Attached files

| file | filename |

|---|---|

| 8-K - HOOPER HOLMES, INC. 8-K - HOOPER HOLMES INC | a51102565.htm |

| EX-99.1 - EXHIBIT 99.1 - HOOPER HOLMES INC | a51102565ex99_1.htm |

Exhibit 99.2

Hooper Holmes, Inc. May 14, 2015 Earnings Presentation Speakers: Henry Dubois, Chief Executive Officer Tom Collins, Chief Financial Officer 1

Safe Harbor Statement This presentation contains forward‐looking statements, as such term is defined in the Private Securities Litigation Reform Act of 1995, concerning the Company’s plans, objectives, goals, strategies, future events or performances, which are not statements of historical fact and can be identified by words such as: “expect,” “continue,” “should,” “may,” “will,” “project,” “anticipate,” “believe,” “plan,” “goal,” and similar references to future periods. The forward‐looking statements contained in this presentation reflect our current beliefs and expectations. Actual results or performance may differ materially from what is expressed in the forward looking statements. Among the important factors that could cause actual results to differ materially from those expressed in, or implied by, the forward‐looking statements contained in this presentation are our ability to realize the expected benefits from the acquisition of Accountable Health Solutions and our strategic alliance with Clinical Reference Laboratory; our ability to successfully implement our business strategy and integrate Accountable Health Solutions’ business with ours; our ability to retain and grow our customer base; our ability to recognize operational efficiencies and reduce costs; uncertainty as to our working capital requirements over the next 12 to 24 months; our ability to maintain compliance with the financial covenants contained in our credit facilities; the rate of growth in the Health and Wellness market and such other factors as discussed in Part I, Item 1A, Risk Factors, and Part II, Item7,Management’s Discussion and Analysis of Financial Conditions and Results of Operations of our Annual Report on Form 10‐K for the year ended December 31, 2014. The Company undertakes no obligation to update or release any revisions to these forward‐looking statements to reflect events or circumstances, or to reflect the occurrence of unanticipated events, after the date of this presentation, except as required by law. This presentation contains information from third‐party sources, including data from studies conducted by others and market data and industry forecasts obtained from industry publications. Although the Company believes that such information is reliable, the Company has not independently verified any of this information and the Company does not guarantee the accuracy or completeness of this information. 2

2015 Objectives and Outlook – Reviewed March and April 2015 Financials Objectives Growth Outlook Strategy Objectives Generate positive operating cash flow for full year 2015 SG&A run rate for full year similar to what was delivered in 4Q 2014 Little to no Discontinued Operations activity Profitable growth Per Employee Benefit Research Institute, 36% of employers expect to add wellness programs in 2015 Strong sales pipeline leading to expansion of wellness customer base Additional focus on Clinical Trials opportunities Continued growth in H&W and Clinical Trials screenings Operational and technology improvements that support all service offerings Explore opportunities for new product offerings and to add new capabilities 3

Building Our Future Leveraging our national health professional network to deliver higher‐value services Biometric Screenings enroll employees in corporate wellness programs each year Clinical Research services support longer-term government and academic studies Wellness Portal services encourage, challenge and support people pursuing healthy lifestyles Telephonic Coaching offers one‐on‐one assistance to those who need it most 4

