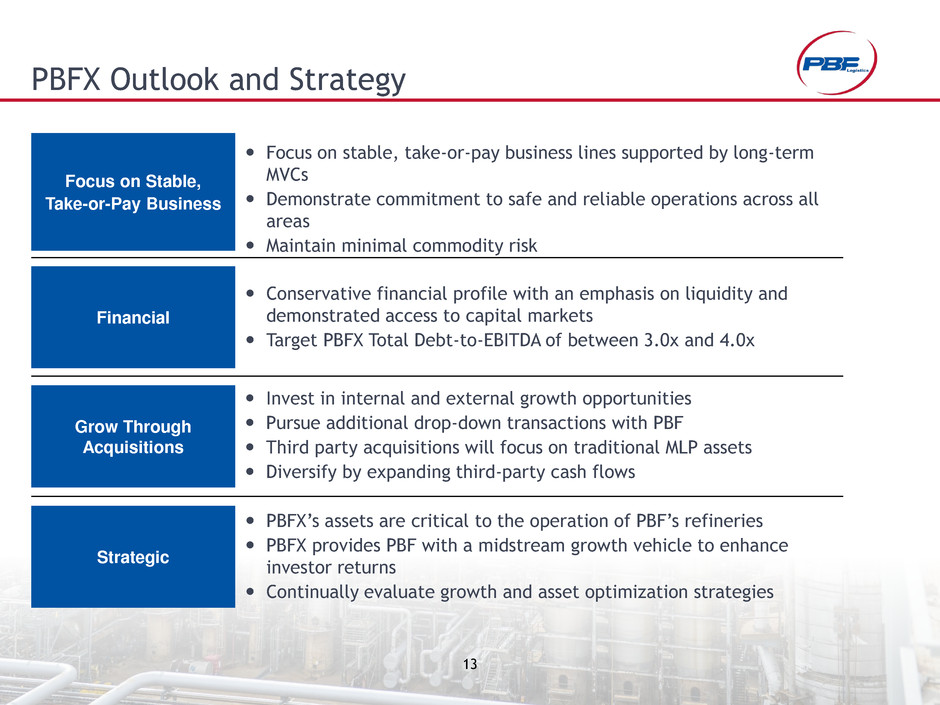

13 PBFX Outlook and Strategy Focus on Stable, Take-or-Pay Business Focus on stable, take-or-pay business lines supported by long-term MVCs Demonstrate commitment to safe and reliable operations across all areas Maintain minimal commodity risk PBFX’s assets are critical to the operation of PBF’s refineries PBFX provides PBF with a midstream growth vehicle to enhance investor returns Continually evaluate growth and asset optimization strategies Financial Strategic Grow Through Acquisitions Invest in internal and external growth opportunities Pursue additional drop-down transactions with PBF Third party acquisitions will focus on traditional MLP assets Diversify by expanding third-party cash flows Conservative financial profile with an emphasis on liquidity and demonstrated access to capital markets Target PBFX Total Debt-to-EBITDA of between 3.0x and 4.0x

14 Increasing Stakeholder Value Operate safely and efficiently Maintain capital discipline and conservative balance sheets Invest in revenue improvement projects Grow through strategic acquisitions Return cash to investors