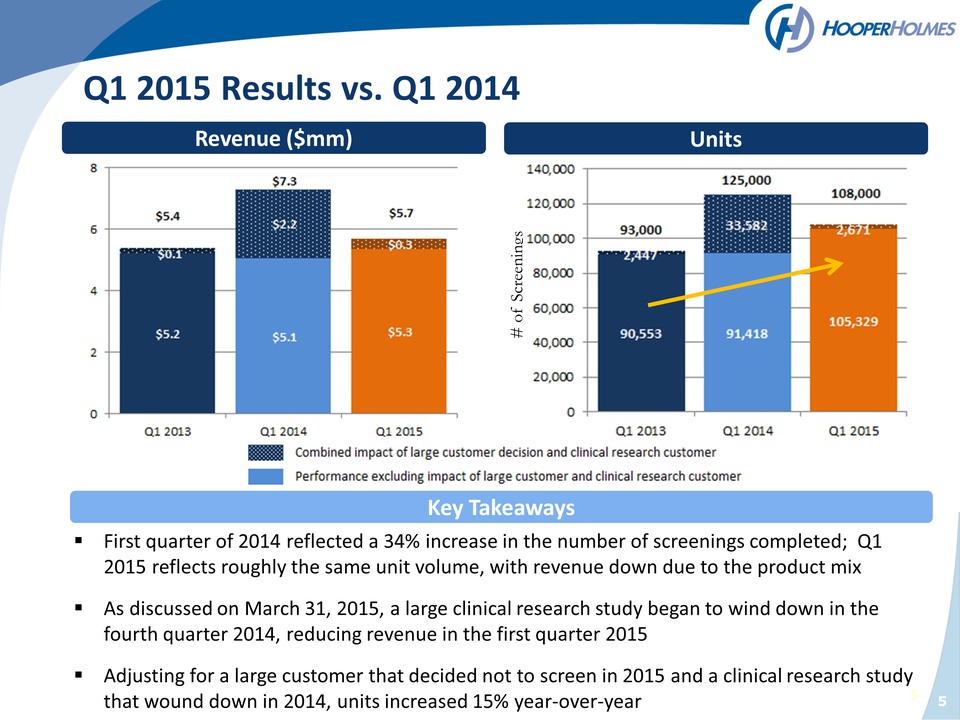

Q1 2015 Results vs. Q1 2014 Revenue ($mm) Units Key Takeaways First quarter of 2014 reflected a 34% increase in the number of screenings completed; Q1 2015 reflects roughly the same unit volume, with revenue down due to the product mix As discussed on March 31, 2015, a large clinical research study began to wind down in the fourth quarter 2014, reducing revenue in the first quarter 2015 Adjusting for a large customer that decided not to screen in 2015 and a clinical research study that wound down in 2014, units increased 15% year‐over‐year 5

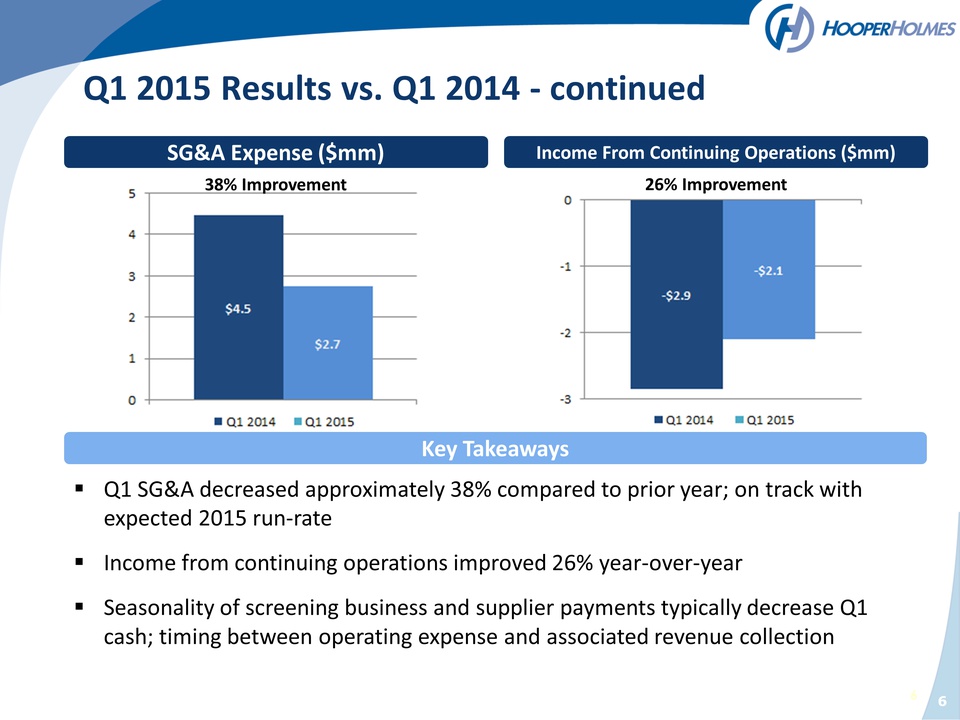

Q1 2015 Results vs. Q1 2014 ‐ continued SG&A Expense ($mm) Income From Continuing Operations ($mm) 38% Improvement 26% Improvement Key Takeaways Q1 SG&A decreased approximately 38% compared to prior year; on track with expected 2015 run‐rate Income from continuing operations improved 26% year‐over‐year Seasonality of screening business and supplier payments typically decrease Q1 cash; timing between operating expense and associated revenue collection 6

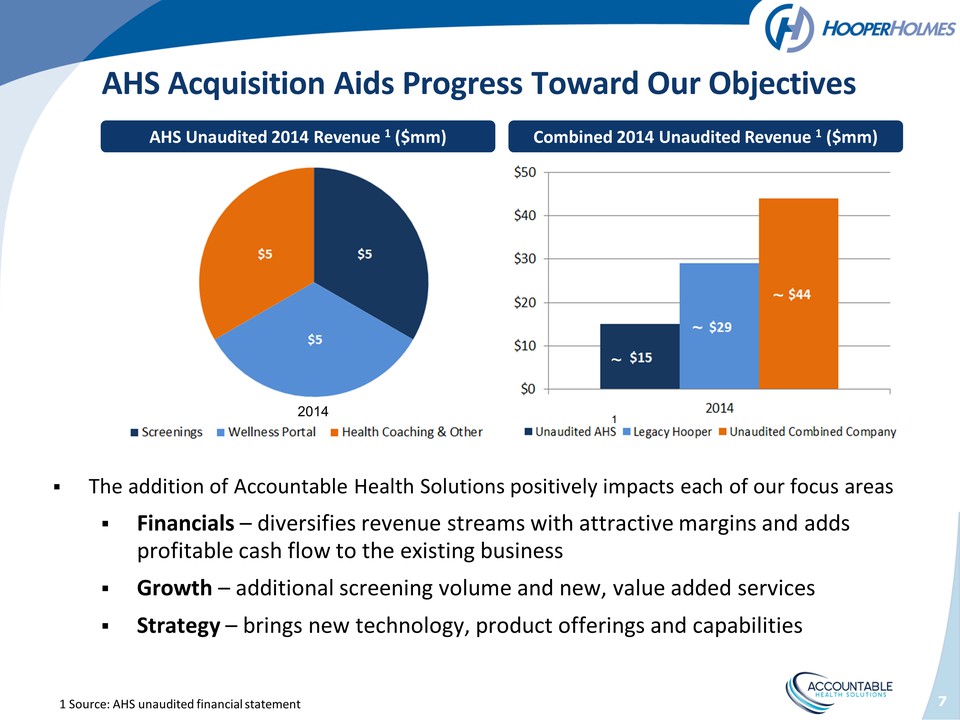

AHS Acquisition Aids Progress Toward 2015 Objectives The addition of Accountable Health Solutions positively impacts each of our focus areas Financials – diversifies revenue streams with attractive margins and adds profitable cash flow to the existing business Growth – additional screening volume and new, value added services Strategy – brings new technology, product offerings and capabilities 1 Source: AHS unaudited financial statement AHS Unaudited 2014 Revenue 1 ($mm) Combined Unaudited Revenue 1 ($mm) 1 ~ ~ ~