1 5 Appendix

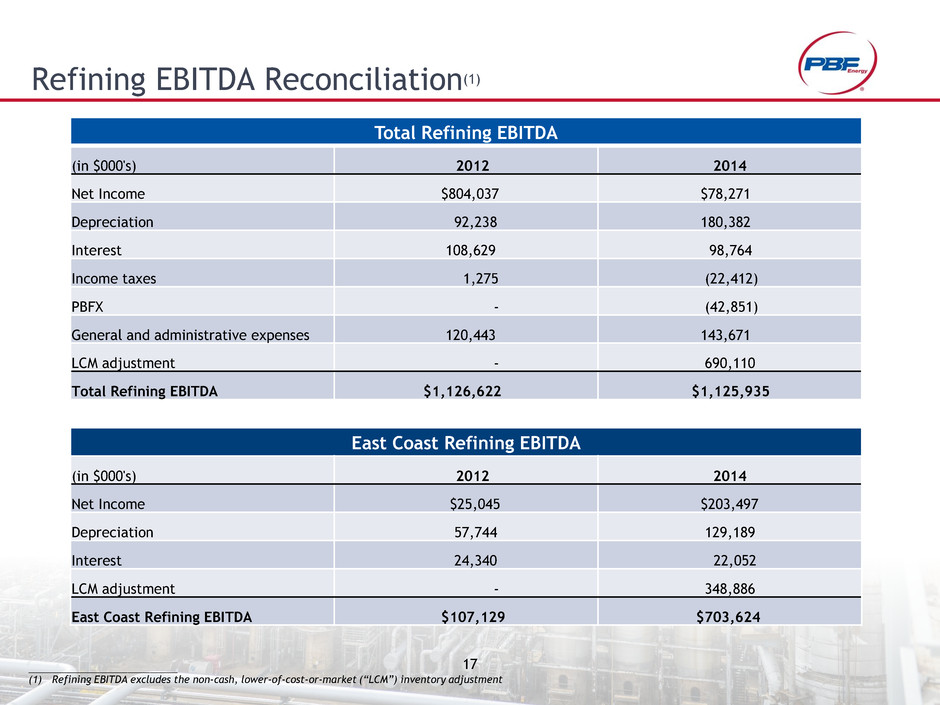

16 Non-GAAP Financial Measures Our management uses EBITDA (earnings before interest, income taxes, depreciation and amortization) and Adjusted EBITDA as measures of operating performance to assist in comparing performance from period to period on a consistent basis and to readily view operating trends, as a measure for planning and forecasting overall expectations and for evaluating actual results against such expectations, and in communications with our board of directors, creditors, analysts and investors concerning our financial performance. Our outstanding indebtedness for borrowed money and other contractual obligations also include similar measures as a basis for certain covenants under those agreements which may differ from the Adjusted EBITDA definition described below. EBITDA and Adjusted EBITDA are not presentations made in accordance with GAAP and our computation of EBITDA and Adjusted EBITDA may vary from others in our industry. In addition, Adjusted EBITDA contains some, but not all, adjustments that are taken into account in the calculation of the components of various covenants in the agreements governing the senior secured notes and other credit facilities. EBITDA and Adjusted EBITDA should not be considered as alternatives to operating income or net income as measures of operating performance. In addition, EBITDA and Adjusted EBITDA are not presented as, and should not be considered, an alternative to cash flows from operations as a measure of liquidity. Adjusted EBITDA is defined as EBITDA before equity-based compensation expense, gains (losses) from certain derivative activities and contingent consideration and the non-cash change in the deferral of gross profit related to the sale of certain finished products. Other companies, including other companies in our industry, may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. Adjusted EBITDA also has limitations as an analytical tool and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. The non-GAAP measures presented include EBITDA excluding special items. The special items for the periods presented relate to a non-cash, lower-of-cost-or-market adjustment (LCM) in the fourth quarter of 2014. Although we believe that non-GAAP financial measures provide useful supplemental information which can allow for more useful period-over-period comparisons. Such non-GAAP measures should only be considered as a supplement to, and not as a substitute for, or superior to, the financial measures prepared in accordance with GAAP.

17 Refining EBITDA Reconciliation(1) Total Refining EBITDA (in $000's) 2012 2014 Net Income $804,037 $78,271 Depreciation 92,238 180,382 Interest 108,629 98,764 Income taxes 1,275 (22,412) PBFX - (42,851) General and administrative expenses 120,443 143,671 LCM adjustment - 690,110 Total Refining EBITDA $1,126,622 $1,125,935 East Coast Refining EBITDA (in $000's) 2012 2014 Net Income $25,045 $203,497 Depreciation 57,744 129,189 Interest 24,340 22,052 LCM adjustment - 348,886 East Coast Refining EBITDA $107,129 $703,624 ___________________________ (1) Refining EBITDA excludes the non-cash, lower-of-cost-or-market (“LCM”) inventory adjustment

1 8