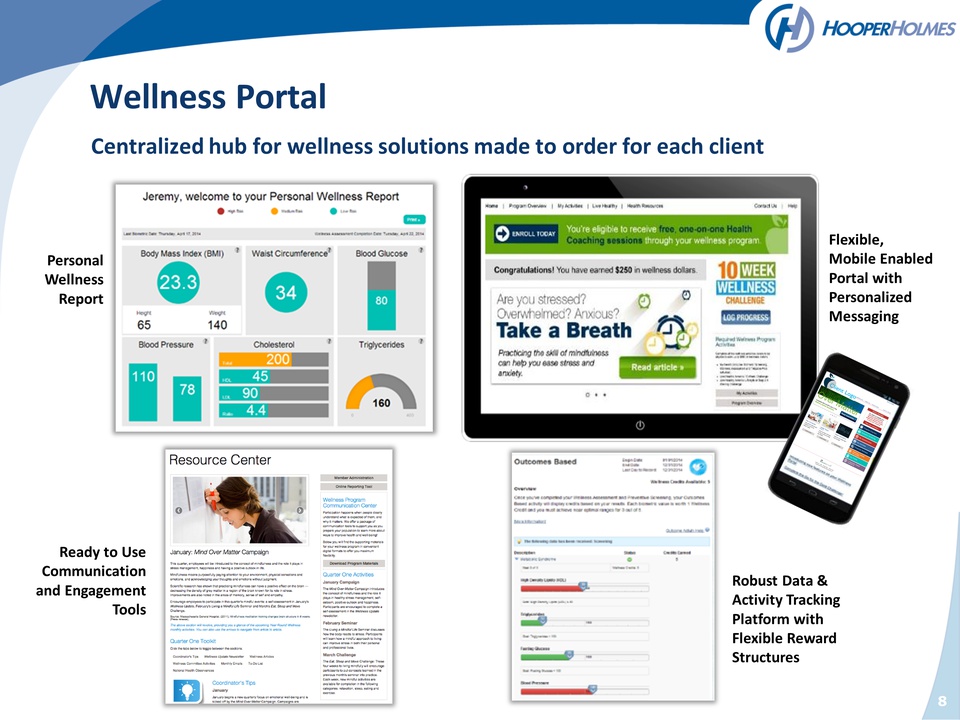

Wellness Portal Centralized hub for wellness solutions made to order for each client Personal Wellness Report Ready to Use Communication and Engagement Tools Robust Data & Activity Tracking Platform with Flexible Reward Structures Flexible, Mobile Enabled Portal with Personalized Messaging 8

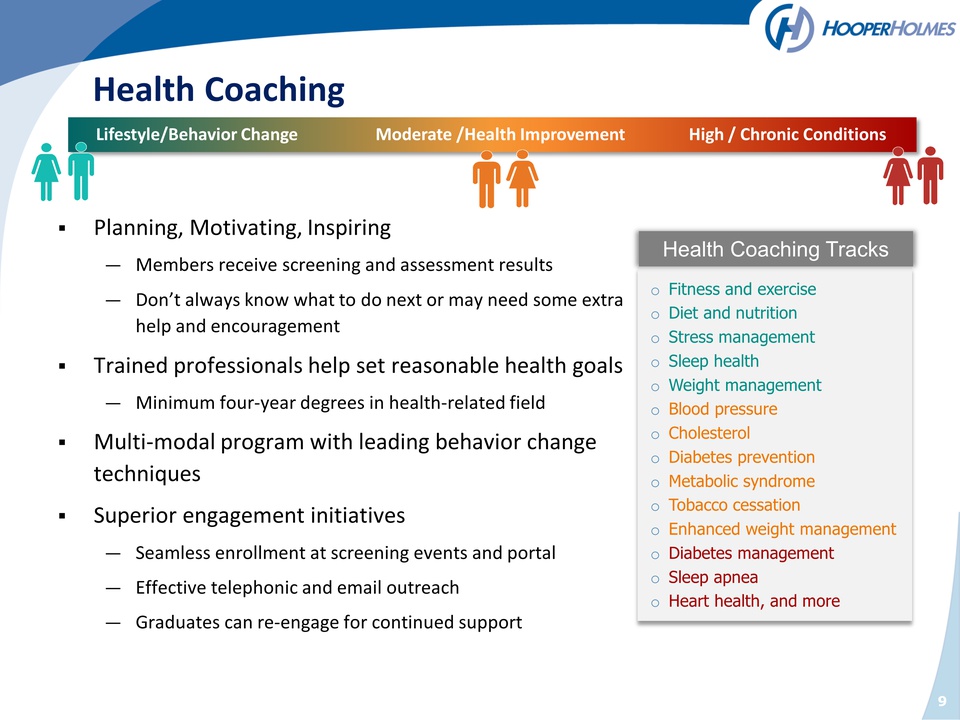

Health Coaching Lifestyle/Behavior Change Moderate /Health Improvement High / Chronic Conditions Planning, Motivating, Inspiring — Members receive screening and assessment results — Don’t always know what to do next or may need some extra help and encouragement Trained professionals help set reasonable health goals — Minimum four‐year degrees in health‐related field Multi‐modal program with leading behavior change techniques Superior engagement initiatives — Seamless enrollment at screening events and portal — Effective telephonic and email outreach — Graduates can re‐engage for continued support Health Coaching Tracks Fitness and exercise Diet and nutrition Stress management Sleep health Weight management Blood pressure Cholesterol Diabetes prevention Metabolic syndrome Tobacco cessation Enhanced weight management Diabetes management Sleep apnea Heart health, and more 9

Operating Initiatives –Mobile Application Update Internal testing is complete Pilots with several clients begin in May Working with existing channel partners and clients to schedule additional pilots in Q2 leading up to a full launch in the fall Feedback from existing clients continues to be positive We believe mobile data collection will create additional opportunities in screening and coaching services 10

What’s Next Focus on integrating Hooper and Accountable Health Continue to execute against our stated goals and objectives Leverage our assets and capabilities for growth 11